April 2025

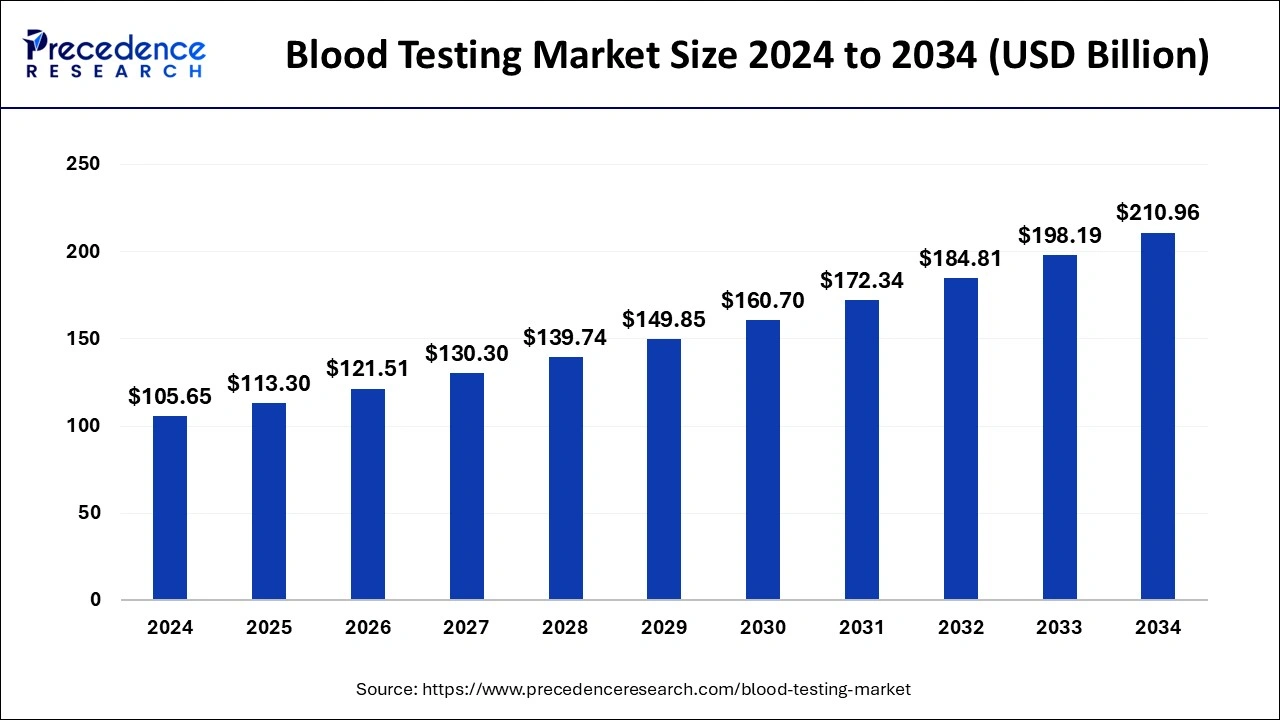

The global blood testing market size is calculated at USD 113.30 billion in 2025 and is forecasted to reach around USD 210.96 billion by 2034, accelerating at a CAGR of 7.16% from 2025 to 2034. The North America blood testing market size surpassed USD 46.49 billion in 2024 and is expanding at a CAGR of 7.28% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global blood testing market size was estimated at USD 105.65 billion in 2024 and is predicted to increase from USD 113.30 billion in 2025 to approximately USD 210.96 billion by 2034, expanding at a CAGR of 7.16% from 2025 to 2034. The rising number of diagnostic centers worldwide is driving the growth of the blood testing market.

