January 2025

Cannabis Testing Services Market (By Testing Type: Microbial Analysis, Heavy Metal Testing, Potency Testing, Residual Testing, Pesticide Testing, Terpene Profiling, Others; By End-Use: Cannabis Cultivators, Cannabis Drug Manufacturers, Research Institutes) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

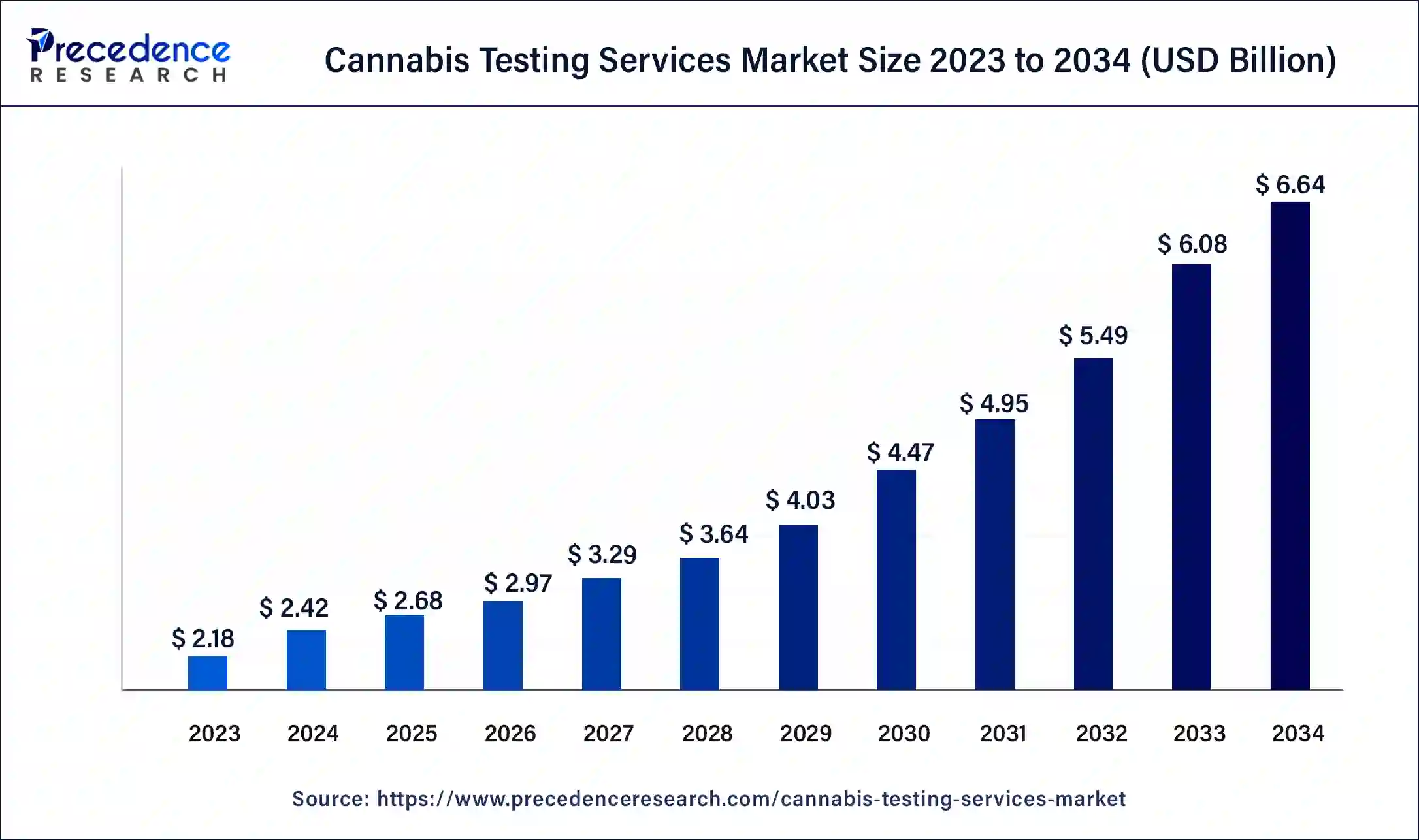

The global cannabis testing services market size is estimated at USD 2.42 billion in 2024 and is expected to reach around USD 6.64 billion by 2034, expanding at a CAGR of 10.61% from 2024 to 2034.

