April 2025

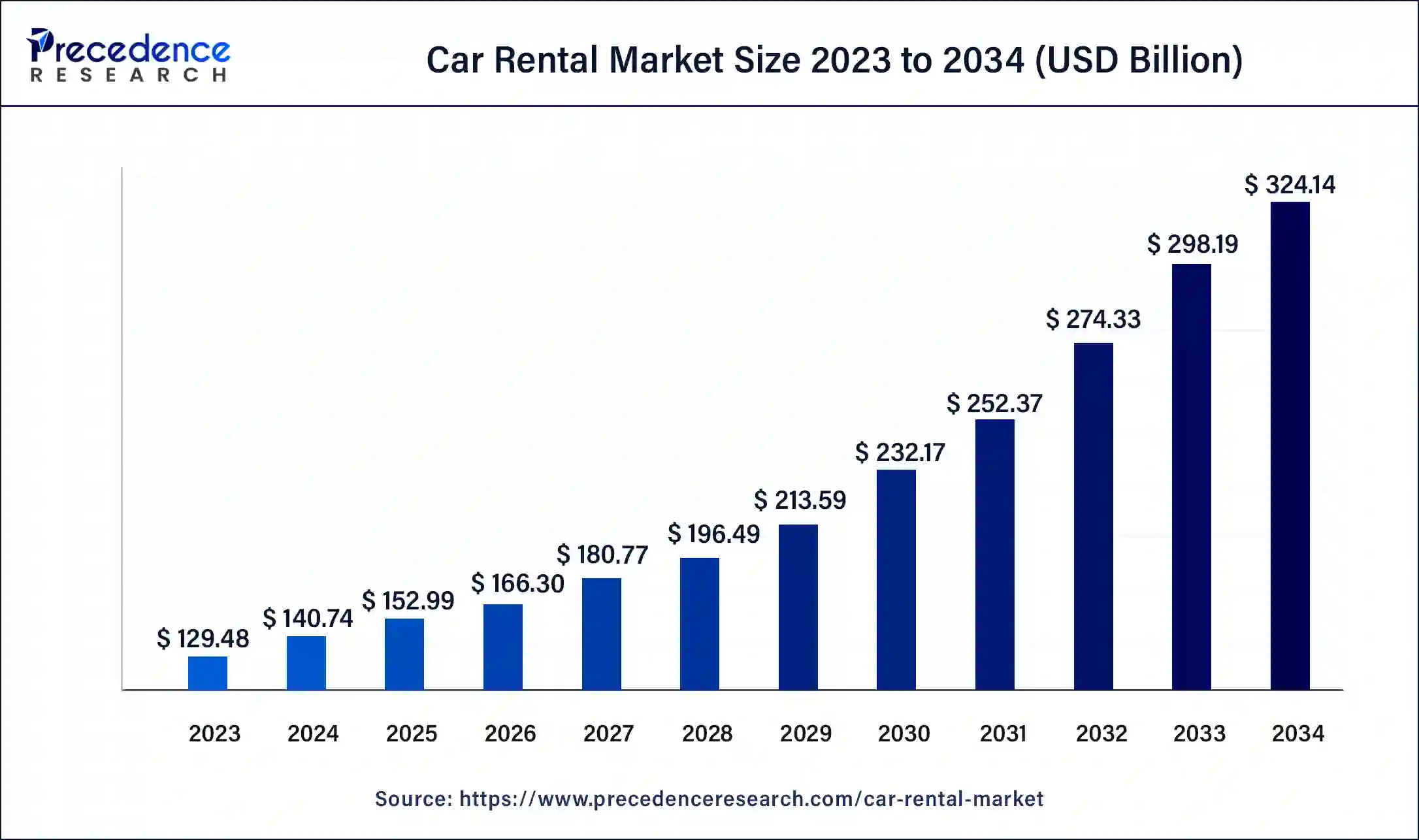

The global car rental market size is estimated at USD 152.99 billion in 2025 and is predicted to reach around USD 324.14 billion by 2034, accelerating at a CAGR of 8.70% from 2025 to 2034. The North America car rental market size surpassed USD 76.00 billion in 2024 and is expanding at a CAGR of 8.80% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global car rental market size was estimated at USD 140.74 billion in 2024 and is predicted to increase from USD 152.99 billion in 2025 to approximately USD 324.14 billion by 2034, expanding at a CAGR of 8.70% from 2025 to 2034.

