January 2025

Beauty and Personal Care Products Market (By Type: Conventional, Organic; By Product: Skin Care, Body Skin Care, Hair Care, Color Cosmetics, Fragrances; By Distribution Channel: E-commerce, Hypermarkets & Supermarkets, Specialty Stores, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

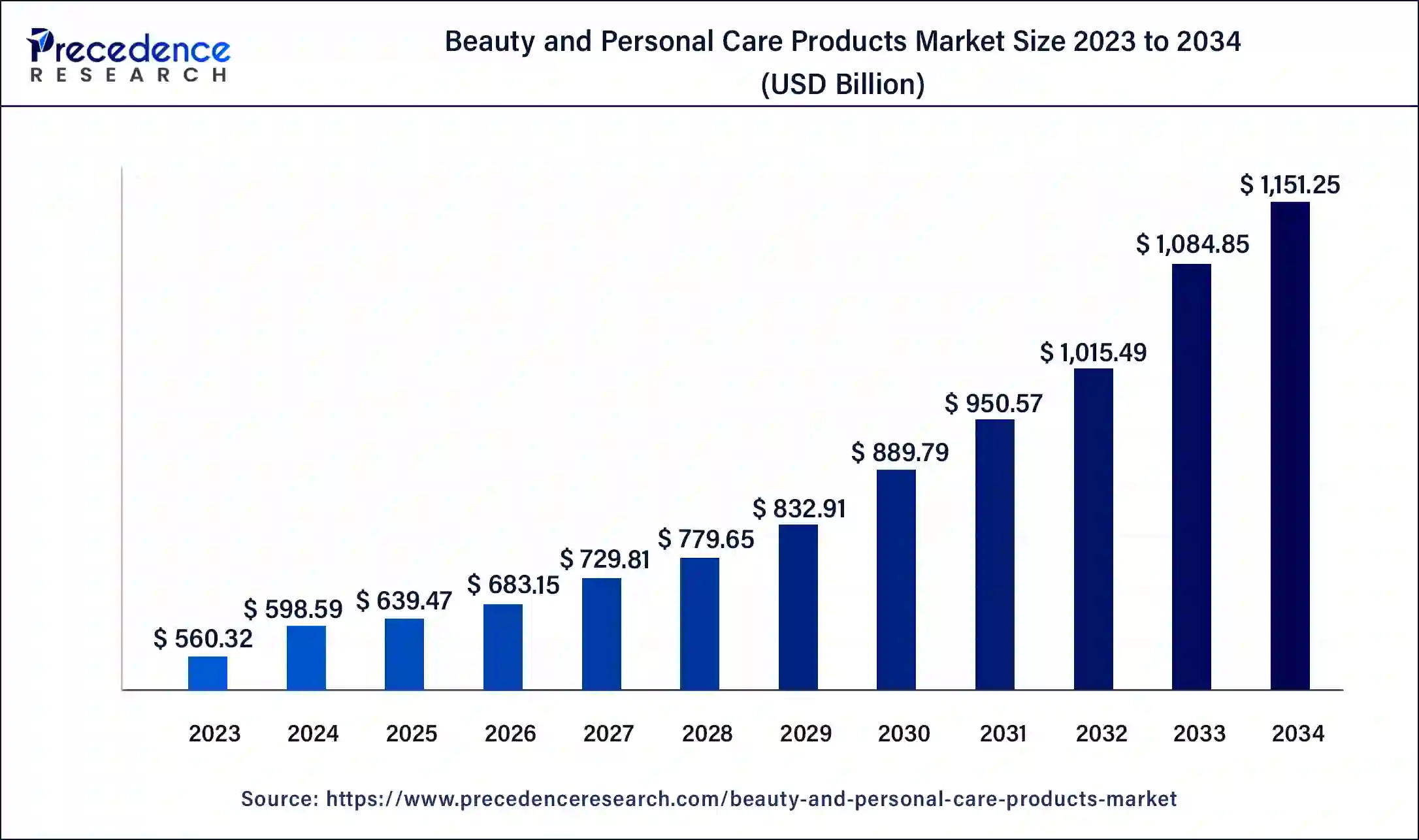

The global beauty and personal care products market size was USD 560.32 billion in 2023, calculated at USD 598.59 billion in 2024 and is expected to reach around USD 1151.25 billion by 2034, expanding at a CAGR of 6.76% from 2024 to 2034.

