January 2025

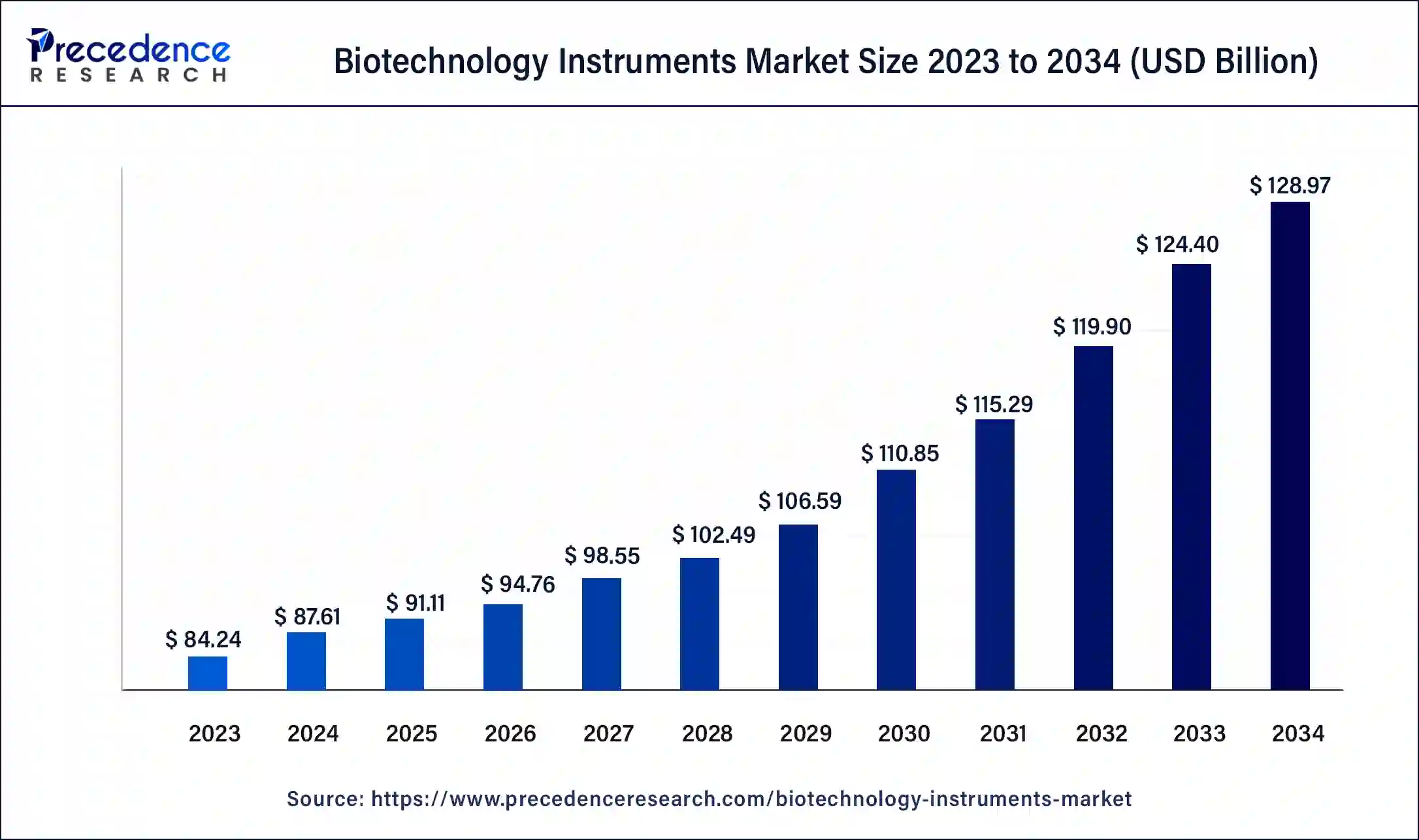

The global biotechnology instruments market size was USD 84.24 billion in 2023, estimated at USD 87.61 billion in 2024 and is anticipated to reach around USD 128.97 billion by 2034, expanding at a CAGR of 3.94% from 2024 to 2034.

The global biotechnology instruments market size accounted for USD 87.61 billion in 2024 and is predicted to reach around USD 128.97 billion by 2034, growing at a CAGR of 3.94% from 2024 to 2034.

