List of Contents

What is Food Cans Market Size?

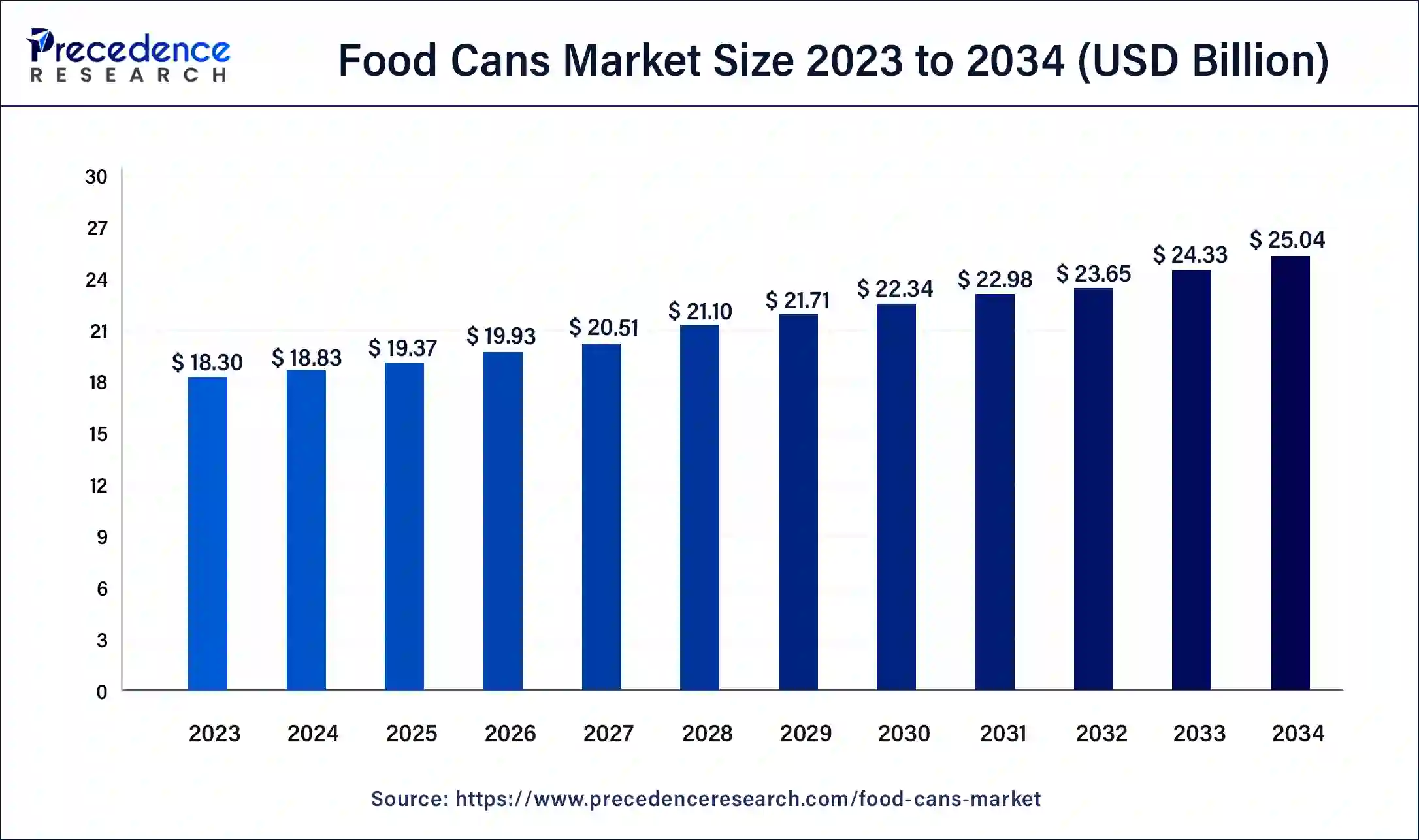

The global food cans market size is calculated at USD 19.37 billion in 2025, and is projected to hit around USD 19.93 billion by 2026, and is anticipated to reach around USD 25.04 billion by 2034, growing at a CAGR of 2.89% over the forecast period 2025 to 2034. North America food cans market Size to reached USD 5.86 Billion in 2023. The rising demand for packaged foods and changing consumer needs drive the market.

Market Highlights

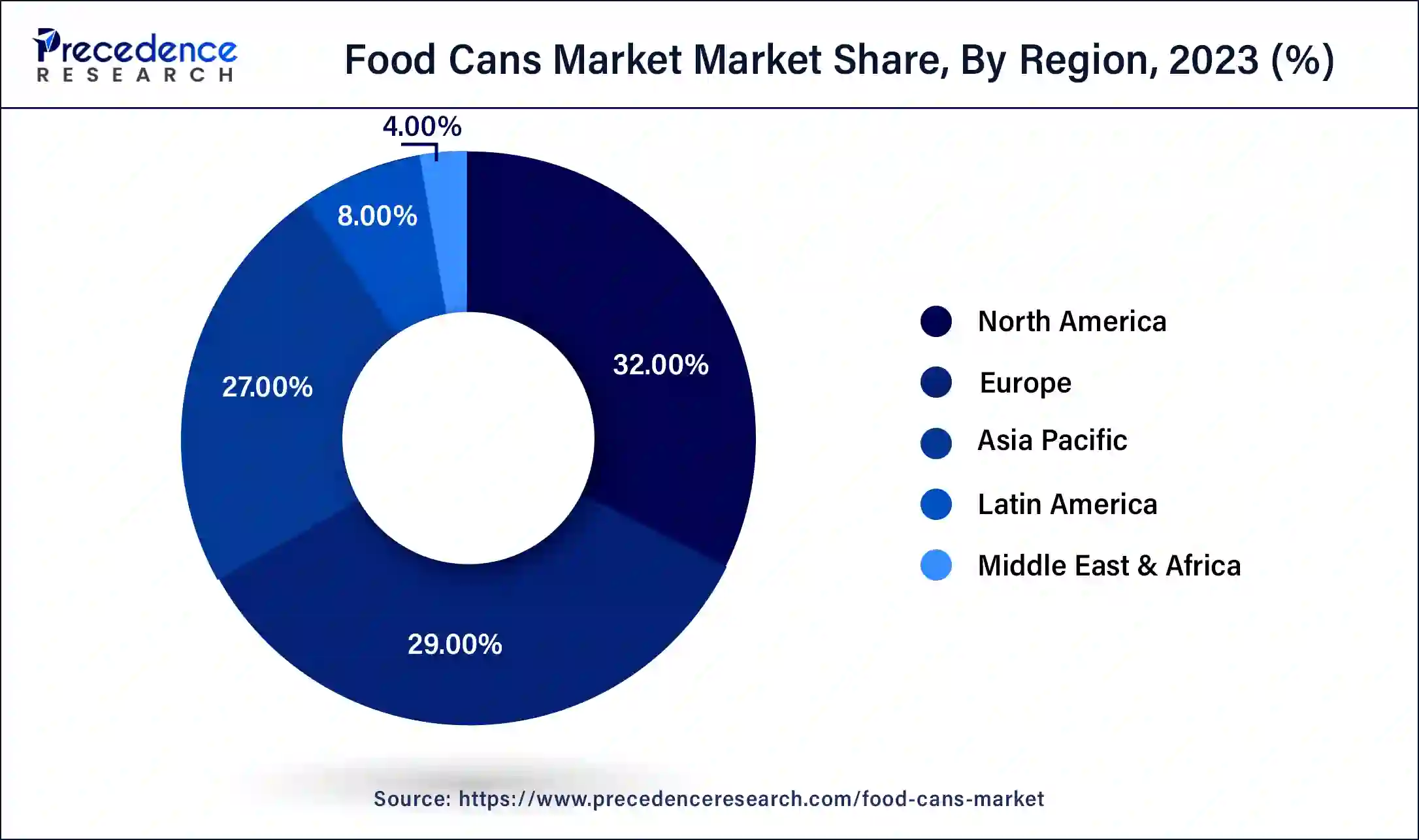

- North America dominated the global food cans market with the highest market share of 32% in 2024.

- Asia-Pacific is projected to host the fastest-growing market in the coming years.

- By type, the steel segment held a dominant presence in the market in 2024.

- By type, the aluminum segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034.

- By can type, the two-piece cans segment accounted for a considerable share of the food cans market in 2024.

- By can type, the three-piece cans segment is anticipated to grow with the highest CAGR in the market during the studied years.

- By closure type, the can ends segment led the global market in 2024.

- By closure type, the screw caps segment is projected to expand rapidly in the market in the coming years.

