Banking Encryption Software Market Size and Forecast 2025 to 2034

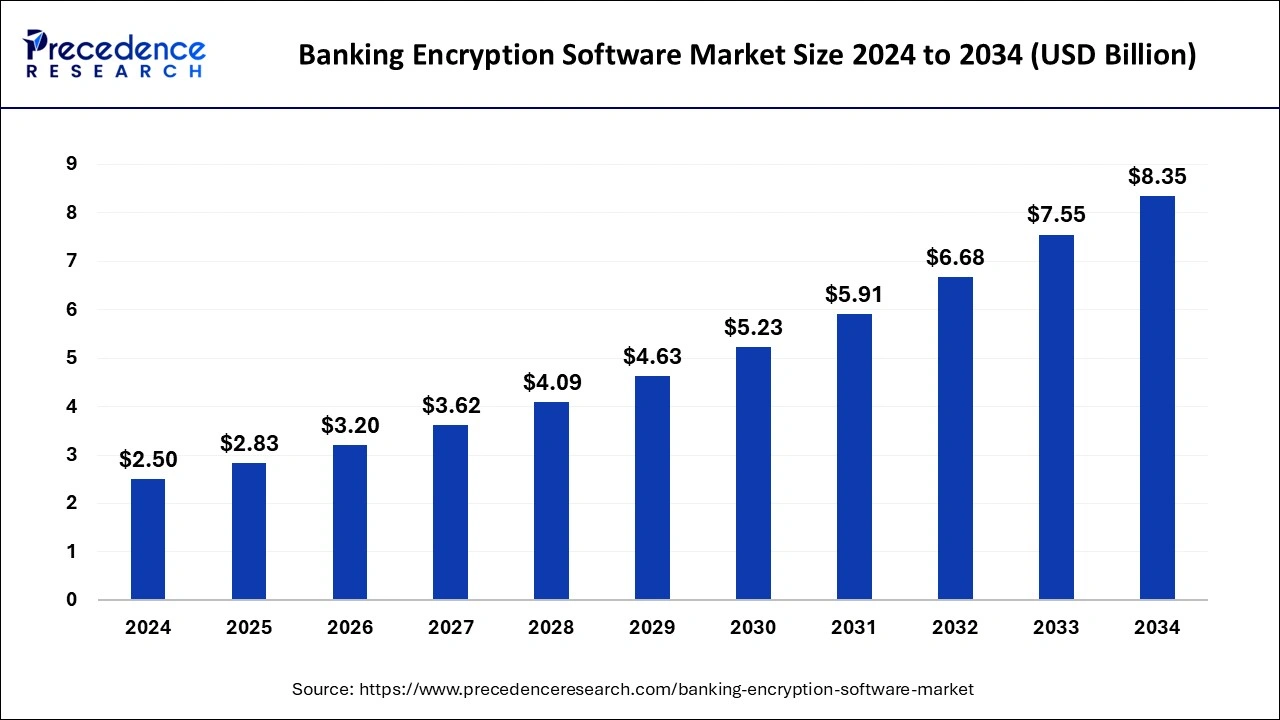

The global banking encryption software market size was estimated at USD 2.50 billion in 2024 and is predicted to increase from USD 2.83 billion in 2025 to approximately USD 8.35 billion by 2034, expanding at a CAGR of 12.82% from 2025 to 2034. The increasing cyber threats in the banking sector due to sensitive data are increasing the demand for this software and contributing to the growth factor of the banking encryption software market.

Banking Encryption Software Market Key Takeaways

- The global banking encryption software market was valued at USD 2.50 billion in 2024.

- It is projected to reach USD 8.35 billion by 2034.

- The banking encryption software market is expected to grow at a CAGR of 12.82% from 2025 to 2034.

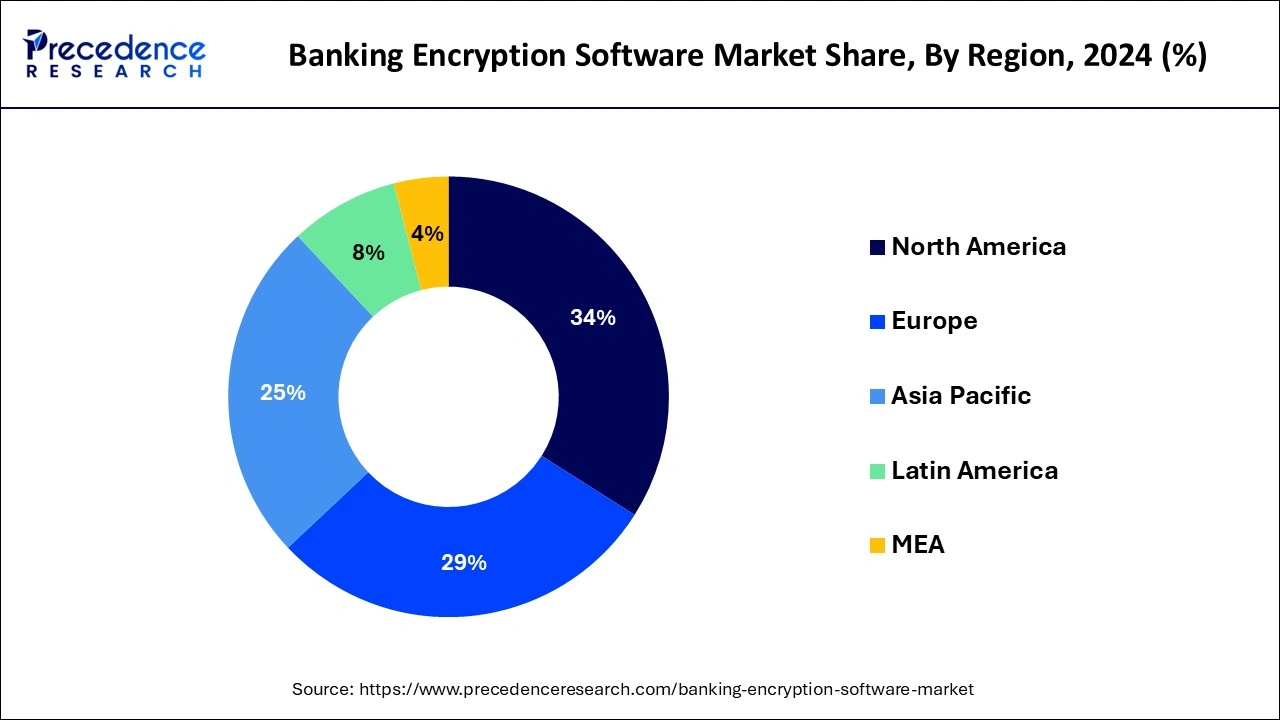

- North America dominated the global banking encryption software market with the largest revenue share of 34% in 2024.

- Asia Pacific is projected to register the fastest growth with an exponential CAGR during the forecast period 2025 to 2034.

