February 2025

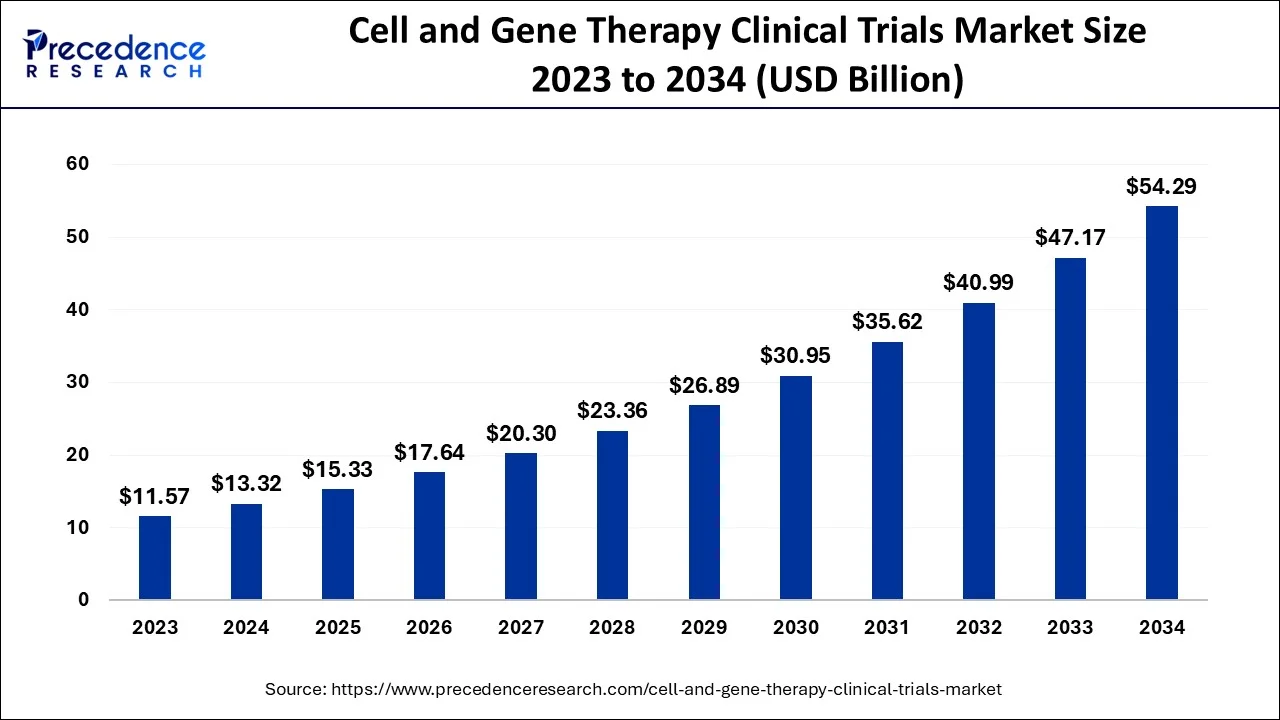

The global cell and gene therapy clinical trials market size accounted for USD 13.32 billion in 2024, grew to USD 15.33 billion in 2025 and is projected to surpass around USD 54.29 billion by 2034, representing a healthy CAGR of 15.09% between 2024 and 2034. The North America cell and gene therapy clinical trials market size is calculated at USD 6.53 billion in 2024 and is expected to grow at a fastest CAGR of 15.19% during the forecast year.

The global cell and gene therapy clinical trials market size is estimated at USD 13.32 billion in 2024 and is anticipated to reach around USD 54.29 billion by 2034, expanding at a CAGR of 15.09% between 2024 and 2034.

Gene therapy entails the delivery of genetic material, frequently in the form of transport or vector, and the incorporation of the gene into the appropriate bodily cells. Cell treatment involves giving the patient cells the right purpose. Gene therapy and cell treatment are sometimes combined in operations.

