January 2025

Cancer Biologics Market (By Drug Class: Monoclonal Antibodies, Cancer Growth Inhibitors, Vaccines, Recombinants Proteins, CAR-T Cells, Angiogenesis Inhibitors, Interleukins, Interferons, Gene Therapy, Others; By Applications: Blood Cancer, Lung Cancer, Breast Cancer, Colorectal Cancer, Prostate Cancer, Gastric Cancer, Ovarian Cancer, Skin Cancer, Liver Cancer, Others; By End-use) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

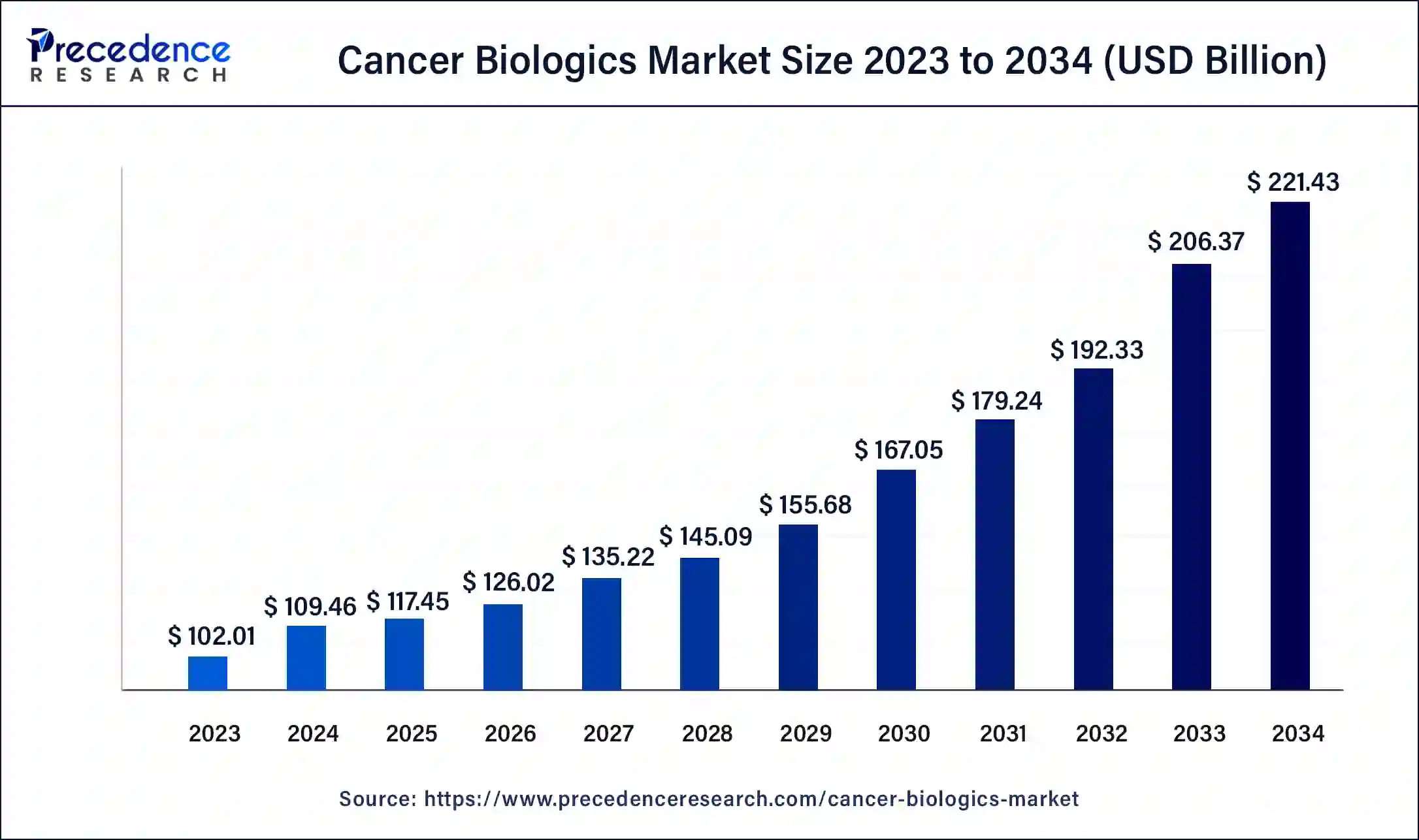

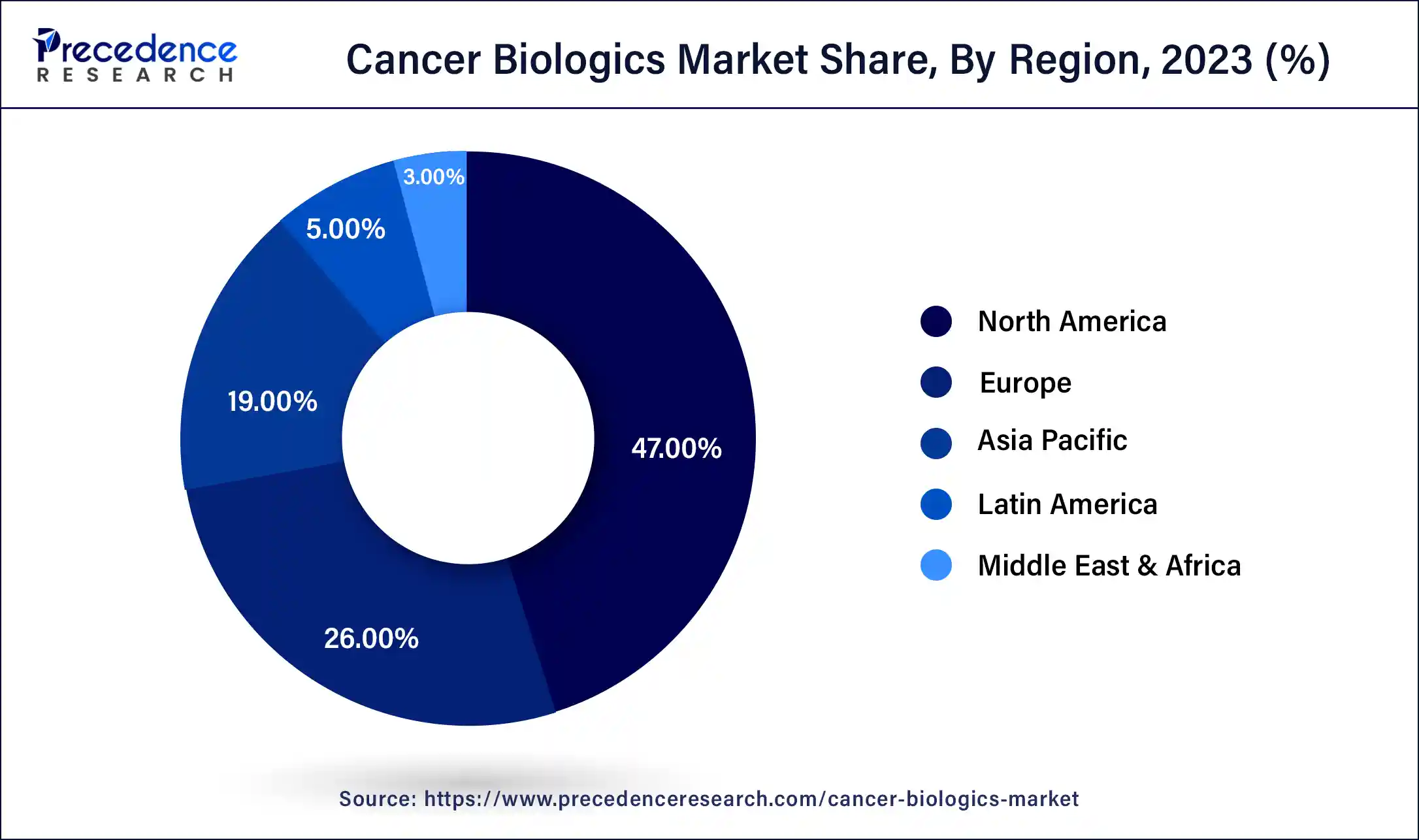

The global cancer biologics market size was USD 102.01 billion in 2023, accounted for USD 109.46 billion in 2024, and is expected to reach around USD 221.43 billion by 2034, expanding at a CAGR of 7.3% from 2024 to 2034. The North America cancer biologics market size reached USD 1.68 billion in 2023.

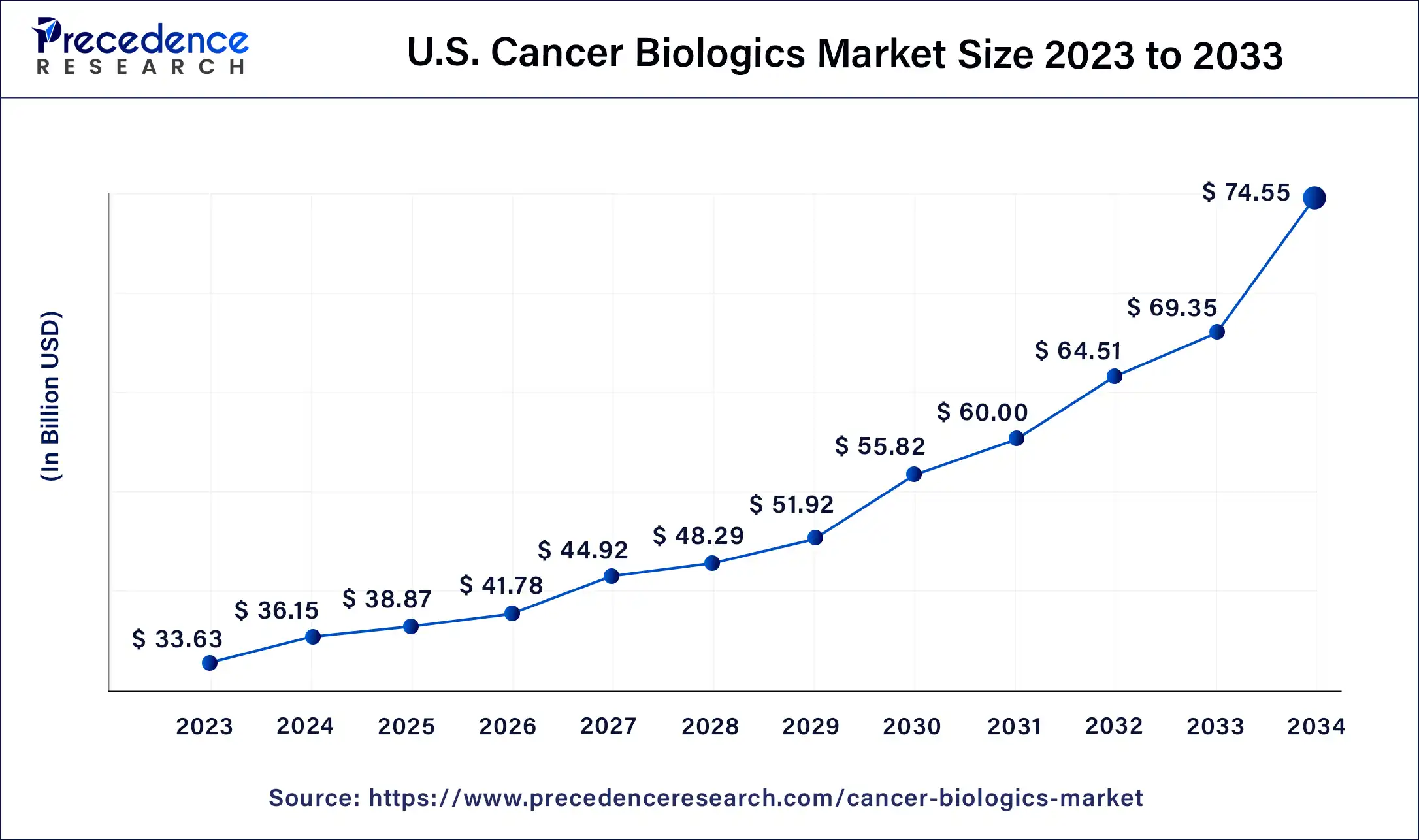

The U.S. cancer biologics market size was estimated at USD 33.63 billion in 2023 and is predicted to be worth around USD 74.55 billion by 2034, at a CAGR of 7.5% from 2024 to 2034.

North America led the cancer biologics market in 2023. Geographic variations in cancer rates are assumed to be mostly due to variances in lifestyle factors, such as smoking, which are found to be connected with a considerable fraction of diagnoses in North America. The need for cancer biologics is increased by the rising incidence and prevalence of cancer among North American populations, which has led to a growth in the market for cancer biologics in the region.

Throughout the forecast period, the cancer biologics market by geography is expected to rise gradually in Asia Pacific. The demand for cancer biologics has surged due to the increasing cancer prevalence in the Asia Pacific population, and as a result, the market for cancer biologics is expanding in this region. Owing to the surge in demand for cancer biologics, the major participants in the Asia-Pacific cancer biologics market are Novartis International AG, Pfizer Inc., Roche Holding AG, Merck & Co., Inc., and AstraZeneca plc.

The cancer biologics market refers to the industry that offers drug or medicines used to treat cancer or to prevent cancer, which are derived from biological sources, including living organisms or their components. Typically, biologics are complex large molecules produced through biotechnological processes. The common types of cancer biologics include monoclonal antibodies, cytokines, cancer vaccines, checkpoint inhibitors, targeted therapies, etc.

Biologics also offers targeted and fewer proxy treatment options compared to traditional chemotherapy, which aims to improve the outcomes of cancer patients. The causes of cancers include lifestyle choices, environmental factors, chronic inflammation, hormonal factors, immune system dysfunction, family history, genetic factors, and viral infection.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 7.3% |

| Global Market Size in 2023 | USD 102.01 Billion |

| Global Market Size in 2024 | USD 109.46 Billion |

| Global Market Size by 2034 | USD 221.43Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Drug Class, By Applications, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising incidence of cancer

The increasing incidence of cancer can be the driving factor in the cancer biologics market. As the number of cancer patients rises in the cancer biologics market, pharmaceutical companies may invest more resources in research, developing, and commercializing biologics to meet the growing demand for cancer biologics.

Rising awareness about cancer biologics can be the driving factor in the market. Cancer biologics are drugs or medicines used to treat or prevent cancer derived from biological sources, including living organisms or their components.

Risks associated with biologics

The risk associated with biologics can be a restraint to the cancer biologics market. People are more concerned about the health and the side effects of biologics, including allergy reactions and common infections. People who take biologics are more likely to get infections such as pneumonia, upper respiratory infections, urinary tract infections, skin infections, opportunistic infections, and types of infections that are less common in healthy people and more common in people whose immune systems are impaired. Some examples of such opportunistic infections include tuberculosis, hepatitis B, and fungal infections such as histoplasmosis.

Advancement in biotechnology

The advancement in biotechnology of cancer biologics can be an opportunity for the cancer biologics market. The advances in biotechnology include next-generation sequencing, also known as NGS, CRISPER-Cas9 gene editing, and single-cell analysis, which have enabled research to understand the genetic mutation driving cancer and develop biologics for cancer patients.

The monoclonal antibodies segment dominated the cancer biologics market in 2023. The monoclonal antibodies are segmented into conjugated monoclonal antibodies, naked monoclonal antibodies and bispecific monoclonal antibodies. Monoclonal antibodies are a category of proteinious structures made in the laboratory that can bind to certain targeted antigens on the surface of cancer cells. A monoclonal antibody is produced from a cell lineage made by cloning a unique white blood cell. Examples of monoclonal antibodies include trastuzumab (Herceptin) for HER2, which is useful for breast cancer, and rituximab for lymphoma cancer.

The cancer growth inhibitors segment is expected to grow to the highest CAGR in the cancer biologics market by application during the forecast period. The cancer growth inhibitors are segmented into tyrosine kinase inhibitors, mTOR inhibitors, and proteasome inhibitors. Cancer growth inhibitors are drugs that interfere with the growth and proliferation of cancer cells. They work by targeting specific molecules that are crucial for cancer sale survival and replication. These cancer inhibitors can act through various mechanisms, including blocking cell signaling pathways, inhibiting DNA replication, or promoting sale death in cancer cells.

The blood cancer segment dominated the cancer biologics market by application in 2023. Blood cancer is also known as hematological malignancy, which refers to cancers that affect the blood, bone marrow, and lymphatic system. There are different types of blood cancer, including leukemia, lymphoma, and multiple myeloma, each with its own sub-types and characteristics. This cancer typically involves the uncontrolled growth of abnormal cells in the areas disrupting the normal functioning of the blood and immune system; when the growth of cells is completed, then the gland is known as a cancer cell.

The lung cancer segment is projected to grow to the highest CAGR in the cancer biologics market by application during the forecast period. Lung cancer is a cancer that affects the lungs. It is the most common type of cancer, and this cancer is caused by smoking or exposure to secondhand smoke, air pollution, or certain chemicals. There are two types of lung cancer, non-small-cell lung cancer and small-cell lung cancer. Both cancers have different characteristics and treatments.

The hospitals segment dominated the cancer biologics market by end-user, in 2023. Hospitals always offer oncology department services, which include treatment and ensuring the availability of biologics. Many hospitals are engaged in cancer research and clinical trials for adopting new biologics. Additionally, the hospital provides cancer care services, including surgery, chemotherapy, diagnostics, and biological therapies. Also, the reimbursement policy is often in favor of hospitals providing cancer care services and incentivizing healthcare providers to offer cancer biologics in healthcare settings.

The cancer centers segment is expected to grow to the highest CAGR in the cancer biologics market by end-users during the forecast period. Cancer center offers multidisciplinary care, which involves collaboration among oncologists, researchers, surgeons, and other specialists according to the type of cancer, which provides personalized treatment plans for patients.

Segments Covered in the Report

By Drug Class

By Applications

By End use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

September 2024

September 2024

October 2024