March 2025

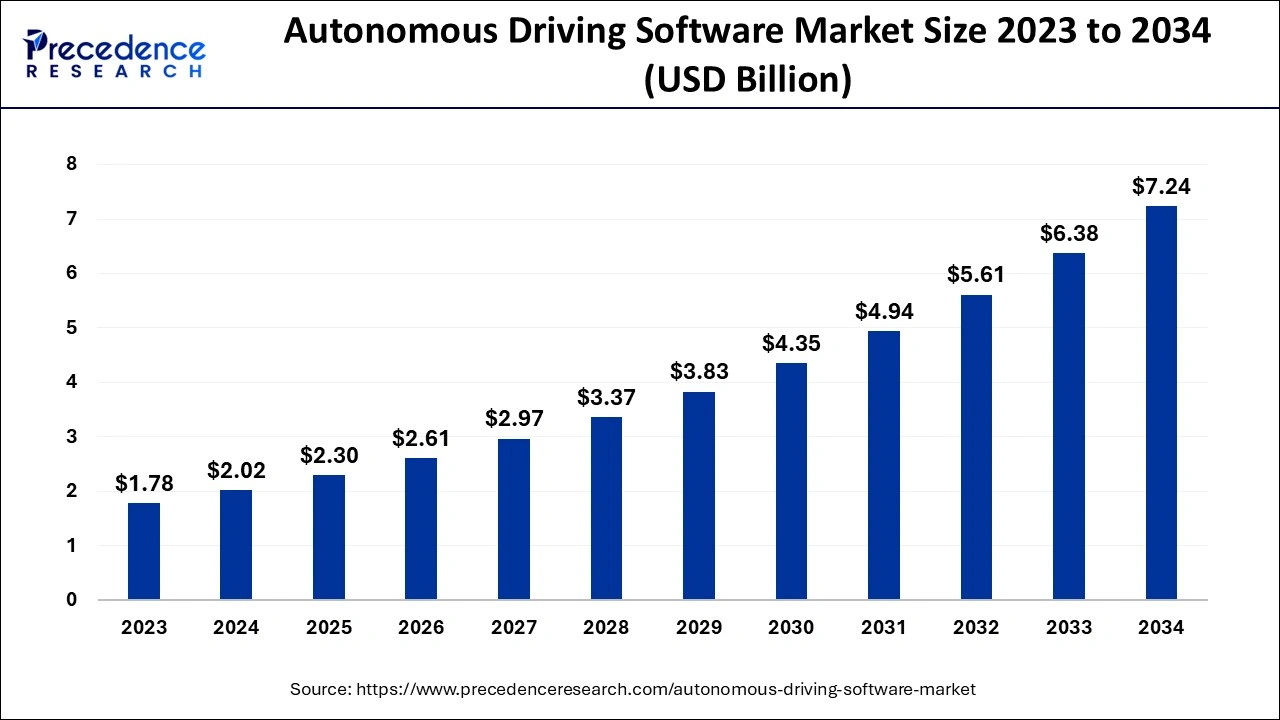

The global autonomous driving software market size is evaluated at USD 2.02 billion in 2024, grew to USD 2.30 billion in 2025 and is projected to reach around USD 7.24 billion by 2034. The market is expanding at a CAGR of 13.61% between 2024 and 2034. The North America autonomous driving software market size is calculated at USD 0.79 billion in 2024 and is expected to grow at a fastest CAGR of 13.79% during the forecast year.

The global autonomous driving software market size accounted for USD 2.02 billion in 2024 and is predicted to surpass around USD 7.24 billion by 2034, growing at a CAGR of 13.61% from 2024 to 2034. The autonomous driving software market growth is attributed to the increasing advancements in AI-driven software and rising demand for safer, more efficient transportation solutions.

