January 2025

The Brazil industrial absorbent market size is calculated at USD 164.52 billion in 2025 and is forecasted to reach around USD 279.47 billion by 2034, accelerating at a CAGR of 6.10% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The Brazil industrial absorbent market size was estimated at USD 156.14 billion in 2024 and is predicted to increase from USD 164.52 billion in 2025 to approximately USD 279.47 billion by 2034, expanding at a CAGR of 6.10% from 2025 to 2034. Brazil's industrial absorbent market is driven by the increased consciousness regarding environmental laws and the necessity of efficient spill control measures.

Brazil's industrial absorbent market is the industry that produces, distributes, and uses materials intended to absorb liquids, especially in industrial settings. In various sectors, including manufacturing, oil and gas, automotive, and chemical processing, these absorbents are essential for handling spills, leaks, and other fluid-related problems. A setting that is safe to work in requires absorbents. By rapidly absorbing spilled liquids, they help to avoid slips, trips, and falls, which lowers the risk of accidents and injuries in industrial facilities.

In industrial environments, spills and leaks are unavoidable, but the costs associated with cleanup, repair, and possible fines from the authorities can be high. By reducing the extent and impact of accidents, investing in high-quality absorbents helps offset these costs and ultimately results in long-term.

| Report Coverage | Details |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.10% |

| Brazil Industrial Absorbent Market Size in 2024 | USD 156.14 Billion |

| Brazil Industrial Absorbent Market Size in 2025 | USD 164.52 Billion |

| Brazil Industrial Absorbent Market Size by 2034 | USD 279.47 Billion |

| Brazil Industrial Absorbent Market Volume in 2024 | 227.91 Kilotons |

| Brazil Industrial Absorbent Market Volume in 2025 | 236.18 Kilotons |

| Brazil Industrial Absorbent Market Volume by 2034 | 331.68 Kilotons |

| Quantitative Units | Revenue in USD Million/Billions, Volume in Tons, CAGR from 2024 to 2033 |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Material Type, Product Type, and End-user |

Growing awareness about environmental conservation

Brazil, known for its abundant natural riches and incredible biodiversity, is experiencing growing strain from industrialization on its fragile ecosystems. Consequently, there is a greater need for sustainable practices in industrial sectors due to increased government restrictions and social expectations. The detrimental impacts of industrial accidents and leaks on the environment are becoming more widely recognized. Contamination incidents involving chemicals, oil, or other dangerous materials have highlighted the need for efficient containment and cleanup techniques. Such accidents have far-reaching effects on human health and the economy, posing immediate hazards to nearby ecosystems and species.

Apart from adhering to regulations, stakeholders and customers are examining businesses' environmental performance more closely, which affects investment and purchase decisions. In Brazil's competitive industrial landscape, organizations prioritizing ecological conservation and responsible resource management are better positioned to garner support and investment.

Lack of awareness about the importance of using industrial absorbents

Industry stakeholders do not fully understand the importance of industrial absorbents. Many businesses, especially those in the petrochemical, automotive, and manufacturing sectors, might not be completely aware of the dangers that could arise from spills, leaks, or other dangerous situations inside their buildings. As a result, the significance of using efficient absorbents to reduce these dangers is still disregarded or undervalued.

Ingrained traditions and cultural considerations within sectors may also hamper the use of industrial absorbents. Conventional perspectives on environmental stewardship and risk management may prioritize immediate financial savings over long-term sustainability and safety precautions. This kind of thinking can stifle attempts to encourage the use of absorbent solutions and breed aversion to change, even in cases where the advantages are amply apparent.

Innovations in absorbent materials technology

Technological advancements in absorbent materials offer substantial potential for Brazil's industrial absorbent industry. The market includes several sectors, including manufacturing, oil & gas, chemicals, healthcare, and automobiles. These industries frequently deal with spills, leaks, and other liquid waste types that need effective and efficient absorption solutions to reduce environmental risks, guarantee worker safety, and adhere to legal requirements.

