September 2024

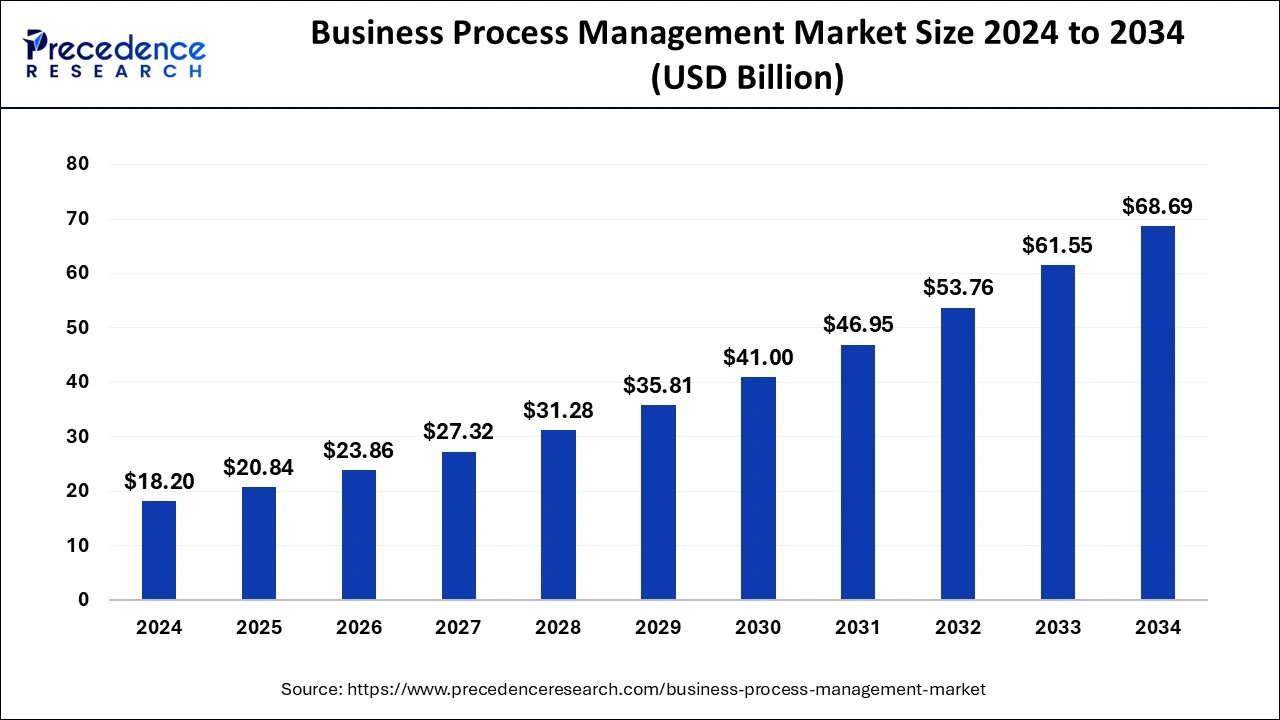

The global business process management market size is calculated at USD 20.84 billion in 2025 and is forecasted to reach around USD 68.69 billion by 2034, accelerating at a CAGR of 14.20% from 2025 to 2034. The North America business process management market size surpassed USD 7.46 billion in 2024 and is expanding at a CAGR of 14.21% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global business process management market size was accounted for USD 18.20 billion in 2024, and is expected to reach around USD 68.69 billion by 2034, expanding at a CAGR of 14.20% from 2025 to 2034.