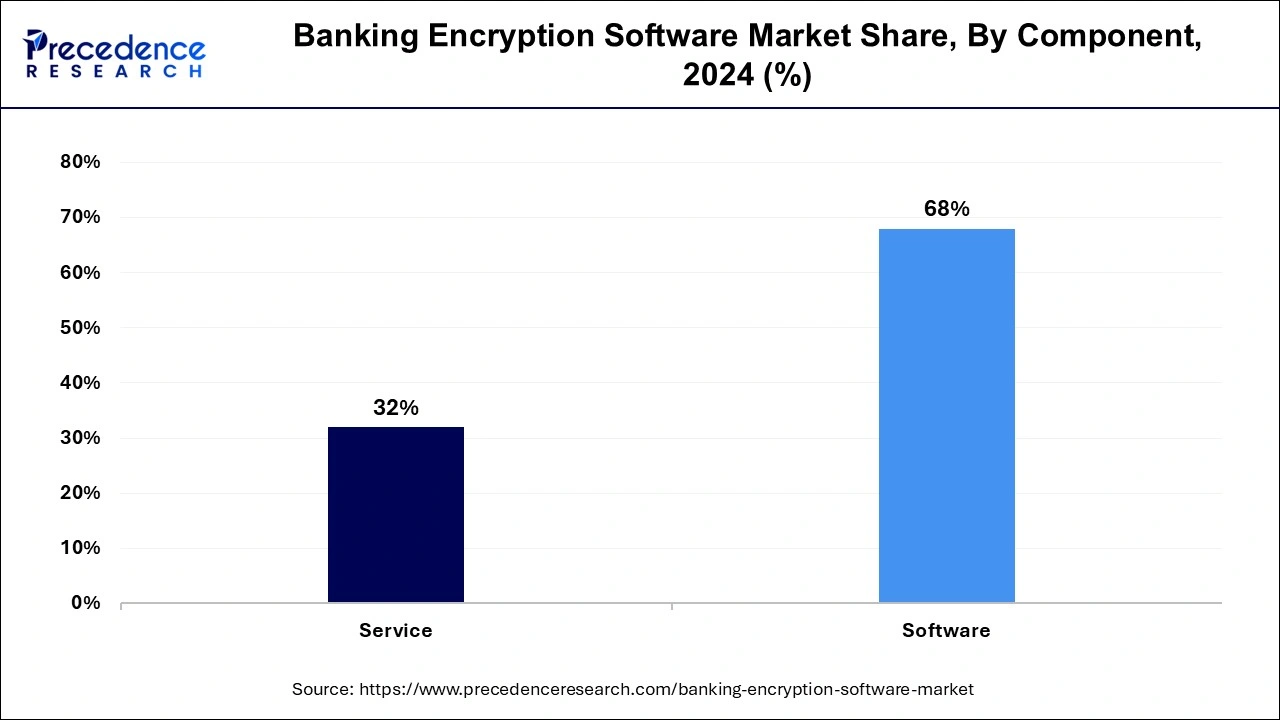

- By component type, the software segment accounted for the largest revenue share of 68% in 2024.

- By component type, the service segment is expected to register the fastest growth during the forecast period.

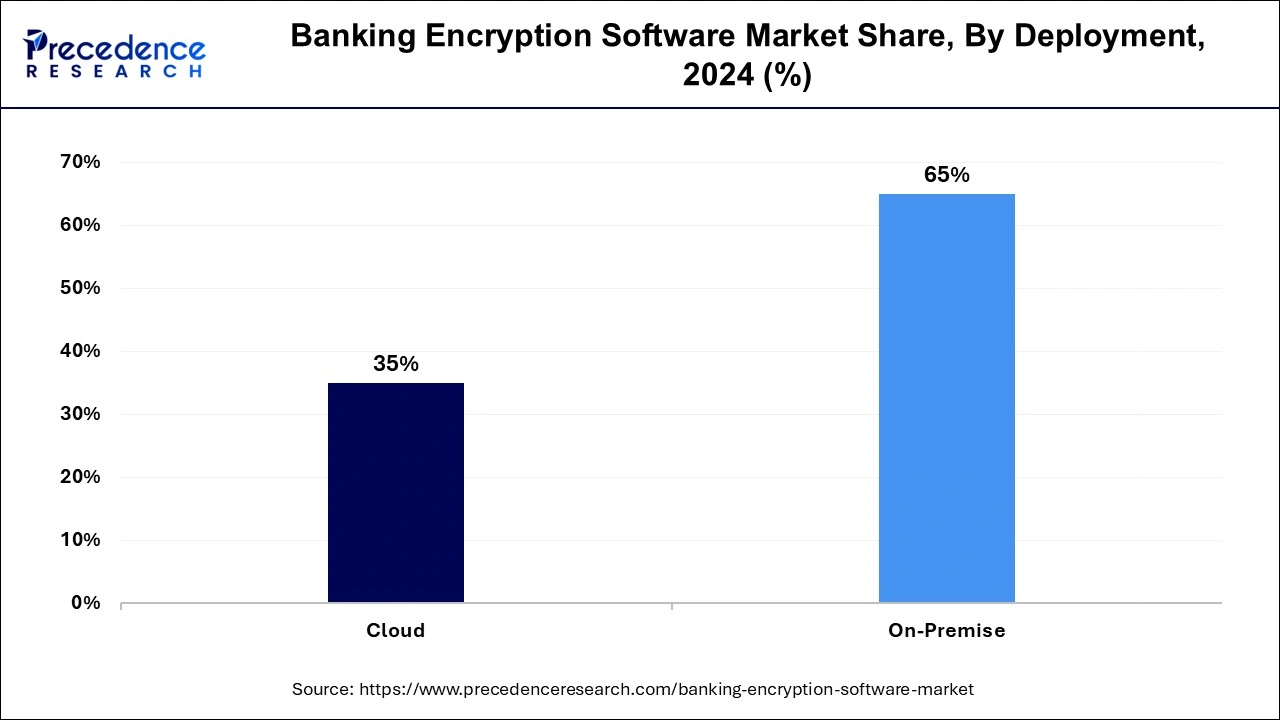

- By deployment, the on-premise segment has held the major revenue share of 65% in 2024.

