January 2024

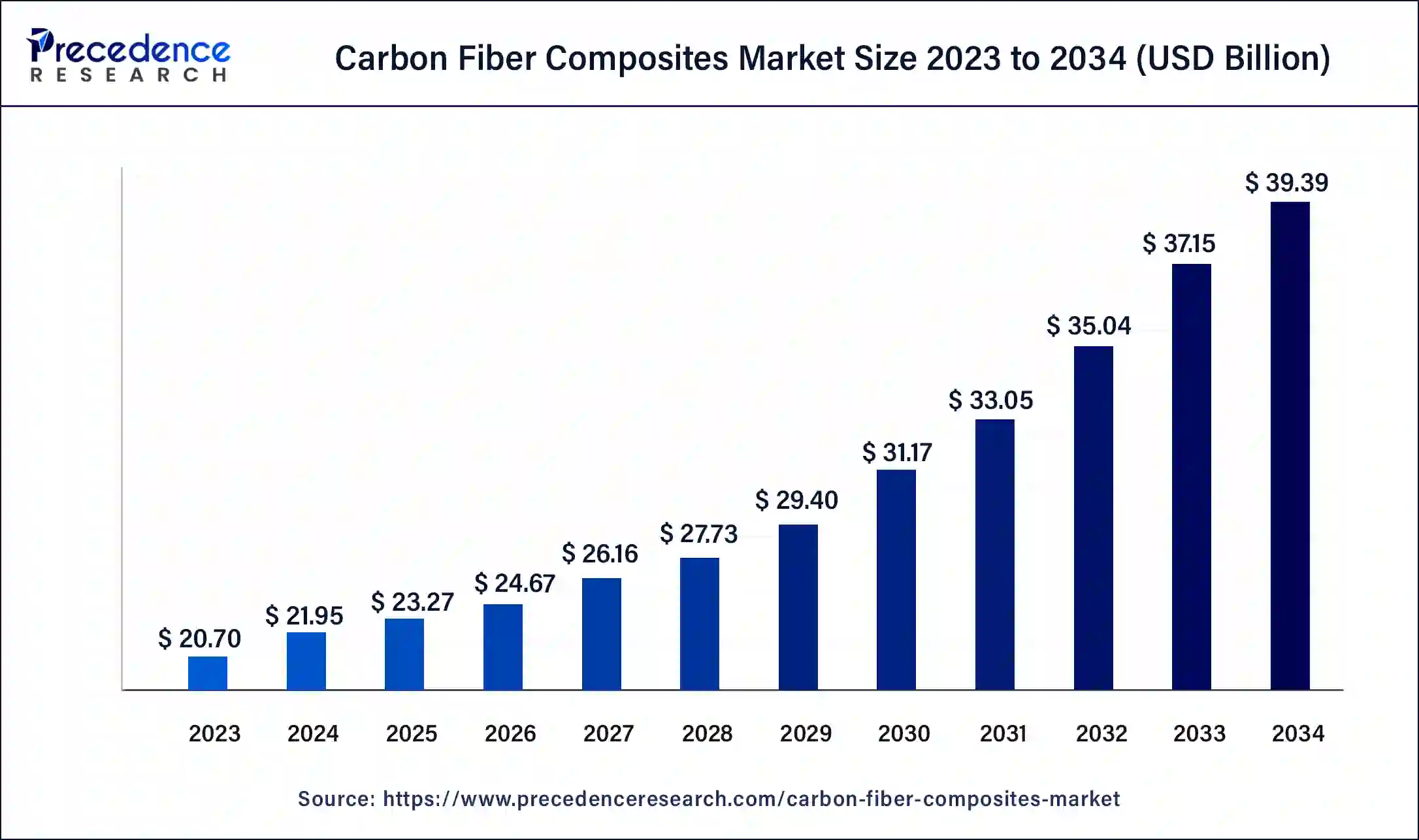

The global carbon fiber composites market size surpassed USD 20.70 billion in 2023 and is estimated to increase from USD 21.95 billion in 2024 to approximately USD 39.39 billion by 2034. It is projected to grow at a CAGR of 6.02% from 2024 to 2034.

