August 2024

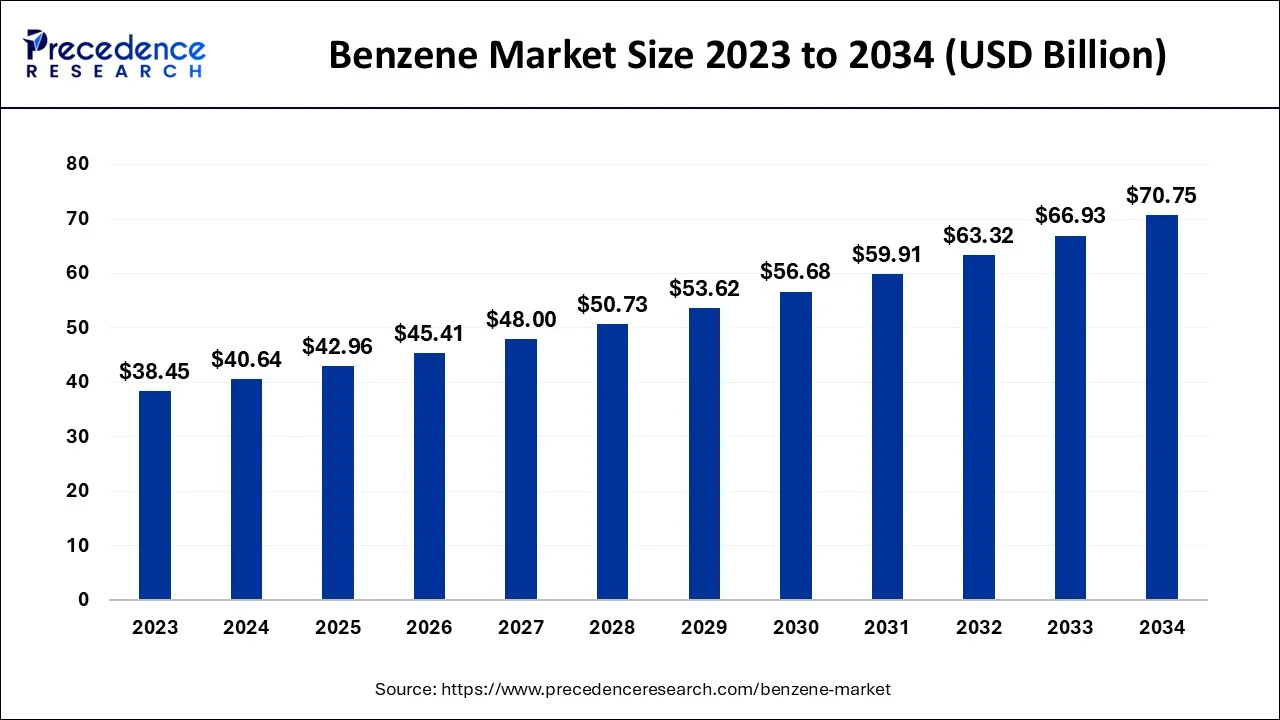

The global benzene market size accounted for USD 40.64 billion in 2024, grew to USD 42.96 billion in 2025 and is predicted to surpass around USD 70.75 billion by 2034, representing a healthy CAGR of 5.70% between 2024 and 2034. The North America benzene market size is calculated at USD 18.29 billion in 2024 and is expected to grow at a fastest CAGR of 5.81% during the forecast year.

The global benzene market size is estimated at USD 40.64 billion in 2024 and is anticipated to reach around USD 70.75 billion by 2034, expanding at a CAGR of 5.70% from 2024 to 2034.

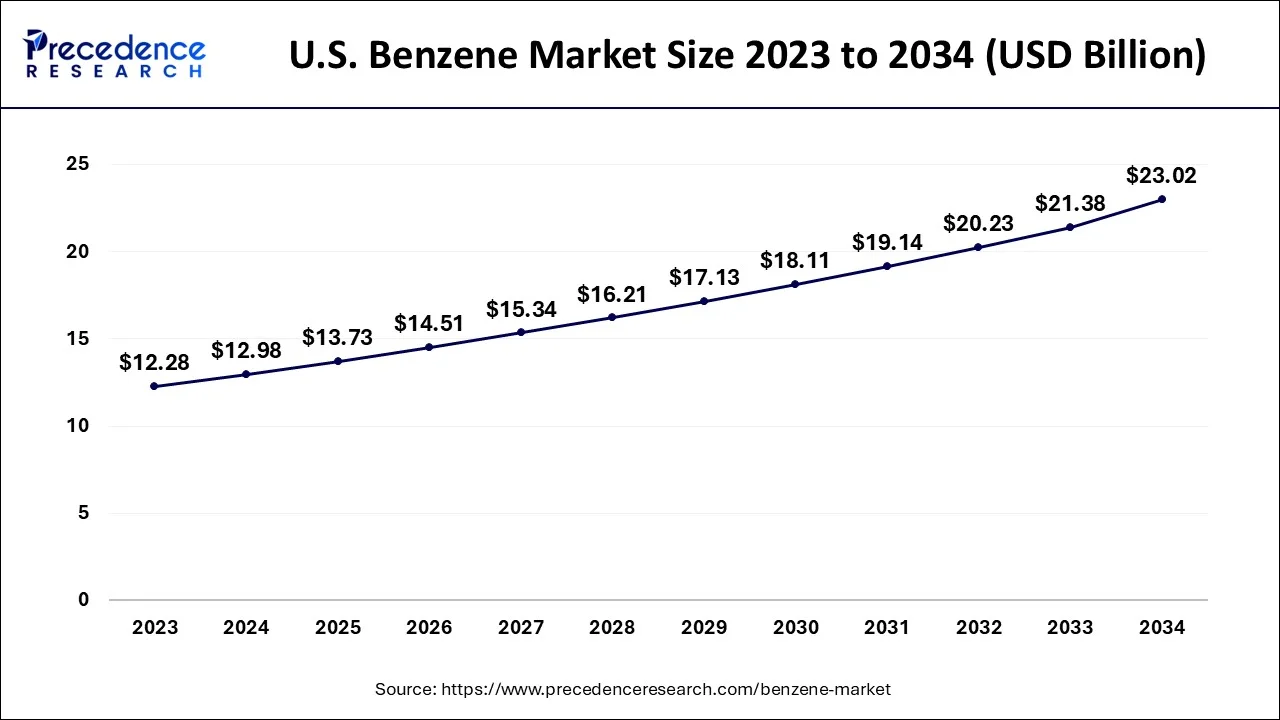

The U.S. benzene market size is evaluated at USD 12.98 billion in 2024 and is predicted to be worth around USD 23.02 billion by 2034, rising at a CAGR of 5.88% from 2024 to 2034.

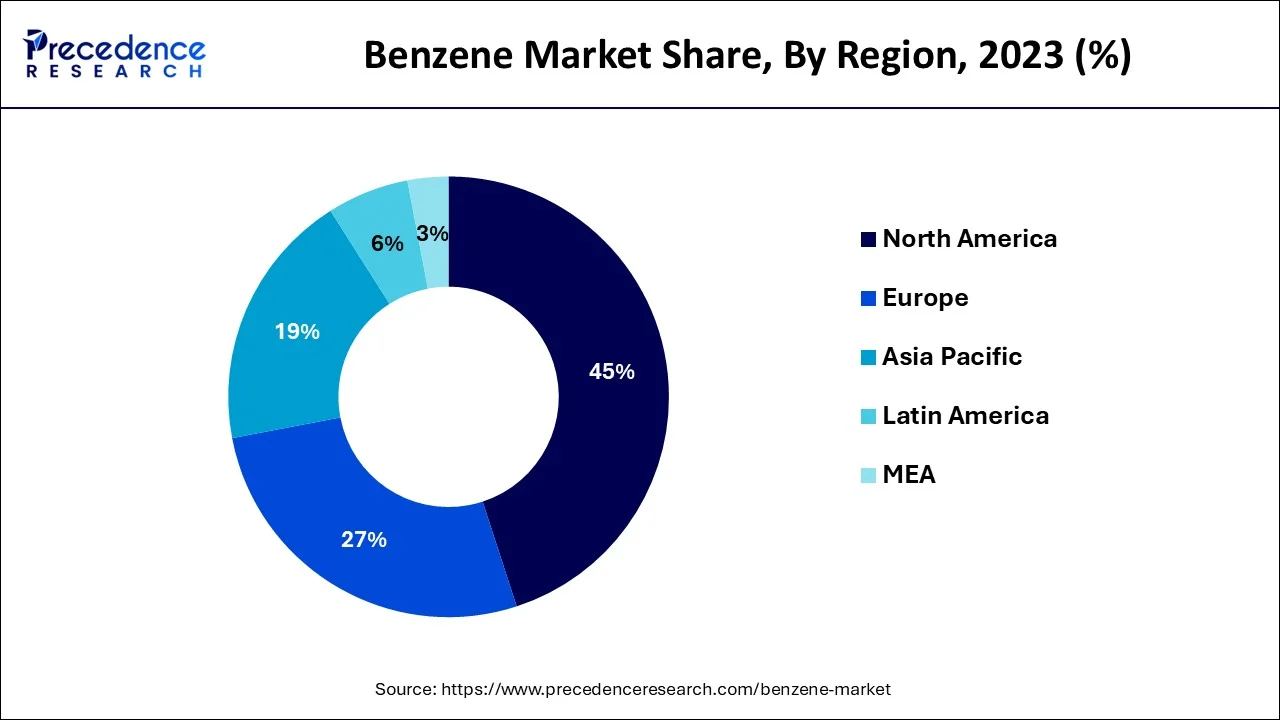

Due to the developing petrochemical industry, the North America region has accounted for the majority revenue share in the market throughout the projection period. The production of benzene, a widely used feedstock in the petrochemical sector for the creation of a variety of chemicals, principally involves the catalytic reforming and steam cracking of crude oil. The upstream petroleum industry in the area has grown dramatically over the past ten years as a result of technical advancements, particularly the hydraulic fracturing method for extracting shale oil. Investors are focusing their efforts on value addition and the development of new petrochemical complexes since the region's oil and gas output has outpaced domestic fuel demand. The availability of excess crude oil and rising demand from the developing petrochemical industry are expected to support market expansion.

The Asia-Pacific region is predicted to see a considerable growth rate. Because of the expanding end-user markets for electronics and home appliances, construction, and textiles in India, China, and other Asian nations, the Asia-Pacific area is anticipated to have the fastest rate of growth in the whole region throughout the time of forecasting. Additionally, benzene is widely utilized in the manufacturing of goods for the construction industry, including paints, carpeting, adhesives, fiberglass, and others. The National Bureau of Statistics of China estimates that in 2023, China's construction production was roughly CNY 29.31 trillion. The Asia-Pacific region's demand for benzene is projected to increase as a result.

A hazardous petrochemical industrial solvent, benzene is described as a highly flammable, colorless, aromatic hydrocarbon with a pleasant fragrance. It is a petrochemical product that tends to evaporate quickly when exposed to air and has a number of subsidiaries, including aniline, cumene, cyclohexane, alkyl benzene, ethyl benzene, chlorobenzene, nitrobenzene, and phenol. It is utilized throughout a wide range of commercial and economic businesses, including those in the consumer goods, transportation, construction, electrical & electronics, and medical sectors.

Despite being widely used for several industrial applications, its caustic toxicity prevents its employment in non-industrial settings. It has been determined that benzene is a carcinogen, or a substance that may cause cancer, and that continued exposure to it might be harmful to one's health. Prior until recently, benzene was frequently used to decaffeinate coffee and clean metals, but less dangerous substances are now swiftly replacing it. One of the major drivers of market expansion is a rise in the use of insulating materials in building operations. Additionally, the demand for consumer goods like furniture wax and thinners has increased globally as a result of expanding urbanization and rising disposable incomes.

Due to the solid expansion of the automotive sector is projected that demand for the product will continue to rise. Due to growing use of benzene derivatives in the automobile industry for the production of synthetic rubber has driven demand in the benzene market.

| Report Coverage | Details |

| Market Size in 2024 | USD 40.64 Billion |

| Market Size by 2034 | USD 70.75 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.70% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Derivative, Manufacturing Process, Application, End-use, and Geography |

| Companies Mentioned | BASF SE, Braskem, Reliance Industries Limited, Shell PLC, SABIC, SIBUR, Chevron Phillips Chemical Company LLC, China Petroleum & Chemical Corporation, Eastman Chemical Company, Exxon Mobil Corporation, Flint Hills Resources, Hengyi Industries Sdn Bhd, INEOS, LG Chem, LyondellBasell Industries Holdings BV, Marathon Petroleum Company, Maruzen Petrochemical, Mitsubishi Chemical Corporation |

Rising demand for styrene polymers from various end-use industries

Increasing demand of domestic cleaning product use

fluctuating crude oil prices and benzene's dangers

On the basis of derivative, the ethylbenzene segment is expected to have the largest market share in the coming years period, this segment has dominated the market in the past with the maximum share in terms of revenue and it will continue to grow well in the coming years. Natural sources of it include coal tar and petroleum, as well as manufactured goods like paints, pesticides, and inks. Chemical styrene is mostly produced from ethylbenzene. As a solvent, in fuels, and in the synthesis of other chemicals are some further uses. Polystyrene, acrylonitrile-butadiene-styrene (ABS), styrene-acrylonitrile (SAN) resins, styrene-butadiene elastomers, latexes, and unsaturated polyester resins are just a few of the products that may be made from styrene.

On the basis of application, the industrial chemical segment has held the largest market share in 2023 in terms of revenue. The majority of industries employ benzene and its derivatives to produce chemicals that are used in nylon, resins, and plastic. Many painkillers, including analgesic medications like aspirin, naproxen, ibuprofen, and rofecoxib among others that are used to alleviate pain, lower fever, and reduce inflammation, include benzene derivatives. Nasal congestion has been treated using phenylpropanolamine, a decongestant made from benzene. In addition, polystyrene is frequently utilized to make medical equipment in the healthcare sector since it is simple to sterilize. Test kits, petri dishes, test tubes, and diagnostic elements are just a few of the medical gadgets made from polystyrene.

The manufacturing of styrene butadiene rubber heavily utilizes the derivative styrene (SBR). SBR is mostly used to make tires for automobiles and other light-weight vehicles. SBR is an excellent material for meeting the high performance and durability requirements of the tire industry since it has special qualities including reduced rolling friction, good grip during braking, and abrasion resistance. In addition to tires, SBR is used to make shoe bottoms, pipes, gaskets, wire insulation, and conveyor belts.

By Derivative

By Manufacturing Process

By Application

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

July 2024