September 2024

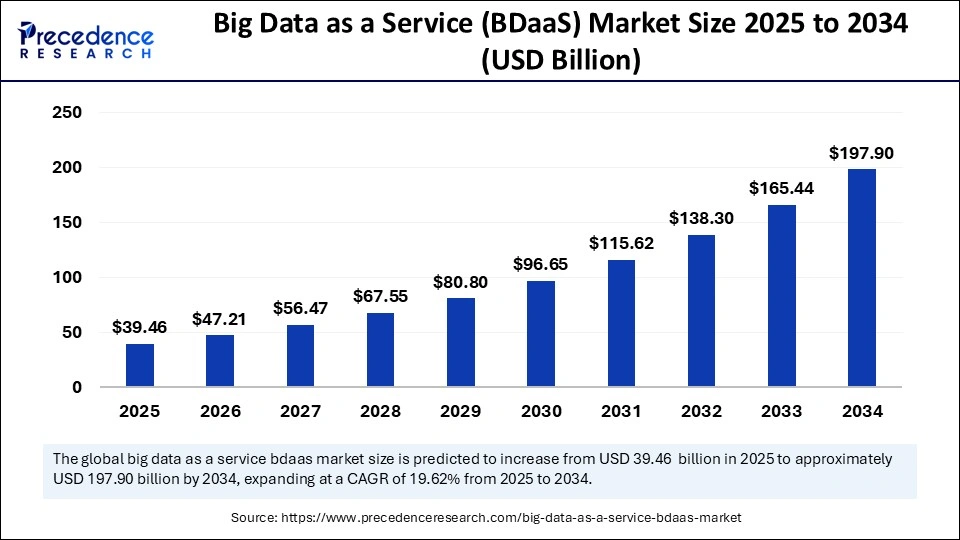

The global big data as a service (BDaaS) market size is calculated at USD 39.46 billion in 2025 and is forecasted to reach around USD 197.9 billion by 2034, accelerating at a CAGR of 19.62% from 2025 to 2034. The North America market size surpassed USD 11.88 billion in 2024 and is expanding at a CAGR of 19.78% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global big data as a service (BDaaS) market size was estimated at USD 32.99 billion in 2024 and is predicted to increase from USD 39.46 billion in 2025 to approximately USD 197.9 billion by 2034, expanding at a CAGR of 19.62% from 2025 to 2034. The market is expanding rapidly due to the rising need for robust solutions to handle huge data volumes generated by social media, increasing internet penetration, and the rising adoption of IoT and cloud computing in various sectors.

The integration of Artificial Intelligence (AI) with big data as a service solution is significantly impacting the market. AI is a cutting-edge technology that can be used to expand the capabilities of existing technologies. AI can automate data processing and analysis. It increases data quality with intelligent data cleaning techniques and normalization processes to gain insights from unstructured and raw datasets. Machine learning algorithms are helpful to achieve more precise and faster predictions from big datasets.

AI-based analytics tools allow businesses to achieve deeper insights in real time, making the decision process efficient. Moreover, natural language processing is beneficial for users with non-technical backgrounds and makes it easier to interact with big data using simple inputs. AI reduces the need for manual analytics, making BDaaS more efficient.

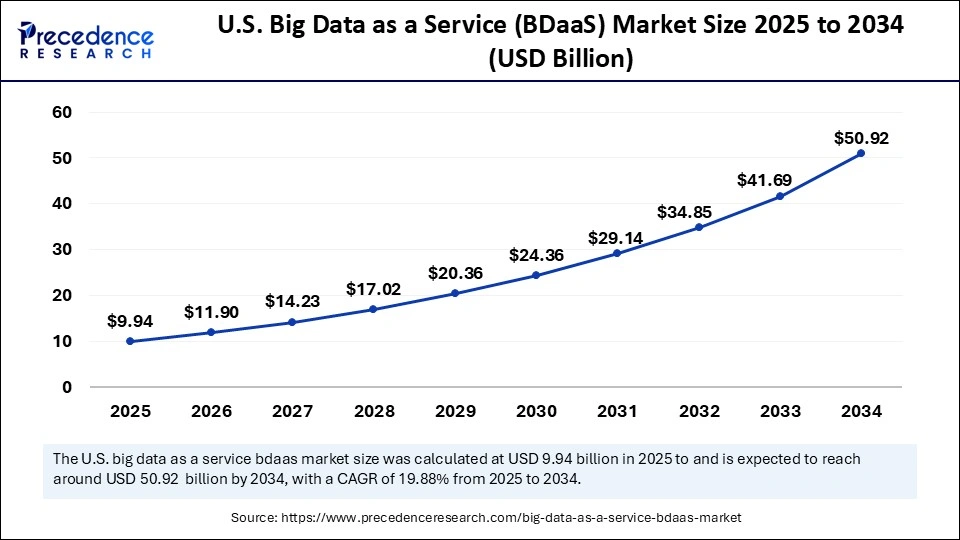

The U.S. big data as a service (BDaaS) market size was exhibited at USD 8.31 billion in 2024 and is projected to be worth around USD 50.92 billion by 2034, growing at a CAGR of 19.88% from 2025 to 2034.

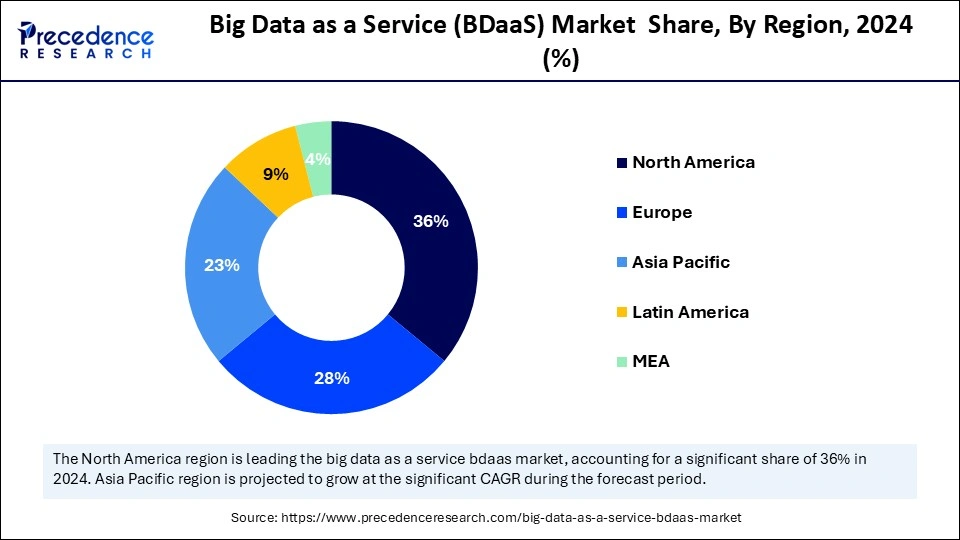

North America dominated the big data as a service (BDaaS) market with the largest share in 2024. The regional market growth is mainly driven by the widespread adoption of cloud computing, providing a robust foundation for BDaaS solutions. Many organizations have shifted their workloads to the cloud due to its offerings like scalability, flexibility, and cost-effectiveness. The U.S. held the maximum share of the market. The country has a well-established cloud infrastructure, with leading tech companies like Amazon, Google Cloud, and Microsoft Azure. Many businesses in the U.S. are adopting cloud services like big data as a service to efficiently manage huge amounts of data, further propelling the growth of the market.

Europe was the second-largest shareholder in 2024 and is expected to grow at a steady growth rate in the coming years. The rising digitalization is a key factor boosting the demand for data-driven insights. With the rising adoption of IoT, data volumes are increasing, boosting the need for BDaaS solutions. These solutions offer capabilities to handle large datasets effectively and store them securely. The expansion of the cloud computing infrastructure further supports market growth.

Asia Pacific is projected to witness the fastest growth during the forecast period. The rising adoption of cloud computing is driving the growth of the big data as a service (BDaaS) market in the region. There is a high demand for flexible, cost-effective, and scalable solutions to handle large datasets. BDaaS offers powerful data analytics tools without requiring substantial investment in infrastructure. The increasing acceptance of cloud technologies and the expansion of IT infrastructure are expected to support regional market growth.

The big data as a service (BDaaS) market is witnessing rapid growth due to an increasing volume of data. BDaaS provides enterprises with efficiency in storing and handling data and analyzing and processing huge amounts of data effectively to gain detailed insights. By using BDaaS, enterprises can cut down on expenses required for infrastructure, leading to cost-saving operations. BDaas offers alternatives to traditional methods of data management systems. Big data as a service offers big data solutions and analytics capabilities with the help of cloud-based platforms without the need for robust hardware and software infrastructure. Due to such unprecedented offerings by BDaaS, many organizations are opting for it to manage extensive datasets and expand their business on a global scale. The growth of the market is driven by the increasing demand for advanced analytics and the expansion of data sources owing to internet penetration and digitalization.

| Report Coverage | Details |

| Market Size by 2034 | USD 197.9 Billion |

| Market Size in 2025 | USD 39.46 Billion |

| Market Size in 2024 | USD 32.99 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 19.62% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Deployment, Solution, Enterprise Size, End-User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Adoption of Cloud Computing

The widespread adoption of cloud computing is a major factor driving the growth of the big data as a service (BDaaS) market. As many organizations are shifting toward cloud computing platforms, data volumes are rising, boosting the demand for real-time data analytics. Rapid development of cloud computing helps organizations leverage the offerings of BDaaS without upfront cost for infrastructure, leading to cost-effectiveness. Cloud platforms provide the infrastructure and scalability required for BDaaS solutions. The rise in exponential data generation due to Internet of things and social media further demands efficient data management systems with highly developed security features to avoid fraudulent activities.

Lack of Skilled Workforce and Data Privacy Concerns

The lack of skilled professionals is a key factor restraining the growth of the big data as a service (BDaaS) market. Implementing and managing BDaaS solutions creates complexities, requiring detailed knowledge and expertise. In addition, concerns regarding data security and privacy limit the adoption of BDaaS solutions. These solutions store and process sensitive data of organizations in the cloud, making it vulnerable to cyber threats. Data breaches and unauthorized access are major concerns that need to be addressed.

Expansion of BDaaS in Various Sectors

The expanding scope of applications of BDaaS solutions in various sectors like finance, healthcare, manufacturing, and retail creates immense opportunities in the market. By providing solutions as per requirements, BDaaS solutions can provide businesses in these sectors with deeper insights to grow businesses and offer better ROI policies for their clients. Expanding BDaaS offerings make big data accessible to a range of businesses, regardless of size and technical expertise. Additionally, rising collaborations and partnerships between leading players and BDaaS providers present opportunities to create synergies and open new gateways to innovate and expand the market horizon.

The public cloud segment led the big data as a service (BDaaS) market with the largest share in 2024. This is mainly due to the rise in the need for cost-effective solutions. Public cloud platforms offer customization in payment model and do not charge fixed amount. The cost pf these platforms depends on how much services or products have been used, making them affordable options while reducing the need for expensive hardware. Cloud public platforms are ideal for small and medium-sized enterprises that require big data analytics without high initial investments.

The hybrid cloud segment is expected to witness the fastest growth during the forecast period. The growth of the segment can be attributed to the flexible solutions. Hybrid cloud platforms offer both public and private cloud solutions to consumers depending on requirements. This flexibility is valuable for enterprises with fluctuating data volumes. With the help of hybrid cloud platforms, enterprises can effectively manage their big data workloads.

The data analytics-as-a-service segment captured the largest share of the big data as a service (BDaaS) market in 2024. The growth of the segment is driven by the increased need for data analytics. Many enterprises are increasingly acknowledging the importance of data-based decisions, making data analytics-as-a-service crucial. With the help of data analytics-as-a-service, businesses can analyze huge datasets in one go, further assisting them in decision-making. Retail, finance, and manufacturing sectors require precise data to drive business efficiently, boosting the demand for data analytics-as-a-service.

The Hadoop-as-a-service segment is projected to grow at the fastest rate over the studied years. Hadoop-as-a-service offers simplified versions to manage and maintain the infrastructure by providing a service that effectively works on technical aspects of Hadoop like configuration, set up, and maintenance. Hadoop-based solutions do not require separate IT staff, making them cost-effective and minimizing technical challenges.

The large enterprise segment accounted for the largest market share in 2024. Large enterprises rely on advanced analytics to achieve a competitive edge and enhance decision processes by optimizing business models. BDaaS provides large enterprises access to powerful tools like machine learning, predictive analytics, and AI without extensive need for in-house infrastructure. Such capabilities enable large enterprises to gain actionable insights along with data-driven decisions. Moreover, large enterprises often deal with vast datasets, boosting the need for BDaaS solutions.

The small and medium-sized enterprises segment is projected to expand at the highest CAGR during the upcoming period. SMEs require more data scientists and robust IT infrastructure for data analytics. Big data as a service offers interfaces and automated processes to minimize complexity of data analytics. Such easy implementation allows SMEs to quickly adopt big data solutions, fueling the segment’s growth.

The BFSI segment held the largest share of the big data as a service (BDaaS) market in 2024. The BFSI sector needs more risk-detecting tools to avoid fraudulent activities. The increased frequency of cyberattacks has boosted the demand for data analytics in the BFSI sector. The growing complexities in financial transactions and the rising digitalization are boosting the demand for advanced data analytics. However, big data as a service offers BFSI organizations ideal solutions to analyze huge datasets precisely in real time and help them to find unusual patterns, which prevent potential risk.

The manufacturing segment is likely to witness the fastest growth in the coming years. Maintaining high product quality is an essential factor for the manufacturing industry. With the help of big data analytics, manufacturers can easily find loopholes in the production process and implement corrective strategies as per requirement, leading to enhanced production process. Manufacturers are increasingly adopting big data analytics to analyze quality control data, contributing to segmental growth.

By Deployment

By Solution

By Enterprise Size

By End-User

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

April 2025

January 2025

March 2025