What is the Bucket Trucks Market Size?

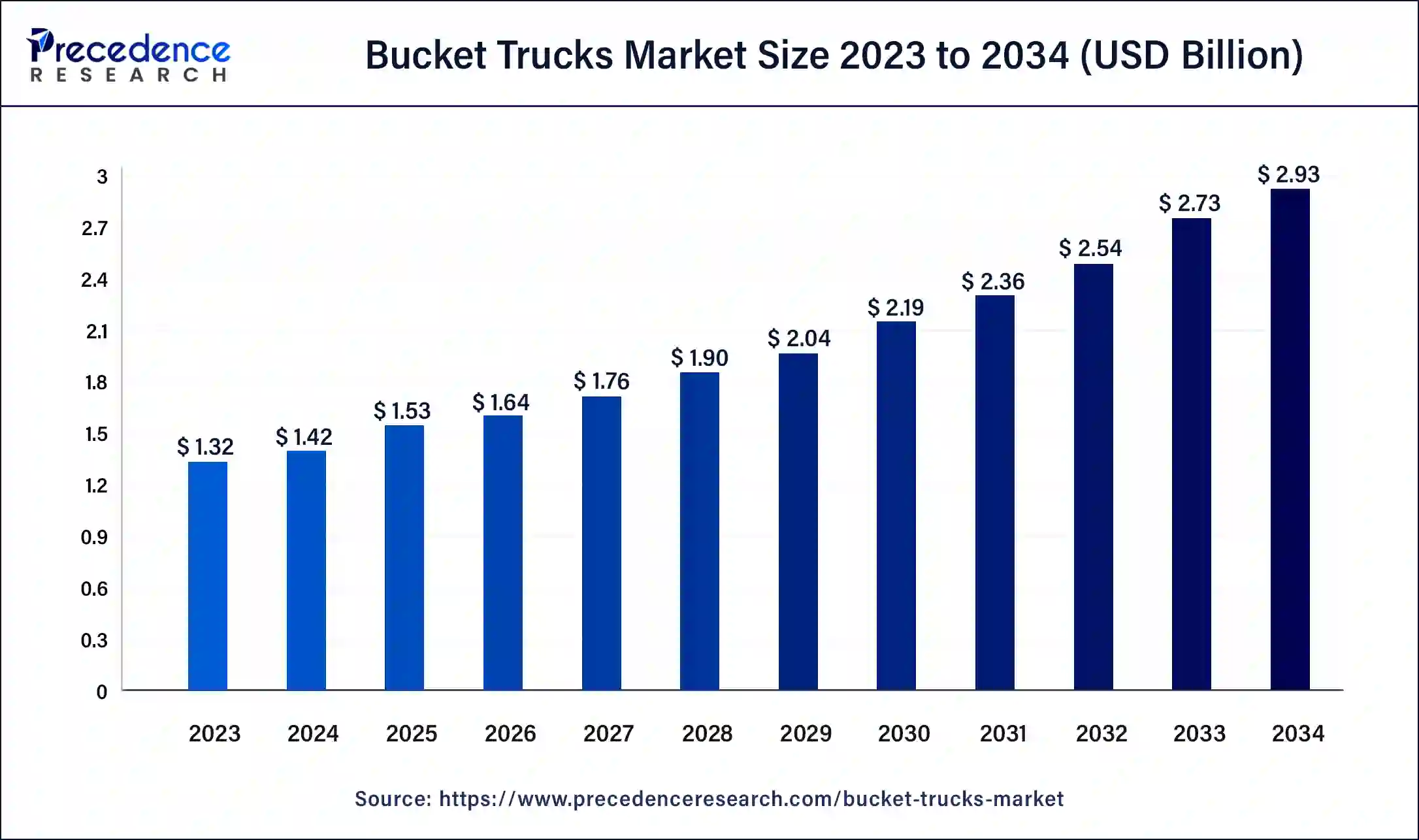

The global bucket trucks market size is accounted at USD 1.53 billion in 2025 and is predicted to increase from USD 1.64 billion in 2026 to approximately USD 2.93 billion by 2034, expanding at a CAGR of 7.51% from 2025 to 2034. The need for the bucket trucks market in maintenance and repairs rises along with the requirement for utilities such as power, telephones, and other services.

Bucket Trucks Market Key Takeaways

- Asia Pacific held the largest share of the bucket trucks market in 2024.

- North America is expected to witness the fastest growth in the market over the studied period.

- By product, the class 8 segment held the largest share of the market in 2024.

