January 2025

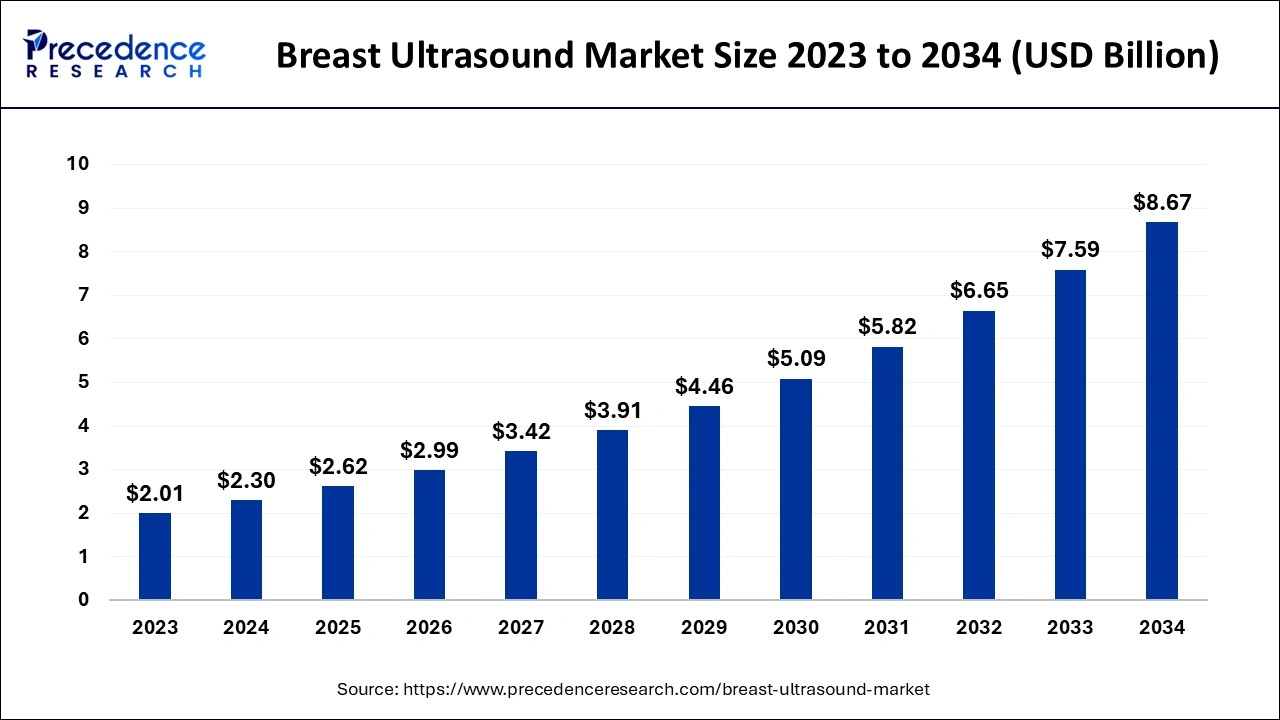

The global breast ultrasound market size accounted for USD 2.30 billion in 2024, grew to USD 2.62 billion in 2025 and is expected to be worth around USD 8.67 billion by 2034, registering a healthy CAGR of 14.21% between 2024 and 2034. The North America breast ultrasound market size is evaluated at USD 0.83 billion in 2024 and is expected to grow at a CAGR of 14.24% during the forecast year.

The global breast ultrasound market size is calculated at USD 2.30 billion in 2024 and is projected to surpass around USD 8.67 billion by 2034, expanding at a CAGR of 14.21% from 2024 to 2034. The rising prevalence of breast cancer is the key factor driving market growth. The increase in demand for breast ultrasound, along with technological advancements, can fuel market growth further.