- By deployment, the cloud segment is anticipated to witness the fastest growth in the market during the forecast period.

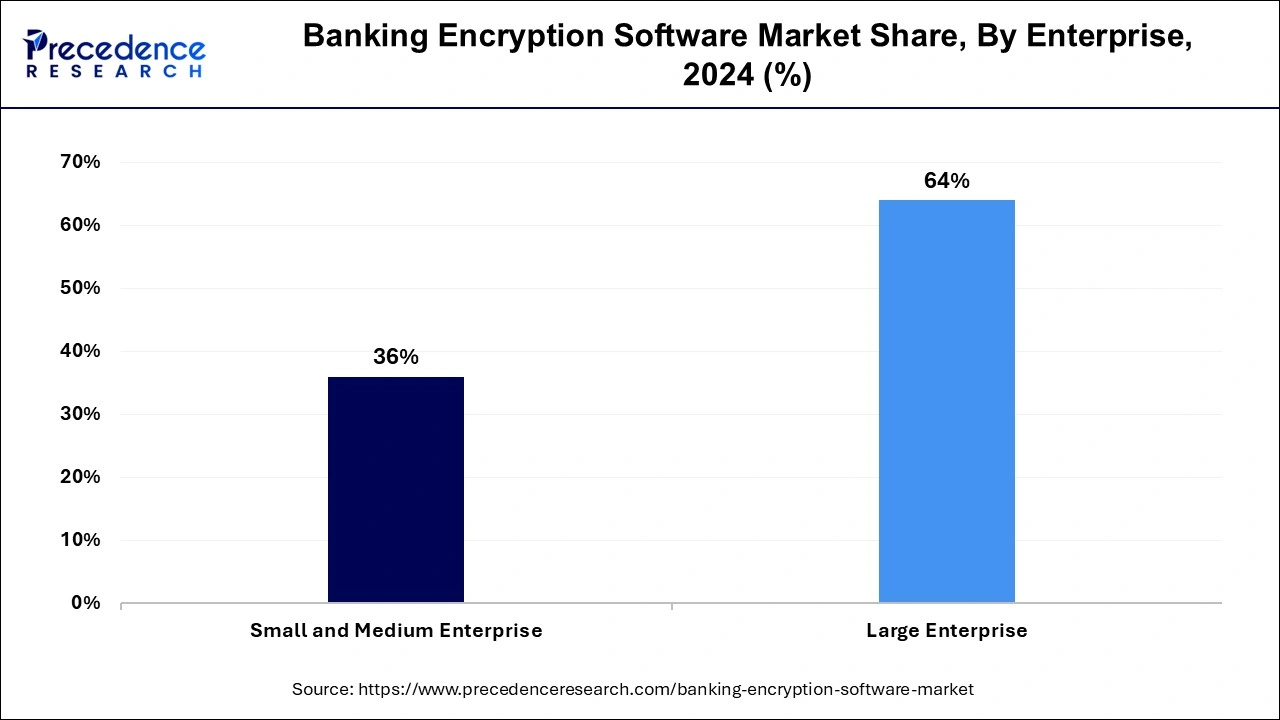

- By enterprise, the large enterprise segment has contributed more than 64% of revenue share in 2024.

- By enterprise, the small and medium enterprises segment is projected to grow at the fastest rate in the market during the forecast period.

- By function, the disk encryption segment has recorded the highest revenue share of 35% in 2024.

- By function, the cloud encryption segment is projected to register the fastest growth during the forecast period 2025 to 2034.

