November 2024

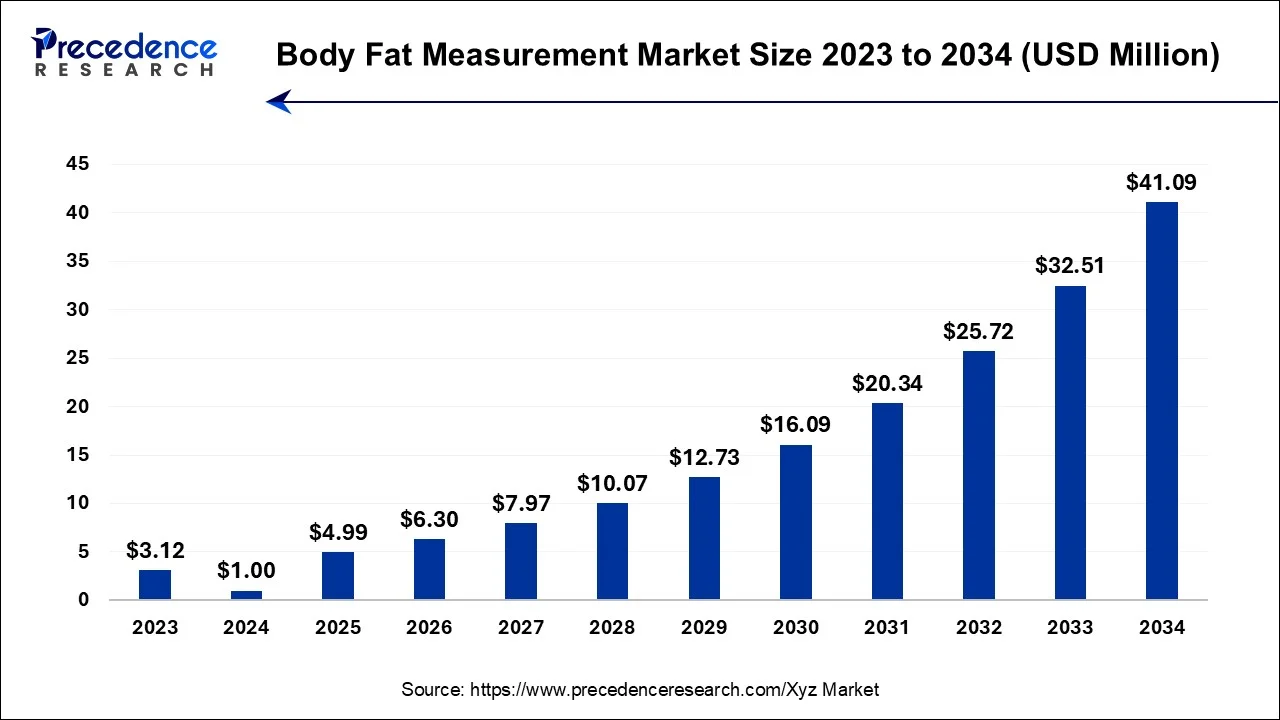

The global body fat measurement market size accounted for USD 830.15 million in 2024, grew to USD 885.77 million in 2025 and is projected to surpass around USD 1,587.81 billion by 2034, representing a healthy CAGR of 6.70% between 2024 and 2034.

The global body fat measurement market size ie estimated at USD 830.15 million in 2024 and is anticipated to reach around USD 1,587.81 billion by 2034, representing a notable CAGR of 6.70% between 2024 and 2034. The rising awareness of assessing health by discovering overall body composition to improve health, fitness, and quality of life contributes to increasing demand for the body fat measurement market.

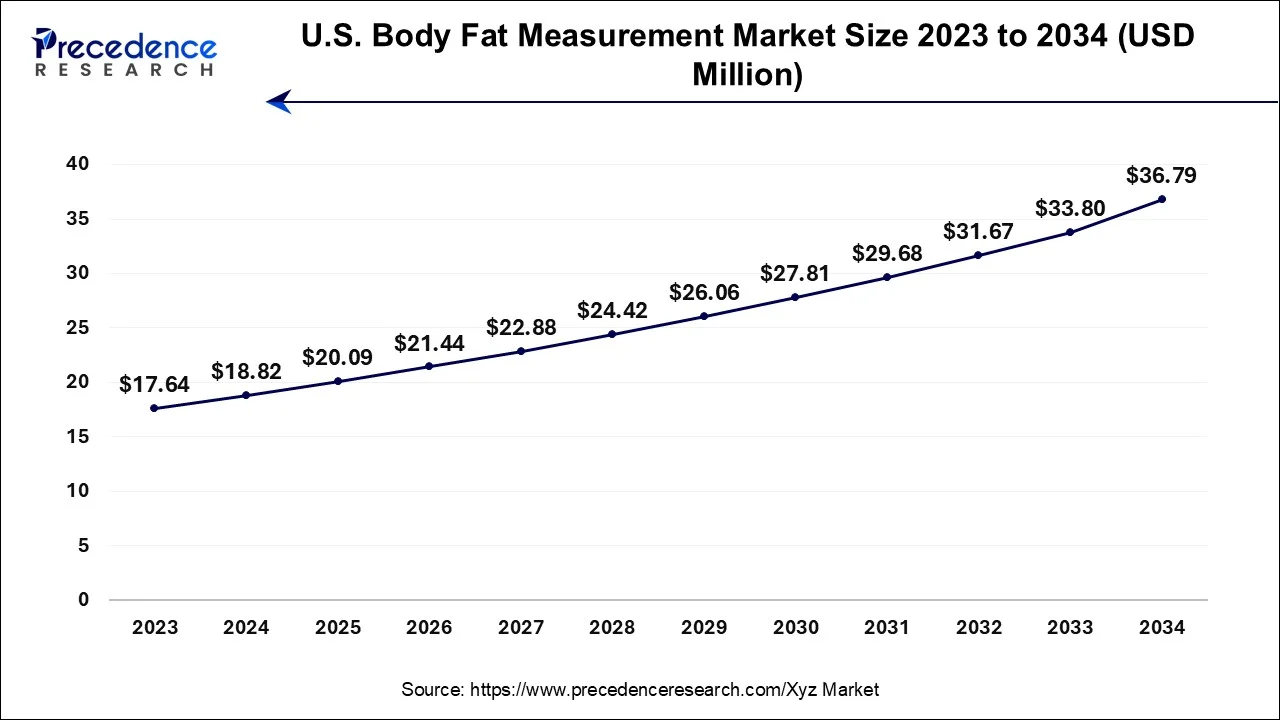

The U.S. body fat measurement market size accounted for USD 203.39 million in 2022 and is estimated to reach around USD 397.39 million by 2034, growing at a CAGR of 6.92% from 2024 to 2034.

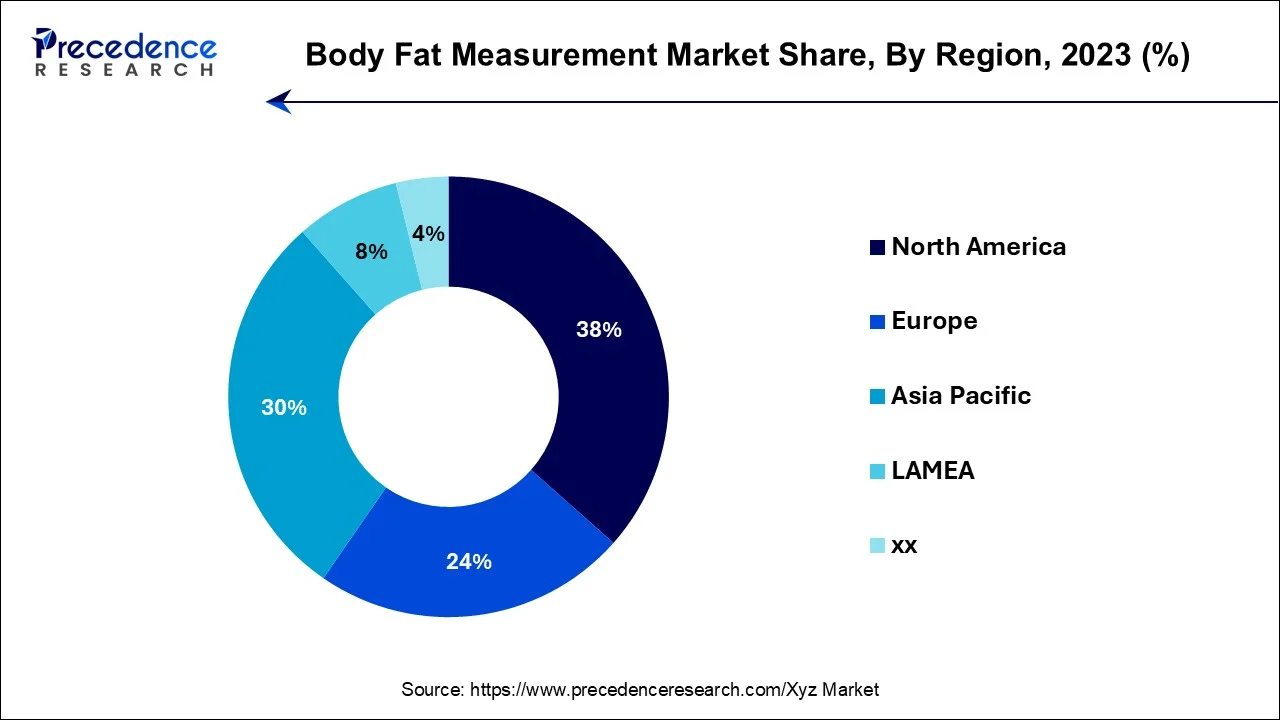

North America has held the largest revenue share of 35% in 2023. In North America, the body fat measurement market is marked by trends such as an increasing focus on preventive healthcare, driven by rising obesity rates. The demand for advanced, user-friendly body fat measurement technologies is growing, with a shift toward digital health solutions. Telehealth integration and partnerships with fitness and wellness programs are on the rise, reflecting the region's emphasis on holistic health management. Additionally, the adoption of body fat measurement capabilities in wearable fitness devices is gaining momentum, further expanding market opportunities.

Asia-Pacific is estimated to observe the fastest expansion. In the Asia-Pacific region, the body fat measurement market is witnessing notable trends. Increasing health consciousness, especially in urban areas, drives demand for accurate body fat measurement tools. Integration of advanced technologies like smart scales and mobile apps is expanding accessibility. Additionally, the region's growing fitness and wellness industry is promoting the adoption of body fat measurement for health monitoring and weight management. As a result, Asia-Pacific presents a burgeoning market for both clinical and consumer-oriented body fat measurement solutions.

The body fat measurement market encompasses the healthcare sector dedicated to assessing and quantifying an individual's body fat content. It involves various methods, including bioelectrical impedance, dual-energy X-ray absorptiometry (DEXA), skinfold thickness measurements, and more. The market serves healthcare professionals, fitness enthusiasts, and individuals aiming to monitor their body composition.

Key drivers include the rising awareness of obesity-related health risks and the desire for personalized health and fitness management. Market players develop innovative, user-friendly devices and technologies for precise and convenient body fat measurement, catering to diverse user needs and preferences.

How AI is changing the body fat measurement industry?

The incorporation of Artificial Intelligence caters is a better assessment and analysis of body composition to enhance the evaluation of obesity and other metabolic risks. The existing and developing AI methods outline the body composition, Adiposity, Skeletal density, and muscle mass. This technique qualified to be used among a wide spectrum of individuals including children, the elderly, sportsmen, and military men. Machine learning techniques under body composition offer a prediction of metabolic outcomes such as exercise capacity and albuminuria.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 6.7% |

| Market Size in 2024 | USD 778.02 Million |

| Market Size by 2034 | USD 1,587.81 Million |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type, End-user, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Health awareness, sports, and athletic performance

Health awareness plays a pivotal role in surging market demand for the body fat measurement market. As people increasingly recognize the health hazards linked to excessive body fat and obesity, there is a heightened drive to oversee and regulate body composition. This heightened awareness fuels an escalating need for precise and accessible body fat measurement tools and services, as individuals actively seek effective ways to monitor their health and take proactive measures toward a healthier way of life.

Moreover, Sports and athletic performance significantly boost the market demand for the market. Athletes and fitness enthusiasts rely on precise body fat measurements to optimize training regimens, tailor nutrition plans, and monitor physical progress. Accurate assessments help them achieve peak performance and meet specific body composition goals. This demand drives the development of advanced body fat measurement technologies and services tailored to the needs of athletes and active individuals, spurring growth in the market catering to this niche but influential segment.

Accuracy concerns and cost of equipment

Accuracy concerns present a significant restraint on the body fat measurement market demand. Inaccurate measurements can lead to distrust among users, undermining the credibility of these assessments. Individuals may hesitate to rely on body fat measurement tools and services if they question the results' precision. This skepticism can deter potential customers from adopting these solutions, impacting market demand as users prioritize accuracy and reliability when monitoring their body composition for health and fitness purposes.

Moreover, the cost of equipment presents a significant restraint on market demand in the market. High-quality body fat measurement devices can be expensive, making them less accessible for smaller healthcare facilities, fitness centers, or individuals. The substantial upfront investment required can deter potential users and limit the widespread adoption of these tools. This cost barrier impedes market growth, particularly in segments where budget constraints play a pivotal role in decision-making, hindering the broader utilization of body fat measurement technologies.

Personalized health solutions and advanced technologies

Personalized health solutions significantly boost market demand in the body fat measurement market. These solutions go beyond simple measurements, offering tailored health and fitness recommendations based on individual body fat data. As consumers increasingly seek personalized wellness approaches, the inclusion of such features adds value to body fat measurement tools and services. It empowers users to make informed decisions about their health, driving adoption and encouraging a proactive approach to managing body composition, ultimately fueling market growth.

Moreover, Advanced technologies are pivotal in driving market demand for the market. The development and commercialization of more accurate, user-friendly, and innovative body fat measurement devices, such as non-invasive and portable options, enhance accessibility and usability. These technologies cater to the evolving needs of healthcare providers and consumers alike, boosting confidence in measurements. As individuals seek convenient and precise tools for health monitoring, the integration of advanced technologies in body fat measurement devices fuels market growth by meeting these demands and promoting broader adoption.

Accuracy Concerns

Despite its growth potential, the body fat measurement market faces several challenges, including the accuracy concerns of body fat measurement methods which lead to discrepancies in results. Inaccurate measurements lose trust among users, undermining the credibility of these assessments. Privacy and data security concerns have emerged as consumers use digital devices for body fat measurement.

Protecting personal health data and ensuring compliance with data protection regulations are critical challenges for both manufacturers and users. This scepticism can deter potential customers from adopting these solutions, impacting market demand as users prioritize accuracy, reliability, and privacy when monitoring their body composition for health and fitness purposes.

Impact of COVID-19

The COVID-19 pandemic had a multifaceted impact on the body fat measurement market. Initially, there was a slowdown in demand for non-essential healthcare services, including body fat measurements, due to lockdowns and restrictions on in-person visits. This led to a temporary decline in market growth as healthcare resources were redirected to pandemic-related priorities.

However, the pandemic also accelerated certain trends that benefited the market. With a heightened focus on health and wellness, individuals became more conscious of the importance of monitoring their body composition. As a result, there was an increased interest in at-home body fat measurement devices and digital health solutions.

The integration of body fat measurement capabilities into telehealth platforms also gained traction, supporting remote monitoring and consultations. Furthermore, the fitness industry adapted to the pandemic by emphasizing home workouts, leading to a surge in demand for fitness-related technologies, including body fat measurement tools integrated into wearable devices.

According to the Product Type, the Bioimpedance Analysers (BIA) segment has held a 27% revenue share in 2023. Bioimpedance analyzers (BIAs) are non-invasive devices utilized to estimate body fat percentage by gauging the resistance encountered by electrical currents as they traverse the body's tissues. These devices have witnessed a surge in popularity owing to their user-friendly and non-intrusive characteristics, rendering them suitable for both clinical and consumer purposes within the body fat measurement market. Recent trends include the integration of BIA technology into smart scales and wearable devices, enhancing accessibility and convenience for users. Additionally, advancements in BIA algorithms aim to improve accuracy and reliability in estimating body fat composition.

The Dual-Energy X-Ray Absorptiometry (DEXA) is anticipated to expand at a significantly CAGR of 7.8% during the projected period DEXA is a high-precision medical imaging technique used in the body fat measurement market to assess body composition, including fat, lean tissue, and bone density. It offers accurate and detailed insights into fat distribution, making it valuable for clinical and research applications. DEXA remains a gold standard in body composition analysis due to its precision. Recent trends include its increasing use in sports medicine, research on obesity-related health concerns, and its integration into wellness and fitness centers, making DEXA an essential tool for diverse applications.

Based on the End-user, the hospitals and clinics segment is anticipated to hold the largest market share of 47% in 2023. Hospitals and clinics represent essential end users in the body fat measurement market. They utilize body fat measurement technologies for health assessments, disease prevention, and treatment monitoring. Recent trends include the integration of advanced measurement devices into routine check-ups, enabling more comprehensive patient evaluations. Additionally, clinics are adopting telehealth solutions with built-in body fat measurement capabilities to offer remote monitoring services, enhancing patient care accessibility and convenience. This aligns with the broader trend of digitization in healthcare.

On the other hand, the Fitness Centers and Gymnasiums segment is projected to grow at the fastest rate over the projected period. Fitness Centers and Gymnasiums in the body fat measurement market refer to establishments that offer body fat measurement services as part of their fitness and wellness programs. These facilities increasingly integrate advanced body fat measurement technologies to provide more comprehensive health assessments to their members. Trends include the use of portable and non-invasive measurement devices, real-time data tracking, and personalized fitness plans based on body composition data. This enhances member engagement, supports goal-oriented fitness regimens, and aligns with the growing emphasis on holistic health in fitness centers and gymnasiums.

Segments Covered in the Report

By Product Type

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024