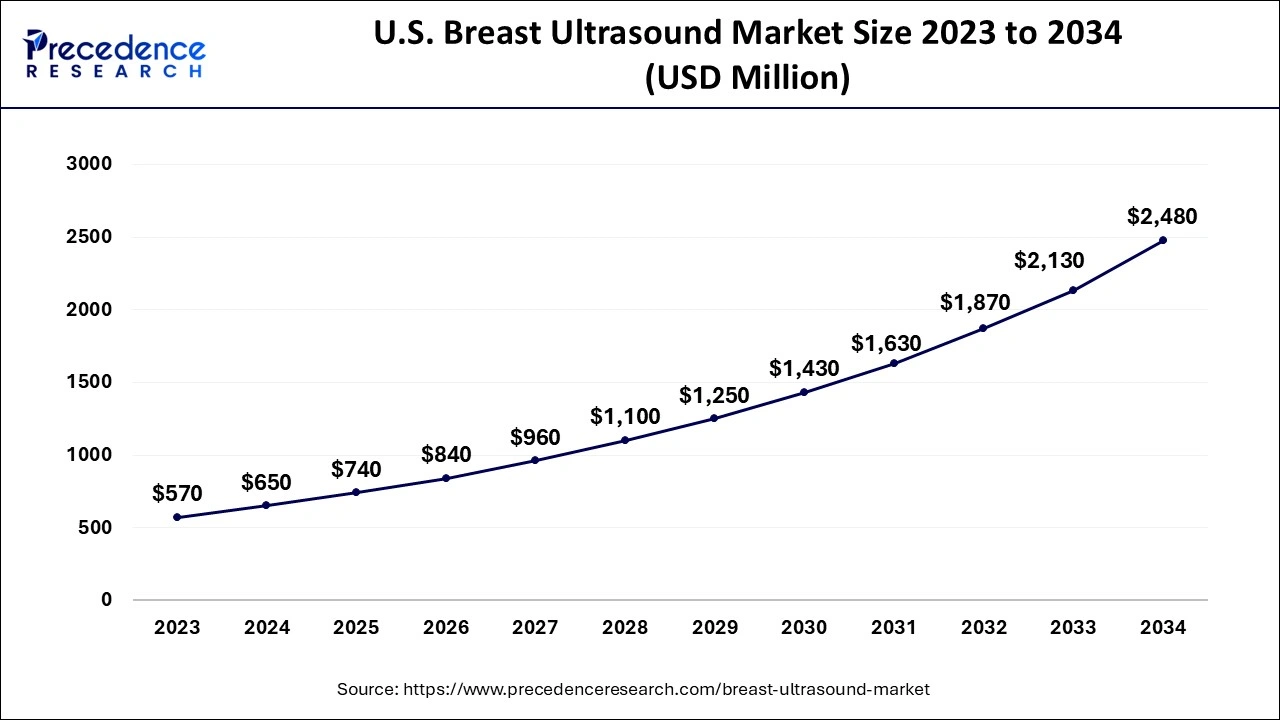

The U.S. breast ultrasound market size is exhibited at USD 650 million in 2024 and is predicted to reach around USD 2,480 million by 2034, growing at a CAGR of 14.30% from 2024 to 2034.

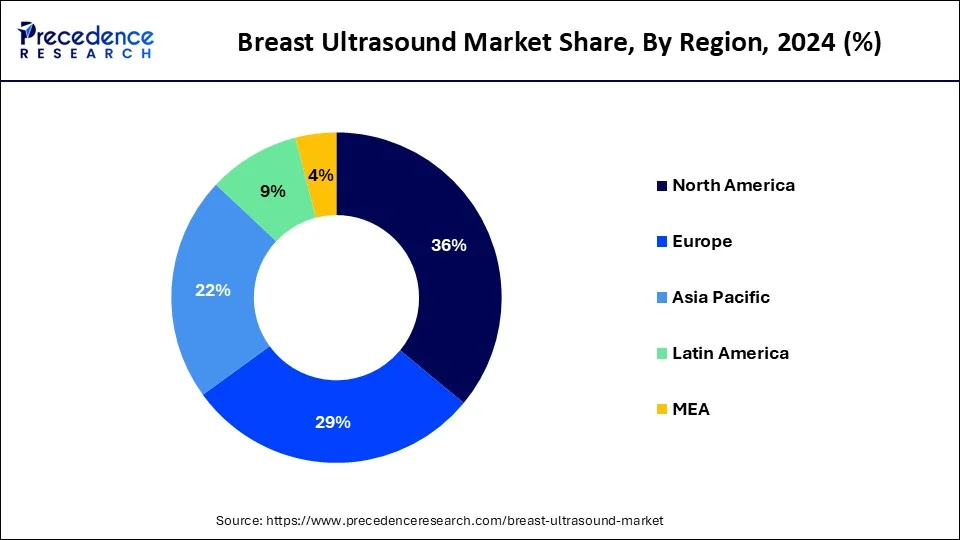

North America dominated the breast ultrasound market in 2023. The dominance of the segment can be attributed to the strong presence of developed infrastructure in the healthcare industry, along with the increasing cases of breast cancer in the region. Furthermore, the presence of major market players, along with significant investments in R&D, will propel the market growth soon. Also, favorable reimbursement initiatives aimed at optimizing the early identification of breast cancer have facilitated the widespread acceptance of the breast ultrasound market in the region.

Asia Pacific is expected to grow at the fastest rate over the forecast period. The growth of the region can be driven by increasing awareness about breast cancer and its treatment in the region. However, nations like China, Japan, and South Korea are adopting the ABUS more rapidly. These countries have an increasing number of breast cancer cases due to a substantial population rise driving the breast ultrasound market growth in the region.

Breast ultrasound is a non-invasive diagnostic technique that utilizes high-frequency sound waves to create images of the breast tissue. The market includes products like probes, ultrasound systems, and other accessories. Government initiatives coupled with the help of some NGOs to increase awareness about breast health are also an important element of women's healthcare. As the need for early detection increases, the breast ultrasound market can play a crucial role in enhancing breast cancer outcomes.

Breast Cancer Number Statistics (2022)

The following table shows the total global breast cancer incidence in 2022 for women.

| Rank (women) | Country | Number |

| 1 | China | 357,161 |

| 2 | United States of America | 274,375 |

| 3 | India | 192,020 |

| 4 | Brazil | 94,728 |

| 5 | Japan | 91,916 |

| 6 | Russian Federation | 78,839 |

| 7 | Germany | 74,016 |

| 8 | Indonesia | 66,271 |

| 9 | France (metropolitan) | 65,659 |

| 10 | United Kingdom | 58,756 |

| World | 2,296,840 |

Role of Artificial Intelligence in Breast Ultrasound

Artificial Intelligence (AI) is gaining popularity in the detection of various images. Hence, it has been widely used in the ultrasound of the breast to do a quantitative assessment, which helps maintain the diagnosis's precision. Furthermore, AI in ultrasound can distinguish between benign and malignant tumors in the breast. Upgrading and standardizing workflow, identifying issues, and reducing monotonous tasks can transform the breast ultrasound market.

| Report Coverage | Details |

| Market Size by 2034 | USD 8.67 Billion |

| Market Size in 2024 | USD 2.30 Billion |

| Market Size in 2025 | USD 2.62 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 14.21% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Integration of telemedicine

The integration of breast ultrasound systems with telemedicine platforms, especially for remote consultations, is an emerging breast ultrasound market trend. By conducting remote consultations between healthcare professionals and patients, BUS can optimize expert interpretations and timely screenings. Additionally, this approach provides the ability for more sophisticated utilization of healthcare resources and decreased patient wait times.

Economic challenges faced by breast imaging centers

Sometimes, breast imaging centers confront major economic challenges in the form of reduced reimbursement, rising patient demand, and stringent federal regulations. However, the density of the breast can be a significant diagnostic challenge, decreasing the sensitivity of ultrasound techniques. Dense breast tissue can make it challenging to interpret mammograms, leading to missed cancer diagnoses.

Increasing preference for non-ionizing diagnostic techniques

An emerging trend in the global breast ultrasound market is the rising preference for non-ionizing imaging techniques because of increasing health concerns related to radiation exposure. Hence, non-ionizing diagnostic techniques are becoming favorable as they offer a safer alternative to conventional mammography for breast cancer screening, especially among young generations. Furthermore, this inclination towards free diagnostic techniques is anticipated to fuel the growth of the market.

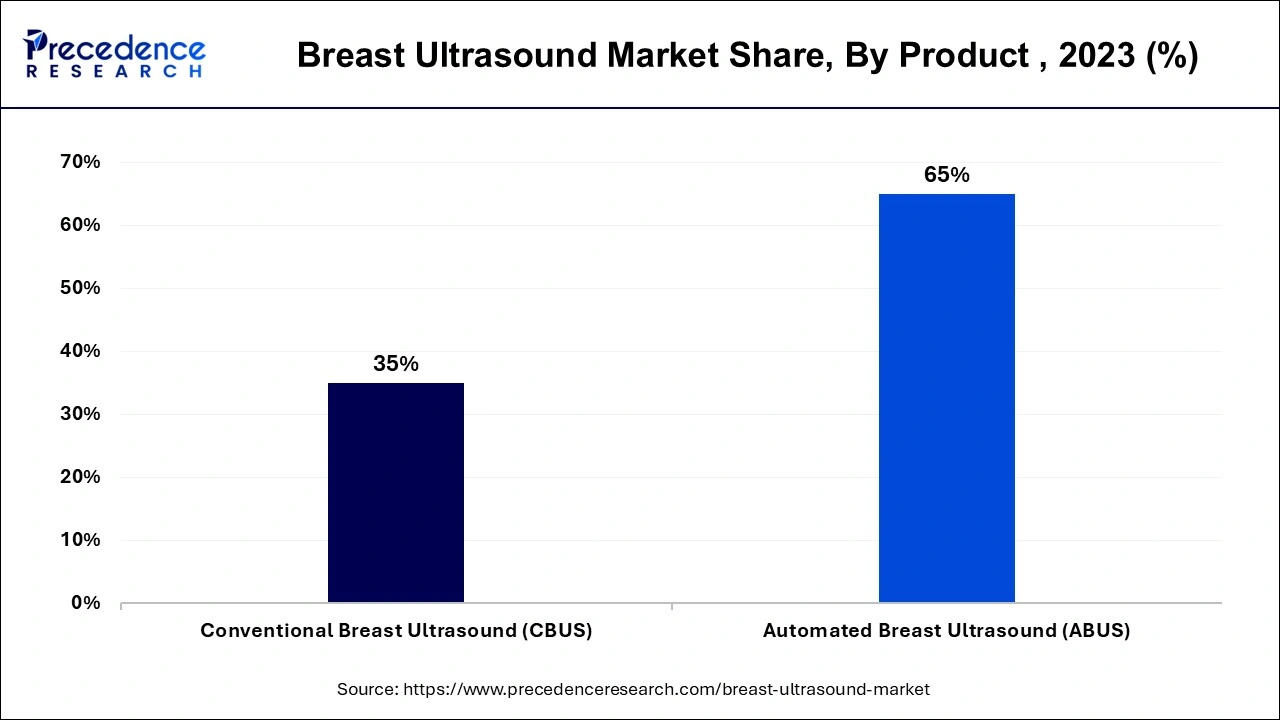

The automated breast ultrasound (ABUS) segment led the breast ultrasound market in 2023. The dominance of the segment can be attributed to the ongoing technological advancements, user-friendly features offered by this device, and regulatory approvals. Additionally, ABUS provides high-resolution and detailed breast evaluations necessary for the early detection of anomalies. Healthcare settings are also adopting automated whole-breast ultrasound systems due to their efficient features and performance.

The conventional breast ultrasound (CBUS) segment is anticipated to grow at the fastest rate in the breast ultrasound market during the forecast period. The growth of the segment can be linked to the increasing adoption of CBUS from various organizations as it detects breast abnormalities more effectively. However, many diagnostic centers and hospitals still use conventional breast ultrasound because of numerous other reasons. Which can impact positively the segment growth in the market.

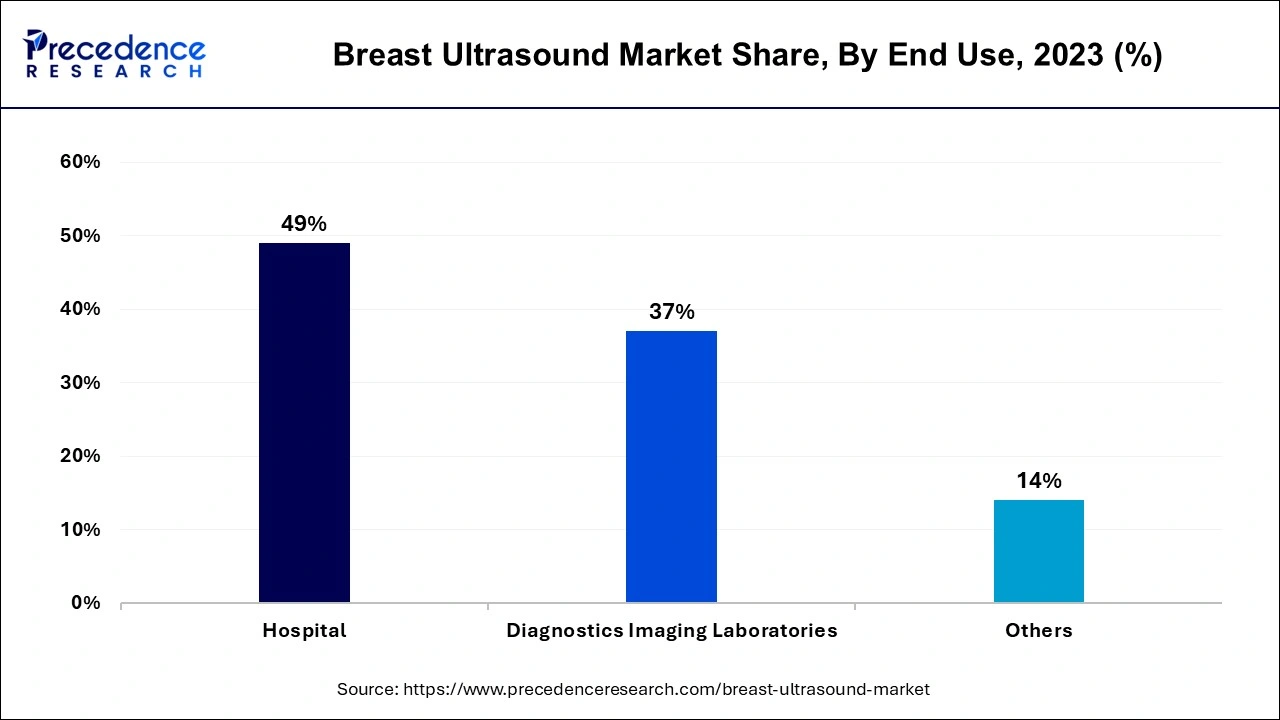

In 2023, the hospitals segment dominated the breast ultrasound market by holding the largest market share. The dominance of the segment can be credited to the increasing adoption of advanced diagnostic tools by hospitals, like automated whole-breast ultrasound systems, to improve the precision of breast health diagnoses. The integration of this innovative system within hospitals is important for the management and early detection of breast conditions, which makes them essential in healthcare scenarios.

The diagnostics imaging laboratories segment is anticipated to grow at the fastest rate in the breast ultrasound market over the projected period. The growth of the segment is linked to the rising number of diagnostic centers across the globe, the high incidence of breast cancer disease, and the increasing need for imaging techniques. In addition, diagnostic imaging centers offer specialized diagnostic services coupled with innovative imaging technologies, resolving the demand for standardized diagnostic services beyond conventional hospital environments.

Segments Covered in the Report

By Product

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

December 2024

November 2024