January 2025

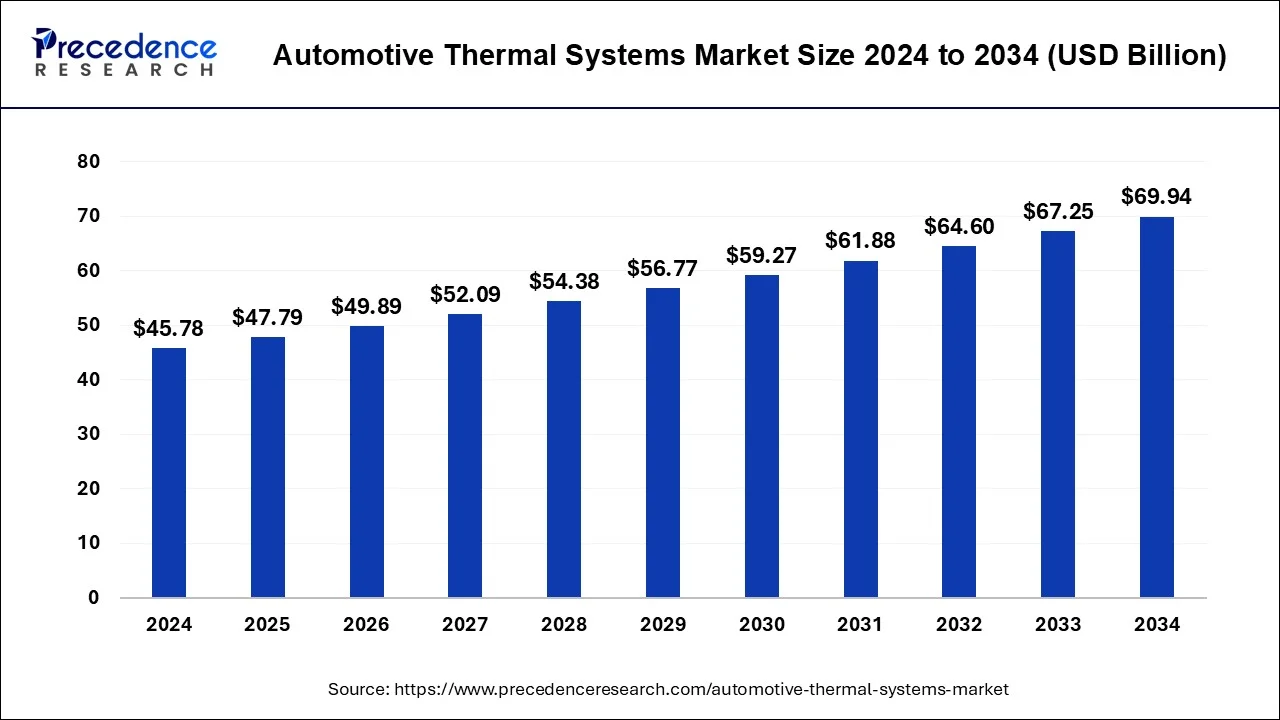

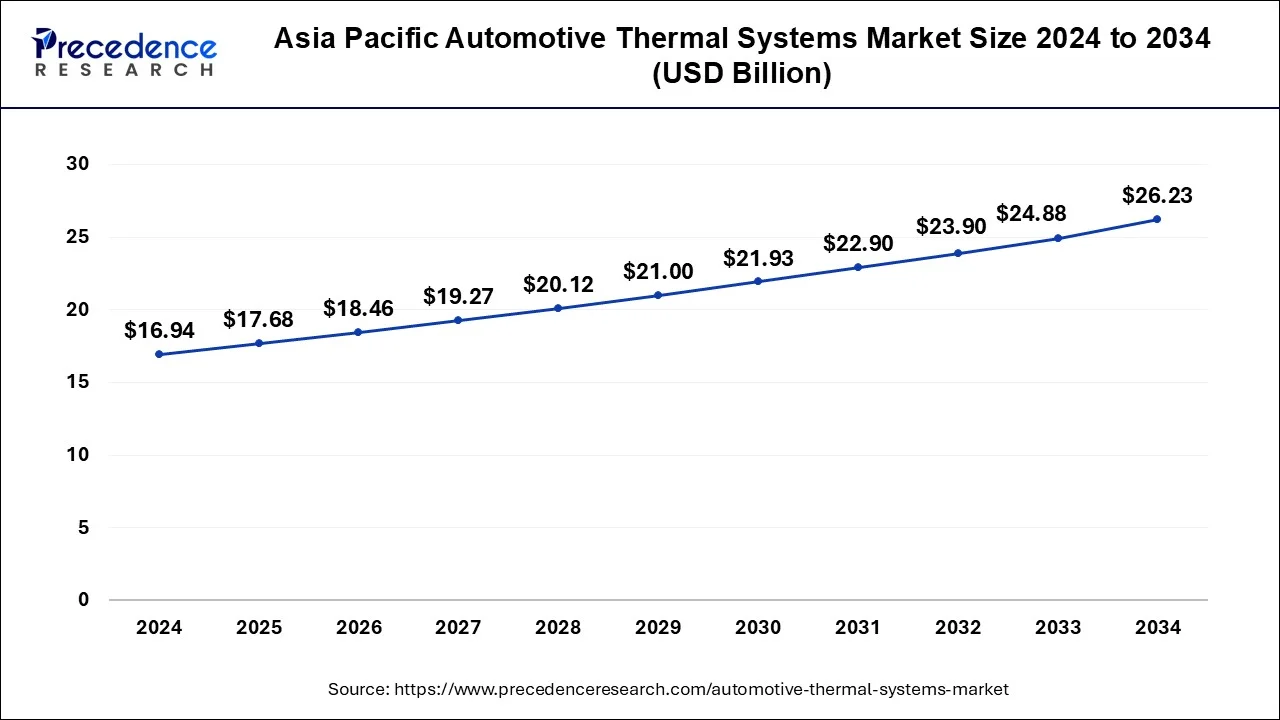

The global automotive thermal systems market size is calculated at USD 47.79 billion in 2025 and is forecasted to reach around USD 45.78 billion by 2034, accelerating at a CAGR of 4.33% from 2025 to 2034. The Asia Pacific automotive thermal systems market size accounted for USD 17.68 billion in 2025 and is expanding at a CAGR of 4.47% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automotive thermal systems market size was estimated at USD 45.78 billion in 2024 and is predicted to increase from USD 47.79 billion in 2025 to approximately USD 45.78 billion by 2034, expanding at a CAGR of 4.33% from 2025 to 2034.

