April 2025

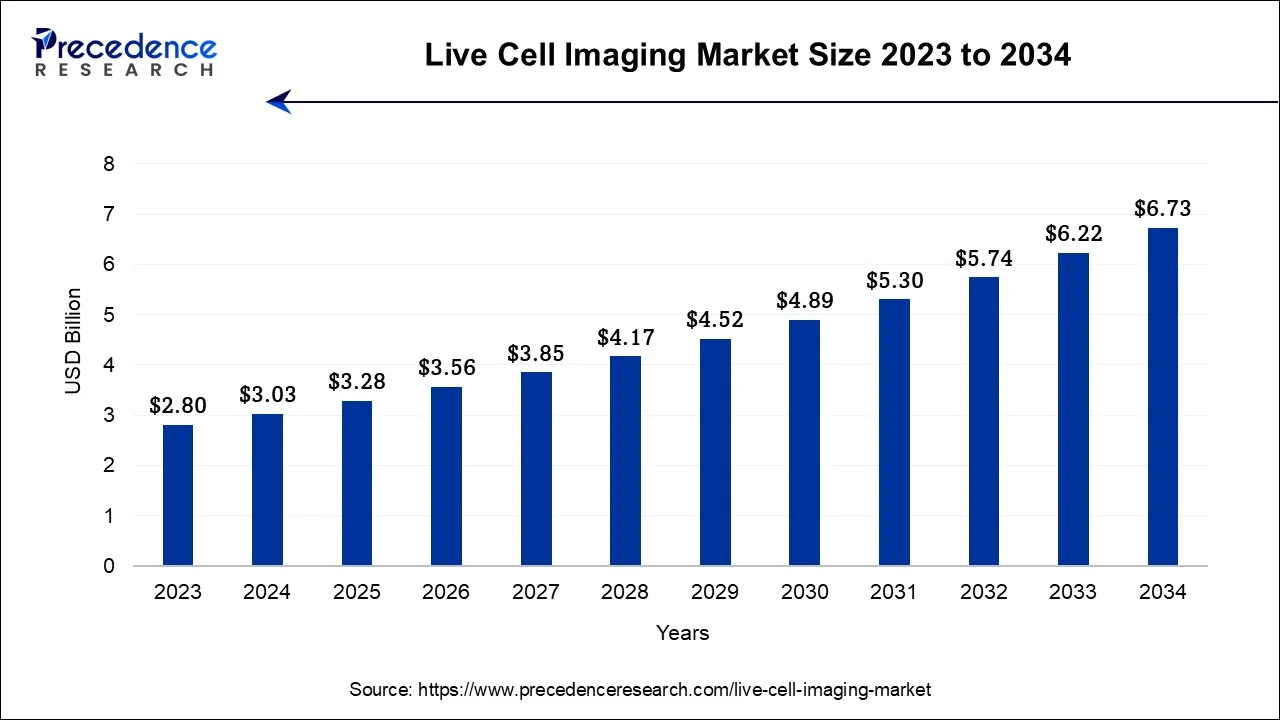

The global live cell imaging market size is estimated at USD 3.03 billion in 2024, grew to USD 3.28 billion in 2025 and is predicted to surpass around USD 6.73 billion by 2034, expanding at a CAGR of 8.30% between 2024 and 2034.

The global live cell imaging market size accounted for USD 3.03 billion in 2024 and is anticipated to reach around USD 6.73 billion by 2034, growing at a CAGR of 8.30% from 2024 and 2034.