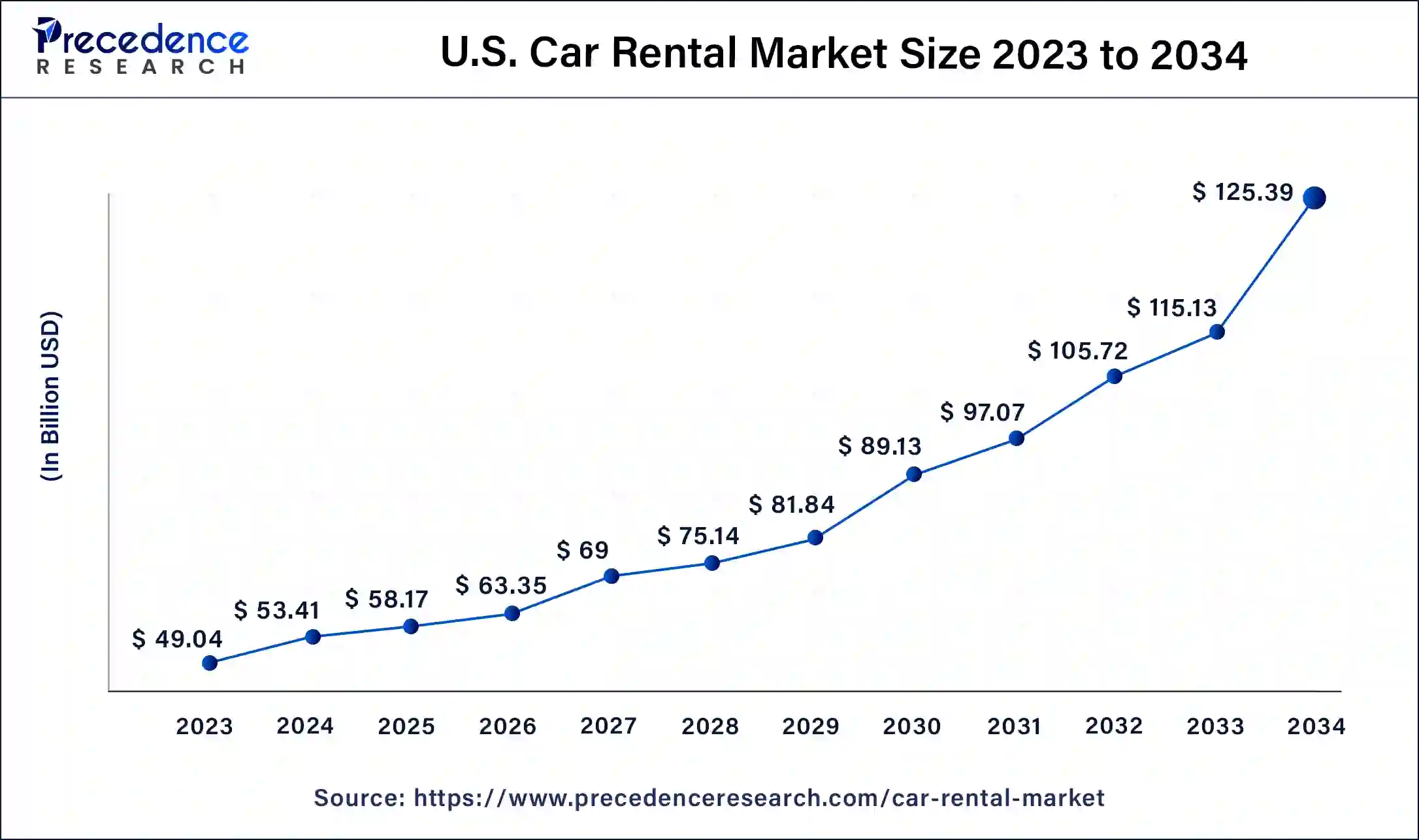

The U.S. car rental market size was estimated at USD 53.41 billion in 2024 and is predicted to be worth around USD 125.39 billion by 2034, at a CAGR of 8.90% from 2025 to 2034.

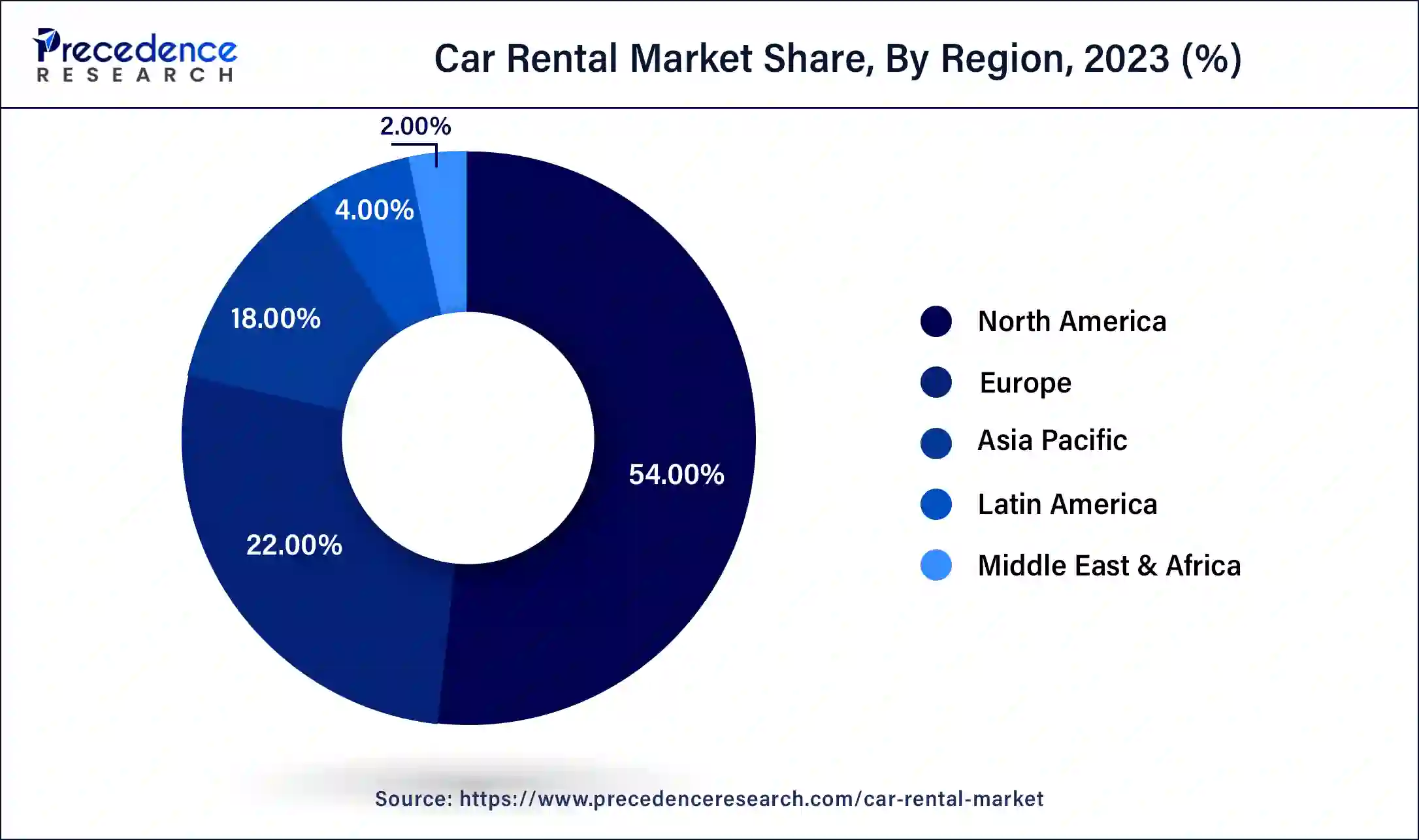

Based on the region, the North America region held 54% revenue share in 2024. The surge in number of leisure and business tours across the North America region is boosting the growth of market. The trips to North American cities such as New York, Los Angeles, Chicago, San Francisco, and Las Vegas are also paving way for the growth of the car rental market.

The U.S. is major contributor to the car rental market in North America. The market growth is driven by re-emergence of travel and tourism for both domestic and international tourism, flexibility offered by rental car service providers, growing use of online booking platforms offering a cost-effective and convenient option for travellers, rising popularity of electric vehicles (EVs), implementation of advance technological solutions such as self-serving kiosks and increased demand of rental cars in popular tourist destinations such as Florida, California, Las Vegas and New York.

The Asia-Pacific is expected to grow at a CAGR of 8.4% during the forecast period. The rise in consumer spending for tourism and traveling combined with rising disposable income is driving the growth of car rental market in the Asia-Pacific region during the forecast period. The market players such as Uber, Avis, Ola, Hertz, Didi Chuxing, Sixt, Zoomcar, Europcar, GrabTaxi, Hailo, Line Taxi, and Blue Bird are offering car rental services in the Asia-Pacific region.

The technology plays vital role for the growth and development of car rental market. The increased adoption of car rental software by key market players is driving the growth of the market. Moreover, the business of car rental service is quite profitable, where venture capitalists and angel investors are funding the startups to start their own car rental services. The startups such as Turo, Getaround, Zoomcar, Zipcar, Socar, and Kovi are the new market players in the car rental market.

The increased in internet penetration will create lucrative opportunities for the growth of the car rental market. The digitalization of developing and underdeveloped regions is also helping the market to grow at a rapid pace. Furthermore, the digital technologies have also helped market players to collect, store, and analyze passenger data to build long-term relationship with its customers.

However, the rise in low-cost public transportation may hamper the growth of car rental market. The government of developed regions is implementing policies for the growth of public transport industry. These government policies include a greater number of public buses and low-cost tickets. Thus, the increase in government activities and initiatives for the development of public transport infrastructure will restrict the growth of car rental market.

The factors such as rise in trend of on-demand transportation services and low rate of car ownership among millennials propel the growth of car rental market. Moreover, the adoption of car rental management technology will provide growth opportunities for car rental market players. However, the low rate of internet penetration in developing regions is hampering the growth of the market during the forecast period.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.5% |

| Market Size in 2024 | USD 140.74 Billion |

| Market Size in 2025 | USD 152.99 billion |

| Market Size by 2034 | USD 292.76 Billion |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Vehicle, By Application, and By Rental Duration |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Based on the vehicle type, the economy cars segment accounted for 35% of revenue share in 2024. The economy cars are very efficient in terms of fuel consumption. Most of the market players prefer economy cars for car rental services, owing to low maintenance and procurement costs. Also, economy cars are compact in nature and provide enough comfort to the passengers.

The executive cars segment is expected to hit 5.8% of CAGR during the forecast period. Executive cars are larger than economy cars but smaller than luxury cars. The regions such as Asia-Pacific and Latin America are flourishing with the strong economic growth, which also helps key market players to provide better transportation services. This factor is driving the growth of the executive cars segment.

Based on the application type, the airport transport segment has garnered a 43% revenue share in 2024. The increase in number of airports in developing regions is contributing towards the growth of airport transport segment. The increase in urbanization has also helped to increase the demand for the car rental services. The rise in upper middle-class group is also contributing for the growth of the market. As a result, the surge in demand for airport car rental services is creating lucrative opportunities for the growth of the segment.

The local usage segment is projected to reach 6.8% of CAGR during the forecast period. The demand for local cars and taxis has increased over the time period. The short trips and tours require car rental services for the local usage.

Based on the rental duration, the short-term segment dominated the global car rental market in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. The short-term duration rental cars are used for short trips, tours, and journeys. This type of rental duration car is also applicable for the local usage, airport transportation, and short distance outstation journeys.

On the other hand, the long-term is estimated to be the most opportunistic segment during the forecast period. The rental cars are used for long-term trips and journeys. It is mostly used for the outstation trips. The car rental service for long-term duration is also gaining traction for the family trips.

Companies Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting different marketing strategies, such as investments, partnerships, and mergers & acquisitions. The companies are also spending on the development of improved products. Moreover, they are also focusing on competitive pricing.

In March 2021, the Uber Technologies Inc. entered into partnership with car a rental company called CarTrawler to launch car rental service called Uber Rent.

The various developmental strategies such as partnerships, new product launches, acquisition, joint venture, R&D investments, and mergers fosters market growth and offers lucrative growth opportunities to the market players.

By Vehicle Type

By Application Type

By Rental Duration

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

November 2024