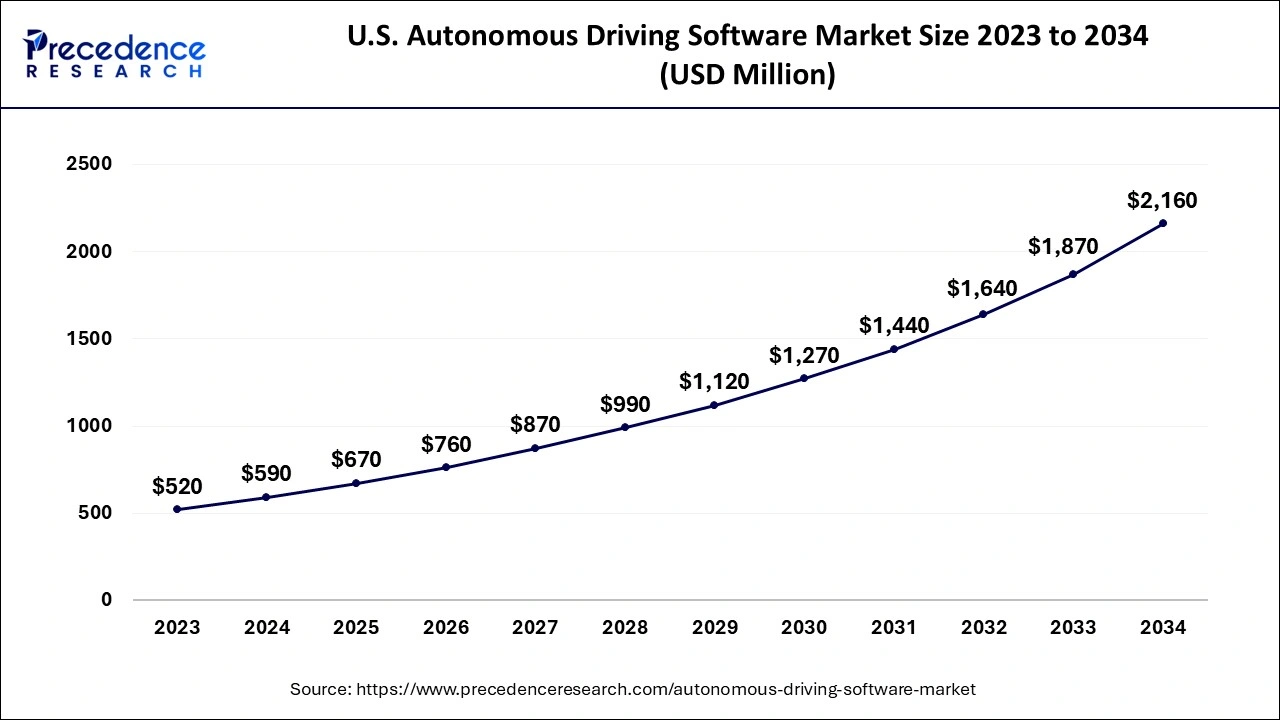

The U.S. autonomous driving software market size is exhibited at USD 590 million in 2024 and is anticipated to be worth around USD 2,160 million by 2034, growing at a CAGR of 13.82% from 2024 to 2034.

