February 2025

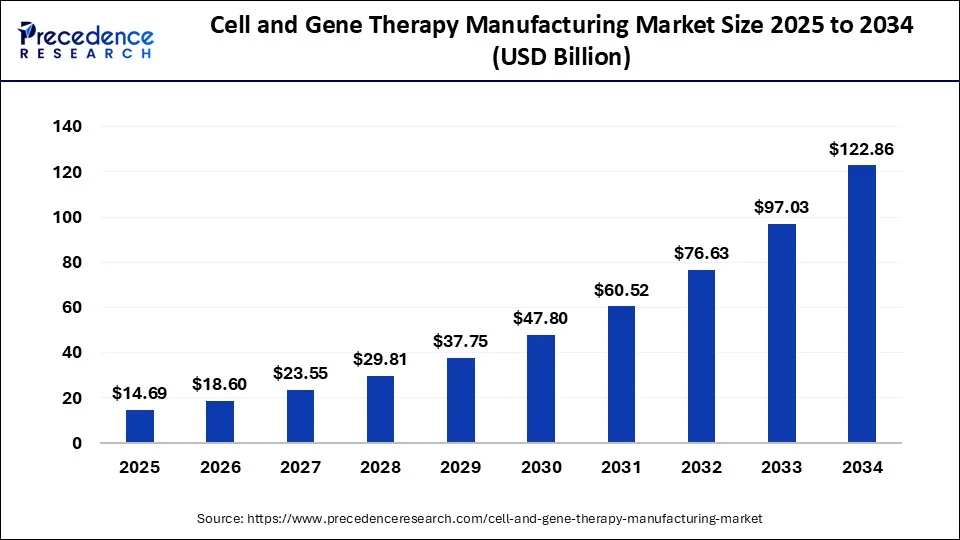

The global cell and gene therapy manufacturing market size surpassed USD 9.16 billion in 2023 and is estimated to increase from USD 11.60 billion in 2024 to approximately USD 122.86 billion by 2034. It is projected to grow at a CAGR of 26.62% from 2024 to 2034.

