January 2025

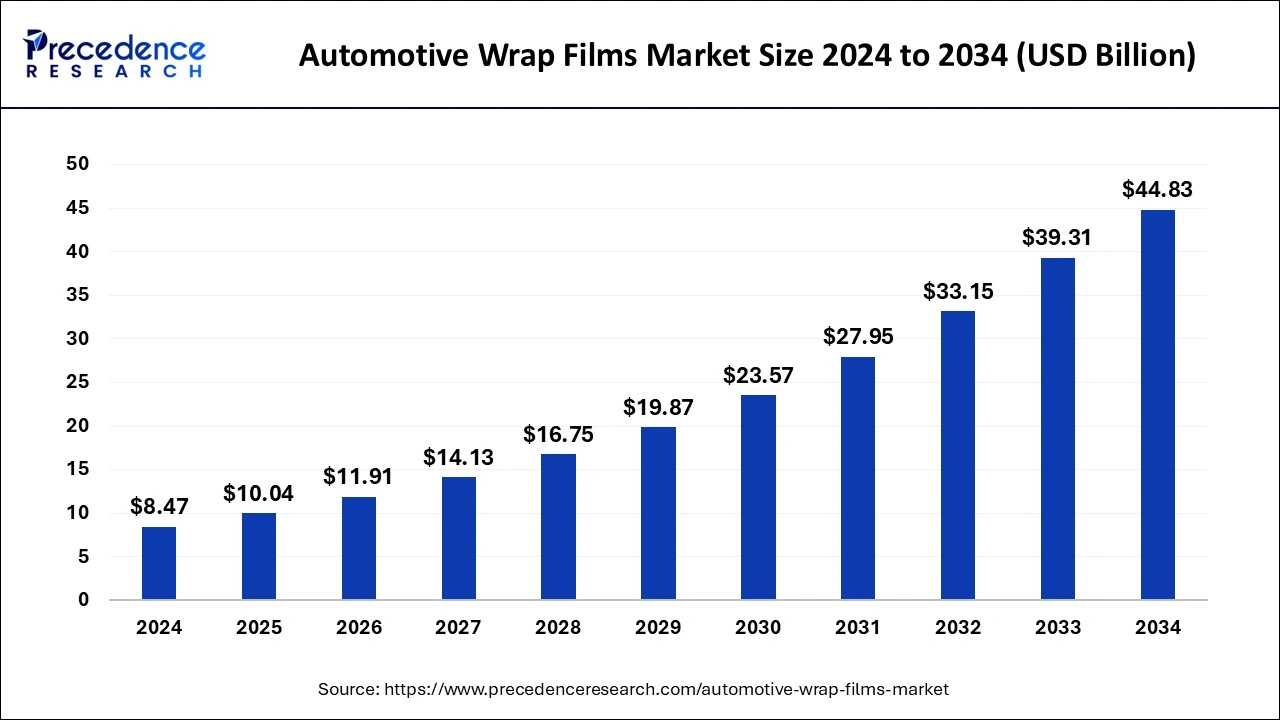

The global automotive wrap films market size is calculated at USD 10.04 billion in 2025 and is forecasted to reach around USD 44.83 billion by 2034, accelerating at a CAGR of 18.13% from 2025 to 2034. The North America automotive wrap films market size surpassed USD 3.39 billion in 2024 and is expanding at a CAGR of 18.16% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automotive wrap films market size was estimated at USD 8.47 billion in 2024 and is predicted to increase from USD 10.04 billion in 2025 to approximately USD 44.83 billion by 2034, expanding at a CAGR of 18.13% from 2025 to 2034.