The high surface area-to-volume ratio and increased porosity of nanomaterials, such as nanoparticles and nanofibers, improve absorbent materials' absorption capacity and efficiency. These materials are useful for various industrial applications because they can efficiently absorb different liquids, such as oils, chemicals, and solvents. Crosslinked polymers, known as superabsorbent polymers (SAPs), can absorb and hold significant amounts of liquid about their mass. New developments in SAP technology have produced superabsorbent polymers with improved swelling capabilities, absorption kinetics, and leaching resistance. These materials are used in many industries, such as environmental remediation, hygiene goods, and agriculture.

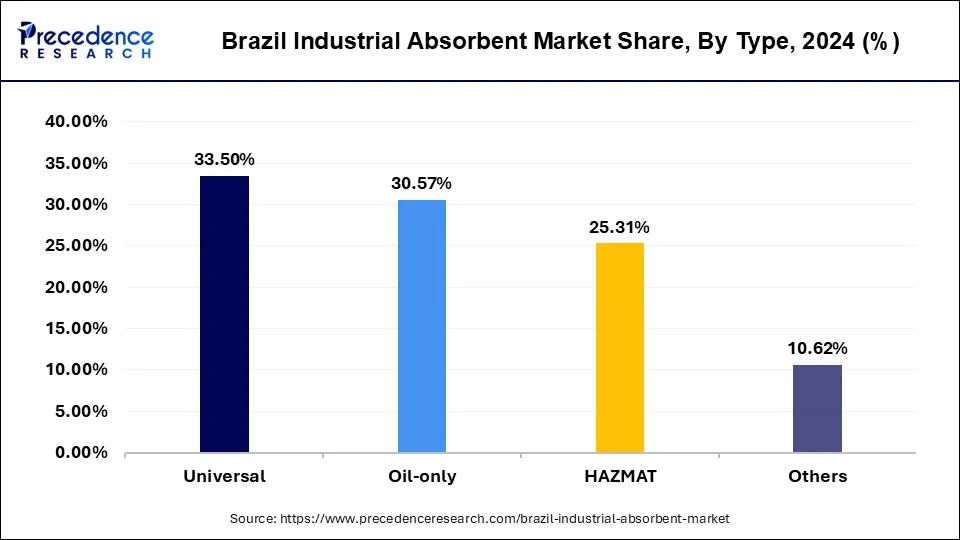

The universal segment dominated with a 33.50% share in the Brazil industrial absorbent market in 2024. All liquids, including oils, water-based fluids, chemicals, and solvents, can be absorbed by universal absorbents. They can be used in various industrial applications with multiple spills due to their adaptability. Other sectors will likely follow suit as more universal absorbents are implemented and positive experiences are shared. Prompt referrals and case studies showcasing the advantages of universal absorbents have the power to sway purchasing decisions in a variety of industries.

The oil-only segment was the second largest with a 30.57% share in the Brazil industrial absorbent market in 2024. Manufacturing, mining, and oil and gas are just a few industries that makeup Brazil's industrial landscape. Effective management solutions are required since there is an inherent danger of oil spills and leaks associated with such a diverse range of sectors. This need is met by the oil-only category, which offers absorbents that repel water while specifically targeting hydrocarbons like fuel and oil. Because of this specialty, companies must handle oil-based compounds. Efficiency and cost-effectiveness are vital factors for enterprises regarding industrial absorbents. Offering absorbent solutions with high absorption capacities, quick absorption rates, and low waste helps the oil-only company stand out.

Brazil Industrial Absorbent Market Revenue, By Type 2022-2024 (USD Billion)

| Type | 2022 | 2023 | 2024 |

| Universal | 47.76 | 49.90 | 52.31 |

| Oil-only | 43.32 | 45.40 | 47.74 |

| HAZMAT | 35.71 | 37.51 | 39.51 |

| Others | 15.19 | 15.84 | 16.58 |

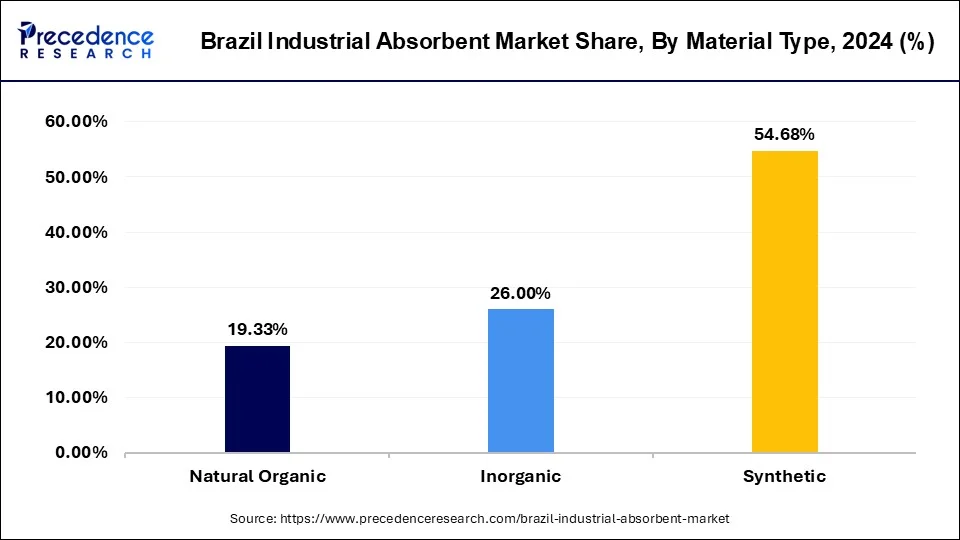

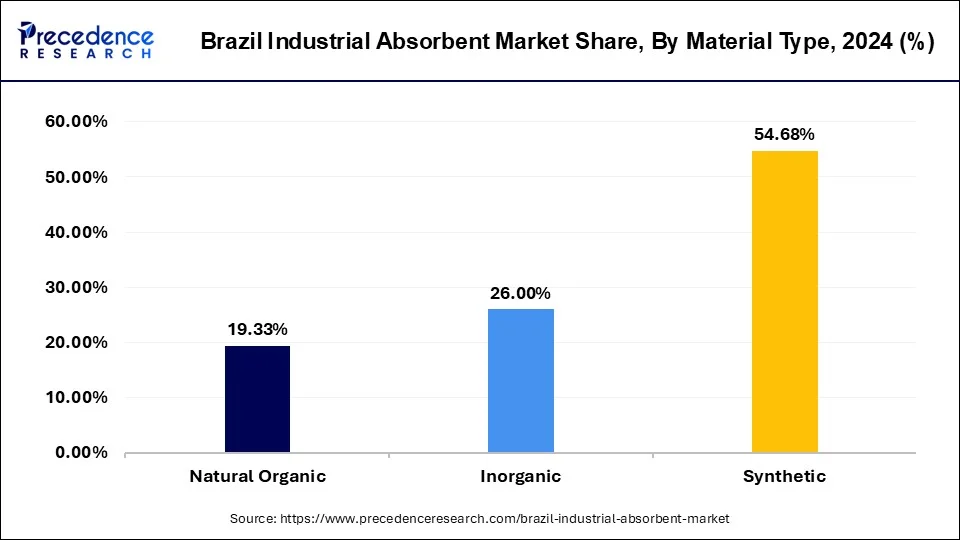

The synthetic segment dominated with market share of 54.68% share in the Brazil industrial absorbent market in 2024. Even when subjected to severe chemicals or extreme environmental conditions, synthetic absorbents have intrinsic durability and resistance to degradation. This longevity guarantees steady performance over time, preserving their efficacy in spill containment throughout their lives. Certain synthetic materials can be reused after being thoroughly cleaned and decontaminated to increase their affordability and sustainability further.

The inorganic segment held the second largest share of 26% in the Brazil industrial absorbent market in 2024. In comparison to organic options, inorganic absorbents frequently provide a more affordable solution for spill treatment. Because of its effective absorption capabilities, spills may be cleaned up with less product, lowering companies' cleanup expenses. Because of their affordability, they are the go-to option for businesses looking to improve their spill management procedures without sacrificing effectiveness. Because inorganic absorbents usually have a longer shelf life than their organic equivalents, firms can store them in anticipation of future usage without worrying about spoiling or degradation. This feature makes them more appealing to businesses operating in distant areas with potentially limited supply access or sporadic spill management requirements.

Brazil Industrial Absorbent Market Revenue, By Material Type 2022-2024 (USD Billion)

| Material Type | 2022 | 2023 | 2024 |

| Natural Organic | 27.41 | 28.72 | 30.18 |

| Inorganic | 37.13 | 38.76 | 40.59 |

| Synthetic | 77.43 | 81.17 | 85.37 |

The rolls segment dominated with 39.09% market share in the Brazil industrial absorbent market in 2024. Due to their simple form, rolls can be quickly deployed in case of an emergency spill. Their roll-out shape makes handling easier and enables personnel to contain and mop up spills with little effort rapidly. This usability is vital in high-pressure industrial settings, where quick thinking is necessary to avert mishaps and guarantee worker safety.

The pads segment is the fastest growing in the Brazil industrial absorbent market during the forecast period. Considering their extreme adaptability, pads are utilized in various industries, including chemical processing, manufacturing, automotive, and oil & gas. Their capacity to adapt to different liquids, including water, chemicals, and oil, makes them essential in various applications. Furthermore, pads are recommended for businesses looking for hassle-free spill and leak management solutions because they are simple to use and require little training.

Brazil Industrial Absorbent Market Revenue, By Product Type, 2022-2024 (USD Billion)

| Product Type | 2022 | 2023 | 2024 |

| Pads | 46.84 | 49.07 | 51.57 |

| Rolls | 55.26 | 57.98 | 61.03 |

| Pillows | 27.31 | 28.57 | 29.98 |

| Granules | 12.56 | 13.03 | 13.55 |

The oil and gas segment dominated with a 32.15% market share in the Brazil industrial absorbent market in 2024. Brazil has a vast oil and gas sector, with various drilling sites, refineries, and transportation networks dispersed throughout the nation. Industrial absorbents must always be on hand for quick reaction and mitigation because of the high danger of spills and leaks associated with these processes. Oil and gas businesses in Brazil are investing in employee training programs and awareness campaigns to promote appropriate waste management practices, as there is an increasing awareness of the environmental impact of industrial activities. This involves utilizing industrial absorbents during spill response processes appropriately, increasing demand for these goods.

The chemicals segment held the second largest share in the Brazil industrial absorbent market in 2023. Chemical spills pose significant risks to the environment, infrastructure, and people's safety. Effective spill response and containment are essential to reducing hazards and guaranteeing workplace safety. To properly handle potential spills, industrial establishments throughout Brazil are investing more and more in thorough spill response plans and outfitting their facilities with the proper absorbents. The chemicals category offers absorbents to properly treat various chemical spills, meeting the unique needs of companies working with hazardous chemicals.

Brazil Industrial Absorbent Market Revenue, By End-user, 2022-2024 (USD Billion)

| End-User | 2022 | 2023 | 2024 |

| Chemical | 40.45 | 42.38 | 44.55 |

| Oil and Gas | 45.43 | 47.68 | 50.19 |

| Food Processing | 29.44 | 30.79 | 32.30 |

| Others | 26.65 | 27.81 | 29.10 |

The need for industrial absorbents has surged due to Brazil's expanding manufacturing, automotive, petrochemical, and mining sectors. Absorbents are necessary in these industries to control oil, chemical, and other hazardous material spills and leaks and maintain worker safety and environmental compliance. More people are choosing environmentally friendly absorbents produced from renewable resources as ecological sustainability becomes a concern. In line with sustainable practices, Brazilian businesses are funding R&D to create absorbents made of natural fibers, recyclable materials, and biodegradable polymers.

By Type

By Material Type

By Product Type

By End-user

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

September 2024

October 2024