January 2025

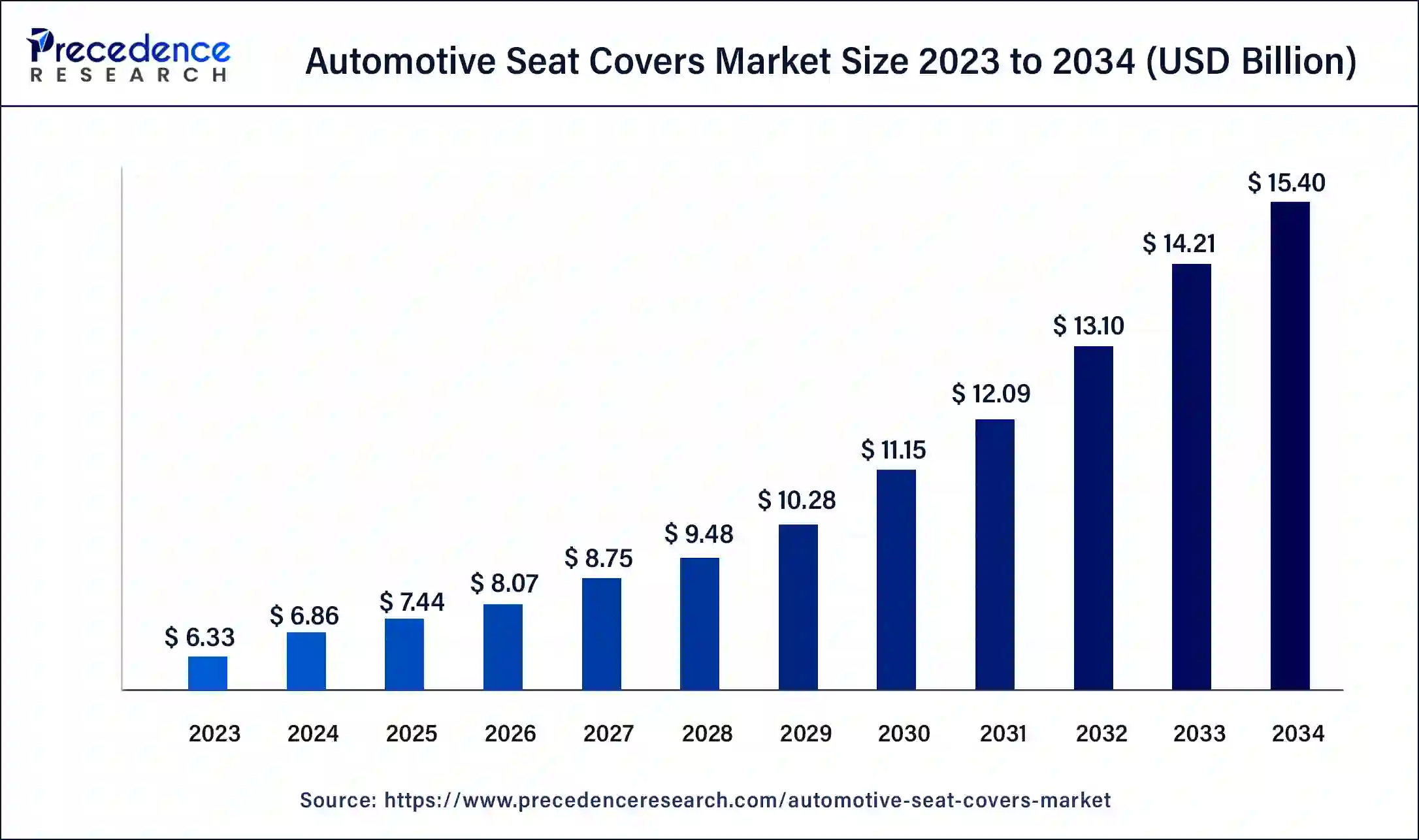

The global automotive seat covers market size surpassed USD 6.33 billion in 2023, calculated at USD 6.86 billion in 2024 and is expected to be worth around USD 15.40 billion by 2034. The market is slated to expand at 8.42% CAGR from 2024 to 2034.

The global automotive seat covers market reached USD 6.86 billion in 2024 and is projected to hit around USD 15.40 billion by 2034, expanding at a CAGR of 8.42% during the forecast period from 2024 to 2034. The automotive seat covers market growth is attributed to increasing consumer demand for vehicle customization and advancements in seat cover materials and technologies.