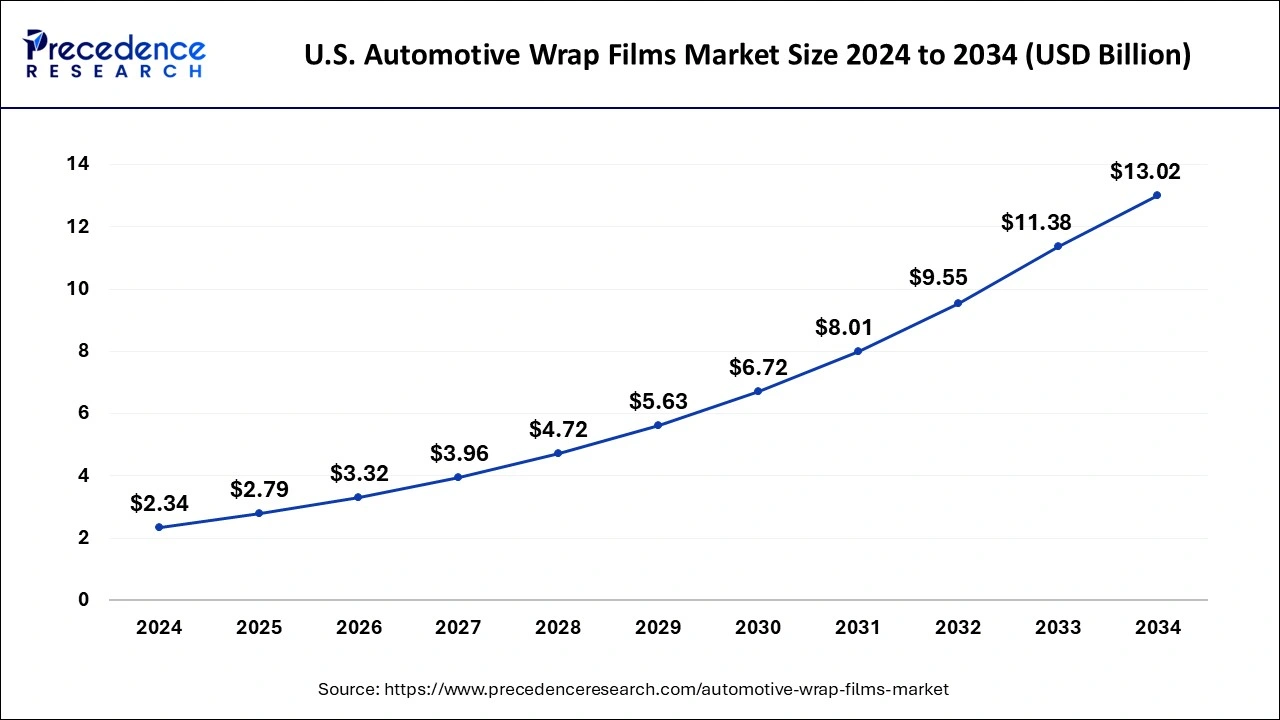

The U.S. automotive wrap films market size was estimated at USD 2.34 billion in 2024 and is predicted to be worth around USD 13.02 billion by 2034, at a CAGR of 18.72% from 2025 to 2034.