- By product, the class 6 segment is expected to show the fastest growth over the projected period.

- By type, the non-insulated segment held the largest share of the market in 2024.

- By type, the insulated segment is expected to show the fastest growth over the projected period.

- By application, the utility segment has held the largest revenue share of 48% in 2024.

- By application, the construction segment is expected to show the fastest growth over the projected period.

What are Bucket Trucks?

The industry that manufactures, distributes, and maintains automobiles with an aerial platform, or bucket, for hoisting people or equipment to higher altitudes is known as the bucket trucks market. These vehicles are vital to many industries, including forestry, construction, utilities, telecommunications, and maintenance services. Hydraulic lifts, stability controls, and other safety measures that enable safe aerial access and work at heights are frequently considered essential components.

Bucket trucks are becoming more and more popular because they improve worker safety and operational efficiency. The industry includes sales of brand-new automobiles as well as aftermarket services for bucket truck upkeep, repair, and modification. The industry is expected to continue growing as the demand for effective infrastructure expansion and maintenance rises.

An essential component of the utility vehicle industry, bucket trucks are mostly utilized for upkeep and repairs in the forestry, construction, telecommunications, and electric utility sectors. In order to maintain telecom networks and overhead utility wires, there is a growing need for bucket trucks due to global infrastructure initiatives. Global growth in the electric utility industry has increased demand for dependable access to power lines for upkeep and repair.

Bucket Trucks Market Outlook

- Industry Growth Overview: Yearly growth in the bucket truck market is projected from 2025 to 2030 due to utility upgrades, telecom growth, and stricter safety standards. There will be an increase in demand from both the construction and electrical maintenance sectors, particularly in the Asia-Pacific Region and North America.

- Sustainability Trends: The industry is trending towards electric and hybrid bucket trucks to reduce both emissions and operating costs. Manufacturers of bucket trucks are focusing more on using lightweight materials and energy-efficient hydraulic systems to meet stricter environmental regulations than ever before.

- Global Expansion: Major manufacturers are expanding into Southeast Asia, Eastern Europe, and Latin America so they can service more rapidly growing construction and modernization of their grid systems. Manufacturers are establishing new assembly plants and dealer networks to improve their service capability.

- Major Investors:There has been increasing attention from private equity investors due to steady demand, longevity of assets, and the provision of necessary services. Private Equity is concentrating on investments in fleet modernization, electrification technologies, and specialized lifting solutions.

What are the Growth Factors in the Bucket Trucks Market?

- The utility industry needs additional bucket trucks to perform chores like fixing lighting and electricity lines as its aged infrastructure needs more upkeep.

- Telecommunications firms are investing in bucket trucks for equipment installation and maintenance due to the growth of 5G networks and rising internet demand.

- Construction operations are driven by growing urban populations, which raises the need for bucket trucks for jobs like building maintenance and signage placement.

- Improvements in safety features and automation, among other technological advances, have made bucket trucks more appealing and useful in a variety of industries.

- Businesses are encouraged to purchase new bucket trucks that comply with safety restrictions by industry standards and strict safety regulations.

- Businesses are moving toward more environmentally friendly and efficient bucket trucks, like ones with electric or hybrid power options, as a result of the growing emphasis on environmental sustainability.

- The significance of bucket trucks in public safety and infrastructure resilience is increased by their critical role in emergency response and catastrophe recovery operations.

- The government's expenditures in smart city initiatives and infrastructure development are driving up demand for bucket trucks in a variety of applications.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 2.93 Billion |

| Market Size in 2026 | USD 1.64 Billion |

| Market Size in 2025 | USD 1.53 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.51% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, Product, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Infrastructure development

Bucket trucks are required to maintain and service solar panels and wind turbines, which are crucial components of renewable energy generation. There is an increasing need for bucket trucks for installation, maintenance, and repair as nations increase their use of renewable energy. Bucket trucks are employed in cities for upkeep and repairs related to overhead electrical lines, signage, and streetlights. Bucket trucks and other dependable infrastructure maintenance vehicles are becoming more and more necessary as cities grow and urbanization progresses.

In order to quickly restore electricity lines and other utilities after natural disasters or power outages, emergency response teams depend heavily on bucket trucks. The use of bucket trucks in various infrastructure development projects is further facilitated by technological advancements such as greater reach capabilities, hybrid or electric models, and improved safety measures.

