August 2024

Bioprocess Containers Market (By Type: 2D Container, 3D Container, Accessories; By Application: Production Process, Upstream Process, Downstream Process; By End-use: Pharmaceutical Companies, Biotechnology Companies) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

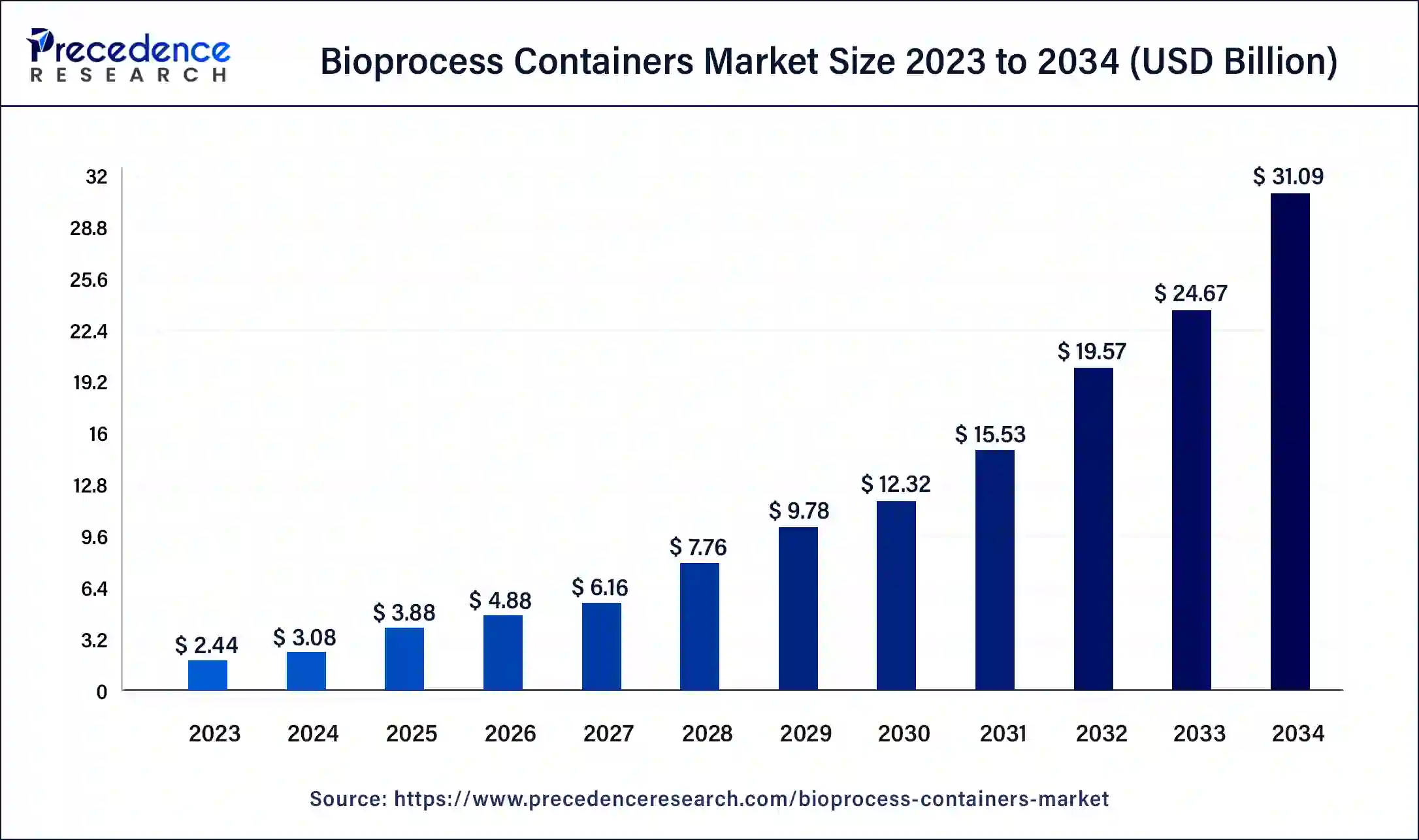

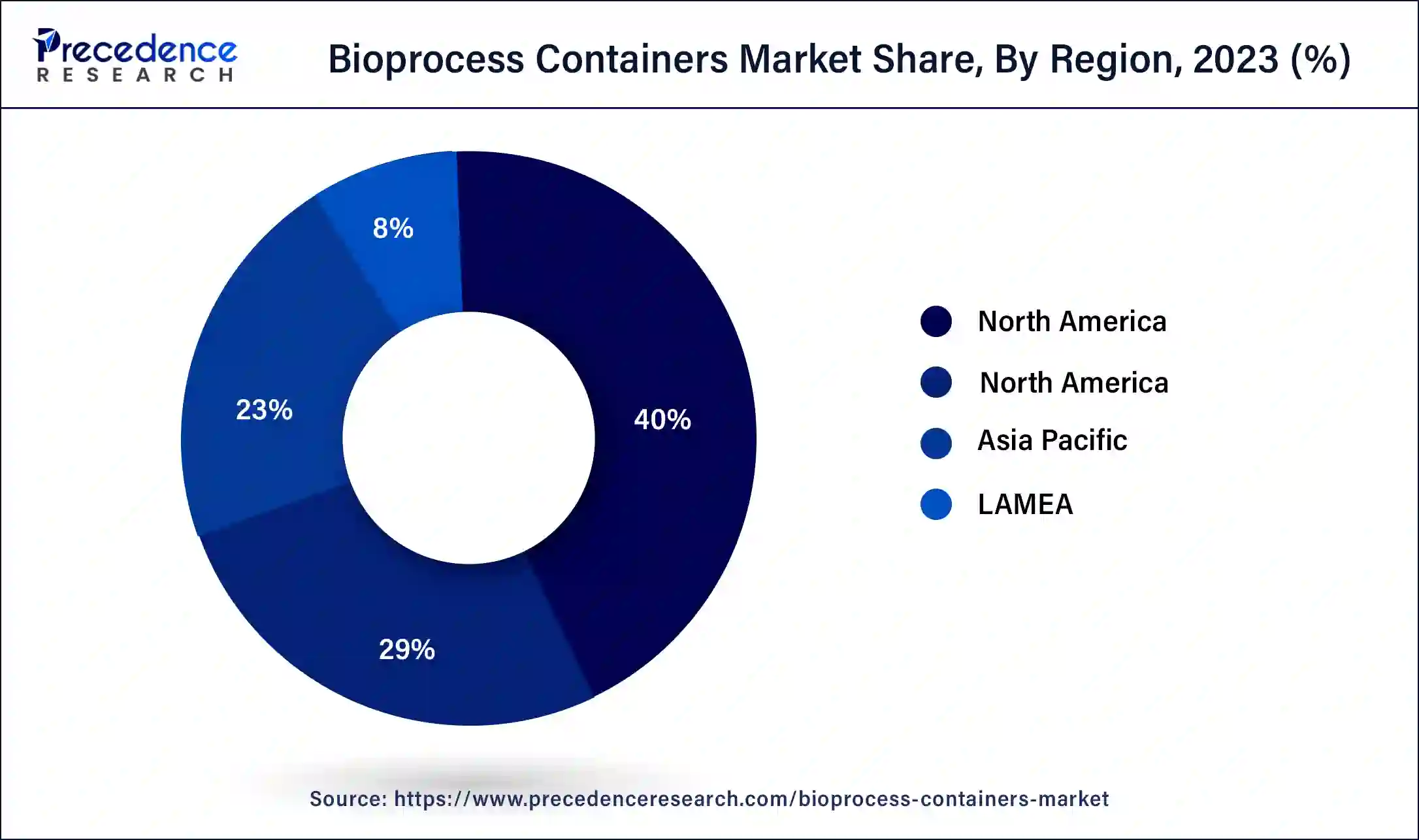

The global bioprocess containers market size was USD 2.44 billion in 2023, calculated at USD 3.08 billion in 2024 and is expected to reach around USD 31.09 billion by 2034. The market is expanding at a solid CAGR of 26.03% over the forecast period 2024 to 2034. The North America bioprocess containers market size reached USD 980 million in 2023. The need for bioprocess containers, which are utilized in the manufacture, storage, and transportation of biopharmaceuticals, is driven by an increase in demand.