The Asia Pacific automotive thermal systems market size was valued at USD 16.94 billion in 2024 and is expected to be worth over USD 26.23 billion by 2034, at a CAGR of 4.47% between 2025 and 2034.

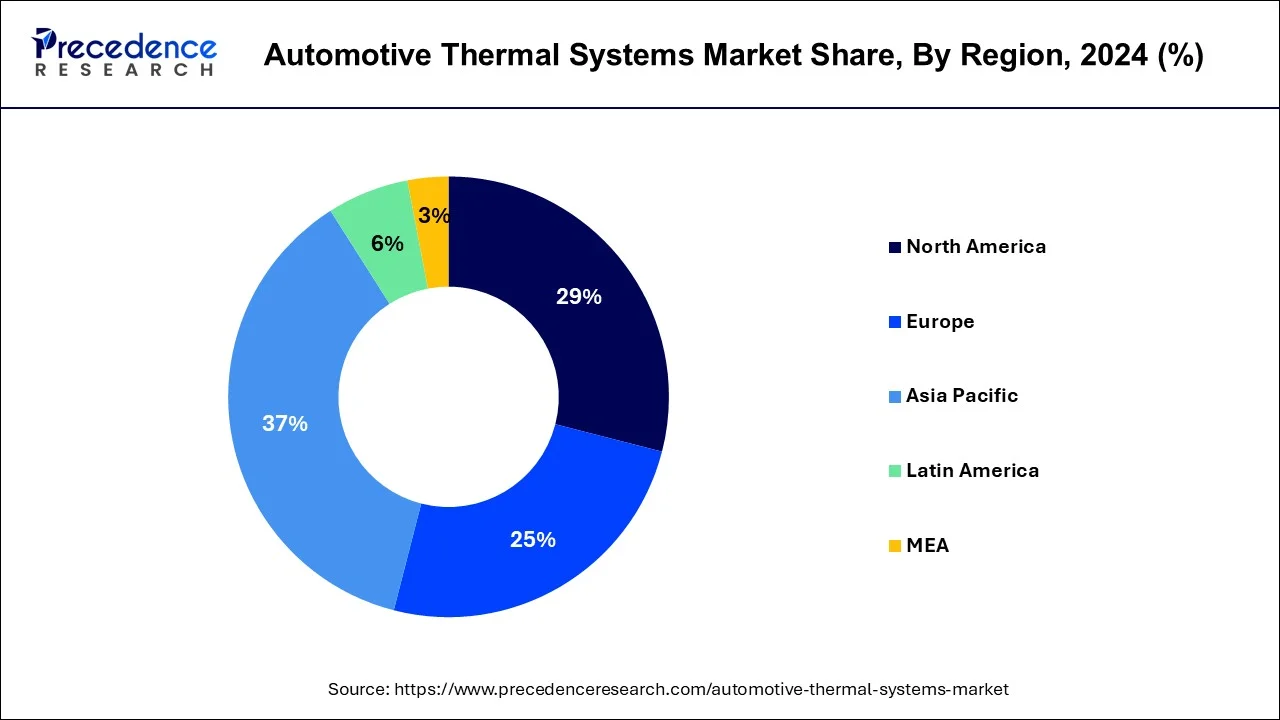

Asia-Pacific segment dominated the global automotive thermal systems market in 2024. The construction equipment and heavy trucks are being driven by huge infrastructure improvements, which are fueling the growth of the automotive thermal systems market. Furthermore, the manufacturing of a large number of automobiles in Japan, South Korea, China, and India is fueling the demand in the Asia-Pacific region.

