Autonomous Trucks Market Size and Forecast 2024 to 2034

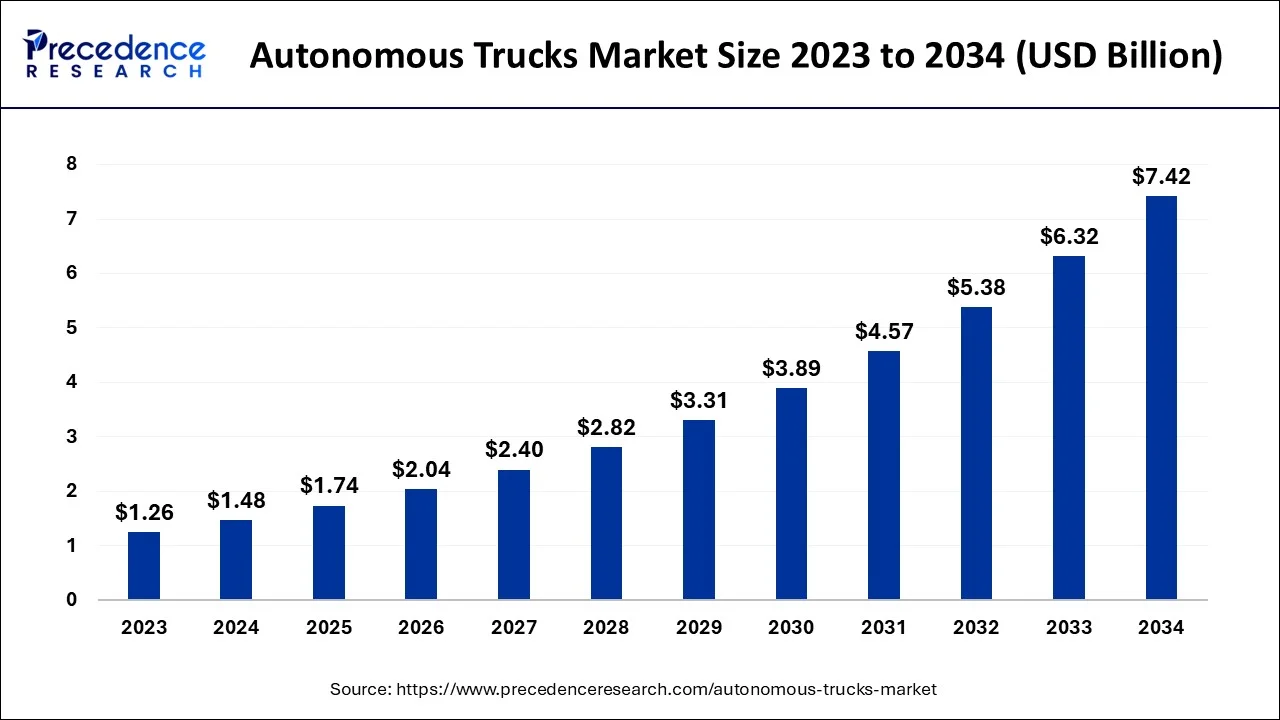

The global autonomous trucks market size was estimated at USD 1.48 billion in 2024 and is predicted to increase from USD 1.74 billion in 2025 to approximately USD 7.42 billion by 2034, expanding at a CAGR of 17.49% from 2025 to 2034.

Autonomous Trucks Market Key Takeaways

- North America region is expected to expand at the fastest CAGR between 2024 and 2034.

- By types, the heavy-duty trucks segment generates for majority of the market.

- By level of autonomy, the semi-autonomous contributes to the largest of the market.

- By ADAS, the blind spot detection segment is recording the maximum of market.

- By component types, the sensors segment generates for majority of the market.

- By drive type, the electric capturing for highest of the highest market.

Market Overview

The autonomous truck market refers to the industry that produces and sells self-driving trucks or autonomous vehicles that can control without a human driver. These trucks use various technologies such as sensors, cameras, radar, lidar, and GPS to navigate the roads and transport goods from one location to another.

The market for autonomous trucks is growing rapidly, driven by increased demand for efficient and safer transportation, technological advancements, and the need to reduce labor costs. Autonomous trucks have the potential to revolutionize the transportation industry by improving efficiency, reducing accidents, and lowering operating costs. The market includes several players, including technology companies, truck manufacturers, and logistics companies, who are investing in developing and deploying autonomous trucks. While the market is still in its initial stages, it is expected to grow significantly in the coming years as the technology improves and more companies adopt autonomous vehicles in their operations.

Furthermore, Developing advanced sensors, machine learning algorithms, and communication technologies has made autonomous driving more viable and reliable, leading to more investments and innovations in the field. Also, governments worldwide are encouraging the adoption of autonomous trucks through policies and regulations that support research and development, testing, and deployment of the technology. Thus, these factors further create demand in the market

However, with the technology's ability to fully replace human drivers in all situations, the general public may have concerns about the safety and reliability of autonomous trucks, and the cost of implementation is anticipated to impede market growth. Despite significant advancements in autonomous driving technology, there are still limitations in the technology's ability to replace human drivers in all situations fully. For instance, driving in extreme weather conditions or poorly marked roads can be challenging for autonomous trucks.

