January 2025

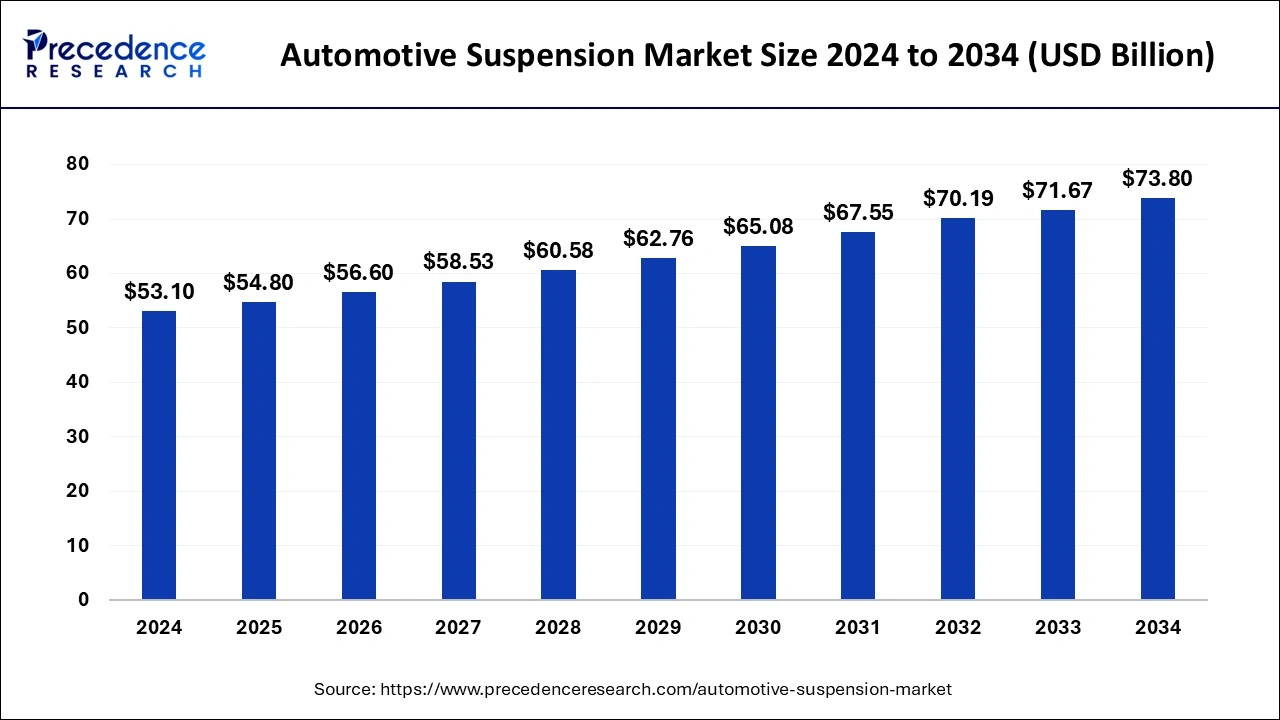

The global automotive suspension market size is calculated at USD 54.80 billion in 2025 and is forecasted to reach around USD 73.80 billion by 2034, accelerating at a CAGR of 3.34% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automotive suspension market size was estimated at USD 53.10 billion in 2024 and is anticipated to reach around USD 73.80 billion by 2034, expanding at a CAGR of 3.34% from 2025 to 2034. The rising demand for safety and comfort standards in vehicles is the key driver of the global automotive suspension market. The rising demand for premium and luxury vehicles is playing a crucial role in market growth.

AI is becoming a lifesaver for the automotive suspension market. The need for predictive maintenance to improve the overall quality, safety, and efficiency of automotive suspension is significantly encouraging the adoption of AI in manufacturing sectors. The rising demand for advanced vehicles requires cutting-edge technologies to support productivity and maintain quality and safety standards, which is becoming easier thanks to AI integration. AI algorithms provide real-time monitoring, operation optimization, and quick decision-making abilities. For the development of luxury and advanced vehicle models, AI technology is becoming essential in automotive suspension systems.

The mechanism of two adjoining parts or gears in a vehicle or locomotive, regardless of proportions and size, is known as automotive suspension. The automotive suspension systems come in a variety of shapes and sizes, including tire air and springs. It is a shock absorption process that includes the relative motion of both wheels and shock absorbers between the locative and the surface on which the machine is functioning. The main objective of an automotive suspension is to minimize discomfort and exertion in the face of adversity.