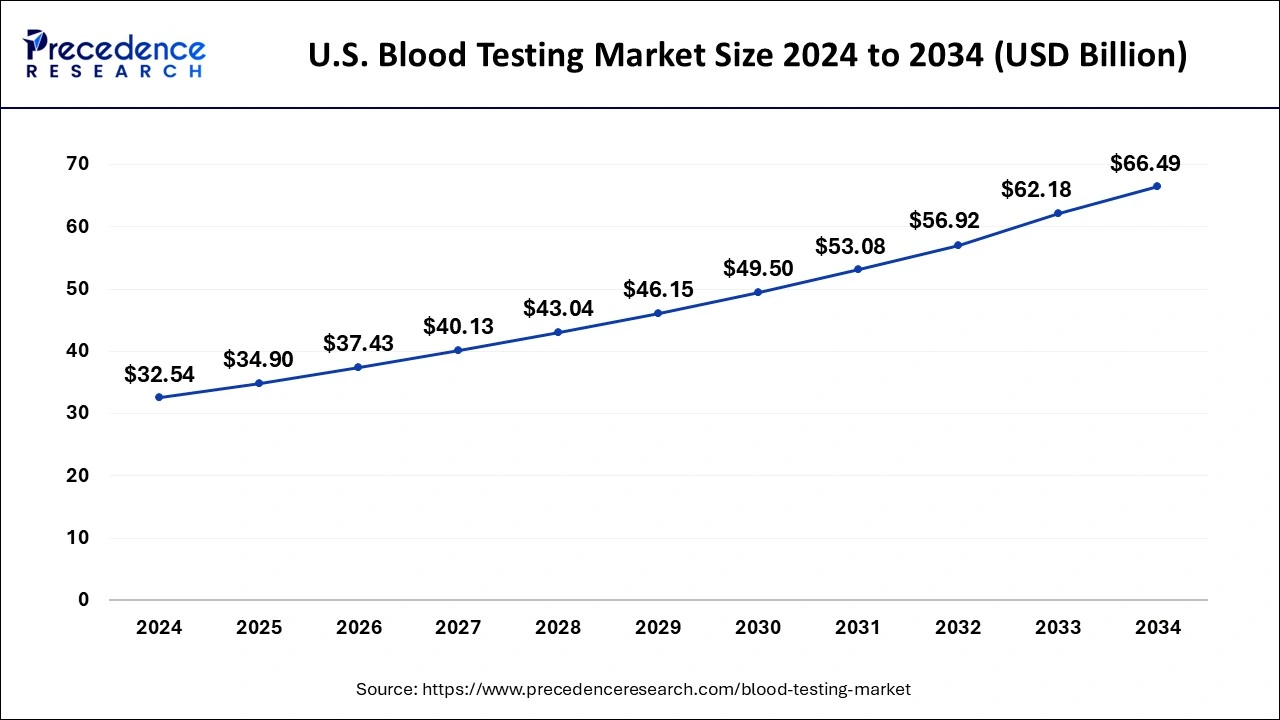

The U.S. blood testing market size surpassed USD 32.54 billion in 2024 and is projected to attain around USD 66.49 billion by 2034, poised to grow at a CAGR of 7.40% from 2025 to 2034.

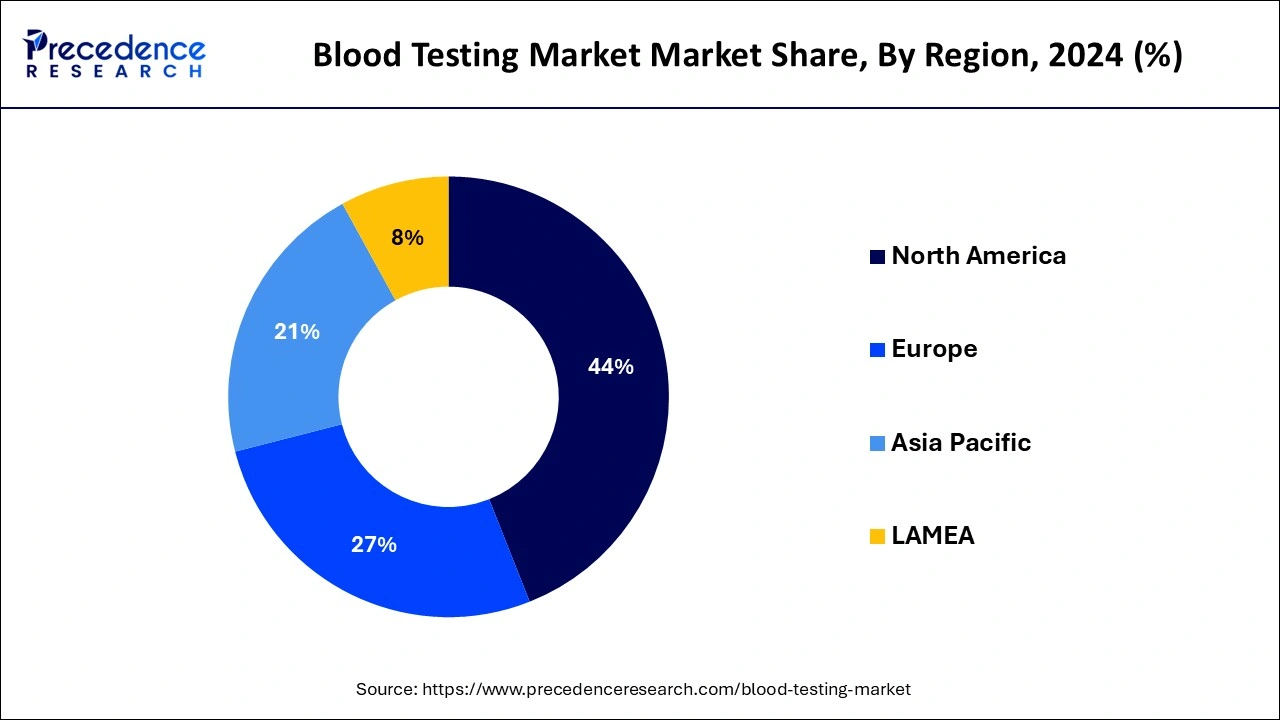

North America holds the largest blood testing market share in 2024 and is expected to maintain its dominance throughout the forecast period. The growth of this region is mainly driven by the rising technological developments in the healthcare industry. Also, the increasing prevalence of chronic diseases such as Cancer, Cardiovascular diseases, and others has increased the demand for blood testing for proper diagnosis and getting cured, thereby driving the market growth. According to a study by Cancer.net, around 14% of lung cancer patients suffer from Small Cell Lung Cancer (SCLC) in the U.S.. It is also estimated that approximately 238,440 adults will be suffering from lung cancer in 2023 in the U.S.A.