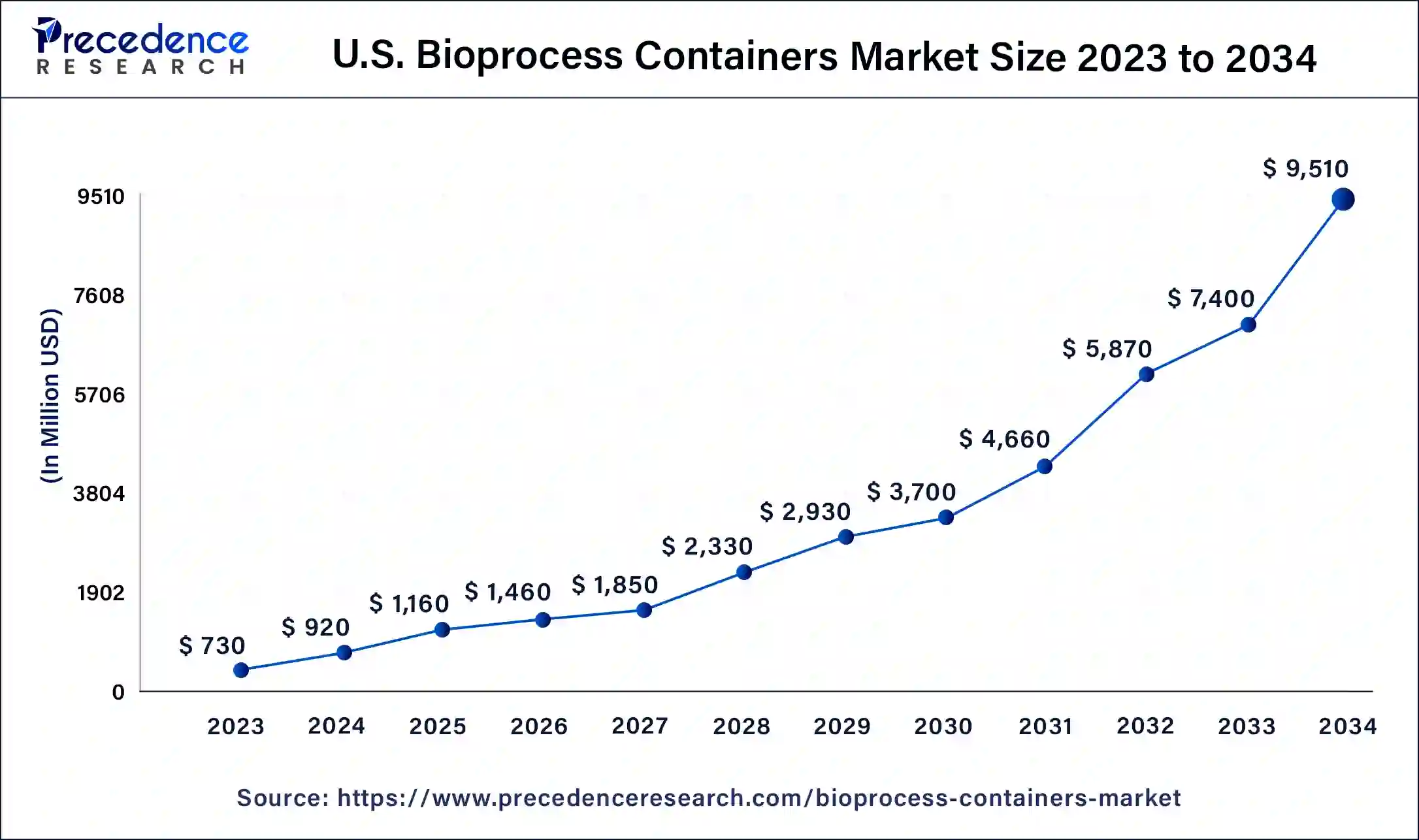

The U.S. bioprocess containers market size was exhibited at USD 730 million in 2023 and is projected to be worth around USD 9,510 million by 2034, poised to grow at a CAGR of 26.28% from 2024 to 2034.

