Biosurgery Market (By Product Type: Anti-Adhesive Agents, Bone Graft Substitutes, Hemostatic and Surgical Sealant, Mesh, Others; By Application: Cardiovascular and Thoracic Surgery, Neuro and Spine Surgery, Orthopedic Surgery, General Surgery; By Source: Biologics Products, Synthetic Products; By End User: Hospital, Clinics, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

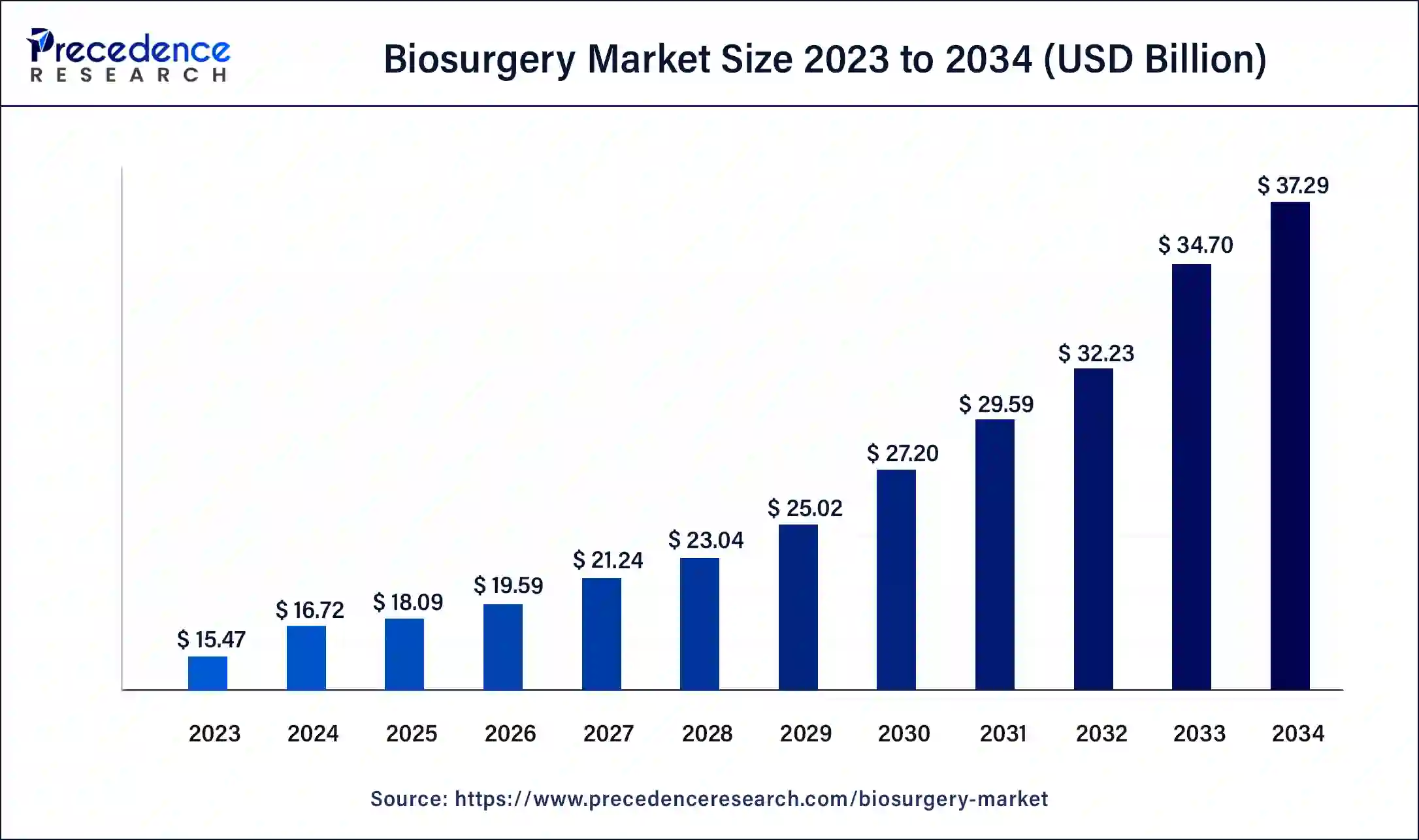

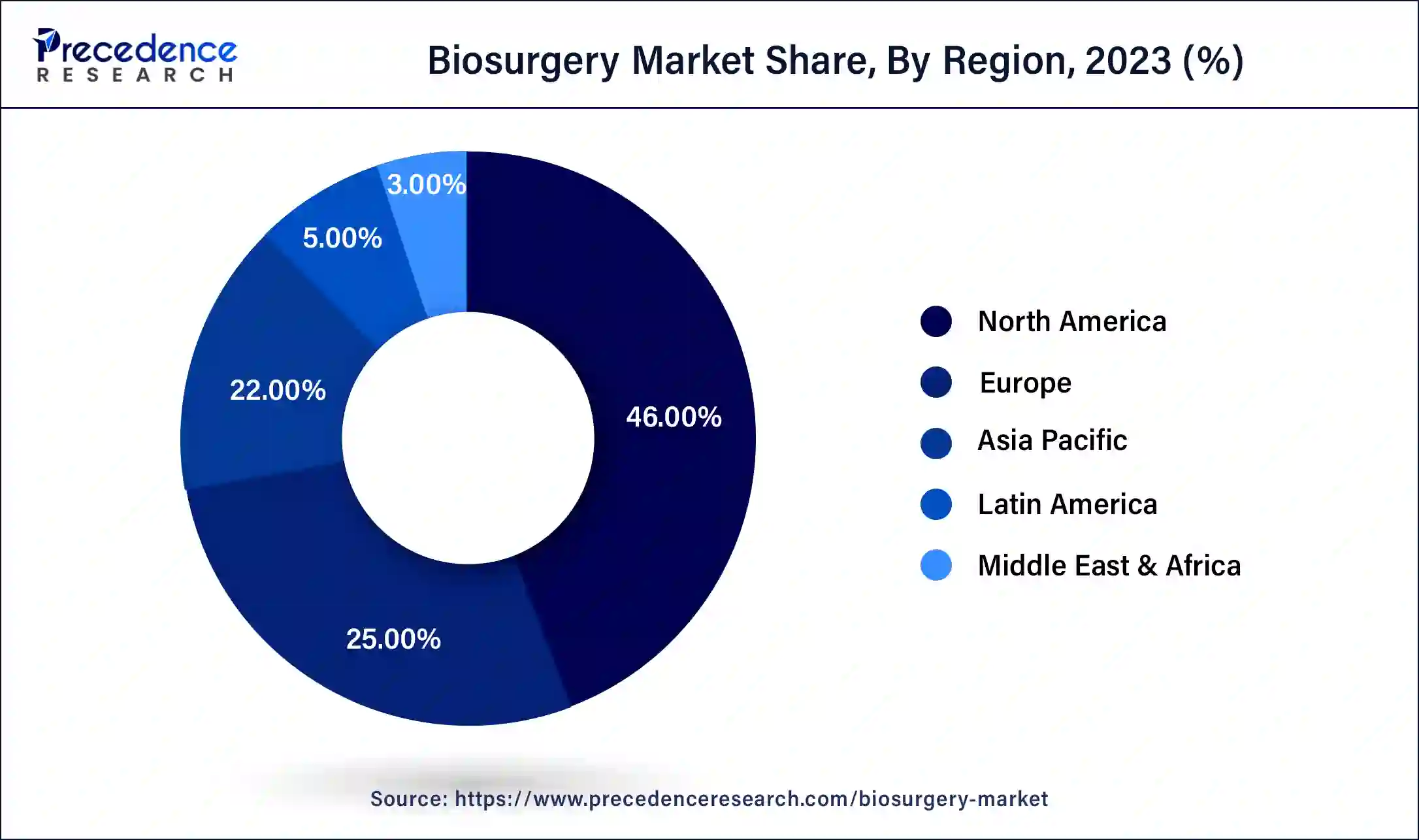

The global biosurgery market size was USD 15.47 billion in 2023, calculated at USD 16.72 billion in 2024 and is expected to reach around USD 37.29 billion by 2034, expanding at a CAGR of 8% from 2024 to 2034. North America biosurgery market size was valued at USD 7.12 billion in 2023.

