October 2023

Carboxymethyl Cellulose Market (By Purity Level: Highly Purified, Technical Grade, Industrial Grade; By Property: Thickening Agent, Stabilizer, Binder, Anti-repository Agent, Lubricator, Emulsifier, Excipient; By Application: Food & Beverages, Oil & Refining, Pharmaceutical, Paint & Textile, Cosmetics & Personal Care, Paper Coating & Household Care, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

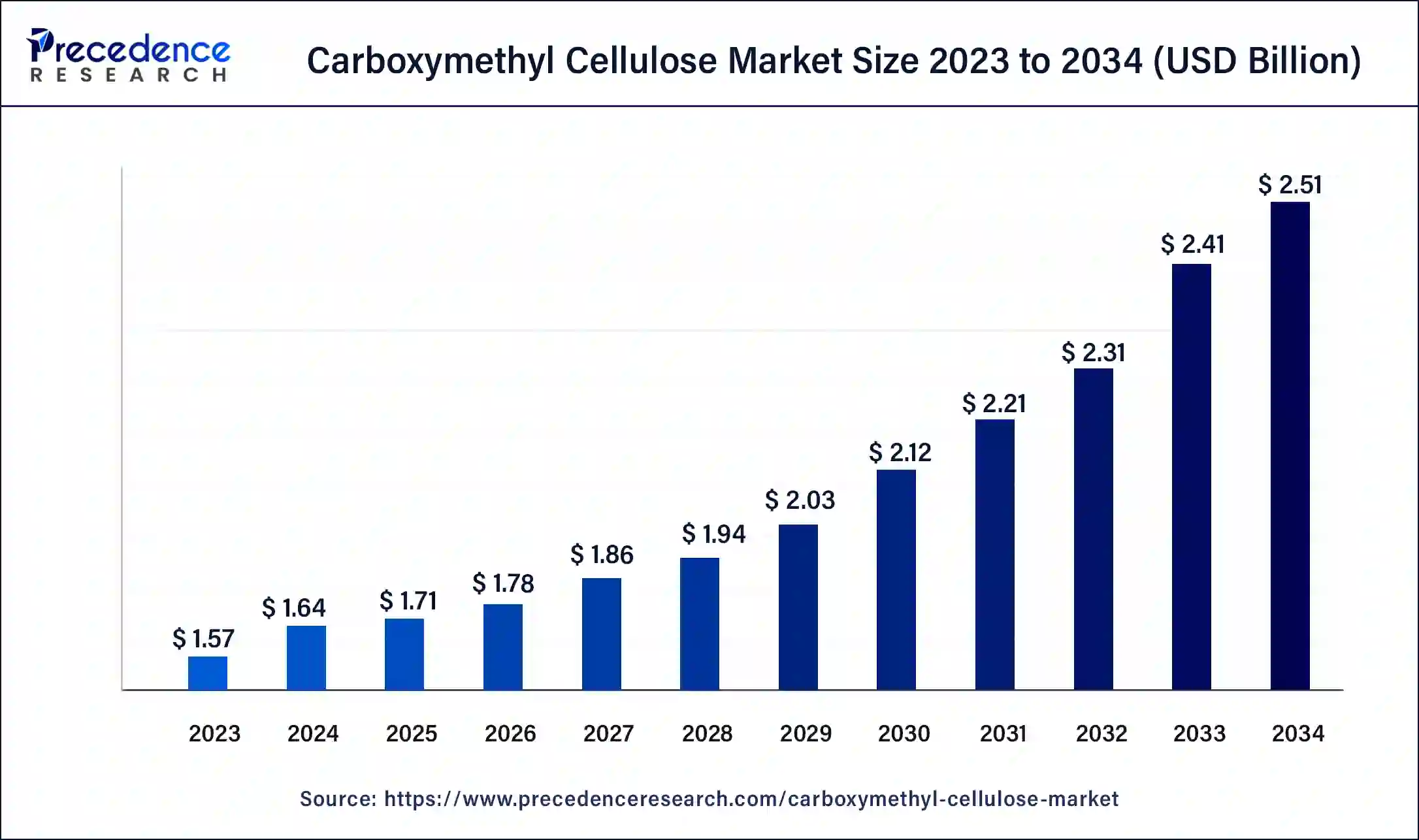

The global carboxymethyl cellulose market size was USD 1.57 billion in 2023, calculated at USD 1.64 billion in 2024 and is expected to reach around USD 2.51 billion by 2034, expanding at a CAGR of 4.35% from 2024 to 2034.

