November 2024

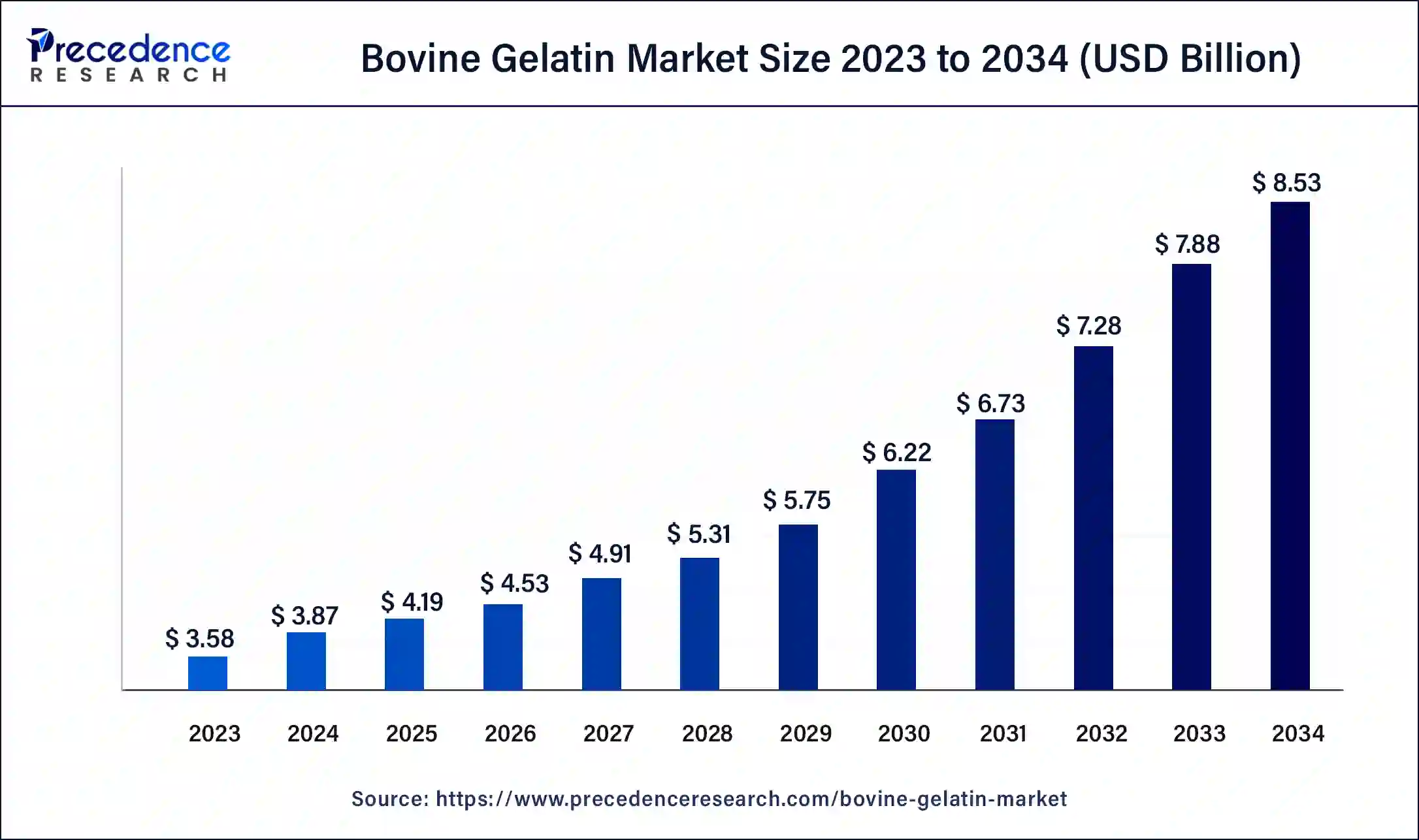

The global bovine gelatin market size was USD 3.58 billion in 2023, calculated at USD 3.87 billion in 2024 and is expected to be worth around USD 8.53 billion by 2034. The market is slated to expand at 8.23% CAGR from 2024 to 2034.

