January 2025

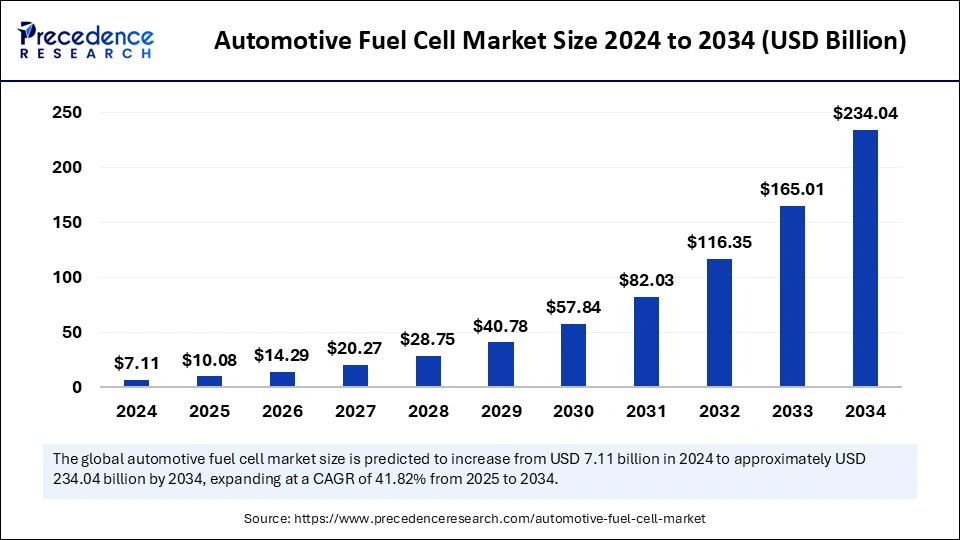

The global automotive fuel cell market size is calculated at USD 10.08 billion in 2025 and is forecasted to reach around USD 234.04 billion by 2034, accelerating at a CAGR of 41.82% from 2025 to 2034. The Asia Pacific market size surpassed USD 5.26 billion in 2024 and is expanding at a CAGR of 41.92% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automotive fuel cell market size accounted for USD 7.11 billion in 2024 and is predicted to increase from USD 10.08 billion in 2025 to approximately USD 234.04 billion by 2034, expanding at a CAGR of 41.82% from 2025 to 2034.The increasing advancement in fuel cell technology and the government support over the zero carbon emission policies drives the growth of the market.

The integration of artificial intelligence into the fuel cell technology for enhancing its performance, energy management, efficiency, and sustainability. The deployment helps in addressing the challenges associated with the automotive sector. AI technology optimizes resource utilization and energy management. AI promotes the eco-friendly driving approach with reducing the negative environmental impact.

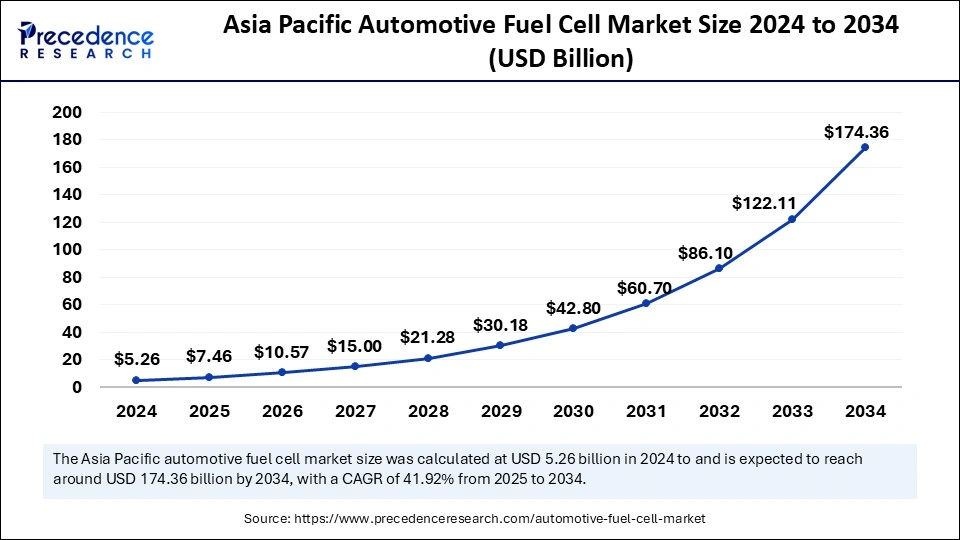

The Asia Pacific automotive fuel cell market size was exhibited at USD 5.26 billion in 2024 and is projected to be worth around USD 174.36 billion by 2034, growing at a CAGR of 41.82% from 2025 to 2034.

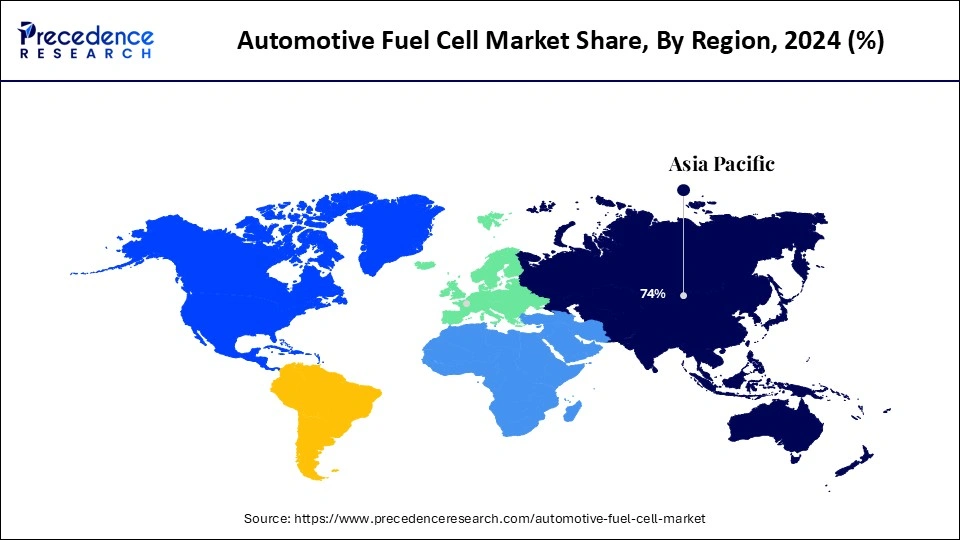

Asia Pacific dominated the global automotive fuel cell market in 2024. The growth of the market is attributed to the rising demand for the automotive industry owing to the population in the regional countries like India, China, and Japan. The rising deployment of the fuel cell vehicles due to reducing carbon emission into the environment drives the demand for the fuel cell vehicle. The rise in electric vehicles and the inclination towards the greenhouse gas reduction program and the rising research and development activities in the expansion of the advanced fuel cell system is collectively accelerating the growth of the market in the region.

North America is expecting substantial growth in the market during the predicted period. The growth of the market is attributed to the rising automotive infrastructure with the presence of the leading automotive players in the United States, and Canada working on the technological advancement and integration of advance fuel cell system drives the growth of the market. The region is known for its innovations and early adoption of technology and transformation which boosts the growth of the automotive fuel cell market across the region.

Automotive fuel cells are the hydrogen power electric generation system that is deployed in electric cars as the advancement in the automotive industry. Hydrogen is one of the highly available elements on earth which is used in the automotive technologies for power generation. The fuel cell vehicle helps in lowering carbon emission by minimizing fossil fuel dependencies. The increasing awareness about the carbon emission on the environment is accelerating the growth of the market.

| Report Coverage | Details |

| Market Size by 2034 | USD 234.04 Billion |

| Market Size in 2025 | USD 10.08 Billion |

| Market Size in 2024 | USD 7.11 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 41.82% |

| Leading Region/ Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Power Ratings, Vehicles and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Benefits associated with the fuel cell

The rising adaptation of the fuel cell technology in the automobile owing to the benefits associated with the hydrogen gases over the other sources. Hydrogen is abundantly available on the earth, its affordability, limitless availability, and sustainability make it ideal for mitigating zero-carbon integrated demand for power and heat. Water and heat are the only by-product of hydrogen thus it is the cleaner form of energy that does not emit any type of environment polluting element, it has the greater productive capacity per kilogram of fuel. Other than that, it minimizes carbon residues, reduces sound pollution, visual pollution, and other advantages make it ideal for the different automotive applications that drive the growth of the automotive fuel cell market.