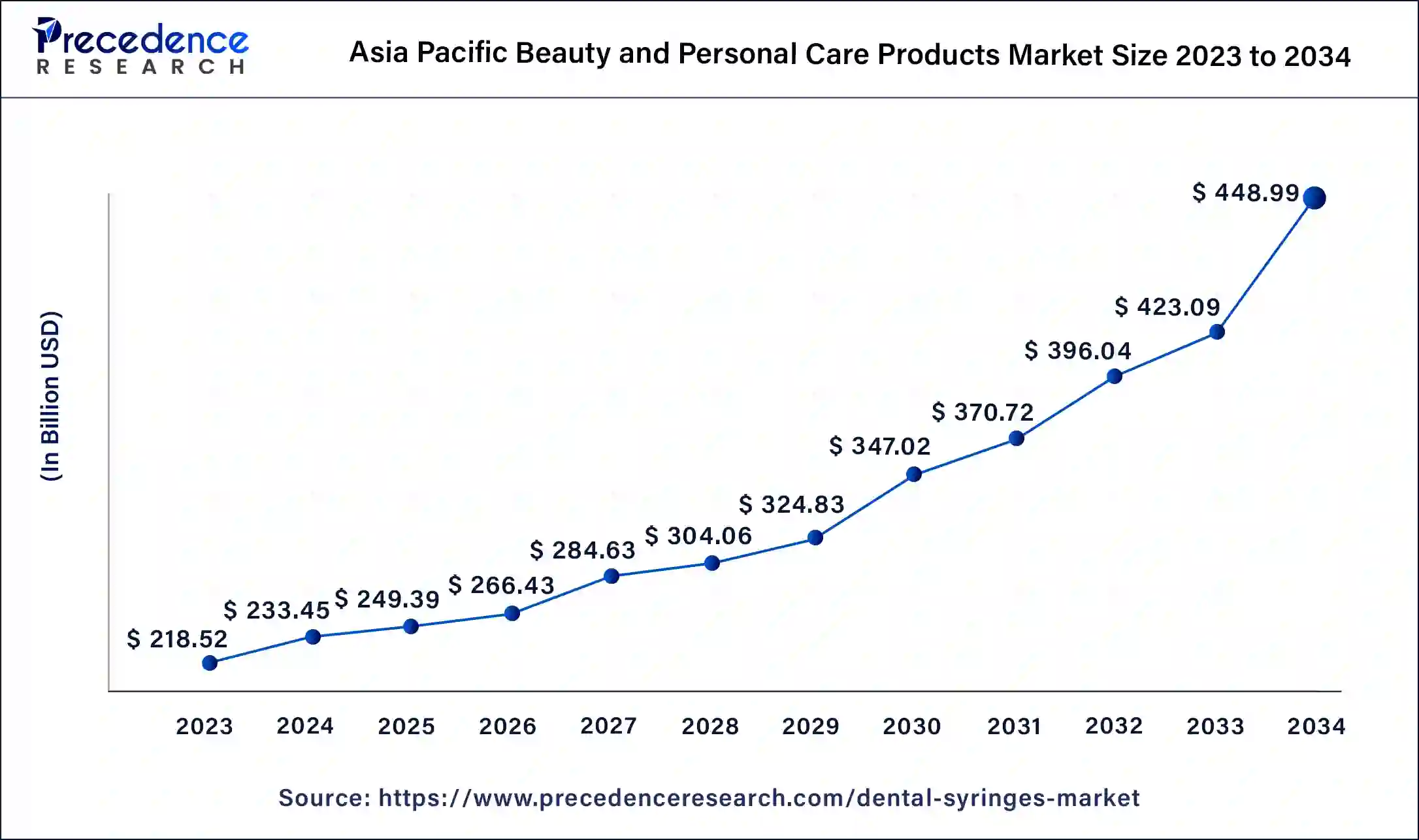

The Asia Pacific beauty and personal care products market size was estimated at USD 218.52 billion in 2023 and is projected to surpass around USD 448.99 billion by 2034 at a CAGR of 7% from 2024 to 2034.