The global bovine gelatin market size is projected to be worth around USD 8.53 billion by 2034 from USD 3.87 billion in 2024, at a CAGR of 8.23% from 2024 to 2034. The bovine gelatin market is driven by the increasing demand for products that are healthy and natural. Customers prefer natural ingredients like bovine gelatin because they seek healthier substitutes for artificial chemicals. This drives the growth of the bovine gelatin market.

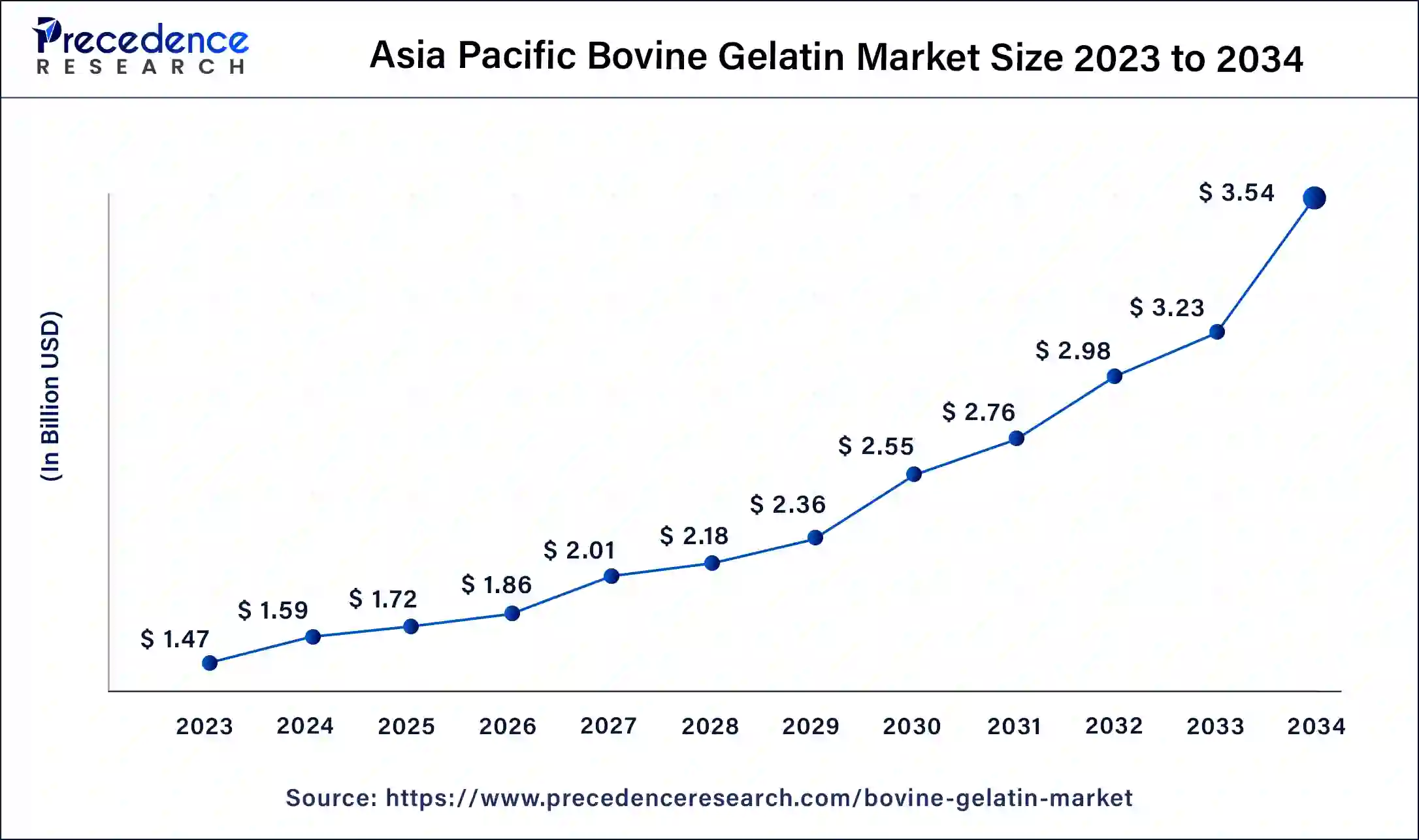

The Asia Pacific bovine gelatin market size was exhibited at USD 1.47 billion in 2023 and is projected to be worth around USD 3.54 billion by 2034, poised to grow at a CAGR of 8.31% from 2024 to 2034.

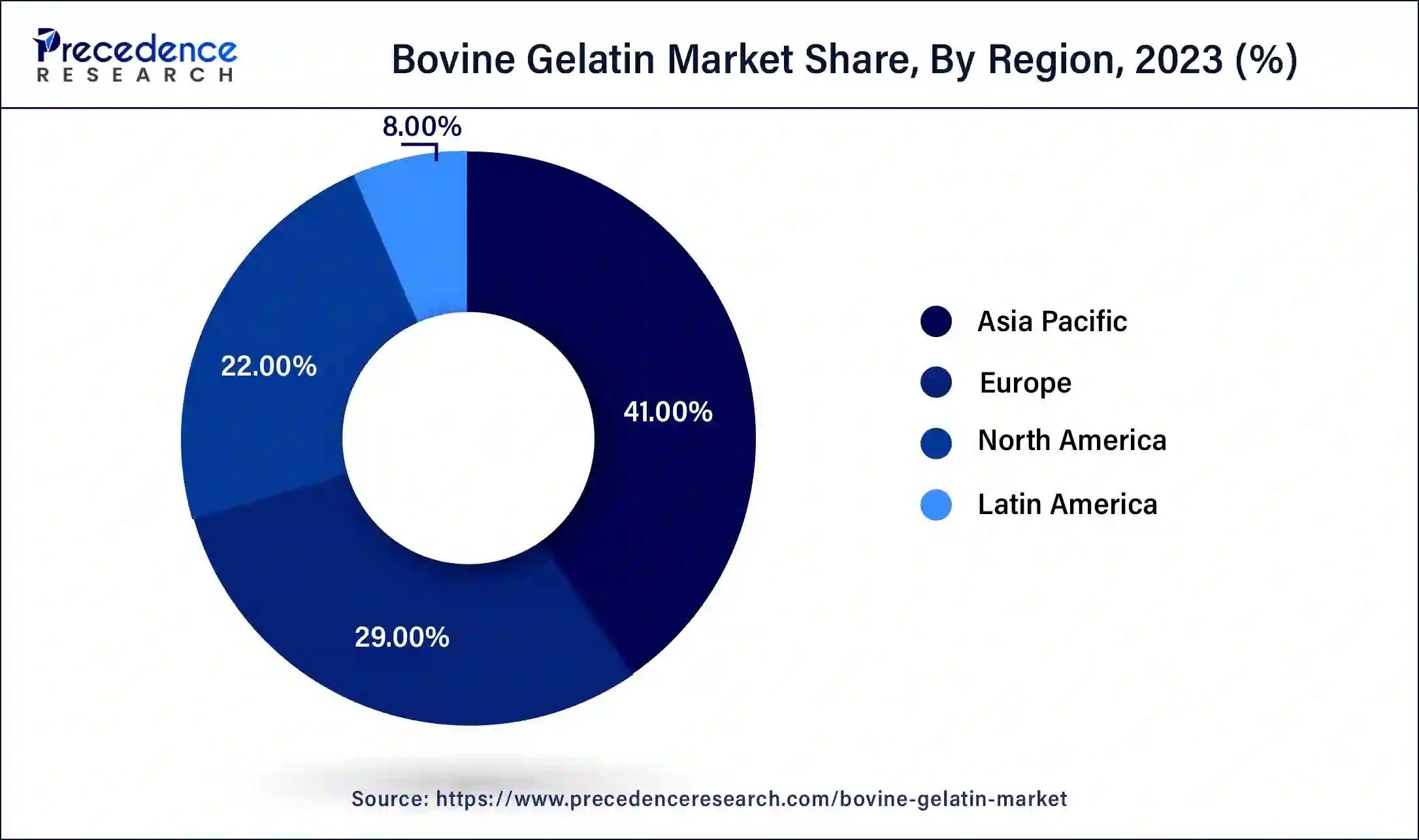

Asia Pacific held the largest share of the bovine gelatin market and is observed to sustain the position during the forecast period. Businesses are adopting green manufacturing techniques and environmentally conscious product development in response to the growing emphasis on sustainability and eco-friendly products. Moreover, customers' need for customized and personalized products affects market dynamics as they seek specialized solutions that satisfy their unique needs.

Because of its many health benefits, the Japanese food sector uses a lot of bovine gelatins. It is an essential component in sweets and confections. Japan's food producers are propelling the market's expansion by consistently experimenting and developing new goods that use gelatin for stability and texture. Japan's aging population is driving the need for health and wellness goods that address aging-related issues. The benefits of bovine gelatin for skin elasticity and joint health are making it more and more popular among older adults, driving the market's expansion.

North America is observed to witness the fastest rate of growth in the bovine gelatin market during the forecast period. Sustainability and ethical sourcing are now essential considerations for North American enterprises and consumers. To reduce waste, companies are increasingly implementing sustainable approaches in the manufacture of bovine gelatin, such as employing meat industry by-products. Traceability and animal welfare considerations are two more ethical sourcing techniques that are becoming increasingly important. The need for bovine gelatin made ethically and ecologically conscious will probably be driven by these reasons.

Europe is observed to grow at a notable rate during the forecast period. The need for bovine gelatin in biotechnology is driven in Europe by biological sciences and research technology developments. Biotechnologists and researchers use gelatin because of its adaptability and consistency in facilitating research and development procedures. The growing demand for creative and superior personal care solutions drives the bovine gelatin market in cosmetics. Cosmetic manufacturers are investigating novel ways to incorporate gelatin into their products to match consumer expectations for high-end, effective skincare treatments.

A variety of culinary products require bovine gelatin. Because of its capacity to produce gels, it helps achieve the texture and consistency of many well-known foods. The beauty and personal care markets are growing because bovine gelatin adds functional benefits like hydration and texture enhancement to cosmetics and personal care products. Concerns over the moral treatment of animals and the environmental effects of gelatin production are on the rise. As a result, there is now more interest in gelatin from non-traditional sources, like synthetic or plant-based alternatives.

| Report Coverage | Details |

| Market Size by 2034 | USD 8.53 Billion |

| Market Size in 2023 | USD 3.58 Billion |

| Market Size in 2024 | USD 3.87 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 8.23% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Form, Nature, End-use, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing demand for beauty products

Demand for bovine gelatin sourced sustainably is growing as people become more aware of the ethical and environmental effects of their purchases. In response, businesses make sure the bovine gelatin they use comes from calves that are grown in morally and environmentally responsible ways, which helps to fuel the market. A growing youth segment concerned with preventative skincare and an aging population is driving up demand for anti-aging products, which is being felt by the global beauty business. Because it effectively increases skin suppleness and minimizes wrinkles, bovine gelatin is in high demand in this profitable sector.

Increasing concerns about sustainability

Due to its high land and water requirements, cattle farming contributes to habitat degradation, deforestation, and water scarcity in some areas. The sustainability of producing bovine gelatin over the long run is an issue due to the resource-intensive nature of cattle rearing. More consumers are scrutinizing items containing bovine gelatin as they become more aware of their purchases' ethical and environmental consequences. As a result of consumers shifting their preferences toward more environmentally friendly substitutes for items using bovine gelatin, the market's overall demand may decline.

Growing investment of market players in nutritional industry

Protein supplements, joint health formulas, and cosmetic supplements are just a few of the nutritional goods made with bovine gelatin in the health and nutrition industry. Because of its high protein content and useful qualities, gelatin is the perfect element to improve the effectiveness and distribution of nutritional supplements. Supplemental capsules, powders, and gummies frequently contain gelatin, which offers a practical and efficient way to distribute nutrients.

An increasing consumer focus on health and wellness drives the need for nutritional supplements that promote immune system function, general well-being, and particular health objectives. Bovine gelatin is a vital component of many of these supplements, especially those that address joint, skin, and digestive health, because it is high in collagen and amino acids. Another emerging trend is personalized nutrition, which involves designing goods based on each individual's preferences and health requirements. Bovine gelatin can be modified to be used in various specialized goods, such as collagen supplements and amino acid profiles that are specifically targeted.

The capsule & tablets segment dominated the bovine gelatin market in 2023. In the pharmaceutical business, bovine gelatin is an essential excipient primarily used in producing soft and hard capsules and tablets. Because of its gelling, stabilizing, and thickening qualities, it's perfect for encasing medications and regulating their release. Its widespread use greatly influences demand. Compared to other gelling agents and substitutes like fish gelatin or synthetic polymers, bovine gelatin is comparatively more affordable. Manufacturers of capsules and tablets choose it because of its economical and practical advantages.

The conventional segment dominated the bovine gelatin market in 2023. The food and beverage industry uses conventional bovine gelatin widely as a thickening, stabilizing, and gelling ingredient. It is an essential component of products like dairy, confections, and sweets because its qualities create the right texture and consistency. Conventional gelatin production is less expensive than other production methods like organic or plant-based gelatin. Many manufacturers choose this option because of its cost-effectiveness, particularly in regions where prices are crucial.

The organic segment shows significant growth in the bovine gelatin market during the forecast period. Customers are growing more concerned about their health and aware of the possible dangers of artificial additives and chemical residues in food items. The rise in customer preferences toward natural and organic products drives the market for organic bovine gelatin. Organic bovine gelatin is especially appealing to health-conscious consumers because it is thought to be a cleaner, healthier substitute devoid of artificial hormones, antibiotics, and pesticides.

The food and beverages segment dominated the bovine gelatin market in 2023. Bovine gelatin is abundant in collagen, a protein widely prized for promoting skin, hair, and joint health. Bovine gelatin-enriched food and beverage items are in higher demand due to consumers' rising awareness of these advantages, especially in the market's health-conscious segments. Bovine gelatin is becoming increasingly popular in emerging countries but is still primarily used in food and beverages in developed regions. In these areas, the use of bovine gelatin is growing as disposable incomes rise and customer preferences become more processed and convenient meals.

The cosmetics & personal care segment shows significant growth in the bovine gelatin market during the forecast period. Collagen, a protein necessary for preserving skin suppleness and minimizing the effects of aging, is abundant in bovine gelatin. Products based on collagen are in great demand in the cosmetics market's anti-aging category. Due to its high collagen concentration, anti-aging lotions, serums, and masks increasingly use bovine gelatin. Bovine gelatin is an essential component of anti-aging products because of collagen's capacity to increase skin suppleness, minimize wrinkles, and enhance overall skin texture.

According to industry standards and regulatory organizations, natural and safe components are becoming more and more critical in cosmetics. Since it is a natural product, bovine gelatin is frequently easier to certify and accept in different markets. The regulatory support for incorporating ovine gelatin in a broader range of products facilitates the expansion of the market.

Role of Bovine Gelatin in Food Products

| Function | Product | Key Applications |

| Stabilizer | Jams | To avoid big ice crystals from forming, which enhances the ice cream's texture and lengthens its shelf life. |

| Viscosity Modifier | Ice cream | It gives ice cream a smooth texture and a youthful appearance when made. |

| Thickener | Yogurt | To keep the yogurt's creamy quality throughout its shelf life and to stop it from separating. |

| Binder | Capsules | It can be used as a binding solution during the wet granulation process to create tablets, or it can be used as a dry binder to compress tablets directly. |

| Texturizing Agent | Candies | To impede the growth of microbes. |

The B2C segment dominated the bovine gelatin market in 2023. Consumer understanding of the advantages of health supplements has significantly increased, particularly those that support digestive, skin, and joint health. Due to its high collagen concentration, cow's gelatin has gained popularity among people looking for safe, all-natural health supplements. Because of its ability to create films and retain moisture, bovine gelatin is utilized in various topical beauty products and is not edible. Its dual use in topical and edible products has bolstered this market's growth.

The B2B segment shows significant growth in the bovine gelatin market during the forecast period. In many different food products, including candies, dairy products, sweets, and meat products, bovine gelatin is utilized as a thickening, stabilizing, and gelling agent. The B2B market for bovine gelatin has dramatically increased due to the increasing need for these items, driven by changing consumer tastes. Better-quality bovine gelatin products are being developed due to advancements in production methods. These high-end goods, which provide superior functionality and consistency, are in greater demand from B2B clients.

Segments Covered in the Report

By Form

By Nature

By End-use

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

November 2024

February 2025