The lockdown measures implemented by various governments in anticipation of the COVID-19 pandemic have disrupted global supply chains, leading to delays in the deployment and production of autonomous trucks. The pandemic has also increased demand for contactless delivery, increasing demand for autonomous trucks as a safer alternative to traditional trucking.

Market Scope:

| Report Coverage | Details |

| Market Size in 2024 | USD 1.48 Billion |

| Market Size in 2025 | USD 1.74 Billion |

| Market Size by 2034 | USD 7.42 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 17.49% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Types, Level of Autonomy, ADAS, By Component Types, Drive Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, andthe Middle East & Africa |

Market Dynamics

Key Market Drivers

Reduce labor costs, fuel consumption, and maintenance costs to brighten the market prospect

Labor costs can be reduced as autonomous trucks do not require a human driver to operate the vehicle, eliminating the need to pay for wages, benefits, and overtime. Additionally, autonomous trucks can operate continuously without needing rest breaks or shift changes, increasing productivity and further reducing labor costs. Furthermore, fuel consumption can also be reduced with autonomous trucks. These vehicles can be programmed to optimize their routes, avoid congestion and reduce idling time, resulting in fuel savings. In addition, autonomous trucks can maintain a consistent speed, reduce aggressive acceleration and braking, and take the most fuel-efficient route, resulting in further fuel savings.

Moreover, maintenance costs can also be reduced with autonomous trucks. These vehicles can be designed with more durable and reliable components, reducing the need for repairs and replacement. Additionally, autonomous trucks can monitor their performance, detect potential issues, and schedule maintenance proactively, reducing downtime and maintenance costs. Thus, autonomous trucks can offer several benefits to companies, including cost savings, increased productivity, and improved safety. Companies can improve their bottom line by reducing labor costs, fuel consumption, and maintenance costs while benefiting from a more efficient and sustainable supply chain.

Reduce accidents caused by human error

Human error, such as driver fatigue, distraction, or impaired driving, can lead to accidents that result in property damage, injuries, and even fatalities. Autonomous trucks can eliminate these risks by removing the human driver from the equation. Autonomous trucks have advanced sensors, cameras, and radar systems to detect obstacles, monitor traffic, and identify potential hazards. These systems can respond much faster than a human driver and are not subject to the same limitations, such as fatigue or distraction. They are also programmed to follow the rules of the road, maintain a safe following distance, and avoid dangerous maneuvers, such as sudden lane changes or abrupt braking. By doing so, they can reduce the risk of accidents caused by driver error.

In addition to these safety features, autonomous trucks can also be equipped with communication systems that enable them to communicate with other vehicles on the road and with traffic control centers. This can help to improve coordination and reduce the risk of accidents caused by miscommunication or misunderstanding. Therefore, autonomous trucks can potentially reduce accidents caused by human error by eliminating the human driver from the equation and replacing them with advanced sensors and communication systems that can respond faster and more accurately than human drivers.

Key Market Challenges

The high cost of implementation is causing hindrances to the market

The cost of implementing autonomous trucks can be a significant barrier for companies, especially small businesses, and may prevent them from investing in this technology. Autonomous trucks require complex and advanced technology, such as sensors, software, and communication systems, which can be expensive to develop and maintain. It requires advanced infrastructure, such as high-speed internet, GPS, and charging stations, which can be costly to build and maintain. Also, deploying autonomous trucks requires training for drivers and other workers to operate and maintain the technology, which can be time-consuming and costly.

Thus, the high cost of implementation is a significant barrier to adopting autonomous trucks. However, as technology advances and becomes more widespread, the costs are expected to decrease, making it more accessible for companies of all sizes to invest in this technology. The potential benefits of autonomous trucks, such as increased efficiency, improved safety, and reduced environmental impact, could outweigh the initial costs in the long run, making it a worthwhile investment for companies.

Key Market Opportunities

- Increased efficiency and productivity

- Technology advancements

- Improved road infrastructure

Types Insights

On the basis of types, the autonomous trucks market is divided into light-duty trucks, medium-duty trucks, and heavy-duty trucks, with the heavy-duty trucks segment accounting for most of the market. This is because heavy-duty autonomous trucks have a weight-carrying capacity of over 26,000 pounds and are commonly used for long-haul transportation and freight delivery.

Level of Autonomy Insights

On the basis of the level of autonomy, the autonomous truck market is divided into semi-autonomous and fully autonomous, with semi-autonomous accounting for most of the market. This is because these trucks have some degree of automation but still require human intervention or oversight. For instance, semi-autonomous trucks may have features like adaptive cruise control, lane departure warning systems, and automated braking systems. However, a human driver is still required to operate the vehicle in some capacity, such as steering or monitoring the road conditions. It is worth noting that the transition from semi-autonomous to fully autonomous trucks may occur gradually. Some vehicles may possess varying degrees of autonomy depending on the specific use case and the level of automation technology available.

ADAS Insights

On the basis of advanced driver assistance systems (ADAS) features, the autonomous trucks market is divided into adaptive cruise control, lane departure warning, intelligent park assist, highway pilot, automatic emergency braking, blind spot detection, traffic jam assist, and lane keeping assist system, with the blind spot detection segment accounting for most of the market. This feature uses sensors to detect vehicles or objects in the truck's blind spots and alerts the driver to their presence. These ADAS features can enhance autonomous trucks' safety, efficiency, and comfort and may be incorporated into different levels of autonomy.

Component Types Insights

On the basis of the component types, the autonomous truck market is divided into LIDAR, RADAR, camera, and sensors, with sensors accounting for most of the market. This is because Various types of sensors, such as ultrasonic, infrared, and temperature sensors, can detect obstacles and other objects in the truck's path, providing information on distance, shape, and texture. These components work together to provide the truck's autonomous driving system with the information needed to navigate the environment, detect obstacles, and make real-time decisions. Different combinations of these components can be used depending on the specific requirements of the autonomous truck and the level of autonomy desired.

Drive Type Insights

On the basis of the drive type, the autonomous trucks market is divided into IC engine, electric, and hybrid, with electric accounting for most of the market. This is because there is growing interest and development in electric drive type for autonomous trucks, particularly for short-haul or last-mile delivery applications in urban areas. Therefore, each drive type has advantages and disadvantages regarding efficiency, environmental impact, and operating costs, which may influence the adoption of autonomous trucks in different applications and regions.

Regional Insights

Asia-Pacific dominates the market, primarily driven by factors such as the increasing demand for safer and more efficient transportation, the need to reduce operating costs for fleet owners, and the development of advanced technologies such as AI and ADAS for autonomous driving.

Europe is a significant market for autonomous trucks, with Germany, the United Kingdom, and France being the major contributors to the market's growth. This is due to the development of advanced technologies such as AI and ADAS for autonomous driving. However, the growth of the Europe autonomous trucks market may also face challenges such as the high costs of implementing autonomous driving technologies, concerns over job displacement for truck drivers, and regulatory hurdles related to the safety and liability of autonomous trucks. Despite these challenges, the Europe autonomous trucks market is expected to see significant growth in the coming years, driven by the increasing adoption of autonomous driving technologies and the growing demand for more efficient and sustainable transportation solutions.

The region in North America is anticipated to have the greatest CAGR. This is due to factors such as the government's support for adopting autonomous driving technologies, the increasing demand for transportation in the region's rapidly growing economy, and a well-established manufacturing industry. In addition, the demand for autonomous trucks is expected to be highest in industries such as logistics and transportation, mining, and construction, which require heavy-duty vehicles to transport goods and materials, which is expected further to drive the demand for autonomous trucks in the region.

Autonomous Trucks Market Companies:

- TuSimple, Inc. (San Diego, US)

- Waymo LLC (Mountain View, US)

- Embark Trucks (San Francisco, US)

- Tesla (California, US)

- Caterpillar (Illinois, US)

- AB Volvo (Gothenburg, Sweden)

- Daimler AG (Stuttgart, Germany)

- Continental AG (Hanover, Germany)

- Robert Bosch GmbH (Stuttgart, Germany)

- NVIDIA Corporation (Santa Clara, US)

- Aptiv (Dublin, Ireland)

Recent Developments

- In October 2020, Daimler Trucks partnered with Waymo to develop self-driving semi-trucks for the U.S. market.

- In December 2020, Aurora Innovation announced the acquisition of Uber's self-driving unit, including its autonomous trucking division, Uber Freight.

- In February 2021, Scania and TuSimple announced a partnership to test self-driving trucks on public roads in Sweden.

- In September 2021, Embark Trucks and HP Inc. announced a partnership to develop autonomous driving solutions for the logistics and transportation industry.

- In December 2021, Plus and IVECO announced a partnership to develop and commercialize self-driving trucks in Europe.

Segments Covered in the Report

By Types

- Light-duty Trucks

- Medium-duty Trucks

- Heavy-duty Trucks

By Level of Autonomy

- Semi-Autonomous

- Fully Autonomous

By ADAS

- Adaptive Cruise Control

- Lane Departure Warning

- Intelligent Park Assist

- Highway Pilot

- Automatic Emergency Braking

- Blind Spot Detection

- Traffic Jam Assist

- Lane Keeping Assist System

By Component Types

- LIDAR

- RADAR

- Camera

- Sensors

By Drive Type

- IC Engine

- Electric

- Hybrid

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344