May 2025

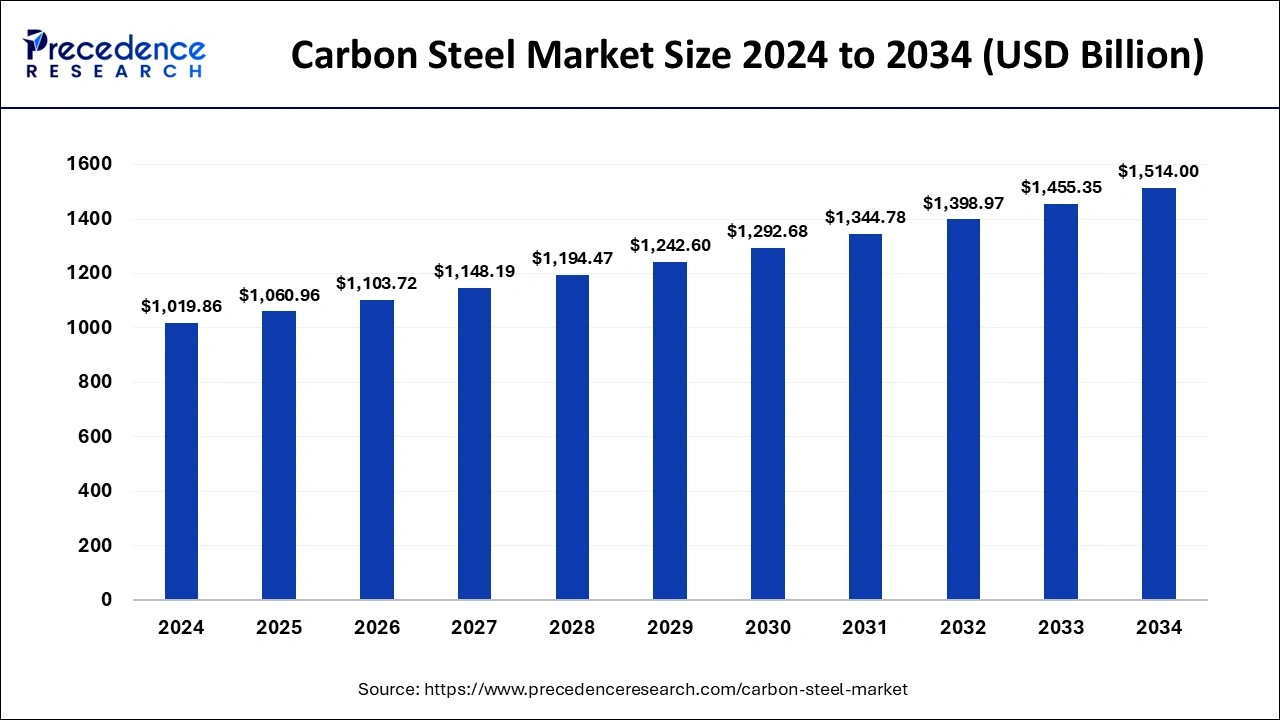

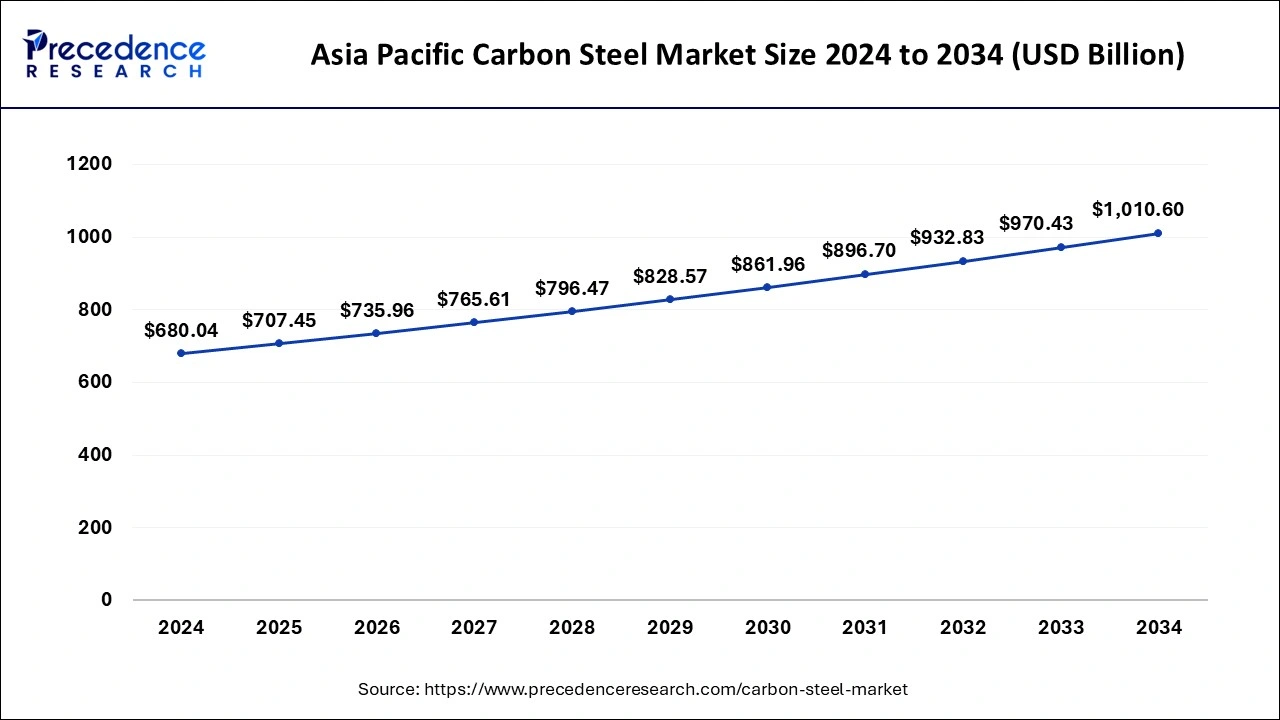

The global carbon steel market size accounted for USD 1,060.96 billion in 2025 and is forecasted to reach around USD 1,514 billion by 2034, accelerating at a CAGR of 4.03% from 2025 to 2034. The Asia Pacific market size surpassed USD 680.04 billion in 2024 and is expanding at a CAGR of 4.04% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global carbon steel market size was worth around USD 1,019.86 billion in 2024 and is predicted to surpass around USD 1,514 billion by 2034, growing at a CAGR of 4.03% from 2025 to 2034. The carbon steel market is driven by the rising demand from the construction industry, mainly bolstered by urbanization.

Carbon steel industry has embraced artificial intelligence to transform its processes by optimizing different aspects of steel production, from improving process efficiency to ensuring the best quality products. It even helps optimize energy usage by adjusting the heating and cooling processes, reducing waste, and ensuring energy-intensive equipment operates efficiently.

AI contributes to identifying faults in steel products through advanced computer vision techniques. High-resolution cameras and sensors are used to seize detailed images of steel surfaces. Its algorithms then analyze these images to spot imperfections like surface irregularities, cracks, or impurities. This automated process is far more concise and efficient than manual inspections, ensuring that even the tiniest defects are not overlooked.

The Asia Pacific carbon steel market size was exhibited at USD 680.04 billion in 2024 and is projected to be worth around USD 1,010.60 billion by 2034, growing at a CAGR of 4.04% from 2025 to 2034.

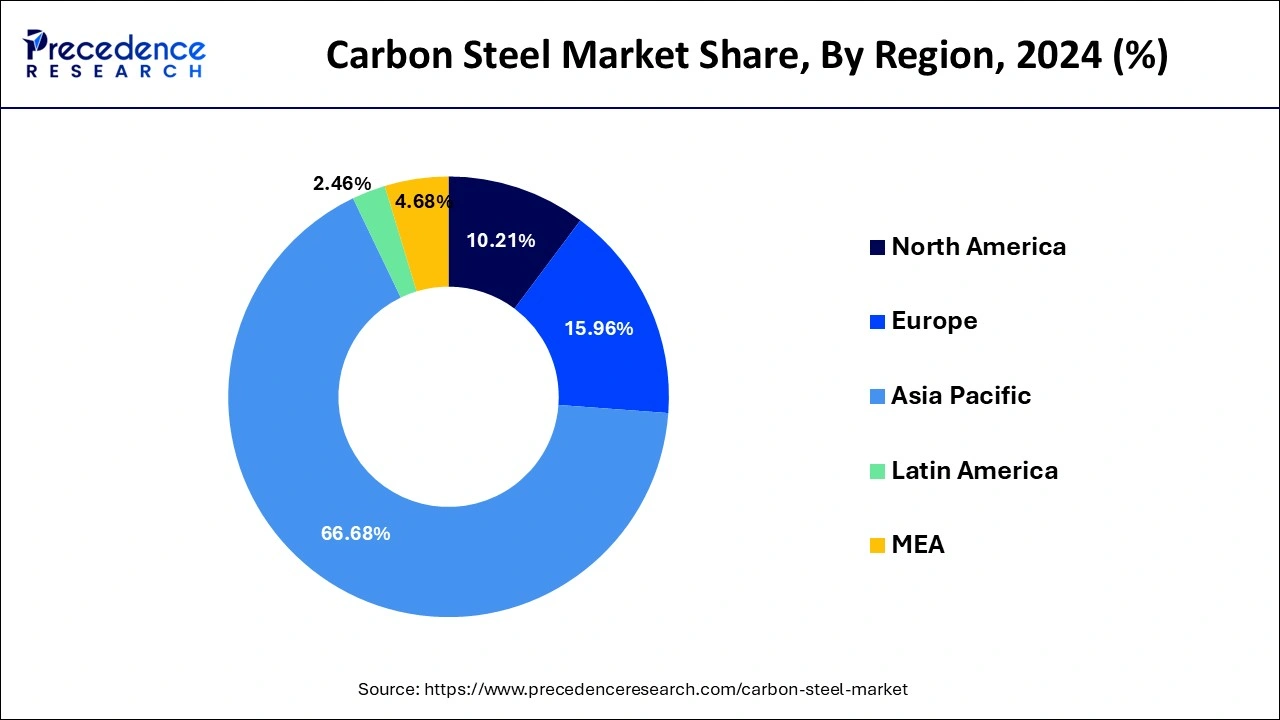

The Asia-Pacific segment dominated the global carbon steel market in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. The shipbuilding segment expansion in recent years, together with high industrial output from the construction and automotive industries, is expected to contribute to increased demand for the commodity.

The North America is estimated to be the most opportunistic segment during the forecast period. The carbon steel demand in the U.S. has benefited from strong economic development fueled by government-led fiscal stimulus, resulting in high company confidence. This resulted in a significant increase in construction spending in the North America region.

Carbon steel is an alloy made up of steel and carbon concentration of at least 2.1%. The carbon steel is classified into three types such as low carbon steel, medium carbon steel and high carbon steel. Carbon steels are typically soft and have a low compressive strength. They do, however, have a high ductility, making them ideal for machining and welding, as well as being inexpensive in nature.

The automobile body components, structural shapes such as angle iron and I-beams, pipes, building and bridge components, and food cans all use low carbon steels. The medium-carbon steels are commonly used for railway tracks, train wheels, and equipment parts that require the high strength, wear resistance, and toughness. The high-carbon steels are utilized in cutting tools, springs, great-strength wire because of their high wear resistance and hardness.

The spheroidizing, complete annealing, isothermal annealing, quenching, martempering, and a variety of other techniques can all be used to improve the characteristics of carbon steel. By tempering carbon steel with the inherent qualities of a specific type of carbon steel, it can be employed in a variety of end-user industries. The weldability factor is lower in carbon steel with a high carbon content.

One of the most extensively utilized end-user industry alloys in carbon steel. The inclusion of carbon in steel, on the other hand, boosts its strength and hardness, making it a desirable material for producers in the automotive and construction industries.

The rising gross domestic product (GDP) of developing countries in Asia-Pacific, Latin America, and the Middle East is resulting in rapid urbanization, which is boosting construction activity. This is helping to drive up demand for carbon steel, which is used to make small utensils and wires. The rise in urbanization and industrialization has resulted in the growth of carbon steel market during the forecast period.

The carbon steel is used in a variety of products, including automobile parts. Aside from the wide range of uses, technological advancements that have resulted in the development of higher quality carbon steel are also boosting demand.

The carbon steel’s ductility and forming qualities make it suitable for automobile body structures and trunk closures, as well as wear resistant gears. The medium carbon steel is also employed in the automotive industry since it has higher strength and endurance than low carbon steel but less ductility. The carbon steel use in the automotive industry is predicted to increase as the emphasis on lightweight vehicles grows.

However, one disadvantage of carbon steel is preventing wider adoption. The welding of carbon steel is the challenging part. Carbon content reduces the steel’s temperature resistance and melting point, lowering the steel’s weldability.

| Report Highlights | Details |

| Market Size by 2034 | USD 1,514 Billion |

| Market Size in 2025 | USD 1,060.96 Billion |

| Market Size in 2024 | USD 1,019.86 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.03% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

The low carbon steel dominates the carbon steel market during the forecast period. The carbon content is less than 0.25% by weight in low carbon steel. The low carbon steel can be formed into a variety of shapes, from structural beams to flat sheets. It has ductility, malleability, and the ability to form cold. When compared to its substitutes, it is cheap in nature.

The medium carbon steel is expected to grow at rapid pace during the forecast period. The carbon and manganese content of medium carbon steel is more than that of low carbon steel, making it stronger but more difficult to shape. It is popular in the production of machine and automotive parts due to its properties such as high strength and good weldability.

The shipbuilding segment dominated the market with highest market share during 2024. Steel is used in shipbuilding because of its mechanical characteristics and affordable price. The carbon steel is critical in the shipbuilding industry, but declining industry growth and a preference for replacements such aluminum alloys are expected to limit product use in the shipbuilding sector throughout the forecast period.

The construction segment is fastest growing segment in the carbon steel market. The low carbon steel has great forming and welding capabilities, as well as benefits such as no bending fractures, flexibility, ductility, plasticity, and earthquake resistance, making it a popular choice in the construction industry. The strength of carbon steel in severe scenarios is its primary advantage, since it protects the building from falling and saves the residents.

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

April 2025

December 2024

January 2025