March 2025

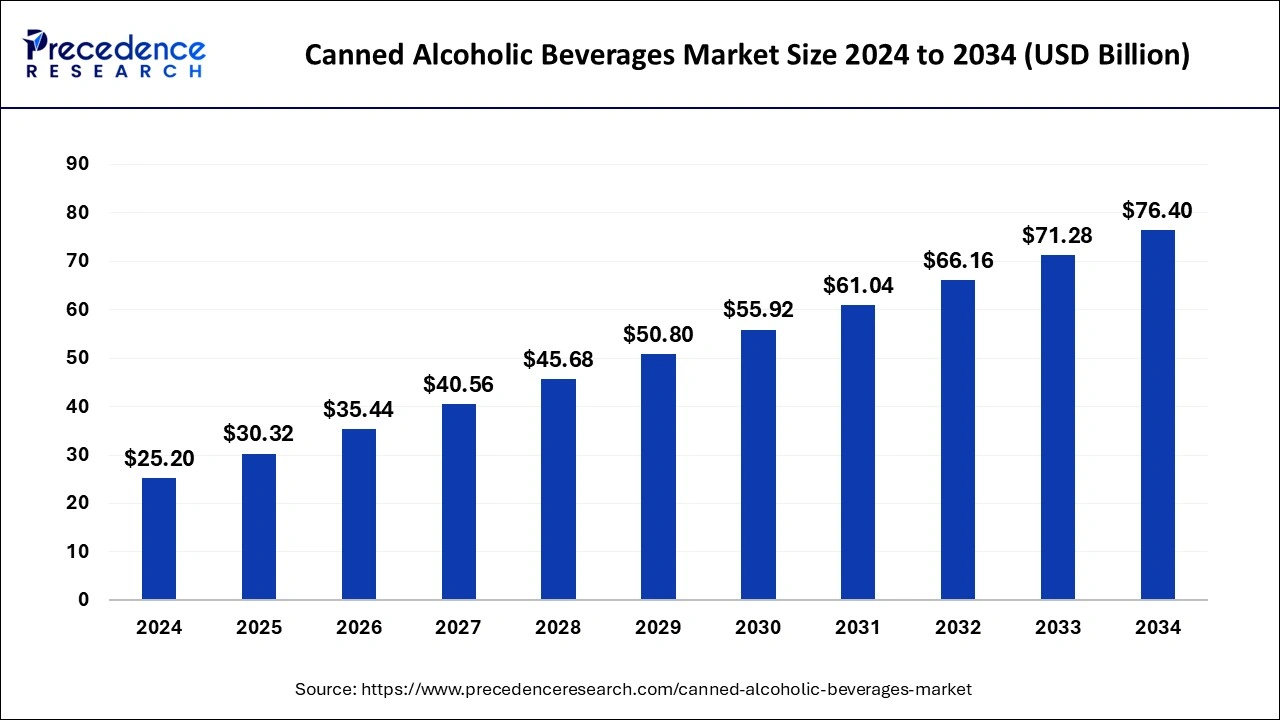

The global canned alcoholic beverages market size is calculated at USD 30.32 billion in 2025 and is forecasted to reach around USD 76.40 billion by 2034, accelerating at a CAGR of 11.73% from 2025 to 2034. The North America canned alcoholic beverages market size surpassed USD 23.94 billion in 2024 and is expanding at a CAGR of 11.76% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global canned alcoholic beverages market size was estimated at USD 25.20 billion in 2024 and is predicted to increase from USD 30.32 billion in 2025 to approximately USD 76.40 billion by 2034, expanding at a CAGR of 11.73% from 2025 to 2034. The rising demand for convenient alcoholic beverages is expected to boost the growth of the global canned alcoholic beverages market.