North America held the largest share of the bioprocess containers market in 2023. The market for bioprocess containers in North America is expanding due to a number of causes. The need for adaptable and affordable manufacturing solutions, the development of bioprocessing technologies, and the rising demand for biopharmaceuticals are some of the major forces behind this. Bioprocess containers include benefits like lower contamination concerns, more efficient processes, and easier single-use applications. Market expansion is also aided by the region's strong regulatory framework and healthcare infrastructure. All things considered, biopharmaceutical manufacturing innovation and bioprocess container adoption continue to be heavily concentrated in North America.

Asia Pacific is expected to host the fastest-growing bioprocess containers market during the forecast period. The Asia Pacific bioprocess containers market is expanding due to a number of factors. The region's expanding need for tailored medications, growing output of biopharmaceuticals, and improvements to the healthcare system are all important factors. The use of single-use technologies to improve efficiency and lower contamination risks in bioprocessing activities, as well as the existence of major biopharmaceutical manufacturers, are contributing factors to the market's growth. The growth of the biotechnology market in Asia Pacific is further supported by investments in research & development as well as regulatory assistance.

One area of the biopharmaceutical business that is expanding quickly is the bioprocess containers market. In the production of biopharmaceuticals, sterile liquids, and solutions are handled, transported, and stored in bioprocess containers. Compared to conventional stainless-steel containers, they have a number of benefits, such as being more affordable, simpler to use, and less likely to become contaminated. Comparing bioprocess containers to conventional stainless-steel systems reveals that the former is more economical. They lessen the chance of cross-contamination and cut down on cleaning and validation expenses.

The bioprocess containers market is expanding due to the growing need for biopharmaceuticals, which include cell and gene therapies, vaccines, and monoclonal antibodies. These containers are indispensable for the manufacture and storage of these goods. These receptacles provide adaptability in biopharmaceutical manufacturing procedures and are readily expandable or contracted to meet production requirements. Regulatory agencies like the FDA have offered assistance and guidelines for the use of single-use systems, such as bioprocess containers, in the production of biopharmaceuticals.

Bioprocess containers are becoming more and more dependable due to ongoing developments in design and materials, which have increased industry acceptance of these containers. The bioprocess containers market is expected to increase significantly in the upcoming years due to the growing usage of single-use technologies in the production of biopharmaceuticals. The biopharmaceutical supply chain will depend heavily on these containers as their efficiency and dependability are progressively improved by ongoing innovation and technical breakthroughs.

| Report Coverage | Details |

| Market Size by 2034 | USD 31.09 Billion |

| Market Size in 2023 | USD 2.44 Billion |

| Market Size in 2024 | USD 3.08 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 26.03% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increased biologics production

Single-use bioprocess containers and other effective bioprocessing solutions are becoming more and more necessary as the biopharmaceutical industry grows. Compared to conventional stainless-steel systems, these containers have benefits such as a decreased chance of cross-contamination, quicker turnaround times, and cheaper operating expenses.

Single-use bioprocess containers save money on both capital and operating expenses by doing away with the requirement for cleaning and validation in between batches. This cost-effectiveness is especially alluring when expanding production or producing several goods at once. The increasing need for biological treatments, such as vaccinations, cell therapies, and monoclonal antibodies, has led to a need for flexible and scalable production options. The bioprocess containers market line setup and breakdown enables agile manufacturing in response to demands.

Material limitations

The materials used to construct bioprocess containers must be compatible with the biologics being processed. This involves taking leachables, extractables, and chemical resistance into account. The materials employed should not compromise integrity or introduce contaminants while supporting sterilizing techniques like steam sterilization or gamma irradiation. Containers must be able to endure the rigors of handling, moving, and storing without losing their structural integrity.

Materials used in the production of biopharmaceuticals must adhere to regulatory requirements and guidelines, such as those set forth by the FDA in the U.S. or the EMA in Europe. Cost-effectiveness and scalability of the materials employed are significant considerations in the selection of bioprocess containers. However, they are not limitations in and of themselves.

Emerging biotech hubs

Biotech clusters are frequently fostered in regions with strong biotechnology and life sciences-focused universities and research institutions. The U.S.'s Cambridge/Boston and the UK's Golden Triangle (London, Oxford, Cambridge) are two examples. For biotech startups and businesses, the availability of venture finance, private equity, and government funding is crucial. Biotechnology-focused investment networks are frequently active in emerging hubs.

Being close to suppliers, pharmaceutical companies, and other biotech companies promotes knowledge sharing and cooperation, which increases a region's appeal as a biotech cluster. It is essential to have access to a skilled labor force in the bioprocessing, bioengineering, and allied industries. A strong talent pipeline is facilitated by hubs housing prestigious universities and life sciences-related vocational training programs.

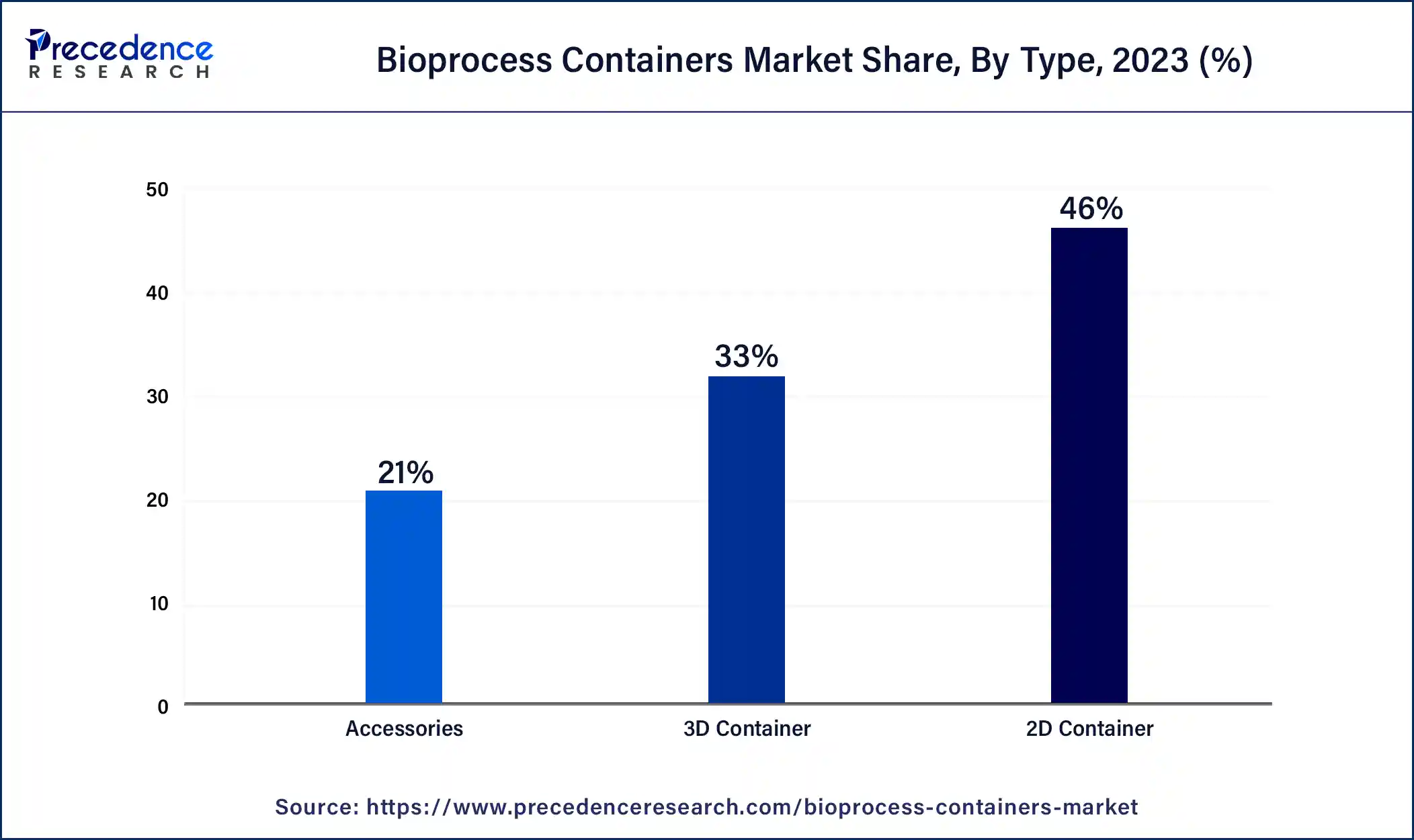

The 2D containers segment dominated the bioprocess containers market in 2023. '2D containers' in the context of the bioprocess containers market often refer to single-layer, flat film bags that are used in the production of biopharmaceuticals for the storage and transportation of liquids or powders. The purpose of these containers is to maintain product integrity and safety during the production process by offering a sterile environment for delicate biological products. They are widely used in bioprocessing for buffer solutions, media storage, and the storage of intermediate products. Because of their flat, flexible design, which facilitates effective handling and storage, they are a mainstay in the bioprocess container solutions market.

The 3D containers segment is expected to experience the fastest growth in the bioprocess containers market during the projected period. 3D containers, as used in the bioprocess container market, are made using three-dimensional printing technology. These containers have a number of benefits, including fast prototyping, adaptable designs, and the capacity to construct complicated geometries that could improve bioprocessing applications' functionality or efficiency. They contribute to flexibility and innovation in the biopharmaceutical and biotechnology sectors by being able to be adjusted to individual needs in terms of volume, form, and compatibility with different bioprocess applications. By cutting down on material waste and streamlining production procedures, this strategy also promotes sustainable practices.

The upstream process segment held the largest share of the bioprocess containers market in 2023. The first steps of manufacturing, which are essential for the preparation and culture of biological resources like cells, proteins, or other biomolecules, are usually included in the upstream process. Selecting premium raw materials that satisfy the particular needs of the bioprocess, including sterile plastics or films that guarantee biocompatibility and preserve the biological material's integrity.

Specialized manufacturing procedures are used in the fabrication of bioprocess containers to ensure that the containers fulfill strict specifications for sterility, integrity, and compatibility with bioprocess conditions. Strict quality control procedures guarantee that every bioprocess container satisfies legal requirements and specifications. Throughout the manufacturing process, this includes testing for sterility, integrity, and material compatibility.

The production process segment is expected to witness the fastest growth in the bioprocess containers market over the forecast period. High-quality materials are selected based on their compatibility with biologics and capacity to preserve sterility. Examples of these materials include plastics (like polyethylene and polypropylene), films (like polyethylene terephthalate), and occasionally stainless steel. For plastic components, the production process uses methods like blow molding, thermoforming, or injection molding.

Films can be laminated and extruded to make systems of flexible containers. Containers are made to comply with regulations, particular capacity needs, and various bioprocessing methods (such as chromatography and filtration). Strict quality control procedures are followed during production to guarantee that containers fulfill requirements related to sterility, robustness, and compatibility with biopharmaceutical procedures. This covers dimensional verification, visual examination, and leak testing.

The pharmaceutical companies segment led the bioprocess containers market in 2023. The market for bioprocess containers is heavily influenced by pharmaceutical businesses, mainly because of their widespread use in the production of biopharmaceuticals. These containers are essential for the sterile containment, storage, and transportation of biologics, vaccines, and other pharmaceutical goods. These businesses use bioprocess containers to shorten the time it takes for pharmaceutical items to reach the market, increase flexibility, and lower the danger of contamination. Their single-use technology advancements have a major positive impact on the expansion and effectiveness of biopharmaceutical manufacturing processes. Offers disposable bioprocess containers for cell culture and downstream processing, among other bioprocessing products. Offers complete bioprocessing solutions, such as single-use equipment and bioprocess containers.

The biotechnology companies segment is expected to show the fastest growth in the bioprocess containers market during the forecast period. Because they require sterile and dependable containers for media storage, cell culture, and bioreactor operations, biotech companies are the ones driving the market for bioprocess containers. To ensure product safety and dependability, biotech companies prioritize quality assurance and adherence to regulatory norms (such as FDA and EMA) while purchasing bioprocess containers.

Single-use bioprocessing solutions, such as bioprocess containers, are being adopted by a growing number of biotech companies in order to limit cross-contamination hazards, lower cleaning and validation costs, and expedite production schedules. Their spending power and demand patterns have a big impact on the market's growth and direction for bioprocess containers, which pushes producers to develop and broaden their product lines.

Segment Covered in the Report

By Type

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

November 2024