The passengers will be more comfortable, the cargo will be less damaged, and driver tiredness will be reduced on lengthy trips if the rise is of high quality. The suspension is in charge of ride quality and automobile handling control since vehicles with firm suspension may have better body control and quicker reactions. As a result of these aforementioned factors, the demand for enhanced driving comfort has increased, favorably impacting the global automotive suspension market’s growth during the forecast period. As the suspension system connects the wheel to the vehicle chassis and is one of the most important sections of a vehicle, demand for it is directly tied to new vehicle production.

| Report Coverage | Details |

| Market Size in 2025 | USD 54.80 Billion |

| Market Size by 2034 | USD 73.80 Billion |

| Growth Rate from 2025 to 2034 | 3.34% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | System Type, Vehicle Type, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Demand for luxury passenger vehicles

Passenger vehicles are widely productive vehicle types. The demand for advanced, safer, more secure, and superiorly experienced passenger vehicles has demonstrated the market. The rising demand for ride quality and handling is contributing to the market expansion. Additionally, the ability of luxury vehicle manufacturers to provide modern suspension systems is fueling the market growth. The demand for luxury passenger vehicles, including S-class and E-class, is playing a crucial role in the market.

Issues such as improved global vehicle regulations, high maintenance costs, and modern suspension systems are expected to slow the automotive suspension market’s growth. Additionally, the lack of standardization and high prices of independent suspension systems may function as a major hurdle to the market’s expansion. Consumers often prefer original equipment manufacturer (OEM) components because of their high quality and lengthy service life. However, the original equipment manufacturer (OEM)-supplied vehicle suspension parts and components are more expensive than aftermarket-supplied parts and components.

Technology developments

The adoption of cutting-edge technologies like 3D printing, active and semi-active suspension systems, air suspension systems, electronic stability control systems, and advanced sensor systems is playing a favorable role in the automotive suspension industry. Additionally, the rising adoption of predictive and adaptive suspension systems is emerging in the market. The growing adoption of automobiles due to rising population and urbanization is continually seeking better safety and quality standards. The ongoing innovation of cutting-edge technologies is supporting the market in witnessing growth opportunities. The development of sensor technologies to provide real-time monitoring and adjustments of suspension systems is expected to be a game changer for the market in the forecast period.

Based on the system type, the active suspension segment accounted largest revenue share in 2024. A control device that receives input from sensors control the vertical movement of the wheels in active suspension systems. During the projected period, the active suspension is predicted to be the market leader in suspension systems. With the help of the onboard system, it can control the vertical movement of the wheel in relation to the vehicle.

On the other hand, the semi active suspension segment is estimated to be the most opportunistic segment during the forecast period. The semi active suspensions vary the strength of the shock absorber based on dynamic driving conditions, whereas inactive suspension actuators raise and lower the vehicle independently at each wheel. The onboard computer system aids in the operation of semi active and active suspensions by sensing vehicle movement via sensors throughout the vehicle.

By vehicle, the passenger vehicle segment dominated the global automotive suspension market due to the large production value of the passenger cars. The vast demands for passenger cars are required to comply with safety and comfort standards. Passenger cars are widely produced and sold worldwide. The rising innovation and development of customized suspension systems are fueling the segment's growth.

On the other hand, the light commercial vehicle segment is expected to witness spectacular growth in the forecast period due to rising demands for commercial vehicles, including trucks, vans, and pickups. The demand for high payload capacity is the major factor driving segment growth.

Asia Pacific is Dominant

Countries like China, India, and Japan are leading the regional market. India and China are dominating the market due to their rich and well-established automotive manufacturing industries and government initiatives and investments in the expansion of the industry. The rising population has surged for luxury vehicles in Asia. The adoption of cutting-edge technologies is playing a favorable role in market expansion in India, China, and Japan.

Europe is Fastest Growing

Germany stands out in the European automotive suspension market due to its well-established automotive sectors. Presently, leading car manufacturing companies like the Volkswagen Group and BMW are also contributing to the country's market expansion. The superior focus of the competitive landscape in Germany is to develop high safety standards, ride quality, and innovative technologies, which are the major highlights of the market.

To build a firm presence in the automotive suspension market, the key market players are employing several methods such as increasing production capacity, diversifying sales and distribution networks, product differentiation and new product development, and strategic partnerships and collaborations.

By System Type

By Vehicle Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

January 2024

January 2025