What is the Automotive Steel Market Size?

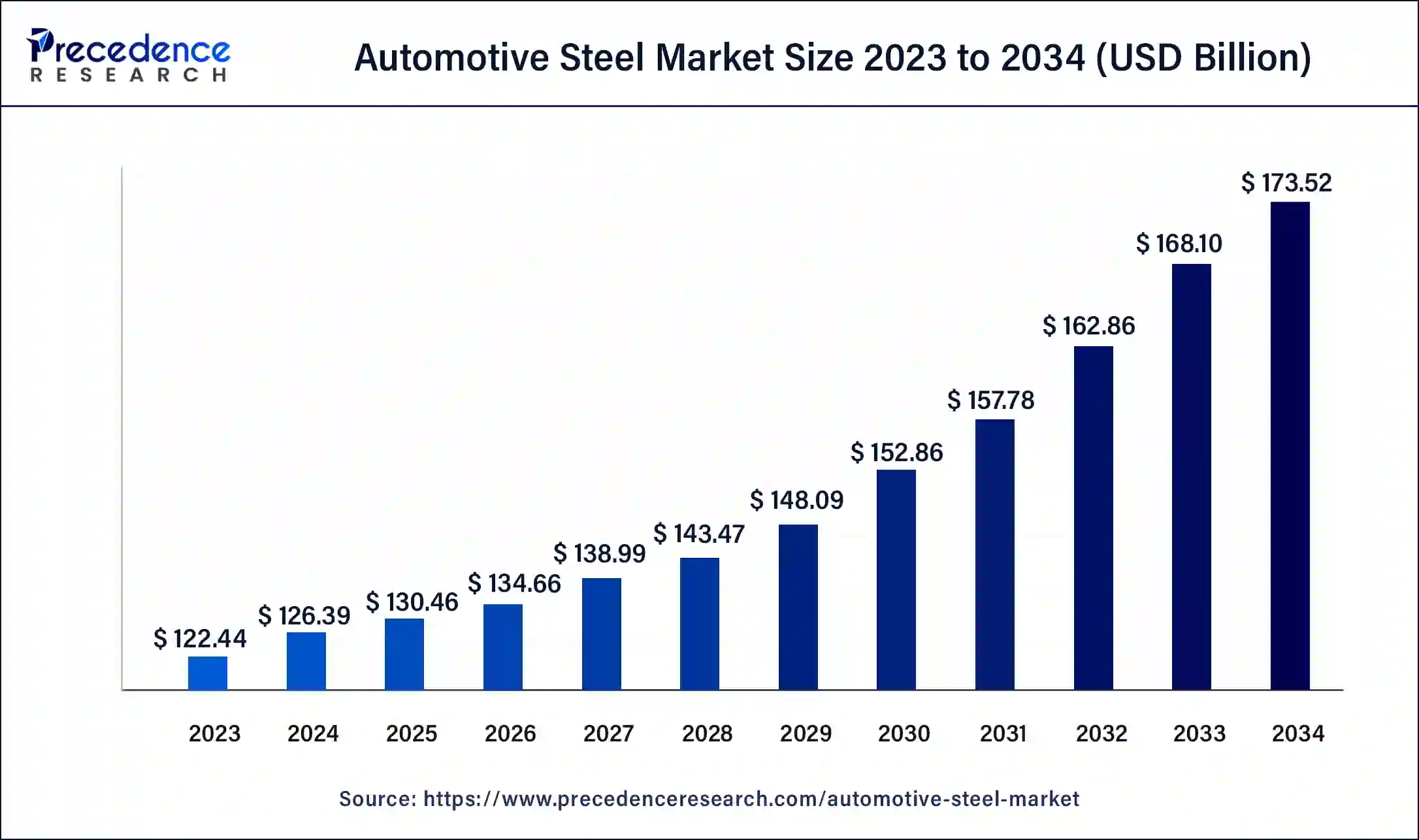

The global automotive steelmarket size is calculated at USD 130.46 billion in 2025 and is predicted to increase from USD 134.66 billion in 2026 to approximately USD 178.82 billion by 2035, expanding at a CAGR of 3.20% from 2026 to 2035.Since automotive steel is a key component used in the construction of car bodywork and other parts, the demand for it is increased by the ongoing increase in demand of the automotive steel market worldwide.

