April 2025

Cardiac Pacemaker Market (By Product Type: Implantable pacemakers, External pacemakers; By Type: MRI Compatible Pacemakers, Conventional Pacemakers; By Application: Arrhythmias, Congestive Heart Failure, Others; By End-Use: Hospitals & Cardiac Centers, Ambulatory Surgical Centers, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

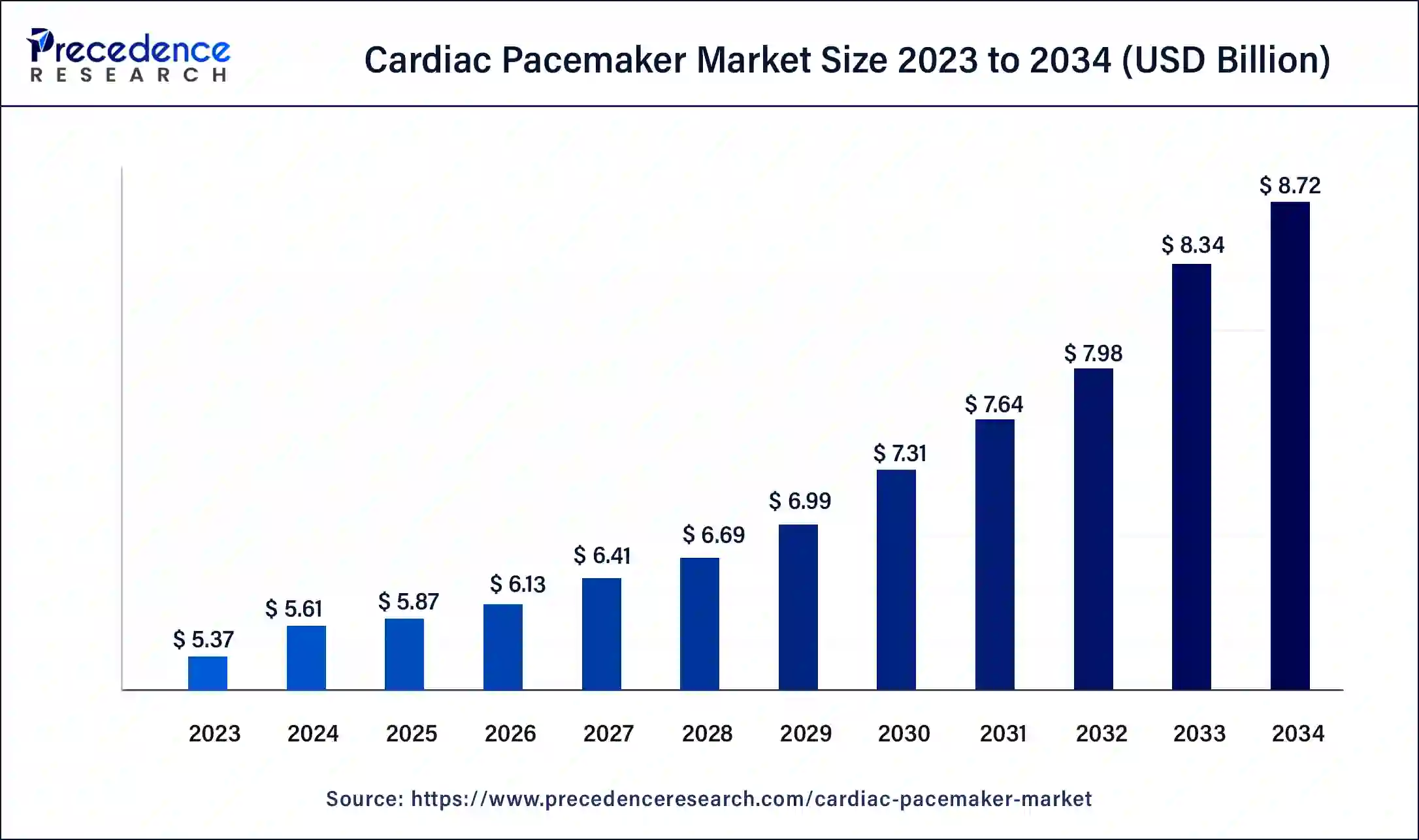

The global cardiac pacemaker market size was USD 5.37 billion in 2023, accounted for USD 5.61 billion in 2024, and is expected to reach around USD 8.72 billion by 2034, expanding at a CAGR of 4.5% from 2024 to 2034. The North America cardiac pacemaker market size reached USD 2.31 billion in 2023.

