December 2024

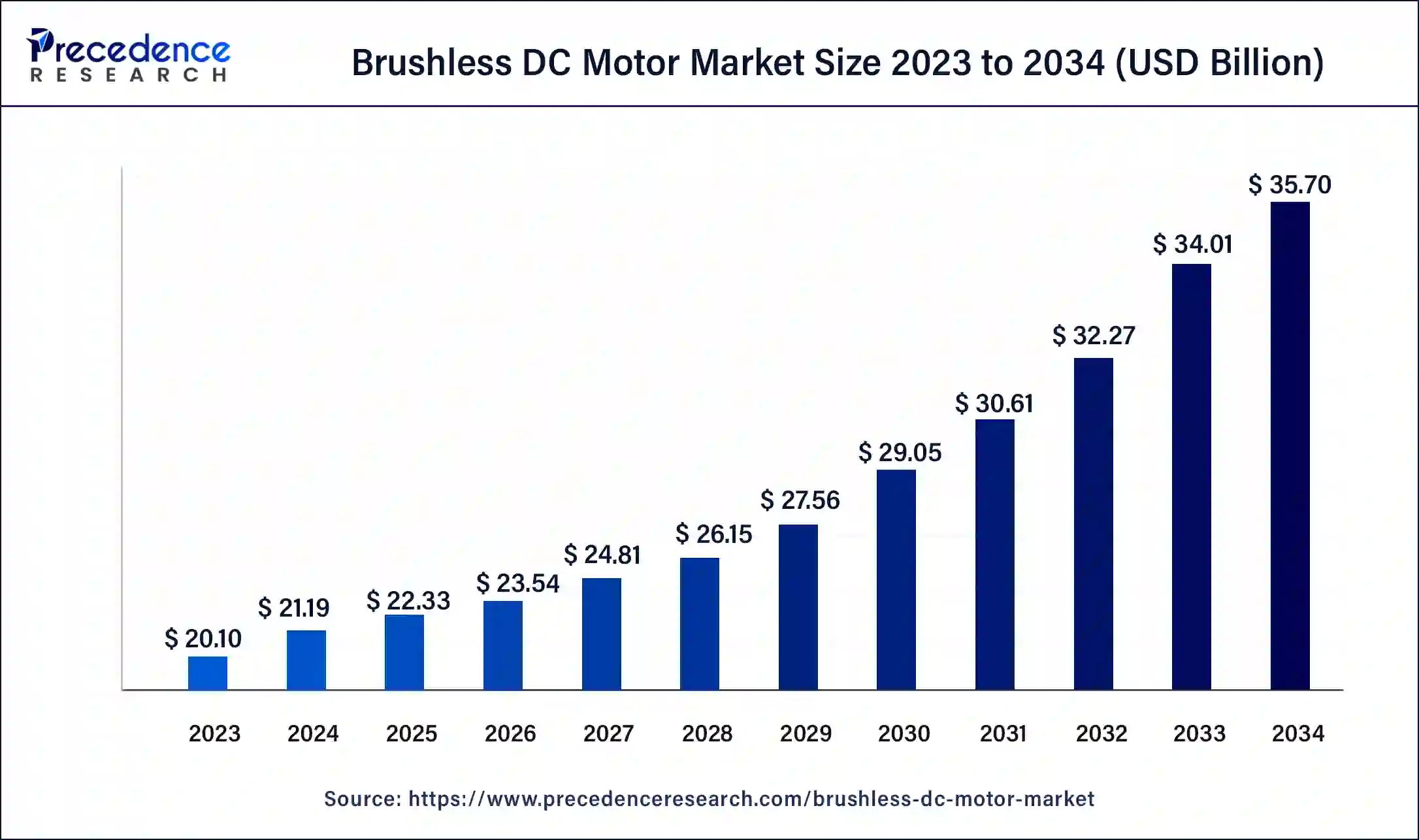

The global brushless DC motor market size was estimated at USD 21.19 billion in 2024, and is projected to hit around USD 22.33 billion by 2025, and is expected to reach around USD 35.70 billion by 2034, expanding at a CAGR of 5.40% from 2025 to 2034. The rising automobile production across the globe is observed to fuel the demand for brushless DC motors during the projected timeframe.

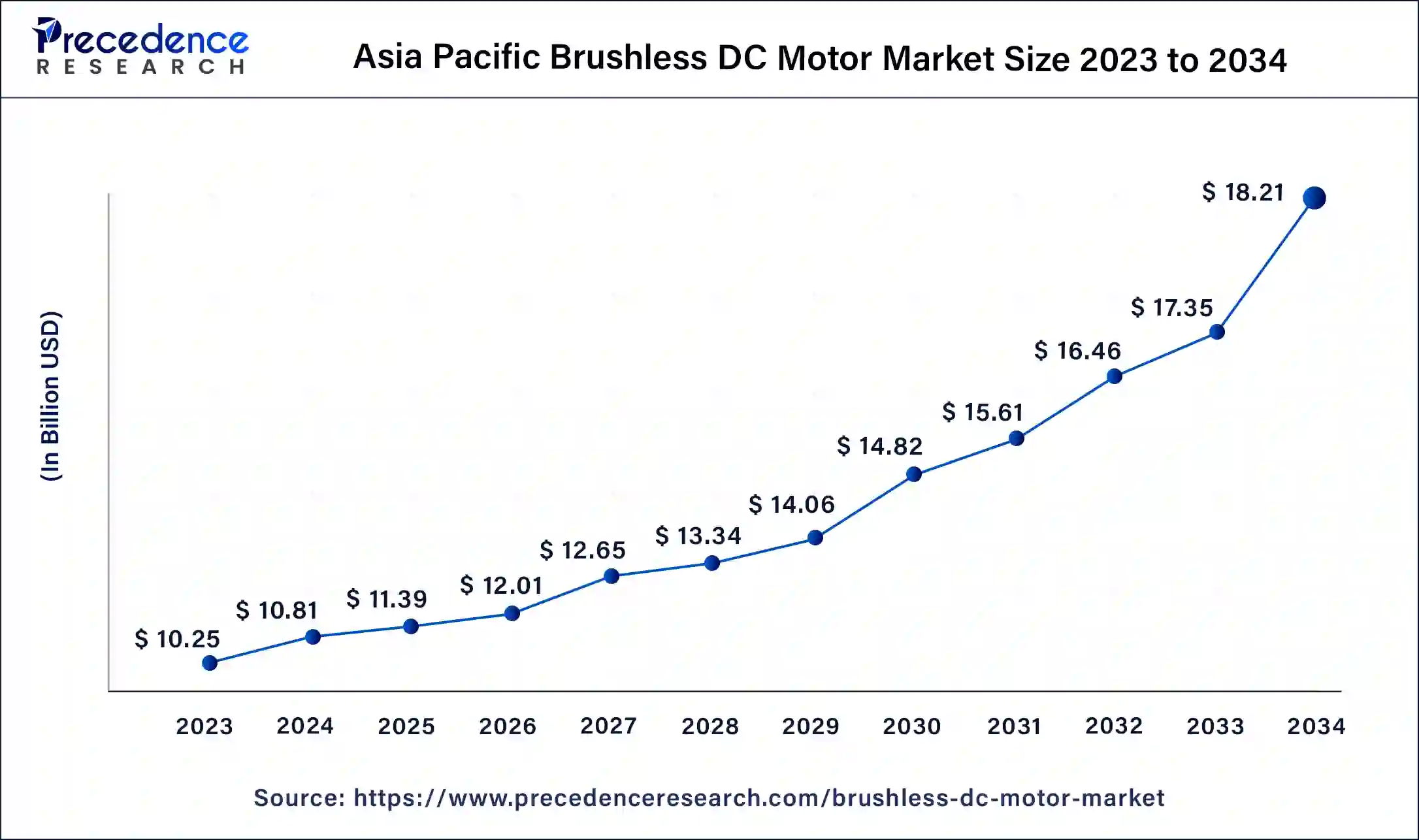

The Asia Pacific brushless DC motor market size is estimated at USD 11.39 billion in 2025 and is predicted to be worth around USD 18.21 billion by 2034, at a CAGR of 6% from 2025 to 2034.