- By application, the food & beverages segment registered its dominance over the global food cans market in 2024.

- By application, the pet food segment is predicted to witness significant growth in the market over the forecast period.

What are Food Cans?

The food cans market is rapidly evolving, with many variants available for storing and preserving food. Food cans are generally made of steel, tin, oraluminum. The modern tin can is made up of 98.5% sheet steel with a thin coating of tin. Cans are preferred for food items like fruits, vegetables, beverages, sweets, and meat. The canning process comprises multiple steps: cleaning and further preparing the raw food material, blanching it, filling the containers, closing and sealing the containers, sterilizing the canned products, and labeling and warehousing the finished goods. These cans keep the food fresh and increase its shelf life while maintaining the nutritional content. They also help to reduce food waste by eliminating unnecessary food spoilage and keeping food ready to eat without the need for cold storage.

How can AI help the food cans market?

Automation and robotics are the essential components of a digital revolution. artificial intelligence (AI) and machine learning (ML) integration in the food sector promises increased productivity and response to market demands, resulting in a more complex and resilient food ecosystem. AI plays a crucial role in the food industry, from agriculture to food sales. Metal cans are most widely used for storing, preserving, and transporting food items to consumers. AI is also helpful in the manufacturing of metal cans by optimizing processes and enhancing product quality. Technologies like artificial neural networks (ANN) can assist in predicting mechanical properties like tensile strength and surface roughness to meet stringent quality standards. These technologies can also aid in monitoring the real-time manufacturing process to identify defects. AI expedites the design and production cycles, enabling manufacturers to launch their products faster in the market. Apart from manufacturing, AI can also assist in supply chain management, resulting in the timely delivery of cans.

- In September 2023, the Can Manufacturers Institute (CMI) announced the funding for the development of a robot at a California material recovery facility. The robot designed by EverestLabs is expected to capture 1 million used beverage cans annually and promote its recycling.

What are the Growth Factors in the Food Cans Market?

- Changing Consumer Needs: The gradually increasing population results in changing consumer demands for food, increasing the demand for food cans.

- Sedentary Lifestyle: The fast, sedentary lifestyles of individuals have shifted consumers' interest toward packaged foods, boosting the market growth.

- Demand for Nutritional Food: Food cans preserve the nutritional content of the food for a longer period, thereby driving the food cans market.

- Demand for Sustainability: The use of metal cans can contribute to environmental sustainability as they are recyclable and reused.

Food Cans Market Outlook

- Industry Growth Overview: Between 2025 and 2030, demand for prepared food products continues to drive growth in the food can market. The trend is strong throughout Asia/Pacific and North America, where consumers are increasingly choosing food packaging that is both convenient and durable.

- Global Expansion:Major manufacturers have begun to expand their business into emerging markets throughout Southeast Asia, Eastern Europe, and Latin America to capitalize on rapid growth in the pre-packaged food category. Additionally, companies are now investing in local production facilities to reduce their logistics costs while meeting local food safety standards.

- Major Investors: A strong and stable demand for product metallization and the high value of metal-based packaging have encouraged both private equity and strategic buyers to increase their investment in this sector. A significant investment was made in organizations involved in metal-based products and the systems used to coat products.

- Startup Ecosystem: Several startups focused on smart can technology, advanced sealing systems, and sustainable linings are entering the market and establishing themselves in the packaging industry. Young companies from the U.S. and India are attracting considerable attention and financing for their innovative, sustainable alternatives to traditional products by leveraging technology in their businesses.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 19.37 Billion |

| Market Size in 2026 | USD 19.93 Billion |

| Market Size by 2034 | USD 25.04 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 2.89% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material, Can Type, Closure Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Demand for environmental sustainability

After food is processed, it is stored and packed in different containers, depending on its storage requirements. However, the use of plastic containers poses severe risks to the environment. Governments of various countries have imposed policies to ban the use of plastics. Hence, metal containers are widely preferred. Metal food cans serve as a barrier to oxygen, light, and bacteria for food products, extend the shelf life of products, and prevent premature spoilage. Metal cans made up of steel and aluminum are easily reusable and recyclable. This ultimately helps to keep our planet healthier, reduce greenhouse gas emissions, and save energy. Additionally, recycling metal cans helps save landfill space, providing a valuable scrap resource to the steel industry. The Government of India aims to achieve net-zero emissions by 2070 and reduce the carbon intensity of the economy by 45% by 2030.

- In January 2024, Ball Corporation and Del Monte Foods announced a collaboration to pledge their commitment to sustainability. They introduced two-piece aluminum beverage cans that contribute to environmental sustainability and enhance aesthetic appeal.

Restraint

High Raw Material Cost

Despite numerous advantages, food cans face several limitations. One of the major limitations of the food cans is the fluctuating cost of raw materials. The high cost of raw materials increases the ultimate price of the product, restricting its use. Also, the geopolitical developments pose a risk of disruptions in the supply chains, which have an adverse effect on profitability. Additionally, the stringent packaging regulations also make it difficult to use.

Opportunity

Rising Food Processing Industry

The food processing sector involves the processing of raw materials from agriculture to consumable foods. The rising food processing industry presents significant opportunities for the food cans market. The increased demand for packaged and ready-to-eat foods increases the need for food cans. Consumers desire food products with longer shelf life and, at the same time, maintaining their nutritional value. This can be achieved through food cans. The food processing industry is not only growing in developed nations but also in developing nations to cater to the changing needs of customers. Rapid urbanization and lifestyle changes escalate the need for the food processing industry. Additionally, the industry is innovating with new products requiring canned packaging. India has the largest food processing sector in the world, with a total FDI of $12.58 billion from April 2000 to March 2024.

According to the Food Processing Industry Report published in February 2025, the food processing sector is a key contributor to India's economy, owing to the progressive policy measures by the Ministry of Food Processing Industries (MoFPI). The sector has performed well with an impressive average annual growth rate of 7.3% from 2015 to 2022. It has significantly contributed to GDP, employment, and investment. As of 2024, it contributes around 8.80% and 8.39% of Gross Value Added (GVA) in Manufacturing and Agriculture, respectively, 13% of India's exports, and 6% of total industrial investment.

Segment Insights

Material Insights

The steel segment held a dominant presence in the food cans market in 2024. Steel is the widely preferred choice of material for food cans. Steel cans have more strength and durability than plastics and are less fragile than glass. Steel cans can be recycled multiple times without downgrading the material. Hence, over 75% of all steel produced is still used today. Additionally, the nutritional content, freshness, and flavor of foods are retained in steel cans without needing preservative agents. Foods stored in steel cans do not require refrigeration or cold storage; hence, they help save energy. According to the World Steel Association, the total global crude steel production was found to be 1,888.2 million tonnes in 2023.

The aluminum segment is expected to grow at the fastest rate in the food cans market during the forecast period of 2024 to 2034. Aluminum offers numerous benefits over other materials used for producing food cans. It is lightweight, aiding in less transportation costs. It has a very clean and elegant appearance, attracting more customers. Aluminum does not undergo rusting; hence, food materials are safe and protected. It can be pressed into any shape, making it easy for manufacturers. Additionally, like steel, aluminum can also be easily recycled and reused, thereby reducing waste. They are most commonly used for food & beverages like olives, soups, sweets, seasonal fruits, etc. According to the International Aluminum Institute, the primary aluminum production was found to be 70,581 metric tonnes in 2023, with China being the leading producer, producing 59% of the global primary aluminum.

Can-Type Insights

The two-piece cans segment accounted for dominant share of the food cans market in 2024. A two-piece is a packaging container in which the metal discs are reshaped into cylinders with integrated ends. In order to seal the can, a loose end or lid is used. The manufacturing process of two-piece cans is easy and efficient. The can is tightly sealed from all ends, as there is no seam between the body and the bottom end. Hence, it requires less raw materials.

- In May 2024, Ball Corporation announced a partnership with CavinKare, an Indian company, to launch retort aluminum cans for milkshakes. The new two-piece aluminum cans by Ball Corporation will be used for CavinKare's milkshake flavors.

The three-piece cans segment is anticipated to grow with the highest CAGR in the food cans market during the studied years. Three-piece cans are made up of a cylindrical body that is rolled from a flat sheet of metal and joined by a longitudinal seam, as well as two can ends that are welded onto the body at each end. They are generally rigid and can be made from any material. Large-scale production of three-piece cans with different shapes and sizes is simple and versatile. Additionally, it can be easily opened and requires less machinery for production.

Closure Type Insights

The can-ends segment led the global food cans market in 2024. The lids of the cans are called can-ends. Can-ends are essential in a food can as they tightly seal the container to protect the contents. It not only preserves the food but also provides an aesthetic and premium appearance to the cans. There are different types of can-ends available depending on the requirements, including single or double-die ends, multi-die ends, deep-drawn ends, easy peel ends, easy opening ends, etc. They can be made of different materials like aluminum, tinplate, and plastic.

The screw caps segment is projected to expand rapidly in the food cans market in the coming years. Screw caps are also a type of lid used in a food can. They are widely preferred as they can be easily opened and closed by the consumer. They are generally used for preserving honey and beverages like soft drinks, soda, beer, and wine. Hence, screw caps prevent leakage and tampering, keeping the product airtight and fresh during transportation. They are made of plastic, tinplate, or aluminum. The increased consumption of carbonated beverages and alcohol boosts the market.

Application Insights

The food & beverages segment registered its dominance over the global food cans market in 2024. The dynamic consumer needs for food & beverages due to the rising global population augment the market. Cans for food & beverages are generally made of outer aluminum or steel coating and tin-plated inside. This preserves the food product and protects the food from light, moisture, and bacteria. Also, the rising demand for packaged foods due to busy lifestyles and the demand for seasonal fruits and vegetables throughout the year drive the market. Additionally, the growing research & development for the latest innovation in the design, manufacturing, and packaging of food cans to attract more customers boost the market.

- In June 2024, Pepsi announced the launch of Smart Cans at the Cannes Lions International Festival of Creativity. The smart cans will unveil new ways of storytelling and accessing new experiences, especially for the new generation.

The pet food segment is predicted to witness significant growth in the food cans market over the forecast period. Food cans are widely used for wet foods in the form of jelly, gravy, sauce, loaf, or mousse. The high adoption of pets and increasing demand for high-quality and nutritious food drive the market. Also, all pet foods are subject to strict regulations to ensure safe and quality products. The USFDA releases guidelines that pet foods should be safe to eat, produced under sanitary conditions, contain no harmful substances, and be truthfully labeled. The canned pet foods should also be free of viable microorganisms. Hence, food cans meet all such specifications.

Regional Insights

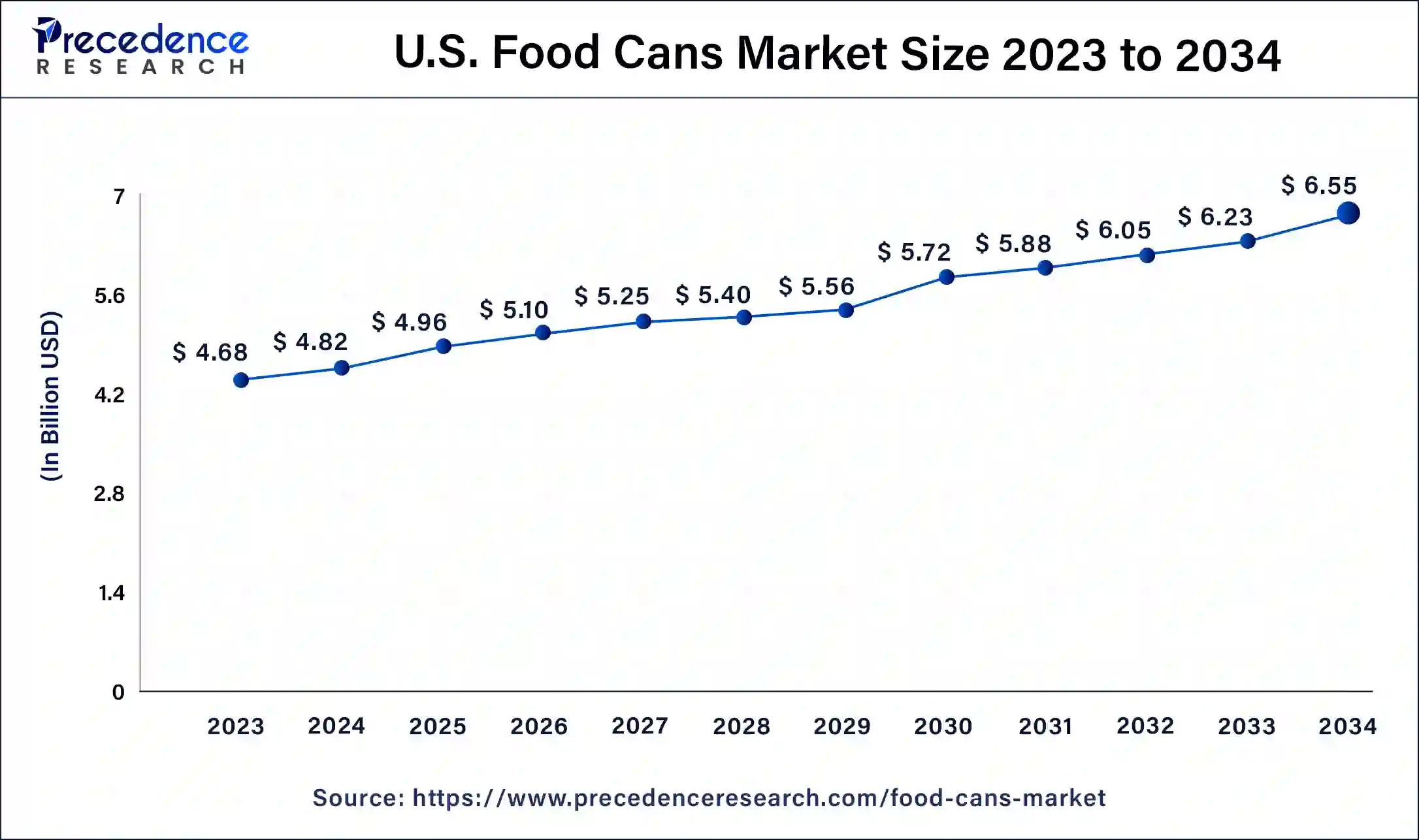

U.S. Food Cans Market Size and Growth 2025 to 2034

The U.S. food cans market size is valued at USD 4.96 billion in 2025 and is predicted to surpass around USD 6.55 billion by 2034, rising at a CAGR of 3.10% from 2025 to 2034.

North America dominated the global food cans market in 2024. The rising demand for packaged foods, sedentary lifestyles, technological advancements, and the presence of key players drive the market. The USFDA's guidelines for high-quality and safe food products also increase the demand for food cans. According to data provided by the US government, approximately 1.7 billion cans are imported into the US, which equates to 10% of the domestic can production. In addition, the US is among the top five countries globally producing steel and aluminum. The demand for nutritious foods also augments the market.

- In May 2024, the U.S. Department of Agriculture (USDA) notified seafood suppliers of more canned pink salmon for use in the government's domestic food distribution programs. It also announced awarding $21.8 million to several U.S. seafood companies.

- In October 2024, Sonoco Products Company announced the launch of its new, state-of-the-art technical and engineering center for manufactured metal packaging in Columbus, Ohio. The new 11,000-square-foot facility will provide design support, advanced technical services, process development, and training to its customers.

Asia-Pacific is projected to host the fastest-growing food cans market in the coming years. The rising population, changing consumer demands, increasing demand for ready-to-eat foods, favorable manufacturing infrastructure, and increased investments and collaborations boost the market. China is the leading producer of both steel and aluminum globally. India and Japan are the second and third-largest global producers of steel, respectively. Myanmar is the third-largest producer of tin ore in the world. Additionally, the high exports of canned foods from India and China to the world drive the market. China accounts for 70% of the total export of canned asparagus in the world and is the leading producer of canned tomatoes. In 2022, China exported around 3.13 million tonnes of canned food, with a value of $6.89 billion. Additionally, the government's policies emphasize food security in the region, which augments the market.

- In May 2024, Godiva Japan released a new item on its menu, canned cakes. The cakes were sold in an elegant and aesthetic transparent can with aluminum can-ends.

The strategic initiatives adopted by key market players to expand their presence in Asia-Pacific, such as new product launches, partnerships, acquisitions, collaborations, and investments, are expected to drive the market's growth. For instance, in July 2024, Ball Beverage Packaging Pvt Ltd, the USA-based global leader in aluminium packaging, revealed its interest in setting up a production unit in Telangana, which is expected to create 500 jobs.

Why did Europe grow rapidly in the Food Cans Market?

Sustainable packaging is widely used in Europe and contributes to the region's healthy growth along with other factors such as extensive consumer safety regulation, significant demand for canned products, and the need for recycled versus non-recycled packaging. Additionally, the continued rise in popularity of convenience foods and foods that have a long shelf life is providing continued growth opportunities for can manufacturers as well.

Germany Food Cans Market Trends

Germany is the leading region in Europe in the food cans market through its focus on sustainable packaging practices, highly efficient production methods, and advanced technology for the manufacture of metal cans. In addition, German consumers are primarily focused on purchasing cans that can be fully recycled, thereby providing an additional benefit for the manufacturer of these cans.

Additionally, through its investments in modern can-making technology and highly effective production lines, Germany is successfully capitalizing on the increase in canned vegetables, pet food, and beverages.

Why did Latin America see rapid growth in the Food Cans Market?

Latin America has experienced significant growth in demand for cost-effective packaged food products, resulting in the expansion of the area's production of canned fruits, vegetables, and meats. The growth of urban centers and an increase in disposable income have also stimulated growth in the market. Additionally, there are many opportunities for the region's major manufacturing locations to improve quality and to export canned products.

Brazil Food Cans Market Trends

Brazil has established itself as the leader in the regional food cans market through strong production of canned meats, beans, and vegetables. The size of Brazil's population generates strong demand for packaged foods; investments in the development of modern canning facilities and the expansion of supermarkets have supported this growth. In addition to this, the continued growth of interest in long-shelf-life products and metal packaging has been a driving force behind the increase in Brazil's market share of canned goods within Latin America.

Why did the Middle East & Africa see rapid growth in the Food Cans Market?

There has been a substantial increase in the demand for long-term food storage within both urban and rural communities in the Middle East and Africa. Therefore, many canned products, including canned vegetables, fruits, and meats, are heavily relied upon throughout the region, as storage and climate constraints have limited the ability to store food for lengthy periods of time. The growth in these two sectors of the Middle East and Africa was primarily driven by a high level of investment in food processing and a growing number of imports of packaged and processed foods.

The UAE Food Cans Market Trends

Within the region, the UAE was the leader in growth due to the high level of demand for packaged foods, as well as the high level of imports of packaged foods. As such, the UAE developed a number of modern food-processing plants and used metal cans of high quality to package their food products. The growth of retail stores in conjunction with the growing popularity of tourism in the UAE and an increasing number of people purchasing ready-to-eat meals created a strong market for packaged foods in the UAE.

Food Cans Market Companies

- Ardagh Group

- Ball Corporation

- CAN-PACK S.A.

- Crown Holdings

- Dell Monte Foods

- Dole plc

- Kaira Cans

- Kian Joo Group

- Kraft Heinz

- Silgan Holdings

- Nampak

- Sonoco Products Company

- Trivium Packaging

Recent Developments

- In December 2024, Ball Corporation, the leading global provider of sustainable aluminum packaging for beverages, personal care, and home products, partnered with Dabur India Ltd to expand their Réal juice portfolio with the launch of the new Réal Bites in fully recyclable aluminum cans in India.

- In June 2024, Sonoco Products Company, a leading producer of sustainable packaging, agreed to acquire Eviosys, a European supplier of food cans, ends, and closures, from KPS Capital Partners for $3.9 billion. The acquisition of Eviosys will establish the company's global leadership in metal food cans and aerosol packaging.

- In May 2024, Ball Corporation, a global leader in sustainable packaging, announced its partnership with CavinKare, a pioneer in the dairy industry. The collaboration is set to revolutionize dairy packaging by introducing retort two-piece aluminum cans for CavinKare's popular milkshakes. Retort Aluminum cans are carefully designed to withstand the rigorous retort process, and these cans align with the evolving modern consumer's on-the-go lifestyle.?The collaboration marks a significant step towards sustainable packaging solutions.

- In August 2022, PPG announced its new product, PPG Innovel PRO, an enhanced internal spray coating with bisphenol-A (BPA). The product meets all consumer safety standards, and its improved application properties provide operational benefits for can production facilities.

- In June 2024, Sonoco Products Company announced the acquisition of Eviosys, a European supplier of food cans, for $3.9 billion. The acquisition was made to scale the business of Sonoco and invest in high-return opportunities.

Segments Covered in the Report

By Material

- Steel

- Aluminum

- Tinplate

- Plastics

- Glass

By Can Type

- Two-Piece

- Three-Piece

- Composite Cans

By Closure Type

- Can Ends

- Screw Caps

- Pull Tabs

- Easy-Open Lids

By Application

- Food & Beverages

- Pet Food

- Industrial Products

- Pharmaceuticals

- Personal Care Products

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client