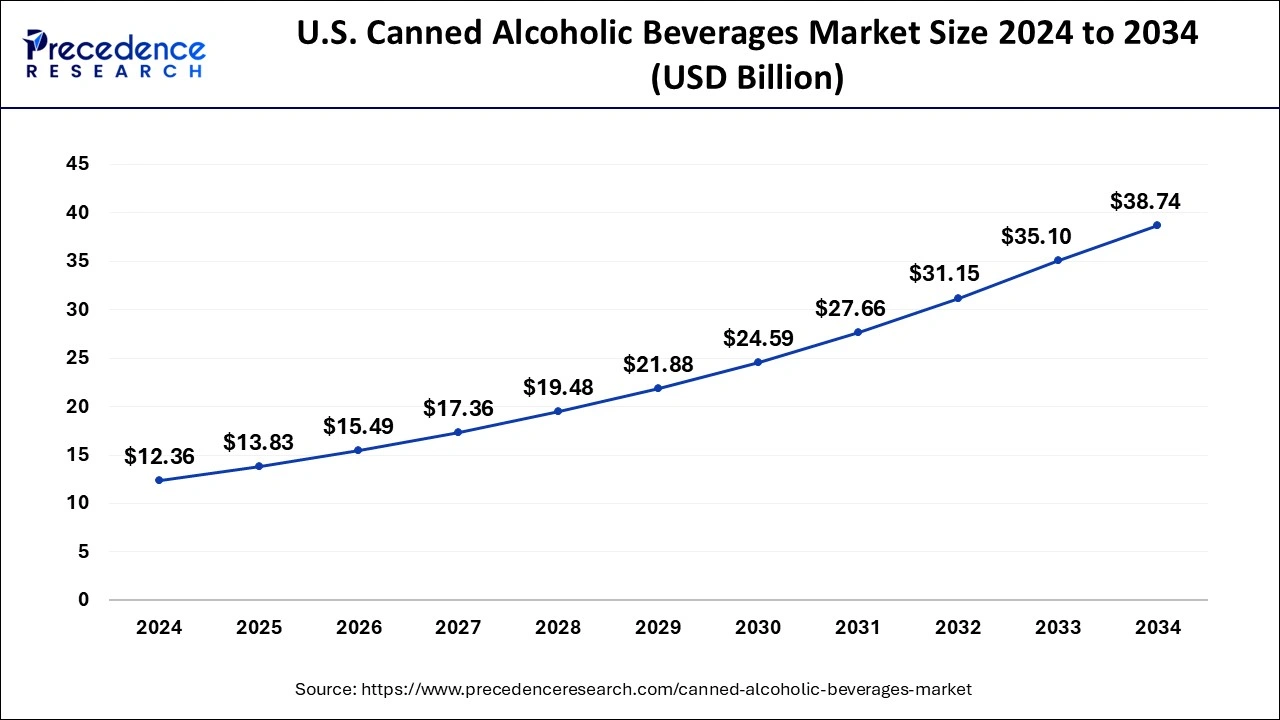

The U.S. canned alcoholic beverages market size was valued at USD 12.36 billion in 2024 and is expected to reach USD 38.74 billion by 2034, growing at a CAGR of 12.10% from 2025 to 2034.

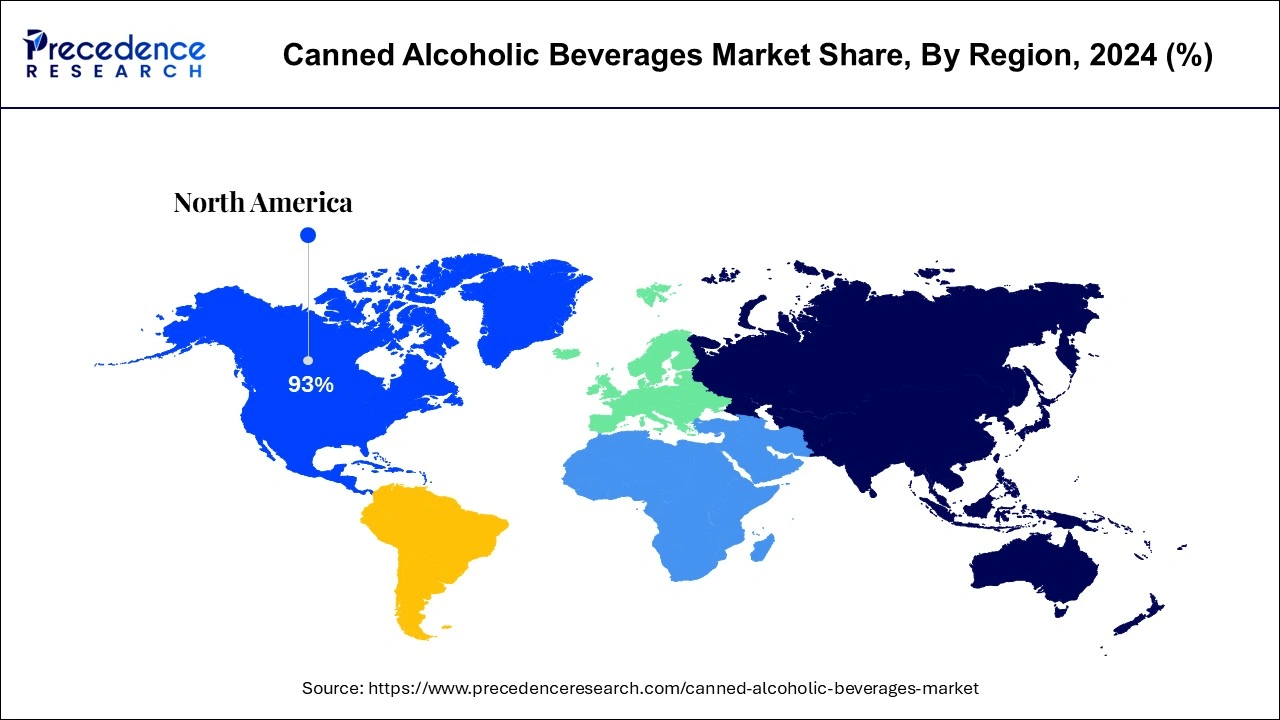

North America holds the largest share of around 93% in 2024. The availability of a wide range of alcoholic beverages in the region has supplemented the growth of the canned alcoholic beverages market. Along with this, the rising spending on alcoholic drinks in the region is expected to maintain North America’s growth. Moreover, the increasing demands for premium and super-premium alcoholic beverages, especially beer and vodka, are fueling the development of the canned alcoholic beverages market in North America.

Asia Pacific is expected to grow at a noticeable CAGR of 29.34% during the forecast period. The growth of the canned alcoholic beverages market in Asia Pacific is attributed to the availability of affordable alcoholic beverages. The shifting interest towards canned beverages in Asia Pacific is expected to boost the growth of the market. Asahi Group Holdings, Sula Vineyards and Suntory Holdings Limited are a few prominent manufacturers of canned alcoholic beverages in Asia Pacific.

Europe is another largest marketplace for the canned alcoholic beverages market. The sudden shift of consumers towards premium and convenient alcoholic drinks has fueled the growth of the canned alcoholic beverages market in Europe. The enormous demand for functional alcoholic beverages in the region is predicted to boost the market’s growth during the projected timeframe.

At the same time, emerging economies and rising disposable income are observed as significant factors in boosting the market’s growth in Latin America, the Middle East and Africa. However, the ban on alcohol production in a few Middle Eastern countries hampers the market’s growth.

Canned alcoholic beverages are premixed cocktails packed in a metal container. The cans used for holding alcoholic beverages are made up of either aluminum or steel. The utilization of cans for alcoholic beverages has increased in recent years with growing demand for premiumization of packaging for alcoholic beverages. Moreover, the preference for canned alcoholic beverages is rising across the globe as can preserve the taste of beverages and they are capable of serving the beverages fresh.

Canned alcoholic beverages are comparatively stable, as aluminum or steel can reduce oxidation. The cans used for alcoholic beverages also offer prolonged shelf life and preserve the beverages even in adverse weather conditions. Generally, vodka, beer, and other cocktails are packaged in cans to protect the inner product from intense heat.

The global canned alcoholic beverages market is expected to witness noticeable growth during the forecast period. The rising demand for convenient alcoholic beverages is one of the most significant factors to drive the growth of the canned alcoholic beverages market. Canned beverages are travel friendly and portable; the convenience offered by canned alcoholic beverages is fueling the growth of the market.

In recent years, many governments have approved the sales of canned alcoholic beverages in supermarkets, this factor is driving the market’s growth. However, the rising environmental concerns are likely to hinder the growth of canned alcoholic beverages market.

Other factors such as rising disposable incomes, emerging economies and rapidly rising interest in alcoholic beverages across the globe are expected to boost the growth of canned alcoholic beverages market. Moreover, the rising demand for ready-to-drink beverages worldwide is fueling the growth of canned alcoholic beverages market.

The rising focus on business strategies to expand the product line in the alcoholic beverages industry is supplementing the market’s growth. Additionally, companies involved in the global canned alcoholic beverages market are turning their sales of alcohol beverages online, the convenient availability of beverages online is highlighting the growth of the market. 5Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 11.73% |

| Market Size in 2025 | USD 30.32 Billion |

| Market Size by 2034 | USD 76.40 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Alcoholic Content and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increased demand for convenient alcoholic beverages

Canned alcoholic beverages are portable and lightweight. Cans used for alcoholic drinks hardly weigh up to 15 grams. Cans are unbreakable, which makes them travel-friendly and easy to dispose of. Canned alcoholic beverages are stackable and also provide an easy storage option as the material used for packaging protects the inner liquid from light or excess oxygen.

Aluminum or steel cans are a durable and accessible form of drinking. Canned alcoholic beverages offer convenience to drinkers and can be immediately consumed. The rising demand for convenient alcoholic drinks across the globe is observed as a significant driving factor for the market’s growth.

Expensive and complicated production of cans

Economically, aluminum and steel are costly as compared to plastic materials. The high production costs of cans for alcoholic beverages limit the involvement of small-scale alcoholic beverage manufacturers. The raw materials required to produce cans are 20-25% more expensive than plastic bottles. Apart from this, the initial investment in the machinery needed for the manufacturing process is hefty.

Additionally, the production of aluminum or steel cans for beverages is complex and consumes more electricity. Considering these limitations, the complicated and expensive production of cans required for packaging alcoholic beverages is prone to hamper the market’s growth.

The rising popularity of ready-to-drink alcohols

The rising trend of ready-to-drink alcoholic beverages promises a plethora of opportunities for the global canned alcoholic beverages market to grow. The market is witnessing an enormous demand for ready-to-drink canned alcoholic beverages as they offer convenience and a premium experience for drinkers. According to the distilled spirits council, the global consumption of ready-to-drink cocktails rose by 42.3% in 2021.

Moreover, prominent companies in the market are focused on the production of ready–to–drink alcoholic beverages. For instance, in October 2022, IMFL manufacturers Radico Khaitan Limited launched its ready-to-drink Magic Mix Vodka Cocktail with 4.8% alcohol; this beverage will be sold in the can packaging. The company has announced the launch of three variants, mojito, cosmopolitan and cola.

The hard seltzers segment dominated the global canned alcoholic beverages market in 2024. The hard seltzers alcoholic beverages are generally made of malted barley or grain-neutral spirits. The low-calorie content in the hard seltzers canned alcoholic beverages has fueled the growth of the hard seltzers segment. New product launches, increasing demand for gluten-free alcoholic drinks and rising health concerns are a few factors to maintain the development of the hard seltzers segment during the forecast period.

The wine segment is expected to grow at a CAGR of 14.30% during the forecast period. The growth of the wine segment is attributed to the rising premiumization of aluminum cans to offer a high-class drinking experience to consumers. The preference for white wine in canned packaging is rising as aluminum cans chill the white wine much faster than traditional bottles. The improving quality of packaging for canned wine will drive the growth of the wine product segment during the forecast period.

The ready-to-drink (RTD) segment is the fastest-growing segment of the global canned alcoholic beverages market, owing to the growing popularity of convenient at-home alcoholic beverages that can be consumed immediately after purchase. RTD canned alcoholic beverages are proven to keep the ingredients fresh for a long time. Moreover, the rising preference for travel-friendly canned beverages is observed to propel the growth of the RTD segment. Key players are focused on launching new attractive flavors in RTD canned alcoholic beverages; this promises a bright future for the segment’s development.

The medium alcohol content segment dominates the global canned alcoholic beverages market. The medium alcohol content can vary from 5% to 8% typically. These alcoholic beverages have a moderate number of calories and act as a regular brew. At the same time, the increasing production of light alcoholic beverages with refreshing flavors and tastes will serve as a driving factor for the growth of the light alcohol content segment.

The liquor stores segment accounts for over 55% of the total share of the global canned alcoholic beverages market. The liquor stores are generally located all over with the availability of a wide range of premium and private brands of alcoholic beverages. According to the survey by Chase Design, a New York-based human behavior strategy and design firm, 40% of people prefer choosing their favorite labels from liquor stores directly. Walmart and Costco are a few of the leading prominent in-store distributors of canned alcoholic beverages.

The online distribution channel segment is expected to witness a significant increase during the forecast period. Key players in the global canned alcoholic beverages market are focused on launching their websites to reach out to a wide range of consumers across the globe. In addition to this, consumers are inclined towards buying alcoholic beverages online due to the availability of multiple options, hassle-free doorstep delivery and easy payment options.

By Product

By Alcoholic Content

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

November 2024

March 2025

October 2024