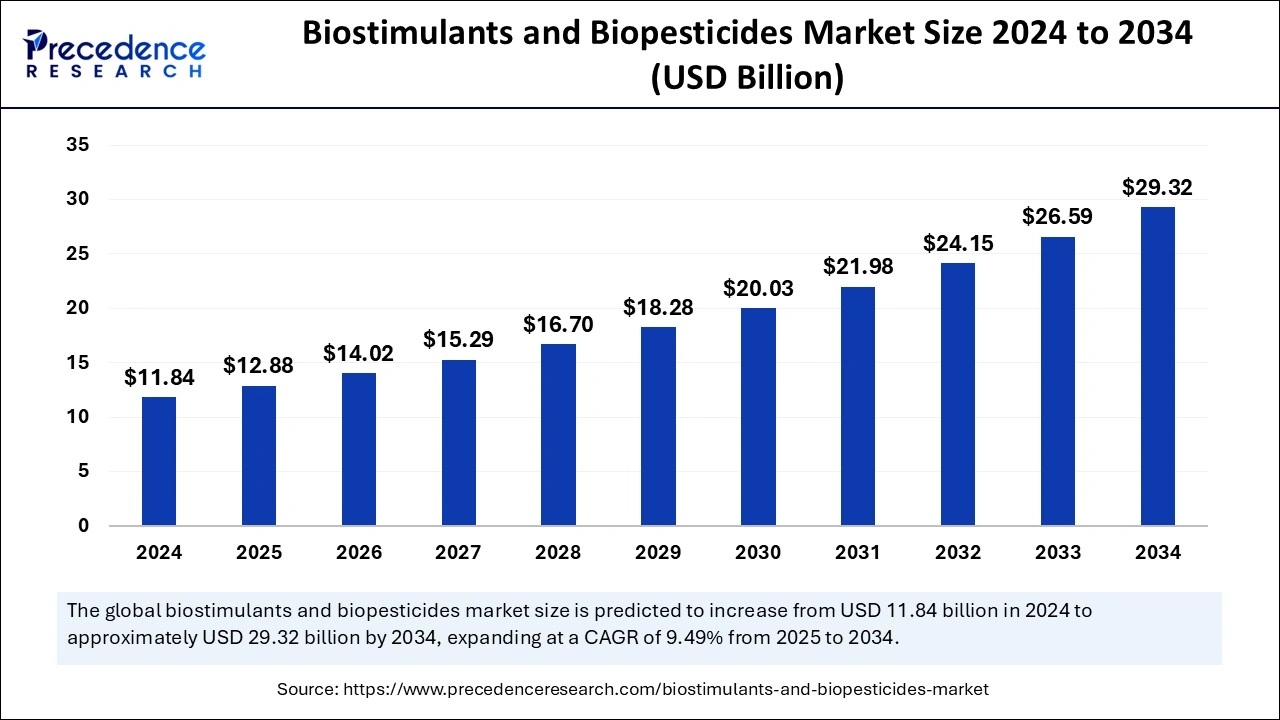

The global biostimulants and biopesticides market size is calculated at USD 12.88 billion in 2025 and is forecasted to reach around USD 29.32 billion by 2034, accelerating at a CAGR of 9.49% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global biostimulants and biopesticides market size was estimated at USD 11.84 billion in 2024 and is predicted to increase from USD 12.88 billion in 2025 to approximately USD 29.32 billion by 2034, expanding at a CAGR of 9.49% from 2025 to 2034. The demand for sustainable agriculture is driving the global market. The growing demand for organic and high-nutritional-based products is boosting the adoption of biostimulants and biopesticides. Government investments in the reduction of chemicals are shaping the importance of biostimulants and biopesticides in agricultural settings.

Artificial Intelligence is playing a crucial role in the innovation and development of the biostimulants and biopesticides market. AI is significant in analyzing vast amounts of data, detecting novel bioactive components, and optimizing. The increased demand for organic products is driving the need for cutting-edge technologies for the innovation and the development of biological products in agricultural settings. With the leverage of modern technologies, the agriculture sector is shaping the world. The ability of AI algorithms to provide effective databases and reactions of plants to new biostimulants and biopesticides helps to innovate and develop microbial strains and time requirements for the existing materials.

The ability of machine learning algorithms to advance the efficacy of products and the R&D processes and reduce timelines makes them popular in technology settings. The growth of AI utilization has surged in biostimulants and biotechnology research and developments in recent years due to factors like its ability to provide extensive crop biology understandings and detect highly specific indicators for plants and soils. To improve efficiency and performance, manufacturing companies in the biostimulants and biopesticides market are surging in AI integration with exciting technologies.