Moreover, growing government investments in the development of healthcare sectors in countries such as the U.S.A., Canada, Mexico, and some others have also boosted the growth of the blood testing market. For instance, in August 2022, the U.S. Department of Health and Human Services (HHS) announced an investment of 60 million USD to increase the healthcare workforce along with providing good quality healthcare in rural areas of the U.S.A.. Additionally, the increased prevalence of rare diseases in North America has increased the demand for blood testing, thereby driving the market growth. According to the National Institutes of Health (NIH), around 7000 people in the U.S. suffer from rare diseases. It also stated that one in every ten people across the U.S. suffered from rare diseases. Furthermore, the presence of healthcare companies such as Abbott, Biorad Laboratories, Thermo Fisher Scientific, Danaher Corporation, and others boosts the market growth.

Asia Pacific is estimated to be the fastest-growing region during the forecast period. The growth of this region is mainly driven by the scientific advancements in the healthcare sector in countries such as India, Israel, China, Japan, and some others. Also, the rising interest from the public and private sectors for development & research related to blood testing methodologies has also boosted the market growth. Moreover, rising government initiatives in countries such as India and Japan to develop the medical sectors have fostered market growth.

Market Overview

The blood testing market is a very important industry in the healthcare domain. This industry has gained prominence due to the prevalence of various diseases worldwide. A blood test is a laboratory diagnosis done by extracting a blood sample from a person through different parts of the body. This testing methodology is the first step to diagnosing any mild or serious disease. There are several types of blood tests, including glucose testing, A1C testing, direct LDL testing, lipid panel testing, prostate-specific antigen testing, and others.

| Report Coverage | Details |

| Market Size in 2025 | USD 113.30 Billion |

| Market Size by 2034 | USD 210.96 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.16% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising cases of Alzheimer’s disease across the world

The prevalence of Alzheimer’s disease has increased rapidly due to several lifestyle factors, such as smoking, overdrinking, unhealthy diets, and others. This disease is mainly associated with memory loss along with other mental dysfunctionalities. According to the Alzheimer’s Association, around 7 million people in America suffer from Alzheimer’s disease. Thus, with the rising cases of Alzheimer’s disease, the demand for blood testing also increases, thereby driving the growth of the blood testing market. Moreover, several healthcare companies such as Abbott, Biorad, Quanterix, and others have started developing advanced blood testing methods for faster diagnosis of Alzheimer’s disease, which, in turn, boosts the market growth.

Several risks are associated with testing and wrong results

There are several problems associated with blood testing. Firstly, there are various side effects such as fever, headache, digestion issues, fainting, allergic reactions, appetite loss, and some others. Secondly, the problems associated with the storage and transportation of blood samples can result in false reports. Thus, several side effects and wrong results related to blood testing are expected to restrain the market growth to some extent.

Integration of modern technologies for blood testing

The blood testing industry has grown drastically with rapid developments in the healthcare sector. Nowadays, doctors prescribe different types of blood testing for the detection of very mild and serious diseases. Also, the advancement in modern technologies such as AI, Blockchain, and Machine Learning (ML) has allowed healthcare companies to integrate these technologies into their system to get accurate results of blood tests quickly.

The glucose testing segment held the largest share in 2024. The growth of this segment is driven by the rising cases of diabetes patients across the world. Also, the rise in the number of diagnostics centers, along with scientific developments associated with glucose testing, has driven the growth of the blood testing market. Moreover, healthcare companies are continuously engaged in research and development to develop new blood testing systems to get accurate glucose testing results, thereby driving market growth. Additionally, the ongoing trend of over-the-counter continuous glucose monitoring systems (CGM) among people across the world is driving the growth of the blood testing market. Furthermore, the growing trend of AI-based glucose monitoring systems across the world has boosted market growth.

The A1C segment is expected to show significant growth during the forecast period. The growth of this segment can be attributed to the growing number of patients suffering from anemia across the world. Also, the growing number of surgeries across the world has increased the demand for A1C testing, as surgeries are associated with blood loss, thereby driving the growth of the blood testing market. Moreover, healthcare companies are developing and launching several portable A1C testing devices across the world, which, in turn, drive the growth of the blood testing market.

By Test Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

August 2024

March 2024