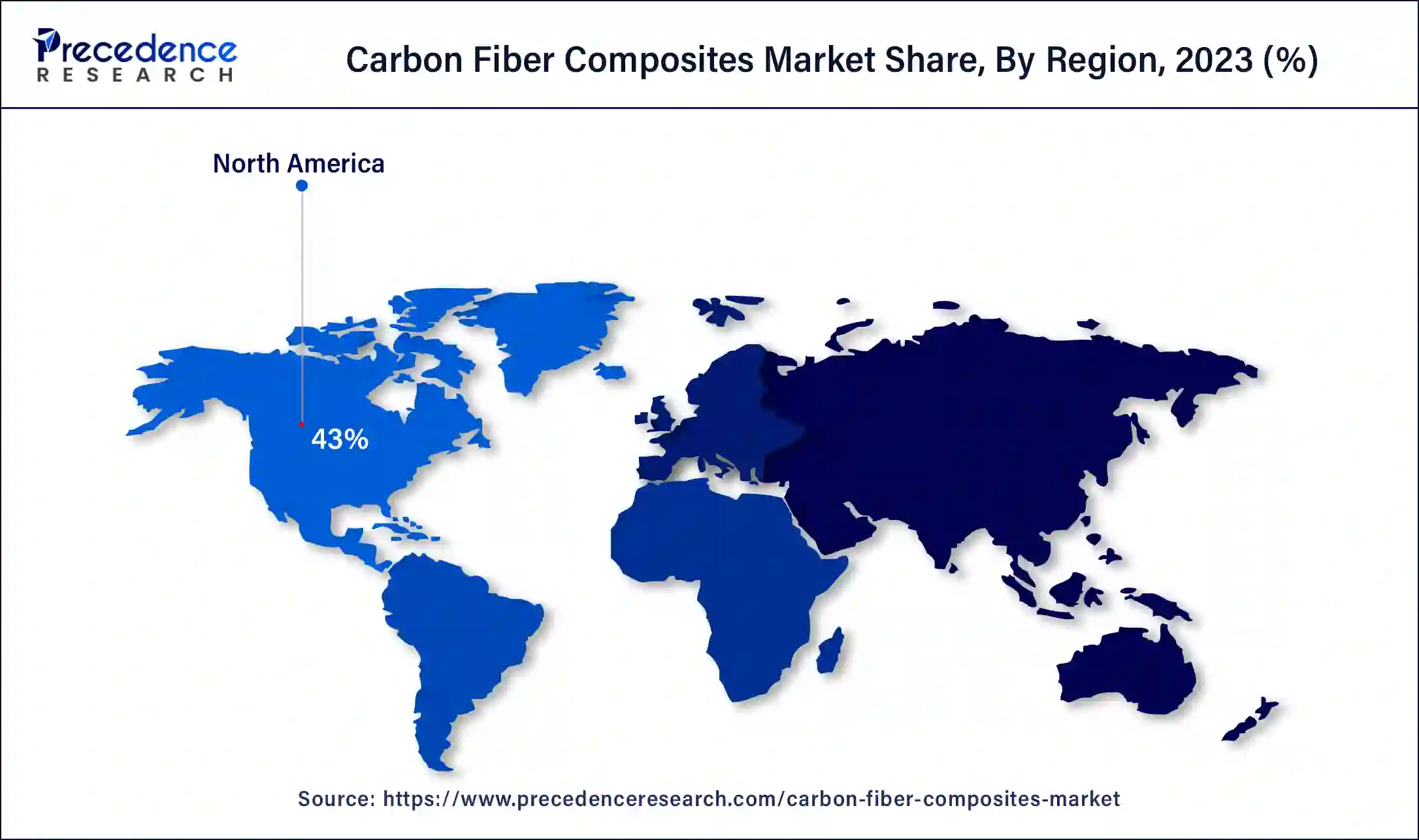

The global carbon fiber composites market size is projected to be worth around USD 39.39 billion by 2034 from USD 21.95 billion in 2024, at a CAGR of 6.02% from 2024 to 2034. The North America carbon fiber composites market size reached USD 8.90 billion in 2023. The increasing demand is expected to grow due to the increasing manufacturing of aircraft, automobiles, and construction, as well as rising carbon fiber production capacity, promotes the growth of the carbon fiber composites market.

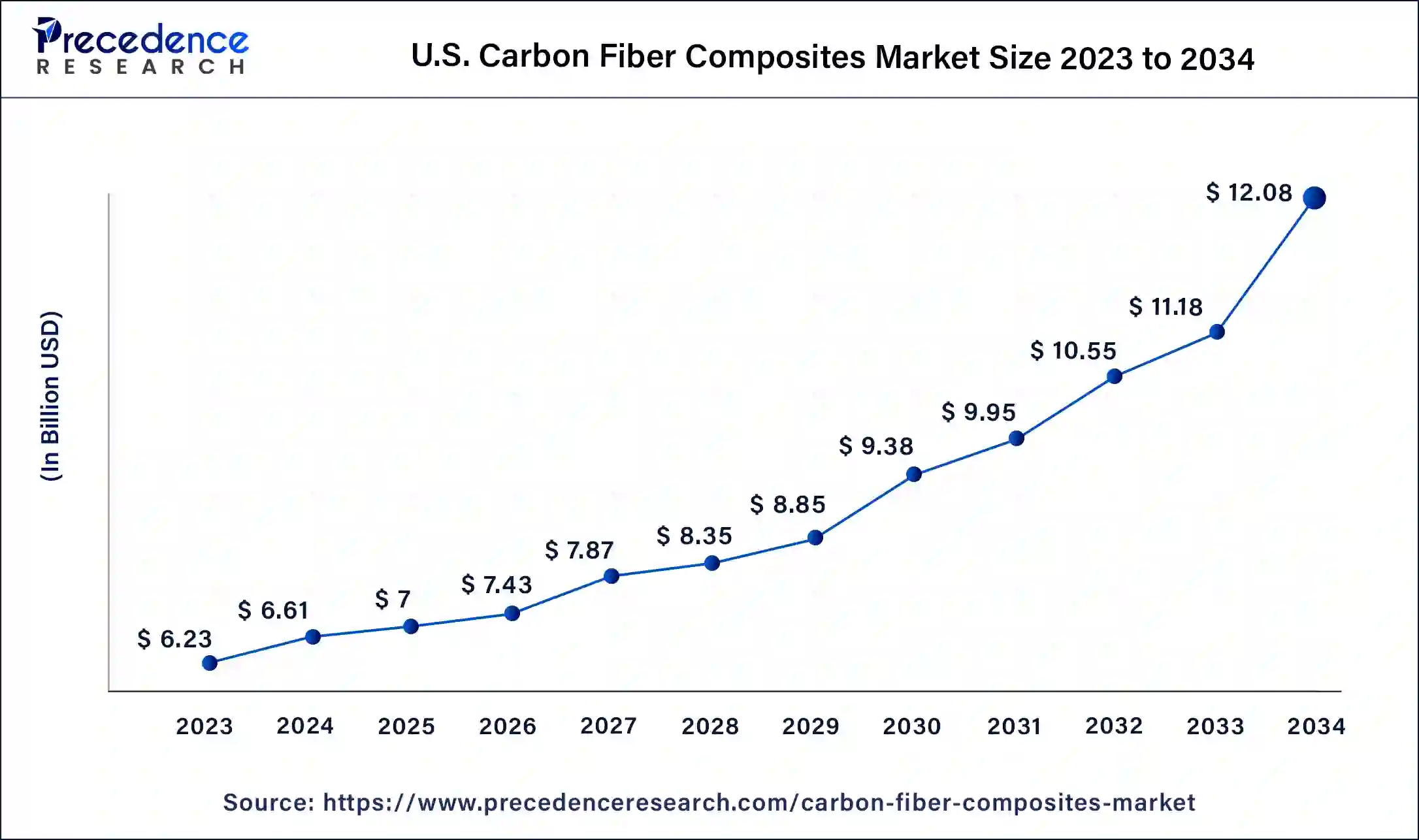

The U.S. carbon fiber composites market size was exhibited at USD 6.23 billion in 2023 and is projected to be worth around USD 12.08 billion by 2034, poised to grow at a CAGR of 6.20% from 2024 to 2034.

Asia Pacific is anticipated to grow at a notable rate in the carbon fiber composites market during the forecast period. The automotive industry, particularly the car and commercial vehicle manufacturing sector, is under tremendous pressure owing to the rising industrialization and urbanization trends in the Asia Pacific countries such as China, Japan, and India. This growth has also been fuelled by great investments in infrastructure and an increase in manufacturing technologies in the region. In addition, concerns about energy intensity and reducing carbon footprints are also similar to the benefits of the carbon fiber composites market.

Carbon fiber reinforced polymers (CFRP), or carbon fiber composites, consist of carbon fiber that is woven with a resin to come up with a single material; properties are way better than the constituent components. They are stronger, lighter, and more durable alternatives for many applications traditionally made with wood or metal. Certain examples of the use of carbon fiber composites that are increasing the demand for carbon fiber composites market include consumer goods area such as archery bow limbs, sail battens, etc. They are also used in automotive body panels, wind turbine blades, and orthopedic external fixators. This is because the advancement of carbon fiber composite material provides benefits to transportation, consumer products, healthcare, energy, construction, and infrastructure industries.

How is AI Changing the Carbon Fiber Composites Market?

Carbon fiber production can be made more cost-effective and efficient with the help of artificial intelligence (AI) monitoring the manufacturing processes. This eliminates the need for expensive manual inspection of the carbon fiber, ultimately leading to reduced production costs. The availability of larger production capacities and technological advancements is expected to expand market access and meet the growing demand for carbon fiber in various industries such as automotive and aviation. A camera system, when combined with artificial intelligence, can automatically detect defects in the production of carbon fiber.

| Report Coverage | Details |

| Market Size by 2034 | USD 39.39 Billion |

| Market Size in 2023 | USD 20.70 Billion |

| Market Size in 2024 | USD 21.95 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.02% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | End-use, Matrix Material, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Electric vehicle advancement

Governments around the world are encouraging manufacturers to go for electric and hybrid cars, and this is an opportunity for lightweight materials that drive the carbon fiber composites market. Lighter vehicles result in enhanced total energy consumption and an improved driving range of electric or hybrid cars, boosting the demand for carbon fiber-reinforced parts. Carbon fiber compounds have low density, high strength, high modulus, better vibration and fatigue properties, and corrosion resistance, which cut down the vehicle weight by up to 60%.

Regarding electric vehicles, the use of carbon fiber composites market services is an effective way to deal with the elevated weight of cars burdened with battery packs and energy inefficiency. Composites help improve energy efficiency in the following areas by reducing the weight of vehicles, improving battery power, brake and acceleration systems, aerodynamics, thermal control of batteries, and enabling longer drive cycles.

High cost and complexity of carbon fiber production

The carbon fiber composites market products are recognized for their strength yet being rather light in weight. Over the years, it has spread its wings in the aerospace and automobile industries as well as in the athletic apparel and accessories industries, not forgetting the prestigious luxury industries. However, these superior properties of composites have their price; carbon fiber is amongst the most expensive materials available.

Furthermore, carbon fiber manufacturing also requires such processes as the carbonization process, which is energy-consuming. Specialized equipment and controlled conditions throughout the process of production are other costs that make up the total. While using carbon fiber composites as market products, manufacturers must face one of the main disadvantages, which is higher production costs in comparison with materials such as steel or aluminum. Since carbon fiber components require special knowledge, tools, and materials for maintenance, car owners may end up paying more for their automobiles and even taking more time on repairs.

Expansion and innovation in carbon fibre

The manufacturing base of carbon fiber is on the rise, as is the level of research being dedicated to the industry. The increase in production capacity and the introduction of new carbon fiber materials are some of the drivers of the carbon fiber composites market. This has also been supported by the industry’s efforts to minimize the carbon emission of composite material manufacturing. Improving the production line and inventing more efficient ways to produce carbon fiber are part of the strategies that companies use to drive costs down, hence making it more affordable.

The polymer segment dominated the carbon fiber composites market in 2023. Carbon fiber-reinforced polymers are perhaps known as carbon fiber composites, which are produced by a combination of carbon fiber with a resin-like vinyl ester or epoxy. Then, a polymer composite material that is stronger than the components is shaped. Since that is the case, it can be said that polymer materials are improved versions intended for many structures that were initially developed using wood or metals. The carbon fiber-reinforced polymer matrix composite (PMC) has thereby come to the fore as a leading material in aerospace, automobile, sporting articles, and other such uses wherever high strength and high modulus are needed. In addition, it should be noted that its price has progressively reduced over time due to innovations in technology regarding carbon fiber.

The carbon segment is estimated to grow significantly in the carbon fiber composites market during the forecast period. The strong accumulation is due to rising usage in different higher-quality sectors such as automobiles, aircraft, and sports equipment. Further, technology is also enhancing and making carbon fiber lighter, cheaper, and more versatile, thus making it even more attractive. Its utilization in fundamentally exploitative uses as applied to the principle of sustainability in an attempt to make the material more efficient, lighter, and so on are some of the elements that make people consider using the material.

The aerospace segment accounted for the biggest share of the carbon fiber composites market in 2023. Its characteristics, such as high corrosion resistance, low coefficient of thermal expansion, high strength, and durability, are widely used in the manufacturing of aerospace components. On the primary structure, including the wings, carbon fiber is used, which helps to enhance the aerodynamic features of having a swept wing structure. It is noteworthy that, when applied for both the primary and secondary structures, the use of carbon fiber decreases the weight, thus enhancing the aerodynamics of an aircraft. Aerodynamics also.

The automotive segment is expected to witness significant growth in the carbon fiber composites market during the forecast period. The increasing use of carbon fiber in automotive applications is also a result of current research and developments. Carbon fiber became available through research and studies in manufacturing, making the material useful for higher volume applications at an effective cost and time. Carbon fiber is used in a variety of auto parts, including body panels, wheels, and parts. This helps to reduce the weight of the vehicle and improves fuel efficiency and performance. For these reasons, carbon fiber is becoming increasingly popular in automotive applications, racing cars, and series production models.

Segments Covered in the Report

By End-use

By Matrix Material

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2024

January 2025

December 2024

January 2025