November 2024

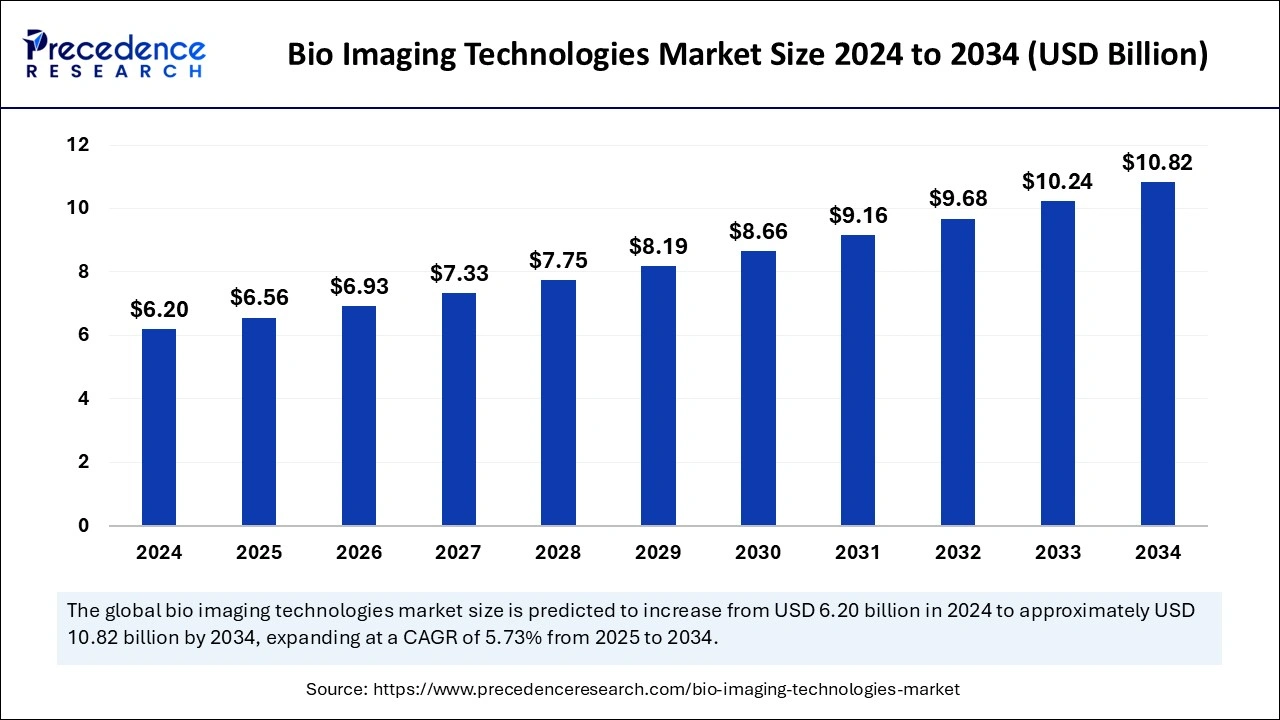

The global bio imaging technologies market size is accounted at USD 6.56 billion in 2025 and is forecasted to hit around USD 10.82 billion by 2034, representing a CAGR of 5.73% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global bio imaging technologies market size accounted for USD 6.20 billion in 2024 and is predicted to increase from USD 6.56 billion in 2025 to approximately USD 10.82 billion by 2034, expanding at a CAGR of 5.73% from 2025 to 2034. The market is driven by increased diagnoses of chronic illnesses and the healthcare needs of aging populations; demand for bio imaging grows due to increased AI implementation and healthcare funding.

The bio imaging technologies market advances medical imaging methods through integration with artificial intelligence. Fast real-time analysis performed through these systems results in reduced diagnostic times, which in turn enables physicians to make more timely medical choices. Medical professionals visualize AI imaging solutions as essential elements for personalized treatment since they build specific therapy plans that stem from individual patient scan results. Artificial intelligence powers modern diagnostic healthcare by improving performance speed and accuracy, which expands healthcare access and patient-responsive care.