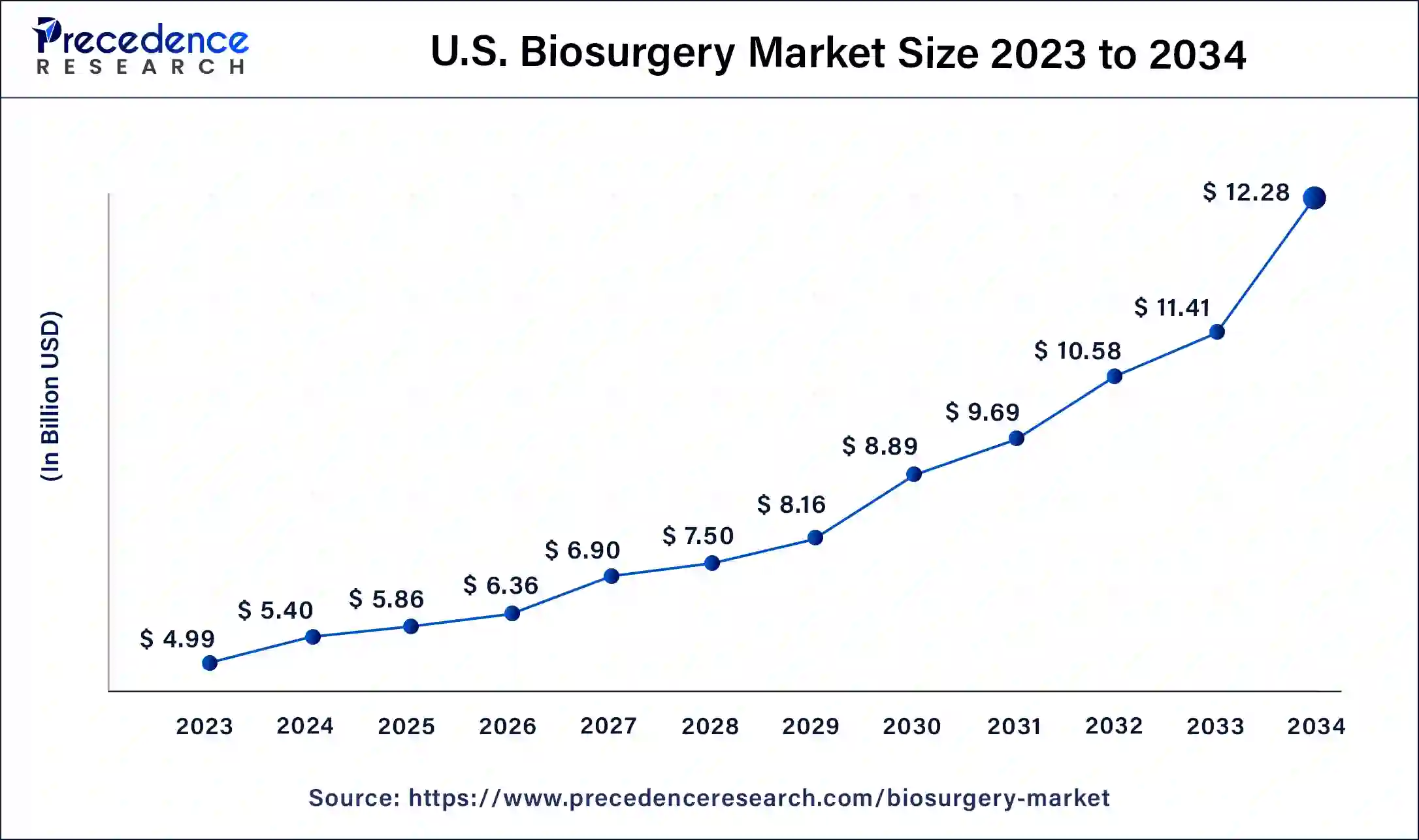

The U.S. biosurgery market size was valued at USD 4.99 billion in 2023 and is projected to hit around USD 12.28 billion by 2032, growing at a CAGR of 8.55% between 2024 and 2034.

North America has held the largest revenue share 46% in 2023. In North America, the biosurgery market sees a trend towards rapid technological adoption, driven by a robust healthcare infrastructure. Advanced biotechnological innovations, coupled with a growing aging population, propel the demand for biosurgical solutions. Increasing focus on personalized medicine and a surge in minimally invasive surgeries further contribute to the market's dynamism, creating opportunities for companies to meet evolving healthcare needs.