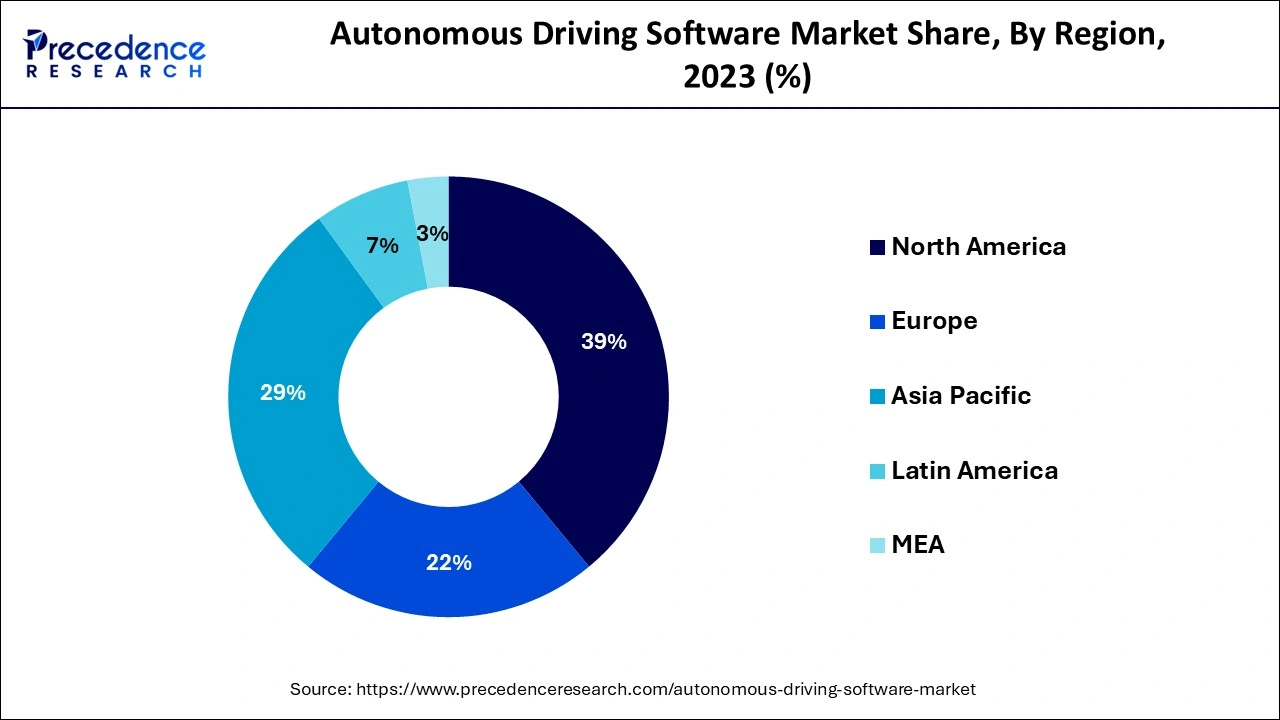

North America dominated the autonomous driving software market in 2023 due to its developed technology endowment, technology intensity of industries, and first-mover advantage in innovation and implementation of Level 4/5 AV technologies. The increase in investment in this segment is attributed to giants such as Tesla, Waymo, and General Motors, as well as huge R&D expenditures. Furthermore, the government policies and regulation systems, mainly in the United States, provided support and facilities to build and test autonomous driving systems.

Asia Pacific is projected to host the fastest-growing autonomous driving software market in the coming years, owing to continued urbanization, higher funding for smart mobility applications, and influential governmental policies supporting the improvement of self-driving cars. China, Japan, and South Korea are most active in this connection, and both public and private entities are actively engaged in the developmental processes of AV technology. The rapid rise in China’s ambitions of becoming a world power for autonomous driving with the help of its industrial plan ‘Made in China 2025’ and vast investments into artificial intelligence are expected in the region. Additionally, the region has a relatively large population, and more densely populated cities develop transport networks.

The increased need for safe and efficient transportation solutions fuels the growth of the market for autonomous driving software. They found that autonomous driving technology is implemented in different levels of autonomy, which include Level 2 vehicles with assistant driving systems and Level 3 to 5, which are fully driverless cars. Such systems depend on difficult programming algorithms to analyze information collected from cameras, radar, or LiDARs to help vehicles see the environment, decide on actions, and perform them.

The increasing uptake of Artificial Intelligence (AI) and machine learning, along with the increasing investment in smart city technology, will further boost the autonomous driving software market in the coming years. The World Health Organization, which promotes road safety, agrees with such measures, stating that self-driving abilities reduce a large number of fatalities in accidents.

Impact of Artificial Intelligence on the Autonomous Driving Software Market

In the autonomous driving software market, real-time analytics improved decision-making opportunities in the form of complex data pulled at high rates from sensors, cameras, and radar systems by AI-powered systems. This technology enables driving software to detect complex traffic conditions, identify the risks, and rapidly react to them. AI enables the identification of patterns that compromise the performance of a vehicle, which further minimizes breakdown risks and further crates demand for advanced AI-powered autonomous driving software. Furthermore, these technologies allow the exchange of information to improve traffic flow and reduce fuel consumption.

| Report Coverage | Details |

| Market Size by 2034 | USD 7.24 Billion |

| Market Size in 2024 | USD 2.02 Billion |

| Market Size in 2025 | USD 2.30 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 13.61% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Level Of Autonomy, Vehicle Type, Software Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Rising consumer demand for driverless mobility solutions

Rising consumer demand for driverless mobility solutions is anticipated to fuel the autonomous driving software market. Increased customer interest in a self-driving transport system is due to the high levels of urbanization and a deteriorating traffic situation, which is offering demand for an alternative to their current modes of transport. The environmental issues, including the pressure to cut back on emissions, also contribute to the growth of driverless systems. Introducing self-driving cars has been estimated by federal ministries, such as the U.S. Department of Transportation, to strongly contribute to the decrease of traffic density and the improvement of safety. Moreover, various companies, such as Mercedes-Benz, have planned to introduce Level 3 autonomous vehicles in the markets of Nevada and California in 2024.