U.S. Banking Encryption Software Market Size and Growth 2025 to 2034

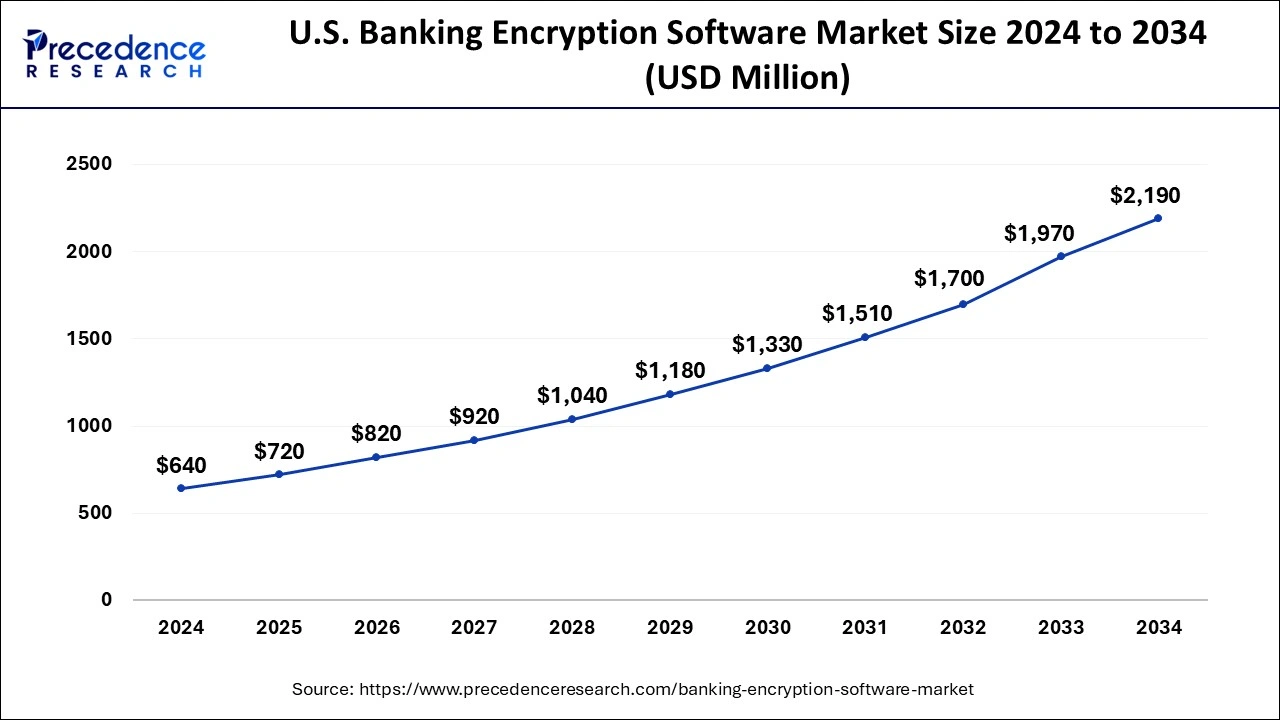

The U.S. banking encryption software market size was exhibited at USD 640 million in 2024 and is projected to be worth around USD 2,190 million by 2034, poised to grow at a CAGR of 13.09% from 2025 to 2034.

North America dominated the global banking encryption software market in 2024. The well-established infrastructure in countries like the United States and Canada stands behind the region's dominance. Regulations like the Gramm-Leach-Bliley Act (GLBA) and the California Consumer Privacy Act contribute to increasing demand for these services in financial institutions. The presence of all the technologies and the availability of other resources helps the region to invest in cybersecurity as there has been an increasing threat to various cyber-crimes. The increasing adoption of artificial intelligence and machine learning might contribute to the development of the market.

- In 2022, the U.S. National Institute of Standards and Technology (NIST) unveiled new cryptographic algorithms to safeguard sensitive data from the threat of quantum computers, improving the overall security for multiple activities like banking, shopping, etc.

Asia-Pacific is projected to register the fastest growth with an exponential CAGR in the banking encryption software market during the forecast period 2025 to 2034. The increasing number of financial institutions in countries like India, China, and Japan are driving the need for encryption software in the region. The region possesses a strong digitalization of online banking services, which increases the need for advanced encryption technologies and drives the growth of the market. Asia Pacific contains a large number of developing regions, which open the gates for new companies and investments in the region, too. These initiatives might help in the growth of the market.

Europe is estimated to account for a decent share of the banking encryption software market. The regulations and policies in Europe might contribute to the market growth in the upcoming years. The system and government in the region support the widespread of encryption technologies all over the region. The increasing popularity of encryption services in financial institutions is likely to help the growth of the banking encryption market.

Market Overview

Banking encryption software is security software designed to protect the financial data within the banking systems. It allows the banks to exchange the transaction detail document with the consumers confidentially. The software uses encryption algorithms to change plaintext information like transaction data and customer and account details into a coded form that can only be accessed by authorized partners. This protects sensitive financial data and ensures its confidentiality across the banking networks.

Many banking and financial institutions are using banking encryption software as it enables a secure payment processing service to the customers. The increasing digitalization in financial services and the need for security in data transmission are playing a crucial role in the rising demand for bank encryption software services. These factors are leading to the adoption of the banking encryption software market.

The banking encryption software market focuses on the maintenance of software used for data encryption and Security management to maintain other regulatory standards of the banking industry. The market is one of the fastest-growing segments of the cybersecurity industry. The increasing security threats to financial institutions are leading to the need for security advancements in the banking sector.

Banking Encryption Software Market Growth Factors

- The increasing number of online banking users is surging the demand for robust encryption solutions for user data production. This is leading to the growth of the banking encryption software market.

- Constant technological advancements in encryption algorithms like homomorphic encryption and quantum-resistant cryptography are some of the major growth factors of the banking encryption software market.

- The rapid incline towards the use of cloud services for enhanced encryption solutions is fostering the growth of the banking encryption software market as it offers centralized security management and scalability.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 8.35 Billion |

| Market Size in 2025 | USD 2.83 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.82% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment, Enterprise, Function, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Digital transformation in payment technology

The digital transformation is the increasing rate of online payment tools and platforms. It provides a cashless service option that has gained significant popularity in recent years. It includes contactless payments, digital wallets, and many more technologies that are changing the dynamics of the finance industry. The growth is attributed to the increasing consumer preferences for convenient payment options. The increasing security of digital payment options is projected to drive the growth of the banking encryption software market.

- A study by Statista projected that 2.5 billion people will utilize online banking services in 2024.

Increasing emphasis on regulations

The finance industry is one of the fastest-growing industries, and it has gained a lot of limelight in recent times. This also increases the threat to privacy and data with the increasing cybercrimes. The governments and the authorities are bound to provide a safe business environment for the institutions, which increases the need for strict regulations in the finance sector. Laws like GDPR in Europe work on the protection of sensitive data to ensure safety in encryption operations. Regulations like KYC and AML, i.e., Money Laundering, play a vital role in the development of the banking encryption software market.

Restraint

Higher implementation costs

The growth of the banking encryption software market is hampered by higher implementation costs, especially in small and medium enterprises. Advanced encryption technologies require a higher investment in software and hardware. The new technologies in the market are often hard to afford by the local banks, which acts as a restraint for the market.

Opportunities

Technological advancements in fraud detection

The emergence of artificial intelligence and machine learning is helping in the rapid growth of the banking encryption software market. The emergence of these technologies is projected to offer a predictive analysis of the data, which will help in the development of the market. Early fraud detection tools are expected to play a vital role in the development of the market in the upcoming years.

Increasing focus on specialized solutions

The expansion of technology has led to a competitive environment in the finance sector. The emergence of new technologies will create an opportunity for many upcoming businesses, which will increase the demand for solutions at the local level. Small and mid-cap banks with specialized services will help expand their customers. Focusing on the development of specific problems will help to promote market expansion in the coming years.

Component Insights

The software segment accounted for the largest share of the banking encryption software market in the year 2024. This software includes encryption algorithms, tools, and platforms invented to protect the sensitive data of financial institutions. It is considered to be an indispensable way to protect the data and run other financial operations smoothly.

The absence of this software in financial institutions might be a big blow to companies and might cause havoc for them. Increasing bank customers leads to more demand for a robust security infrastructure. The emergence of advanced encryption standards (AES) and RSA play a vital role in increasing the efficiency of encryption methods. The increasing adoption of encryption software by banks might help increase the demand for encryption software, leading to the growth of the market.

