April 2025

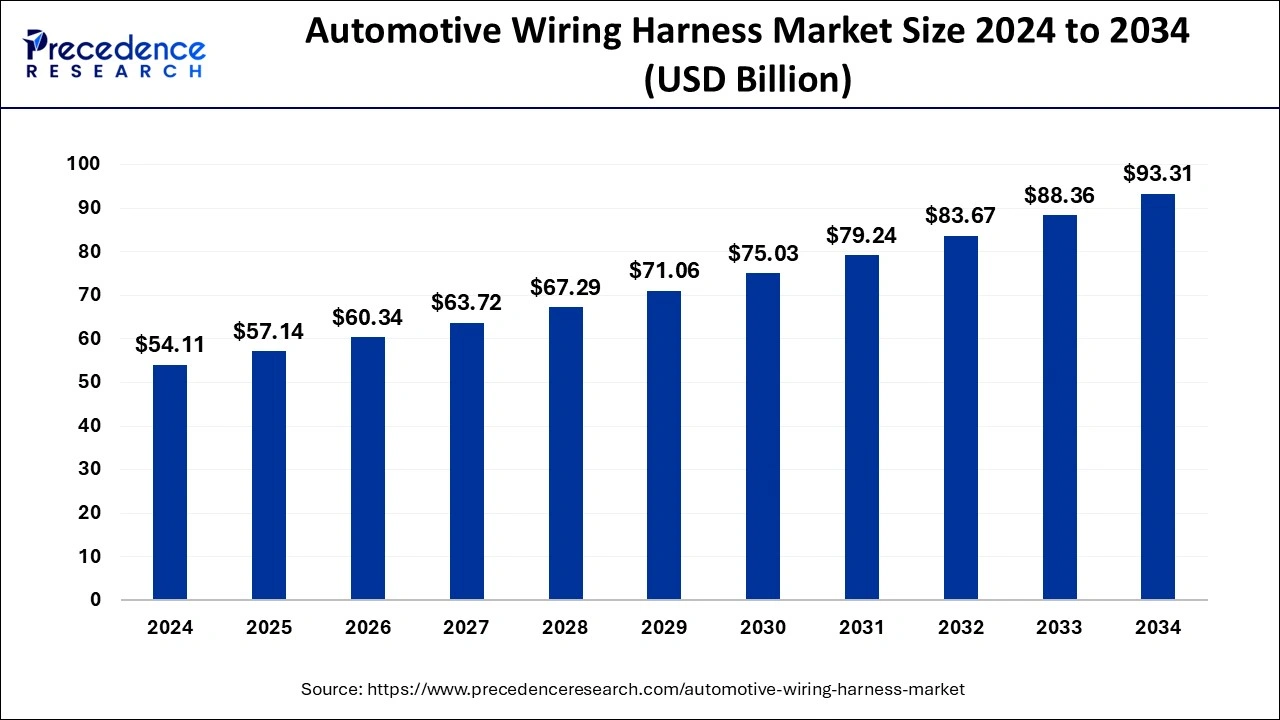

The global automotive wiring harness market size is calculated at USD 57.14 billion in 2025 and is forecasted to reach around USD 93.31 billion by 2034, accelerating at a CAGR of 5.60% from 2025 to 2034.

The global automotive wiring harness market size was estimated at USD 54.11 billion in 2024 and is anticipated to reach around USD 93.31 billion by 2034, expanding at a CAGR of 5.60% from 2025 to 2034. The automotive wiring harness market is driven by the adoption of electric vehicles.

Artificial intelligence algorithms understand spatial problems within vehicles, which ensures the optimal arrangement of wiring components that leads to more efficient usage of space and a reduction in the overall weight of the wiring harness. This method can automatically create wiring harness designs derived from vehicle specifications and needs, reducing the demand for excess human intervention.

By reducing the wiring harnesses length and optimizing equipment placement, producers can significantly reduce material costs and labor hours. AI algorithms lead to eco-friendly designs by optimizing wiring harnesses for energy efficiency and reducing environmental impact.

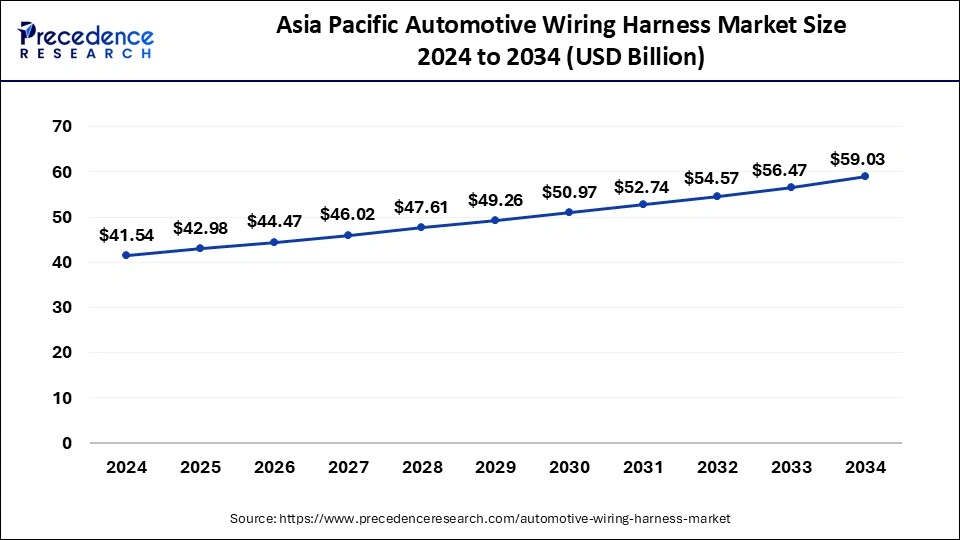

The Asia Pacific automotive wiring harness market size was evaluated at USD 25.97 billion in 2024 and is predicted to be worth around USD 44.79 billion by 2034, rising at a CAGR of 5.63% from 2025 to 2034.

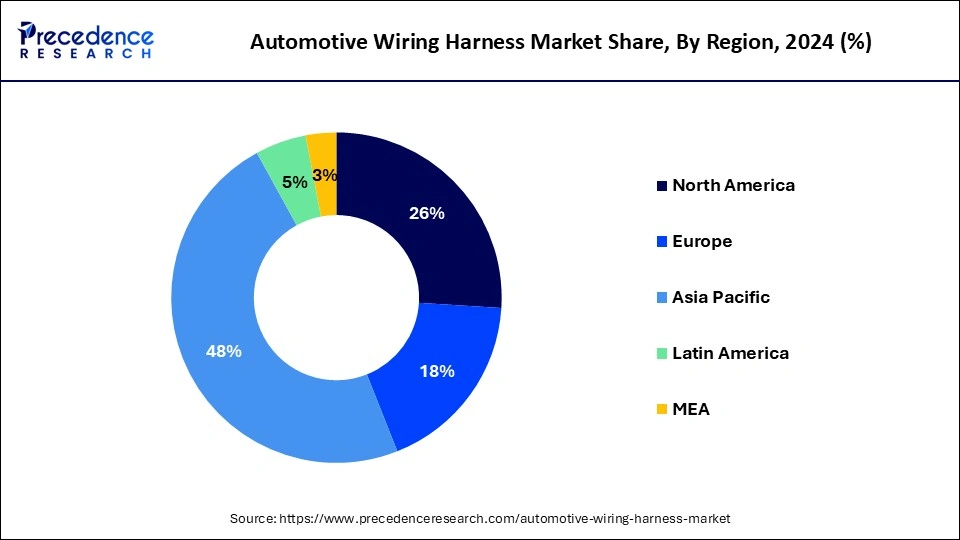

Asia Pacific dominated the global market with the largest market share of 48% in 2024. Luxury car sales in China have been so robust that prominent luxury players like Maserati and Lamborghini observed their finest year for their sales growth in 2016. This growth lead to increased vehicle production over past few years in China, Japan, and India, vehicle. Several dominant market competitors of luxury cars including Volkswagen, BMW, Mercedes Benz, Daimler, Porsche and Audi have vigorously developed their footprint in Asian nations particularly in China. Further, there is a great demand for vehicle access control in this region.

India holds the highest market share in the Asia-Pacific automotive wiring harness market. The growth of automotive wiring harness market in Asia-Pacific region is being driven by the growing government initiatives and growing fundings for expansion and development of new technologies. The largest automobile manufacturer in the world is China. As a result, the Chinese market for automobile wire harnesses is expected to expand rapidly. Lightweight wiring harnesses are a priority for Chinese original equipment manufacturers.

In 2024, Europe also gathered a noteworthy share in the global automotive wiring harness market. Existence of prominent automobile manufacturers like BMW, Audi and Mercedes Benz in this region is propelling the growth.

North America is the largest segment for automotive wiring harness market in terms of region. This can be attributed to increased road building initiatives as well as increased car production, particularly in developing economies like the U.S. In addition, rising demand for enhanced safety and convenience features in mid-segment vehicles, as well as cheap labor costs, are driving up sales. As a result, rising automobile manufacturing, drive technology improvement, and widespread use of electric vehicles are expected to fuel demand in North America.

An automotive wiring harness is a collection of wires, terminals, and connectors that run throughout the car and convey data and power. Governments all across the world are promoting the use of electric vehicles. Electric vehicles are eco-friendly and help to reduce pollution. Electric vehicles are powered by electricity, and any damage to the wiring harness might result in catastrophic vehicle damage. As a result, the demand for technologically improved high voltage wire harness in electric vehicles is likely to drive market expansion.

Rising demand from consumer end, rapid growth of the manufacturing sector, presence and development activities of vehicle OEMs, augmented implementation of advanced vehicle technologies on account of surge in per capita income are some of the major factors driving the growth of automotive wiring harness market. Further, growth in vehicle electrification and preference to nominal human efforts are heightening the importance of wiring harness across automotive sector. Growing incorporation of electronic devices inside vehicles to offer improved safety features has clearly impacted growth of the market. Engaging these systems in a vehicle gives many paybacks like heightened performance, upgraded fuel efficacy, and small likelihood of electrical shortage. Pioneering software tools have played an essential part in streamlining the design process and reducing the amount of design errors.

| Report Highlights | Details |

| Market Size in 2024 | USD 54.11 Billion |

| Market Size in 2025 | USD 57.14 Billion |

| Market Size by 2034 | USD 93.31 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.60% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Material, Propulsion, Transmission, Vehicle, Sales Channel, Geography |

Surge in demand for light weight harness

Specialty cables are in high demand due to their lighter weight, lower cost, and smaller bundle diameter. There will be plenty of demand for cameras, displays, and other infotainment applications, resulting in the development of new techniques to combine video and camera signals into a single specialty cable, decreasing the weight and expense of wiring harnesses even further. For lightweight and high-speed harnesses, original equipment manufacturers chose aluminum and optical fiber. Thus, this factor is driving the growth of global automotive wiring harness market.

Unstable prices of materials

Copper prices have been volatile, affecting demand for optical fiber cables in the global market. Original equipment manufacturers emphasize the use of optical fibers that are more durable than copper/aluminum and can endure hard environments and weather. The relatively higher expense of optical fiber cables, on the other hand, is likely to limit its adoption in the global market.

Growing advanced features of vehicles

The desire for driver aid technologies to integrate advanced features in automobiles has been spurred by a growing awareness of safety and security. Vehicle makers must also adhere to safety regulations and include features such as airbags. Ambient lighting, chilled cupholder, voice recognition, heated steering wheels, heated seats, digital display, better infotainment capabilities, and extra power steering functions have all gained popularity among consumers as ways to improve the driving experience.

Short life of wiring harness

Due to rapidly changing surroundings such as extreme hot to extreme cold temperatures and fast temperature swings, the wiring harness can bend. These issues might cause the wiring harness to deteriorate and shorten its lifespan. As a result, this is a major challenge for the market growth.

This research study segments this market on the basis of type into, chassis wiring harness, body & lighting harness, dashboard/cabin harness, engine harness HVAC wiring harness, battery wiring harness, seat wiring harness, wiring harness and sunroof wiring harness.

The dashboard/cabin harness segment holds the largest market share in the global automotive wiring harness market. The growth of the segment is attributed to the growing demand for various types of vehicles. Among all, dashboard/cabin harness sector dominates the global automotive wiring harness market on account of growing implementation of displays on dashboards and infotainment systems in different types of vehicles. Incorporation of systems including active health monitoring and heated seats upsurges utilization of wiring harness in vehicles seat. As a result of thispushes the growth prospects of seat harness segment of this market.

Based on material, the automotive wiring harness market is classified into metallic and optical fiber. The optical fiber is then divided into plastic optical fiber and glass optical fiber. The metallic segments is categorized into aluminum, copper, other metals. the copper segment contributed the highest market share of 65% in 2024.

At present, metallic wiring harnesses are considered together a greater market share. However, the acceptance of optical fibers, predominantly plastic variants, is expected to achieve noteworthy grip during years to come. Elevated demand for high-speed data transmission from several vehicles OEM is pushing the growth of optical fiber cables in different vehicles. On the other hand, copper may not serve the necessities of forthcoming technologies and functions. Optical fiber cables have a comparatively greater speed compared to copper and other materials. Optical fiber with growing need for advanced features such as automatic door locking, augmented dashboards, ADAS, automatic gear box, and in electric and ICE vehicles, projected to show lucrative demand in near future.

Among different transmission types, electric wiring is expected to show potential demand on the basis of its greater demand for electricity transfer compared to data transmission in mid-segment and entry vehicles. During years to come sales of semi-autonomous and autonomous vehicles is anticipated to surge. This as a resultwill support sale of highly advanced systems with more complicated and cutting-edge wiring harness.

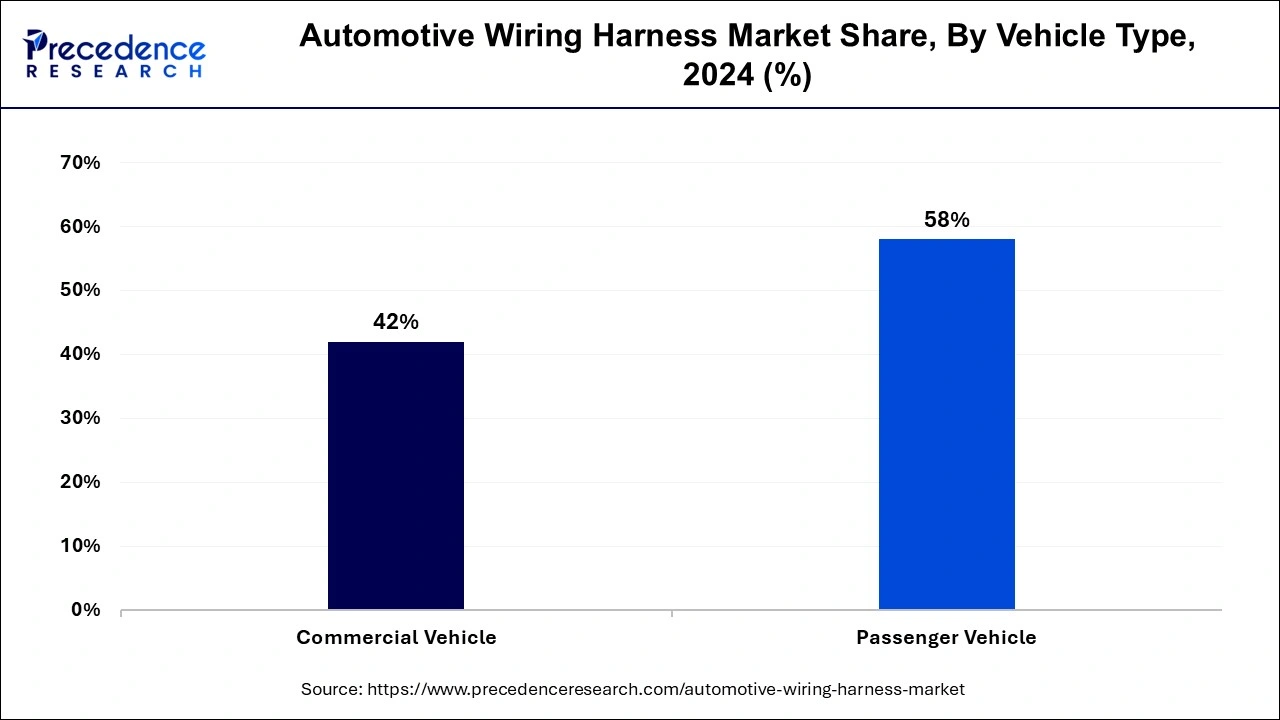

Among different vehicles, the passenger cars segment generated the major market share of 58% in 2024. Improved fuel combustion and low maintenance are expected to promote the acceptance of automotive wiring harness in the coming years.

A passenger vehicle is a four-wheeled vehicle with at least two axles and its own driver. Its main purpose is to transport passengers. The vast majority of passenger cars are public transportation vehicles.

At present, BEVs have achieved popularity on account of their capability to provide numerous societal, environmental, and health assistance. They are incorporated with more user-friendly features since there is augmented need for ease and amenity in passenger cars. This in turn supports the sale of number of wires in wiring harness.

By Type

By Material

By Propulsion

By Transmission

By Vehicle

By Voltage

By Sales Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2024

January 2025

January 2025