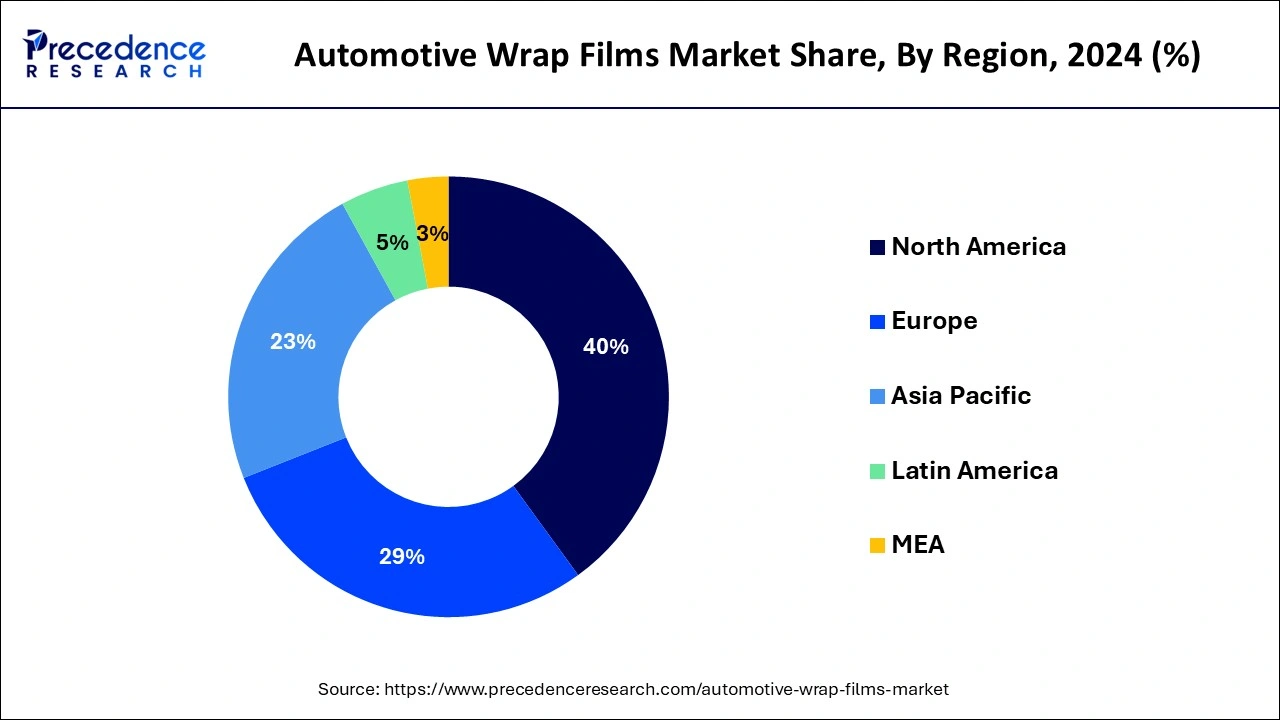

North America generated more than 40% of revenue share in 2024. Customized vehicle graphics and wraps are more popular than ever, especially among companies trying to promote their brands. automotive wrap films provide businesses with an economical and adaptable way to have their vehicles display eye-catching graphics and messaging. Second, the market has expanded due to the growing self-employment culture.

To change the color or design of their automobile without hiring an experienced painter, many people are now opting to wrap their vehicles in vinyl films. Furthermore, technological developments have produced long-lasting, high-quality automobile wrap films, increasing demand even further.

Moreover, Europe has the most significant R&D activity in creating automotive vehicles, predicted to increase demand for automotive vehicle wraps in the area.

The increase in population, urbanization, and disposable income is driving up sales on a larger scale. The advantages of automotive wrap films are:

Computer-aided design (CAD) and 3D printing technology are used to create wrap films with premium photos, logos, and stunning graphics for the benefit of the clients. By using advertising and brand promotion, the major players, including Orafol Group, Vvivid Vinyl, Hexis S.A., Avery Dennison, and JMR Graphics, Inc., aid in extending the distribution channels. In addition, it offers environmentally friendly automotive wrap films to help reduce carbon footprints.

The desire for car personalization is expected to develop significantly on a larger scale. Additionally, its control over advertising promotes market expansion. Throughout the forecast period, more R&D combined with an improvement in the economy is anticipated to boost demand for automobile wrap films. During the forecast period, the market for the product is expected to increase because of the low price of wrap films and the expanding popularity of transit advertising nationwide.

The market is divided into segments based on the kind of film, the application, and the region. Cast vinyl, calendered vinyl, and specialty films are a few of the prominent film kinds, and vehicle wraps, fleet graphics, and architectural wraps are some of the most common uses. North America and Europe lead the industry geographically, but it is also expanding quickly in developing areas like Asia Pacific and Latin America.

Automotive wrap films protect the car's original paint against abrasions, sand, dust, UV radiation, weathering from monsoons, corrosion, and more. Moreover, it provides defense against minor dings and chips. It is a fantastic option for individuals who lease their cars or constantly change their appearance because it can be removed without harming the car's original paint job. It offers countless design options due to its extensive range of colors, finishes, and textures.

