December 2024

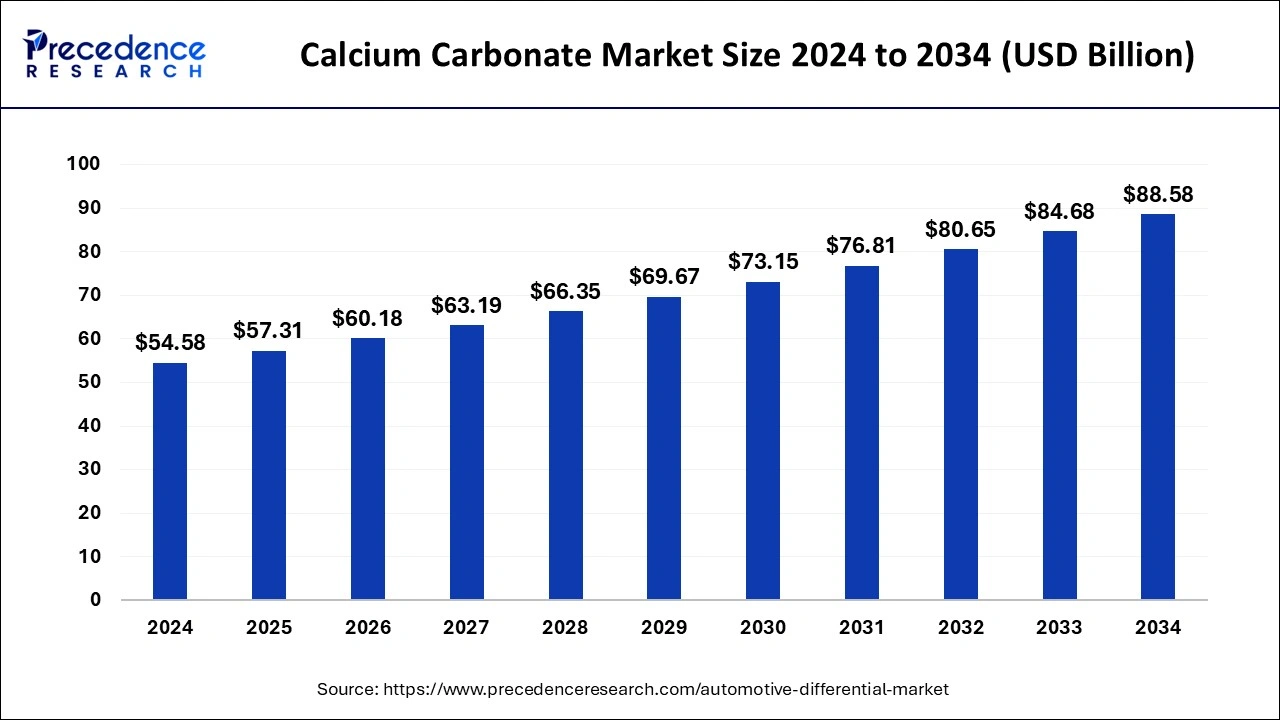

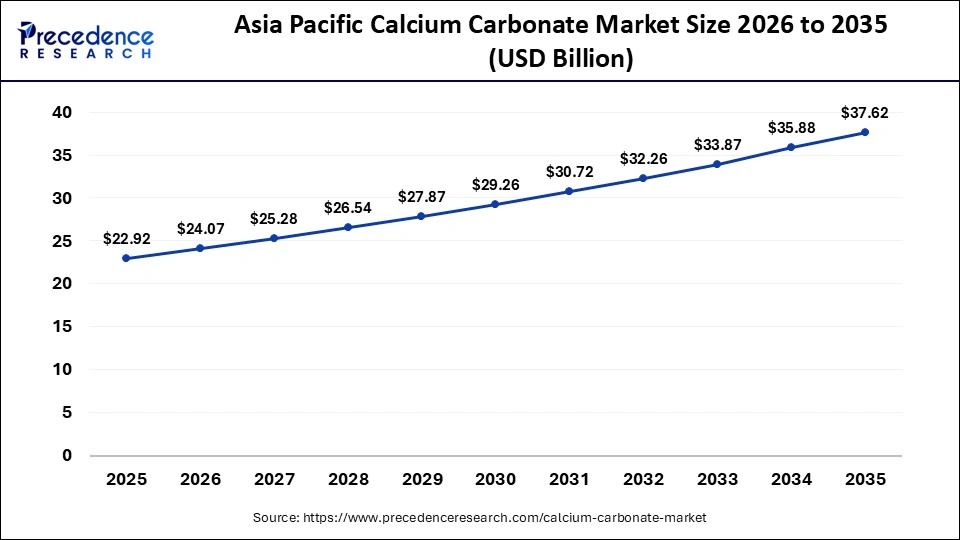

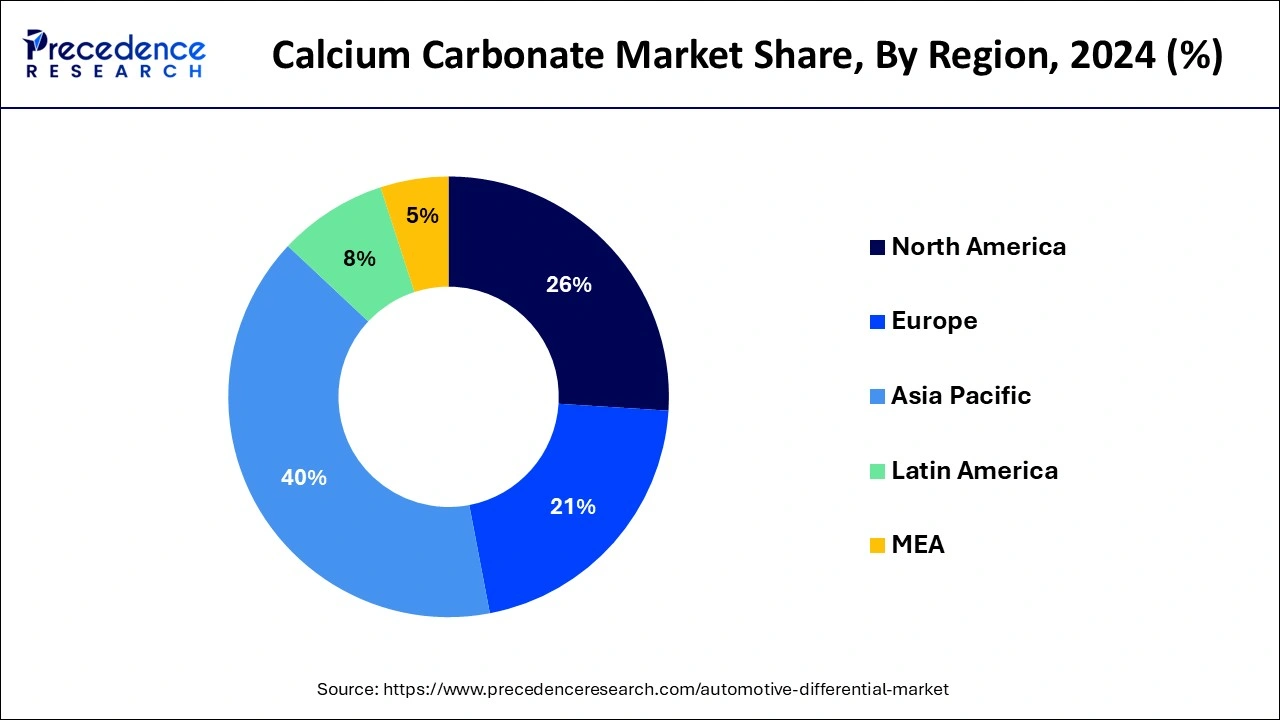

The global calcium carbonate market size is estimated at USD 57.31 billion in 2025 and is forecasted to reach around USD 88.58 billion by 2034, accelerating at a CAGR of 4.96% from 2025 to 2034. The Asia Pacific calcium carbonate market size surpassed USD 22.92 billion in 2025 and is expanding at a CAGR of 5.09% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global calcium carbonate market size was accounted for USD 54.58 billion in 2024, and is expected to reach around USD 88.58 billion by 2034, expanding at a CAGR of 4.96% from 2025 to 2034.