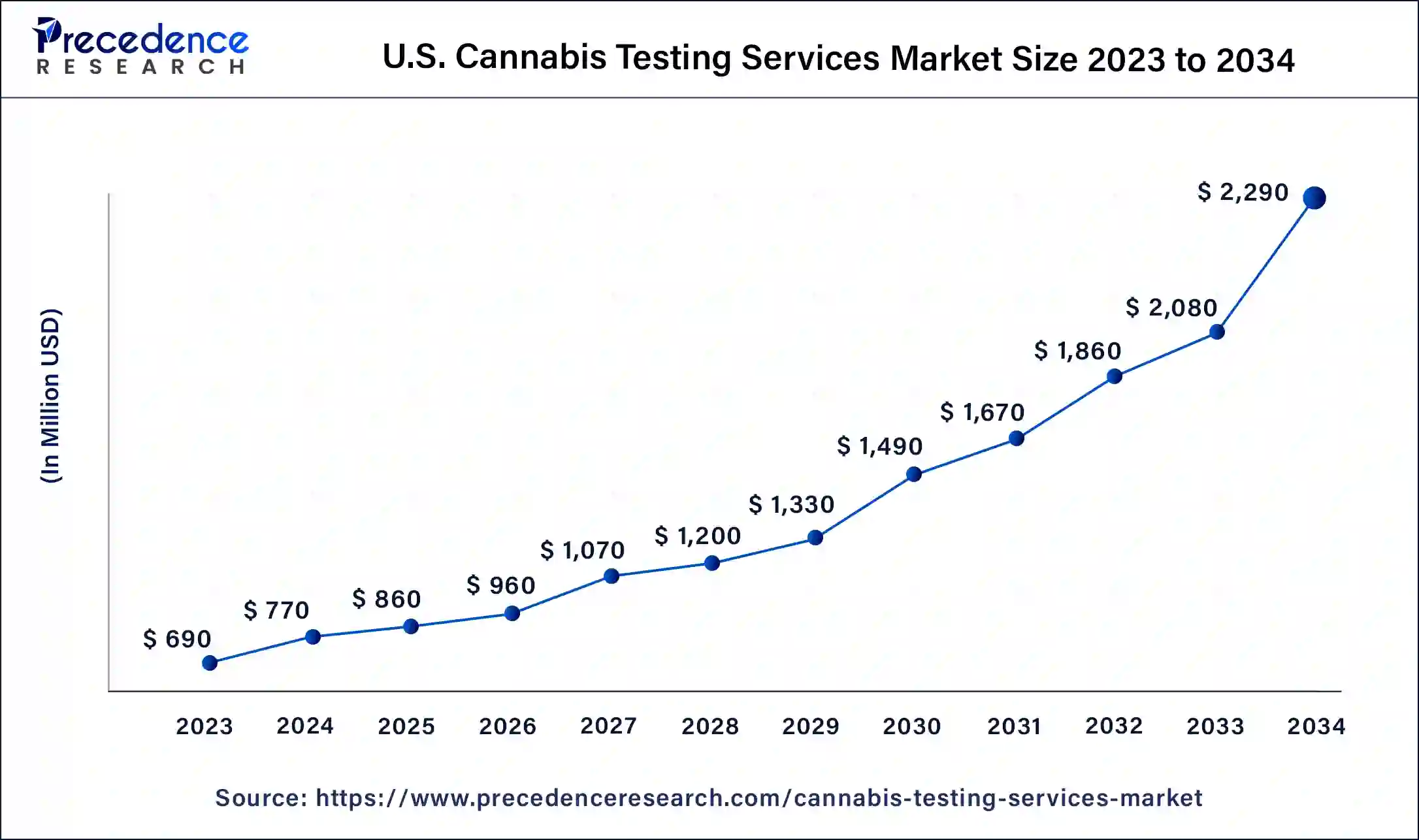

The U.S. cannabis testing services market size was valued at USD 690 million in 2023 and is predicted to be worth around USD 2,290 million by 2034, at a CAGR of 11.52% from 2024 to 2034.

