April 2025

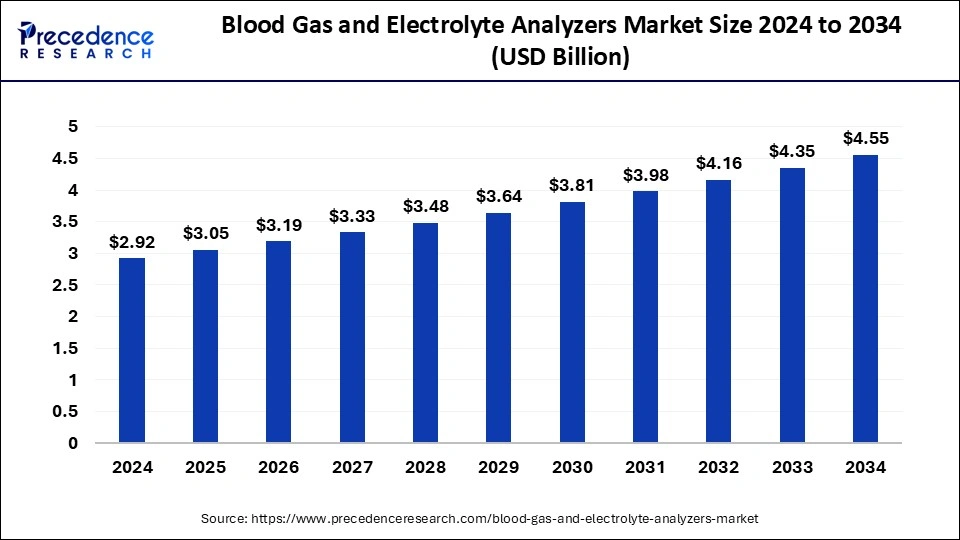

The global blood gas and electrolyte market size accounted for USD 3.05 billion in 2025 and is forecasted to hit around USD 4.55 billion by 2034, representing a CAGR of 4.54% from 2025 to 2034. The North America market size was estimated at USD 1.23 billion in 2024 and is expanding at a CAGR of 4.61% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global blood gas and electrolyte analyzers market size was calculated at USD 2.92 billion in 2024 and is predicted to increase from USD 3.05 billion in 2025 to approximately USD 4.55 billion by 2034, expanding at a CAGR of 4.54% from 2025 to 2034.

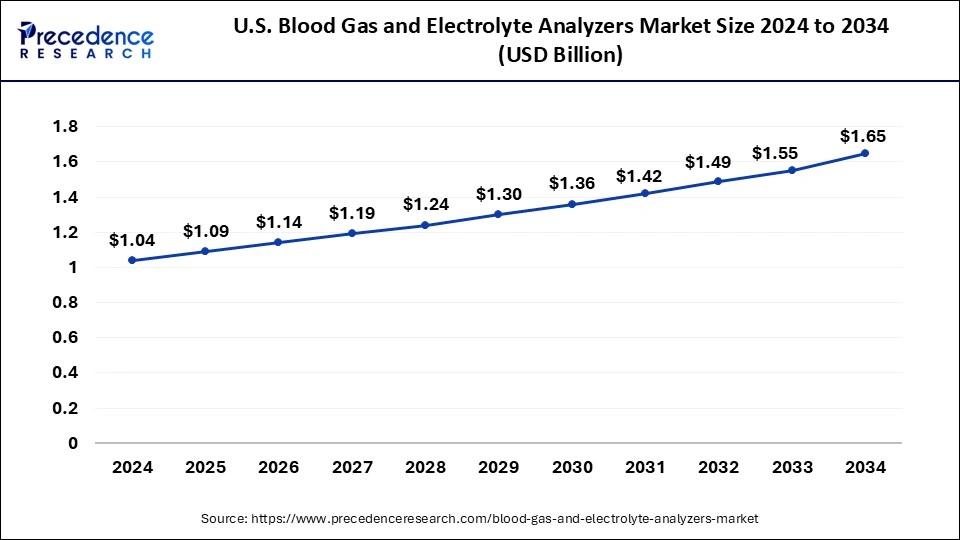

The U.S. blood gas and electrolyte analyzers market size was exhibited at USD 1.04 billion in 2024 and is projected to be worth around USD 1.65 billion by 2034, growing at a CAGR of 4.72%.

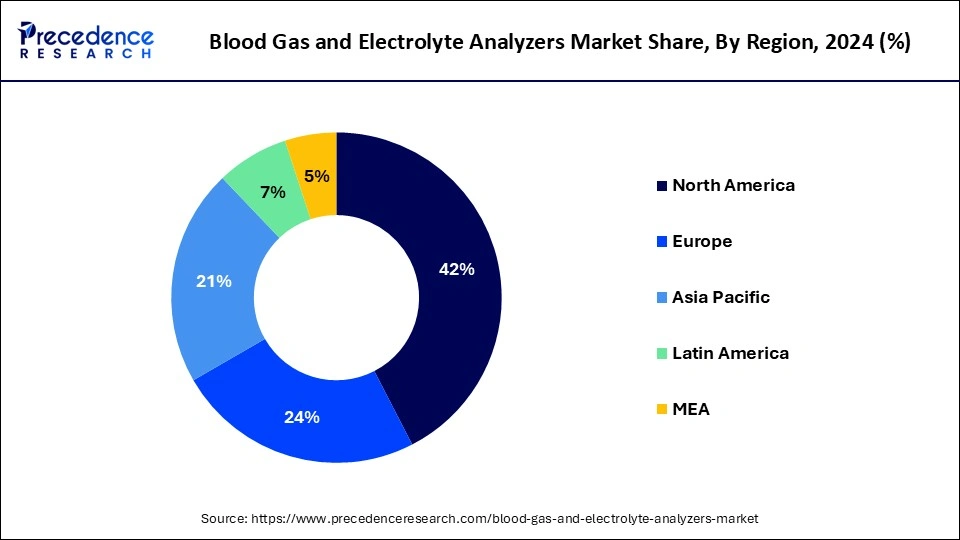

North America dominated the blood gas and electrolyte analyzers market with the largest share of 41% in 2024. The dominance of the market is attributed to the well-developed healthcare infrastructure and rapid adoption of advanced technologies by the healthcare industry. North America boasts a highly developed healthcare infrastructure with modern hospitals, diagnostic laboratories, and research facilities. This infrastructure enables widespread adoption of advanced medical technologies, including blood gas and electrolyte analyzers. North America is a hub for medical device innovation, with many companies in the region focusing on developing cutting-edge technologies for healthcare applications. Technological advancements in blood gas and electrolyte analyzers, such as the integration of automation, connectivity, and point-of-care testing capabilities, have contributed to their widespread adoption in the region.

The region has stringent regulatory standards for medical devices, ensuring the safety, efficacy, and quality of blood gas and electrolyte analyzers. Compliance with these standards is essential for market entry, and manufacturers in North America often prioritize meeting these requirements to gain a competitive edge.

Asia Pacific is expected to witness the fastest rate of expansion in the blood gas and electrolyte analyzers market during the forecast period. Governments in the Asia Pacific region are implementing various healthcare reforms aimed at improving access to quality healthcare services and enhancing patient outcomes. This includes initiatives to strengthen healthcare infrastructure, expand diagnostic capabilities, and improve the affordability of medical devices, all of which are driving the demand for blood gas and electrolyte analyzers.

There is a growing trend towards point-of-care testing in the Asia Pacific region, driven by the need for rapid and accurate diagnostic results, particularly in remote and resource-limited settings. Blood gas and electrolyte analyzers are commonly used as point-of-care devices due to their ability to provide real-time results, which is driving their adoption in hospitals, clinics, and emergency departments across the region.

The blood gas and electrolyte analyzers market revolves around the production, innovation and distribution of tools and services offered for the measurement of various parameters associated with blood samples. They offer important information about a patient's respiratory health, electrolyte levels, and acid-base balance. In critical care, emergency medicine, and other therapeutic settings, these analyzers are indispensable.

The field of blood gas and electrolyte analysis is changing due to emerging trends driven by technological advancements. The increasing demand for automated blood gas and point of care combined with electronic medical records and laboratory information is contributing to the growth of the market.

| Report Coverage | Details |

| Market Size in 2025 | USD 3.05 Billion |

| Market Size by 2034 | USD 4.55 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.54% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Expansion of healthcare institutions

The expansion of healthcare institutions across the globe is observed to act as a major driver for the blood gas and electrolyte analyzers market. As healthcare institutions expand, they are able to accommodate a larger patient population, leading to higher demand for diagnostic testing services, including blood gas and electrolyte analysis. The growing number of patients requires efficient and accurate diagnostic tools to support timely and effective patient care. Expanded healthcare institutions aim to offer comprehensive medical services to address the diverse needs of patients. Blood gas and electrolyte analyzers are essential components of laboratory diagnostics, enabling healthcare facilities to perform a wide range of tests to monitor patients' physiological status and manage conditions such as respiratory and metabolic disorders.

Blood gas and electrolyte analyzers contribute to workflow efficiency and optimization within healthcare institutions by streamlining the diagnostic process. These analyzers offer automation and integration capabilities that minimize manual tasks, reduce turnaround times, and enhance laboratory productivity, allowing healthcare providers to deliver timely and efficient care to patients.

Lack of skilled professionals

Lack of skilled professionals in the sector acts as a major restraint for the blood gas and electrolyte analyzers market. Blood gas and electrolyte analyzers are sophisticated medical devices that require specialized training and expertise to operate effectively. The lack of skilled professionals means that healthcare facilities may struggle to find personnel capable of operating these analyzers accurately and efficiently. Proper calibration and maintenance of blood gas and electrolyte analyzers are crucial for obtaining accurate and reliable results. Skilled professionals are needed to ensure that these analyzers are calibrated correctly and maintained according to manufacturer specifications. Without skilled personnel, there is a risk of errors in test results, leading to incorrect diagnoses and treatment decisions.

Skilled professionals are required to interpret the results generated by blood gas and electrolyte analyzers accurately. This includes understanding the significance of various parameters measured by the analyzers and recognizing abnormal values that may indicate underlying health conditions. Without skilled professionals, there is a risk of misinterpretation of results, potentially leading to inappropriate patient management.

Integration of advanced technologies

The integration of advanced technologies in the sector is observed to act as a significant opportunity for the expansion of the blood gas and electrolyte analyzers market. Advanced technologies, such as biosensors and microfluidics, can improve the accuracy and precision of blood gas and electrolyte measurements. This allows for more reliable and consistent results, reducing the margin of error in diagnostic testing and improving patient care. Integration of automation and high-throughput processing capabilities enables faster turnaround times for blood gas and electrolyte analysis. This is particularly beneficial in critical care settings where rapid results are essential for timely patient management and decision-making.

The portable analyzers segment held the largest share of the blood gas and electrolyte analyzers market in 2024. The dominance of the segment is attributed to its properties like it delivers instantaneous test results and turnaround time. The rising demand for point-of-care blood gas analyzers is driving the demand for the segment. Portable blood gas analyzers can provide real-time results at the patient's bedside or in ambulatory settings, and they are made for quick on-site testing. As portable analyzers are more compact and portable than tabletop ones, they are appropriate for use in operating rooms, intensive care units, and emergency departments. Portable analyzers allow rapid assessments for prompt clinical decision-making by providing a subset of critical values.

The benchtop analyzers segment is observed to witness the fastest rate of expansion during the forecast period in the blood gas and electrolyte analyzers market. The growth of the segment is attributed to the rate of adoption for benchtop analyzers by hospitals and other healthcare institutions. High-throughput testing is made possible by the automatic functions that benchtop analyzers frequently provide for handling, mixing, and calibrating samples.

They can efficiently handle a high number of samples, making them perfect for facilities that need to perform comprehensive blood gas analysis. A wide range of diagnostic parameters, such as pH, pO2, pCO2, electrolytes, and more, are available with these analyzers. Larger, more capable devices and benchtop blood gas analyzers are typically found in large-scale hospitals and clinical laboratories.

The combined analyzers segment dominated the blood gas and electrolyte analyzers market with the largest market share in 2024. Combined analyzers integrate multiple functions into a single platform, allowing healthcare providers to perform various tests simultaneously, including blood gas analysis, electrolyte analysis, and metabolite testing. This streamlines the testing process, reduces turnaround time, and enhances workflow efficiency in clinical settings. Investing in a combined analyzer eliminates the need to purchase separate instruments for different tests, reducing capital expenditure for healthcare facilities. Moreover, combined analyzers require less space, maintenance, and training compared to multiple standalone devices, resulting in cost savings over time.

The blood gas analyzers segment is expected to grow at the fastest pace in the blood gas and electrolyte analyzers market in the forecast period. The growth of the segment is attributed to the rising consumption of blood gas analyzers in hospitals and emergency care centers. The evaluation of a patient's oxygenation level, acid-base balance, and general metabolic health depends heavily on these analyzers. The equipment has gained significant value for healthcare practitioners in making precise diagnoses and well-informed treatment decisions due to technological improvements.

The clinical laboratories segment led the blood gas and electrolyte analyzers market in 2024 with the largest share. The rising demand for blood gas and electrolyte analyzers in the clinical laboratory for the efficiency in workflow and disease detection in the patients acts as a major driver for the segment’s growth. In addition to measuring blood gases, blood gas analyzers (BGA) also measure electrolytes, metabolites such as glucose and lactate, and total hemoglobin, or hematocrit. This allows clinicians to quickly diagnose and treat a variety of metabolic and respiratory disorders, which can lead to life-threatening situations.

Clinical laboratories handle a large volume of blood gas and electrolyte tests on a daily basis. These tests are essential for diagnosing and monitoring various medical conditions, including respiratory and metabolic disorders, electrolyte imbalances, and acid-base disturbances. The high testing volume in clinical laboratories drives the demand for blood gas and electrolyte analyzers.

The point-of-care segment is expected to grow at a significant rate in the blood gas and electrolyte analyzers market during the forecast period. The growth of the segment is attributed to the increasing diagnoses in inpatient locations and the rising trend for minimizing the hospital stays to control healthcare expenditure. The growing adoption of point-of-care treatment is due to the ease of use, lower turnaround time, higher accuracy, and less space. The point-of-care treatment provides faster analysis at the point of need. The portability and efficiency in use fuel the demand of the point-of-care segment in the market.

By Product

By Application

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

August 2024

March 2024