February 2025

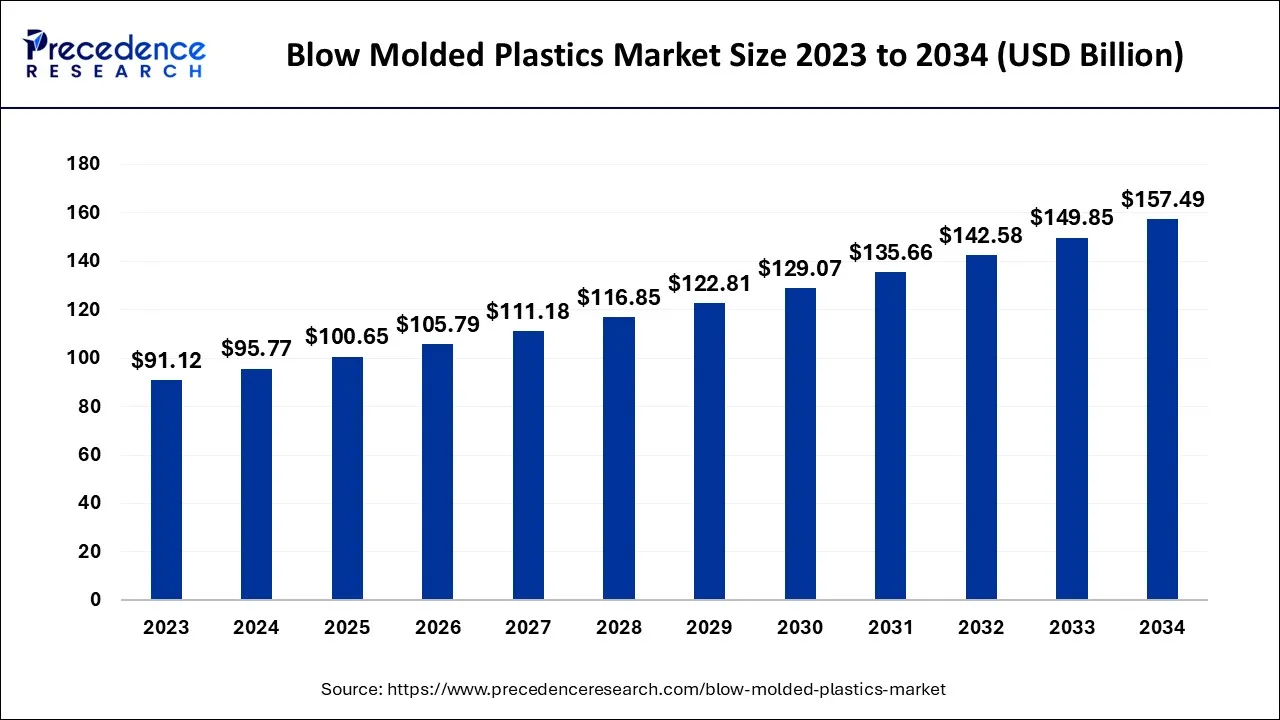

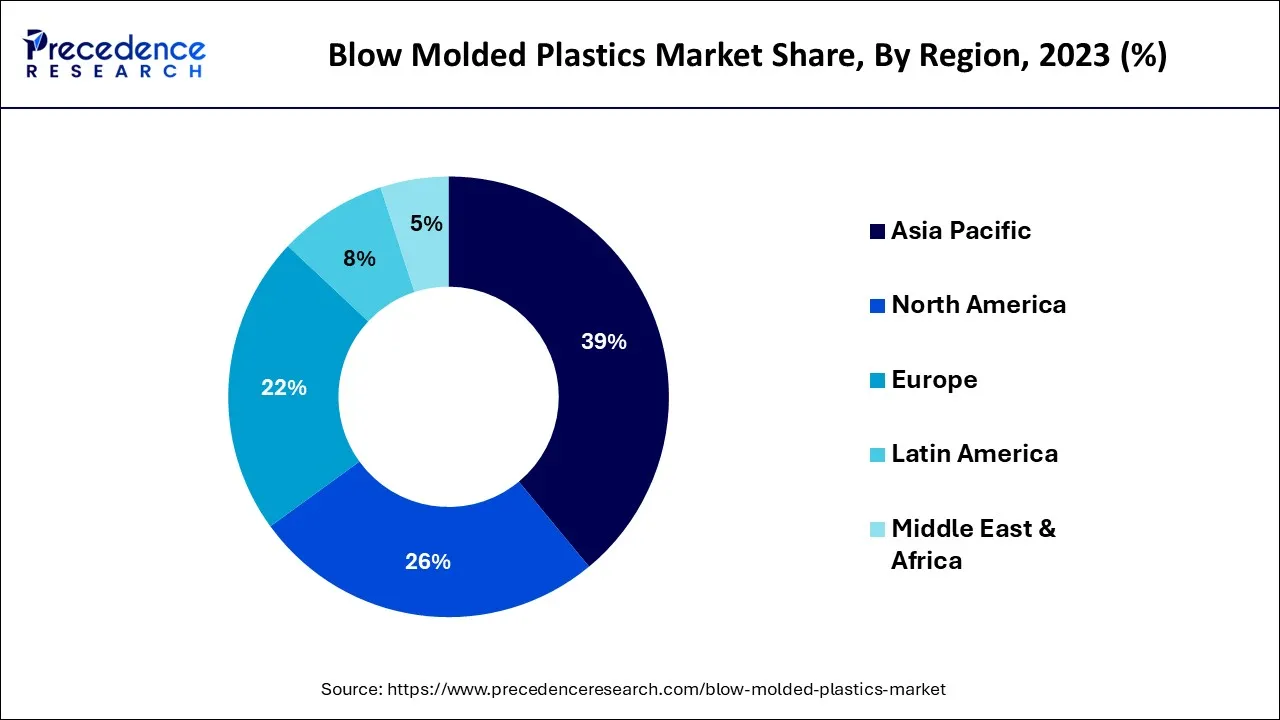

The global blow molded plastics market size accounted for USD 95.77 billion in 2024, grew to USD 100.65 billion in 2025, and is expected to be worth around USD 157.49 billion by 2034, poised to grow at a CAGR of 5.1% between 2024 and 2034. The Asia Pacific blow molded plastics market size is predicted to increase from USD 37.35 billion in 2024 and is estimated to grow at the fastest CAGR of 5.23% during the forecast year.

The global blow molded plastics market size is expected to be valued at USD 95.77 billion in 2024 and is anticipated to reach around USD 157.49 billion by 2034, expanding at a CAGR of 5.1% over the forecast period from 2024 to 2034.

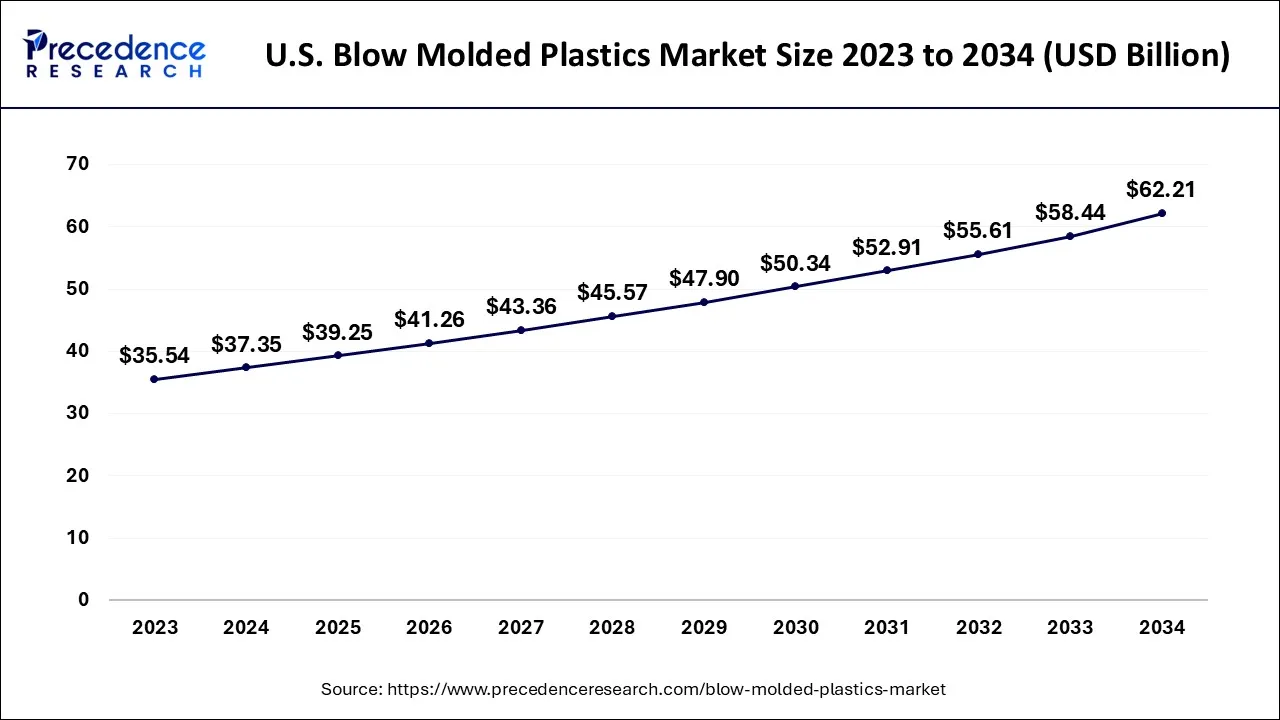

The Asia Pacific blow molded plastics market size is exhibited at USD 37.35 billion in 2024 and is projected to be worth around USD 62.21 billion by 2034, growing at a CAGR of 5.23% from 2024 to 2034.

Asia Pacific was the regional driving blow molded plastics market, accounting for total market revenue. Increasing framework spending, coupled with the expanding automobile need in countries like China, India, Indonesia, and Malaysia, is estimated to push the demand for blow-molded plastics in Asia.

The blow molded plastics market in North America is predicted to grow slowly due to the COVID-19 outbreak as the cross-border trade amongst economies got damaged. The increasing need for polypropylene and ABS in the packaging use section for manufacturing bottles, face shields, face masks, and, among others, boosts the market.

The market is foreseen to grow slowly in Europe due to various elements, like stalled industrial output resulting from the pandemic, emerging unemployment, and debt crisis. However, a favorable scenario throughout Eastern Europe will drive the market in terms of consumerism and production. Landfill bans have existed in many European countries like France, Germany, Denmark, and Austria for decades. High landfill tipping fees, waste management, dumping tariffs, and closing costs of landfills have promoted the European population to change to recycled products.

Blow molding is building empty plastic portions by creating and gluing them together to produce glass bottles and open containers. The parison maintains the form of the metal mold, and then it demolds and trims the constructed portion to pull out the flash or trim. Extrusion blow formation, injection blow formation and injection stretch blow blowing are three types of blow formations.

The benefits of extrusion-blowing molding are low product cost, simple process, and high efficiency. However, its significant drawback is the wall thickness and yield uniformity. Extrusion blow molding usage has a lower pressure level, reducing manufacturing costs and making the product cost-efficient. In addition, using the blow molding procedure will permit producers to reduce high labour expenses.

The medical field is projected to bolster the utilization of blow-molded plastic bottles as they are used for wrapping medicines and maintaining the property of the drugs without damage or degradation. The healthcare sector's expansion has vastly aided the development of the blow molding plastics market. Plastic packaging encourages hygienic practices and is less susceptible to detriment and drips than glass packaging. Syringes, cylinders, bottles, and medical vessels are healthcare supplies.

The rise in pharmaceutical equipment has led to an increase in the approval of blow-molded plastic bottles, contributing to the overall development of the blow-molded plastic bottle market. The experts also estimate that regulating and fulfilling regulation laws in the use of plastics have affected the general packing industry, with a rising need for more lasting solutions, pressuring producers to invest severely in biodegradable and economical packing solutions.

| Report Coverage | Details |

| Market Size in 2024 | USD 95.77 Billion |

| Market Size by 2034 | USD 157.49 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.1% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Technology, By Product and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

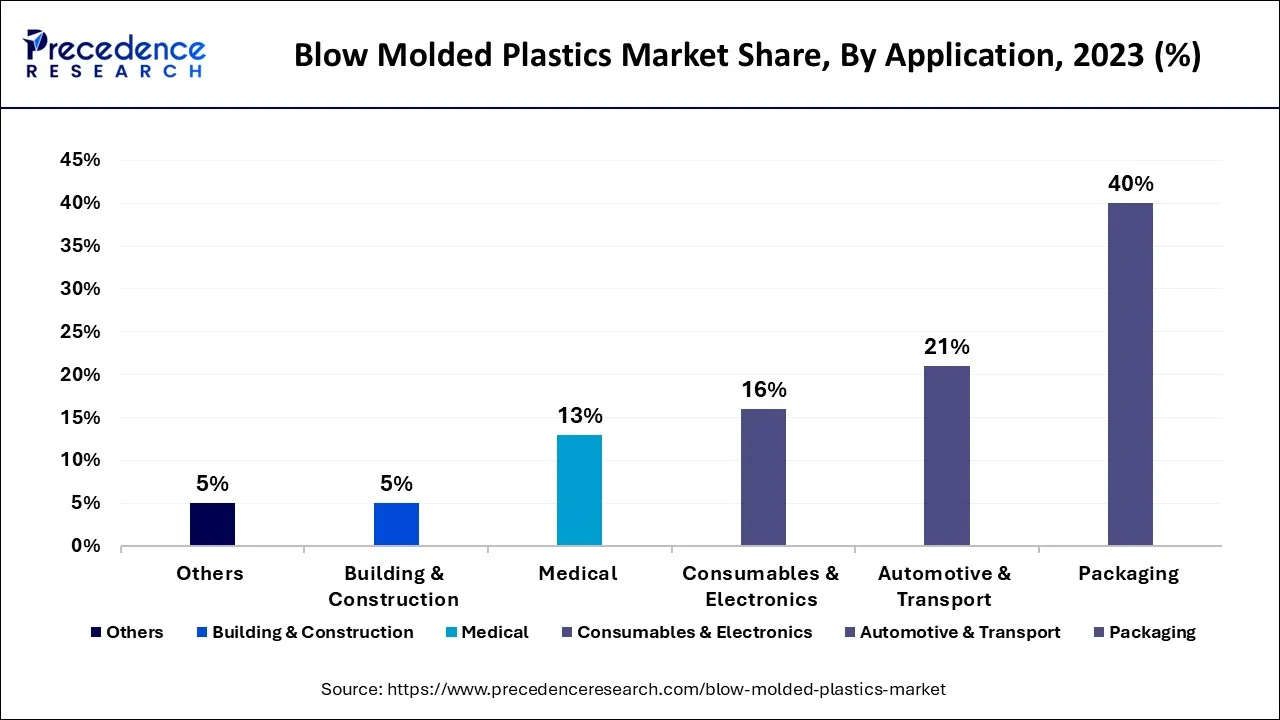

The food and beverage sector accounts for over 70% of the blow molded container market worldwide, attributed to changing customer preferences for more eco-friendly and convenient packing solutions. Molded plastics are mainly utilized in the packaging and automobile sector, and the packaging manufacturing industry is a significant user of molded plastics.

The commonly used molded plastics in packing applications comprise PE, PET and PP. These rigid or flexible products rely on the end-user requirements and are used in various packaging usages, for example, food and beverage, cosmetics, and pharmaceutical.

Different molding technologies cover blow molding, injection molding, and extrusion molding, offering various advantages like durability, food preservation, medical safety and effectiveness. Plastic packaging has found universal use due to these benefits over other materials, and products manufactured over blow molding methods replace traditional materials.

Plastic waste damages the ecological system as it takes decades to break down. Governments address this matter worldwide by imposing rigid laws that the plastics industry must adhere to. European governments have undertaken several measures to address packaging waste and recycling issues.

The growing approval of 3D printing methods in commercial uses supports the development of 3D printing plastic combined worldwide that grades perform optimistically in highly corrosive and high temperature/ pressure environments. After some value additions like carbon fibres, the composite grades of plastics offer improved performance. Usually used molded plastics comprise PC, ABS, and PA. Some popular qualities of 3D printing plastic composites cover carbon fiber-PLA and.

Significant producers of molded plastics, like SABIC, have started manufacturing 3D printing plastics with advanced integration in recent years. The advancement in the need for 3D printing plastic composites will provide growth provisions for the molded plastics market. The blow molding procedure affects quality output, so it is one of the most used in plastic production globally. With machines with 3D molding capacity, blow molding can help makers yield many units quickly.

The injection blow molding section accounted for the maximum revenue of the overall market share. The expense of extrusion blow mold is less than the injection blow as per the lower pressure needed. The machinery expenses are also less for extrusion blow mold, which is an advantage.

The stretch blow molding method makes high-quality and high-clarity bottles with application limitations. It is applied for producing soda bottles, household cleaners, and personal care containers, and they are made mainly on customized orders from consumers.

The polyethylene (PE)section accounted for the overall market share in the revenue. PE compounds are commonly used in the packaging and electrical and electronics industries. The primary packaging uses of PE compounds comprise various grades of bottles for packing a wide range of food and chemical products.

It has numerous uses in the packaging industry, such as manufacturing bottles to pack food and beverage products. The requirement for polypropylene and polyethylene terephthalate is anticipated to grow due to the rising need for protective gowns, face masks, and packaging bottles for hand sanitizers during the pandemic.

Packaging evolved as the leading application section with a maximum revenue share of the entire blow-molded plastics market. The packaging industry is chiefly impelled by high consumerism in emergent economies. Expanding the packaging sector will likely boost the need for plastic compounds like polyethylene and PET in the upcoming years. The upsurge for blow molding plastics is growing primarily in packaging applications. This is due to the increasing demand for plastic bottles for disinfectants, household cleaning liquids, hand sanitizers, and others to tackle the pandemic.

Automotive & transportation was the second-largest application section with a volume share. The rising integration of plastics in automotive elements and the simultaneous growth in the manufacture of electric passenger cars and heavy-duty automobiles, particularly in Asia and Central and South America, are predicted to propel the development of the automotive & transportation application section over the estimated period.

Segments Covered in the Report

By Technology

By Product

By Application

By Geography

For questions or customization requests, please reach out to us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

January 2025

February 2025

October 2024