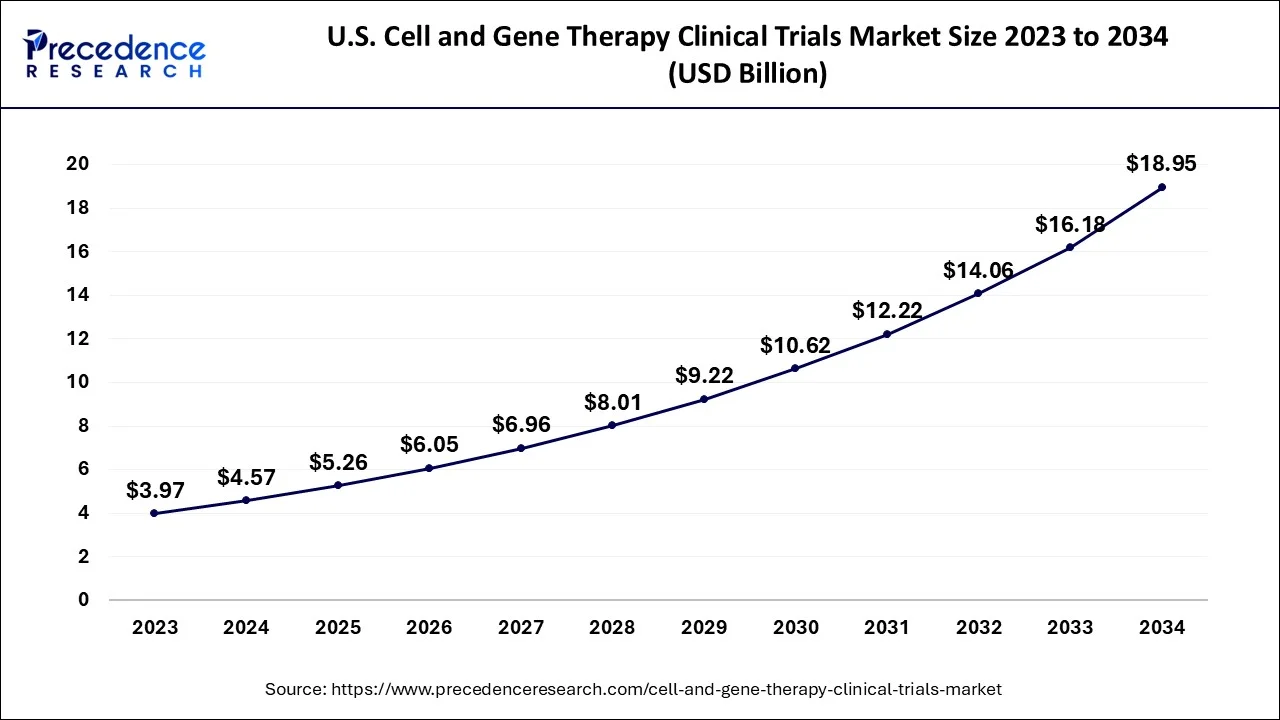

The U.S. cell and gene therapy clinical trials market size accounted for USD 4.57 billion in 2024 and is predicted to be worth around USD 18.95 billion by 2034, growing at a CAGR of 15.26% from 2024 to 2034.