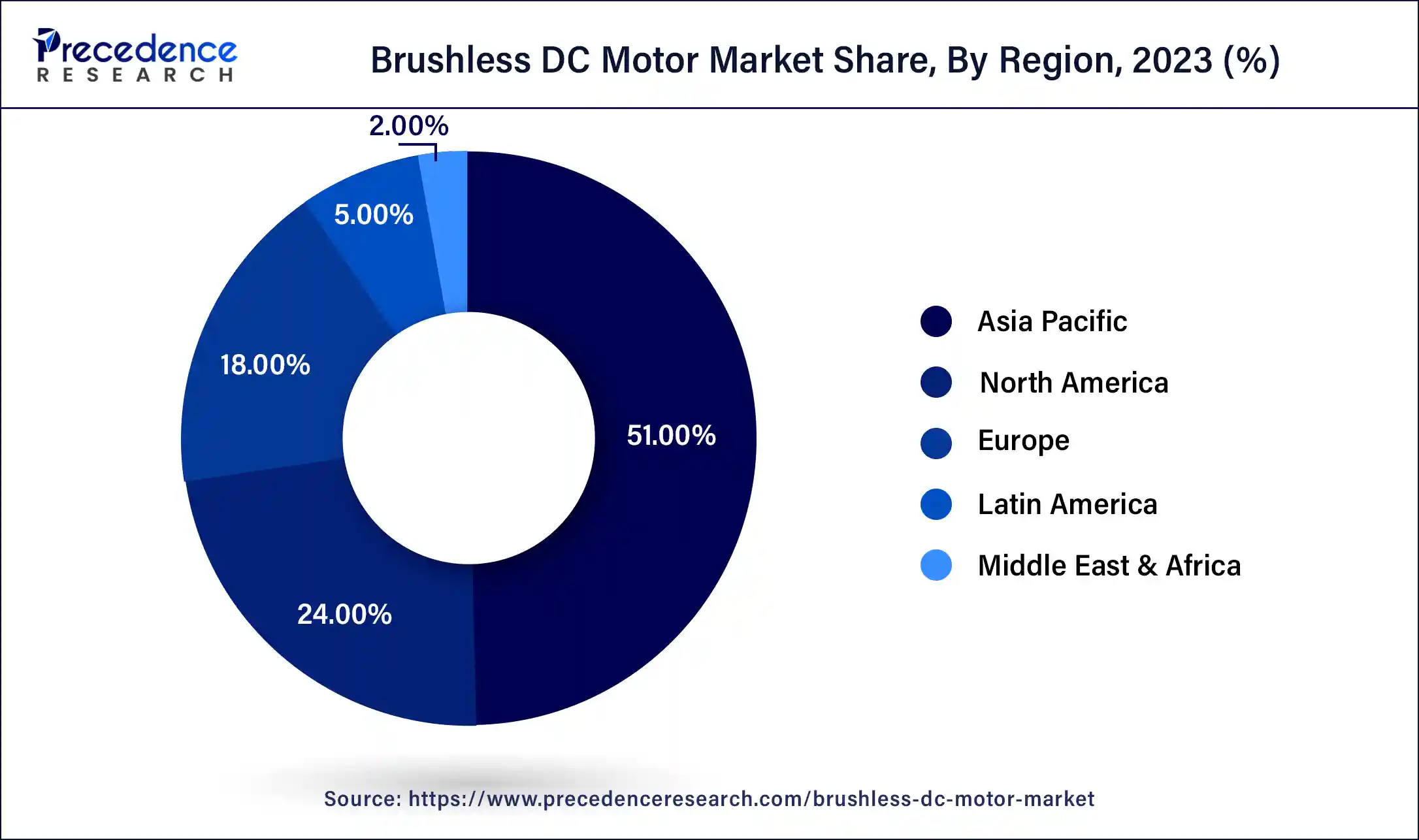

Asia Pacific holds the largest and over 51% of the total share in the global brushless DC motor market. The growing industrialization has supported the market’s growth in Asian countries. According to the World Economic Forum, the Asia Pacific area will account for nearby 60% of the global growth by 2030, the rising modernization in industries and the establishment of an economic hub in the region are observed to fuel the growth of the brushless DC motor market.

Moreover, the improving automotive industry in countries such as India, China and Japan are expected to boost the demand for brushless DC motors. The Chinese government has implemented policies to support the development of the automotive industry. The rising investments in the Chinese automotive industry will subsequently boost the growth of the brushless DC motor market in the Asia Pacific.

The rising adoption of electric vehicles in India is predicted to boost the demand for advanced brushless DC motors. The India Energy Storage Alliance (IESA) projects that the Indian electric vehicle market will grow at a CAGR of 49% from 2021 through 2030. The first quarter of the financial year 2022 has witnessed a 250% year-on-year boost in electric vehicle launches in India. The presence of commercial logistics, production capacity and government support are strengthening the electric vehicle market in the country.

During the forecast period, North America is expected to witness significant growth in the brushless DC motor market. The rising adoption of HVAC systems in the region is considered a substantial factor in the development of the market. The increasing emergence of lab automation in countries such as the United States and Canada, which includes brushless DC motors for accurate sample preparation, is another factor propelling the market’s growth in North America.

The United States-headquartered Hensen Corporation offers a range of brushless DC motors under ‘ElectroCraft’ for lab automation applications such as centrifuges, liquid pipetting, fluid pumps, drug dispensing systems and meters that carry both brushed and brushless DC motors.

Europe is expected to remain the most lucrative marketplace for brushless DC motors owing to the rising demand for energy-efficient medical equipment from the well-established healthcare industry. Brushless DC motors are increasingly used in electric vehicles throughout Europe. The European Union has set ambitious targets for reducing CO2 emissions from cars and trucks, and electric vehicles powered by brushless DC motors are seen as a critical technology for achieving these goals.

The European brushless DC motor market is experiencing a notable growth rate due to factors like the growing automotive industry and its applications like powertrain systems, safety fittings with features like adjustable seats, sunroof systems, etc. The growing adoption of energy-efficient, along with eco-friendly solutions across various industries in the European region is a key driver for the market. On a country level, Germany and the UK are frontiers in the market expansion as Germany is well known for its automotive sector, while, UK is adopting automation and robotics where BLDC motors offer precise control and reliability, making them highly demanding for automotive applications.

The operation of a brushless LDC motor is based on the interaction between the stator's stationary magnetic field and the rotor's rotating magnetic field. The stator contains coils of wire, which are energized in a specific sequence to create a rotating magnetic field. The rotor has permanent magnets that interact with the stator's magnetic field, causing the rotor to rotate. With their higher efficiency and power density, brushless DC motors have become an integral part of numerous machinery and equipment.

Globally rising industrialization is expected to highlight the importance of energy-efficient motors along with the automation of machinery. Such factors will subsequently fuel the growth of the global brushless DC motor market. Brushless DC motors are more efficient compared to traditional motors, which results in reduced energy consumption and lower operating costs. Thus, the growing demand for energy-efficient motors in various industries is driving the growth of the BLDC motor market.

Numerous governments across the globe have started focusing on bringing energy efficiency in the industrial sector to limit carbon emissions by considering environmental concerns.

For instance, the UK government has set several policies and regulations aimed at promoting energy-efficient machinery in various sectors of the economy. Energy Savings Opportunity Scheme (ESOS), Minimum Energy Efficiency Standards (MEES) Energy Technology List (ETL), Industrial Energy Transformation Fund (IETF) and Carbon Reduction Commitment (CRC) are a few regulations and policies that encourage energy efficiency in various infrastructures, such efforts by governments are intended to boost the demand for brushless DC motor.

The market is expanding due to the rise of sensor-less control for BLDC type is a confirmation of durability and reliability of the product, which helps reduce the possible mechanical misalignments, faults in electrical connections, and weight of the final product. The increasing popularity of features in vehicles like adjustable mirrors, sunroof systems, and motorized seats is fueling the market's growth.

The market is witnessing another prominent trend, which is the increasing production of automobiles and a growing number of brushless DC motors in a car. Automotive motors play a critical role in vehicle powertrain systems, safety fittings, and chassis.

Manufacturers are embracing a shift in the market by increasing the production of brushless DC motors for adjustable mirrors, wipers, motorized seats, and massage seats.

The increasing popularity of EVs due to their offerings, like a lesser need for oil, supportive of CO2 reduction, is again a key factor that elevates the market growth. Electric car manufacturers are integrating BLDC motors in vehicles as they offer higher efficiency, maximum operating speed, and quick response with low maintenance.

| Report Coverage | Details |

| Market Size by 2034 | USD 35.70 Billion |

| Market Size in 2025 | USD 22.33 Billion |

| Market Size in 2024 | USD 21.19 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.4% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Rotor Type, Power Range, Speed, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The development of advanced motor control technologies, such as sensorless control and field-oriented control, has improved the performance of brushless DC motors, making them more efficient and reliable. These advancements are driving the growth of the brushless DC motor market. Moreover, rising automation in industries such as food processing, automotive and logistics is predicted to fuel the demand for brushless DC motors. Furthermore, the rotation and thermal control capabilities of brushless DC motors have created a significant opportunity for such motors to be utilized in the aerospace industry.

The electric vehicles utilize brushless DC motors to offer smoother rides with controlled heat insulation. The rising development and demand for electric vehicles around the globe are supplementing the growth of the global brushless DC motor market.

For instance, in February 2023, Okaya EV launched ‘Okaya Faast F2F’, a new electric scooter offering two-year/20,000 kilometers warranty motors. The new Okaya Faast F2F electric scooter carries 800 watts brushless DC motor that claims to provide 50-55 kmph top speed.

At the same time, in February 2023, Hop Electric announced the launch of the Hop Oxo electric motorbike that uses a brushless DC motor that is claimed to produce a peak power of 5.2 kW and a maximum torque of 185 Nm/ 200 Nm.

Moreover, the unmatched benefits offered by brushless DC motors over brushed DC motors, such as minimal electric noise, improved dependability, clean operations, reduced errors, and prolonged lifespan, are expected to boost the growth of the global brushless DC motor market globally.

The rising demand for electric vehicles

Brushless DC motors are commonly used in electric vehicles due to their high efficiency, reliability, and low maintenance requirements. The increasing adoption of electric vehicles, particularly in the automotive industry, drives the demand for BLDC motors. Moreover, brushless DC motors can provide high power output in a small and lightweight package, making them an ideal choice for electric vehicles where space and weight are critical factors. BLDC motors operate smoothly and quietly, providing a comfortable driving experience for passengers.

The International Energy Agency (IEA) predicts that the global EV stock will continue to grow rapidly, with an estimated 145 million EVs on the road by 2030, and the unmatched benefits of brushless DC motors in electric vehicles highlight the future of the market with rising demand for electric vehicles across the globe.

For instance, in March 2023, Tata-backed Stryder launched a new addition to its e-bike range, equipped with a brushless DC motor that claims to offer smooth and silent rides. The newly launched e-bike by Tata-backed comes with inner- framed lithium-ion battery that can provide a range of up to 40 km by charging for 2:30-3 hours.

The high initial cost of brushless DC motors

The high initial installation cost required for brushless DC motors is observed to hinder the growth of the global brushless DC motor market. The initial cost of a brushless DC motor is higher than a conventional motor, which may deter some customers from choosing BLDC motors. Brushless DC motors are made up of a variety of materials, including copper, steel, aluminum, and rare-earth magnets.

The cost of these raw materials can fluctuate based on supply and demand, which can impact the overall cost of the motor. Additionally, the manufacturing complexity affects the final price of the motor. This is particularly true for small applications, where the cost of the motor may be a significant portion of the overall system cost.

Rising deployment of robots in various industries

Brushless DC (BLDC) motors are capable of being used in robotics due to their high efficiency, high torque-to-weight ratio, and precise control capabilities. BLDC motors can be used to drive various gripper designs, such as parallel-jaw grippers, three-fingered grippers, and suction-cup grippers. According to the report published by Zippia in March 2023, about three million robots are used in industries across the globe.

At the same time, approximately 400,000 robots are set to enter the global market, with 88% of companies planning to invest in robotics for better performance. The rising deployment of robotics is observed to offer lucrative opportunities for the market players in the global brushless DC market.

For instance, the healthcare sector in the United States is focused on automation by deploying robotics for surgical procedures. Robotic surgery is a minimally invasive surgical procedure that uses robotic systems to perform surgical procedures. Robotic surgery provides increased precision and accuracy, reducing the risk of complications and improving patient outcomes.

The inner rotor segment acquires the largest share of the global brushless DC motor market; an inner rotor brushless DC (BLDC) motor is a type of motor that uses permanent magnets on the inside of the rotor. The growth of the inner rotor segment is attributed to the enormous demand for inner rotor brushless DC motors in robotics, electric vehicles and other significant applications. Inner rotor brushless DC motors are a superior choice for applications that require high performance and reliability, as they can provide high torque and fast acceleration.

The outer rotor brushless DC motor segment is expected to witness a noticeable growth during the forecast period due to rising demand for advanced and compact applications such as drones. Outer rotor brushless DC motors can be designed to be more compact than inner rotor brushless DC motors of the same power output, and this makes them ideal for applications where space is limited.

The 750 W- 3 kW segment is projected to dominate the global brushless DC motor market; a 3 kW brushless DC motor is a powerful and versatile motor technology that can be used in a wide range of applications. A 3 kW BLDC motor can be used in robotic and automotive applications that require high power and precision motion control. It can provide precise speed and torque control, which is essential for these types of applications.

The 0-750 W segment is expected to hold a significant share of the global brushless DC motor market. Brushless DC motors up to 750 W power range are applied in various medical equipment such as surgical tools, diagnostic equipment and imaging systems. The rising demand for brushless DC motors from the healthcare industry will fuel the growth of the 0-750 W segment.

The 2001-10000 RPM segment is expected to hold the largest share of the global brushless DC motor market. The wide range of applications of brushless DC motors ranging from 2001-10000 in medical equipment and HVAC systems are anticipated to boost the segment’s growth. Moreover, the rising requirement of brushless DC motors in aerospace and electric vehicles to offer adequate propulsion highlights the importance of brushless DC motors ranging from 2001 to 10000 RPM.

The automotive segment holds the largest share of the global brushless DC motor market. Brushless DC (BLDC) motors have become increasingly popular in the automotive industry due to their high efficiency, low maintenance, and reliability. The rising application of brushless DC motors in the automotive industry for electric braking, smoother rides, engine cooling, and power steering highlights the growth of the automotive segment.

For instance, in February 2023, headquartered in Japan, Toshiba Electronic Devices and Storage Corporation launched a new TB9083FTG brushless DC motor to support automotive applications such as electric steering, electric brakes and shift-by-wire. The new automotive brushless DC motor has a built-in three-channel gate driver for the safety motor and to drive the power supply.

The rising demand for installation of HVAC systems in the residential sector is predicted to boost the growth of the HVAC segment. Brushless DC motors are used in HVAC systems to power the blower fan, and they offer high efficiency, low noise, and precise speed control. Brushless DC motors are deployed in air conditioners, ventilation systems and other applications that improve air quality in an indoor environment.

The healthcare segment is expected to be the most lucrative segment of the global brushless DC motor market during the forecast period. Brushless DC motors provide precise control and accurate movement, making them ideal for use in medical applications. The rising focus by prominent players on the development of mid-power range brushless DC motors, especially for medical applications, is expected to boost the growth of the healthcare segment.

For instance, in February 2023, a one-stop online platform for the solution of brushless DC motors, Brushless.com, announced the availability of its new customizable brushless DC motor with a flexible motor controller that can be used in various surgical and medical equipment. These motors are available in a more comprehensive yet mid-power range.

By Rotor Type

By Power Range

By Speed

By End-User

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

May 2025

April 2025

July 2024