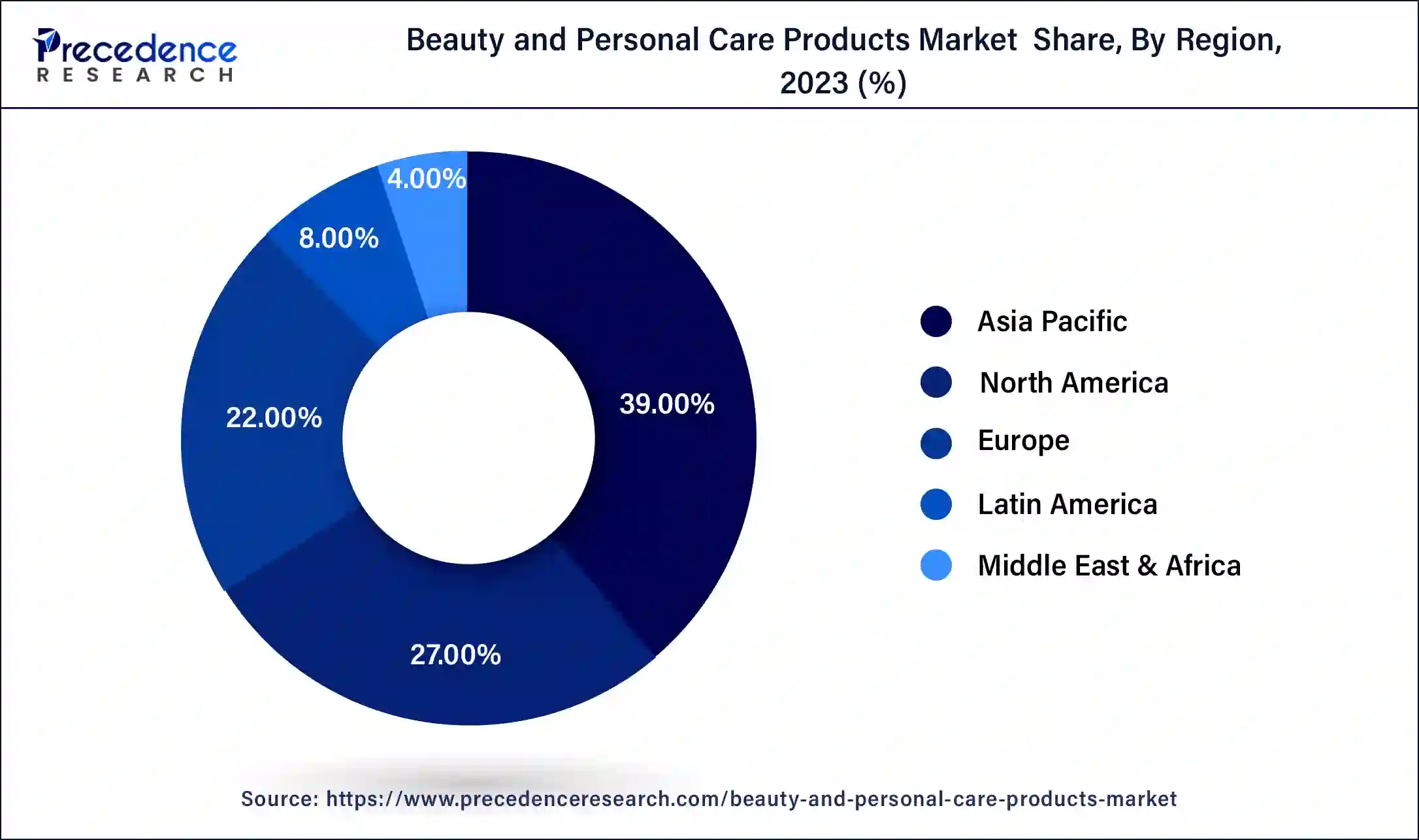

Asia Pacific led the beauty and personal care products market with the largest market share in 2023. The growth of the market in the region is increasing due to the rising number of younger population and the rising expenditure on personal care by the people due to the rising income in developing countries like China, India, and Japan which creates the potential marketplaces for the cosmetics and beauty products in the countries.

The rising investment by international brands for the development of the beauty industry in the region is also propelling the growth of the beauty and personal care products market in the region. Moreover, the overall risen popularity of K-beauty products in the area of South Korea has established a strong base for the beauty and personal care products market. Furthermore, the expansion of Korean beauty products across the region is observed to support the market’s expansion.

North America is expected to witness the fastest growth in the beauty and personal care products market during the forecast period. The region is expecting the highest growth in the market owing to the rising adoption of beauty and skincare products along with the rising awareness for enhanced beauty standards and well-being. Majority of cosmetics and beauty product brands are based in North American region, product innovations and launches thus become major factors for the expansion of the market in the region.