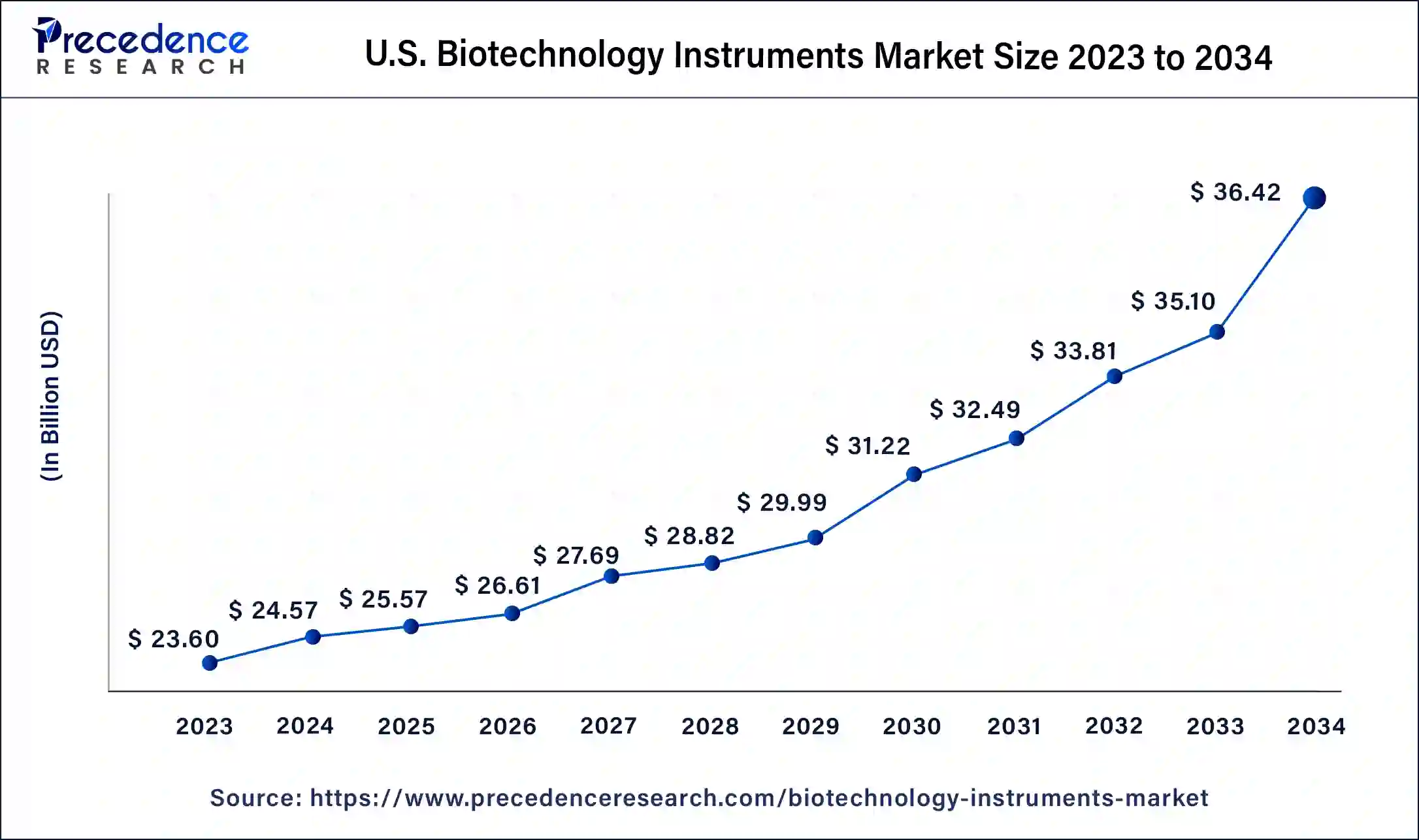

The U.S. biotechnology instruments market reached USD 23.60 billion in 2023 and is predicted to be woeth around USD 36.42 billion by 2034, at a CAGR of 4.02% from 2024 to 2034.

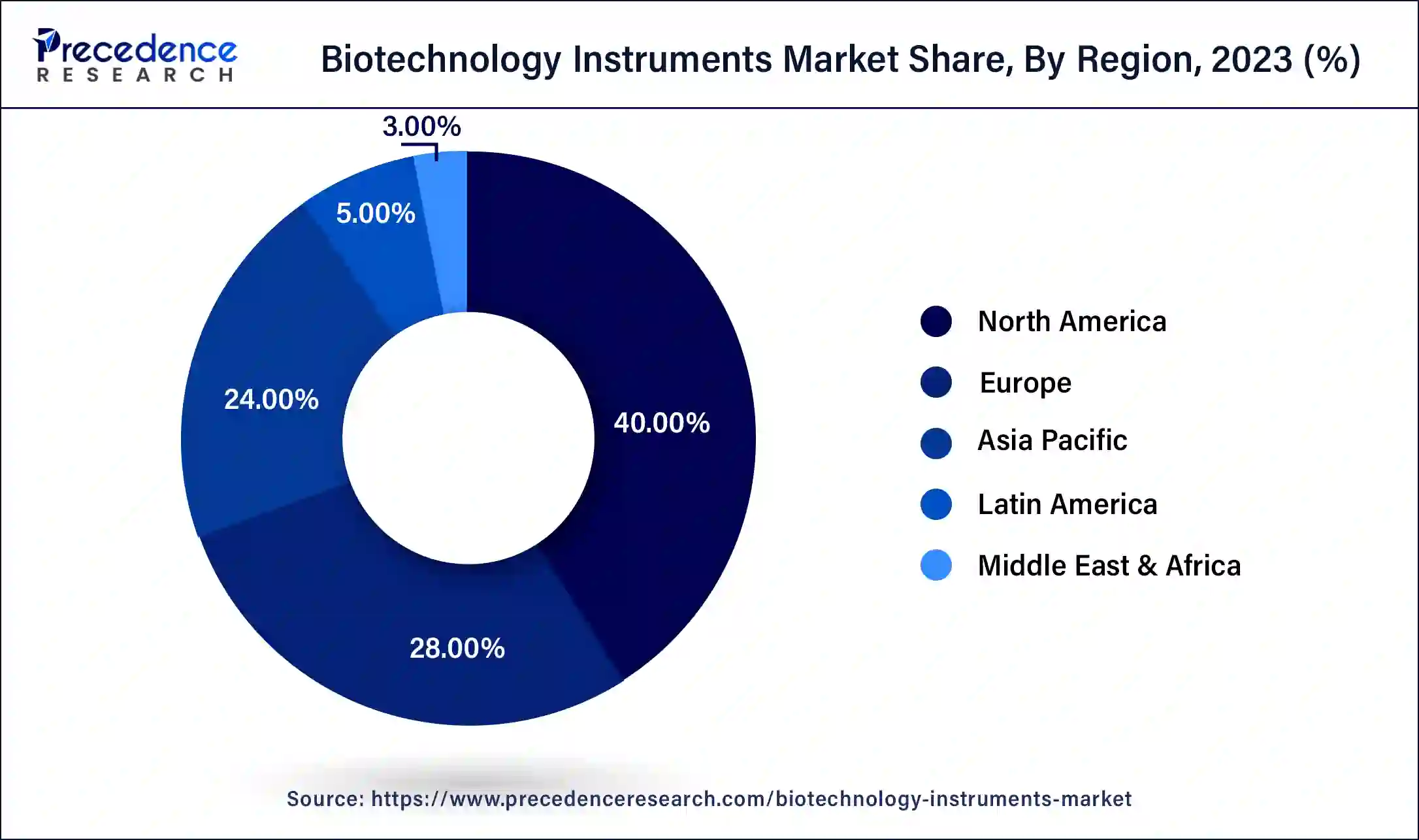

North America accounted for more than 40% of the market share in 2023 and dominated the global biotechnology instruments market. The higher adoption rate of the advanced technologies in the biopharmaceutical industries, increased demand for biotechnology instruments, high affordability, and the presence of numerous top market players in US are the prominent factors that drives the growth of the North America biotechnology instruments market. Moreover, the increased demand for the new and innovative drugs, rising investments in the research & development of vaccines, and favorable government support to the pharmaceutical industry has led to the dominance of North America in the global biotechnology instruments market.

Asia Pacific is estimated to be the most lucrative market during the forecast period. The favorable government investments is attracting FDIs and facilitating the collaborations of the local companies with the foreign companies. This is a major driving force of the biotechnology instruments market. Furthermore, the emerging countries like China, India, Australia, and Japan are inclining towards the utilization of the biotechnology instruments in the agriculture, energy, and environment protection fields, which is fueling the demand for the biotechnology instruments.

The increased adoption of the point of care diagnostic devices across the healthcare units is augmenting the growth of the global biotechnology instruments market. The growing needs for the development of vaccines, drugs, therapies, and diagnostic devices has fueled the demand for the biotechnology instruments across the globe. The rising investments in the research & development has improved the capabilities of the biotechnology instruments that further resulted in the enhancements of the point of care testing systems. The biotechnology instruments are extensively used in the production of various novel therapies, diagnostic devices, and gene modifications in the life science filed. The surging usage of the biotechnology instruments in the agricultural field has resulted in the development of the transgenic crops, which are resistant to pests and insects and provides higher yields. The growing concerns regarding the safety of environment from toxic and harmful chemicals is fueling the growth of the biotechnology instruments. The biotechnology instruments can help to degrade the toxicity of various harmful chemicals and thus help in resolving environmental issues. All these factors are expected to drive the growth of the global biotechnology instruments market during the forecast period.

The rising prevalence of various chronic diseases such as cancer, cardiovascular diseases, diabetes, and respiratory diseases is significantly boosting the usage of the biotechnology instruments in the production of various new drugs and therapies. Furthermore, the increasing investments by the biopharmaceutical companies towards the development of vaccines, medicines, and diagnostic tests is expected to have a positive and significant impact on the growth of the global biotechnology instruments market. The rising demand for the personalized medicines pertaining to the biological make up and the rising efforts to reduce the side-effects of the medicines is fueling the consumption of the biotechnology instruments. The rapid surge in the usage of the 2D and 3D cell cultures in the drug discovery and manufacturing of compounds is further driving the growth of the biotechnology instruments market across the globe.

The outbreak of the COVID-19 had a significant impact on the biotechnology instruments market in 2020. The pandemic spiked the demand for the biotechnology instruments as the demand for the RT-PCR tests were growing at a burgeoning rate across the globe. The demand for the RT-PCR is expected to sustain during the forecast period and hence, the growth will be significantly attributed to the impact of the COVID-19 pandemic on the global biotechnology instruments market.

| Report Coverage | Details |

| Market Size in 2023 | USD 943.97 Billion |

| Market Size in 2024 | USD 10,756.69 Billion |

| Market Size in 2024 | USD 10,756.69 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 24.68% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, End User, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Based on the product, the life science consumables segment accounted for a market share of over 55% and dominated the global biotechnology instruments market in 2023. The extensive usage of the PCR tests during the pandemic period in 2020, significantly fostered the growth of the life science consumables segment. The growing demand for the RT-PCR tests is one of the major drivers of this segment during the forthcoming years.

On the other hand, the medical laser is estimated to be the most opportunistic segment during the forecast period. The growing applications of the medical lasers especially in the surgical procedures is expected to drive the growth of this segment. The latest advancements in the medical lasers such as convenient use, increased miniaturization, and self-modulation is boosting its adoption. The rising adoption of the medical lasers in ophthalmology, dentistry, neurosurgery, and dermatology is anticipated to have a significant impact on the growth of this segment.

Based on the end user, the hospitals & healthcare facilities segment dominated the global biotechnology instruments market in 2023. The outbreak of the COVID-19 pandemic in 2020 resulted in a rapid surge in the demand for the IVD instruments in hospitals. The technological advancements has increased the efficiency of the IVD instruments, which will boosts its demand in the forthcoming years. Moreover, the rising prevalence of chronic diseases, growing geriatric population, and rising number of hospital admissions are the several prominent factors that are estimated to drive the growth of this segment.

The academic & government institutions is expected to grow at a rapid rate during the forecast period. This is attributable to the increased adoption of the biotechnology instruments to conduct various studies and researches on the vaccines, diseases, drugs, and life science consumables.

Key Market Developments

The biotechnology instrumentsmarket is highly fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

Segments Covered in the Report

By Product

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

August 2024

January 2025