The service segment is expected to register the fastest growth in the banking encryption software market during the forecast period. It includes various types of services, such as professional services, managed services, consulting services, and training development. Managed services ensure that the software is updated from time to time by continuous monitoring. They also focus on threat detection, which ensures the software runs smoothly. The evolving technological advancements in encryption software require skilled professionals to manage the software, and this leads to the rising demand for consultation and training development in the institution.

Deployment Insights

The on-premise segment held the largest share of the banking encryption software market in the year 2024. It is the installation of banking encryption software on the banks' local servers, which also hold control over the data and the whole process. The control helps the authorities provide customized and specialized services to tackle encryption-related errors. The on-premise deployment enhances the security of sensitive financial data as there is a minimum risk for any physical threat. The on-premise segment holds control over the market because it allows one to view the data in the absence of the Internet. To hold control over the data and encryption process, the banks are focusing on the deployment of on-premise services.

The cloud segment is anticipated to witness the fastest growth in the banking encryption software market during the forecast period. This includes the use of encryption services on the cloud provider's infrastructure. This provides a flexible work type for the professionals and also reduces the need for on-premise IT resources, which saves additional costs. The model also provides pay-as-you-go pricing, which is also a convenient option for the banks. The biggest factor behind the growth of the cloud segment is that it can be accessed through any location, which provides the option for remote work. Therefore, the cloud segment is gaining popularity due to cost reduction and flexibility, which will drive the growth of cloud services in the market.

Enterprise Size Insights

The large enterprise segment dominated the global banking encryption software market in 2024. This includes multinational financial institutions that have access to the latest technologies and a well-established infrastructure. They carry out operations on a global level, which creates brand value for these companies. The reason behind the dominance of large-scale enterprises is that they hold a large amount of financial data while ensuring robust security. The advanced infrastructure helps them invest in security and cyber threats. The increasing preference for hybrid models is helping large-scale enterprise boost their growth as they can offer multiple on-premise and cloud services.

The large enterprise segment dominated the global banking encryption software market in 2023. They deal with regional banks and have limited access to resources as compared to large enterprises. The limited access to technologies leads companies to focus on cost-effective solutions without the need for a wide on-premise infrastructure. These companies are gaining significant importance in the market as they offer specialized and customized services.

Function Insights

The disk encryption segment held a dominant share of the banking encryption software market in 2024. This includes encryption at a hardware level in physical storage devices like the hard drive. It protects sensitive data from unauthorized accessors, which protects against cyber threats. Key features like full disk encryption (FDE) play a vital role in protecting sensitive data. The main factor behind the popularity of disk encryption is that it is one of the most secure ways to store sensitive data. The growth of the market is attributed to the enhanced performance of hardware-based disk encryption.

The cloud encryption segment is projected to register the fastest growth in the banking encryption software market during the forecast period 2024 to 2032. The data here is stored in cloud environments, which protects the data during transit and rest. The real-time data can be tracked by cloud encryption, which results in a wide adoption of cloud-based encryption functions. Cloud encryption is expected to attract more financial institutions as it is a convenient and cost-effective function model for the industry.

Banking Encryption Software Market Companies

- McAfee, LLC

- Microsoft

- Sophos Ltd.

- Broadcom

- ESET North America

- IBM Corporation

- Intel Corporation

- Thales Group

- Trend Micro Incorporated

- WinMagic

Recent Developments

- In 2024, Kurdistan International Bank (KIB) partnered with Azentio Software. The partnership involves the implementation of the latest version of Azentio's core banking platform as a part of a digital evolution.

- In 2024, FBNBank Ghana launched Finacle 11x, a modern banking software, to enhance customer experience with seamless, secure, and personalized services, reflecting its commitment to banking excellence in Ghana.

- In 2024, Raman Research Institute's qkdSim software, granted an Indian patent, validates Quantum Key Distribution (QKD) experiments via simulation, aiding in the efficient design and deployment of secure communication systems.

Segments Covered in the Report

By Component

- Software

- Service

By Deployment

- On-premise

- Cloud

By Enterprise

- Large Enterprise

- Small and Medium Enterprise

By Function

- Disk Encryption

- Communication Encryption

- File/Folder Encryption

- Cloud Encryption

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting