January 2025

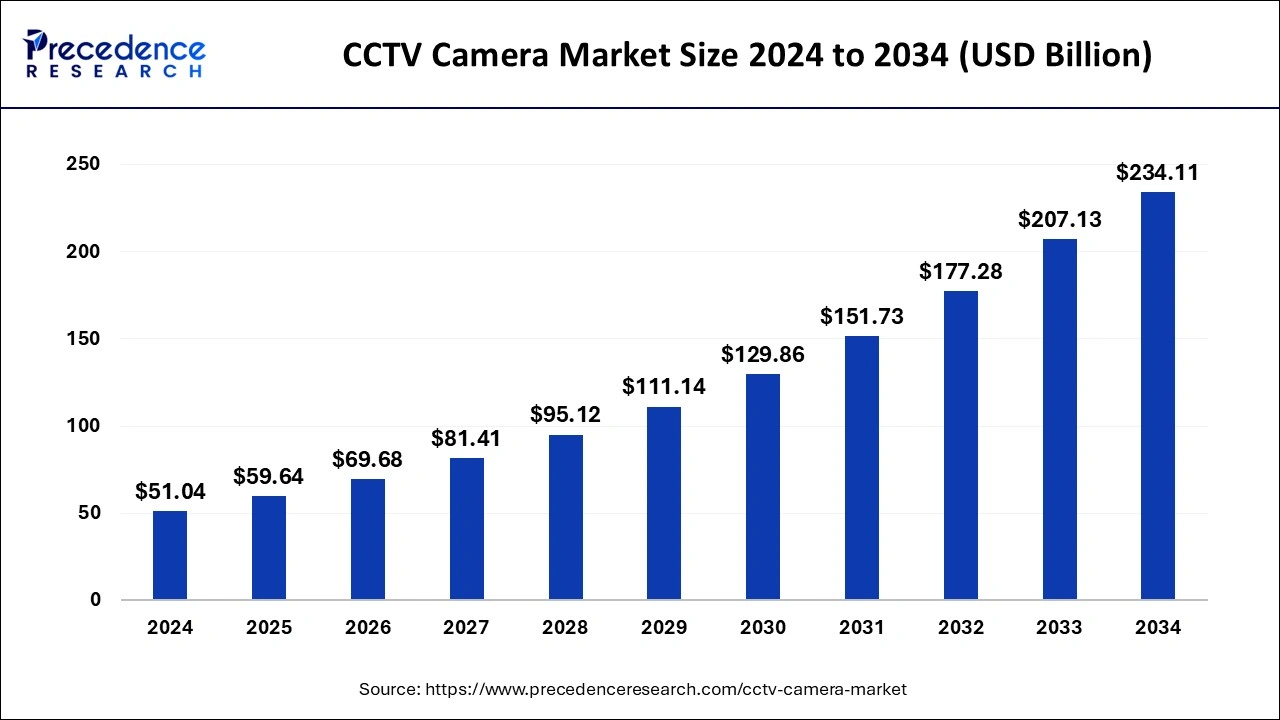

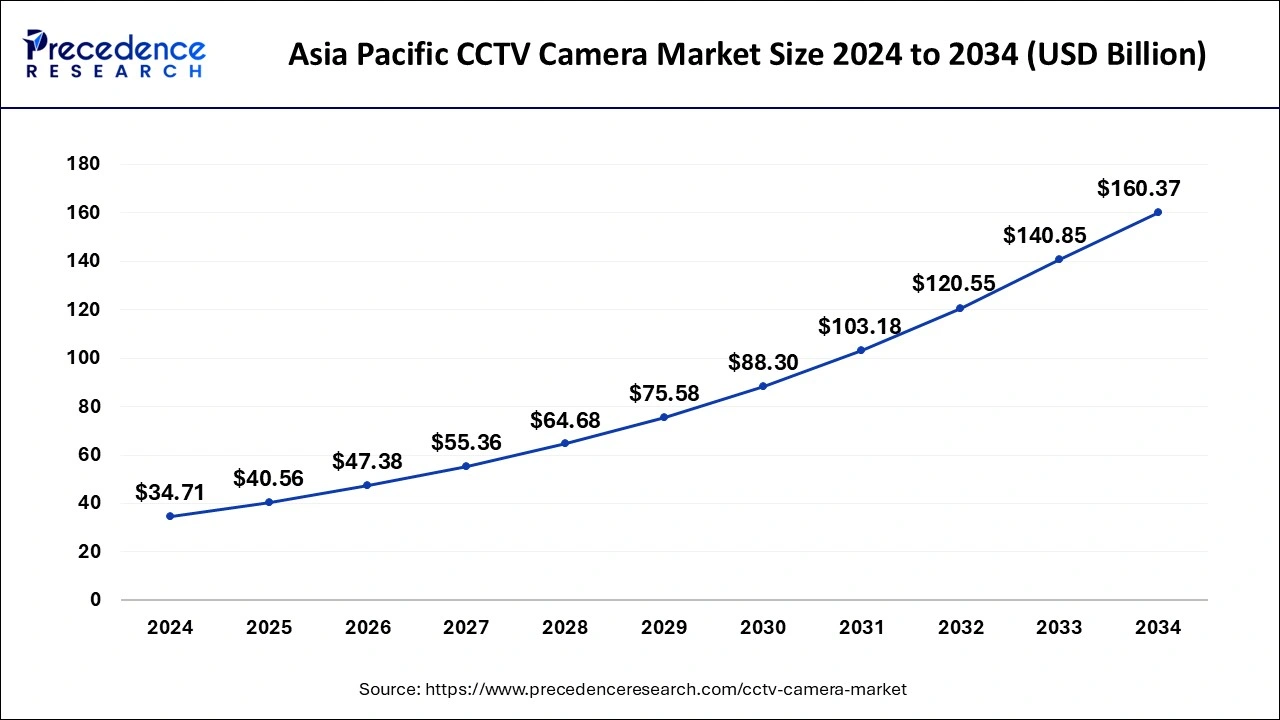

The global CCTV camera market size is calculated at USD 59.64 billion in 2025 and is forecasted to reach around USD 234.11 billion by 2034, accelerating at a CAGR of 16.45% from 2025 to 2034. The Asia Pacific CCTV camera market size surpassed USD 40.56 billion in 2025 and is expanding at a CAGR of 16.54% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global CCTV camera market size was estimated at USD 51.04 billion in 2024 and is predicted to increase from USD 59.64 billion in 2025 to approximately USD 234.11 billion by 2034, expanding at a CAGR of 16.45% from 2025 to 2034. The CCTV camera market is driven by the growing need for critical infrastructure security solutions.

