April 2025

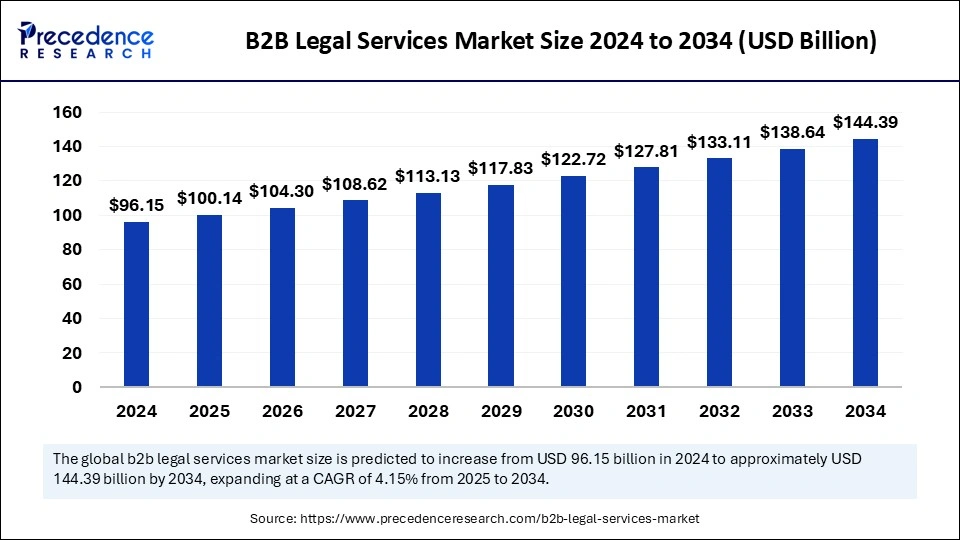

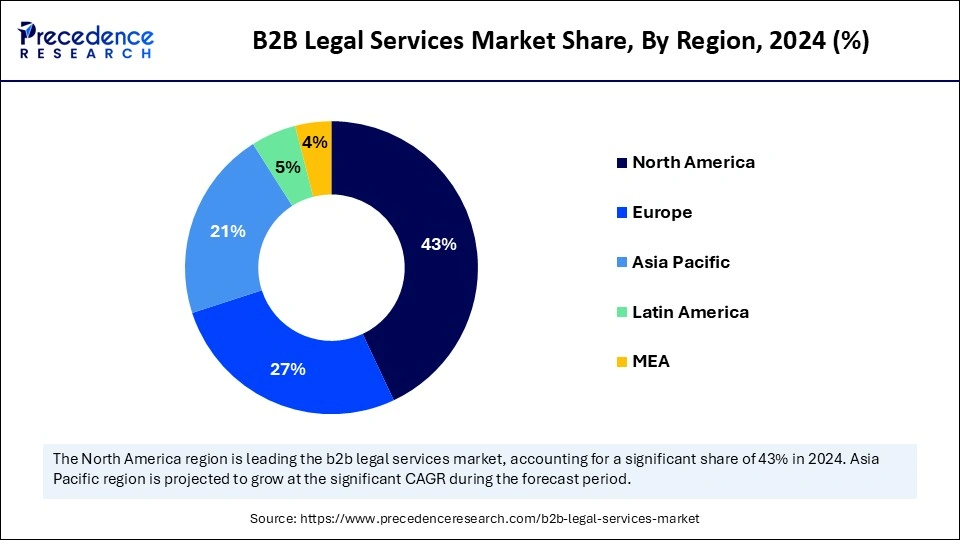

The global B2B legal services market size is calculated at USD 100.14 billion in 2025 and is forecasted to reach around USD 144.39 billion by 2034, accelerating at a CAGR of 4.15% from 2025 to 2034. The North America market size surpassed USD 41.34 billion in 2024 and is expanding at a CAGR of 4.27% during the forecast period. The market size and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global B2B legal services market size was estimated at USD 96.15 billion in 2024 and is predicted to increase from USD 100.14 billion in 2025 to approximately USD 144.39 billion by 2034, expanding at a CAGR of 4.15% from 2025 to 2034. The growth of the market is driven by the rising complexity of regulations, an increase in corporate transactions, and the necessity for specialized legal knowledge. There are numerous opportunities within this market as companies are increasingly adopting technology-driven solutions.

Artificial Intelligence is revolutionizing the B2B legal services market by improving contract analysis, legal research, compliance oversight, and litigation management. AI-powered software such as natural language processing and machine learning streamline the review of contracts, identify risks, and ensure adherence to regulatory standards. Tools like Evisort and Kira Systems automate the management of contracts, minimizing manual workload.

AI-enhanced legal research platforms, including Westlaw Edge and Casetext CARA AI, expedite the analysis of case law, enhancing the decision-making process in legal matters. Compliance solutions such as IBM Watson Compliance offer real-time updates on regulatory changes, which are critical for sectors like finance and healthcare. AI also improves litigation analytics by predicting outcomes of cases and refining strategies for dispute resolution.

Legal applications powered by artificial intelligence and automation tools present firms with the chance to enhance their service delivery and increase efficiency. AI chatbots and virtual legal assistants manage routine inquiries, scheduling, and document preparation, boosting efficiency. Blockchain-enabled smart contracts further improve legal security and transparency. As the adoption of AI grows, law firms and businesses harness these technologies to reduce costs, enhance precision, and proactively manage legal risks.

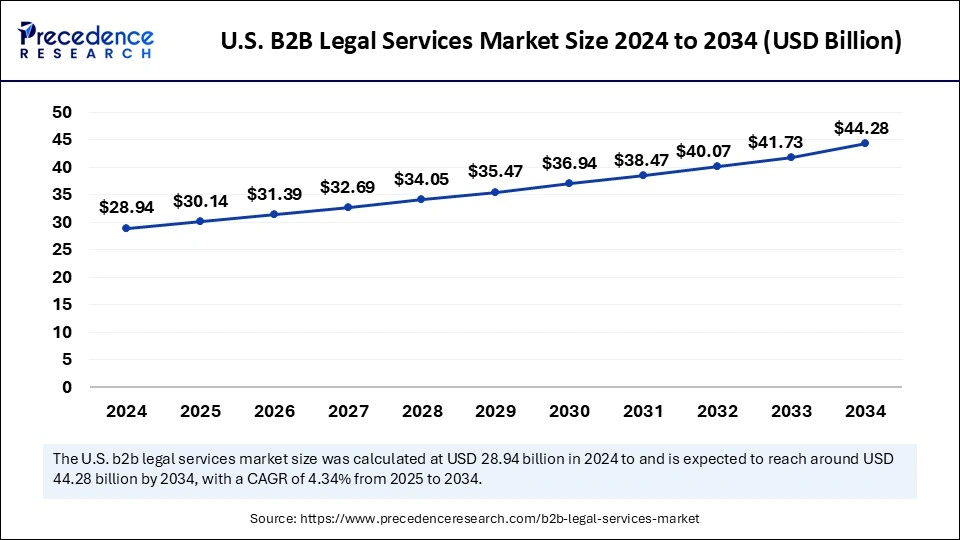

The U.S. B2B legal services market size was exhibited at USD 28.94 billion in 2024 and is projected to be worth around USD 44.28 billion by 2034, growing at a CAGR of 4.34% from 2025 to 2034.

North America dominated the B2B legal services market with the largest share in 2024, driven by high corporate legal spending, intricate regulatory frameworks, and a robust presence of multinational law firms. The region, primarily represented by the United States and Canada, saw the U.S. legal sector generate more than USD 437 billion in revenue. Demand for legal services in North America is largely influenced by stringent regulatory compliance mandates in areas such as financial services, healthcare, technology, and corporate governance.

Legislation like the California Consumer Privacy Act, the General Data Protection Regulation, and anti-money laundering regulations have greatly contributed to the rise in corporate legal expenditures. North America features a well-established mergers and acquisitions environment, where businesses require legal support for due diligence, contract structuring, and securing regulatory approvals during cross-border deals. There's also a noticeable increase in intellectual property conflicts, employment lawsuits, and antitrust inquiries, particularly in the technology and pharmaceutical industries.

Asia Pacific will host the fastest-growing B2B legal services market from 2025 to 2034. This region is witnessing swift economic development, a rise in foreign direct investments, and a shift in regulatory frameworks, especially in nations like China, India, Japan, and Singapore. The growth of multinational corporations and cross-border trade agreements has heightened the need for corporate legal services, protection of intellectual property, and compliance advisory.

China’s increasing regulations surrounding foreign investments, antitrust laws, and cybersecurity measures are compelling companies to seek specialized legal counsel to successfully navigate their operations within the country. The flourishing startup environment, fintech industry, and digital marketplace in India have resulted in a significant rise in the need for contract management, intellectual property law, and compliance services.

As Asia Pacific integrates further into global financial and digital economies, businesses operating here require legal knowledge to manage cross-border dealings, rights related to intellectual property, and adherence to changing business laws. Law firms are extending their footprint in the area, while ALSPs and legal tech startups are surfacing to provide affordable legal solutions for small and medium enterprises and multinational corporations.

The B2B legal services market is witnessing substantial growth driven by several major market factors. The increasing complexity of business regulations and the increased necessity for compliance with both local and international laws lead companies to seek legal guidance. The ongoing digital transformation across various sectors is also influencing the demand for legal services as organizations require support with contracts, data privacy, and intellectual property issues. Additionally, the growth of e-commerce and international trade has intensified the demand for specialized legal counsel, creating a thriving atmosphere for B2B legal service providers.

Advantages in this market include exploration as businesses progressively adopt technology-driven approaches. Legal applications based on artificial intelligence and automation tools provide firms with the opportunity to improve their service delivery and enhance efficiency. There is a notable opening in some specialized legal domains focusing on emerging fields like blockchain and cryptocurrency. As more companies embrace digitization, their exposure to legal technology will increase, providing the foundation for new service types and innovation.

| Report Coverage | Details |

| Market Size by 2034 | USD 144.39 Billion |

| Market Size in 2025 | USD 100.14 Billion |

| Market Size in 2024 | USD 96.15 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.15% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Client Type, Industry Sector, Geographical, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Escalating corporate compliance and regulatory requirements

The growing complexity of global regulatory systems is a significant contributor to the B2B legal services market. Governments and regulatory agencies are establishing more stringent financial, data privacy, environmental, and labor laws, forcing businesses to seek specialized legal services. Regulations like the General Data Protection Regulation, California Consumer Privacy Act, Digital Markets Act, and Anti-Money Laundering Directives have amplified the demand for compliance advisory services.

Companies operating in various jurisdictions need to comply with different corporate governance standards, tax laws, and industry-specific regulations, making legal risk management crucial. The financial sector, in particular, is under intense scrutiny, with banks, investment firms, and fintech entities needing legal guidance to adhere to anti-money laundering regulations, securities laws, and international trade embargoes. Likewise, technology companies need to manage intellectual property protection, cybersecurity compliance, and antitrust regulations, resulting in heightened demand for legal assistance.

Increasing legal costs and financial limitations for businesses

A major hurdle in the B2B legal services market is the steep cost of legal representation, which can restrict access for small and medium enterprises and startups. Leading law firms charge hourly fees between USD 500 and USD 2,500, making legal services a considerable expense for businesses. Many companies, especially SMEs, find it challenging to bear the financial weight of hiring external legal counsel, prompting them to seek alternatives like ALSPs or build in-house legal teams to cut costs.

The legal sector is also experiencing pressure on pricing, with businesses increasingly requesting fixed-fee arrangements, subscription-based services, and outcome-based pricing models instead of traditional hourly rates. The surge in legal technology solutions and AI-driven contract management tools is further disrupting conventional legal billing practices, enabling companies to automate routine legal processes at a fraction of the cost. Despite the growing demand for legal services, cost-sensitive businesses are increasingly pursuing more economical legal options, constraining revenue growth for established law firms.

Growth of legal technology solutions

The swift integration of artificial intelligence and automation within legal services is presenting new avenues for expansion. AI-driven legal analytics, software for contract review, and tools for compliance monitoring are improving efficiency, decreasing manual tasks, and offering insights based on data. Startups in legal technology are creating cloud-based systems for managing contract lifecycles, analyzing litigation, and assessing regulatory risks, making legal services more reachable and cost-effective for businesses.

Solutions powered by AI, like Westlaw Edge, Kira Systems, and Evisort, are equipping legal professionals to enhance document analysis, case investigation, and compliance reporting in the B2B legal services market. Furthermore, blockchain technology is revolutionizing smart contracts and digital legal agreements, mitigating fraud risks and enhancing transaction clarity. As law firms and in-house corporate legal teams prioritize digital transformation, AI-driven legal services are anticipated to transform the industry and generate new revenue opportunities.

The litigation segment dominated the B2B legal services market with the largest share in 2024. The rise in corporate disputes, intellectual property issues, regulatory inquiries, and financial misconduct cases has increased the need for specialized litigation support. Organizations from various sectors face heightened risks linked to contract conflicts, employment litigation, fraud claims, and shareholder advocacy. The finance, technology, and healthcare sectors have shown particular susceptibility to legal conflicts, leading companies to invest in skilled legal representation. Prominent cases concerning data breaches, antitrust claims, and compliance shortcomings have further driven litigation expenditures. Law firms focusing on business litigation, arbitration, and alternative dispute resolution are broadening their offerings to accommodate the growing demand.

The regulatory compliance segment is predicted to witness significant growth over the forecast period. With governments and regulatory agencies enacting more stringent financial, environmental, and data privacy legislation, businesses must ensure ongoing compliance to avert penalties and protect their reputations. New laws such as the General Data Protection Regulation in Europe, the California Consumer Privacy Act in the U.S., and evolving anti-money laundering regulations globally have compelled organizations to seek specialized legal advisory services. Companies operating across various jurisdictions require regulatory oversight, risk evaluations, and legal audits to stay compliant with a multitude of legal systems. The Digital Markets Act and Digital Services Act in Europe, targeting monopoly practices and promoting fair competition in digital domains, have introduced further layers of regulatory complexity, particularly for tech companies.

The large corporations segment dominated the B2B legal services market in 2024, as these entities frequently engage in mergers and acquisitions, global expansion, intellectual property preservation, tax structuring, and international business transactions. Fortune 500 companies, multinational enterprises, and publicly traded firms depend on their corporate legal teams and external legal advisors to address significant regulatory challenges, employment disputes, and intricate litigation cases. The heightened emphasis on corporate governance, ESG compliance, and cross-border trade regulations has increased the legal demands placed on large corporations. Particularly, multinational companies in sectors like banking, pharmaceuticals, and technology must navigate multi-jurisdictional legal requirements, making global legal services vital.

The small and medium enterprises (SMEs) segment will gain a significant share of the market over the studied period of 2025 to 2034. The swift rise of startups, e-commerce companies, and tech-oriented SMEs has heightened the need for cost-effective legal solutions. Unlike large corporations with in-house legal teams, SMEs frequently lack dedicated legal resources, leading them to depend heavily on external counsel for contract negotiations, dispute resolution, and compliance with regulations. The increasing intricacy of employment laws, intellectual property rights, and tax regulations has driven SMEs to seek legal guidance in order to minimize risks. The advent of alternative legal service providers and subscription-based legal platforms has improved access to legal services for SMEs.

The financial segment dominated the B2B legal services market with the largest share in 2024 fueled by the complexities of banking regulations, compliance mandates, and investigations into financial fraud. Banks, investment firms, insurance companies, and fintech startups are subject to rigorous legal oversight to deter financial crimes, insider trading, and unethical business conduct. The growing emphasis on anti-money laundering compliance and know-your-customer regulations has led financial institutions to invest significantly in legal advisory services. Regulatory agencies like the U.S. Securities and Exchange Commission, the European Banking Authority, and the UK’s Financial Conduct Authority continue to enforce stringent legal requirements on financial entities. Moreover, the emergence of digital banking, cryptocurrency exchanges, and decentralized finance platforms has brought about new legal challenges that necessitate specialized knowledge in financial law.

The technology segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. The growth of this segment is fueled by the rising regulatory oversight concerning data privacy, cybersecurity, and antitrust issues. Prominent technology giants like Google, Amazon, Meta, and Microsoft have faced notable antitrust challenges and regulatory reviews concerning monopolistic practices, digital advertising strategies, and the safeguarding of user data. Governments around the globe are enacting new legislation to regulate the digital marketplace, necessitating that tech companies adapt to shifting legal frameworks. The implementation of AI governance regulations, digital rights management laws, and rules regarding cross-border data transfers has considerably elevated the demand for legal advisory services within the technology sector

The domestic segment held a dominant presence in the B2B legal services market in 2024 because the businesses primarily required legal assistance to navigate local employment regulations, taxation laws, and compliance with rules in their respective areas. The complexity of national legal systems and specific industry regulations has made local law firms the preferred option for companies concentrated on regional operations. Nations with rigorous domestic business regulations, such as Germany, Japan, and Australia, have observed a strong demand for national legal advisory services. In the United States, domestic corporate law firms offer legal counsel for contract disputes, intellectual property safeguarding, and compliance with state regulations.

The international segment is anticipated to grow with the highest CAGR during the studied years driven by the increasing globalization of business activities. Companies venturing into foreign markets require legal assistance to navigate cross-border trade agreements, international taxation frameworks, and foreign investment regulations. The emergence of multinational corporations and global supply chains has amplified the demand for legal expertise in international contract negotiations, dispute resolution, and compliance with trade restrictions. Law firms providing global legal services are seeing heightened demand from businesses engaged in foreign direct investment, international mergers and acquisitions, and trade negotiations between governments.

By Service Type

By Client Type

By Industry Sector

By Geographical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

October 2024

February 2025

July 2024