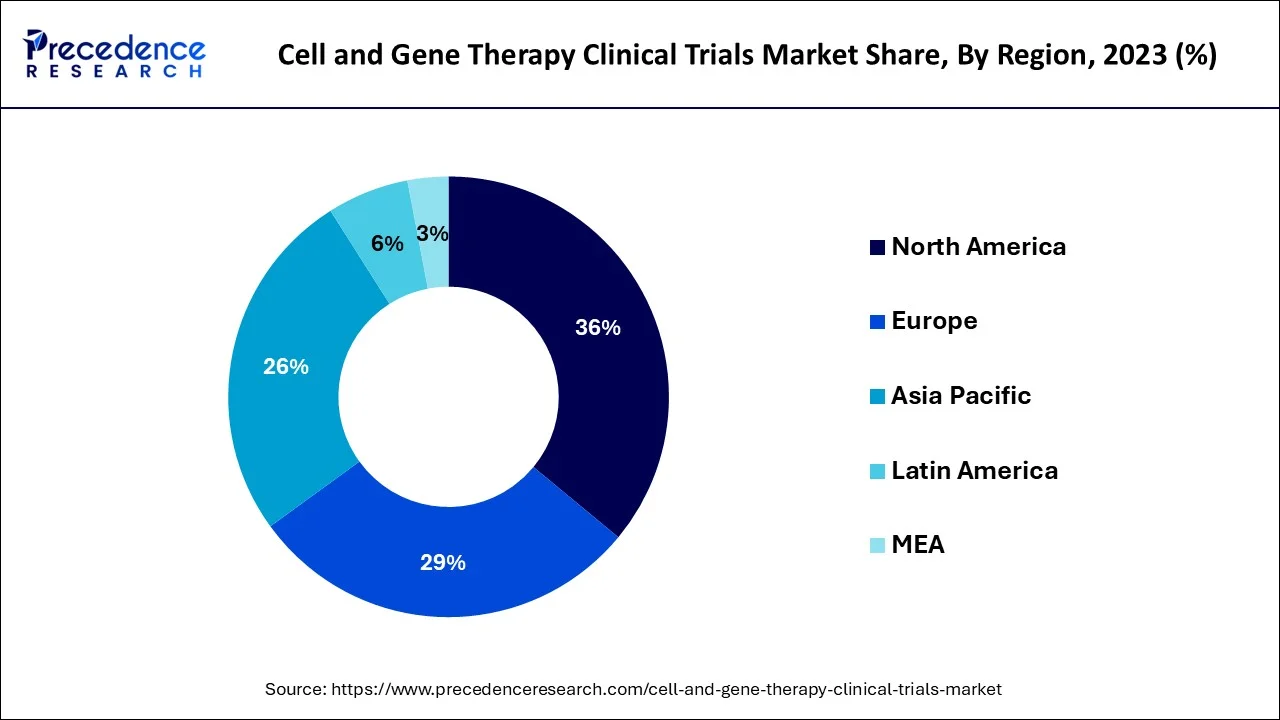

In 2023, North America made for the biggest portion of worldwide revenue 49% and it is anticipated that it will continue to hold the lead throughout the forecast period. A favorable legislative climate, particularly in the US, is blamed for this. In addition, the United States is home to many of the world's top research institutions and has a well-established regulatory framework for conducting clinical trials. The region has a strong focus on oncology, with many trials evaluating cell and gene therapies for various types of cancer.

Asia Pacific is predicted to experience the fastest CAGR growth during the forecast period. Bioengineering firms with an emphasis on regenerative medicine are multiplying in the Asia Pacific region. The region is also anticipated to maintain its status as the center of cell research and therapy due to the constant growth of medical tourism hotspots like Thailand, Singapore, and India. Asia is also experiencing an increase in CGT clinical study subjects compared to North America and Europe. Due to the large patient population and low cost of testing, this is advantageous for the Asia Pacific industry.

An increase in R&D financing, increasing patient demand for novel therapies, rising interest in cell and gene therapies for cancer treatment, and a supportive regulatory climate are the main market drivers. A brand-new front in the battle against numerous fatal illnesses, such as cancers and uncommon genetic conditions, is cell and gene therapy (CGT). It stands for the most recent round of invention in the life sciences sector. Early in the 2020s, the COVID-19 epidemic decreased the number of gene therapy clinical trials because the majority of research was devoted to treating and identifying COVID-19.

An increase in R&D financing, increasing patient demand for novel therapies, rising interest in cell and gene therapies for cancer treatment, and a supportive regulatory climate are the main market drivers. A brand-new front in the battle against numerous fatal illnesses, such as cancers and uncommon genetic conditions, is cell and gene therapy (CGT). It stands for the most recent round of invention in the life sciences sector. Early in the 2020s, the COVID-19 epidemic decreased the number of gene therapy clinical trials because the majority of research was devoted to treating and identifying COVID-19.

In comparison to small-molecule compounds, which had an R&D success rate of 8.2% between 2008 and 2018, CGT medicines had an 11% success rate from Phase I to commercialization. The size and sophistication of the new businesses joining the industry are both growing significantly. Small biotech companies made up a large portion of the early movers in this industry. The important biopharma companies attracted a lot of attention. Most of the big pharmaceutical firms are now making CGT investments. For instance, Novartis announced in December 2021 that it had inked a purchase deal with Gyroscope Therapeutics, a provider of ocular gene therapy.

With this purchase, Novartis will be better positioned to offer gene therapy for eye diseases. Other notable purchases include Gilead's purchase of Kite Pharma, Roche's purchase of Spark Therapeutics, and Bristol-Myers Squibb's purchase of Celgene. Since the year 2000 and the advent of new technologies, interest in the CGT sector has steadily increased. By 2025, the FDA projected that it would authorize 10 to 20 novel BLAs for cell therapy products annually in the United States alone. The clearance of CGT by the American FDA has also increased recently.

For instance, the FDA granted CAR T-Cell Therapy, created by Penn Medicine for the treatment of relapsed or Refractory Follicular Lymphoma (FL) in adults, its third clearance in May 2022. Such approvals are anticipated to raise interest in CGT study, which will fuel market expansion. In addition to being used to treat cancer, CGT is increasingly significant in the management of COVID-19. The FDA authorized BioCardia to begin a Phase I/II clinical study of BCDA-04 in adults recovering from COVID-19-linked acute respiratory distress syndrome in April 2022 after the company's Investigational New Drug (IND) proposal was accepted. (ARDS). Such permits are probably going to help the industry expand.

| Report Coverage | Details |

| Market Size in 2024 | USD 13.32 Billion |

| Market Size by 2034 | USD 54.29 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 15.09% |

| Largest Market | North America |

| Fastest Growing Market | Asia-Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Phase and By Indication |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing prevalence of cardiovascular disease

Over the projection period, rising cardiovascular disease rates are anticipated to fuel market development for cell and gene therapies. For instance, according to a World Health Organization study released in June 2021, 32% of all deaths worldwide in 2019 were attributed to cardiovascular illnesses, killing an estimated 17.9 million people. Heart attacks and strokes worldwide accounted for 85% of these deaths. Globally, cardiovascular illnesses were responsible for 38% of the 17 million premature deaths (under the age of 70) in 2019 that were caused by non-communicable conditions. Additionally, the same source estimates that by May 20, 2022, low- and middle-income (LMIC) nations like Bangladesh and India will account for nearly 90% of all COPD-related fatalities in people under the age of 70 worldwide.

High cost

Gene therapy's high upfront cost and the absence of benevolent reimbursement policies are two factors that may limit market development to some degree during the projection period. Other factors that are anticipated to impede market growth in the future include a lack of awareness of cell and gene therapy, the absence of developed healthcare infrastructure in developing and underdeveloped nations worldwide, and the rising number of difficulties in developing products for gene and cell therapy.

Over the course of the forecast period, factors such as the rising prevalence of adverse immune system reactions, severe off-target effects, difficulties with vector delivery to the target cell, and growing challenges with scalability and manufacturing of cell and gene therapy products are predicted to further restrict the uptake of these treatments and possibly restrain market revenue growth.

Increasing private and public investments

Cell and gene therapy businesses are drawing more private and governmental funding despite the low number of approvals. Over the past ten years, life sciences have seen a sharp rise in private equity and capital funding. Similarly, there has been a notable increase in funding in businesses that provide cell and gene therapy. For example, spending has increased dramatically, going from USD 362 million in 2020 to almost USD 68 billion in 2021. The demand for outsourcing is anticipated to rise as a result, fueling the expansion of the cell and gene therapy production industries.

The market has been divided into phases I, II, III, and IV on the premise of phases. Given that the majority of cell and gene therapies are in this stage of the clinical trial, the phase II section dominated the worldwide market in 2023 and made for the biggest part of more than 54% of the total revenue. Due to rising R&D expenditures, an increase in phase II clinical trials funded by both industry and non-industry, and the complexity of phase II clinical trials, the sector is also anticipated to expand at the fastest rate over the forecast period.

Additionally, the majority of studies involving cell and gene therapy are presently stopping short of finishing their research. Additionally, this adds to the segment market's largest portion. In 2022, the phase 1 segment is anticipated to record a sizable percentage. The successful transition of medications from non-clinical initiatives into First-in-Human clinical trials is one of the main factors contributing to the segment's growth. Even though phase I and phase II clinical trials for cell and gene therapy still make up the overwhelming majority of trials, the percentage of trials now in phase III and phase IV is marginally increasing. The market development in the later stages of clinical research is anticipated to be enhanced by this.

Oncology, Cardiology, CNS, Musculoskeletal, Infectious Diseases, Dermatology, Endocrine, Metabolic, Genetic, Immunology & Inflammation, Ophthalmology, Hematology, Gastroenterology, and others make up the market's indications segment. With a revenue share of more than 47.70% in 2023, the oncology sector dominated the global market, and it is expected that it will continue to hold the lead throughout the projection period. Global data projects that in 2021, the cancer sector will alone account for 1,375 of the total number of CGT clinical trials. The investment in cancer emphasizes the significance of creating quick and effective CGT clinical study delivery methods and tackling scaling to commercialization challenges.

Due to the worldwide proliferation of the COVID-19 pandemic, clinical trials for cancer were put on hold in the early 2020s. However, due to the increasing burden of cancer globally, there has been a sizable increase in clinical trials for cancer in 2022 and is anticipated to expand at a faster pace during the forecast period. A greater interest in CGTs in cancer has been made possible by the creation of CAR-T cell therapies like Kymriah and Yescarta as well as their effectiveness in treating hematological malignancies. Global investments in this strategy to treat different kinds of cancer are being made by both biotech and pharmaceutical firms.

Segments Covered in the Report:

By Phase

By Indication

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

January 2025

January 2025

January 2025