Asia-Pacific is estimated to observe the fastest expansion. In the Asia-Pacific biosurgery market, rapid urbanization and healthcare infrastructure development contribute to robust growth. Increasing surgical procedures, particularly in emerging economies, drive demand for advanced biosurgical solutions. The region's expanding middle-class population and rising healthcare awareness further fuel market dynamics. Additionally, strategic collaborations and investments in research and development underscore Asia-Pacific's role as a key player in shaping the future of the biosurgery market.

Europe's biosurgery market is characterized by a strong emphasis on sustainable practices. Eco-friendly biosurgical products gain traction as environmental awareness rises. Additionally, the market witnesses a trend of collaboration between research institutions and industry players, fostering innovation. Stringent regulatory standards shape product development, ensuring safety and efficacy. The diverse preferences of the skincare-conscious European population also influence the market, driving the formulation of advanced biosurgical solutions.

The biosurgery market involves the use of biological materials, such as surgical sealants, hemostatic agents, and soft tissue grafts, to facilitate tissue repair and regeneration. It encompasses advanced medical techniques that leverage natural components to enhance the healing process. Key drivers include the rising prevalence of chronic diseases and increasing surgical procedures. Growth is also attributed to advancements in biotechnology, providing innovative solutions for wound care and tissue reconstruction.

With a focus on minimizing postoperative complications, the biosurgery market continues to evolve, offering promising prospects for medical professionals and patients alike. Market expansion is driven by the demand for minimally invasive procedures and the growing aging population. Technological advancements, such as the development of bioactive materials and personalized medicine, further propel biosurgery market growth, fostering a dynamic healthcare landscape.

| Report Coverage | Details |

| Market Size by 2034 | USD 37.29 Billion |

| Market Size in 2023 | USD 15.47 Billion |

| Market Size in 2024 | USD 16.72 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 8% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type, Application, Source, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Driver

Rising incidence of chronic diseases and growing demand for minimally invasive surgeries

The rising incidence of chronic diseases and the growing demand for minimally invasive surgeries are dual catalysts propelling the biosurgery market to new heights. Chronic diseases, including cardiovascular ailments and diabetes, have witnessed a surge globally, necessitating advanced medical interventions. Biosurgery, with its emphasis on utilizing biological materials for tissue repair and regeneration, aligns perfectly with the intricate needs of these conditions. The ability of biosurgical products to facilitate efficient and targeted interventions in the treatment and management of chronic diseases has become pivotal, fostering a surge in market demand.

Moreover, the increasing preference for minimally invasive surgeries has reshaped the landscape of surgical procedures. Patients and healthcare professionals alike are drawn to these procedures due to reduced postoperative complications and quicker recovery times. Biosurgery plays a vital role in this paradigm shift by providing specialized products that complement minimally invasive techniques, driving market demand. As the healthcare industry continues to prioritize patient outcomes and recovery experiences, the biosurgery market stands at the forefront, offering innovative solutions that address the evolving landscape of medical interventions.

Restraint

High cost of biosurgical products and stringent regulatory approval processes

The high cost of biosurgical products poses a significant restraint on the market demand. The intricate processes involved in the development and manufacturing of these advanced biotechnological products contribute to elevated production costs. As a result, these higher expenses are often transferred to end-users, including healthcare providers and patients. The financial burden associated with acquiring biosurgical solutions may limit their accessibility, particularly in regions with constrained healthcare budgets. This pricing challenge hampers the widespread adoption of biosurgical products, hindering market expansion and potentially limiting their availability to a broader patient population.

Additionally, stringent regulatory approval processes act as a formidable barrier to the biosurgery market. The nature of biosurgical products, involving biological materials and innovative technologies, necessitates rigorous evaluation by regulatory authorities to ensure safety and efficacy. The lengthy and intricate approval procedures contribute to delays in product launches, restricting the timely entry of innovative biosurgical solutions into the market. This regulatory bottleneck not only prolongs the time-to-market but also requires substantial financial investments, further intensifying the challenges faced by companies operating in the biosurgery sector.

Opportunity

Rising demand for advanced wound care solutions and integration of sustainable practices

The biosurgery market experiences a surge in demand attributed to the rising need for advanced wound care solutions. With an increasing global aging population and a higher incidence of chronic wounds, there is a growing demand for innovative biosurgical products that facilitate enhanced wound healing. Biosurgery solutions, such as surgical sealants and hemostatic agents, play a crucial role in addressing complex wounds, supporting faster recovery, and reducing the risk of complications. This demand is further amplified by a shift towards minimally invasive procedures, where biosurgery products prove instrumental in achieving optimal patient outcomes.

Moreover, the integration of sustainable practices in the biosurgery market contributes to heightened demand. As environmental awareness grows, there is a preference for eco-friendly and sustainable products in healthcare. Biosurgery companies adopting green practices and developing products with reduced environmental impact find increased acceptance in the market. This alignment with sustainable values not only meets consumer expectations but also opens new avenues for market expansion, as healthcare providers increasingly seek environmentally responsible solutions in their medical practices.

The bone graft substitutes segment has held 41% revenue share in 2023. Bone graft substitutes in the biosurgery market are synthetic or natural materials used to replace or augment missing bone tissue. They promote bone regeneration and healing, addressing issues such as fractures or bone defects. Current trends involve the development of advanced substitutes, including bioactive ceramics and growth factor-infused matrices, enhancing their efficacy. The market is witnessing a shift towards minimally invasive procedures, driving the demand for bone graft substitutes that facilitate efficient bone repair with reduced patient morbidity.

The anti-adhesive agents segment is anticipated to expand at a significant CAGR of 12.1% during the projected period. Anti-adhesive agents in biosurgery prevent the formation of undesirable adhesions during surgeries. These agents reduce postoperative complications by preventing tissues from sticking together. Trends in the biosurgery market show a growing demand for anti-adhesive agents due to increased awareness about their benefits in minimizing complications like post-surgical adhesions. Ongoing research focuses on developing improved formulations that offer enhanced efficacy and safety, catering to the rising demand for surgical solutions with better patient outcomes.

The neuro & spine surgery segment is anticipated to hold the largest market share of 37% in 2022. In the biosurgery market, neuro & spine surgery involves the application of biological materials for intricate procedures related to the nervous system and spine. Trends indicate a rising demand for biosurgical products tailored to neurosurgical interventions, driven by advancements in biomaterials and a growing prevalence of neurological disorders. The focus is on innovative solutions that enhance tissue repair and regeneration in delicate neurosurgical procedures, providing improved outcomes for patients.

On the other hand, the general surgery segment is projected to grow at the fastest rate over the projected period. For general surgery, biosurgery involves the use of biological materials in a wide range of surgical procedures. A notable trend is the increasing adoption of biosurgical products in general surgery, where they contribute to hemostasis, tissue sealing, and wound management. This trend is fueled by the desire for effective and efficient solutions in diverse surgical scenarios, emphasizing the versatility and applicability of biosurgery products in the general surgical setting.