The Asia Pacific calcium carbonate market size was estimated at USD 21.83 billion in 2024 and is predicted to be worth around USD 35.88 billion by 2034, at a CAGR of 5.09% from 2025 to 2034.

APAC to overwhelm the calcium carbonate market during the estimate time frame. The development in the APAC locale can be credited to the developing interest for calcium carbonate from different end-use businesses like paper, plastic, glues and sealants, and paints and coatings. In any case, because of the pandemic, the assembling tasks and production network have been monstrously affected. Aside from China, any remaining significant Asian nations have detailed negative GDP development for the second quarter of 2024.

Economies are investing additional amounts of energy for the legitimate working of activities in various areas by keeping up with fundamental conventions expected during the pandemic. As the tasks continue, certain ventures have announced positive news; for example, auto deals in India went up in the beyond two months. What's more, the interest for paints and coatings and vehicles is expected to increment, which, thusly, will increase the interest for calcium carbonate.

North America held the second position in 2024. However, the area has been seriously affected by the pandemic, the end-use businesses of the market have started their activities at negligible limit considering the ascent in purchaser interest. Businesses including clinical, bundling and DIY are helping the interest for items, for example, cements and paper, which is a positive sign for the market.

The U.S. held the biggest income share in the North American market in 2023 and is supposed to keep up with its lead over the figure period. Taking into account the item interest in the nation, organizations are participated in supporting their creation limits and growing their presence in the country. For example, in March 2020, Anglo Pacific Group PLC declared going into a supporting concurrence with Incoa Performance Minerals LLC for subsidizing the development of a calcium carbonate-related framework in the Dominican Republic.

Calcium carbonate is a substance compound addressed by the synthetic recipe CaCO3. It is assessed that around 4% of the world's outside layer is comprised of calcium carbonate. It is found normally as minerals and rocks, some of which incorporate calcite, limestone, chalk, marble, and aragonite. Calcium carbonate is utilized either in its normally happening state or in the unadulterated structure. Unadulterated calcium carbonate is extricated from normal sources by different strategies like mining and quarrying. As of now, calcium carbonate utilized is generally utilized for different capabilities, including as a mineral filler, brightening specialist, and an alkalizing specialist.

Expanding interest for paper from bundling applications and cleanliness related items like tissue paper is a significant development driver for the market. Nonetheless, the item request saw a decrease in 2020 inferable from the episode of the Covid. The pandemic caused far and wide closures across the globe, which essentially affected the economy overall in the main portion of 2020. No sweat in limitations in the final part of the year, organizations are investing additional amounts of energy to continue their tasks, which is a positive sign for market development.

The U.S. has been a conspicuous objective for the item considering popularity from enterprises including paints and coatings, glues and sealants, and paper producing. Paper is the biggest application section of the market and the U.S. is among the world's biggest paper producers. In spite of the pandemic that significantly affected the nation's economy, the interest for calcium carbonate keeps on enduring, particularly in the paper creation area attributable to a developing accentuation on tidiness.

The market for calcium carbonate has been hampered by store network precariousness, a log jam in natural substance creation, exchange development easing back, and a decrease in development, vehicle, and paint and coatings request because of the COVID-19 pandemic. Calcium carbonate request is tied straightforwardly to various enterprises that are seeing business vulnerability, for example, car, plastics, paper, and building and development.

A drop in paper utilization from corporate workplaces, schools, and colleges, and the paper and printing enterprises has hampered the development of the paper business. Nonetheless, new application classes including cleanliness paper items, food bundling, clinical specialty sheets, and folded bundling have given open doors to the business, which is driving up the interest for calcium carbonate, consequently lessening the pandemic's effect on some degree.

As per the American Forest and Paper Association, the U.S. paper and wood items industry kept elevated degrees of tissue creation in February and March 2020. The U.S. factories created around 700 kilotons of tissue in March. Factors like lockdown and additional cleanliness concerns prompted alarm purchasing and storing of tissues and other cleaning items, in this way helping the market development.

Regardless of the interest for calcium carbonate in the paper portion, the market saw a plunge in 2023 attributable to confined transportation, a stop in assembling tasks for unnecessary businesses, and the closure of mines across different locales. A few market players detailed negative deals and benefits for the main portion of 2023.

For example, LafargeHolcim, a coordinated player on the lookout, revealed a 14% benefit fall in Q1 of 2020 as the pandemic made building locales shut down around the world. The organization mines limestone produces calcium carbonate and uses it to fabricate concrete, which is additionally taken care of the development business. The organization needed to stop its mining exercises in March 2020 in Meghalaya, India because of lockdown; nonetheless, the tasks continued following two or three months as mining exercises were permitted by the state government with the requirement of social separating standards and appropriate cleanliness conditions.

| Report Coverage | Details |

| Market Size in 2025 | USD 57.31 Billion |

| Market Size by 2034 | USD 88.58 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.96% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, and End Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing interest from paper and plastic businesses in APAC

Declining paper industry because of expanding digitization

The ground calcium carbonate ruled the item type fragment, representing over 71% in 2024. Ground calcium carbonate is normally utilized as a modern mineral. It is utilized in paints and coatings, paper and plastic fillers. GCC additionally tracks down application in concrete and can be changed over into calcium oxide and calcium hydroxide. It builds the pH in soils or water and can be utilized to kill ignition fumes.

Subsequently, different favorable properties of GCC drive the development of item type segment. Precipitated calcium carbonate (PCC) is expected to enlist the highest CAGR of more than 4.5%. The different state of PCC permits them to go about as a utilitarian added substance in glues, sealants, elastic, plastic, inks, paper, drug, and nutraceutical, helping the development of this portion.

Plastic to be the quickest developing end-use industry of calcium carbonate over the forecast period. This is because of the rising interest for calcium carbonate-supported polypropylene from the auto business and the capacity of calcium carbonate to upgrade the properties of plastics and help in better intensity dissemination. Additionally, the rising utilization of plastics in different end-use ventures like bundling, building and development, and electrical and hardware has expanded the interest for plastics. These elements add to the development of the calcium carbonate market in the plastic business. The plastics application segment is growing at a CAGR of 6.6% between 2025 to 2034.

The ongoing pandemic has constrained makers to increase their creation to take special care of the rising shopper needs. For example, in August 2020, Celulosa Argentina declared an expansion in its development of paper bundling by 30%. The organization's emphasis was on the food business as the interest flooded in this area. With the development of the web-based business area and the developing utilization of tissue papers, the paper application fragment is expected to keep up with its lead over the estimate period.

The paints and coatings portion hit as the second-biggest application section in 2024. The item is utilized in a few applications in the paints and coatings area. It goes about as a specialist for decreasing or upgrading shine, as an extender, and as an added substance for expanding thickness. In spite of many purposes, the item request was influenced in this application portion in 2023 inferable from an end in the assembling tasks, which upset the whole presentation and store network of the paints and coatings industry.

Albeit the creation has continued effortlessly in limitations, the rising instances of COVID-19 and activities at negligible limit are still matters of worry for the market players. Certain organizations have taken on techniques to adapt to this situation. For example, Asian Paints, a main player in Asia, has sent off another scope of items in the wellbeing and cleanliness section. The organization is running a "Protected Painting Campaign" to help its deals. Moreover, the organization has started a "San Assure" administration for disinfecting homes, working environments, and shops. Such drives are expected to build the interest for paints and coatings, accordingly prompting market development.

By Product Type

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

February 2025

February 2025

October 2024