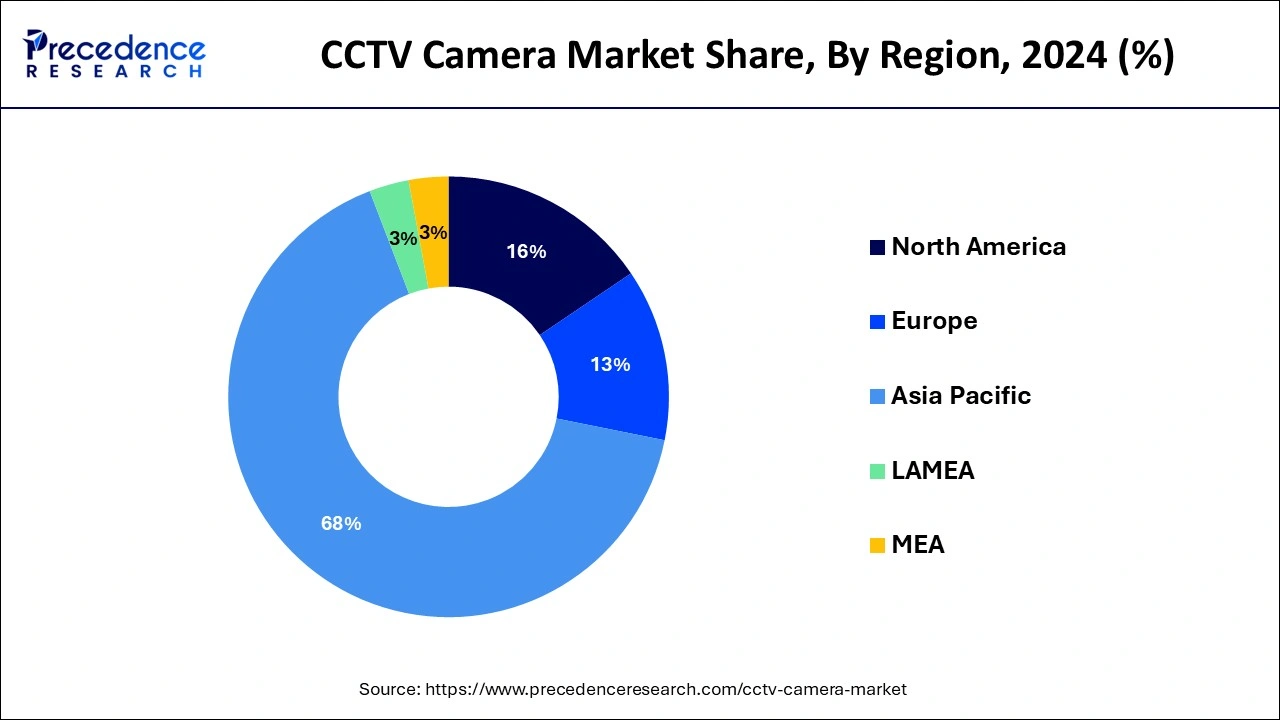

The Asia Pacific CCTV camera market size was estimated at USD 34.71 billion in 2024 and is expected to be worth around USD 160.37 billion by 2034, at a CAGR of 16.54% from 2025 to 2034.

Asia-Pacific carried the largest share of the CCTV camera market, and the region is observed to sustain dominance throughout the predicted timeframe. A large amount of infrastructure has been developed due to many countries experiencing fast economic growth in the Asia-Pacific region. Building smart cities, transit systems, industrial zones, and business complexes are all included in this. CCTV cameras are in high demand due to significant infrastructure investments made by public and commercial organizations. These investments serve to maintain security and promote effective operations. Society expectations and cultural norms also influence the need for CCTV cameras. Community monitoring and communal security are highly valued in many Asian countries. The middle class's growing wealth has also led to more spending on personal safety and home security systems, driving up demand for CCTV cameras.

North America is the fastest growing CCTV camera market during the forecast period. Use of machine learning and artificial intelligence algorithms-powered video analytics systems drives the need for CCTV cameras. Due to these enhanced analytics capabilities, CCTV systems are now more proactive and effective in detecting and preventing security risks, allowing for real-time monitoring, predictive analysis, and automatic reactions.

CCTV cameras improve security in several locations, such as residences, workplaces, public areas, and government buildings. They assist in real-time activity monitoring, serve as a deterrent to crime, and offer essential proof in the event of an occurrence. CCTV cameras also support public safety in public spaces such as streets, parks, and transportation hubs by keeping an eye out for suspicious activity, mishaps, or crises. They make it possible for authorities to guarantee the public's safety and react to situations quickly.

CCTV cameras are used in business environments for staff monitoring, internal theft prevention, and asset protection. They also support operations monitoring and guarantee that safety procedures and laws are followed. Rapid technical improvements in the CCTV market include machine learning capabilities, artificial intelligence (AI), higher-resolution cameras, and advanced analytics.

CCTV Camera Market Data and Statistics

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 16.45% |

| Global Market Size in 2025 | USD 59.64 Billion |

| Global Market Size by 2034 | USD 234.11 Billion |

| Largest Market | Asia-Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Camera Type, By Technology, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising concerns about security

Due to shifting crime rates and complex criminal operations, people, companies, and governments are spending more on CCTV systems to help detect and apprehend criminals and discourage potential offenders. Visible CCTV cameras discourage would-be offenders and lessen the possibility of criminal activity. Businesses and households are investing in CCTV systems to protect their assets and homes. This is due to the growing awareness of security concerns and the necessity for ongoing monitoring. Broad surveillance coverage is now essential for everything from banks and retail outlets to apartment buildings and industrial operations. CCTV cameras provide continuous monitoring, enabling proactive threat detection and real-time surveillance.

Raising concerns about privacy

Developments in CCTV technology, such as high-definition cameras, facial recognition software, and predictive analytics, raise more privacy concerns. Although these developments improve security, they also raise concerns about intrusive monitoring and widespread spying. Critics contend that face recognition technology in public places should be completely prohibited or subject to more stringent laws since they believe it seriously compromises people's civil rights and privacy.

Advancements in camera technology

CCTV systems that incorporate artificial intelligence (AI) algorithms and advanced analytics. These systems can automatically analyze real-time video feeds, which can then identify and notify users of any suspicious activity or anomalies. Artificial intelligence (AI)-powered features like object tracking, facial recognition, and behavioral analysis improve surveillance systems' capabilities and make them more proactive in identifying and responding to threats. Beyond typical security surveillance, new applications have also been made possible by advancements in camera technology. For example, high-resolution cameras equipped with panoramic or 360-degree viewing capabilities are employed in public areas and events to monitor crowds. Thermal imaging cameras identify any health hazards and screen temperature in public spaces and healthcare institutions.

The dome CCTV segment dominated the CCTV camera market in 2024. Dome cameras are distinguished by their small, discrete, and elegant design. Compared to other CCTV cameras, they are less threatening due to their dome-shaped housing. This design element not only improves the appearance but also acts as a deterrent to possible invaders because they might not be able to determine which way the camera is pointed. Many functions are available on modern dome cameras, including motion detection, pan-tilt-zoom (PTZ) capabilities, infrared night vision, high-definition video resolution, and two-way voice communication. These cutting-edge capabilities give consumers more flexibility and control over their security operations while improving monitoring systems' overall efficacy.

The C-mounted segment is the fastest growing in the CCTV camera market during the forecast period. C-mount cameras are becoming more affordable despite having better features and image quality, which opens more options for a broader spectrum of users. Because of the falling costs of camera components combined with manufacturing economies of scale, C-mount cameras are an appealing option for both cost-conscious consumers and enterprise clients wishing to implement scalable surveillance solutions.

The IP camera segment dominated the CCTV camera market in 2024. IP cameras are an example of how surveillance technology has advanced. Instead of analog CCTV cameras, IP cameras digitize and process video data on-board. There are many benefits to using this digital method in terms of usefulness, resolution, and image quality. IP cameras transmit data over the internet or currently existing computer networks. Because of this connectedness, users can watch remotely from any location with an internet connection and view live or recorded video. Furthermore, IP cameras provide centralized monitoring and control when linked to more extensive security systems.

The wireless camera segment is the fastest growing in the CCTV camera market during the forecast period. Regarding ease and versatility, wireless cameras are superior to their tethered counterparts. They are simple to install in historic buildings, rental homes, or outdoor spaces where laying wires would be expensive or impossible. Wireless cameras are perfect for business and residential applications because of their versatility. Manufacturers can use economies of scale and lower production costs as the demand for wireless cameras increases. Due to this development, a broader spectrum of individuals and companies can now access more affordable wireless camera choices.

The BFSI segment dominated the CCTV camera market in 2024. Significant technological breakthroughs in the CCTV camera industry have included the introduction of high-definition (HD) and ultra-high-definition (UHD) cameras, intelligent video analytics, facial recognition, and the ability to monitor remotely. BFSI firms use these cutting-edge surveillance technologies to strengthen security posture, boost situational awareness, and expedite security operations. BFSI institutions can increase their overall security efficacy by investing in state-of-the-art CCTV systems, providing better coverage, higher resolution images, and more sophisticated threat detection capabilities.

The residential segment is the fastest growing in the CCTV camera market during the forecast period. Homeowners are using CCTV cameras more frequently to monitor their properties as worries about safety and security at home grow. The necessity for surveillance has increased due to trespassing, vandalism, and burglaries. When a property has CCTV cameras installed, several insurance providers reduce the cost of the homeowners' insurance. To lower risks and save insurance costs, this financial incentive encourages homeowners to invest in surveillance systems.

The government segment shows notable growth in the CCTV camera market during the forecast period. Cities are growing denser due to fast urbanization and population increase, which raises security issues, including crime and civil unrest. Governments are spending money on monitoring systems to reduce these threats and guarantee the security of their inhabitants. Governments emphasize public safety programs and invest in surveillance technologies to effectively prevent and respond to security breaches in response to the growing threat of terrorism and organized crime. CCTV cameras are essential for monitoring high-risk locations and spotting possible security risks.

By Camera Type

By Technology

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

August 2024

February 2025

January 2025