January 2025

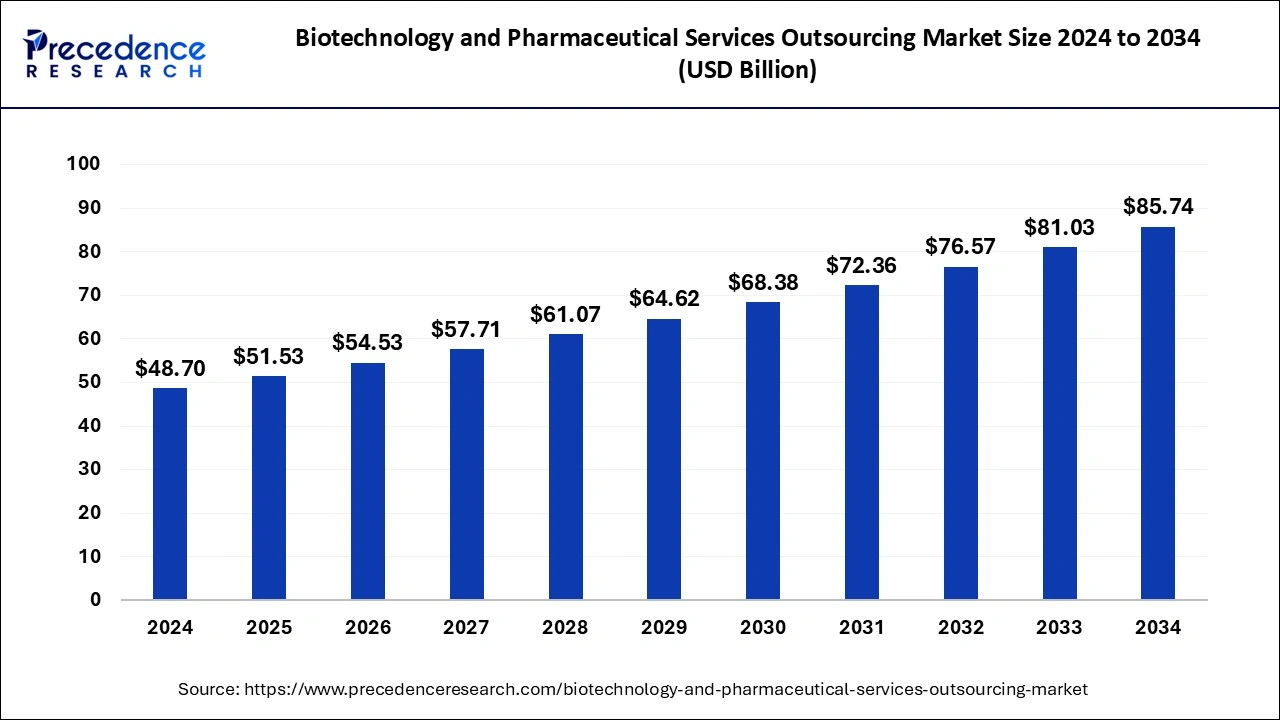

The global biotechnology and pharmaceutical services outsourcing market size is calculated at USD 51.53 billion in 2025 and is forecasted to reach around USD 85.74 billion by 2034, accelerating at a CAGR of 5.82% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global biotechnology and pharmaceutical services outsourcing market size was estimated at USD 48.70 billion in 2024 and is anticipated to reach around USD 85.74 billion by 2034, expanding at a CAGR of 5.82% from 2025 to 2034. The increasing number of well-established CROs, growing demand for innovative and effective therapies, stringent regulatory policies, increasing R&D expenditure, and rising prevalence of chronic diseases are expected to drive the growth of the biotechnology and pharmaceutical services outsourcing market during the forecast period.

As technology continues to advance, its integration of Artificial intelligence (AI) is rapidly transforming the biotechnology and pharmaceutical services. By leveraging AI, pharmaceutical companies and biotechnology companies can rapidly advance the future of healthcare. Through AI, biotech and pharmaceutical companies, the drug discovery process can be accelerated and enhance the accuracy of clinical research and trials as well as reduce costs in the drug discovery process. By shortening the time duration for drug discovery, AI-enhanced workflows assist organizations in increasing their operational efficiency. According to biotechnologists, AI usage allows new drugs to be discovered one-tenth of the time and while the typical drug discovery process takes up to 10 years or more, time savings directly help in cost savings. Therefore, AI has the potential to allow for the faster development of drugs, vaccine development, new medical discoveries, medicine manufacturing, new therapies, and the supply chain in the coming years.

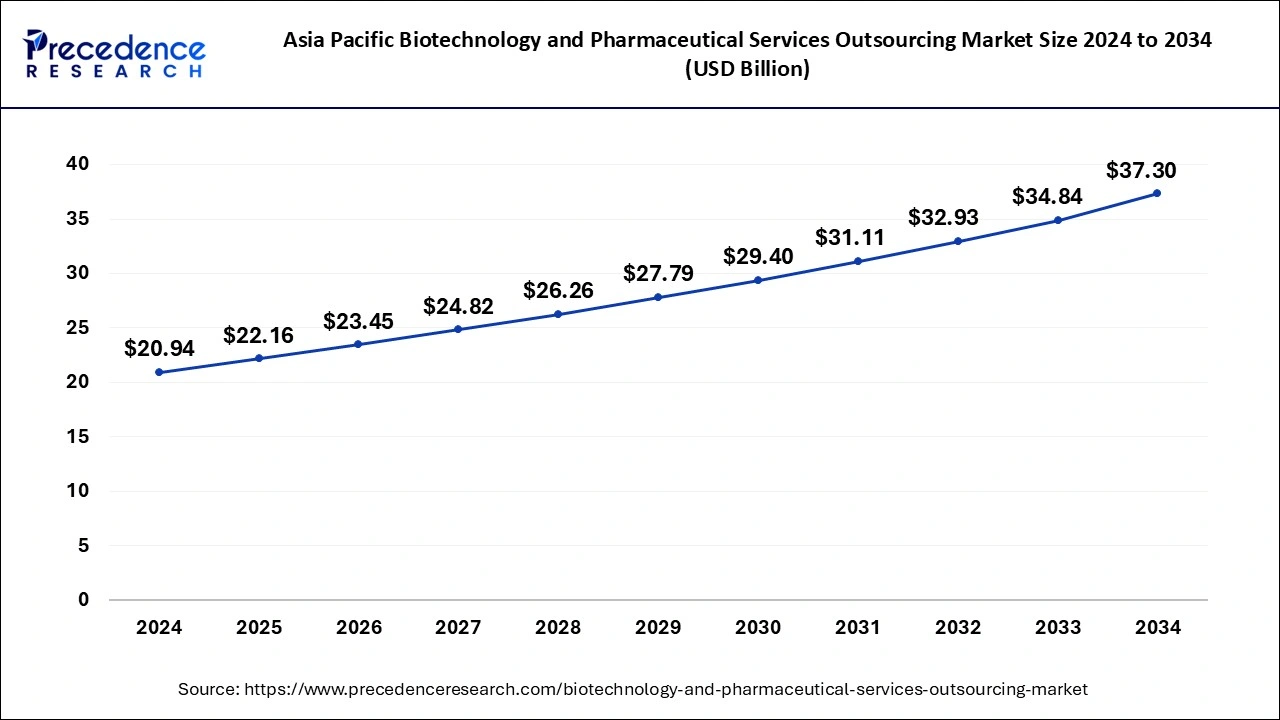

The U.S. biotechnology and pharmaceutical services outsourcing market size was estimated at USD 20.94 billion in 2024 and is anticipated to be surpass around USD 37.30 billion by 2034, rising at a CAGR of 5.94% from 2025 to 2034.

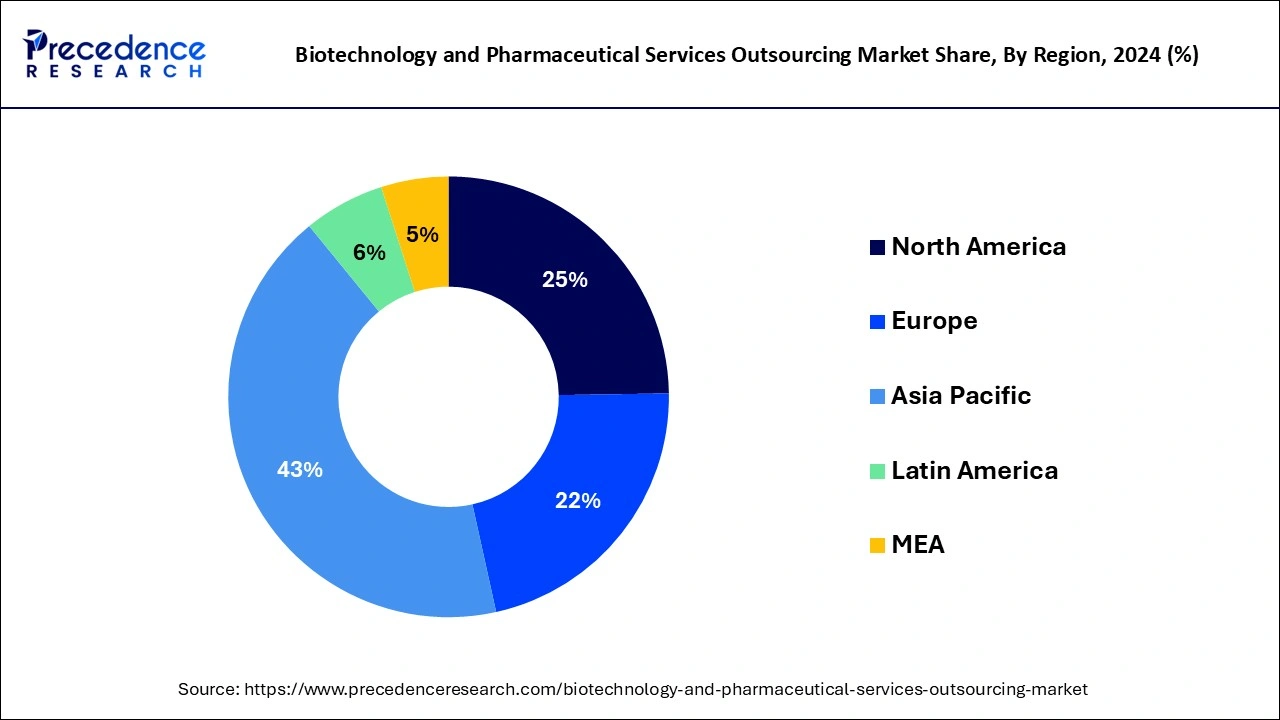

Asia Pacific dominated the global biotechnology and pharmaceutical services outsourcing market with the largest market share of 43% in 2024. The Asia-Pacific biotechnology & pharmaceutical services outsourcing market is fueled by the availability of an experienced labor force, as well as the low cost of drug development and production.

The robust presence of stringent regulatory policies is anticipated to spur the demand for pharmaceutical and biotechnology services in the region. Additionally, the adoption of advanced technology and the rise in R&D investments by pharmaceutical companies and life sciences in the region. Outsourcing helps firms to improve their service delivery and focus more on their core capabilities, thus offering competitive benefits and supporting the market’s growth in the region.

The North America is estimated to be the most opportunistic segment during the forecast period. The expansion of the biotechnology & pharmaceutical services outsourcing market in North America region is expected to be aided by the growth of international Contract Manufacturing Organizations (CMOs) and Contract Research Organizations (CROs).

Outsourcing biotechnology & pharmaceutical services has proven to be beneficial in reducing infrastructural and operational costs. However, due to decreasing research and development activities, the biotechnology & pharmaceutical industry has seen a major decline in its new product portfolio. As a result, many companies have implemented additional internal downsizing and increased outsourcing as a means of lowering capital and payroll costs.

Regenerative medicine, which had a significant impact on overall health, is one of the most recognized and promising application areas for biotechnology & pharmaceutical services outsourcing. The regenerative medicines are experimental treatments that aim to replace or regenerate organs, cells, or tissues, in order to restore function following injury or disease.

In some aspects, this economic-driven expansion in biotechnology &pharmaceutical outsourcing has contributed to a reduction in long-term industry efficiency. Although biotechnology & pharmaceutical outsourcing will eventually be shown to be ineffective in terms of promoting new product research and development and innovation, outsourcing will continue to increase. It is the only option available to biotechnology & pharmaceutical companies that must adjust to lower profitability due to clogged research and development products and drugs that have gone off-patent.

During the projection period, the global biotechnology & pharmaceutical services outsourcing market will continue to grow, although at a faster pace than in the past. The non-core support operations such as human resources, finance, and information technology were the first to be outsourced in the biotechnology &pharmaceutical industry. Outsourced contract research and contract manufacturing have become the norm in the biotechnology &pharmaceutical industry for various key market players.

This strong presence of several established CROs and CMOs is expected to drive the growth of the biotechnology and pharmaceutical services outsourcing market.

Factors such as surging drug development costs, low-cost service deployment, reducing internal capabilities, and rising regulatory frameworks to contract research organizations (CROs), and contract manufacturing organizations (CMOs) are anticipated to contribute to the overall growth of the market.

An increasing number of end-to-end service providers, to meet the rising demand for low-cost drug development and manufacturing, is further anticipated to propel market growth.

The rapid continuous advancements in technology are expected to accelerate the growth of the market during the forecast period. Advanced manufacturing processes, research methodologies, and analytical techniques are increasingly developed to enhance efficiency, reduce costs, and improve the quality of biopharmaceutical products.

The novel drug delivery mechanisms and new product launches are anticipated to drive outsourcing demand. Many companies are opting for outsourcing owing to increasing competition in the healthcare industry.

| Report Coverage | Details |

| Market Size in 2025 | USD 51.53 Billion |

| Market Size by 2034 | USD 85.74 Billion |

| Growth Rate From 2025 to 2034 | 5.70% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Services, Services Outsourcing, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The rising popularity of outsourcing services

The rising popularity of outsourcing services is expected to boost the expansion of the biotechnology and pharmaceutical services outsourcing market during the forecast period. Biotechnology & pharmaceutical services outsourcing, primarily for Contract Manufacturing Organizations (CMOs) and Contract Research Organizations (CROs), has grown in popularity significantly, and it is expected to grow in the coming years. The new outsourcing industry sectors, such as rising screening services, have grown to be prosperous businesses, and many operations that were once considered essential, such as in-house spontaneous animal toxicology testing, are now rare within biotechnology & pharmaceutical services outsourcing market players. In recent years, the growing cell banking business has enabled biotechnology & pharmaceutical services outsourcing companies to generate profit on a large scale. The advanced infrastructure facilities are also expected to be used in clinical research across a variety of applications, including diabetes and cancer treatment and cardiovascular disorders management, due to technological developments. Thus, driving the market’s growth during the forecast period.

Regulatory and Compliance Challenges

The regulatory and compliance challenges are anticipated to projected to hamper the market's growth. Biotechnology and pharmaceutical industries adhere to strict requirements for efficacy, safety, and quality. Outsourcing may result in complexities in guaranteeing compliance with several regulations and standards across different regions. In addition, constraints such as scarcity of competent product developers and contract research organizations (CROs) restricted regional reach may limit the biotechnology & pharmaceutical services outsourcing market’s growth during the forecast period.

Increasing R&D activities to develop innovative and effective drugs

The rising R&D activities to develop innovative and effective drugs are projected to create lucrative growth opportunities for the market’s growth during the forecast period. The market has witnessed a rise in R&D activities by the prominent market players to develop innovative and effective drugs. Outsourcing has evolved into an industry trend that now encompasses the entire scope of corporate activities, from screening and lead identification to toxicology and a variety of other procedures such as clinical trials and preclinical investigations. In these low- and middle-income regions, several of the world’s largest biotechnology & pharmaceutical market players invest lots of money in establishing their own research and development centers and outsourcing to contract manufacturing organizations (CMOs) and contract research organizations (CROs). In addition, Biotechnology & pharmaceutical services outsourcing finds application in auditing & evaluation, product maintenance, consulting, regulatory affairs, and testing & validation in the drug discovery sector. Pharmaceutical firms increasingly rely on these services to stay competitive in the market.

The consulting segment accounted for the highest market share in 2024. This is due to an increase in mergers and acquisitions activities as well as constantly changing regulatory guidelines. The key market players are adhering to established standards and conventions, which necessitates consulting because these they lack such expertise.

The other services segment is expected to grow at rapid pace during the forecast period. As Contract Manufacturing Organizations (CMOs) are offering services at a less cost, more generics and biopharmaceuticals are being outsourced. The contract manufacturing, IT consulting, and product upgrades are all included in this category.

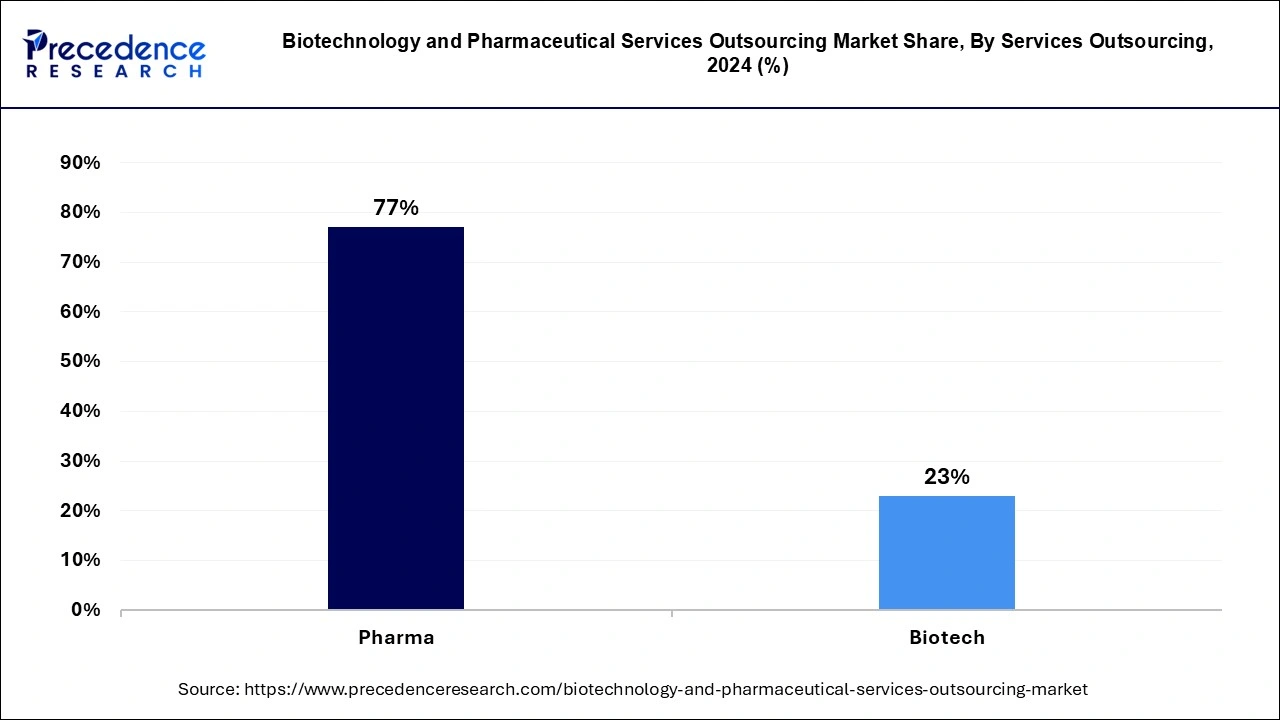

The the pharma segment contributed the highest market share of 77% in 2024. The contract service providers are often regarded as a sound strategic solution for addressing drug shortages and high production costs while also meeting rising demand in the market. Due to lack of resources, many pharmaceutical companies have turned to Contract Manufacturing Organizations (CMOs) and Contract Research Organizations (CROs) to develop and manufacture medicines.

The biotech segment is projected to grow at a solid during the forecast period. As a result of escalating pricing and increased competition, biotechnology companies are outsourcing internal activities on a large scale.

To gain a larger share of the biotechnology & pharmaceutical services outsourcing market and remain profitable in an extremely competitive environment, manufacturing companies are pursuing policies such as reasonable pricing, mergers and acquisitions, business expansion, joint venture, and partnership.

By Services

By Services Outsourcing

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

August 2024

August 2024