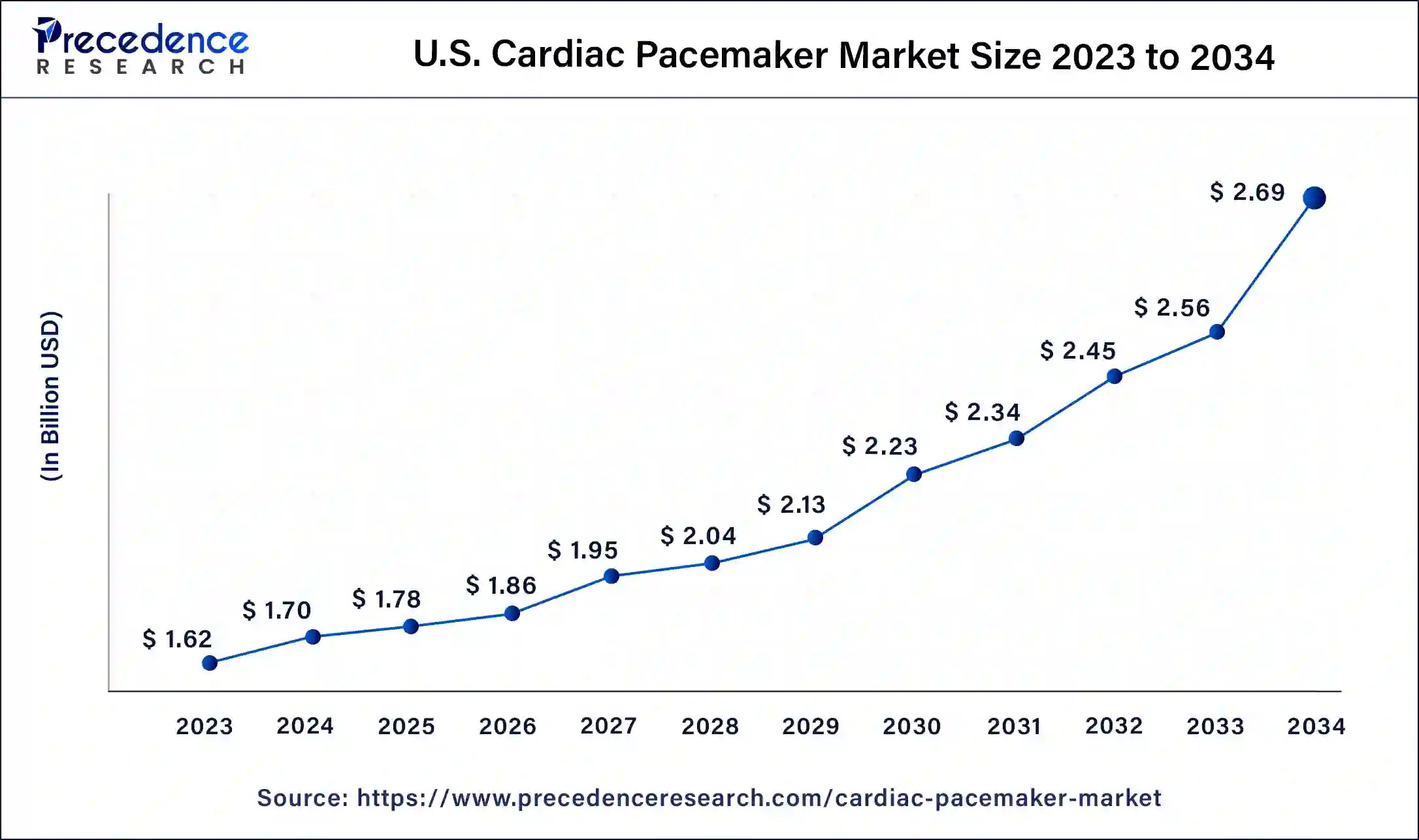

The U.S. cardiac pacemaker market size was estimated at USD 1.62 billion in 2023 and is predicted to be worth around USD 2.69 billion by 2034, at a CAGR of 4.7% from 2024 to 2034.

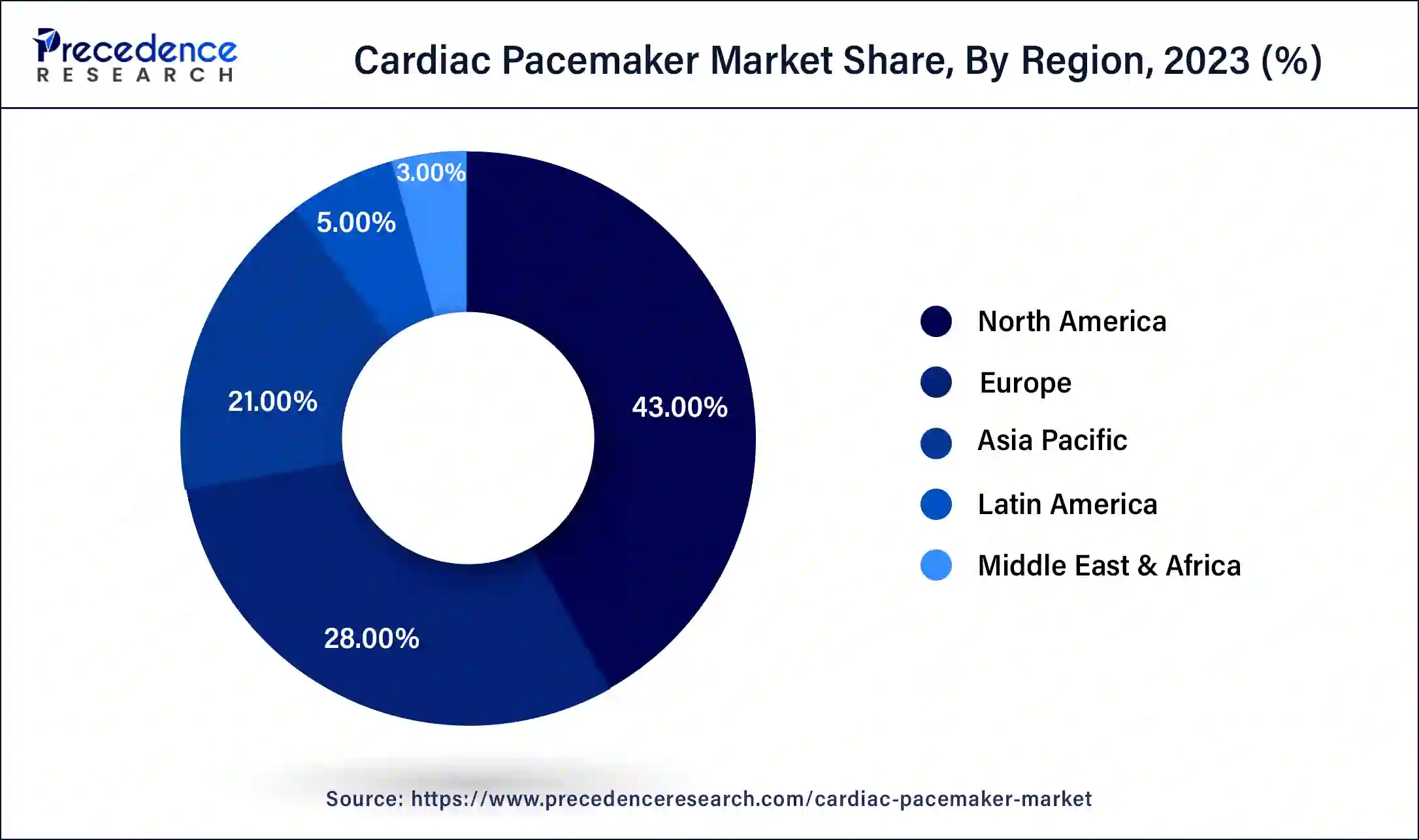

In terms of revenue, North America dominates the global cardiac pacemakers market and generated more than 43% revenue share in 2023. Its enormous market size is mostly due to the high prevalence of cardiovascular illness, high cases of obesity, and favorable revenues. The report "There is the number of elderly people that will strike U.S. economy apparently" like a" brick"—USA trade secretary" published on April 2021 estimates that 54 million people, or 16.5% population in the U.S., were above 65 years of age by 2020 and by the year 2030, this number is expected to grow to 74 million. There is the proportion of people aged over 85 who are at risk of heart disease is projected to significantly increase.

Additionally, nearly half of Americans, including those with high blood pressure, have some sort of heart disease, according to statistics from the American Heart Association that were released in January 2019. The prevalence of cardiac problems has increased the demand for cardiovascular equipment, equipment used for monitoring, and equipment used for diagnostics, as a result, there has been a critical demand for better medical technology, which could drive the market under study.

Every age range is affected by arrhythmia, although as people get older, they are more likely to get atrial fibrillation. According to Heart Disease and Stroke Statistics 2019, 1 in 3 white Americans is thought to be at risk for atrial fibrillation which could be long-term. Alcohol, sedentary, tobacco habits, and several over-the-counter medications may further raise the possibility of arrhythmia. As a result of these factors, the North American cardiac pacemakers market is anticipated to increase significantly during the projected period.

Market Overview

An artificial cardiac pacemaker, often known as a pacemaker, is a medical device that produces electrical impulses and delivers them via electrodes to the heart's upper or lower ventricles to force the targeted chambers to contract and pump blood. The development of advanced pacemakers, like leadless pacemakers as well as pacemakers that are MRI safe, as well as rising CVD incidences, rising cardiac disease management expenses, and supportive government policies are the main drivers for the expansion of the market.

The burden of cardiovascular disease, which is increasing, is also another key factor driving the market's expansion. Coronary heart disease is one of the leading causes of CVD mortality globally. The predicted $1,044 billion cost of these diseases by 2030 highlights the urgent demand for cardiac pacing equipment. Patients benefit from the new products that medical device businesses like Boston Scientific Corporation and Medtronic are now selling that are covered by reimbursement plans. Additionally, companies are concentrating more on making advanced pacemakers that support individualized care. These advancements include enhancing precision, introducing new tools to enhance workflow, and encouraging error minimization. For instance, at the Large Multi-Centre Study in May 2020, the home monitoring system from BIOTRONIK provided secure and affordable remote supervision of pacemaker patients. During COVID-19, this was a crucial step for routine remote follow-ups.

| Report Coverage | Details |

| Market Size in 2023 | USD 5.37 Billion |

| Market Size in 2024 | USD 5.61 Billion |

| Market Size by 2034 | USD 8.72 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.5% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product Type, By Type, By Application, By End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

In 2023, more than 61% of the cardiac pacemaker market was accounted for by the implanted pacemaker segment. Biventricular pacemakers, dual-chamber pacemakers, and single-chamber pacemakers are categorized as implantable pacemakers. The increasing need for these devices to treat failure of heart and arrhythmias, together with current clinical trials, are two major factors propelling market expansion. According to the CDC, atrial fibrillation, which affects between 2.9 and 6.5 million people in the U.S. alone, was the most prevalent kind of arrhythmia in 2017. As a result, the market is growing as CVDs are becoming more common.

The market for external pacemakers is predicted to experience encouraging growth over the projection period because of the segment's straightforward configuration, improved user interface, and improved indicator for low battery. Outside pacemakers are noninvasive, therefore there is a lower chance of problems following surgery. The devices also let patients monitor and record their everyday heart functioning. Additionally, outside pacemakers are the quickest cardiac rhythm synchronization devices currently on the market, which is also anticipated to drive category growth. Market participants who deal in external pacemakers, like Medtronic, Oscor Inc., and Pacetronix, are projected to have a beneficial impact on segment growth.

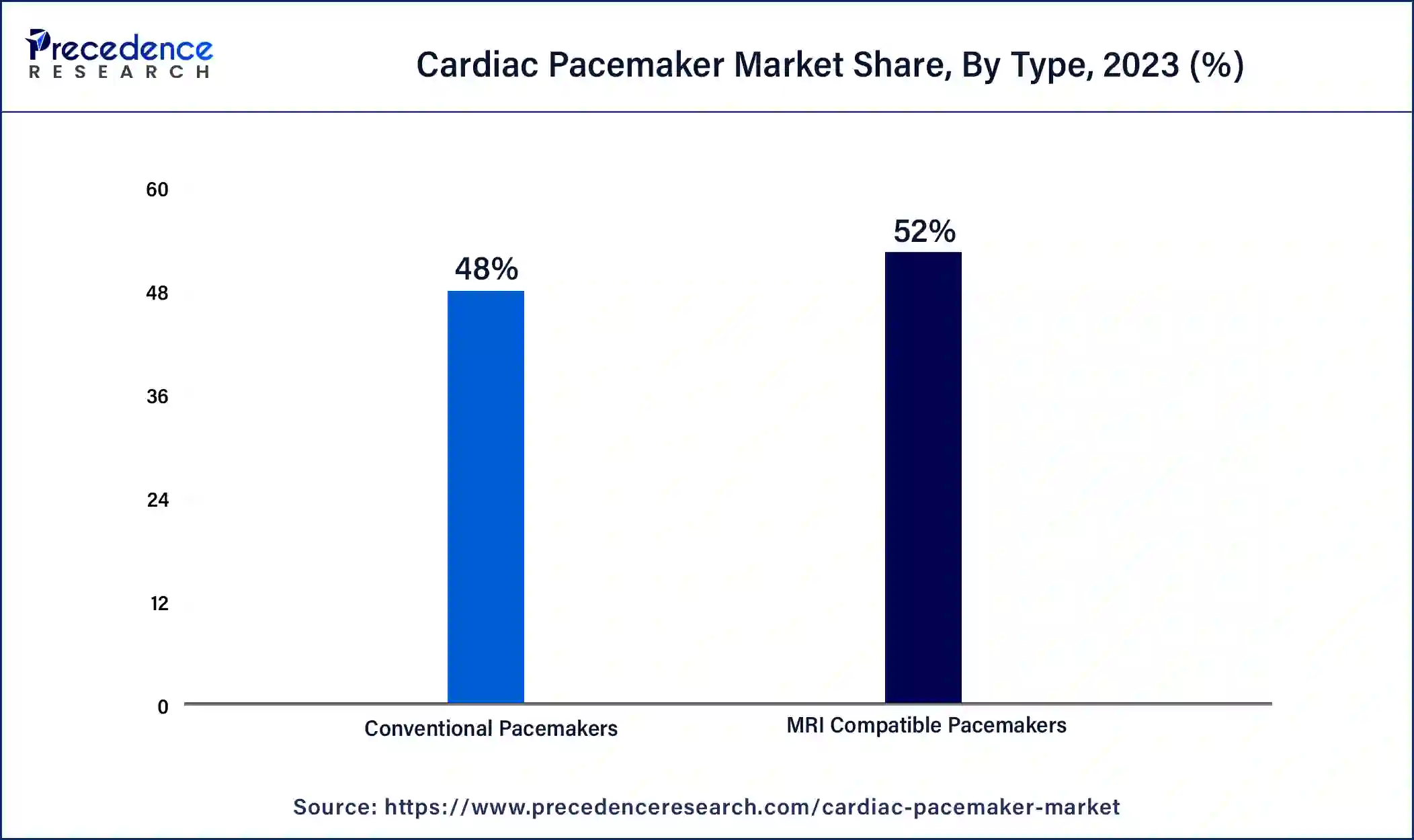

In terms of revenue in 2023, the market category for traditional pacemakers held a dominant share of almost 52% of the market. This growth is brought about by continual advancements, affordability, compactness, and long shelf life. Based on type, the market is split into MRI-compatible and conventional pacemakers. The MRI-compatible pacemaker segment is expected to grow profitably during the forecast period. The high rate can be attributed to the rising use of MRI-based diagnoses. The Mayo Foundation for Medical Education and Research estimates that in 2018, more than 75% of patients with pacemaker implants will eventually need an MRI. As a result, the market is growing at a rapid pace.

Arrhythmias accounted for 38% of all dominating the industry. The part is further divided into three categories: long QT syndrome, heart block, and atrial fibrillation. Pacemaker sales in 2023, several factors, including lifestyle disorders, excessive alcohol consumption, smoking, and obesity, have an impact on the prevalence of cardiac arrhythmia. In the UK, there were 12,33,140 cases of atrial fibrillation and atrial flutter combined in 2019, according to the European Medical Group LTD. The second-fastest predicted growth will occur in the congestive heart failure market. As of December 2018, the CDC estimates more than 6.5 million adults in the U.S. had heart failure. As a result, there will be a greater need for pacemakers with Innovative technology during the anticipated timeframe.

Hospitals and cardiac centers had a dominant share of over 70% in 2023. Hospitals and cardiac centers offer the greatest care while a patient is admitted. The fact that these facilities additionally offer procedure reimbursements is what is causing the category to grow. The American Heart Association estimates that by 2030, there will have been an additional 23.8 million hospital admissions for cardiac arrest. The end-user category includes hospitals, cardiac centers, ambulatory surgery centers, and other facilities.

Due to its extensive market reach, particularly in rural areas, and convenience of treatment, the ambulatory surgery center category is predicted to rise at a promising rate during the projection period. In this situation, ambulatory surgery facilities have shown to be a reliable approach. The increasing need to reduce surgery and post-surgical costs as well as the rising prevalence of CVDs are two additional factors that are projected to have a significant impact on the ambulatory surgical centers market. Another factor driving the industry is the need to lower healthcare costs while also enhancing patient satisfaction.

Segments Covered in the Report

By Product Type

By Type

By Application

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

September 2024

October 2023

August 2024