There is a finish to suit any style or preference, from matte to gloss, metallic to chrome, and even textured finishes like carbon fibers, leather, wood grain, and brushed metals. This fuels the market for wrap films. Especially in emerging nations, the automobile industry is anticipated to grow further in the upcoming years. Automotive wrap films will be more and more in demand as more people buy cars.

| Report Coverage | Details |

| Market Size in 2025 | USD 10.04 Billion |

| Market Size by 2034 | USD 44.83 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 18.13% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Films, By Vehicle, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Cost-effective - Automotive wrap films are more affordable as an alternative to conventional painting, and they are more straightforward and quicker to install, demanding less work and resources. Automotive wrap film installation often takes less effort than traditional painting, which can take several days and necessitates specialized tools. This translates to lower installation costs for automobile owners. A well-maintained car wrap can help maintain a vehicle's market value.

Allowing them to sell their automobile for more money can save car owners money over time. Car owners can alter the color and appearance of their vehicles with automotive wrap film without having to shell out a significant sum of money for a new paint job. Because of its adaptability, car owners can give their vehicles a brand-new look without spending a fortune.

The graphics and sign sector are expanding, cutting costs, and raising awareness of the need for mobile advertising. Digital printing technology has allowed adding high-resolution images, patterns, and graphics to automobile wrap films. With conventional printing techniques, it was previously impossible to produce distinctive designs and wraps. The market for automobile wrap films is continually changing as new materials and technologies are created. Businesses now have the chance to stand out from the competition by providing creative solutions that address consumers' shifting needs.

Protective films shield a vehicle's original paint from dirt, dust, and scratches. An examination of the automotive wraps films market revealed that window films accounted for a sizeable market share. Window wraps reflect up to 60% of solar light, preventing severe heat accumulation and keeping the car's interior temperature stable. Wrap films also collect glass particles following an accident and reduce potential injury. They increase privacy and reduce glare, making the journey more enjoyable and secure. For instance, Avery Dennison introduced dual reflective films designed for residential and commercial applications preventing approximately 99% UV fading and sun damage.

The market is primarily made up of passenger cars. The market is divided into three categories based on the kind of vehicle: trucks, buses, and passenger automobiles. The market is divided into particular and advertisement purposes, with passenger cars contributed more than 54% of revenue share in 2024. Owing to falling costs for car wraps and rising client demand for customized vehicles. The need for modification has grown widely in terms of colors and textures. Drivers love to customize their spots with spot graphics and calligraphy for advertising and personalization.

Over the projection period, it is anticipated that continued industrialization and rising government measures to support various policies in nations like India would fuel the expansion of the bus segment. Due to the booming global construction industry, the trucks segment of the automobile wrap film market is experiencing strong industrial growth in emerging economies and rising demand from the logistics and construction industries. For example, the recently unveiled Hyundai Creta is one of the most well-liked SUVs in its class, and this market contends with vehicles like the Kia Seltos and MG Hector.

It is now a typical sight on our highways because it is so well-liked. Many aftermarket accessories and customization choices have begun to appear on the market. This video shows a new generation Hyundai Creta that differs from standard models, and it is likely the first Creta in the nation to have PPF, or Paint Protection Film, applied to it in a matte finish.

The advertising sector dominates the automotive wrap films market's overall revenue share. That is due to the expanding trend of vehicle advertising and brand promotion. Growing demand for customized vehicles and changing customer lifestyles will significantly impact category growth. The rising demand for wrap advertisements is a factor in the sector's rapid industrial expansion because they are practical and affordable.

Mobile advertising has become a powerful and economical advertising strategy in recent years. With automobile wrap films, any vehicle—whether a van, minivan, or bus—can be transformed into a moving billboard, attracting more and more people daily and fueling the segment's expansion, particularly for luxury cars like Mercedes, Porsche, VW, and BMW. Police officers now deploy vehicle wrap films, commonly called ghost vinyl, to maintain traffic order and public safety.

By Films

By Vehicle

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

April 2025

January 2025