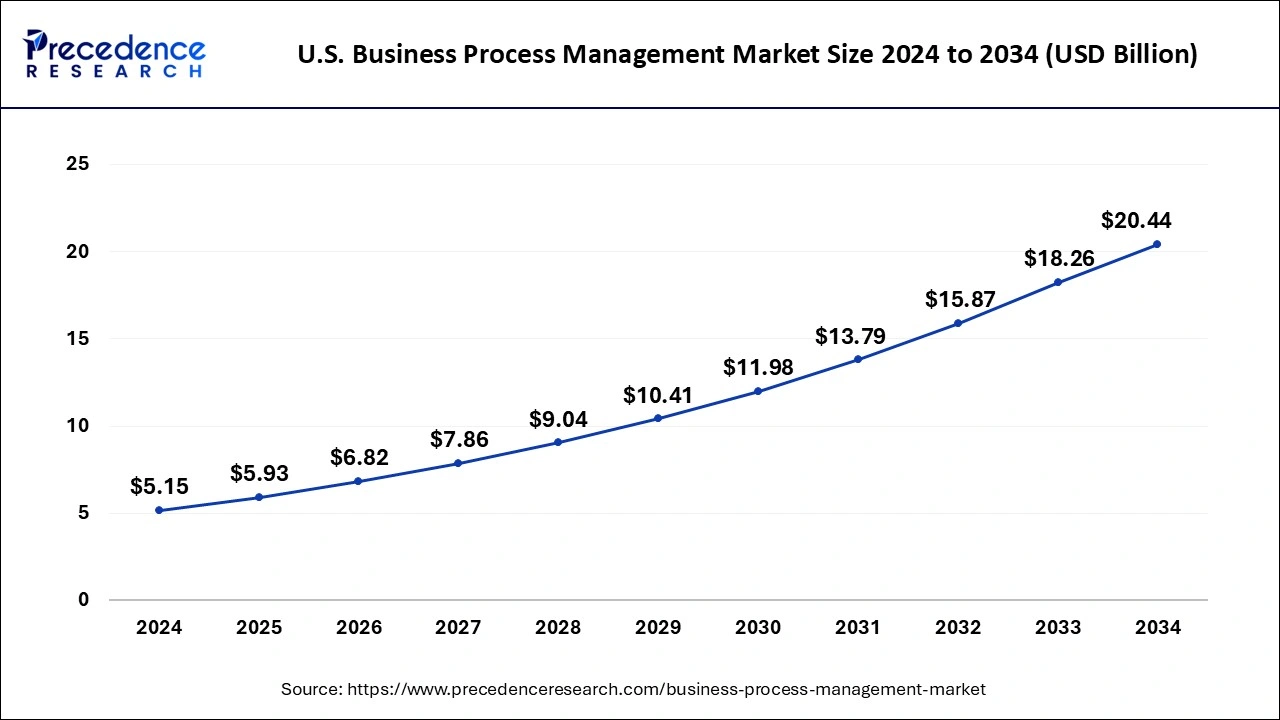

The U.S. business process management market size was estimated at USD 5.15 billion in 2024 and is predicted to be worth around USD 20.44 billion by 2034, at a CAGR of 14.78% from 2025 to 2034.