Automotive Steel Market Key Takeaway

- In terms of revenue, the automotive steel market is valued at $130.46 billion in 2025.

- It is projected to reach $178.82 billion by 2035.

- The automotive steel market is expected to grow at a CAGR of 3.20% from 2026 to 2035.

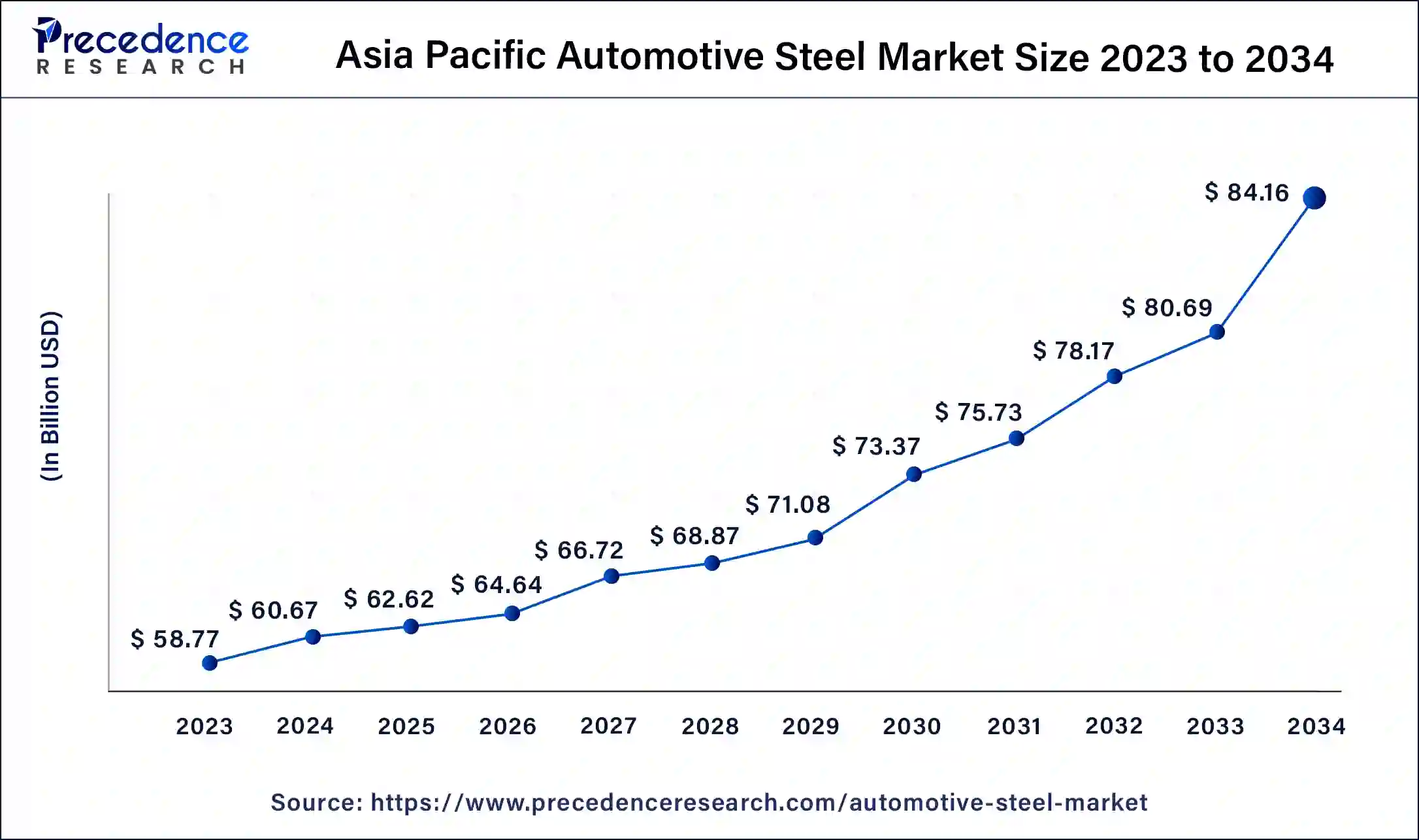

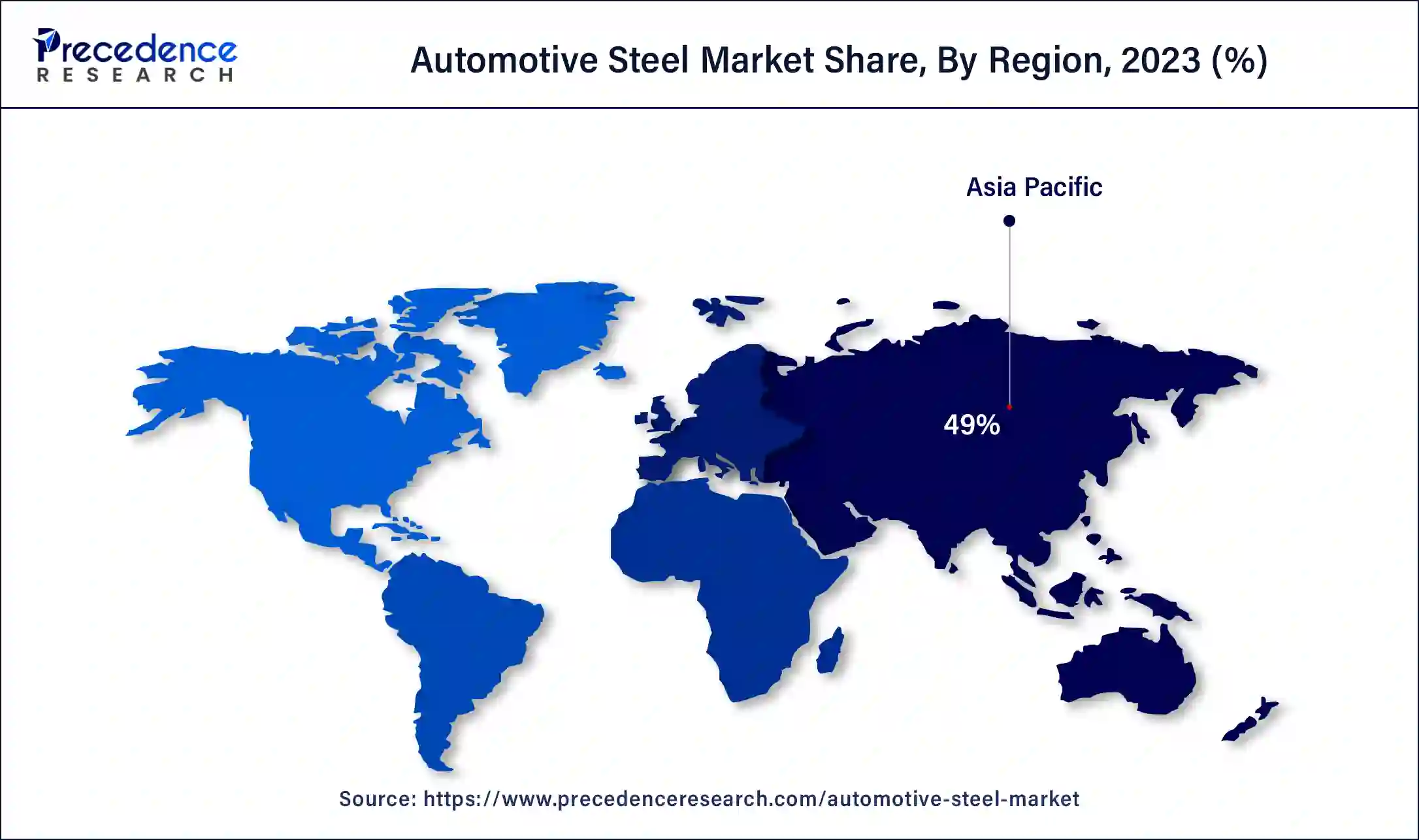

- Asia Pacific led the automotive steel market with the highest market share of 49% of market share in 2025.

- North America is expected to grow at a CAGR of 3.14% during the forecast period.

- By vehicle type, the passenger vehicle segment contributed the largest market share of 74% of market share in 2025.

- By vehicle type, the light commercial vehicles segment is expected to grow at the fastest rate in the market during the forecast period.

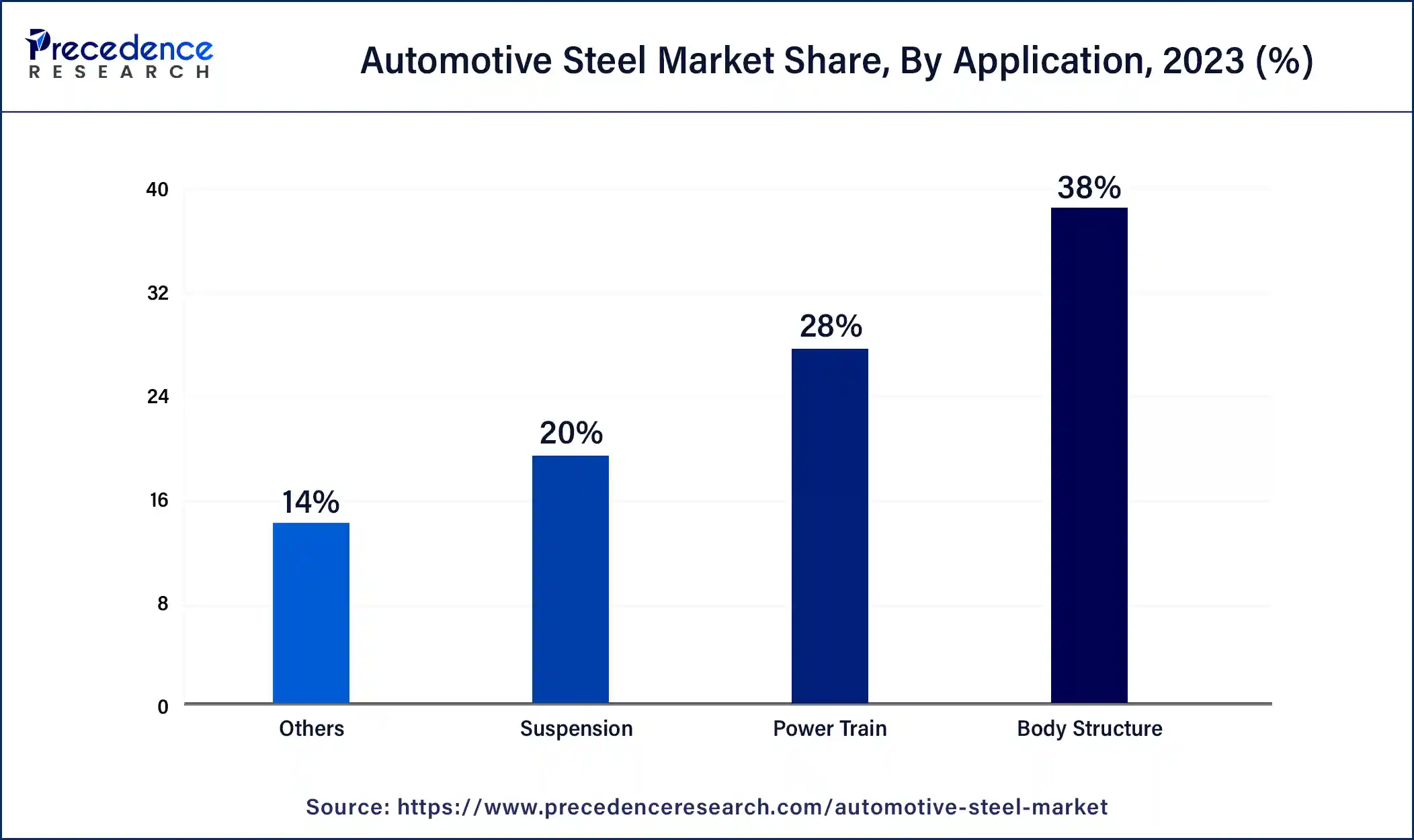

- By application, the body structure segment generated the biggest market share of 38% in 2025.

- By application, the suspension segment is projected to grow at a notable CAGR of 3.12% during the forecast period.

What is automotive steel?

The growing demand for automobiles globally, particularly in emerging nations, has been driving the automotive steel market, which has been expanding steadily. The development of high-strength steel variations and technological breakthroughs are also driving market growth. Automobile production is increasing, especially in China and India, which drives up demand for automotive steel. Automakers are being compelled by strict emission laws enforced by governments across the globe to employ lightweight materials like high-strength steel in order to improve fuel efficiency. Advanced high-strength steels (AHSS) must be used in vehicles in order to increase safety standards and comply with crash test rules without increasing weight.

Because of its exceptional strength-to-weight ratio, which contributes to lighter vehicles and increased fuel efficiency, AHSS is becoming more and more popular. Because of UHSS's extraordinary strength, which improves car safety characteristics, it is also being utilized. As the market for electric vehicles (EVs) expands, certain steel grades that are both lightweight and battery pack-compatible are being developed. A threat to the steel market comes from the car industry's investigation of lightweight substitutes for steel, including aluminum, magnesium, and composite materials. Steel producers must continually innovate and adapt to advances in material science and manufacturing techniques. The automotive steel market is anticipated to keep expanding as steel technology advances and consumer demand for safer, more fuel-efficient cars rises.

How Artificial Intelligence is Transforming the Automotive Metal Market

The adoption of artificial intelligence by steel industries is helping optimize operations, and improving safety with a reduction in overall costs. The application of AI by steel companies helps to improve product quality by automating the identification and classification of defects. AI also assists with predictive maintenance of steel products and ensures high quality control standards, contributing to the optimization of performance parameters.

A smart sensor is used to collect data from each stage of production; from raw materials to the finished product. AI algorithms analyze this data to improve quality and efficiency in the quality control of products. AI algorithms can also identify possible operational issues in the early stages and recommend solutions to resolve them with precision and accuracy. Implementation of robotics in the steel manufacturing process helps by reducing the load of dangerous, complicated tasks to be performed, improving safety of workers and minimizing waste by providing energy-efficient production solutions.

- In June 2024, Tate Steel Nederland announced the launch of an innovative, precisely designed recycled steel product named Zeremis Recycled available to the consumers from automotive, construction, and packaging industries. It has addressed the carbon emission challenges and focused on adopting a decarbonization approach making the environment greener, cleaner, and safer.

Automotive Steel Market Growth Factors

- The automotive steel market demand is expanding due to the growing global car market, especially in emerging economies. Increased output volumes demand greater raw resources, including steel.

- Vehicle performance and safety have increased thanks to the development of advanced high-strength steel (AHSS). Automakers seeking to increase safety standards and fuel efficiency find AHSS appealing since it enables the design of lighter, stronger, and safer vehicles.

- Worldwide, governments are enforcing more stringent regulations pertaining to fuel efficiency and emissions. This forces automakers to employ lightweight materials-like high-strength steel-in order to lighten vehicles and increase fuel economy without sacrificing security.

- The need for particular kinds of steel, which are utilized in EV battery packs and structural components, is being driven by the growing production and use of electric vehicles. High-strength, lightweight steel is necessary to maximize EV performance and safety.

- The creation of new steel grades and more effective production methods are examples of innovations in the steel manufacturing process that are lowering prices and improving the qualities of automotive steel, increasing its appeal to manufacturers.

- The automotive steel market is being positively impacted by the growing popularity of sport utility vehicles (SUVs) and crossovers, which typically require more steel due to their greater size and higher safety regulations.

- Building more infrastructure, especially in emerging nations, helps the automobile sector flourish, which in turn raises the need for automotive steel.

- Consumer spending power rises as a result of economic development in areas like the Asia Pacific, Latin America, and some sections of Africa. This boosts car sales, which in turn raises the demand for the automotive steel market.

- Due to its high recyclable content, steel is becoming more and more popular in the automotive industry. Steel's continuous usage in the production of automobiles is supported by its effective recycling.

Automotive steel market outlook

Between 2025 and 2030, this market is expected to rise significantly due to the rising sales of automotive globally, coupled with the rapid expansion of the steel manufacturing industry.

Numerous market players are actively entering this market, drawn by collaborations, R&D, and business expansions. Several steel companies, such as China Steel Corporation, Nucor Corp., HBIS, Baowu, and some others have started investing rapidly for developing high-quality steel for the automotive sector.

Various startup brands are engaged in delivering steel to the automotive sector. The prominent startup companies dealing in automotive steel consist of Hertha Metals, Meranti Green Steel, POSCORE, and some others.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 178.82 Billion |

| Market Size in 2025 | USD 130.46 Billion |

| Market Size in 2026 | USD 134.66 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 3.20% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Vehicle Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Rising demand for lightweight vehicles

To fight climate change, governments all around the world are enforcing strict emissions rules. Lightweight automobiles help manufacturers meet these rules by reducing greenhouse gas emissions. Advanced high-strength steel technology has allowed for the production of lighter cars without sacrificing durability or safety. Because it reduces weight and has greater strength, AHSS is a material of choice for automakers. In general, lighter cars have superior handling and performance qualities. The need for lightweight automotive solutions is being driven by consumers who are looking for high-performance vehicles. In line with global sustainability aspirations, the automotive steel market is also investing in sustainable manufacturing techniques to lessen the environmental impact of steel production.

Restraint

Raw material price volatility

One of the main basic materials used to make steel is iron ore. The mechanics of global supply and demand, geopolitical unrest, and the state of the economy of major producing nations like Australia and Brazil all affect its prices. Energy-intensive steel production uses a lot of fuel and power. Volatility in steel pricing can be caused by changes in energy prices, which are frequently impacted by geopolitical issues and market speculation. The price of imported raw materials from other nations is impacted by exchange rate fluctuations in the automotive steel market. Imports of raw materials can be more expensive or less expensive depending on how strong the local currency is. Natural disasters, logistical difficulties, and political unrest are examples of events that might interrupt the supply chain and result in shortages of raw materials and price increases.

Opportunity

Global market expansion

Determine which areas are seeing an increase in steel usage and automobile production. The three main automotive steel markets are Asia Pacific, Europe, and North America, each with unique regulatory frameworks and preferences. Verify adherence to regional environmental and vehicle safety norms. This includes regulations pertaining to vehicle safety and emissions that influence material selections. Keep abreast of developments in automotive steel, including ultra-high-strength steels (UHSS) and advanced high-strength steels. These materials help achieve fuel efficiency targets by improving vehicle safety and light-weighting. Establish collaborations with suppliers, research centers, and automakers to jointly create solutions suited to local needs. Partnerships can hasten product uptake and market entry.

Segment Insights

Vehicle Type Insights

The passenger vehicle segment held the largest share of the automotive steel market in 2025. Since it accounts for a sizable amount of the steel demand in the automobile industry, the passenger car segment is important to the market. Steel is a common material used in passenger cars because of its strength, low cost, and capacity to take on intricate designs. Steel is utilized in automobile applications for safety features, including door beams and seat frames, as well as body panels, chassis, and structural elements. Regulations pertaining to vehicle safety and emissions, vehicle production trends, and technological developments in steel manufacture all have an impact on the demand for automotive steel in the passenger car market.

The light commercial vehicles segment is expected to grow at the fastest rate in the automotive steel market during the forecast period. Particularly in Asia Pacific, light commercial vehicles (LCVs) are important to the automotive steel industry. These commercially used light trucks, vans, and pickups are among the vehicles that primarily depend on steel for their durability, safety features, and structural integrity.

LCVs are a significant market segment in the automotive steel industry that drives demand for several steel grades, including advanced high-strength and high-strength steels (AHSS). Manufacturers emphasize steel's capacity to improve fuel economy and lower emissions while also offering advantages for safety and lightweighting. Steel continues to be essential to maintaining commercial vehicle performance and safety standards, as seen by the expansion of the LCV market in Asia Pacific.

Application Insights

The body structure segment held the largest share of the automotive steel market in 2025. For current car bodywork to have the intricate shapes and designs they demand, automotive steels must have a high degree of formability. Achieving both aerodynamic efficiency and aesthetic appeal requires doing this. The steel used for car bodies needs to be sufficiently resistant to corrosion, especially in areas where rust and environmental deterioration are common.

Steel has always been heavier than substitute materials like aluminum or composites, but improvements in AHSS and novel processing methods enable substantial weight savings without sacrificing strength or safety. For instance, the strong automobile industry in Asia Pacific and the need for lightweight, high-strength materials to meet emissions regulations and increase fuel efficiency are driving forces behind the region's automotive steel market.

The suspension segment is expected to grow at the fastest rate in the automotive steel market during the forecast period. In the automotive steel market, suspensions are essential because they support and maintain structural integrity for car components. High-strength steel alloys are frequently used in automotive suspensions because of their exceptional strength, durability, and weight balancing. These components are essential for making sure cars can manage a range of road conditions and still give passengers stability and comfort. The goal of recent developments in automotive steel technology has been to reduce weight and increase strength, which has improved vehicle performance and fuel economy. With new materials and production techniques, this market is still developing while adhering to strict environmental and safety regulations.

Regional Insights

The Asia Pacific automotive steel market size is exhibited at USD 62.62 billion in 2025 and is projected to be worth around USD 87.00 billion by 2035, growing at a CAGR of 3.34% from 2026 to 2035.