The rising living standards in economically developed countries like the United States and Canada are having the higher per capita income which drives the surge in investments in the personal care and health products that are contributing to the growth of the beauty and personal care products market. Additionally, the rising investments and the increasing presence of the major international beauty brands like Lakme, Maybelline, etc. in the United States are further fueling the growth of the beauty and personal care products market in the region.

The global beauty and personal care products market revolves around the innovation, development and offering of products that can be found in the form of cream, lotion, sacrum, shampoos, conditioners, gels, etc. These types of products are applied to the human skin or body for beautifying and cleaning which promotes attractiveness or changing appearance. Beauty and personal care products are generally fragmented into seven categories that are skin care, oral care, hair care, sun care, decorative cosmetics, body care, and perfumes. The rising awareness about health and well-being of the body and the rising expenditure on self-well-being by the people drive the growth of the beauty and personal care products market.

| Report Coverage | Details |

| Global Market Size in 2024 | USD 1151.25 Billion |

| Global Market Size in 2023 | USD 560.32 Billion |

| Global Market Size in 2024 | USD 598.59 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.83% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Product, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising consumer demand across the globe

The increasing consumer demand for high-quality and result-oriented beauty and personal care products is driving the growth of the beauty and personal care products market. The rising demand for organic beauty and personal care products such as skin and hair care products for protection from harmful chemicals and environmental pollution is driving the expansion of the market. Changing societal beauty standards and living standards drive the demand for beauty-enhancing products for maintaining their natural beauty and youth for a longer time drives the demand for the high beauty products. The rising awareness among people regarding their healthy routines in diet and personal care also contributes to the demand for beauty and personal care products.

Cost of production

Many beauty and personal care products require high-quality raw materials, including specialty chemicals, natural extracts, and active ingredients. Fluctuations in the prices of these raw materials can significantly impact production costs, especially if there are shortages or price increases in key ingredients. The production of beauty and personal care products often involves complex manufacturing processes, including formulation, blending, packaging, and quality control. Investments in equipment, technology, and skilled labor are necessary to ensure efficient production, which adds to the overall cost.

Rising competition among market players

The increasing demand for beauty and personal care products in the market drives the entry of the latest market players and manufacturers of beauty and personal care products while creating sustained competition for these players. The rising demand for chemical-free products in the market drives the competition between the major market players to increase the sale of beauty and personal care products.

The increasing investments and collaboration activities between the market competitors for the product launch and the research along with developmental activities for product innovation are boosting the expansion of the market. Additionally, the introduction of a number of startup companies in the beauty and personal care products sector drives the market competition and contributes as an opportunity for the beauty and personal care products market.

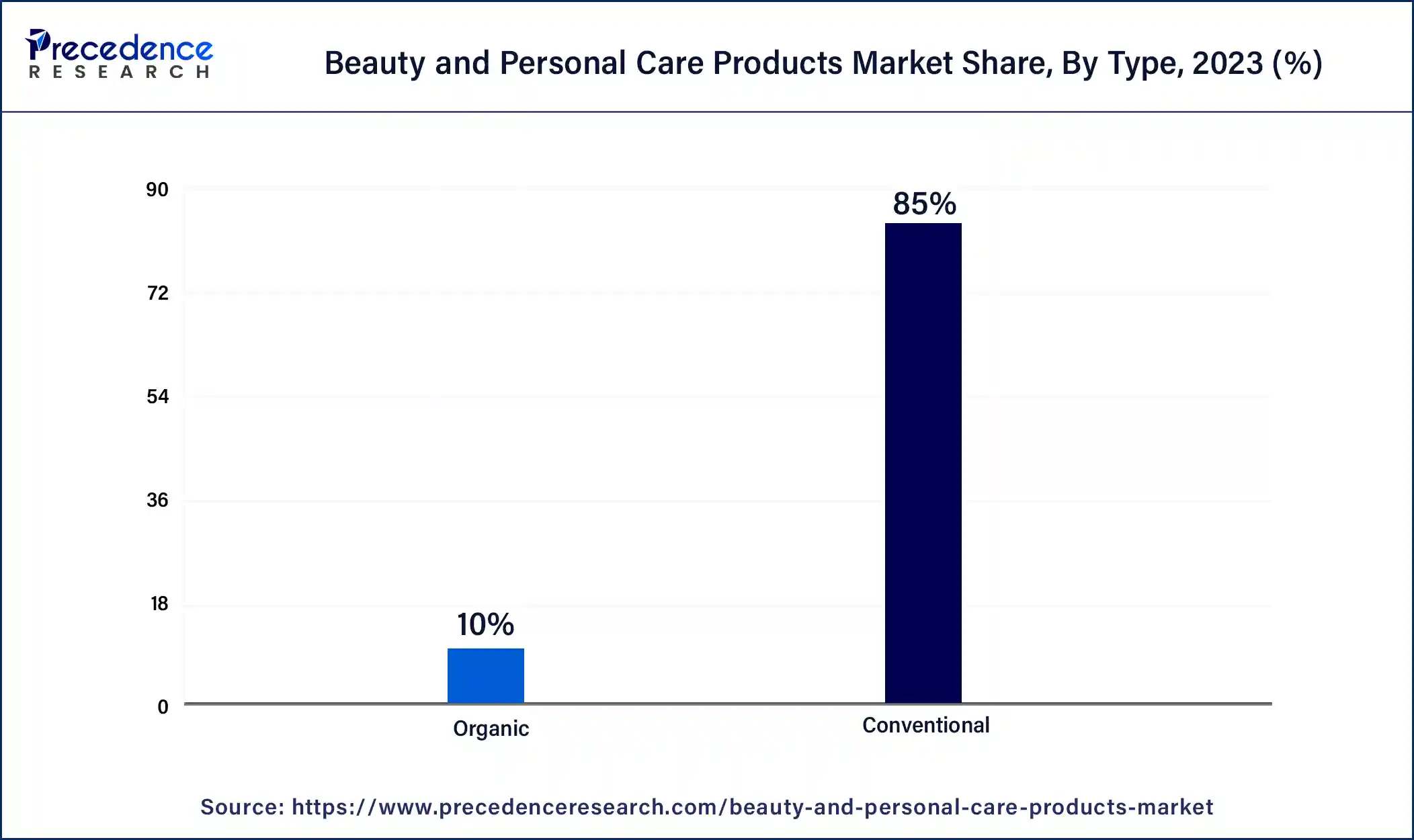

The conventional segment dominated the beauty and personal care products market with the largest market share in 2023. The growth of the segment is attributed to the higher adoption of conventional beauty brands due to their affordability and easy availability of the products. Conventional beauty and personal care products are easily available in specialty stores and supermarkets at affordable prices.

Conventional beauty products are made with formulated chemicals for enhancing the beauty of skin and body. The conventional beauty and personal care products are much lower in price as compared to the organic beauty products that increases the demand for the conventional beauty products and the rising market players participation are further contributing to the growth of the conventional beauty and personal care products segment.

The skincare products segment held the largest share of the beauty and personal care products market in 2023. The growing adoption of skin care products by the consumer to protect their skin from environmental pollution and UV rays drives the demand for skin care products in the market. The rising awareness among consumers for having healthy skin and consciousness about physical appearance drives the demand for skincare products.

The easy availability of the variety of skincare products also promotes the segment’s expansion. The category is divided into the two major parts of face skincare and body skincare. In which the face skincare products are further subcategorized into moisturizers, face creams, cleansers, face wash, sunscreens, and others that applied on the face care. Body skincare category includes body washes or shower gels, hair removal products, body sunscreens, lotions, and others that are applied to the body. Skincare products help with antiaging and make the skin healthy with the proper essentials. Thus, the rising awareness about antiaging products, especially in developed areas, drives the growth of the segment.

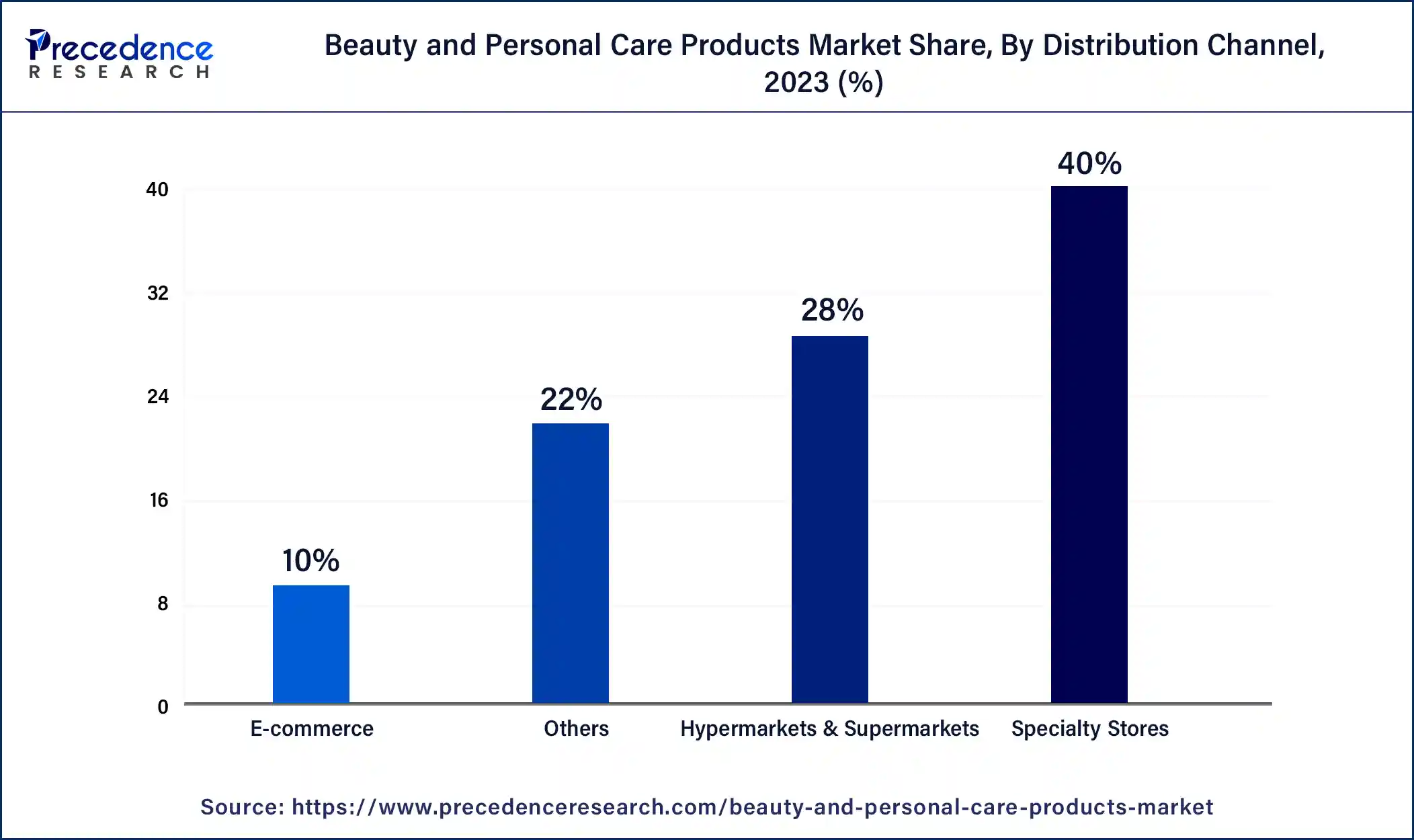

The e-commerce segment is expected to hold the notable share of the beauty and personal care products market during the forecast period. The increasing adoption of e-commerce websites for the shopping of essential needs such as beauty and personal care products are driving the growth of the segment. The rising penetration of e-commerce websites globally is observed to support the segment.

Along with this, the shifting interest towards online shopping by the consumers due to the wide availability of the products with the different varieties with the better price range as compared to the specialty store and supermarkets also promotes the segment’s growth. The rising interest towards the online shopping in the younger generation and the evolving e-commerce platform for the beauty and personal care products like Amazon and Nykaa with the better and secure payments getaways are contributing to the growth of the e-commerce segment.

The hypermarkets and supermarket considerable held a significant share of the beauty and personal care products market in 2023. These stores frequently run promotions, discounts, and sales on beauty and personal care products to attract customers. These promotional activities can include buy-one-get-one-free offers, loyalty programs, and seasonal discounts, encouraging consumers to make purchases. Consumers appreciate the convenience of being able to purchase beauty and personal care products alongside their groceries and other household items. This one-stop shopping experience saves them time and allows them to consolidate their purchases in one transaction.

Segments Covered in the Report

By Type

By Product

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

August 2024

November 2024

January 2025