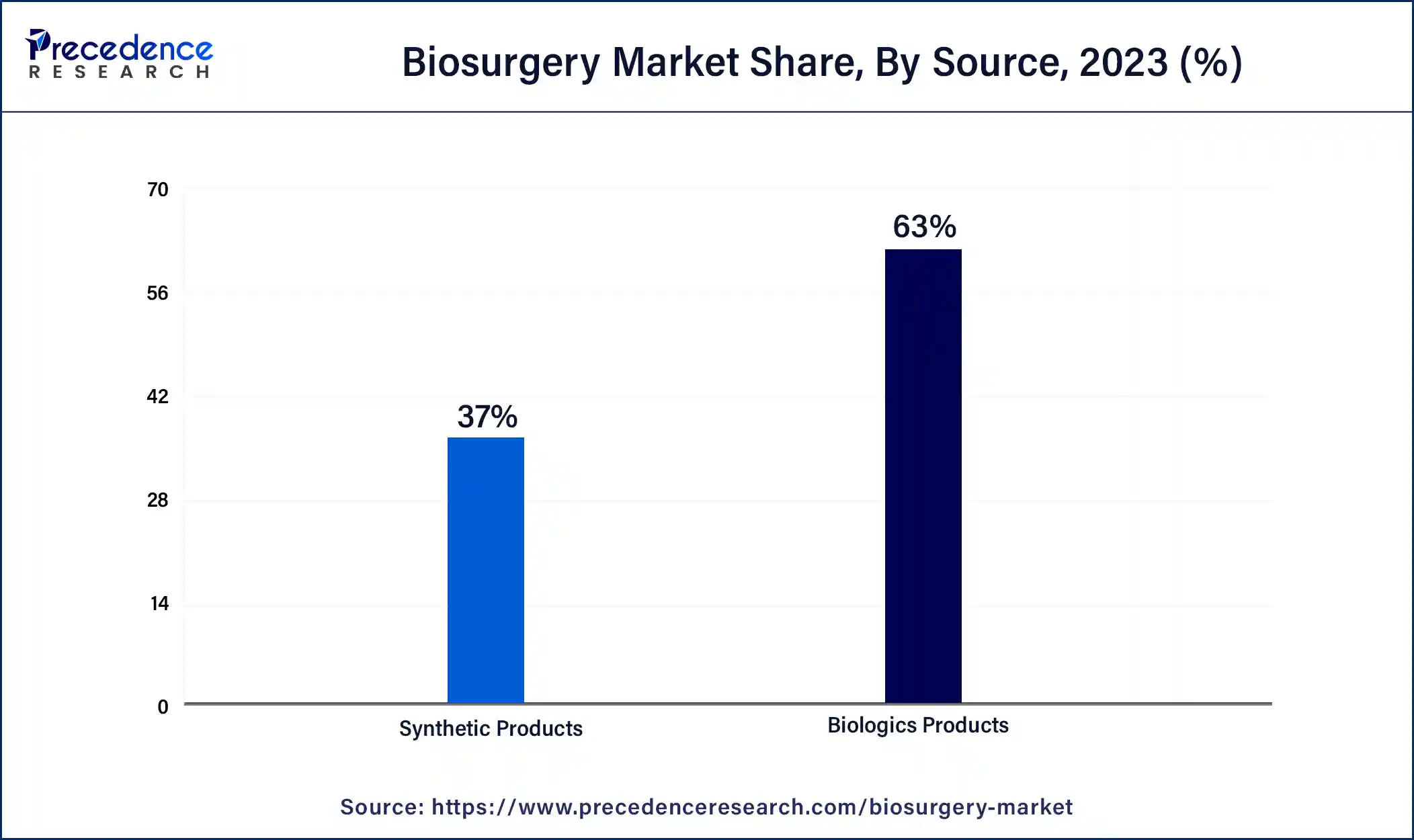

The biologics products segment had the highest market share of 63% in 2023 on the basis of the end user. Biologics products in the biosurgery market are derived from living organisms and include growth factors, stem cells, and tissue-based materials. Their popularity is driven by their ability to closely mimic natural biological processes, promoting effective tissue repair and regeneration. A trend in biologics involves personalized medicine, tailoring treatments to individual patient profiles.

The synthetic products segment is anticipated to expand at the fastest rate over the projected period. Synthetic products in the biosurgery market are artificially created and offer consistency in composition. The trend in synthetics centers on bioengineering advancements, producing highly functional materials for applications like wound closure and tissue augmentation.

The hospitals segment had the highest market share of 76% in 2023 on the basis of the end user. Hospitals, as key end-users in the biosurgery market, employ biosurgical solutions for various surgical procedures. The trend leans towards the integration of biosurgery products in routine surgeries, driven by the need for efficient wound management and reduced postoperative complications. With a focus on advanced wound care, hospitals contribute significantly to the growing demand for biosurgical interventions, enhancing patient outcomes and recovery.

The clinics segment is anticipated to expand at the fastest rate over the projected period. Clinics, encompassing outpatient and ambulatory care settings, increasingly incorporate biosurgery products in their practices. The trend emphasizes the versatility and adaptability of biosurgical solutions in addressing diverse medical conditions in a more accessible and cost-effective outpatient setting. The adoption of biosurgery in clinics reflects a broader shift towards minimally invasive procedures and personalized medicine, offering patients efficient and tailored treatment options outside traditional hospital settings.

By Product Type

By Application

By Source

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client