Impede consumer safety concerns

Concerns regarding the safety of autonomous driving systems are likely to hinder the autonomous driving software market growth. There is still a great reluctance of many customers to entrust their lives to fully autonomous vehicles, as well as the possibility of failure, having an accident, or hacking. Such accidents include those involving the leading brands of self-driving cars, which have ramped up these concerns, causing delays among potential users. Changing the mind of the consumer that these systems are useful, efficient, safe, and utilized routinely to undertake their daily activities.

Surging technological advancements

Soaring technological advancements in AI and machine learning are likely to create immense opportunities for players competing in the autonomous driving software market. The rapidly developing tech spheres of artificial intelligence or machine learning give a unique opportunity to work on the autonomy of the car. The changes in sensor fusion, perception algorithms, and processing of real-time data make the cars respond better to the complex environment on the road. These changes improve the robustness of self-contained solutions and contribute to better decision-making in terms of safety and accuracy. Furthermore, a study conducted by the U.S. Department of Transportation states that the incorporation of AI capabilities into transport systems enhances traffic control, thus boosting the demand for autonomous driving software technology.

The L2+ segment held a dominant presence in the autonomous driving software market in 2023, as it helped to improve safety and convenience at the same time, implying the need for human intervention. Such systems, which perform certain functions such as steering and acceleration, became popular in premium and mid-range cars as producers used demand for affordable and precise ADAS solutions. Moreover, government initiatives, such as the European Commission Vision Zero Initiative, further boost the segment.

The L3 segment is expected to grow at the fastest rate in the autonomous driving software market during the forecast period of 2024 to 2034, owing to the ongoing development of this technology to process large amounts of real-time data. Regulatory support has promoted scale-up and commercialization of L3-capable vehicles. These systems provide precise control over limited autonomy models with human supervision. Moreover, this technology increases the general level of safety and contributes to improving the client’s comfort during the driving process.

The passenger cars segment accounted for a considerable share of the autonomous driving software market in 2023 due to the growing customer interest in the sophisticated ADAS in these types of vehicles. The upsurge of false accident claims and fatalities on roads due to negligence and reckless driving creates demand for autonomous driving software among passengers. This further encouraged car manufacturers to integrate autopilot components in the cars being produced. A report compiled by the U.S. Department of Transportation also revealed that there was growth in the sale of passenger cars that are fitted with L2+ and L3 systems, as they offer better safety, compliance with legal norms on fuel consumption, and enhanced maneuverability, especially in busy cities. Moreover, the European and other international committees approved the use of such technologies in passengers' care.

The commercial vehicles segment is anticipated to grow with the highest CAGR in the autonomous driving software market during the studied years, owing to the growth of autonomous trucks and ride-hailing services. The use of autonomous driving software technologies in commercial vehicles continues to grow due to the need to cut costs, enhance the efficiency of operations, and enhance safety in long-distance transport and distribution. Moreover, the rising demand for efficient and autonomous delivery and transportation services, especially in urban ecosystems, boosts the demand for autonomous driving software-equipped commercial vehicles.

The ICE segment led the global autonomous driving software market. These vehicles have been familiar with modern ADAS mainly deployed in the premium and mid-range car models that help to make the drive better and safer. Established production and supply systems for mass ICE vehicles also worked in their favor, as manufacturers were able to apply these technologies at scale with minimal structural changes to the cars. Furthermore, the solid position in the ecosystem of autonomous drivers of ICE vehicles further contributes to boosting the segment.

The electric segment is projected to expand rapidly in the autonomous driving software market in the coming years, owing to the growing emphasis on emissions control and the integration of renewable energy sources worldwide. EVs are incorporated with highly developed software systems and electronic architecture. Additionally, the combination of electric propulsion and self-driving technology facilitates the widespread adoption of EVs.