Europe is estimated to be the most opportunistic segment during the forecast period. With the rising demand for automobiles in nations such as the UK, France, Italy, and Germany, Europe is expected to emerge as a new market, with consumers shifting their preferences toward climate control and compact, modern Heating Ventilation Air Conditioning (HVAC) systems. Furthermore, stringent government regulations are necessitating the modification and upgradation of the automotive thermal system components, which is expected to drive the demand in this sector.

The automotive thermal system regulates the temperature of the vehicle’s primary components by using alternate engine block monitoring temperatures and reducing block monitoring temperatures and reducing temperature component variations. They improve fuel efficiency and are also utilized to give a variety of interior conveniences like as front and back air conditioning, and steering and seat warmth. These devices recycle waste heat, lowering carbon dioxide emissions in automobiles. The manufacturers of heavy automobiles or vehicles used in transportation, construction, and shipbuilding industries are among the automotive thermal system market’s top purchasers.

With the advancement of automobile electronics and systems such as navigation, Heating Ventilation Air Conditioning (HVAC) systems, entertainment, and transmission, the demand for thermal systems in the automotive sector has grown dramatically during the projected period.

The automotive thermal systems market is predicted to develop due to severe emission regulations, growing demand for front and rear air conditioning, the use of turbo engines in commercial vehicles, and heated steering. In addition, the automotive thermal systems market is also predicted to rise due to the rising need for smart thermal systems in automotive and automobiles and the integration of thermal sensors in passenger cars.

On the other hand, the high cost of thermal system technology, as well as discrepancies in emission levels across nations, result in a lack of standardization, which is projected to stifle the automotive thermal system market expansion during the forecast period.

In the North America and Europe regions, where disposable income is higher, the automotive thermal systems are more often used. The Asia-Pacific region is expected to grow at a rapid pace during the forecast period. The second and third largest markets for automotive thermal systems, respectively, are the Europe and North America regions.

| Report Coverage | Details |

| Market Size by 2034 | USD 69.94 Billion |

| Market Size in 2025 | USD 47.79 Billion |

| Market Size in 2024 | USD 45.78 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.33% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Vehicle, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Based on the component, the compressor segment dominated the global automotive thermal systems market in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. One of the primary factors driving the automotive thermal systems market expansion is the rising use of compressors in A/C systems to absorb the warm air inside the automobile’s cabin.

The Heating Ventilation Air Conditioning (HVAC) segment is estimated to be the most opportunistic segment during the forecast period. The need for Heating Ventilation Air Conditioning (HVAC) systems has risen as customer’s preferences for comfort have grown. The key market players are developing products that provide various additional benefits in addition to meeting the comfort needs of customers.

Based on the vehicle type, the passenger vehicles segment accounted largest revenue share in 2024. The automotive thermal systems market is predicted to rise because to factors such as growing demand for ventilated seats, rear, and front A/C, and heated steering in passenger vehicles, as well as rising passenger vehicle sales in the Asia-Pacific region.

On the other hand, the commercial vehicles segment is estimated to be the most opportunistic segment during the forecast period. The increased per capita income and a higher standard of living are two significant factors driving the commercial vehicle sales in many countries.

Based on the application, the waste heat recovery segment leads the global automotive thermal systems market in 2024, in terms of revenue. The rising sales of commercial vehicles, as well as the standardization of exhaust gas recirculation and turbochargers, and the application of waste heat recovery technology in gasoline vehicles as a result of increased emission regulations, are some of the primary reasons driving the automotive thermal systems market expansion.

Moreover, the seat segment is estimated to be the most opportunistic segment during the forecast period. The increased use of passenger vehicles in the underdeveloped and developing economies is driving the growth of the seat segment during the forecast period.

Key Companies & Market Share Insights

The various developmental strategies such as new product launches, acquisition, partnerships, business expansion, investments, joint venture, and mergers fosters market growth and offers lucrative growth opportunities to the market players. The key market players have been investing in more complex thermal systems to increase vehicle efficiency and fulfil the growing demand for vehicle electrification systems in the global automotive sector, due to the growing trend of light weight and fuel-efficient automobiles.

Segments Covered in the Report

By Component

By Vehicle Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

January 2024

January 2025