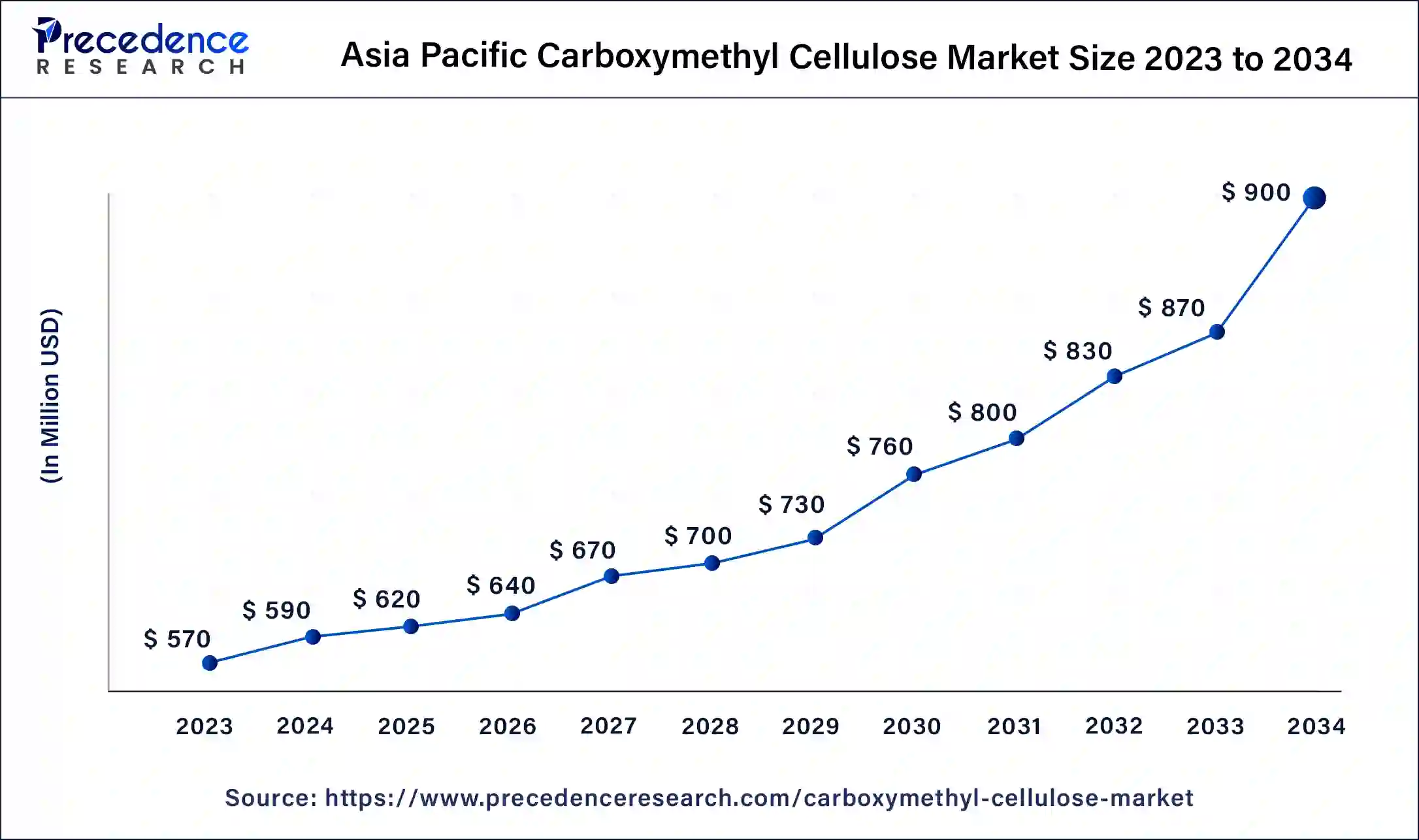

The Asia Pacific carboxymethyl cellulose market size reached USD 570 million in 2023 and is expected to surpass around USD 900 million by 2034 at a CAGR of 5% from 2024 to 2034.

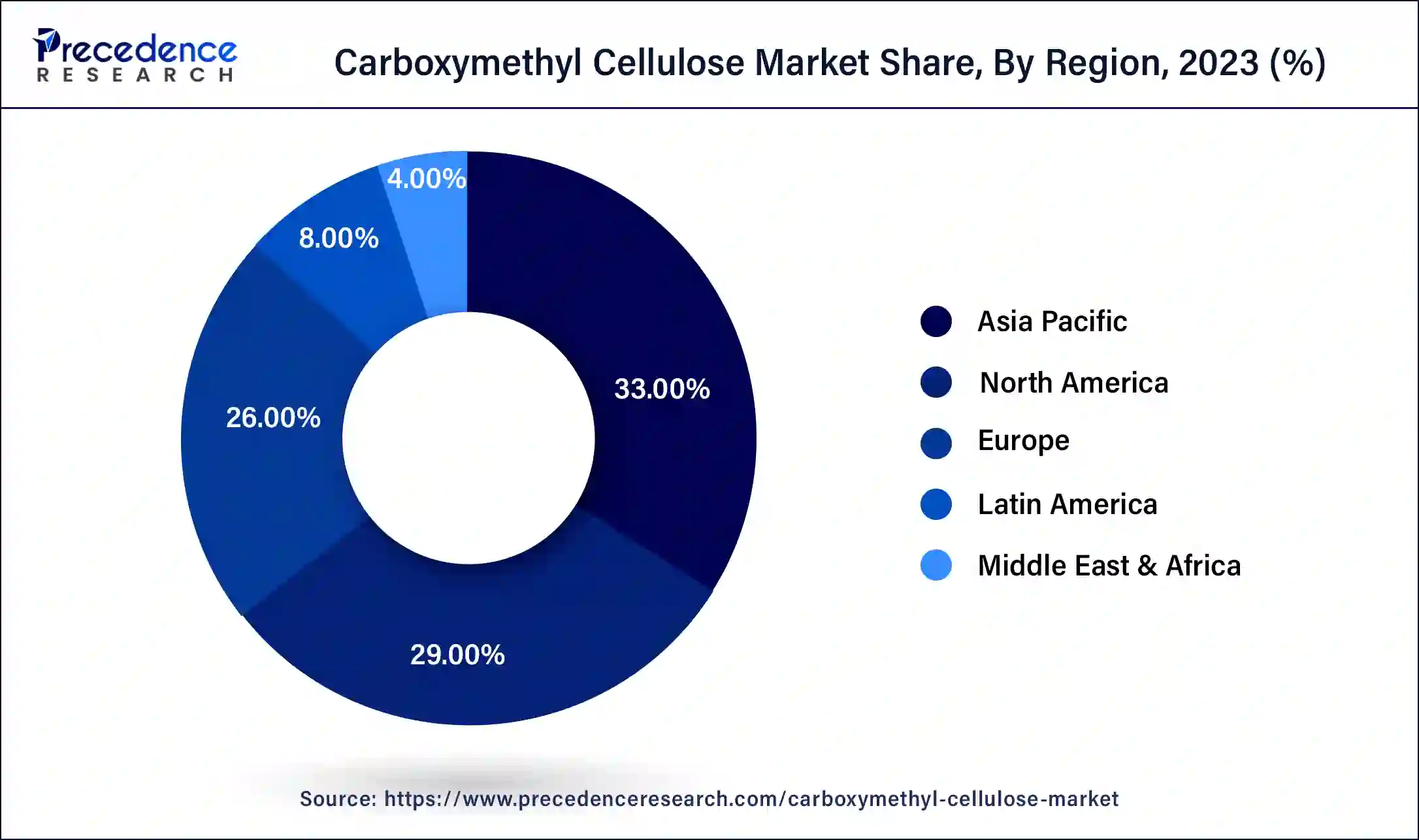

Asia-Pacific held the largest market share of 33% in 2023, due to several factors. The region's robust industrial growth, particularly in sectors such as food and beverage, pharmaceuticals, and personal care, drives the demand for carboxymethyl cellulose (CMC) as a key ingredient in various applications. Additionally, the increasing population and rising disposable incomes in countries like China and India contribute to higher consumption of CMC-based products. Furthermore, Asia-Pacific benefits from extensive CMC production facilities and a growing focus on research and development, enhancing its position in the global market.

North America is experiencing rapid growth in the carboxymethyl cellulose market due to several factors. These include the expanding food and beverage industry, where CMC is used as a thickening and stabilizing agent, and the increasing demand for natural and organic personal care products, where CMC serves as a key ingredient. Additionally, the region's thriving pharmaceutical and oil and gas sectors contribute to the market growth, driving the demand for CMC in drug formulations and drilling fluid applications. These factors collectively propel the market's upward trajectory in North America.

Meanwhile, Europe is experiencing notable growth in the carboxymethyl cellulose market due to several factors. These include the rising demand for natural and sustainable ingredients in various industries such as food and beverage, pharmaceuticals, and personal care. Additionally, stringent regulations promoting the use of CMC in food and pharmaceutical applications contribute to market expansion. Furthermore, advancements in technology and increasing investments in research and development are driving innovation, leading to the development of novel CMC formulations tailored to specific industry needs, thus fueling market growth in Europe.

Carboxymethyl cellulose (CMC) is a versatile, water-soluble polymer derived from cellulose, which is found in plants. It is commonly used in various industries for its thickening, stabilizing, and emulsifying properties. CMC is produced through the chemical modification of cellulose fibers, primarily from wood pulp or cotton. In food and beverage applications, CMC serves as a thickening agent in products like sauces, dressings, and ice cream, improving texture and stability. In pharmaceuticals, it is used as a binder in tablet formulations and as a viscosity modifier in topical creams and ointments.

Additionally, CMC finds widespread use in the production of paper, textiles, personal care products, and drilling fluids. Due to its non-toxic nature and biodegradability, CMC is considered safe for use in various consumer products. Its versatility and effectiveness make it a valuable ingredient in many industrial and commercial applications.

| Report Coverage | Details |

| Global Market Size by 2034 | USD 2.51 Billion |

| Global Market Size in 2023 | USD 1.57 Billion |

| Global Market Size in 2024 | USD 1.64 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.36% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Purity Level, Property, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand in personal care products

The rising demand for personal care products significantly drives the market demand for carboxymethyl cellulose (CMC). CMC serves as a crucial ingredient in various personal care items, including cosmetics, skincare products, and haircare formulations. Its versatile properties make it an ideal thickening agent, stabilizer, and film-forming agent in these products, enhancing their texture, stability, and performance. As consumers increasingly prioritize natural and sustainable ingredients in their personal care routines, CMC's biodegradable and non-toxic nature further contributes to its popularity in the industry.

Moreover, the expanding global population, coupled with growing disposable incomes, fuels the demand for personal care products across different demographics and regions. As a result, manufacturers in the personal care industry continue to seek reliable and effective ingredients like CMC to meet the evolving needs and preferences of consumers. This surge in demand for personal care products drives the consumption of CMC, propelling growth in the carboxymethyl cellulose market.

Stringent regulations regarding food and pharmaceutical grade CMC

Stringent regulations surrounding the production and use of food and pharmaceutical grade carboxymethyl cellulose (CMC) act as a significant restraint on market demand. These regulations are designed to ensure the safety and quality of CMC used in food and pharmaceutical applications, imposing strict standards on manufacturing processes, purity levels, and allowable impurities. Compliance with these regulations often requires extensive testing, documentation, and certification, adding to the production costs and regulatory burden for manufacturers.

Furthermore, the stringent regulatory requirements may limit the availability of CMC for use in food and pharmaceutical products, as only suppliers meeting the necessary standards can supply these industries. This can lead to supply chain disruptions and higher prices for compliant CMC, deterring some manufacturers from utilizing CMC in their formulations. As a result, businesses may seek alternative thickening and stabilizing agents with less stringent regulatory requirements, impacting the overall demand for CMC in the market.

Development of novel formulations for CMC-based products

The development of novel formulations for carboxymethyl cellulose (CMC)-based products presents significant opportunities in the carboxymethyl cellulose market. By innovating new formulations, manufacturers can create customized CMC products tailored to specific industry needs and applications. These novel formulations may offer enhanced functionalities, improved performance, and increased versatility compared to traditional CMC products. For example, CMC-based products with modified rheological properties can cater to diverse industrial requirements, such as in paints, coatings, and adhesives.

Additionally, the development of novel formulations opens doors to new market segments and applications previously untapped by CMC.As industries seek more sustainable and eco-friendly alternatives to conventional materials, innovative CMC formulations can fulfill these demands. This expansion into new applications, coupled with the versatility and adaptability of CMC, positions it as a valuable ingredient across various industries, driving growth opportunities and expanding the market potential for CMC-based products.

The highly purified carboxymethyl cellulose segment held the highest market share in 2023. The highly purified carboxymethyl cellulose (CMC) segment refers to CMC products that undergo rigorous purification processes to achieve high levels of purity, typically exceeding industry standards. This segment caters to industries requiring exceptionally pure CMC for applications demanding strict quality and performance criteria. Trends in this segment include increasing demand from pharmaceutical and food industries, driven by stringent regulatory requirements and the need for premium-quality ingredients in formulations. Additionally, technological advancements in purification techniques contribute to the continuous improvement of purity levels in CMC products, meeting evolving industry standards.

The technical grade segment is anticipated to witness rapid growth at a significant CAGR during the projected period in the carboxymethyl cellulose market. In the carboxymethyl cellulose (CMC) market, the technical grade segment refers to CMC products with a specified purity level suitable for industrial and technical applications. These applications typically do not require the same level of purity as food or pharmaceutical grades. Technical grade CMC finds use in various industries such as textiles, paper manufacturing, drilling fluids, and detergents. Recent trends show an increasing demand for technical grade CMC driven by its versatility, cost-effectiveness, and suitability for non-food and non-pharmaceutical industrial applications.

The thickening agent segment has captured the maximum market share in 2023 in the carboxymethyl cellulose market. In the carboxymethyl cellulose (CMC) market, the thickening agent segment refers to CMC products primarily used to increase the viscosity and consistency of liquids or semi-liquids. These CMC-based thickening agents find extensive applications in industries such as food and beverage, pharmaceuticals, personal care, and industrial processes. Recent trends in this segment include the development of specialized CMC formulations tailored to specific applications, as well as the demand for natural and sustainable thickening agents to meet consumer preferences for clean-label products.

The binder segment is anticipated to witness rapid growth over the projected period. In the carboxymethyl cellulose market, the binder segment refers to CMC's property as an adhesive substance used to bind together various ingredients in formulations across industries. This segment encompasses applications in pharmaceutical tablets, where CMC acts as a binder to hold the active ingredients together, and in the construction sector, where CMC is utilized in mortar and plaster formulations to improve adhesion and cohesion. The trend in the binder segment involves increasing demand for CMC due to its effectiveness as a reliable and versatile binder in diverse applications.

The food & beverages segment has generated the largest market share in 2023 in the carboxymethyl cellulose market. In the carboxymethyl cellulose market, the food and beverages segment refers to the use of CMC as a thickening, stabilizing, and emulsifying agent in food products and beverages. CMC enhances texture, viscosity, and shelf-life in various food applications, including sauces, dressings, dairy products, and baked goods. A notable trend in this segment is the increasing demand for natural and clean label ingredients, driving the adoption of CMC as a plant-based and eco-friendly additive in food and beverage formulations.

The oil & refining segment is anticipated to witness rapid growth over the projected period. In the carboxymethyl cellulose market, the oil and refining segment refers to the utilization of CMC in various processes within the oil and gas industry. This includes applications such as drilling fluids, where CMC is employed to control fluid viscosity, minimize fluid loss, and enhance wellbore stability. Additionally, CMC finds use in oil refining processes for its thickening and stabilizing properties. Trends in this segment include the increasing adoption of CMC in environmentally sustainable drilling practices and the development of CMC-based formulations tailored for specific oil and refining applications.

Segments Covered in the Report

By Purity Level

By Property

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2023

September 2024

October 2024