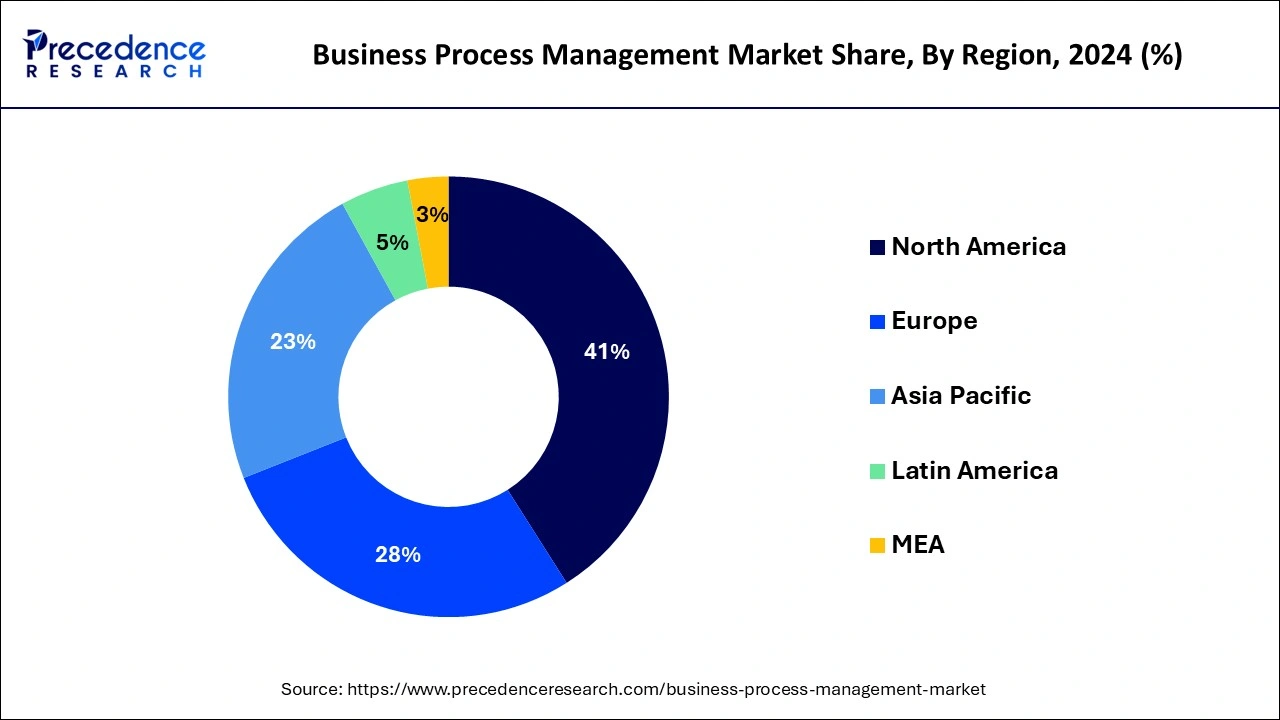

The North American region generated more than 41% of the revenue share in 2024. The region's business process management market development has been aided by factors such as data protection, productivity improvement, and the presence of several BPM-related businesses, including Appian Corporation, International Business Machines Corporation, Genpact, and Open Text Corporation, among others. Some of the world's largest BFSI, IT, and healthcare companies are based in the North American region, and these industries have a significant demand for BPM software.

Major businesses in various areas, including IT, healthcare, banking, insurance, etc., are based in the North American region. In 2023, the U.S. provided almost 24% of the world's GDP alone. These factors apply to the North American region and will likely propel the growth of this region in the market for business process management during the forecast period. In addition to BPM providers with headquarters in North America, many businesses in other parts of the world also have a substantial presence in the region, such as Accenture.

Business process management (BPN) is an area of operation management that focuses on enhancing corporate performance through the upkeep, administration, and optimization of business processes. Supporting organizational goals entails design, automation, modeling, execution, control, process optimization, measurement, and others.

The market for business process management (BPM) includes research on the software and services used to carry out the tasks above with maximum effectiveness and output. Most businesses typically utilize on-premise BPM, although recent developments in cloud computing have raised interest in software-as-a-service (SaaS) on-demand options.

The need to adhere to strict government regulations and policies, increase return on investments (RoI) for organizations and growing demand for improved efficiency and process automation are all factors driving the expected rapid growth of the worldwide business process management (BPM) market shortly.

Additionally, improvements in Big Data and cloud computing that increased BPM software efficiency and IT spending will likely provide a measurable gain for the worldwide BPM market. However, the market expansion is hampered by middle management's reluctance to implement BPM solutions and end users' misunderstanding of the advantages of these solutions.

One of the key factors boosting the BPM market's expansion is a rise in the use of cloud-based BPM software. When it comes to providing a flexible IT environment, cloud-based BPM is far more efficient than traditional BPM. BPM solutions, which are offered as SaaS in the cloud, don't need to be installed or maintained and offer complete software functionality. Low code functionality, which also propelled the adoption of the cloud-based BPM market by deployment, helps SaaS-based BPM platforms in enhancing business units.

BPM software is enhanced by incorporating cutting-edge technology like artificial intelligence and machine learning, ensuring compliance and security. Businesses offer BPM software that incorporates ML and AI technology, like Infosys Limited, SAP SE, BP Logix, Inc., etc. RPA (Robotic Process Automation) is a crucial technology that has made its way into BPM software; this combination enables staff reorganization and job acceleration, among other things.

For instance, K2 Software Inc., whose RPA, workflows, and other technologies helped Nintex Global Ltd. turn into a digital business, was bought by Nintex Global Ltd. in October 2020. Numerous businesses in the business process management sector provide software incorporated with RPA, ML, AI, etc. This has improved BPM's capabilities even further, contributing significantly to cloud endpoint management's market expansion.

The need for BPM is increasing across industries, particularly in IT & Telecom and banking. This is primarily due to increased service quality, flexibility, and lower costs, among other factors. For instance, 70% of the firms implementing BPM, according to the status of BPM by Signavio, did so to increase productivity or cut expenses. Additionally, 36% of the organization said they had worked on more than ten process transformation initiatives, and 60% of the organization had participated in at least one transformation project.

| Report Coverage | Details |

| Market Size in 2025 | USD 20.84 Billion |

| Market Size by 2034 | USD 68.69 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 14.20% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Solution, By Application, By Deployment, and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

By solution, the automation segments is predicted to grow at a remarkable CAGR of 21.6% from 2025 to 2034. Furthermore, by 2034, this market category is anticipated to have a sizable market share. The automation segment has expanded due to the digitalization of workplaces and process automation.

Reduced operational expenses, increased productivity, shorter execution times, and enhanced internal communication are all advantages of automation. These elements will likely have fueled the market for business process management's automation segment expansion. During the projected period, a sizable number of BPM market players that provide solutions for automation have also had a favorable impact on the industry's expansion. Companies that specialize in automation include Accenture, Appian Corporation, and Kissflow Inc.

By 2034, the IT segment will likely hold the largest market share for business process management, with a CAGR of 21.8% in the forecast period. The expansion can be linked to BPM's abilities, including task simplification, process transparency, and increased effectiveness. The growing emphasis on customer service and operational excellence, among other things, is largely responsible for the development of BPM in the IT sector.

Given the growing need for IT services globally, workflow software provides time-saving, efficient work in the IT business. For instance, Nasscom reports that the Indian IT sector's sales climbed by 15.5% YoY to USD 227 billion in FY 2022. The business process management market's IT segment will likely rise due to the expanding demand from the IT sector and the increased effectiveness of BPM.

The cloud-based segment generated more than 64% of the revenue share in 2024. In comparison to the on-premises BPM deployment technique, cloud-based BPM delivers improved performance in areas like reduced error, performance, process improvement, data accuracy, etc. Another factor luring organizations, particularly SMEs, is the cost-effectiveness of cloud-based BPM, which is fueling the expansion of this market.

Numerous cloud-based BPM service providers, including Genpact, IBM, Appian Corporation, and Kissflow Inc., have enabled clients to benefit from the advantages of cloud-based BPM deployment. The market has become more competitive due to the availability of cloud-based BPM providers, which has also reduced the price of cloud-based BPM. These factors have fueled the development of cloud-based BPM software.

Between 2025 and 2034, the SME end-user sector of the business process management market will likely grow the fastest. Cost-reduction measures, particularly when employing cloud-based BPM, help eliminate or minimize the need for previous equipment and technology needed to complete operations. This has been a key driver of the SME segment's growth throughout the projected period.

According to the SBA Office of Advocacy, there are a lot of SME companies in nations like the U.S., which has 31.6 million small enterprises. With the lower cost of cloud-based BPM, the huge number of SMEs will serve as a potential client base, which will likely lead to greater adoption of BPM within the SME section of the business process management market by end-users.

In addition to cost-effectiveness, BPM's key benefits for SMEs include optimizing company operations, eliminating inefficient bottlenecks, and automating repetitive work. All of these factors ensure that the business's requirements are met, enhancing teamwork and communication. Throughout the anticipated period, these factors have significantly contributed to the expansion of the SME market for business process management.

By Solution

By Application

By Deployment

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

January 2025

November 2024