April 2025

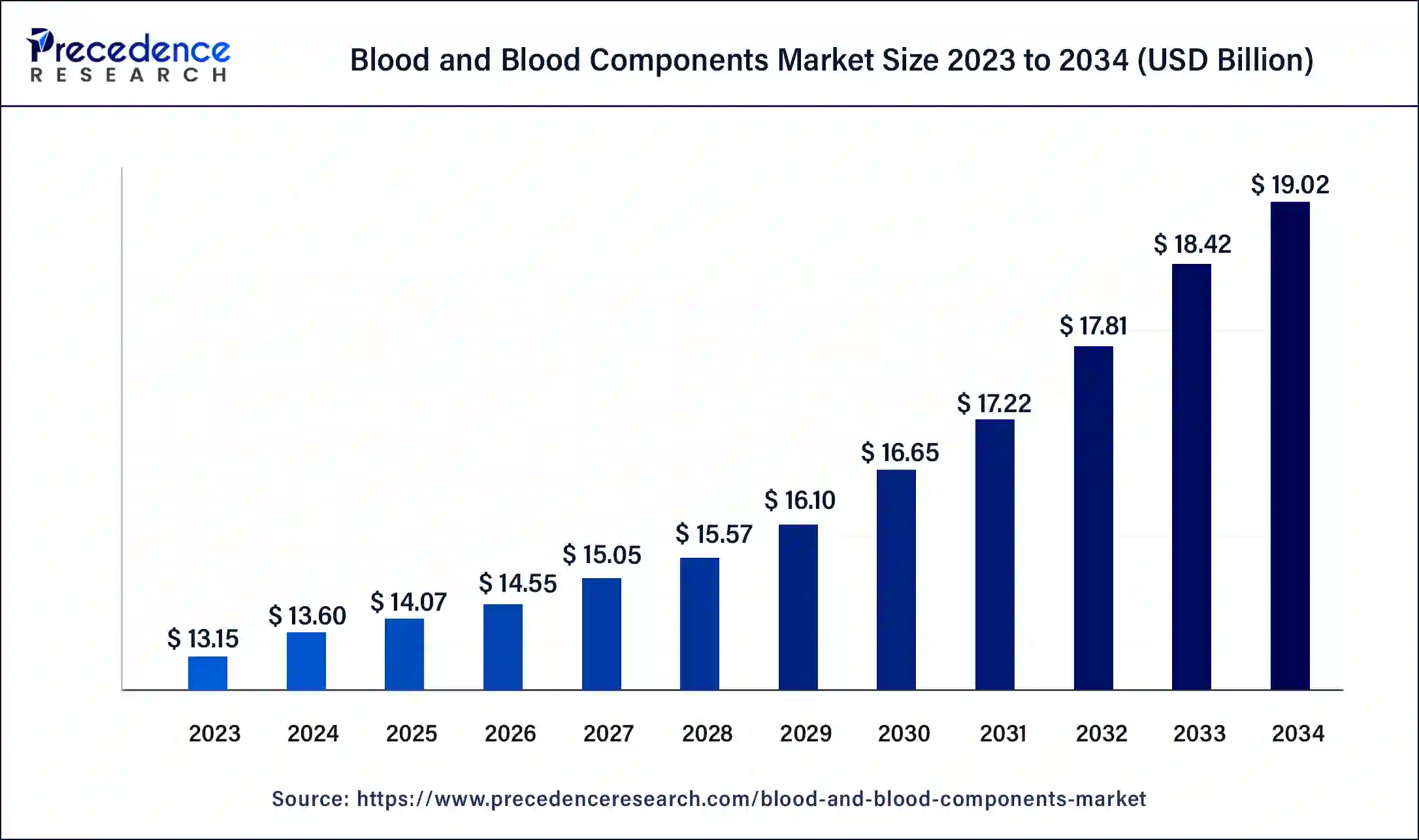

The global blood and blood components market size was USD 13.15 billion in 2023, estimated at USD 13.60 billion in 2024 and is anticipated to reach around USD 19.02 billion by 2034, expanding at a CAGR of 3.4% from 2024 to 2034.

The global blood and blood components market size accounted for USD 13.60 billion in 2023 and is predicted to reach around USD 19.02 billion by 2034, growing at a CAGR of 3.4% from 2024 to 2034. Frequent blood transfusions and component therapy are necessary due to the rising prevalence of chronic disorders like cancer, hemophilia, and anemia, which fuels the need for the blood and blood components market.

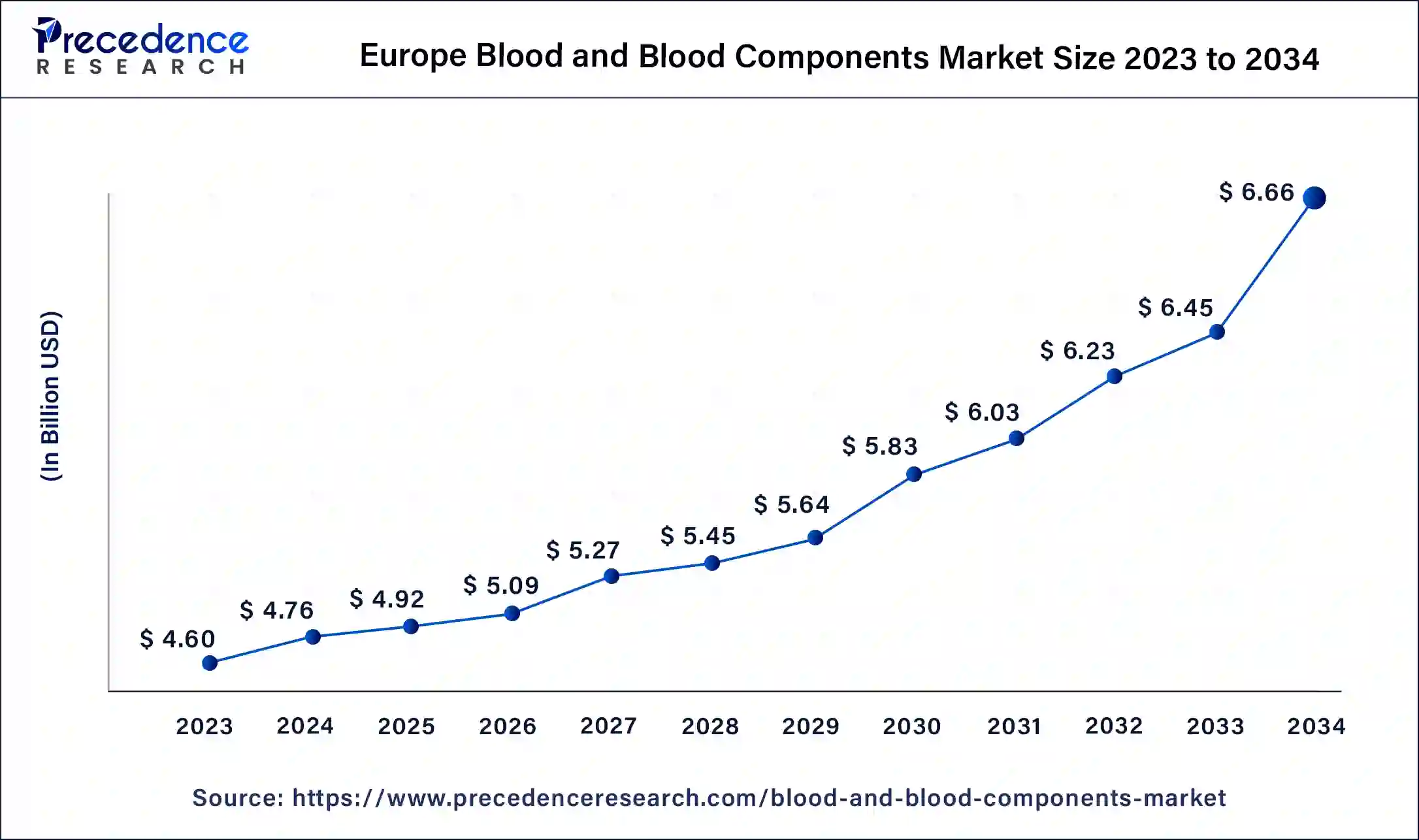

The Europe blood and blood components market size was estimated at USD 4.60 billion in 2023 and is expected to be worth around USD 6.66 billion by 2034 with a CAGR of 4% from 2024 to 2034.

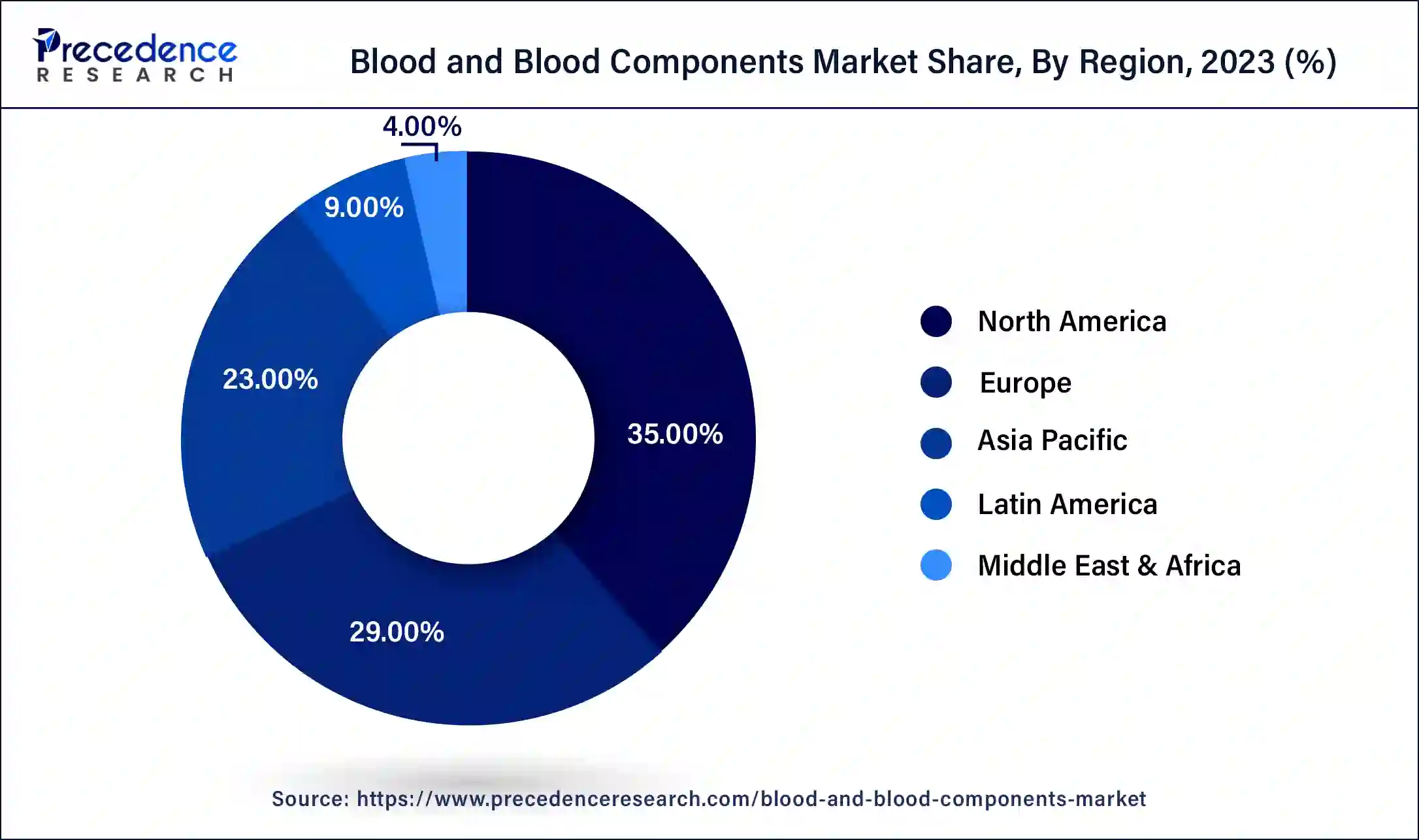

Europe dominated the blood and blood components market in 2023. The European market for blood and blood components is essential to the healthcare system because it provides the supplies needed for procedures, treatments, and transfusions. This market includes a range of products, including plasma, red blood cells, platelets, and whole blood. The market is impacted by various factors, such as the development of blood processing technologies, the rise in surgical procedures, trauma cases, and chronic diseases, which in turn drive the need for blood products. Additionally, strict laws that guarantee blood safety also play a role. Europe's aging populations frequently need more blood products since transfusion-dependent illnesses like cancer and cardiovascular ailments are increasingly common there. Furthermore, pandemics and newly developing infectious illnesses may affect the supply and demand for blood products, highlighting the significance of being ready and having reliable blood management systems.

North America is expected to gain a significant share of the blood and blood components market during the forecast period. Within the healthcare sector, the blood and blood components market in North America is a sizable business. It includes a range of goods and services for the procurement, processing, transfusion, and storage of blood. The need for blood transfusions is rising as a result of surgeries, trauma cases, and chronic illnesses. Additionally, improvements in blood processing technologies are driving this market's expansion.

In North America, the market for blood and blood components is impacted by a number of variables, including government restrictions, healthcare infrastructure, population demographics, and technological breakthroughs in medicine. The aging population, rising rates of chronic illnesses, and continuous improvements in healthcare technologies are all projected to fuel the growth of the blood and blood components market in North America.

An increase in surgical procedures, trauma cases, cancer treatments, and chronic conditions needing blood transfusions are some of the factors driving the demand for blood and blood components. The introduction of new technologies for blood processing and storage, improvements in healthcare infrastructure, and increased public awareness of blood donation have all contributed to the steady growth of the blood and blood components market.

The blood and blood components market can be divided into categories such as platelets, plasma, red blood cells, whole blood, and other blood products. Each ingredient has a distinct medical use, such as the treatment of immunological deficiencies, coagulation disorders, and anemia. The main destinations for blood and blood components are hospitals, clinics, and blood banks. For patients in need to receive safe blood products on time, these organizations need effective transfusion services.

Blood processing and storage methods have seen substantial technological developments in the blood and blood components market. The safety and shelf life of blood products has been improved by automation, pathogen reduction technology, and better storage practices. The market is expanding due to factors like aging populations, rising rates of chronic illnesses, and rising demand for treatments using blood.

Obstacles to market expansion include things like high operating expenses, regulatory compliance, and blood shortages. Due to regional variances in healthcare systems, legal systems, and cultural perspectives on blood donation, the market environment may change. Blood banking systems are generally well-established in developed nations, whereas emerging economies may have obstacles pertaining to limited resources and infrastructure.

| Report Coverage | Details |

| Market Size in 2023 | USD 13.15 Billion |

| Market Size in 2024 | USD 13.60 Billion |

| Market Size by 2034 | USD 19.02 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 3.4% |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, End-use, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Globalization of healthcare

The supply chain of blood and blood components in the market has been optimized thanks to globalization. This implies that blood products can be obtained from different geographical areas, contingent on variables such as market demand, supply, and legal constraints. The market for blood and blood components has grown internationally as a result of globalization. Both suppliers and customers will benefit from this development.

In order to improve patient safety and promote global trade, regulatory agencies collaborate to set uniform criteria and procedures for the collection, processing, and distribution of blood products. The safety and effectiveness of blood products have been improved by innovations, including pathogen reduction technology, better storage strategies, and sophisticated screening procedures, which have benefited healthcare systems all around the world.

Transmissible diseases

Diagnostic tests, tools, and safety precautions meant to stop the spread of infectious diseases through blood transfusions or blood products generally dominate the market for transmissible diseases in blood and blood components. Manufacturers in the blood and blood components market create advanced machinery that helps blood screening labs do tests quickly and precisely. Automated analyzers, NAT (nucleic acid amplification technology) devices, and immunoassay platforms made especially for blood screening could be among these equipment.

Businesses that offer regulatory consulting services assist transfusion facilities and blood banks in navigating the complicated regulatory environment that oversees blood safety. Research organizations and biotechnology businesses spend money on R&D to create cutting-edge technologies that increase the sensitivity and specificity of blood screening tests and can detect newly developing infections that could endanger the safety of human blood.

Rising incidence of chronic diseases

Blood transfusions are frequently required to treat problems like anemia, thrombocytopenia, or bleeding issues that are brought on by chronic diseases. The requirement for a consistent supply of blood and its constituent parts is fueled by this rising demand, which also places strain on blood banks. Certain blood components, such as clotting factors or red blood cells, are necessary for the treatment of some chronic disorders, such as hemophilia or sickle cell disease. The need for these specific blood products increases along with the prevalence of these disorders.

However, the frequency of chronic illnesses may make it difficult to find and keep regular blood donors, particularly if they themselves have underlying medical conditions. In addition to having an impact on the blood supply, the rising prevalence of chronic illnesses is also taxing healthcare systems overall.

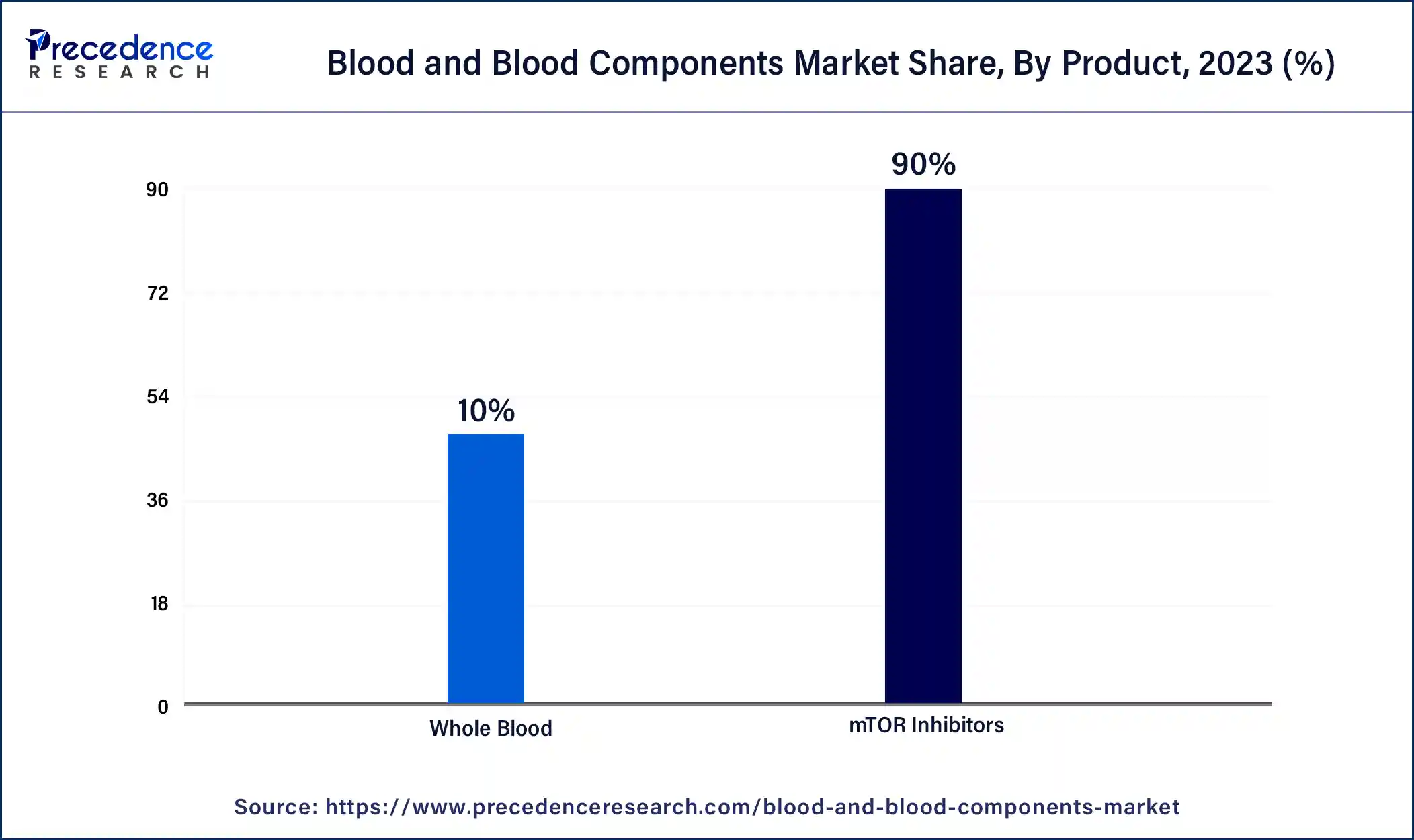

The blood components segment held the largest share of the blood and blood components market in 2023 and is expected to maintain its dominance throughout the forecast period. The distinct components of blood that remain following a whole blood donation are known as blood components. White blood cells, platelets, red blood cells, and plasma are some of these constituents. Each component has a distinct medicinal function, and transfusions are frequently used to treat a range of illnesses, including immunological deficiencies, coagulation disorders, and anemia.

A wide range of stakeholders are involved in the blood and blood component business, including blood banks, clinics, hospitals, and research facilities. Blood and its constituent parts must be collected, processed, stored, and distributed. A number of variables, including population demography, the frequency of disorders needing transfusions, improvements in medical technology, and governmental regulations, affect the demand for blood components.

The whole blood segment is expected to witness the fastest growth in the blood and blood components market during the forecast period. In the blood and blood components market, the term "whole blood" often refers to the procedure of obtaining and handling donor whole blood. Red blood cells, white blood cells, platelets, and plasma are all present in whole blood. In this section, donors' whole blood is collected, and it is then processed and divided into its constituent parts, including red blood cells, platelets, plasma, and other blood products.

Following that, these parts are utilized in a variety of medical settings, such as blood transfusions for individuals suffering from anemia, bleeding problems, or during surgical procedures. Within the larger blood and blood component industry, the whole blood segment is important because it supplies the raw materials needed to produce a variety of blood products that are essential for medical operations and treatments.

The hospital segment dominated the blood and blood components market in 2023. The market for blood and blood components includes a range of organizations, such as blood banks, hospitals, clinics, and vendors of blood products. Because they are big users of blood and blood components for different surgeries, medicinal procedures, and treatments, hospitals are important players in this industry.

In order to collect, process, and store blood and blood components for use by their patients, hospitals frequently establish their own blood banks or blood collection centers. Hospitals can keep a consistent supply of blood products on hand thanks to this vertical integration, which also guarantees that patients in need of blood transfusions may get them quickly. Hospitals are actively engaged in research and development projects pertaining to blood management techniques, transfusion medicine patient outcomes, and blood transfusion technology.

The ambulatory surgical centers segment is expected to grow rapidly in the blood and blood components market during the forecast period. Because they provide a variety of outpatient surgical treatments that don't require an overnight stay, ambulatory surgical centers (ASCs) are important players in the healthcare industry. ASCs can carry out medical treatments like organ transplants, cardiology procedures, and orthopedic surgery that call for blood transfusions. Certain ASCs might focus on treatments like immunoglobulin therapy or uncommon blood types that call for particular blood components for their procedures.

ASCs help meet the need for blood and blood components, but they also have to deal with issues including controlling costs, adhering to regulations, and making sure the supply chain for these perishable goods is properly managed. Blood product producers and suppliers must collaborate closely with ASCs to guarantee prompt delivery, safe storage, and adherence to procedures.

The cancer treatment segment held a significant share of the blood and blood components market in 2023. The market for cancer treatments includes a broad spectrum of therapies, including blood and blood-derived products. Blood is essential to the treatment of cancer, especially for treatments like stem cell transplants, immunotherapies, and blood transfusions. Blood transfusions are frequently necessary for cancer patients receiving treatment to replace blood cells lost as a result of chemotherapy, radiation therapy, or surgery. Bone marrow transplants, sometimes referred to as stem cell transplants, are frequently utilized to treat diseases such as multiple myeloma, lymphoma, and leukemia. During this process, healthy stem cells that can differentiate into healthy blood cells are used to replace damaged or diseased bone marrow.

The anemia segment is expected to grow rapidly during the forecast period. Blood transfusions are frequently necessary for anemic individuals in order to raise their hemoglobin or red blood cell counts. Demand for packed red blood cells (PRBCs), whole blood, and particular blood components such as red blood cell concentrates or packed red blood cell concentrates is driven by this need.

A number of underlying problems, such as genetic disorders, long-term illnesses, or nutritional inadequacies, can cause anemia. Services for blood testing and screening are essential for determining the kind and cause of anemia. Owing to the prevalence and variety of aetiologies of anemia, research, and development on novel medications, treatments, and diagnostic instruments is continuous. This covers developments in iron supplementation, gene treatments, erythropoietin-stimulating drugs, and blood substitutes.

Segment Covered in the Report

By Product

By End-use

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

August 2024

March 2024