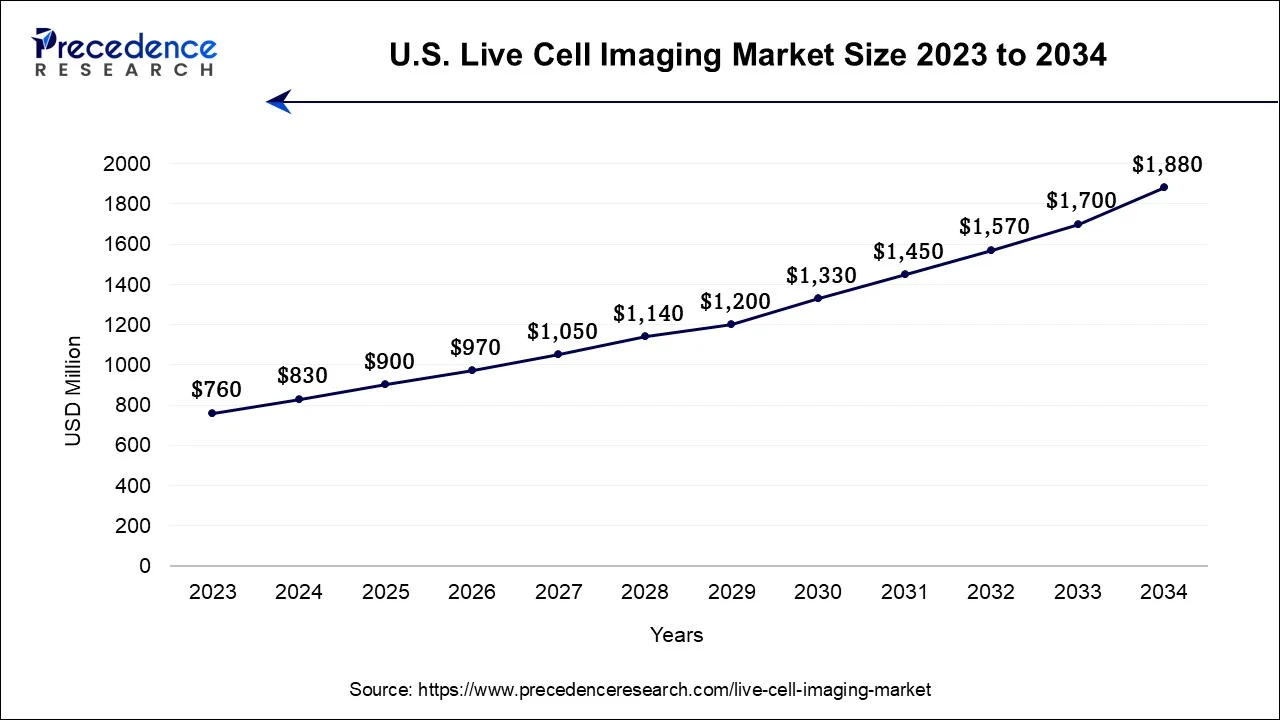

The U.S. live cell imaging market size is estimated at USD 830 million in 2024 and is expected to be worth around USD 1880 billion by 2034, at a CAGR of 8.51% from 2024 to 2034.