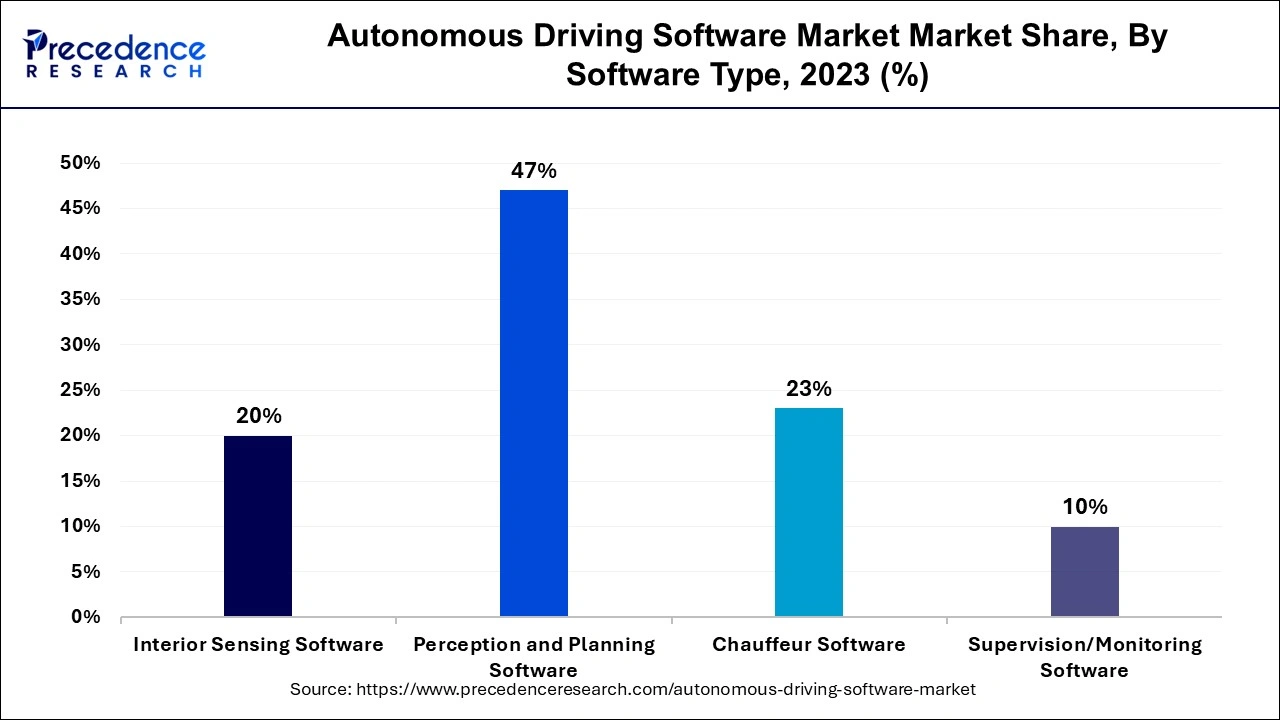

The perception & planning software segment dominated the global autonomous driving software market in 2023 due to its importance in allowing vehicles to understand their environment and make instant decisions. This utilizes the collected input data from the camera, radar, and LiDAR. Basis on this software constructs a three-dimensional map of the car environment, which then enables the system to locate the obstacles, read traffic signs, and estimate traffic conditions. Furthermore, the growing demand for autonomous vaccines creates demand for these types of software.

The chauffeur software segment is projected to grow at the fastest rate in the autonomous driving software market in the future years. Chauffeur software enables the car to assume complete control of driving in the specific environment under conditions where Levels 3 and 4 automation are attained. The utilization of chauffeur software has grown due to the demand for autonomous cars, which subsequently provide a driving experience without requiring human interference. The features of the software include highway driving, urban commuting, and parking in very congested areas. Additionally, the development of self-driving cars is suitable for ride-hailing services and personal use.

Segments Covered in the Report

By Level of Autonomy

By Vehicle Type

By Propulsion

By Software Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

October 2024

November 2024

October 2024