Restraint

High initial cost

Specialized cars with aerial work platforms or hydraulic lifts are called bucket trucks. These features are expensive in large part because of the engineering and technology needed to make them. Tight safety requirements governing bucket trucks must be followed, which frequently call for premium components and production techniques to guarantee operator dependability and safety. To satisfy particular business needs (such as utilities and telecommunications), many bucket trucks are customized, which raises the initial cost of the vehicle. These vehicles require regular maintenance, training, and support services, which raises the total cost of ownership. Modern features like enhanced economy, sophisticated safety systems, and telematics are frequently found in newer vehicles, which might raise their initial cost.

Opportunity

Utility sector

In the bucket trucks market, the utility industry is very important. Utility businesses depend on bucket trucks, often called aerial work platforms or cherry pickers, to do operations like maintaining streetlights, electricity lines, and other infrastructure that need high-altitude labor. For routine maintenance and repairs of overhead power lines, transformers, and other electrical equipment, utility companies make heavy use of bucket trucks. Utility companies rely heavily on bucket trucks because they can be swiftly dispatched to restore services during situations like storm-related or accident-related power outages. Utility workers may access elevated structures securely and effectively with the use of bucket trucks, which decreases downtime and boosts operational effectiveness.

Segment Insights

Product Insights

The class 8 segment held the largest share of the bucket trucks market in 2024. Heavy-duty trucks with a gross vehicle weight rating (GVWR) of at least 33,001 pounds (14,969 kg) are usually classified as being in the Class 8 sector. Compared to lighter classes, these trucks often have larger platforms and greater reach capabilities since they are built to undertake more difficult tasks. They are frequently employed in industries where durability and large lifting capacities are crucial, like telecommunications, construction, and utility maintenance.

The class 6 segment is expected to show the fastest growth in the bucket trucks market over the projected period. In the bucket truck industry, vehicles classified as Class 6 under the GVWR system are commonly referred to as being in the Class 6 category. Utility businesses and telecom service providers often use bucket trucks in this class for installation and maintenance work. Municipalities and other governmental organizations also use them for a variety of maintenance and public works projects. In the private sector, tree care and landscaping businesses use these trucks to maintain, prune, and trim trees and other vegetation.

- In the U.S., cars falling into this category typically weigh between 19,501 and 26,000 pounds (8,845 and 11,793 kg).

Type Insights

The non-insulated segment held the largest share of the bucket trucks market in 2024. In the bucket trucks market, the term 'non-insulated' usually refers to trucks made for applications like general construction, telecommunications, and lighting maintenance that don't demand electrical insulation for operator safety. These trucks are appropriate for a range of utility and municipal applications since they are frequently utilized for overhead work where there is no chance of electrical contact. They can be distinguished from insulated bucket trucks, which are made expressly to shield operators from high-voltage electrical risks while performing electrical utility work.

The insulated segment is expected to show the fastest growth in the bucket trucks market over the projected period. In the bucket trucks market, vehicles with insulated booms and buckets that are intended to be used safely around electrical lines and equipment are referred to as being in the insulated segment. In order to carry out maintenance, repairs, and installs without running the danger of electrical risks, these trucks are crucial for utilities and electrical service providers. In order to keep electricity from traveling from the boom and bucket to the operator, insulated bucket trucks frequently include unique materials like fiberglass-reinforced plastic (FRP) or other non-conductive materials. For electrical maintenance activities to be completed efficiently and with worker safety, this section is essential.

Application Insights

The utility segment held the largest share of the bucket trucks market in 2024. Electric utility companies are the main customers served by the utility section of the bucket trucks market. These vehicles, sometimes referred to as cherry pickers or aerial work platforms (AWPs), are necessary for installing, maintaining, and repairing overhead power lines and other utility infrastructure. High reach capabilities, numerous safety measures, and insulated booms and platforms to shield workers from electrical risks are frequently considered essential components. The segment's growth is frequently propelled by regulatory standards that guarantee worker safety and operational efficiency, infrastructure renovations, and maintenance requirements.

The construction segment is expected to show the fastest growth in the bucket trucks market over the projected period. Bucket trucks are needed when performing maintenance on buildings, bridges, and other infrastructure. They give technicians safe access to carry out height-related maintenance, painting, and cleaning jobs. Bucket trucks are utilized in construction projects to install equipment, signage, and lighting fixtures at high altitudes. Bucket trucks are used in landscaping and construction projects to prune and trim trees, particularly in urban locations where trees may be near buildings or roadways. Utility work, such as constructing or maintaining electricity lines, telecommunications equipment, and street lighting, is done by construction companies using bucket trucks. For window cleaning services, high-rise buildings frequently need specialized equipment like bucket trucks to ensure safe and effective access to external windows.

Regional Insights

Asia Pacific held the largest share of the bucket trucks market in 2024. The Asia Pacific market for bucket trucks is impacted by a number of factors, including the demand for effective utility maintenance, growing urbanization, and the development of infrastructure. Important nations, including South Korea, Japan, China, and India, are major players in this industry because of their continuous infrastructure initiatives and fast urbanization.

Utilities, telecoms, and the construction industries are the key drivers of demand since they need dependable aerial platforms for services like installation, maintenance, and repair at heights. The dynamics of the bucket trucks market in Asia Pacific are also influenced by variables, including growing safety standards and technological developments in truck-mounted platforms.

North America is expected to witness the fastest growth in the bucket trucks market over the studied period. The growth of infrastructure, upkeep efforts, and rising utility service demand are the key drivers of the bucket trucks market in North America. These trucks are essential for jobs like building repair, tree trimming, and electrical line maintenance because they have an aerial platform or bucket that allows personnel to be lifted to great heights.

Innovations in electric and hybrid versions, which address environmental concerns and legal constraints, are major trends in the North American bucket trucks market. In order to increase operator productivity and safety, the market is also seeing advances in safety features and efficiency enhancements. Due to continuous infrastructure investments and the demand for dependable utility services in both urban and rural areas, the market for bucket trucks in North America is predicted to expand gradually overall.

Why did Europe grow at a significant rate in the Bucket Trucks Market?

The growth rate of Europe was projected to be significant due to increased investment in renewable energy education and electric grid modernization, combined with strict worker safety standards throughout Europe. With their current infrastructure providing the framework necessary for growth, upgrades to telecommunication networks, and increased focus on the electrification of equipment, there has been an increase in demand for modern bucket trucks. Additionally, opportunities exist within the replacement of obsolete fleets, the continued maintenance of wind turbines, and the ongoing expansion of urban infrastructure.

Why did the Middle East & Africa region grow at a significant rate in the Bucket Trucks Market?

The projected steady growth in the Middle East and Africa regions is a result of increasing construction activity, the expansion of utility infrastructure, benefit of scheme projects initiated by Government, and many countries are upgrading their existing Electric Grid, building new street lighting systems, and adding additional telecommunication networks and service providers, thus creating a larger need for bucket truck transit via construction equipment to perform services throughout both regions.

The UAE Bucket Trucks Market Trends

The United Arab Emirates led the region due to the UAE's continuous investment in the development of smart infrastructure and large construction projects. Due to the continued expansion of power lines, street lighting, and telecommunication networks in the UAE, there is a significant need for bucket truck transit via construction equipment to perform maintenance services.

Why did the Latin America region grow at a Significant Rate in the Bucket Trucks Market?

Latin America will demonstrate continual growth due to its advancing electric power grids, expanding telecommunications, and enhancing road systems. Power utilities have been improving their networks, while telecommunications companies have been extending their reach into rural areas. As a result, an increase in demand for bucket trucks has occurred in the region.

Brazil Bucket Trucks Market Trends

Brazil was the market leader because of the size of the electric utility network and the growth of the electric utility sector. With all telecommunications operators expanding their service areas to urban and rural regions, the demand for bucket trucks has also increased. Frequent repair needs and support from manufacturers in the local market continue to boost the Brazilian bucket truck market. In Brazil, opportunities exist within the renewable energy sector, in fleet upgrades and expansions, and in the adoption and improvement of safety standards.

Bucket Trucks Market Companies

- Altec Inc.

- Dur-A-Lift Inc.

- Aiche Corporation

Recent Developments

- In December 2023, the MineSense Data Portal, a platform that uses real-time data from ShovelSense and BeltSense to provide mining operators with data-driven insights for mine-to-mill optimization, has officially launched, according to a statement from MineSense Technologies. Access to real-time data produced by ShovelSense and BeltSense at crucial junctures in the ore processing value chain is made possible by the robust digital infrastructure known as the MineSense Data Portal.

- In September 2023, with the introduction of its electric bucket truck, Alectra moved closer to electrifying its whole fleet. An International eMV all-electric double bucket truck has been added to Alectra Utilities' collection. Powerline technicians will utilize the EV for routine overhead line maintenance tasks. Alectra received one of the first trucks delivered in Ontario.

Segment Covered in the Report

By Type

- Insulated

- Non-insulated

By Application

- Construction

- Utility

- Telecommunication

- Forestry

By Product

- Class 4

- Class 5

- Class 6

- Class 7

- Class 8

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting