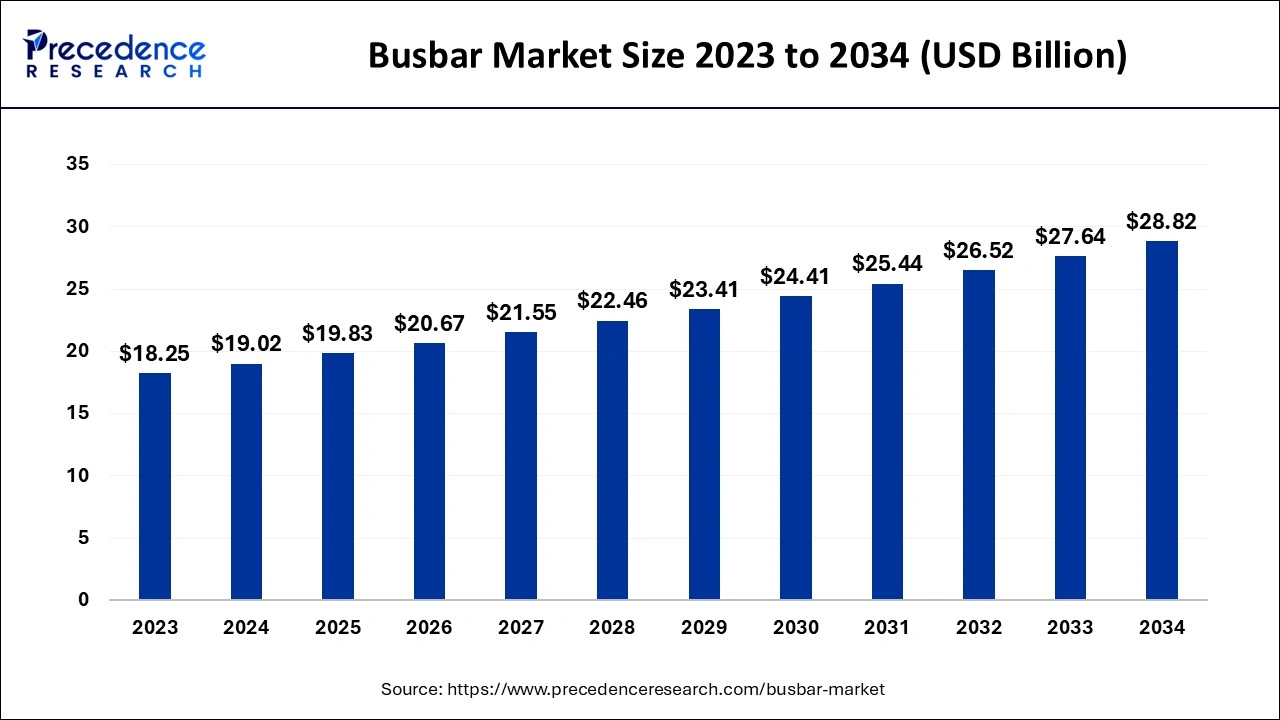

The global busbar market size accounted for USD 19.02 billion in 2024, grew to USD 19.83 billion in 2025 and is projected to hit around USD 28.82 billion by 2034, representing a CAGR of 4.24% between 2024 and 2034.

The global busbar market size is calculated at USD 19.02 billion in 2024 and is predicted to reach around USD 28.82 billion by 2034, expanding at a CAGR of 4.24% from 2024 to 2034. The rising demand for power generation and distribution in economically developing countries is driving the growth of the busbar market.

The busbar is the electric device; it is the conductor or group of conductors that helps in efficiently distributing the power in the different electrical devices. The busbar is a metallic device with high conductivity. Busbar plays an important role in the central link for multiple electric connections. It streamlines the power distribution process with affordability and easy adaptability. The busbar can be found in different metals and in different sizes, depending on the process and operations. The rising industrialization and digitization across the industries are driving the expansion of the busbar market.

How Can AI Impact the Busbar Market?

The integration of AI into electric or power supply management streamlines operational efficiency. It helps reduce utility and consumer costs and computational time and ensures reliability in the power supply system. Artificial intelligence resolves frequency system frequency changes, minimizes fault rate, and maintains voltage profile. It also helps reduce total electricity costs.

| Report Coverage | Details |

| Market Size by 2034 | USD 28.82 Billion |

| Market Size in 2024 | USD 19.02 Billion |

| Market Size in 2025 | USD 19.83 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.24% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Material, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

The rise in infrastructural development

The economic development in many countries that drive the infrastructural development, such as the increasing number of residential, commercial, and industrial infrastructure, is driving the demand for high-end power supply management or systems that can conduct electricity efficiently in the different electrical appliances. Additionally, the rising cases of replacement of old wiring and connectivity are driving the demand for the busbar market.

High prices

The increased and fluctuating prices of raw materials like copper, aluminum, and other conductive materials are limiting production and elevating production costs, which makes the system higher in cost and restrains the growth of the busbar market.

Technological advancements in the busbar

The significant advancement in busbar technologies that help improve performance and sustainability drives future opportunities for market expansion. The integration of the smart grid into the busbar is one of the significant advancements in the technology. The smart busbar includes sensors in it for providing real time insights on temperature, current flow, and other critical parameters. With the integration of IoT into the busbar, the electric system becomes more responsive and adaptive to changing conditions. Additionally, the diversion of people towards sustainability is driving the adoption of co-friendly material for manufacturing busbars, which also contributed to the growth of the market.

The copper segment led the busbar market in 2023. The wide adoption of the copper busbar from various end-use industries such as hospitals, manufacturing industries, data centers, and others is due to the several industries driving the demand for the segment. The copper busbar includes several benefits, such as increased efficiency, durability, cost-effectiveness, and flexibility. It requires lower maintenance, weather resistance, and compact designs, making it more convenient to use. The high-quality busbar is corrosion-resistant and plays an important role in the electrical flow of different electric appliances. The copper busbar can be found in different spaces such as flat, hollow, round, custom-shaped busbar, and others. The flow of electricity depends highly on the shape of the busbar.

The aluminum segment is predicted to witness significant growth in the busbar market over the forecast period. There is an increased use of aluminum busbars in different industries and applications. These can be used in transformers, electric panel boards, and distribution boards. Aluminum has larger surface areas and lower conductivity than aluminum; they are economically affordable and lighter in weight. It is cost-effective, used in multiple applications in different electrical panels, easy to install and transport by weight, and provides great heat exchange and efficient thermal dissipation.

The industrial segment accounted for the largest growth in the busbar market in 2023. The busbar is used in different industrial applications, such as power distribution. It efficiently distributes the power to each of the electrical devices in the industry. The busbar plays an important role in distributing power to industrial machinery such as motors and other things. It provides power to the renewable energy system, data centers, electrolysis processes, and others.

The commercial segment saw substantial growth in the busbar market during the predicted period. The rising economic growth drives the rise in urbanization and drives the demand for efficient electric supply and distribution devices that drive the demand for the busbar in commercial applications. The rising commercial infrastructure, such as the rising construction of commercial buildings such as corporate offices, malls, hospitals, restaurants, schools, and others, is creating the demand for an electric supply system that helps in the seamless distribution of electricity for effective operations.

Asia Pacific dominated the busbar market in 2023. The growth of the market is attributed to the rising infrastructural development and the rise in the demand for electric supply. The rapidly growing residential, industrial, and commercial infrastructure is anticipated to increase demand for effective electric distribution and supply, which are contributing to the increased demand for the busbar. Additionally, the rising population and the economic stability in the regional countries are driving the demand for electric applications, and the rising presence of the factories is collectively driving the growth of the busbar market in the region.

North America expects the fastest growth in the market during the forecast period. The growth of the market is attributed to the rising presence of the factories and the commercial applications. Regional countries like the United States and Canada are the most economically stable countries with increased commercial and industrial infrastructure development, which are anticipated to drive the demand for the busbar for the efficient supply and distribution of energy. Additionally, the ongoing technological advancement in electricity and electric appliances is accelerating the growth of the busbar market across the region. The total generation of electricity from utility-scale generators in the U.S. is 4,178 billion kilowatt-hours (kWh).

By Material

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client