January 2025

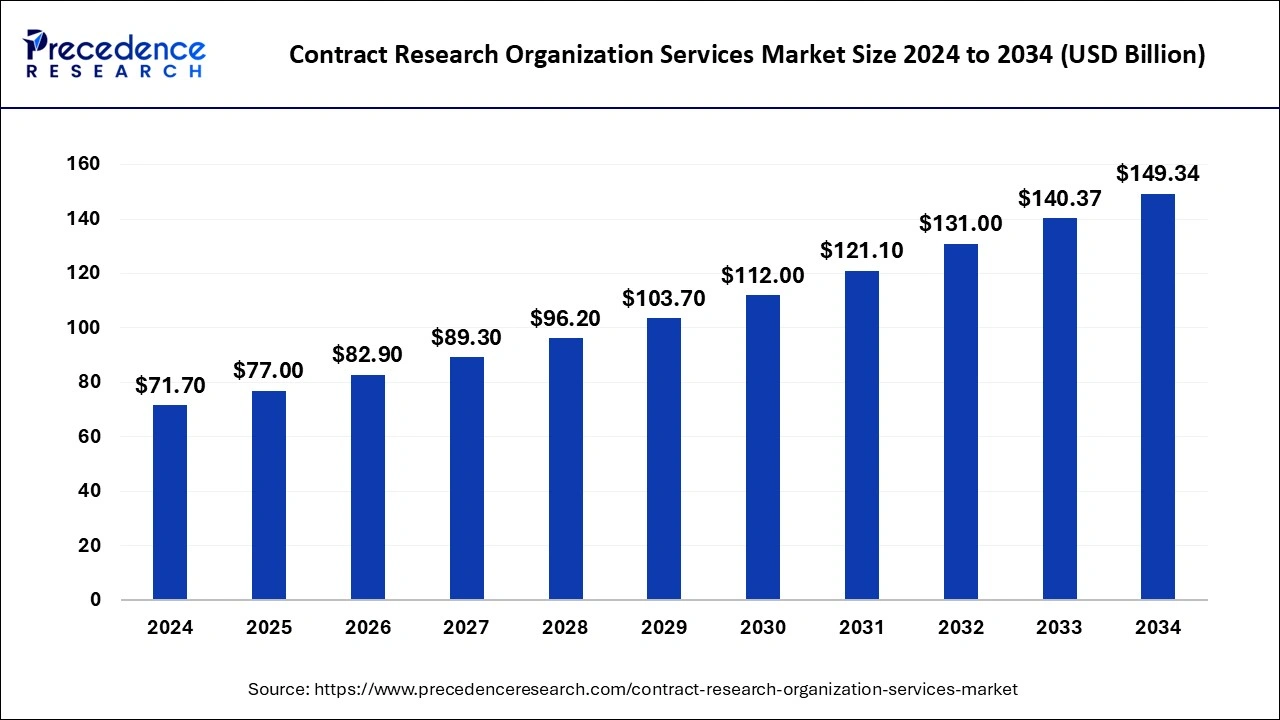

The global contract research organization (CROs) services market size is calculated at USD 77 billion in 2025 and is forecasted to reach around USD 149.34 billion by 2034, accelerating at a CAGR of 7.61% from 2025 to 2034. The North America contract research organization (CROs) services market size surpassed USD 25.10 billion in 2024 and is expanding at a CAGR of 7.65% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global contract research organization (CROs) services market size was valued at USD 71.7 billion in 2024 and it is expected to reach over USD 149.34 billion by 2034, growing at a CAGR of 7.61% from 2025 to 2034.

The U.S. contract research organization (CROs) services market size was valued at USD 17.24 billion in 2024 and is expected to reach USD 37.63 billion by 2034, growing at a CAGR of 8.12% from 2025 to 2034.

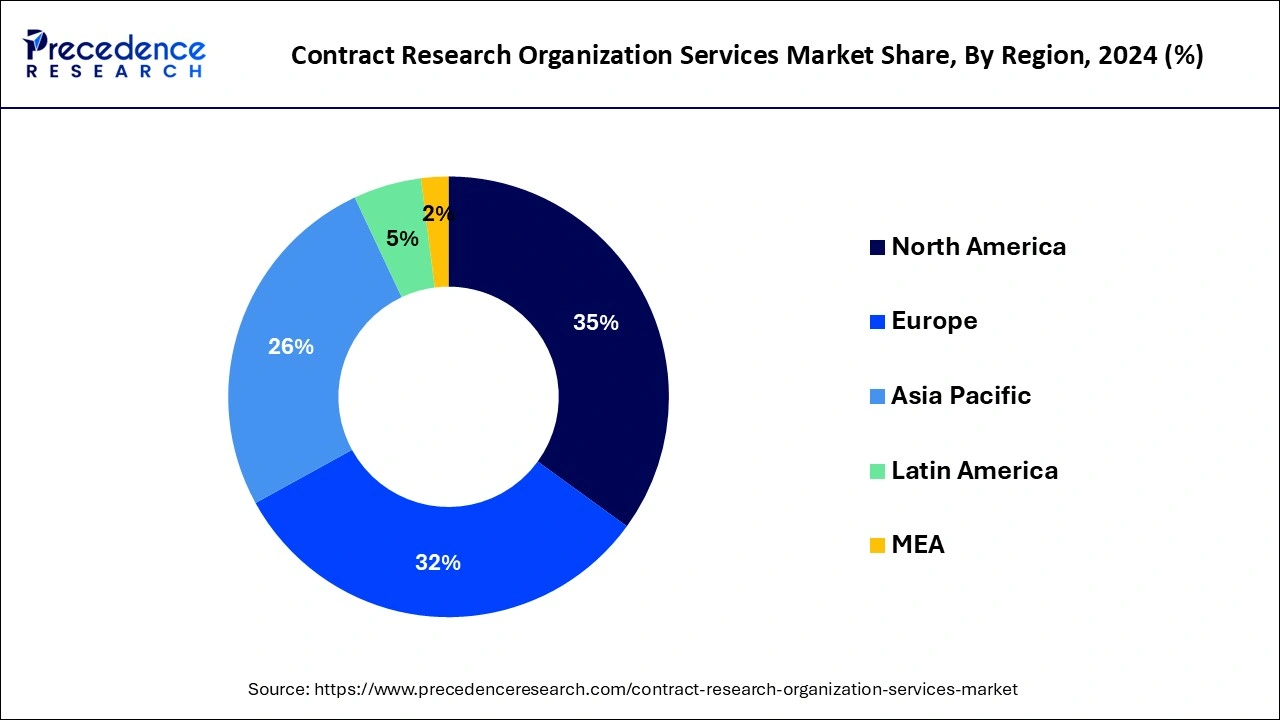

North America accounted for 35% of revenue share in 2024. Increasing government spending in research and development, as well as rising need for efficient medicines for the management of chronic diseases, are expected to drive contract research organization (CROs) services market sales in North America during the forecast period. Due to strong healthcare awareness, rising demand for technologically advanced products and massive spending on healthcare services in the region, the North America is projected to maintain its predominance.

Increasing demand for the novel technologies for diagnosis and treatment of various diseases, along with the increased research and developed expenditure will boost the growth of the market in North America. Furthermore, many companies, research institutes and non-profit organizations have invested in this region over the years that escalates the growth of the market. Additionally, rising chronic disease prevalence, surging demand for cost- effective digital health and increase in ageing population base has boosted the research and development in this region in recent years. Thus, demand for research and development increases substantial demand for outsourcing and contract research organizations, thus driving the growth of the global contract research organization market.

The Europe is estimated to be the most opportunistic segment during the forecast period. This is attributed to the rising focus on research and development initiatives in various companies such as biotechnology and pharmaceutical companies.

Contract research organization (CROs) provides research services to biotechnology, pharmaceutical, and medical device firms. The drug discovery to pharmacovigilance and commercialization to post-approval services are only some of the services available. A sponsor contracts a contract research organization (CROs) on a project-by-project basis for clinical trials. Contract research organization (CROs) provide the expert assistance, expertise, and execution experience needed to finish clinical trials safely and efficiently, without requiring the sponsor to engage full-time staff.

The growing importance of contract research organization (CROs) services will contribute to the market’s expansion. In recent years, contract research organization (CROs) services have become more prevalent in the healthcare industry. There have been substantial advancements in the healthcare field, including research and drug development. Contract research organization (CROs) services organizations are becoming increasingly popular.

The contract research organization (CROs) services market demand is being accelerated by the expanding ageing population, the rise in chronic disease, and lifestyle-related disorders. The market is growing because of the rising prevalence of chronic disorders, particularly among the elderly.

The other factors contributing to the growth of contract research organization (CROs) services market are the massive increase in patient specimens tested in the labs and the resulting demand for clinical lab testing services include increased disease monitoring and screening, which is supported by government public health screening policies; epidemic spread of chronic diseases such as diabetes; rise in new strains of infectious diseases, and the need for routine diagnostics in long-term disease management.

Due to increase in the rate of cancer, diabetes, and other infectious diseases, the contract research organization (CROs) services market is in a developing state; as the number of patients pool grows, so does the demand for clinical laboratory services. These services are also cost-effective, and they are the least invasive technique for making therapeutic decisions. These medical technologies allow for greater flexibility in healthcare management by allowing for earlier disease detection and treatment.

Furthermore, the development of new and innovative technologies that enables faster analysis and are more user-friendly that contribute to the growth of the contract research organization (CROs) services market. Other key factors driving the global contract research organization (CROs) services market are the increasing acceptance of digital pathology portals and the increasing inclination among the global population for comprehensive health checkups provided by clinical laboratories.

Another key factor driving the market growth of contract research organization (CROs) services is the development and expansion of the clinical laboratory services globally. The inadequate reimbursements, a scarcity of experienced specialists, and strict government rules, on the other hand, stifle the growth of contract research organization (CROs) services market during the forecast period.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.61% |

| Market Size in 2025 | USD 77 Billion |

| Market Size by 2034 | USD 149.34 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Service Type, By Application, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Emphasis on precision medicine with technological advancements

The shift towards precision medicine, which involves tailoring medical treatments to individual patients based on their genetic makeup and other factors, is driving demand for specialized clinical research services. Contract research organizations with expertise in genomics, biomarker development, and personalized medicine are well-positioned to capitalize on this trend. Technological advancements such as electronic data capture (EDC), wearable devices, and remote monitoring are transforming the clinical trial landscape. CROs that embrace these technologies and offer innovative solutions are in high demand to help sponsors optimize trial efficiency and data quality.

Dependency on client pipeline

Contracts with clients provide for the majority of a CRO's income. These agreements frequently entail delivering assistance for particular initiatives or stages of the drug development process. The majority of the time, CRO services are project-based, with contracts that run for a set amount of time or until a certain stage of drug development is finished. Thus, in order to preserve revenue streams and continue operating, CROs require a steady influx of new initiatives. Whereas the dependency on clienTo draw clients and land contracts, CROs must set themselves apart using attributes like experience, technological prowess, geographic reach, and reputation. Comprehending newly developed therapeutic domains, such gene therapy or immuno-oncology, can aid CROs in matching their service portfolio to changing customer demands.

Expansion of clinical trials

CROs may reach a wide range of patient groups by conducting clinical trials worldwide, which is essential for guaranteeing the generalizability of research data and evaluating the safety and efficacy of medications across various demographics. By reaching a wider range of eligible participants, global trials may hasten the recruitment of patients. This may result in new drug trials finishing sooner and bringing them to market sooner. Global trials improve the caliber of data collecting and analysis by providing access to a larger network of eligible researchers and study locations. Increased creativity and cooperation in clinical research may also result from this. Globalization presents CROs with chances to enter new markets and broaden their geographic reach. Revenue growth and greater competition may result from this.

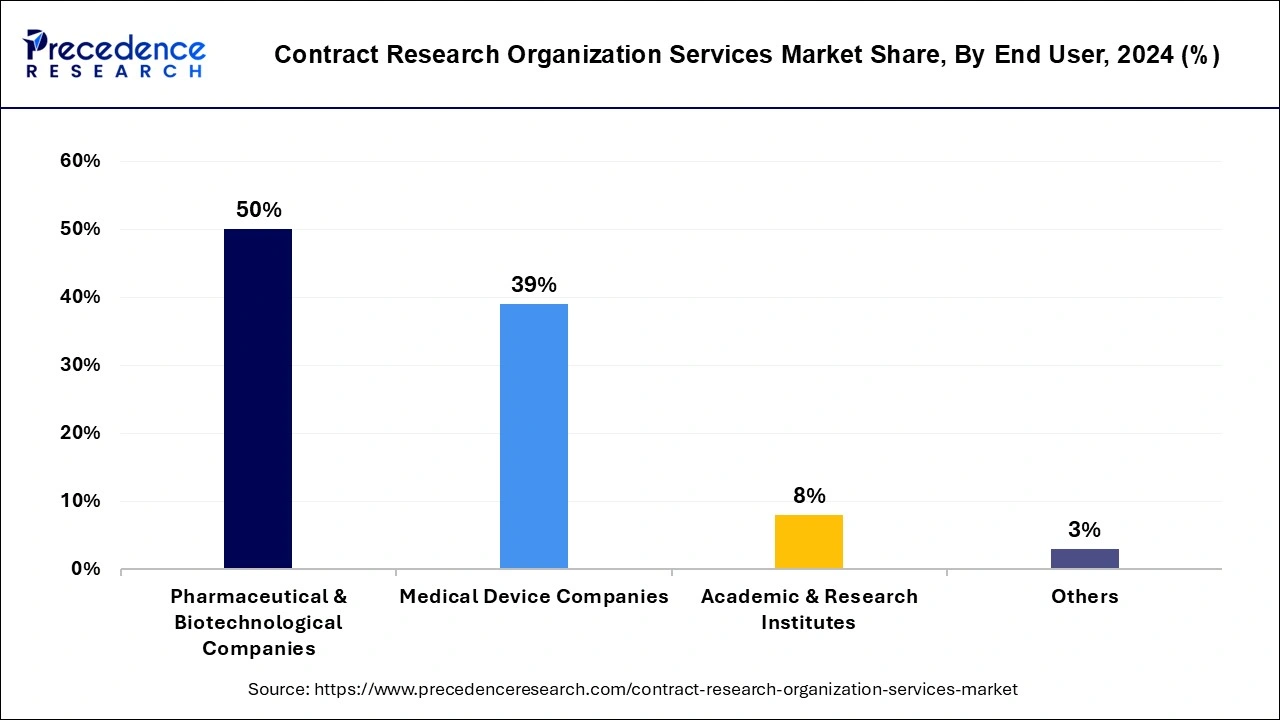

The pharmaceutical and biotechnological segment dominated the global contract research organization (CROs) services market in 2024,with revenue of 50%. The growing trend of outsourcing end-to-end services among pharmaceutical and biotechnological companies, particularly among small and mid-size enterprises without significant competence in the preclinical phase of drug development, is projected to raise demand for the segment during the forecast period. This expansion is fuelled primarily via growing biotechnology product pipelines, as well as a trend towards biotech companies retaining their assets for longer period of time. The established pharma customers bring more services back in-house, and the benefit that CROs bring to smaller biotech firms has become more evident over the years. Furthermore, running a clinical trial or a clinical research project by contract research organization eliminates the company to hire full time staff thus saving the money. Along with that, delivery by CRO’s to pharmaceutical companies enhances the flexibility of working simultaneously driving the demand in outsourcing the clinical investigation to a contract research organization thus spawning the growth of the market.

The academic and research institutes segment is estimated to be the most opportunistic segment during the forecast period. In the preclinical stage of discovery development, academic and research institutes play a crucial role. Furthermore, the segment will rise as a growing number of academic institutions outsource pre-clinical research activities to contract research organization (CROs) services companies.

The segment is broadly distributed into oncology, metabolic disorder, cardiology, infectious diseases and CNS disorder. The oncology segment is expected to hold the largest revenue share in the global contract research organization market. The demand for the oncology drugs development with advanced clinical practices have massively elevated thus increasing the growth of the market. Moreover, the importance of oncology and its rising cases puts pressure on the pharmaceuticals and biopharmaceuticals in emerging new drugs. Therefore, emerging advanced technologies and clinical research practices have been driving the demand for oncology-based contract research organization research.

Based on the service type, the drug discovery segment garnered 33% of revenue share in 2024. The rising prevalence of chronic diseases, as well as the growing demand for accurate and timely disease diagnosis, is driving the segment growth.

The pre-clinical segment is estimated to be the fastest growing segment during the forecast period. The increased research and development budgets for drug development are driving up demand for pre-clinical contract research organization (CROs) services, which will propel the segment growth during the forecast period.

The clinical segment held the largest share in contract research organizations market and are also expected to grow at a faster CAGR during the forecast period. The growth of the segment is driven by the rising demand for clinical research contributing to increasing chronic case diseases. Additionally, the demand for the new innovative drugs creates a pressure on the biopharmaceuticals and pharmaceuticals for outsourcing the research and development activities thus propelling the growth of the market.

By Service Type

By Application

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

September 2024

December 2024

August 2024