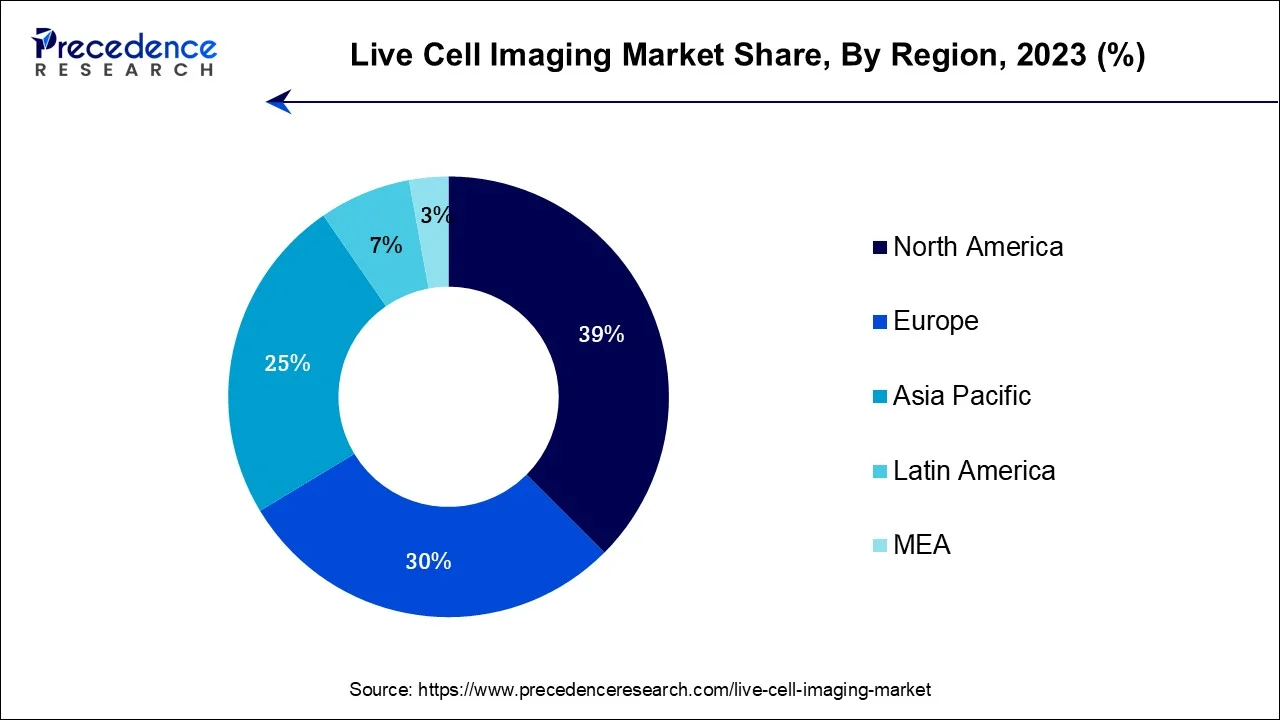

North America has held the largest revenue share 39% in 2023. The live cell imaging market in North America has been characterized by steady growth, primarily driven by robust research and development activities in the region. North American countries, particularly the United States and Canada, are home to numerous prominent pharmaceutical and biotechnology companies, creating a high demand for live cell imaging technologies in drug discovery and development.

Moreover, a strong emphasis on personalized medicine and advancements in healthcare further boost the adoption of live cell imaging. The presence of leading vendors and academic institutions contributes to North America's leadership in this market.

Asia-Pacific is estimated to observe the fastest expansion. The Asia-Pacific region is experiencing significant growth in the live cell imaging market due to expanding life sciences research, increasing investments in healthcare infrastructure, and a rising awareness of the technology's potential. Countries like China, Japan, and India are witnessing substantial demand for live cell imaging systems. Furthermore, collaborations between local research institutions and global players are driving technology transfer and knowledge exchange, fostering market growth.

The Asia-Pacific region is emerging as a vital player in the global live cell imaging market, with a focus on addressing regional healthcare needs and contributing to scientific advancements.

Europe's Live Cell Imaging market thrives on a strong academic and research community, particularly in Germany, the UK, and France. Collaborative research efforts, EU investments, and a growing emphasis on precision medicine contribute to the region's significance in advancing live cell imaging technologies and applications.

Live cell imaging is a microscopy technique that enables real-time observation of living cells and their dynamic processes. It involves using specialized microscopes and fluorescent dyes or markers to track cellular activities such as division, migration, and protein interactions. This non-invasive approach provides invaluable insights into dynamic cellular behaviors, allowing researchers to study biological phenomena, track disease progression, and assess the effects of experimental treatments. Live cell imaging has revolutionized fields like cell biology, neuroscience, and drug development by capturing the intricacies of cellular dynamics with high precision and temporal resolution.

Live cell imaging is a groundbreaking technique that allows real-time observation of living cells through specialized microscopy and advanced imaging tools. The market for live cell imaging is experiencing robust growth, driven by several key factors. Major growth factors include the increasing demand for better understanding cellular processes, aiding drug development, and studying diseases like cancer and neurodegenerative disorders. Additionally, advancements in imaging technologies, such as super-resolution microscopy and 3D imaging, are enhancing the precision and capabilities of live cell imaging systems, further fueling market expansion.

