April 2025

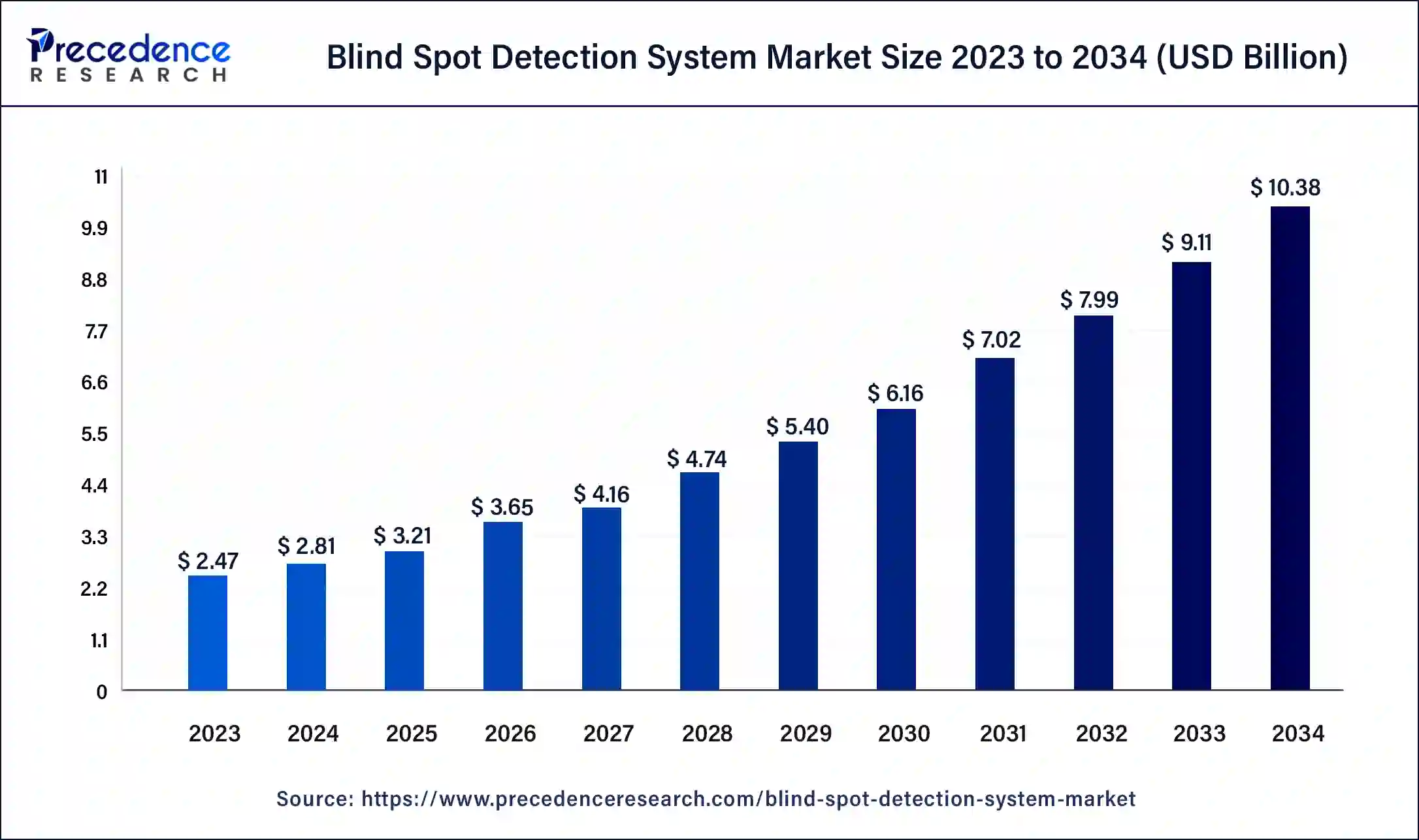

The global blind spot detection system market size was USD 2.47 billion in 2023, calculated at USD 2.81 billion in 2024 and is expected to be worth around USD 10.38 billion by 2034. The market is slated to expand at 13.94% CAGR from 2024 to 2034.

The global blind spot detection system market size is worth around USD 2.81 billion in 2024 and is anticipated to reach around USD 10.38 billion by 2034, growing at a solid CAGR of 13.94% over the forecast period 2024 to 2034. The blind spot detection system market is expanding due to the increasing vehicle production along with stringent government regulations across the globe. Moreover, the consumers increasing awareness of advanced safety features and their importance is fuelling the growth of the market on a global scale.

The blind spot detection system market has showcased significant growth owing to the rising consumer awareness about the strong possibility of blind spots that lead to accidents while driving a vehicle. The market is again propelled by a rising emphasis on safety on roads and the adoption of ADAS system-advanced driver assistance systems in vehicles. The market is anticipated to continue its upward growth due to the government's initiatives for safety and stringent regulations for driving across the globe, including rising awareness about vehicle glitches.

Blind spot detection system is basically referred to the term where advanced technology is used to help a driver detect and avoid obstacles in front of vehicles due to the blind spot, which means a spot on the road that does not reflect and noticed by the driver while traveling, causing major accidents. A blind spot detection system is made up of sensors and cameras with advanced technology, as well as radar, to monitor the areas of the blind spots and offer a visual or audible message to the driver to avoid the blind spots.

AI Impact on the blind spot detection system market

AI is prominently affecting the blind spot detection system, owing to the increasing integration of artificial intelligence (AI) and machine learning (ML) technologies, the development of more compact and streamlined blind spot detection sensors, the emergence of 360-degree surround view systems, incorporation of radar and LiDAR technologies for improved accuracy of the system which further provides safety strongly. Integration of blind spot detection with other ADAS features, development of wireless communication protocols for seamless connectivity, and the introduction of augmented reality (AR) and heads-up display (HUD) in blind spot detection systems are the waves in the market, helping to the proliferation of blind spot detection system market on a larger scale.

| Report Coverage | Details |

| Market Size by 2034 | USD 10.38 Billion |

| Market Size in 2024 | USD 2.81 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 13.94% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Technology, Vehicle Type, Vehicle Propulsion, Sales Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Governments stringent regulations for safety purposes

A significant driver for the growth of the blind spot detection system market is the government's initiatives to spread awareness about safety regulations by enforcing stringent laws regarding vehicle safety while traveling from one place to another. Major leading manufacturers have made huge R&D investments to re-design their vehicles to reduce the blind spot detection area and equip cutting-edge technology for safety features, which aids in saving the lives of passengers in the unfortunate occurrence of accidents.

Heavy-duty trucks and cars witness a huge blind spot area due to their size and are prone to more accidental tendencies while traveling as they carry huge loads. Hence, to mitigate such a fatal risk, many organizations and governments across the globe have established protocols and rules for safety and encourage the installation of the blind spot detection system market products.

Unidentified patterns of the weather

A major restraining factor of the blind spot detection system market is poor weather conditions and its unidentified patterns leading towards glitches in the advanced safety systems in the vehicles. Weather changes such as heavy rainfall, Fog, and snowfall are the significant hindrances that affect the data collection system of ADAS. It makes the system inefficient for blind spot detection with the harsh situation of climate.

Extreme changes in the weather make the camera-based systems more difficult to work efficiently; they produce an image that is blurry due to the extra accumulation of moisture, creating fog in front of the camera's lens, harming the system of the lens and damaging it further increasing the overall repairing cost which will be a substantial investment for common people.

CMOS image sensors

The major opportunity for the blind spot detection system market is customers increasing demand for CMOS (complementary metal-oxide semiconductor) image sensors. The traditional system of vehicles uses CCD-charged coupled device technology to produce images on the multimedia screen to better analyze the environment while traveling. CMOS image sensors refer to the system used in an advanced digital camera, which is made up of integrated circuits that record an image perfectly. Due to its unprecedented benefits, major players in the original equipment market are investing heavily in developing this technology of advanced image sensors, further enhancing the safety features and reliability of the vehicle.

The radar segment led the global blind spot detection system market. The growth of the segment is attributed to the increasing demand for safety features while traveling, like automotive safety. It will help Radar's assertion in the market even in the upcoming period, as it does not have any strong alternative in terms of automotive safety. There are three types of radar available in the market, each exhibiting different properties as per consumers' requirements.

The camera segment is expected to grow at a lucrative rate in the blind spot detection system market over the forecast period. The growth of this segment is due to the integration of highly advanced cameras with CMOS image sensor cameras. These cameras are more efficient than traditional ones like CCD cameras, making them more appealing to consumers.

The passenger car segment accounted for the highest share of the blind spot detection system market in 2023. The segment is fuelling due to strict government regulations that require vehicles with high safety features to avoid any mishaps. The rising global production of vehicles is also fuelling the demand for the passenger car segment further. Also, automotive features and their ease of availability make them more inexpensive and available to use for many automobiles.

The commercial vehicle segment is anticipated to proliferate with a rising growth rate in the blind spot detection system market in the upcoming period. The segment is proliferating due to the booming e-commerce and logistics sector, increasing demand for heavy-duty vehicles equipped with advanced safety features.

The ICE segment dominated the global blind spot detection system market in 2023. The growth of this segment is due to the inclination of the automotive industry toward advanced technologies and the rising trend to convert older internal combustion engine-based vehicles into cutting edge technologically advanced vehicles, including safety features. Bothe consumers and manufacturers are looking for newer solutions to improve existing system of the vehicles into better one, without a need to change complete fleet.

The electric segment is anticipated to proliferate rapidly in the blind spot detection system market in the upcoming period. The segment is proliferating due to the increasing demand, production, and adoption of electric vehicles across the globe. EVs are mainly equipped with cutting-edge technologies like the integration of the ADAS system as a feature, which is a significant change that is notable in the EV system.

The OEM segment accounted for the highest share of the blind spot detection system market in 2023. The growth of this segment is due to various reasons. OEM-installed systems have come with a warranty, which is reliable for consumers. Incidents like a malfunction or dismantling of any part of the vehicle can be fixed by service centers that are in the manufacturer's network, creating an efficient way to solve technical issues regarding vehicle parts.

The aftermarket segment is anticipated to proliferate rapidly in the blind spot detection system market in the upcoming period. This segment is expanding for various reasons, such as its comprehensive range of products and services related to vehicles that are not provided by the original manufacturer. This includes parts, accessories, equipment, and enhancements made by third-party companies. Aftermarket products can range from replacement parts for repairs to performance-enhancing accessories and aesthetic modifications.

Asia Pacific accounted for the largest share of the blind spot detection system market in 2023. The growth of this region is fuelled by the increasing urbanization in evolving countries like India, Japan, and China, which leads towards higher production rates even in the automotive industry, including demand for advanced safety features in the vehicles. Additionally, the abundance of raw materials at lower cost attracts more consumers to invest in the automotive industry in the region.

North America is anticipated to witness the fastest growth in the blind spot detection system market during the foreseeable period. The region is showing lucrative growth due to the government's strict regulations for advanced safety features in the automotive sector and higher sales of automobiles in North America.

Segments Covered in the Report

By Technology

By Vehicle Type

By Vehicle Propulsion

By Sales Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

March 2025

January 2025

February 2025