In October 2023, Exo launched its newest product, Exo Iris; it brought together portable ultrasound technology, AI systems, and health information technology platforms with point-of-care imaging functions.

Bio imaging is a branch of science that focuses on creating functional and structural images of living systems. Different image-capturing techniques and processing methods within this field enable molecular-level visualizations of human bodily structures. Medical use of the bio imaging technologies market technology includes both diagnostic evaluation and disease assessment. Through these technologies, researchers can establish biological macromolecule structural measurements within the entire human body.

The healthcare industry predicts that the bio imaging technologies market will establish itself as a primary diagnostic method, which will generate new product releases and operational opportunities. Research efforts focus on cancer, cardiovascular diseases, neurological disorders, and orthopedic conditions to create exact diagnosis methods that drive effective treatment plans and management protocols. Advanced imaging technologies are needed due to rising global populations with aging demographics and escalating disease incidence to enhance disease management and achieve improved patient results.

| Report Coverage | Details |

| Market Size by 2034 | USD 10.82 Billion |

| Market Size by 2025 | USD 6.56 Billion |

| Market Size in 2024 | USD 6.20 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.73% |

| Leading Region | North America |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Sample Type, Application, End User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing incidence of chronic diseases

The bio imaging technology market will grow because of three factors: rising numbers of senior citizens combined with escalating critical illness early detection requirements alongside heightened usage of radiopharmaceutical diagnostic products. Healthcare research and development investments aimed at medical imaging and molecular imaging technologies together propel market growth.

The growing incidence of chronic diseases such as cancer and cardiovascular diseases requires sophisticated imaging techniques. These technologies gained acceptance within the medical field for enhancing both diagnostic speed and accuracy since timely treatment depends heavily on quick, accurate assessment results. The bio imaging technologies market continues to grow alongside healthcare priorities of high-quality patient care for senior citizens through sustained capital injections that expand diagnostic tool availability.

High cost of advanced imaging systems

The high expense of advanced imaging systems creates a major obstacle in medical settings, particularly for underfunded developing countries. Bio imaging technologies market technologies provide scientists with multiple sophisticated microscopy and imaging methods to view biological processes and structures across cellular and molecular dimensions. Access to bio imaging equipment proves challenging for multiple researchers and laboratories because of the large financial cost involved in buying advanced machines, high-quality optical instruments, specialized analysis tools, and analytic capabilities.

Focus on the growth of personalized medicine.

Healthcare professionals now prioritize the development of patient-specific medical solutions. Bio imaging technologies market techniques, including magnetic resonance imaging (MRI), computed tomography (CT) scans, and PET scans, collect detailed structural and functional data that allow physicians to make exact diagnoses and develop individualized treatment strategies. Bioimaging technology will experience increased demand because chronic disease numbers keep rising.

Patient-specific bioimaging technologies experience rapid research progress because acceptance of personalized medicine has become a fundamental standard in healthcare. Imaging technologies of today enable medical experts to view disease patterns for developing targeted therapeutic strategies. Medical diagnosis has become more specific as HealthCare continues providing better treatment effectiveness.

The confocal microscopy segment generated the largest bio imaging technologies market share in 2024. Confocal microscopy employs light to create exceptionally clear three-dimensional visuals of biological specimens for biological imaging investigation. Biomedical scientists prefer this technology because its flexibility, together with high-resolution features, lets it create distinct optical section images from densely detailed complex specimens. Research activity in neuroscience, together with materials science and life sciences, has led to increased demand for confocal microscopes. The adoption rate of the confocal microscope system has accelerated because ongoing imaging technology advancements generate better resolution and faster data acquisition.

The super-resolution microscopy segment is projected to witness the fastest growth during the forecast period. Super-resolution microscopy (SRM) functions as an advanced imaging approach through fluorescence that generates precise biological process models. Super-resolution microscopy comes with nanometer-range resolution extending far beyond regular light microscopy diffraction limits. SRM technology receives substantial funding from independent labs that couple their efforts with government-backed facilities that also use universities as research partners. Industry growth relies on super-resolution microscopes because these devices deliver unmatched resolution capabilities and scientific benefits that standard optical instruments lack.

The live cells segment dominated the global bio imaging technologies market in 2024. Bio imaging technologies, along with live cell imaging research sectors, continue to grow at a steady pace driven by technological improvements combined with rising chronic disease frequency and increasing need for customized patient treatments. Medical research organizations heavily depend on cancer statistics because they need data for both exploration and therapy development. A therapeutic target becomes possible through live cell imaging analysis of living cancer cells since it enables the development of individualized drug treatments. The technology delivers improved medical diagnostics by facilitating both early disease detection and accurate diagnoses while monitoring treatment responses, which results in higher-quality healthcare delivery.

The fixed cells segment is projected to witness the fastest growth during the forecast period. The visualization of biological materials through fixed cells depends on bio imaging technology, which utilizes different investigative methods. Fixed cell preservation techniques seek to keep cellular form and constituent content as close as possible to their native state. Bio imaging implements technologies to analyze cells that are fixed along with tissues and three-dimensional biological samples. These research tools enable detailed laboratory analysis of biological processes by letting researchers observe physiology without affecting authentic organism functions.

The cell biology segment noted the largest share of the bio imaging technologies market in 2024. Researchers use bio imaging tools to view cellular operations instantly while they monitor intercellular interactions together with ion parameters and metabolite measurements inside their native conditions. Scientists employ bio imaging tools for real-time direct cell observations to view cellular function as well as the interplay between cells and compounds within biological environments. These technologies enable scientific disciplines to design novel medical treatments and interpret disease mechanisms while advancing regenerative medicine as a field.

The neuroscience segment is estimated to witness the fastest growth in the market during the forecast period. Bio imaging technologies with neuroscience to create images that assist in diagnosing brain disorders through biological process observation. Real-time biological observation without the need for invasive procedures becomes possible through bio imaging technology. Neuroscience utilizes bio imaging technologies to investigate brain structures and study nervous system activity. Technologies create enhanced opportunities for brain research, enabling researchers to study the nervous system's functioning in combination with disease impacts and drug responses.

The pharmaceutical and biotechnology segment led the global bio imaging technologies market in 2024. Modern organizations use imaging technologies to advance both educational techniques and pharmaceutical development together with preclinical research. The partnership of academic institutions together with industry sectors advances inventive imaging technology development as well as extends bio imaging platforms into medical environments outside standard healthcare facilities. Advanced biomedical research investments, together with precision medicine movements, can enhance the adoption rates of these imaging technologies.

The medical diagnostics segment is estimated to witness significant growth in the forecast period. Imaging exams run by healthcare facilities diagnose illnesses by evaluating patients who receive referrals from medical practitioners. The rising practice of medical facilities delegating imaging services to specialized centers requires advancements in diagnostic equipment technology. Bio imaging technologies produce detailed images of tissues and organs with the help of light or sound waves and magnetic fields, which enable medical professionals to identify diseases and injuries. The expansion of diagnostic imaging centers has responded to growing patient demand for cost-effective and convenient outpatient diagnostic services.

North America accounted for the largest bio imaging technologies market share in 2024. The United States stands at the forefront of healthcare innovation because of its strong healthcare facilities, substantial funding, and important healthcare members taking part. Due to swift technological adoption rates nationwide, advanced imaging technology will fuel future marketplace growth.

The combined effect of enhanced healthcare technology implementations alongside increasing demand for diagnostic imaging solutions unleashes substantial market growth in North America. Chronic illness frequency combined with improved diagnostic imaging technology availability drives market developments throughout the region.

Asia Pacific is anticipated to witness the fastest growth in the bio imaging technologies market during the forecasted years. The growth of hospital infrastructure across China and India represents an emerging opportunity zone because these countries are witnessing increasing demand for healthcare technology. These countries use advanced imaging solutions to enhance diagnostic capability while investing in healthcare development.

The increasing number of elderly individuals, together with heightened healthcare expenses, generate rising demand for these technologies. The markets experience growth because healthcare infrastructure developments combined with progressive early diagnosis understanding create additional expansion opportunities.

By Technology

By Sample Type

By Application

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

July 2024

February 2025

October 2024