Industry trends include the integration of artificial intelligence and machine learning for automated image analysis, making data interpretation faster and more accurate. Furthermore, the adoption of live cell imaging in personalized medicine and regenerative therapies is opening up new business opportunities.

However, challenges like the high cost of equipment and the need for skilled operators can hinder market growth. Live cell imaging is a dynamic field with a promising future. Growth is being propelled by increased research demands, technological advancements, and applications in various industries. While challenges exist, the continuous evolution of this technology promises numerous business opportunities for companies operating in the live cell imaging market.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 8.3% |

| Market Size in 2024 | USD 3.03 Billion |

| Market Size by 2034 | USD 6.73 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product, By Application, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising incidence of chronic diseases and biological research advancements

The growing incidence of chronic illnesses such as cancer, diabetes, and cardiovascular disorders has heightened the necessity for a more profound comprehension of cellular processes. Live cell imaging offers a distinctive avenue to examine the dynamic behavior of living cells in real time. Researchers can use this technology to investigate disease mechanisms, screen potential drug candidates, and assess treatment responses.

As personalized medicine gains prominence, live cell imaging enables the study of patient-specific cells, offering insights into disease progression and personalized treatment strategies.

Moreover, biological research has seen remarkable advancements, with scientists continuously uncovering new insights into cellular functions and interactions. Live cell imaging plays a pivotal role in these discoveries, allowing researchers to visualize dynamic cellular events and track cellular behavior over time. This technology is instrumental in studying phenomena like cell division, migration, and signaling pathways, leading to breakthroughs in various fields, including neuroscience, immunology, and regenerative medicine.

As researchers seek to unravel the complexities of life at the cellular level, live cell imaging remains an indispensable tool, fostering its growing demand in the market.

Limited compatibility, phototoxicity and photobleaching

The live cell imaging market faces challenges due to limited compatibility with certain cell types and samples. Specifically, primary cells and fragile specimens may not withstand the conditions necessary for live cell imaging, including exposure to fluorescent dyes and intense light. Consequently, this limitation impedes researchers from effectively studying a wide spectrum of cell types and biological processes.

Phototoxicity and photobleaching pose challenges in live cell imaging. The exposure of cells to high-intensity light sources, which is often necessary for capturing detailed images, can damage or alter cellular structures and functions. This can lead to inaccurate observations and compromise the validity of research results. Moreover, the repeated exposure to light during imaging sessions can cause photobleaching, where the fluorescent labels lose their signal over time, limiting the duration and quality of observations. Addressing these limitations through technological innovations and optimized imaging protocols is crucial to expanding the market for live cell imaging and ensuring its broader adoption in various research applications.

Advanced imaging technologies and personalized medicine

Advanced imaging technologies and personalized medicine have significantly surged the demand for live cell imaging. The integration of advanced imaging technologies, such as super-resolution microscopy and high-speed imaging, has revolutionized the capabilities of live cell imaging systems. These innovations provide researchers with higher-resolution images, faster data acquisition, and improved sensitivity.

As a result, scientists can capture intricate cellular details and dynamic processes more accurately, making live cell imaging an indispensable tool in understanding complex biological phenomena.

Moreover, the rise of personalized medicine, which tailors medical treatment to individual patients based on their unique genetic makeup and cellular responses, has propelled the demand for live cell imaging. Researchers and clinicians utilize live cell imaging to study patient-specific cells and their responses to treatments.

This enables the development of personalized therapeutic approaches for conditions like cancer, where treatment efficacy can vary significantly between individuals. Live cell imaging's ability to track cellular behavior in real time is instrumental in optimizing treatment strategies, making it a vital component in the era of personalized medicine. Together, these factors drive the increasing adoption of live cell imaging technologies across the life sciences and healthcare sectors.

Impact of COVID-19

The COVID-19 pandemic had a mixed impact on the live cell imaging market. In the initial stages, the market experienced disruptions due to supply chain interruptions and the diversion of resources towards combating the pandemic. Many research laboratories temporarily shut down or scaled back their operations, impacting the demand for live cell imaging equipment and services. However, as the pandemic progressed, the importance of cellular research became more evident, particularly in understanding the virus and developing vaccines and treatments. This led to a resurgence in demand for live cell imaging tools and technologies.

Additionally, the pandemic accelerated certain trends in the market, such as the adoption of remote monitoring and data analysis solutions, which allowed researchers to continue their work while adhering to social distancing measures. Furthermore, the urgency of the pandemic highlighted the need for faster and more efficient drug discovery and development processes, further emphasizing the role of live cell imaging in these efforts. While the initial impact of COVID-19 was disruptive, the pandemic ultimately underscored the value of live cell imaging in research and healthcare, leading to a resurgence in demand and the exploration of innovative applications in response to the global health crisis.

According to the product, the equipment segment has held 43% revenue share in 2023. Equipment in the live cell imaging market refers to the physical hardware used for capturing real-time images of living cells. This includes specialized microscopes, cameras, stage incubators, and imaging chambers. Trends in equipment involve a shift towards more advanced and user-friendly systems, such as those offering multi-modal imaging capabilities and automation features. High-content screening systems and live cell 3D imaging setups are gaining prominence, enhancing researchers' ability to study cellular dynamics with greater precision.

The software segment is anticipated to expand at a significantly CAGR of 12.8% during the projected period. Software in the live cell Imaging market refers to the digital tools and applications used for data analysis, image processing, and visualization. Current trends in software include the integration of artificial intelligence and machine learning for automated cell tracking and analysis, speeding up research workflows and improving data accuracy. Cloud-based solutions are also on the rise, allowing remote access to data and facilitating collaboration among researchers, irrespective of their physical locations.

The cell biology held the largest market share of 29% in 2023. Live cell imaging in cell biology involves observing and studying cellular processes within living cells. It enables researchers to visualize cellular events like division, movement, and signaling, providing insights into fundamental biological mechanisms. In recent trends, the adoption of super-resolution techniques and 3D imaging has enhanced cellular visualization, while the integration of artificial intelligence facilitates automated analysis. Additionally, live cell imaging is increasingly used to explore subcellular structures and organelles, aiding our understanding of complex cellular dynamics and advancing drug discovery and disease research.

On the other hand, the developmental biology segment is projected to grow at the fastest rate over the projected period. In developmental biology, live cell imaging tracks the growth and differentiation of cells into tissues and organisms. Researchers use it to study embryonic development, tissue regeneration, and organ formation. A significant trend is the use of live cell imaging to investigate stem cell behavior and gene expression during development. Furthermore, 4D imaging, which adds the temporal dimension, is gaining prominence, allowing researchers to track dynamic processes over time, offering valuable insights into developmental biology and regenerative medicine.

In 2023, the Fluorescence Resonance Energy Transfer segment had the highest market share of 37% based on the technology. Fluorescence Resonance Energy Transfer (FRET) is a sophisticated live cell imaging technology. It involves the transfer of energy between two fluorophores when they are in close proximity. FRET is used to monitor protein-protein interactions, molecular conformational changes, and cellular signaling events with high sensitivity and precision.

The High Content Screening (HCS) is anticipated to expand at the fastest rate over the projected period. High Content Screening (HCS) is a live cell imaging approach that combines automated microscopy with advanced image analysis algorithms. It allows for the simultaneous examination of multiple cellular parameters, such as morphology, intensity, and localization, in high-throughput assays. In the live cell imaging market, the trend is towards the integration of FRET and HCS, offering a comprehensive view of cellular processes and enabling more efficient drug discovery, toxicity testing, and personalized medicine development. This combination enhances the capacity to study complex cellular events and is driving innovation in the field.

Segments Covered in the Report

By Product

By Application

By Technology

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

February 2025

January 2025

January 2025