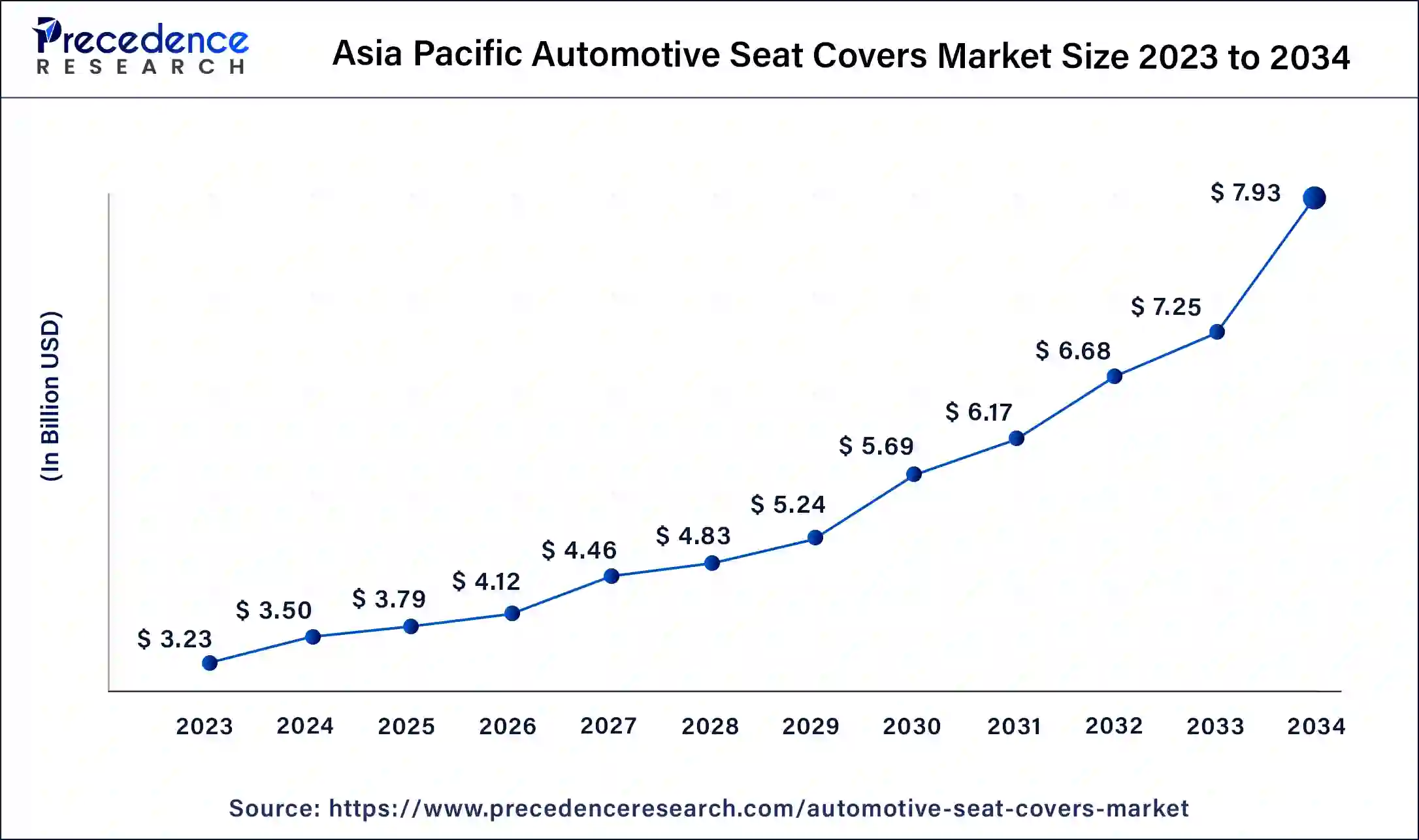

The global asia pacific automotive seat covers market size was exhibited at USD 3.23 billion in 2023 and is projected to reach around USD 7.93 billion by 2034, expanding at a CAGR of 8.50% during the forecast period from 2024 to 2034.

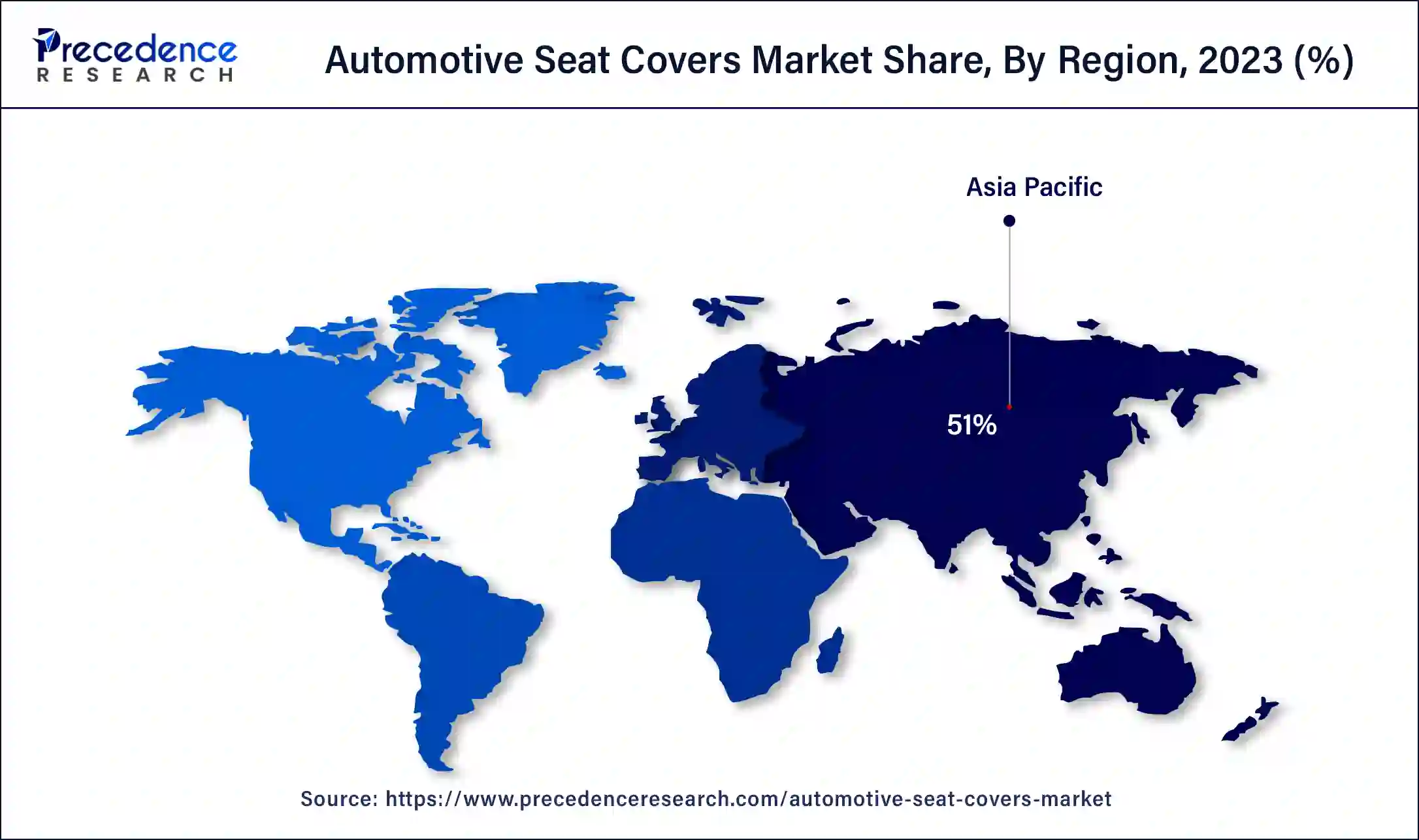

Asia Pacific dominated the global automotive seat covers market in 2023, owing to the big market for automotive production for middle-income earners that is evident in countries, including China, India, and Japan. Industry trends, including the increasing rate of urbanization, the use of vehicles, and the need to look for new and economical ways to provide seat covers, are factors that fuel the market. Additionally, the region’s ability to offer low-cost manufacturing facilitates the growth of the automotive industry, further creating the demand for automotive seat cover suppliers in the coming years.

North America is projected to host the fastest-growing automotive seat covers market in the coming years due to the region’s highly developed automotive sector and customers’ desire for sophisticated and individual automotive interiors. Furthermore, the new comfort and customization needs of the consumers further boost the demand for automotive seat covers.

A higher requirement for customizing vehicles in terms of their appearance is expected to boost the demand for automotive seat covers. Driven by the need for consumers to strive to get a better experience in driving and individualizing their cars, the seat covers market has experienced remarkable growth. This trend of increased vehicle ownership across the globe and advances in technology have seen interiors' interior looks and feel gain prominence.

There is also a wide variety of materials used in developing seat covers sometimes using leather, fabric materials, or synthetic materials depending on telexed consumer needs and financial capacity. In the automotive seat covers market, the growth in the types of material and techniques of producing the material allowed for coming up with new design seat covers with more resilience and comfort. Furthermore, an increased vehicle production is observed globally.

Impact of Artificial Intelligence on Automotive Seat Covers Market

AI is utilized in innovation in the automotive seat covers industry by improving the efficiency of production and giving customizable solutions in the automotive seat covers market. Manufacturing activities that involve material cutting, stitches, and quality assurance checks, among others, can be automated, eliminating human vulnerability. This technology can also be applied to make smart seat covers that have the ability to control the temperature and posture of a passenger, thus adding more value to the overall driving experience. Furthermore, the case of AI increases the potential to analyze consumer trends and, thereby, better design and material to fit these seats considering the customer’s needs.

| Report Coverage | Details |

| Market Size by 2034 | USD 15.40 Billion |

| Market Size by 2023 | USD 6.33 Billion |

| Market Size by 2024 | USD 6.86 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 8.42% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Material Type, Vehicle Type, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising sales of electric vehicles (EVs) are expected to fuel the demand for automotive seat covers market. There is an upsurge in demand for long-lasting, high-quality, and environmentally friendly auto interiors, including seat covers. Car manufacturers are shifting towards environmentally friendly cars and sustainable parts, including vegan leather or recycled fabric.

The transition to electric vehicles is also in line with the global endeavors of manufacturing cars with low carbon emission and thus integrates seat covers as a necessary component towards the achievement of fully sustainable car interiors. This tends to cause car manufacturers to invest in sustainable automotive materials, such as plant-based fabrics and animal-friendly leather, to be on the rise.

Restrain fluctuating raw material prices

Fluctuating raw material prices are projected to restrain the automotive seat covers market. Raw materials that include leather, polyurethane, and synthetic fibers are affected by supply chain disruptions, geopolitical risks, and shifting of trade relations. IMF and WEF have warned that these disruptions, plus higher material costs, account for a large part of inflation and consumer price instabilities. The raw material is imported, especially in the U.S. and Europe, and seat cover manufacturers are realizing low profits as they are not able to fully recover the rising costs. Such instability results in limiting steady production, making it difficult to produce seat covers based on requirements.

High demand for sustainable materials

Growing environmental consciousness among consumers is expected to create favorable opportunities for manufacturers competing in the automotive seat covers market. Customers have shifted towards sustainable products, and the requirement for vegan leather, recycled polyester, and organic cotton is rising. With greater emphasis being placed on ‘Green’ policies, the automotive industry appears to be already on the hunt for materials that have a lower impact on the environment for use in vehicle interiors. It is widely argued by UNEP that the automotive sector has a sizable influence on global CO2 emissions, which drives the search for sustainable materials for the manufacturing of automotive parts, including seat covers.

Tesla, Audi, Volvo, and other auto manufacturers have already begun a trend to use vegan leather and other eco-friendly materials in interior cars. EU’s Green Deal and other international sustainability strategies have plans for reducing the emission levels in production, driving the increase in the use of eco-friendly materials in the automotive sector. Furthermore, this demand is expected to spur due to the growing market of electric vehicles since people shifting to electric vehicles are environmentally sensitive individuals.

The fabric segment held a dominant presence in the automotive seat covers market in 2023, as they are cheap and easy to wash and reuse. Surge in the future due to advances in fabric technologies, including stain resistance factor and other enhanced durability. The U. S. Department of Energy’s Vehicle Technologies Office has reported that the improvements in textile engineering are boosting the use of fabric seat covers. Furthermore, the current market advancement in vehicle accessories and the low cost of fabric seat covers further fuels the segment in the coming years.

The leather segment is expected to grow at a notable rate in the automotive seat covers market during the forecast period of 2024 to 2034. Leather remains the most popular material, as people enjoy its feels, long it lasts, and easy to clean. This material managed to gain a rather large market share thanks to the continuing passion for better vehicle interiors. The International Organization of Motor Vehicle Manufacturers (OICA) shows the growth rate of luxury vehicles, most of which are fitted with leather interiors. Additionally, the European Automobile Manufacturers Association (ACEA) data shows that the demand for high-quality materials remains high, which boosts the demand for leather.

The passenger car segment accounted for a considerable share of the automotive seat covers market in 2023 due to the high sales volume and consumers’ increasing demand for interior styling. Furthermore, the increasing level of comfort and beauty of the car’s interior is anticipated to be instrumental in fuelling the segment.

The commercial vehicles segment is anticipated to grow at the highest CAGR in the automotive seat covers market during the studied years, owing to the emphasis put on the durability of the vehicles and comfort of the drivers in the commercial segment. Moreover, the growing demand for strong, quality, and safety cum comfort requirements for seat covering for long-haul drivers further propels the segment.

The OEM segment led the global automotive seat covers market in 2023, due to the relatively high volume of direct deliveries of seat covers during the process of car manufacturing. Original equipment manufactured seat covers are usually installed directly into the vehicles during production and possess quality and design requirements given by vehicle makers. OEM seat covers are considered preferable, as they are designed to match vehicle specifications and are part of measures to deter automotive interior quality and durability.

The aftermarket segment is projected to expand rapidly in the automotive seat covers market in the coming years. Self-ownership of automobiles and recent trends such as car modification are expected to turn into key drivers towards the growth of aftermarket seat covers. Clients demand newer, trendy seat covers, comfortable designs, and protection from the original seats, which are likely to boost the growth of the aftermarket sector.

Segments Covered in the Report

By Material Type

By Vehicle Type

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

April 2025

January 2025