Cost of energy

The increased cost of hydrogen energy as compared to other resources like solar energy limits the adoption of fuel cells. Additionally, hydrogen is a highly flammable fuel which apparently creates the hazardous conditions that collectively restraining the growth of the automotive fuel cell market.

Evaluation of electric vehicles

The advancements in the automotive industry with the rising demand for the low carbon emitting vehicles like electric and hybrid electric vehicles drive the demand for the fuel cell into the automotive fuel cell market. Fuel cell cars are the electric cars in which the hydrogen is reacting electrochemically for electricity generation into the cars. The hydrogen fuel cell electric cars offer several advantages including instant torque and smooth consistent power, high technology, faster refueling, low maintenance, zero carbon emission, high range, and attractive discounts on pricing with free fuel/maintenance. All these advancements attract consumers towards electric vehicles which contributes in the growth of the market.

The PEMFC segment led the global automotive fuel cell market in 2024. The PEMFC is also known as the polymer electrolyte membrane fuel cells that provide several advantages in the vehicle. It provides high-power density and offers volume and weight compared to the other fuel cells. Polymer electrolyte membrane fuel cells are mainly used in a wide range of transportation applications like buses, cars, and heavy-duty commercial vehicles. It is also used in some of the stationary applications. It is considered as one of the ideal fuel cells for the different transportation applications due to the faster start-time, reduce operational temperature, increased efficiency, safer and easy handling.

The PAFC segment expects notable growth in the market during the forecast period. The PAFC which also referred to as phosphoric acid fuel cells using liquid phosphoric acid as an electrolyte. It is also known as the first generation of modern fuel cells. These types of fuel cells are used in commercial and private vehicles. The PAFC is mostly used in large commercial vehicles and stationary power generating applications.

The below 100 kW rated FC systems segment dominated the automotive fuel cell market in 2024. The increasing demand for lightweight vehicles and the expansion of electric vehicles in the automotive industry is driving the demand for the below 100 kW rated FC system. The rising consumer demand for private vehicles for personal consumption boosts the demand for the 100 kw rated FC system segment.

The 100 – 200 kW segment expects substantial growth in the market during the predicted period. The rising adoption of the fuel cell from the heavy weight commercial vehicle as the replacement of old fleet. The fuel cell in the heavy weight commercial vehicle helps in addressing the challenges associated with the carbon emission on the environment. The increasing demand for the fuel cell based commercial vehicles drives the demand for the 100 – 200 kW fuel cell segment.

The passenger vehicles segment dominated the automotive fuel cell market in 2024. The increasing demand for the passenger vehicles from the worldwide population due to the rising disposable income in the population and economic stability and the rising awareness of environmental pollution by the gasoline vehicles drives the demand for the fuel cell-based passenger vehicles. The rising inclination towards sustainability and the major automotive manufacturers are focusing on the development of fuel cell automobile production boosts the demand for the fuel cell passenger vehicles.

The buses segment expects significant growth in the market during the predicted period. The rising population worldwide drives the demand for commercial passenger vehicles like buses for efficient transportation. The rising government intervention on reducing the carbon footprint is driving the adoption of fuel cell buses on lowering carbon emission by transportation applications like buses. Additionally, the rising commercial applications drives the growth of the market.

In October 2024, Hyundai Motor Company launched the INITIUM hydrogen fuel cell electric vehicle (FCEV) at the event at the Hyundai Motorstudio Goyang.

By Type

By Power Rating

By Vehicles

By Regional

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

January 2024

January 2025