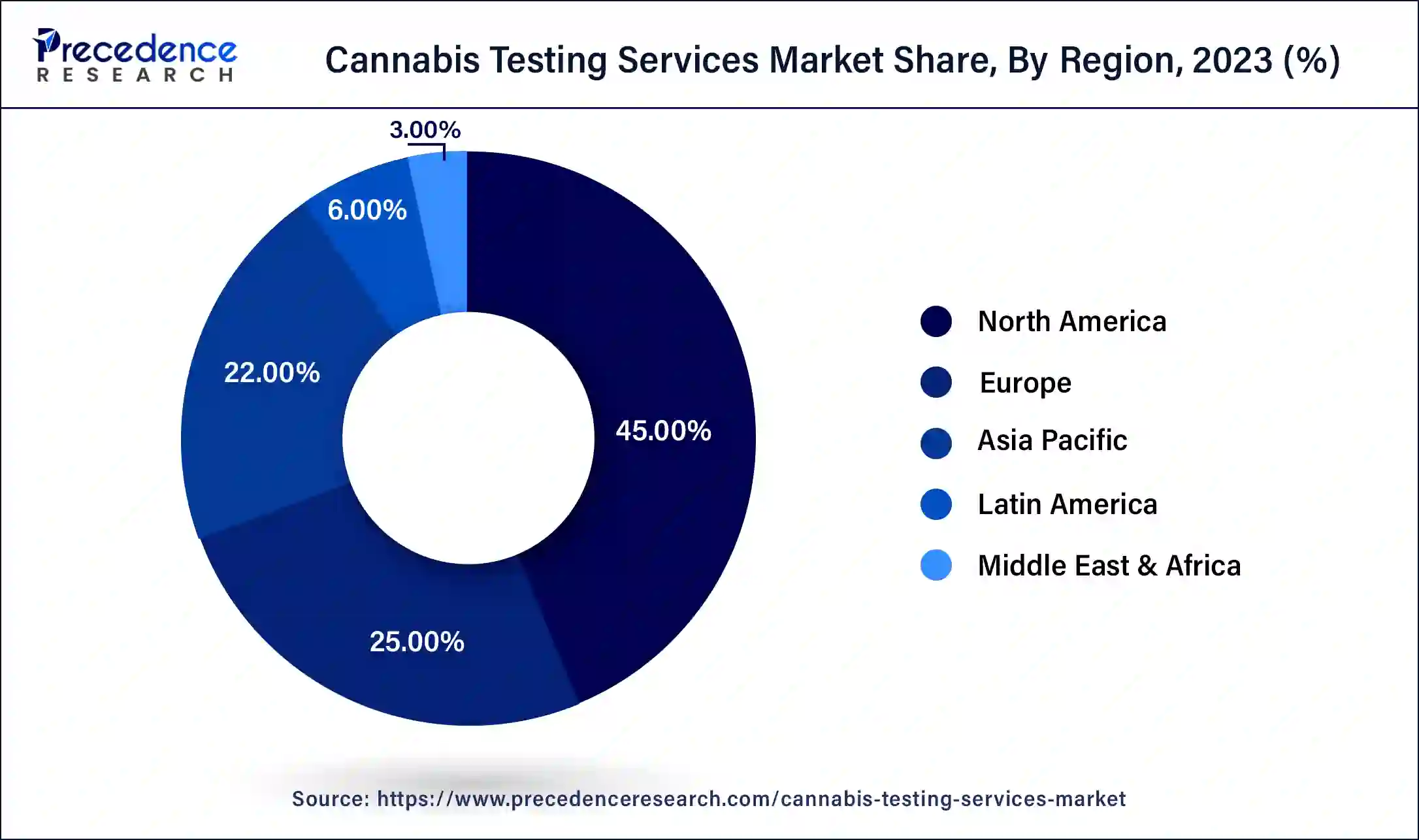

North America dominates the global cannabis testing services market and generated more than 45% of the revenue share in 2023. The United States is the largest market in North America, with Canada following closely behind. In the United States, cannabis testing services have become increasingly important in recent years as more states have legalized cannabis for medical and recreational use. Cannabis testing services are crucial for ensuring the safety and quality of cannabis products and compliance with state regulations.

North America is witnessing a rising prevalence of neurological illnesses, including epilepsy, anxiety, and ADD. According to the Centre for Disease Control and Prevention (CDC), approximately 1.2% of the United States population have active epilepsy. CBD compounds obtained from cannabis plants are considered an ideal component for reducing symptoms of neurological disorders. The rising cases of such illnesses will boost the demand for advanced cannabis or CBD products; this is intended to accelerate the number of cannabis testing services in North America.

Europe is predicted to be the most lucrative market for cannabis testing services. The rising legalization of cannabis products in various geographical areas and increasing awareness about the health benefits of cannabis in the medical sector are observed to boost the market’s growth. The market is also expected to benefit from advancements in testing technology, which will enable faster and more accurate testing of cannabis products.

Asia Pacific is another fastest-growing region for the cannabis testing services market. Cannabis has a long history of traditional use for medicinal and religious purposes in various Asian countries, especially in India. In recent years, there has been growing interest in the potential therapeutic benefits of cannabis, and there are efforts to legalize medical cannabis in India. The increasing importance of medical marijuana is observed to raise the number of cannabis testing services. Additionally, the presence of technology, available capital for investing in testing facilities, and potential key players in the region are expected to boost the growth of the market in the upcoming years.

China is a major producer of hemp, which is a strain of cannabis that contains low levels of THC and is used in a variety of industrial applications. As the global market for hemp products continues to grow, there may be opportunities for testing services related to hemp production in China.

The Latin American cannabis testing service market is growing with significant potential. Several countries in the region, including Uruguay, Colombia, and Mexico, have legalized cannabis for medical and/or recreational use, and others are considering legalizing cannabis in the near future. This has created a growing demand for testing services to ensure the safety and quality of cannabis products.

The Middle East and Africa cannabis testing service market is still in its early stages due to the strict regulations surrounding cannabis in the region. However, as the global trend toward the legalization of cannabis continues, the Middle East is slowly opening up to the idea of medical cannabis and exploring its potential benefits. As a result, there is an emerging market for cannabis testing services in the region.

Cannabis testing services play a crucial role in ensuring the safety and quality of cannabis products. With the increasing demand for cannabis for both consumer health and recreational purposes, it is essential to ensure that the products are safe for consumption and meet regulatory standards. These services may be performed by independent testing labs, government agencies, or in-house by cannabis cultivators, processors, and manufacturers.

Moreover, the rising legalization of medical marijuana and cannabis cultivation in various geographical areas is observed to increase the number of cannabis testing services globally. Cannabis contains compounds called cannabinoids, such as THC and CBD that have potential therapeutic effects for conditions such as chronic pain, nausea and vomiting due to chemotherapy, and muscle spasms caused by multiple sclerosis. As a result, many countries have legalized cannabis for medical purposes.

In March 2023, The House Economic Development and Finance Committee in Minnesota passed the marijuana legalization bill in Minnesota. The committee has approved the testing services and safe/secure delivery of cannabis under the recently passed bill.

According to the German government, patients with certain serious illnesses, such as chronic pain, multiple sclerosis, and cancer, can access medical cannabis with a prescription from a doctor. Under German law, medical cannabis can be prescribed in the form of dried flowers, extracts, or finished pharmaceutical products. Patients can obtain medical cannabis from pharmacies approved by the Federal Institute for Drugs and Medical Devices (BfArM). The rising market for cannabis cultivation has highlighted the importance of cannabis testing services in various geographical areas.

Overall, the cannabis testing services market is expected to continue its growth trajectory as the demand for cannabis products increases and regulations become stricter.

As more companies enter the cannabis industry, there is a need to differentiate themselves by offering high-quality and safe products; the rising competition in the cannabis industry is driving the demand for testing services to ensure the safety and quality of cannabis products.

Along with this, strict testing regulations for hemp and cannabis offer assurance of the safety and quality of cannabis products, which expands the consumer base. Several testing agencies are focused on pesticide testing to avail additional quality testing of cannabis and hemp.

In November 2022, the Department of Business Regulation in the province of Rhode Island went through strict pesticide testing for marijuana; the department destroyed all nine marijuana samples that failed the pesticide testing as none of them were capable of human consumption. The rising importance of testing services for cannabis highlights the bright future of the global cannabis testing services market.

The cannabis testing services market has seen significant technological advancements in recent years; these technological advancements, such as the deployment of infrared spectroscopy, DNA testing, portable testing devices, and gas chromatography, are helping to improve the accuracy, speed, and accessibility of cannabis testing services, allowing for better quality control and safety in the cannabis industry.

However, the cannabis industry is still subject to federal prohibition in several countries, which can limit the growth and development of the industry. In addition, regulatory and compliance challenges can make it challenging for cannabis testing services providers to navigate the market.

| Report Coverage | Details |

| Market Size in 2023 | USD 2.18 Billion |

| Market Size in 2024 | USD 2.42 Billion |

| Market Size by 2034 | USD 6.64 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 10.61% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Testing Type, End-Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising involvement of government and regulatory bodies in ensuring the quality of cannabis products.

With the legalization of medical marijuana and other CBD products, governments have started regulating the testing of cannabis products considering public health concerns; this is observed to support the growth of the cannabis testing services market. Cannabis is a complex plant with many active compounds, and the effects of these compounds can vary widely depending on the strain and growing conditions; testing can help to identify the potency of the product, as well as any contaminants or harmful substances that may be present.

The UK's Medicines and Healthcare products Regulatory Agency (MHRA) has issued guidelines for the testing before the distribution of CBD products, expressing concerns about the safety of cannabis products, particularly in relation to the potential health risks associated with their use. The MHRA has also warned that unlicensed CBD products, which may be available online or in unregulated outlets, may not meet these standards and pose health risks to consumers.

The high cost required for setting up cannabis testing facility.

Setting up a cannabis testing facility can be expensive, and the ongoing costs of maintaining equipment and personnel can be significant. Quality control measures and personnel training to ensure the accuracy and reliability of testing results add to the high price required in setting up cannabis testing facilities. Professionals involved in cannabis testing services command high salaries considering the current demand and required skills. Cannabis testing facilities face significant liability risks, and high levels of insurance coverage add to the overall costs.

Moreover, testing facilities require sophisticated equipment, such as high-performance liquid chromatography (HPLC), gas chromatography-mass spectrometry (GC-MS), and inductively coupled plasma mass spectrometry (ICP-MS). These instruments are expensive to purchase, maintain, and calibrate. These costs can be a barrier to entry for smaller companies and startups, which is considered a significant restraint for the growth of the cannabis testing services market.

Deployment of portable testing devices.

The rising requirement for cannabis testing across the globe demands faster yet more reliable testing services to meet the market demand. Deployment of portable testing devices is observed to offer significant growth opportunities to market players by boosting the speed and accuracy of testing. The global market is witnessing a growing demand for portable testing devices that can be used in the field, allowing for rapid testing of cannabis products on-site. Advances in portable testing technology have led to the development of handheld devices that can detect THC levels and other essential compounds in cannabis products in just minutes. These devices allow for on-the-spot analysis of the potency and purity of cannabis samples.

Advanced portable devices are even capable of testing the chemical composition of cannabis flowers. Such devices offer better quality control for companies involved in the market. MyDx Analyzer, CannaDx Sensor, Purpl PRO, and TCheck are a few of the portable testing devices currently available in the global cannabis testing services market.

Covid-19 Impacts:

The Covid-19 pandemic has had a mixed impact on the cannabis testing service market, with increased demand for testing services offset by supply chain disruptions and multiple financial constraints on businesses. The pandemic has had economic impacts on businesses, including those in the cannabis industry. Some cannabis testing labs have had to reduce their operations or even shut down due to financial constraints during this critical period; this has affected the availability of testing services in some areas.

The pandemic has disrupted supply chains and logistics, leading to delays and shortages of testing supplies and equipment. This has affected the ability to test labs to operate at total capacity and has resulted in longer turnaround times for testing results. Moreover, the additional expenses for implementing safety and hygiene measures at testing facilities during the Covid-19 pandemic impacted the financial management of the key players.

The pandemic has led to changes in regulatory policies, with some governments relaxing regulations to ensure that cannabis products are available to patients who need them. This has led to an increased demand for testing services to ensure compliance with regulatory standards. On the other hand, with the pandemic spreading globally, people have become more conscious of their health and safety. The cannabis industry has seen a surge in demand for products as people seek relief from anxiety, depression, and other health issues. This has led to an increased demand for cannabis testing services to ensure the safety and quality of the products.

The potency testing segment holds the largest share of the global cannabis testing services market. Potency testing has become a vital testing phase for cultivators to optimize their growing methods and produce consistent strains with specific cannabinoid profiles. By analyzing the potency of their cannabis samples, cultivators can adjust their growing methods to produce higher or lower concentrations of particular cannabinoids. Moreover, the regulations on cannabis drugs are associated with the concentration of THC and CBD in cannabis; the potency segment helps determine the concentration of THC and CBD. The rising consumption of cannabis for medical purposes will supplement the growth of the potency segment.

At the same time, the rising requirement for analyzing the detailed chemical composition of cannabis, especially from the pharmaceutical sector, is expected to boost the growth of the terpene profiling segment. Testing for terpenes can ensure that the product is accurately labeled and contains the expected levels of terpenes, which is essential for medical and recreational cannabis consumers.

The cannabis cultivators segment accounts for the largest revenue share of over 63% in the global cannabis testing services market. Considering the stricter regulations and guidelines for the manufacturing and distribution of cannabis and cannabis-derived products, along with the rising consumer safety concerns, cannabis cultivators need testing services to ensure they are safe for human consumption and meet specific quality standards.

On the other hand, the cannabis drug manufacturer segment is expected to register growth at a significant CAGR rate. Medical marijuana qualifies for the treatment of HIV/AIDS, glaucoma, and muscle spasms. The increasing prevalence of chronic diseases has highlighted the importance of cannabis in the medical sector; many countries have started the legalization of medical marijuana by considering the benefits of cannabis; this is observed to fuel the growth of the cannabis drug manufacturer segment.

In addition, drug manufacturers also need to test the finished products that contain cannabis or cannabis-derived ingredients, such as pharmaceuticals. This testing helps to ensure that the finished product is safe and effective for its intended use.

Recent Developments

Segments Covered in the Report:

By Testing Type

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

November 2024

October 2024

April 2025