Asia Pacific held the largest share of the automotive steel market. Asia Pacific is a major hub for the automotive industry, especially for nations like China, India, Japan, and South Korea. The need for automotive steel is driven by the rise in car production. The market is being helped by innovations in steel production, such as ultra-high-strength steels (UHSS) and advanced high-strength steels (AHSS). These materials provide better safety and fuel economy, which are essential for contemporary automobiles. Strong laws governing safety requirements and car emissions are pressuring producers to use premium steel. The dynamics of the steel market may be impacted by governments in the region's promotion of electric vehicles (EVs). The region's growing economies are becoming more urbanized, and there are higher rates of vehicle ownership, which is fueling demand for automotive steel.

Due to an increase in demand for lightweight fuel-efficient vehicles, growing emission regulations, Europe is the second fastest-growing region in the Automotive Steel market. The evolving landscape of automotive manufacturers, combined with technological improvements in high-strength steel production, will bolster market expansion in the region. The European steel industry, with approximately 500 production sites across 22 Member States, contributes around 80 billion to the EU's GDP and supports over 2.6 million jobs. Additionally, investments in electric vehicle support infrastructure and a commitment to sustainability and green manufacturing will enhance further opportunities for the growth of specialized steel components in the region.

What made Latin America hold a Considerable Share of the Automotive Steel Market?

Latin America held a considerable share of the industry. The growing demand for modified cars in numerous countries, including Brazil, Argentina, Peru, Venezuela, and some others, has boosted the market expansion. Also, rapid investment by steel manufacturers for opening up new production centers is expected to accelerate the growth of the automotive steel market in this region.

North America is expected to host the fastest-growing automotive steel market during the forecast period. Automakers are using ultra-high-strength steels and advanced high-strength steels to reduce vehicle weight without compromising safety as a result of the drive for fuel economy and pollution reduction. The demand for lightweight, high-performance materials is expected to fuel expansion in the North American automotive steel industry. Strong industry alliances and developments in steel technology are anticipated to support the market's growth even as it faces obstacles from substitute materials and fluctuations in the price of raw materials. The pricing volatility of raw materials such as coking coal and iron ore can affect the profitability and cost structure of steel manufacturers. Automakers and steel producers are collaborating to provide customized steel solutions that satisfy regulatory and performance criteria.

- In March 2025, Gov. Landry joined President Trump at the White House to announce plans for a USD 5.8 billion Hyundai steel mill in Louisiana as part of a USD 20 billion investment in the U.S. The project is expected to create 1,300 direct jobs with an average salary of USD 95,000 and approximately 4,100 indirect jobs, resulting in a total of 5,400 new jobs. Hyundai Steel Company President and CEO Gang Hyun Seo stated, "We plan to supply automotive steel plates not only for Hyundai Motor and Kia's strategic models but also to expand sales to U.S. automakers in the future."

The Middle East and Africa held a notable share of the market. The rising sales of luxury vehicles in various nations such as Saudi Arabia, UAE, South Africa, Qatar, and some others has driven the market growth. Additionally, the presence of various market players, coupled with technological advancements in the automotive sector, is expected to drive the growth of the automotive steel market in this region.

Automotive Steel Market- Value Chain Analysis

The raw materials used for automotive steel production are iron ore, coal, and limestone.

Key Companies: Vale, Rio Tinto, BHP and others.

The distribution channel for automotive steel is a multi-tiered supply chain that primarily flows from steel manufacturers to steel service centers/processors, and then to component suppliers and Original Equipment Manufacturers (OEMs).

Key Companies: Hyundai Steel, POSCO, United States Steel and others.

Testing and quality control (QC) of automotive steel is a rigorous, multi-stage process that involves both destructive and non-destructive testing to ensure the material meets stringent industry standards like IATF 16949 and ISO 9001.

Key Companies: Bureau Veritas, Intertek, Elemech Labs Pvt. Ltd and others.

Automotive Steel Market Companies

ArcelorMittal is a leading global steel and mining company with a presence in over 60 countries. It produces a wide range of steel products for sectors like automotive, construction, and packaging, and is a major supplier to the energy industry. The company's operations involve both steel manufacturing and the mining of iron ore and coal.

Thyssenkrupp is a German industrial and technology group that originated from the 1999 merger of Thyssen AG and Krupp. It operates across five business segments: Automotive Technology, Decarbon Technologies, Materials Services, Steel Europe, and Marine Systems.

Nippon Steel Corporation is a Japanese steel manufacturer and the world's fourth-largest steel producer. Its business is divided into four segments: steelmaking and steel fabrication, engineering and construction, chemicals and materials, and system solutions.

Hyundai Steel is a South Korean steel manufacturer, established in 1953, that produces a wide range of steel products, including hot-rolled and cold-rolled steel sheets, plates, and special steels. This company also has a focus on next-generation steel for the automotive industry and is expanding into advanced materials and hydrogen production.

POSCO is a South Korean steel manufacturing company that has expanded into other industries, including secondary battery materials and trading, through its subsidiaries. It is a global leader in steel production, known for products like cold-rolled and hot-rolled steel, stainless steel, and silicon steel sheets, which are used in various sectors, including automotive, shipbuilding, and home appliances.

United States Steel Corporation (U.S. Steel) is an American steel producer that manufactures a wide range of steel products for industries like automotive, construction, and energy. Its products are used in the automotive, construction, energy, and appliance industries, among others.

JFE Holdings is a Japanese multinational corporation formed in 2002 by the merger of NKK Corporation and Kawasaki Steel. It is a holding company with core businesses in steel production and engineering, supplemented by trading.

Nucor Corp is a Charlotte, North Carolina-based company that is the largest steel producer in the United States and the largest recycler of scrap in North America. The company manufactures a wide range of steel and steel products, including raw materials such as direct reduced iron, and operates over 300 facilities primarily in North America.

Other Major Key Players

- HBIS

- Baowu

- China Steel Corporation

Recent Developments

- In September 2025, Mukand Sumi Special Steel opened a steel manufacturing plant in Kanakapura, Koppal, Karnataka, India. This new production unit is inaugurated to enhance the production of steel for the automotive industry in this nation.

(Source: motownindia.com ) - In July 2025, ArcelorMittal Nippon Steel inaugurated a new steel production unit in Gujarat. This new manufacturing plant is inaugurated to increase the production of automotive steel for the consumers of India.

(Source: domain-b.com ) - In March 2025, Hyundai Steel announced it to invest around US$5.8 billion. This investment is for opening an automotive steel factory in the U.S.

(Source: reuters.com ) - In January 2025,ArcelorMittal Nippon Steel India (AM/NS India), a prominent joint venture between global steel titans ArcelorMittal and Nippon Steel, launched advanced automotive steel production lines 2025. Dilip Oommen, CEO of AM/NS India, stated, "These two units mark a significant step toward our goal of delivering high-quality, tailored steel solutions for the automotive sector, strengthening India's steel ecosystem and reinforcing the 'Atmanirbhar Bharat' vision." Source: knnindia.co.in

- In October 2024, Flowmaster, part of the Holley Performance Brands portfolio, announced the launch of the Flowmaster Signature Series, the brand's new premium exhaust line. Engineered for increased power and performance, the next-generation exhaust system provides a finely tuned sound and features brushed stainless steel for a clean, high-end look that resists premature rusting. Source: businesswire.com

- In September 2024, GM, Hyundai signed a strategic agreement to explore future collaborations. The partnership aims to leverage the strengths of both companies to enhance efficiency, reduce costs, and accelerate the development of a broader range of vehicles and technologies. Additionally, GM and Hyundai will explore joint sourcing opportunities for critical materials like battery raw materials and steel. Source: mobilityoutlook.com

- In April 2024, The Treo Plus with a metal body is the newest electric vehicle from Mahindra Last Mile Mobility Limited (MLMML), the top-ranked electric 3-wheeler manufacturer in India. In response to consumer input, MLMML gave its immensely popular Treo Plus product a metal body. Mahindra has arranged a number of discounts with its financing partners in order to make the new Treo Plus more accessible to consumers.

- In January 2024, as of the last quarter of 2023, BYD sold more battery-powered vehicles than Tesla, making it the largest EV manufacturer in the world. However, China accounted for the majority of BYD's top-performing sales. That might alter now that the company, backed by Warren Buffett, is attempting to enter Southeast Asian, Latin American, and European markets.

Segment Covered in the Report

By Vehicle Type

- Passenger Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Application

- Body Structure

- Power Train

- Suspension

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting