November 2024

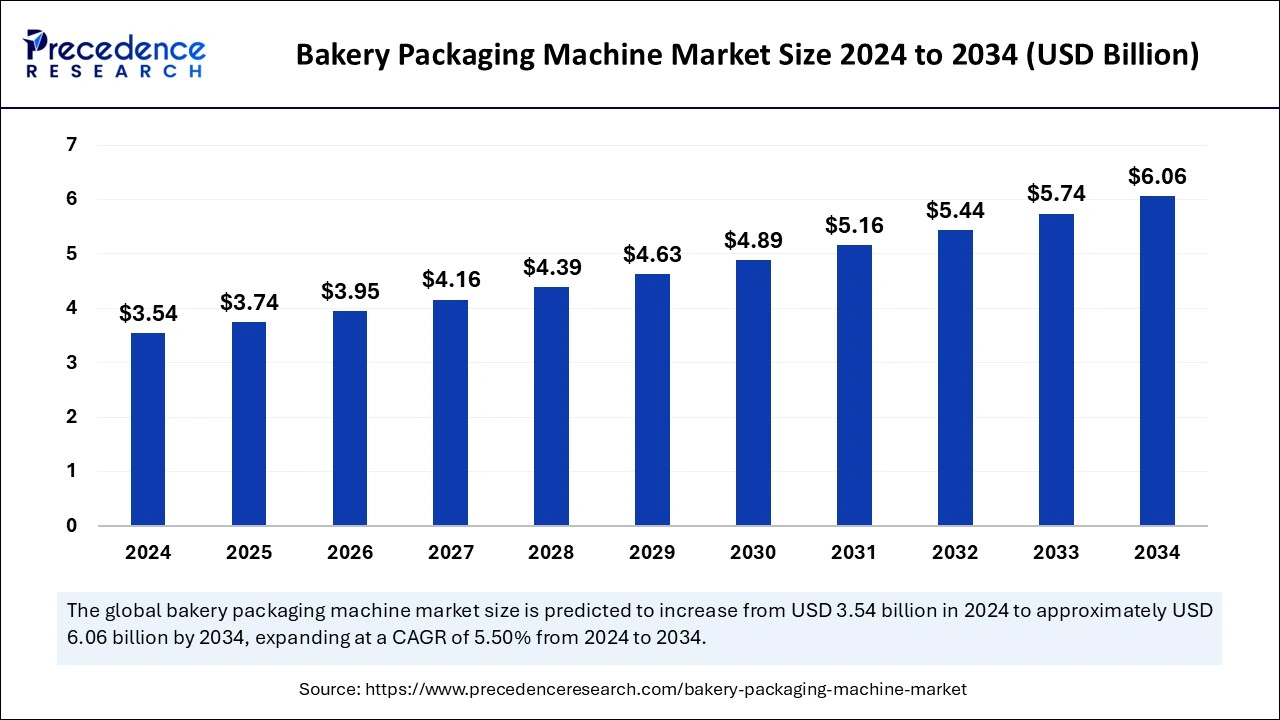

The global bakery packaging machine market size is calculated at USD 3.74 billion in 2025 and is forecasted to reach around USD 6.06 billion by 2034, accelerating at a CAGR of 5.50% from 2025 to 2034. The North America market size surpassed USD 1.27 billion in 2024 and is expanding at a CAGR of 5.69% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global bakery packaging machine market size accounted for USD 3.54 billion in 2024 and is expected to exceed around USD 6.06 billion by 2034, growing at a CAGR of 5.50% from 2025 to 2034. The surge in bakery chains in online and offline retail outlets is the key factor driving the bakery packaging machine market. Also, the growing demand for aesthetic bakery packaging solutions coupled with technological advancements in the packaging industry can fuel market growth soon.

Artificial Intelligence technology substantially enhances customer visibility and product tracking, resulting in a smooth delivery experience. AI-powered chatbots and call centers offer customers precise and detailed updates about their packages, such as current location, arrival time, and transit status. In the bakery packaging machine market, AI can detect hurdles in packaging, such as tasteful packaging. Furthermore, AI can identify potential theft and tampering by managing access to the packages to ensure shipment security.

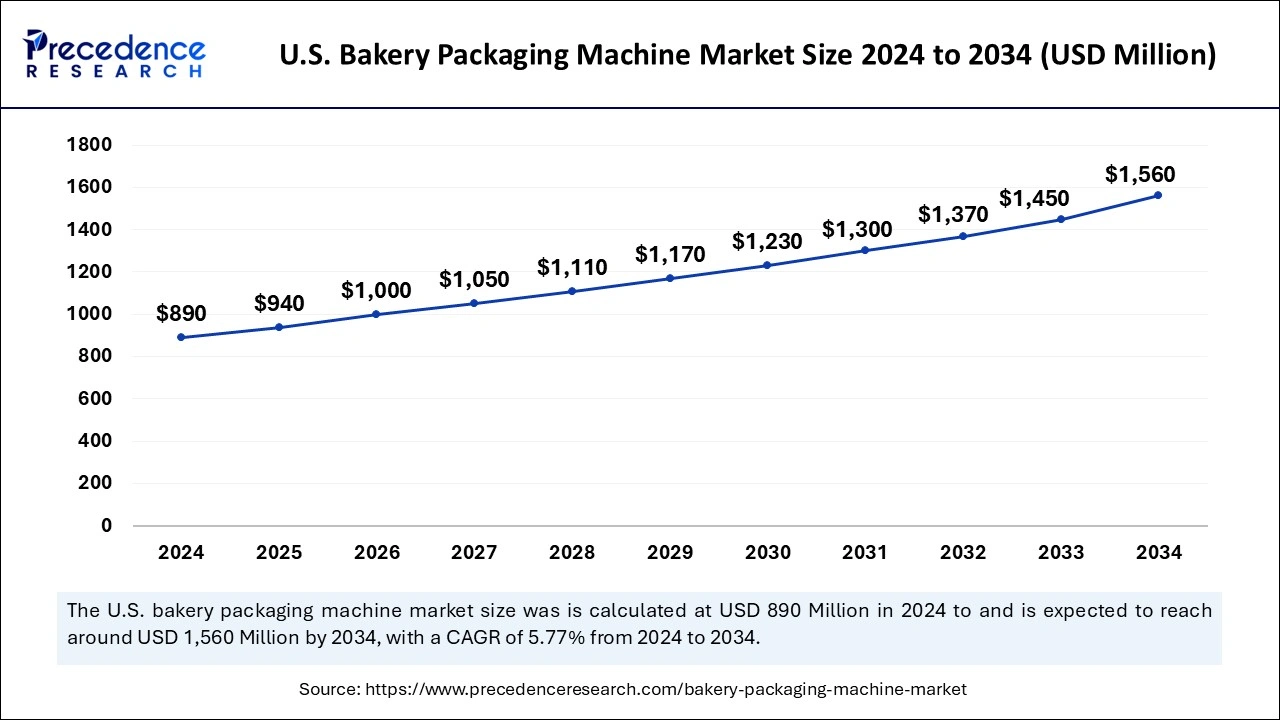

The U.S. bakery packaging machine market size was exhibited at USD 890 million in 2024 and is projected to be worth around USD 1.56 billion by 2034, growing at a CAGR of 5.77% from 2025 to 2034.

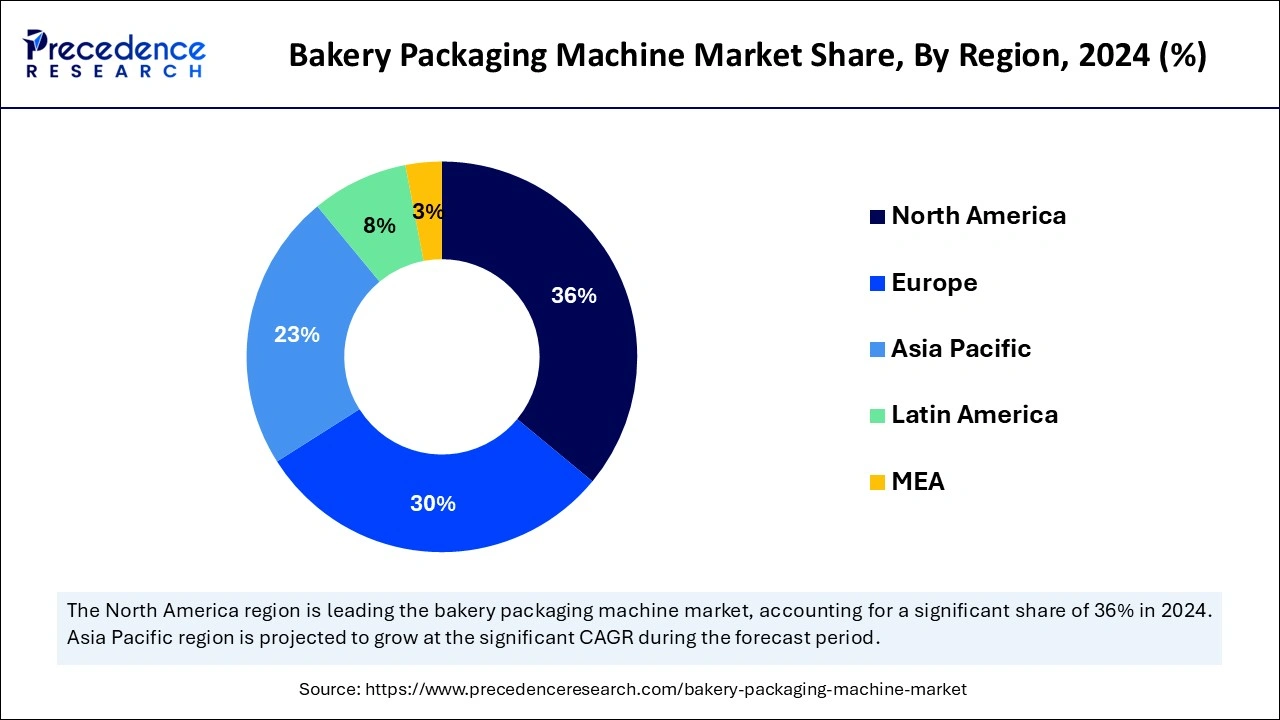

North America dominated the bakery packaging machine market in 2024. The dominance of the region can be attributed to the strong presence of a highly advanced and well-established packaging industry, as well as the presence of key market players. The region's expanding e-commerce sector is further escalating market growth. Moreover, in North America, the U.S. led the market owing to the increasing investments in smart packaging technologies and automation, which helped the market to expand.

Asia Pacific is expected to show the fastest growth in the bakery packaging machine market over the projected period. The growth of the region can be linked to the rising household spending capacity along with the surge in population growth. Furthermore, the expanding personal care and pharmaceutical industries in the region are expected to boost market growth soon. In Asia Pacific, China witnesses the fastest growth due to the ongoing expansion of the e-commerce industry.

A bakery packaging machine is an instrument used in the food industry to package baked goods like cakes, bread, and cookies. These machines are also manufactured to speed up the whole process along with maintaining product quality and freshness. The bakery packaging machine market products can help to enhance productivity, decrease labor costs, and give persistent packaging that safeguards the products from moisture, contamination, and potential damage. Today, robotic packaging is gaining more traction.

Top Packaging Industry M&A Deals in 2024

| Companies | Deal Value |

| Smurfit Kappa’s acquired WestRock to form Smurfit WestRock | USD 12.7 billion |

| International Paper’s acquisition of DS Smith | USD 7.2 billion |

| Sonoco’s acquisition of Eviosys | USD 3.9 billion |

| Amcor’s acquisition of Berry Global | USD 8.4 billion |

| Report Coverage | Details |

| Market Size by 2024 | USD 3.54 Billion |

| Market Size in 2025 | USD 3.74 Billion |

| Market Size in 2034 | USD 6.06 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.50% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Automation Grade, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Changing food consumption patterns

Changing food consumption patterns and modern living are directing consumers to buy ready-made bakery products. Which, in turn, fuels the demand for the bakery packaging machine market. In addition, retailers like restaurants, bakery chains, and supermarkets prefer buns, frozen breads, and pastries as financial alternatives to meet the evolving demands of consumers. Working women across the globe prefer frozen bakery products like cakes and cookies to save cooking time.

Stringent government regulations

The strict government regulations imposed by the government, especially in industrialized nations, act as the key restraining factor for the bakery packaging machine market. These regulations are meant to promote sustainability, decrease waste, and reduce the overall environmental effect of packaging materials. Moreover, the increasing demand for refurbished packaging machinery poses a significant challenge to market growth.

Rising health awareness among consumers

As more people become aware of the effect of their dietary choices on their health, there is an increasing need for healthier bakery products. This includes the preference for gluten-free, whole grain, low sugar, and organic products, which requires the use of tailored packaging that maintains the freshness and integrity of these items. Furthermore, bakery manufacturers are working on upgrading their packaging materials and processes to meet this health trend.

The filling and sealing packaging machine segment dominated the bakery packaging machine market in 2024. The dominance of the segment can be attributed to the increasing demand for these machines to handle various sizes and shapes of bakery products. This demand is particularly propelled by the need for efficient and rapid processes, specifically in large-scale operations. Additionally, these machines are required to support custom packaging to fulfill the requirement for branded packaging.

The labeling machine segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the increasing use of new technologies such as QR codes, RFID, and the Internet of Things in labeling systems for traceability and tracking. Smart labels offer new data and enable the supply chain to be more sophisticated. Also, advanced labeling machines are generally utilized with automated manufacturing lines to decrease the need for manual work.

The automatic segment led the global bakery packaging machine market in 2024. The dominance of the segment can be linked to the increasing demand for these machines, which function in high production volumes. These machines are important for fulfilling the needs due to their speed and efficiency. Moreover, automatic machines ensure uniform and consistent packaging to maintain product quality while fulfilling standardized packaging demands.

The semi-automatic segment is anticipated to grow at the fastest rate during the forecast period. The growth of the segment is driven by the increasing use of this machine in an industrial setting, as it offers a balance between automation and manual intervention. Moreover, semi-automatic machines give flexibility and are much easier to operate. These machines also require less maintenance compared to fully automatic machines.

By Type

By Automation Grade

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

February 2025

September 2024

October 2024