Biostimulants and biopesticides help plants to grow and develop as well as improve general health. Both are made of natural and organic materials to help plant growth and health. Biostimulants help to improve yield, quality, abiotic stress tolerance, plant nutrition, fruit settings, root system developments, and early crop emergencies. Compared to conventional pesticides and fertilizers, biostimulants and biopesticides help to enhance the nutrition intake of soil and plants and the ability to tolerate stress. The ability of biostimulants and biopesticides to enhance soil fertility and productivity has made them eco-friendly and innovative technology for agricultural landscapes.

As agriculture steps toward sustainability, the biostimulants and biopesticides market is being highlighted. The growing awareness of cutting-edge methods for crop protection and yield productivity is driving farmers' attention toward biostimulants and biopesticides. The rising health consciousness worldwide has led to increased demand for natural, organic, and nutrition-based foods, making it essential for the utilization of biological ingredients for agricultural practices, including biostimulants and biopesticides.

Ongoing developments of biostimulants and biopesticides are making an impact on market expansion and agriculture settings. For instance, recent developments of biostimulants and biopesticides from microalgae have become a spectacular approach to enhancing soil fertility, plant growth, protection, and alternatives for reducing dependence on chemical fertilizers for agriculture. Additionally, ongoing research is emerging in the market for the development of new microbial strains to boost biopesticide activity against specific pests and traditional pesticides.

| Report Coverage | Details |

| Market Size in 2024 | USD 11.84 Billion |

| Market Size in 2025 | USD 12.88 Billion |

| Market Size in 2034 | USD 29.32 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.49% |

| Dominating Region | Europe |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Crop Type, Form, Application, Distribution Channel, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Shift toward sustainable agriculture

The biostimulants and biopesticides market provides a sustainable approach to agriculture due to their ability to improve yield, crop productivity, and organic strategies and reduce environmental impacts. Also, biostimulants and biopesticides allow us to address various challenges for agriculture, including soil health, food consumption, energy, and water consumption. The need for the utilization of biological inputs to improve plant nutrition has seen growth due to rising demands for organic and nutrition-based food products.

Growing health consciousness has led to the adoption of organic products. Additionally, increasing environmental concerns are driving the requirement for biostimulants and biopesticides as they influence solid degradation, water pollution, and power consumption. With growing government support and investment in sustainable agriculture, adopting these agricultural biological alternatives is likely to boost in the upcoming period.

Limited regulations

Manufacturing companies in the biostimulants and biopesticides market are frequently facing difficulties with the approval process. The lack of registration processes and standardizations makes it lengthy and expensive and hinders the availability of biostimulants and biopesticides across various countries. The lack of harmonized regulations leads to hampering the trade of biostimulants and biopesticides in various countries or regions. Furthermore, the lack of enforcement of regulations leads to unauthorized product entry into the market, creating unfair market competition. To overcome this market restraint, leverage between regulatory frameworks, farmers, and manufacturers is essential to prepare for the complexity and adaptiveness of novel formulations.

Collaborations and investments

The increased demand for organic and natural foods has had a significant impact on agriculture. The need for advanced biological ingredients and technology advancements is driving collaboration between key companies and investments in the discovery and development of novel biological ingredients. Major biostimulants and biopesticides market companies are focusing on advancing the range of new formulations using natural and biological ingredients, leading to enhanced investments in R&D.

Companies are seeking collaborations with research institutes and universities, making more ways for the development and innovation of novel biostimulants and biopesticides. Growing manufacturing companies' distribution networks enable the availability of biological ingredients, which is boosting modern strategies for organic and sustainable agriculture practices.

The biopesticides segment held the largest share of the biostimulants and biopesticides market in 2024. The segment growth is accelerated due to the rising need for biopesticides against pests like worms, mites, and insects, which promotes the healthy growth of crops or plants. The demand for sustainable pest control has increased due to rising consumer demands for organic and natural fruits & vegetables, and grains. Additionally, the government has been investing in the innovation and development of new biopesticides to reduce environmental impacts. The government's ban on chemical pesticides is driving a significant impact on the adoption of biopesticides.

The biostimulants segment is expected to witness rapid growth over the forecast period due to increased awareness of the importance of biostimulants for soil health. The rising adoption of sustainable agriculture is driving demands for biostimulants to reduce water consumption and soil degradation. The ability of biostimulants to improve crop yield, quality, and lifespan is heightening their adoption. Additionally, the utilization of biostimulants has increased to improve the nutritional value, flavor, and color of food products.

The fruits and vegetables segment held the largest share and will remain significant in the upcoming period. The segment growth is majorly attributed to increased consumer demands for organic fruits and vegetables. The increased utilization of biopesticides to control pests in fruits and vegetables is fueling the segment expansion. Additionally, rapid use of biostimulants in fruits and vegetables improves plant growth by accelerating fruit setting, flowering, and root development. The increased adoption of biostimulants and biopesticides to improve yield productivity, healthy developments, protection from pests & disease, and the production of higher-quality fruits and vegetables is shaping the segment growth.

The dry segment led the biostimulants and biopesticides market in 2024 due to its ability to make storage, handling, and transport easy. The functionality of dry formulations makes storage and applications easier. Utilization of dry biopesticides such as granules, powders, and micro granules with a preference to use as dust and seed treatments. Additionally, dry biostimulants are used for pre-planting treatments, such as soil amendments, or mixed with seeds before sowing. Dry formulations of biostimulants and biopesticides are cost-effective compared to liquid formulations, making them more preferred by end-users.

The liquid segment is expected to witness significant growth during the forecast period due to increased utilization of biostimulants that comprise solutions, suspensions, or emulsions. The rapid absorption of liquid biostimulants of plants makes them essential for plant growth and yield productivity. Similarly, high purity levels, longer shelf life, and direct and immediate applications of liquid biopesticides make them popular in agricultural settings. Liquid biostimulants and biopesticides provide immediate impacts on crops or plants.

The foliar treatment segment dominated the global biostimulants and biopesticides market in 2024. The foliar treatment segment is the leading market due to the rapid adoption of biostimulants and biopesticides for foliar treatment. Foliar treatment rapidly absorbs and concentrates nutrients through leaves. The rapid absorption of nutrients helps for the speedy and healthy development of plants. Foliar treatment is an effective and quick treatment application for stressed plants. Characteristics of foliar treatment to integrate with other crop management practices improve their effectiveness and convenience.

The soil treatment segment is expected to witness significant growth during the forecast period because of the increased utilization of biostimulants and biopesticides in improving soil health and fertility. Soil treatments, including soil amendments, soil conditioners, and soil fumigants, help to improve soil structure, fertility, and control of soil-borne pests and diseases. Soil treatment by biosimulants is a significant component for enhancing crop resilience and yield. Regions are driving the preference for biopesticides and biostimulants to improve regional soil conditions and structure outputs.

The direct segment accounted for the largest biostimulants and biopesticides market share in 2024. The manufacturing companies have established crucial relationships with farmers, growers, horticulturists, and agronomists. The direct sale of biostimulants and biopesticides to these end-users is driving the segment's growth. End-users purchase direct distribution from companies to allow technical support and margin control. Direct distribution from companies to end-users helps to reduce distribution costs as well as reduce margins taken by intermediaries. Rising consumer engagements are driving direct distribution from companies, leading to enhanced segment expansion.

Europe held the largest share of the biostimulants and biopesticides market in 2024. Europe has stepped ahead in sustainability. The surge for sustainable farming, utilization of eco-friendly products and materials, and consumer demands for natural and organic food products are contributing to market growth. Expanding the agricultural biological industries in the UK and Germany is playing a favorable role in demonstrating the biostimulants and biopesticides in Europe.

Countries like France, Spain, and Italy are driving the regional market because of rising consumer awareness of organic products, government investments in agricultural settings, and various agricultural policies. France is leading the regional market due to the country's government support and investment in reducing the use of chemical pesticides. Regulatory policies of France to promote organic farming are fueling the country's share in the market growth.

Asia Pacific is forecasted to grow at a significant rate in the biostimulants and biopesticides market during the forecast period of 2025-2034 due to rising innovations, developments, and adoption of advanced methods and components in the region's agriculture. Asia Pacific is known for its extreme agricultural landscapes. Government initiatives to shift agriculture toward sustainable practices and support research and developments are playing favorable roles in market growth.

China is leading the regional market due to government investments in the R&D sector and the adoption of cutting-edge technologies in agricultural settings. India is the second largest country, eluding the regional market due to the country's rising population and increased demand for food. The growing emphasis on sustainable agriculture, including the use of biostimulants and biopesticides, is driving market growth in India. Government investments in innovations and developments of new biological products and methods are enhancing the availability of cutting-edge agricultural practices in the country.

By Type

By Crop Type

By Application Method

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client