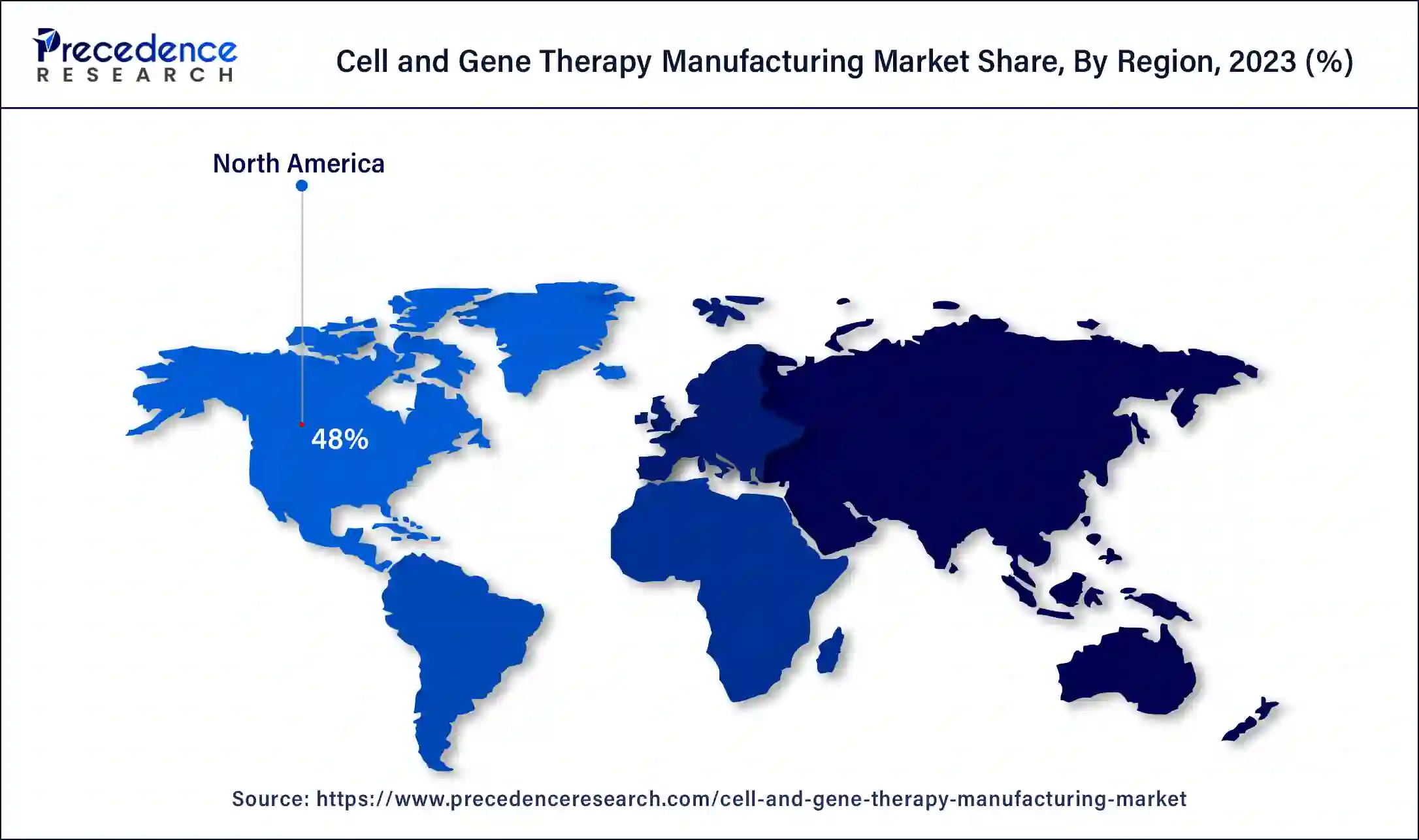

The global cell and gene therapy manufacturing market size is expected to be valued at USD 11.60 billion in 2024 and is anticipated to reach around USD 122.86 billion by 2034, expanding at a solid CAGR of 26.62% over the forecast period from 2024 to 2034. The North America cell and gene therapy manufacturing market size reached USD 4.40 billion in 2023.

The benefits of cell and gene therapy manufacturing include improved traceability throughout the process to ensure the chain of custody, high product efficiency and consistency, elimination of risk and contamination, enhanced resource utilization, streamlined decision making, and effective coordination of diverse functions can help to the growth of the market.

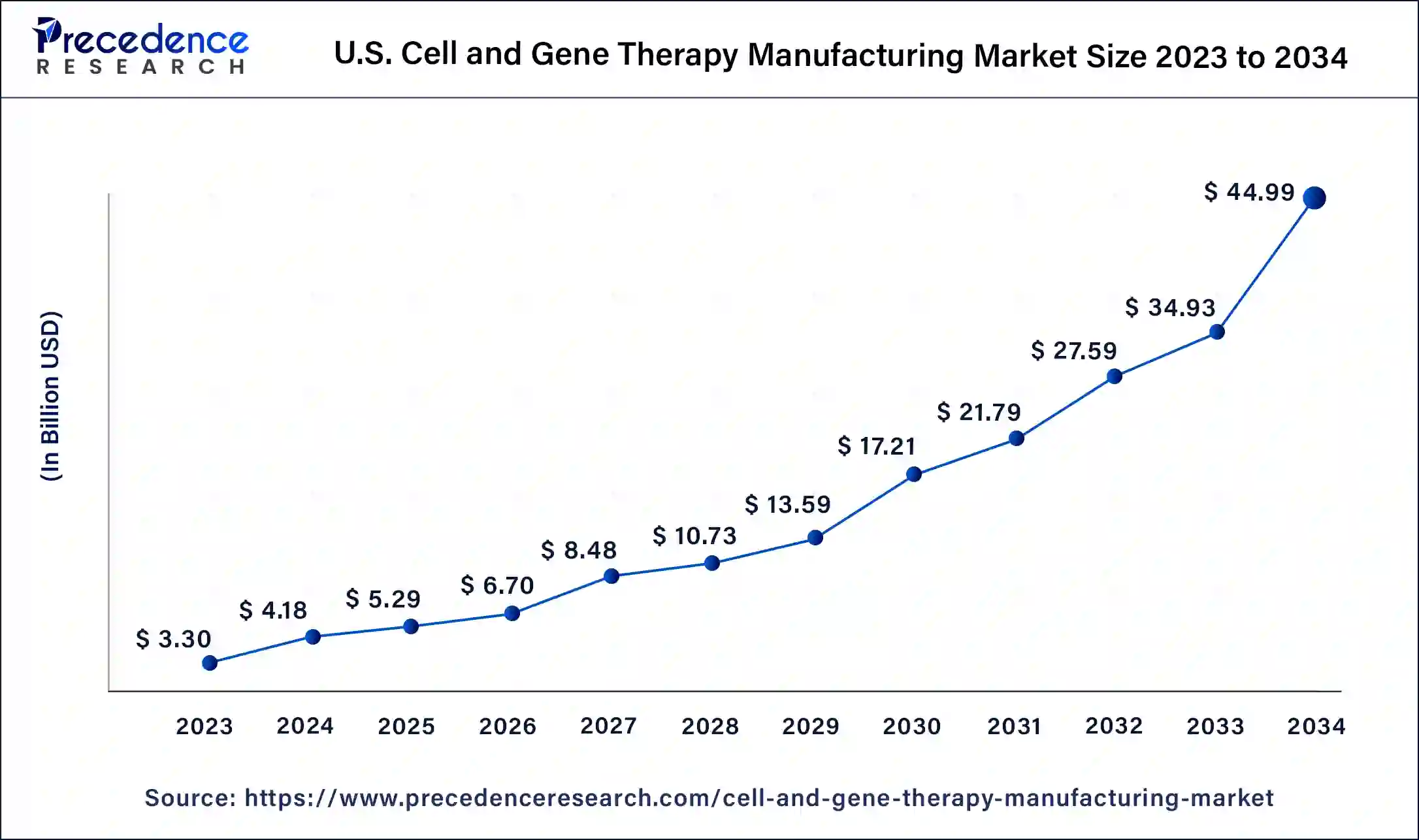

U.S. Cell and Gene Therapy Manufacturing Market Size and Growth 2024 to 2034

The U.S. cell and gene therapy manufacturing market size was exhibited at USD 3.30 billion in 2023 and is projected to be worth around USD 44.99 billion by 2034, poised to grow at a CAGR of 26.80% from 2024 to 2034.

North America dominated the cell and gene therapy manufacturing market in 2023. Increasing engagement in product and research development in cell and gene therapy, growing manufacturing facilities, increasing cancer incidences, and increasing research activities in stem cells and cancer cells help the growth of the market in the North American region. The United States is the leading country for the growth of the market in the North American region.

Asia Pacific is estimated to be the fastest-growing during the forecast period of 2024-2033. Increasing government and private investments, growing healthcare needs, and initiation of rapid approval pathways help the growth of the market in the Asia Pacific region. India and China are the leading countries for the growth of the cell and gene therapy manufacturing market in the Asia Pacific region.

Cell and gene therapy manufacturing stands at the forefront of medical innovation and is assured to revolutionize the treatment landscape for many diseases. The benefits of cell and gene therapy manufacturing include improved traceability throughout the process to ensure the chain of custody, high product efficiency and consistency, elimination of contamination and risk, enhanced resource utilization, streamlined decision-making, and effective coordination of diverse functions. These are helpful for academic research & institutes, pharmaceutical & biotechnology companies, and other end users. These factors help the growth of the cell and gene therapy manufacturing market.

| Report Coverage | Details |

| Market Size by 2034 | USD 122.86 Billion |

| Market Size in 2023 | USD 9.16 Billion |

| Market Size in 2024 | USD 11.60 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 26.62% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Therapy, Scale, Mode, Workflow, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising prevalence of chronic diseases and development in manufacturing processes

The rising prevalence of chronic disease and development in manufacturing processes help the growth of the market. In the medical field, cell and gene therapy manufacturing offers innovative approaches to treating diseases. Gene therapy can help to create modified/new proteins, increase disease-fighting protein production, and reduce disease-causing protein levels. Cell therapy targets specific functions depending on the treatments. These factors help the growth of the cell and gene therapy manufacturing market.

High cost and complexity

Cell and gene therapy manufacturing is linked with specific challenges, including the high cost of development and manufacturing, changing regulations, ensuring product quality, and scaling up and out. The high complexity of cell and gene therapy manufacturing can hamper the growth of the market. The major challenges of cell and gene therapy manufacturing include variability in the total yield of the final product, having many manufacturing spaces to increase production, and patient-to-patient variability in the starting material. These factors can restrict the growth of the cell and gene therapy manufacturing market.

Opportunities in the academic & research institutes and pharmaceutical & biotechnologycompanies

The cell and gene therapy manufacturing market opportunities in the academic & research institutes and pharmaceutical & biotechnology companies can help to the growth of the market. The cell and gene therapy manufacturing benefits for pharmaceutical & biotechnology companies and academic research & institutes include advanced therapy medicinal products (ATMPs) to ensure patient access and meet rising demands and flexibility in manufacturing.

The collaboration with CDMOs (Contract Development & Manufacturing Organizations) offers benefits such as expert project management, flexibility, and cost efficiency. Collaboration between academic & research institutes, pharmaceutical & biotechnology companies, and regulatory bodies advance the development and manufacturing of cell and gene therapy. This approach ensures innovative treatments reach patients in a cost-effective and timely manner. This helps to the growth of the market.

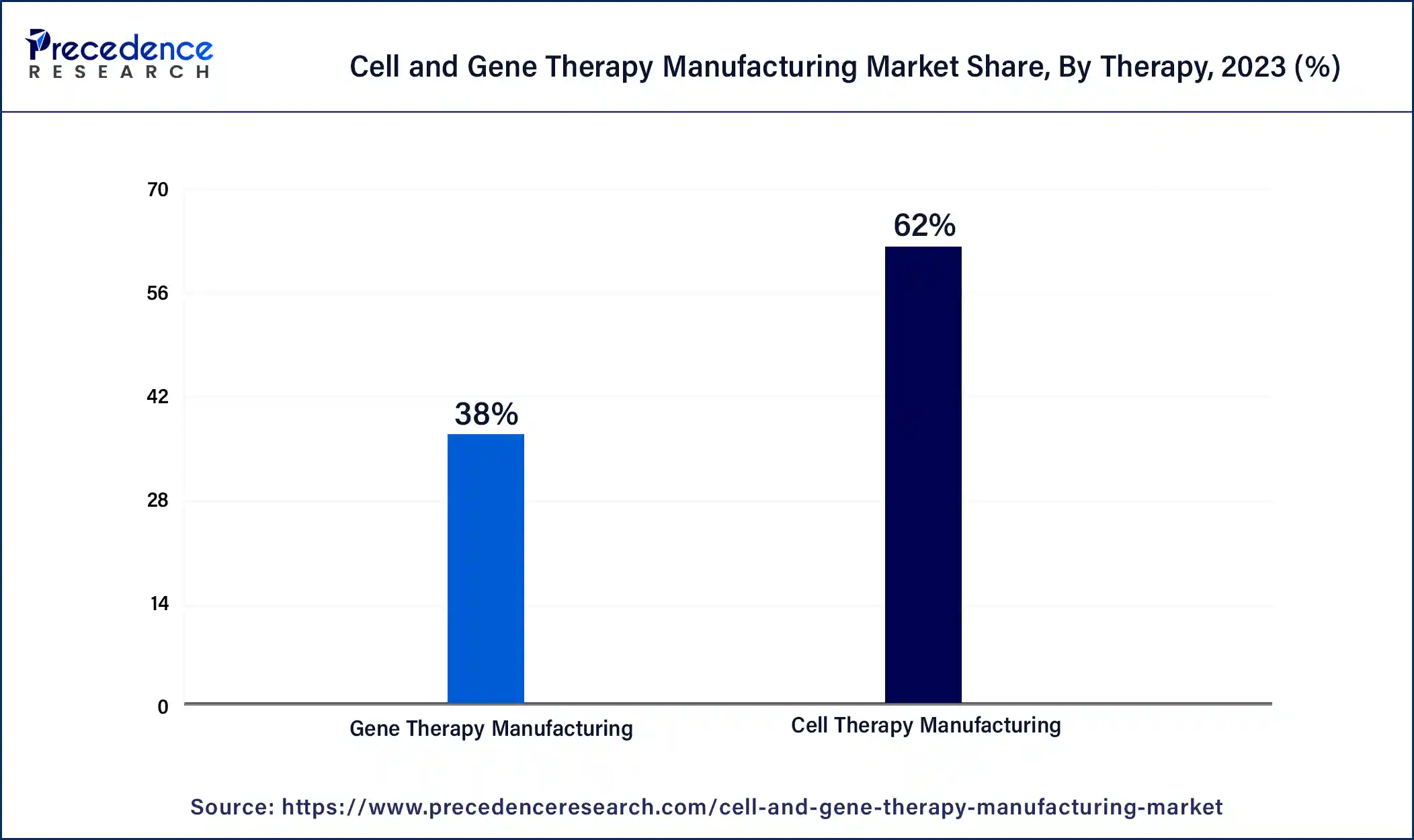

The cell therapy manufacturing segment dominated the cell and gene therapy manufacturing market in 2023. The benefits of cell therapy manufacturing include helping to increase stability, potency, reproducibility, purity, batch size, and product yield and decreasing manufacturing cost and time. It also includes automation and digital systems to reduce costs and improve operational efficiency in cell therapy manufacturing. It helps to scale up and streamline manufacturing processes to deliver therapies rapidly to patients. These factors help the growth of the cell therapy manufacturing segment and contribute to the market's growth.

The gene therapy manufacturing segment is estimated to grow significantly during the forecast period. Gene therapy manufacturing includes the production of therapeutic products that manipulate or modify gene expressions for therapeutic use. Gene therapy development and manufacturing offers many benefits over customized solutions. The benefits of gene therapy manufacturing include improved resource utilization, effective coordination of diverse functions, and streamlined decision-making. These factors help to the growth of the gene therapy manufacturing segment and contribute to the growth of the cell and gene therapy manufacturing market.

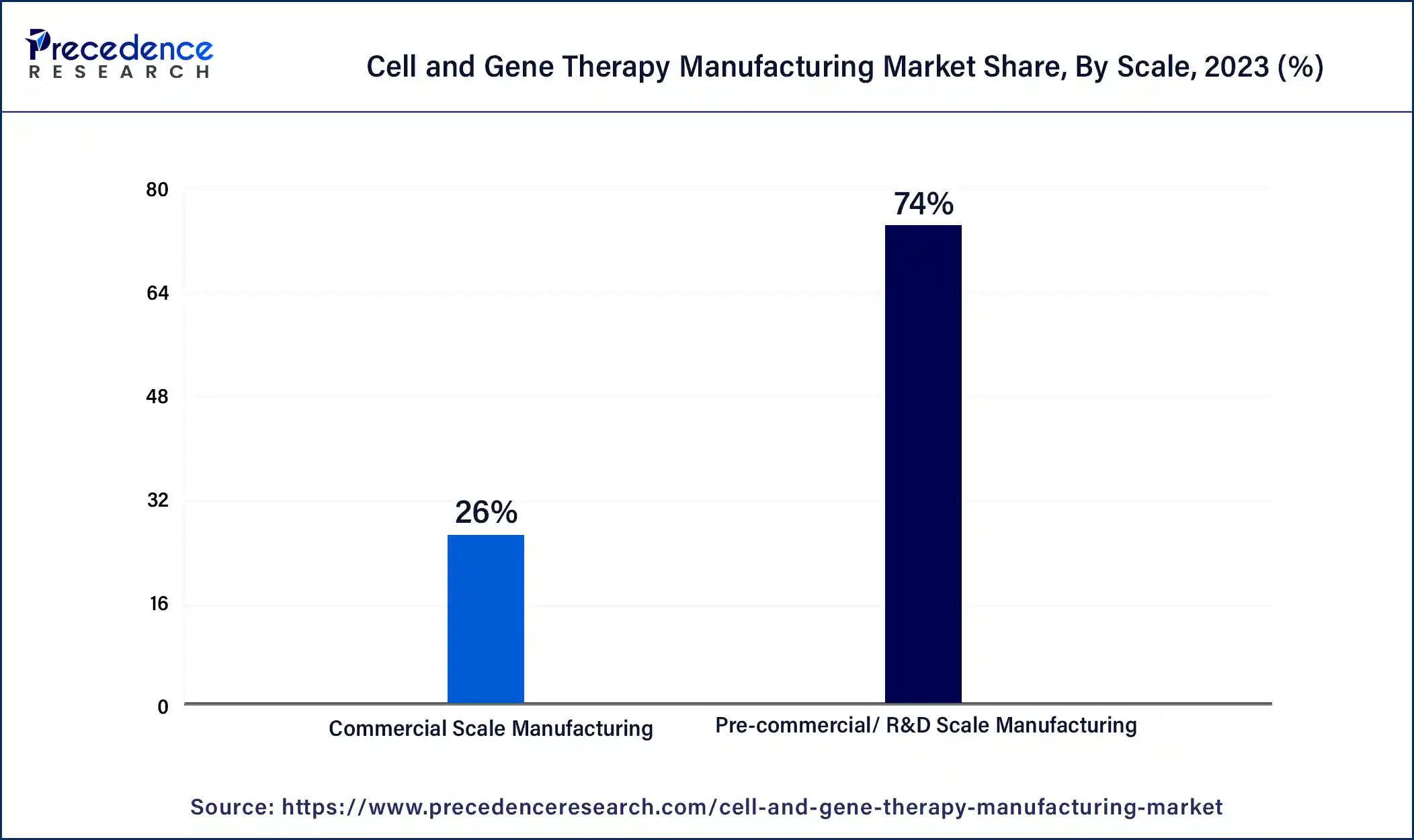

The precommercial R&D scale manufacturing segment dominated the cell and gene therapy manufacturing market in 2023. The benefits of precommercial/R&D scale manufacturing include job creation, customization, flexibility, and cost-effectiveness over large-scale manufacturing. It also includes innovation and adoption more quickly, reduced production downtimes, automation, accuracy, and improved overall efficiency.

Investment in precommercial/R&D scale manufacturing helps to reduce dependency on manual operations. Process improvement and automation help to enhance cost-effectiveness and productivity. These factors help the growth of the precommercial/R&D scale manufacturing segment and contribute to the growth of the market.

The commercial scale manufacturing segment is expected to be the fastest-growing during the forecast period. The commercial-scale manufacturing benefits include safety, cost-effectiveness, efficiency, and accuracy. Efficiency is the main in the manufacturing process because it ensures that resources are used specifically, increasing productivity and reducing costs.

Accuracy is also important for the manufacturing process because it ensures that the final product meets the required specifications. Applications of commercial-scale manufacturing include accurate weighing of raw materials is essential, shipping and receiving, quality control, inventory management, and weighing finished products. These factors help the growth of the commercial scale manufacturing segment and contribute to the growth of the cell and gene therapy manufacturing market.

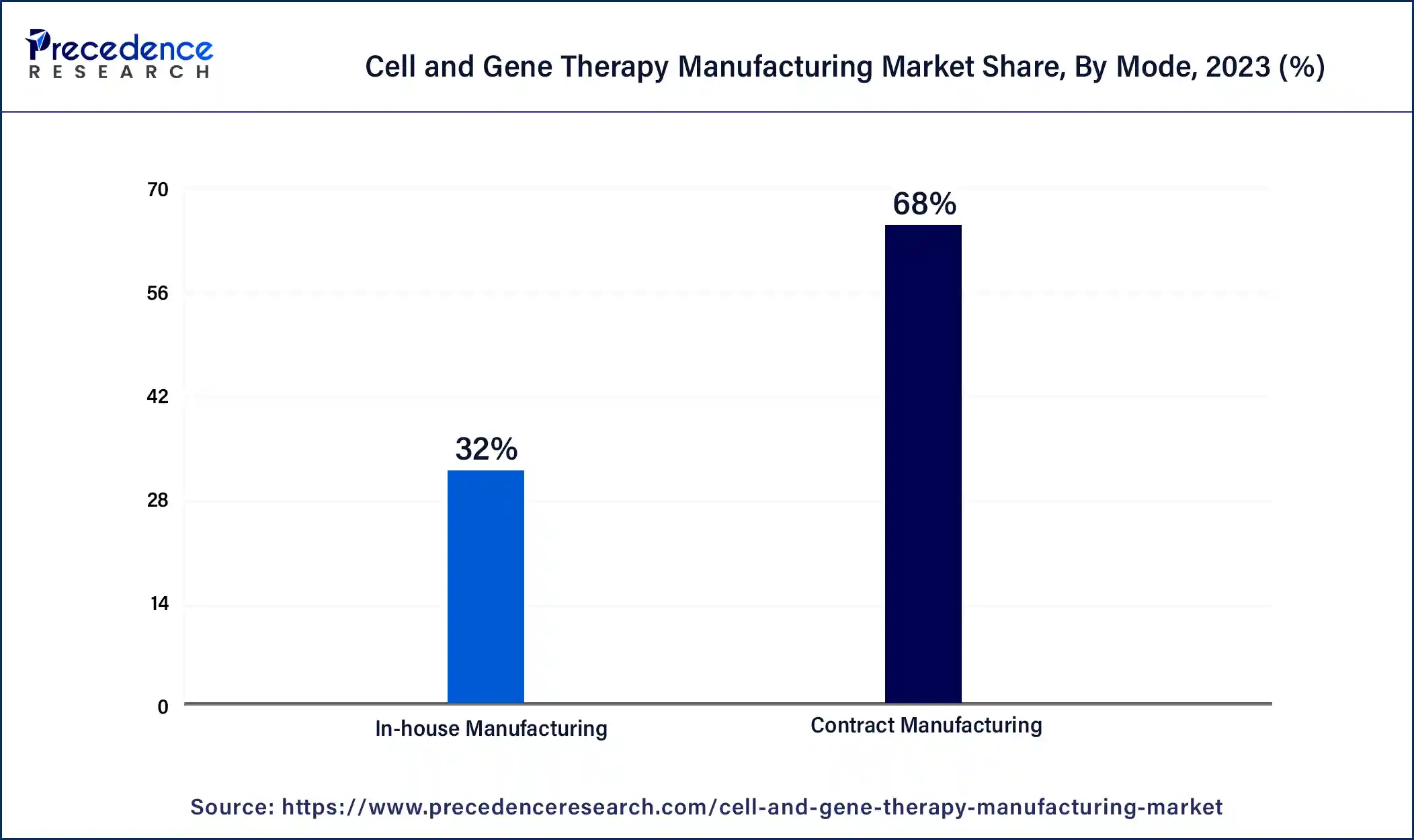

The contract manufacturing segment dominated the cell and gene therapy manufacturing market in 2023. The contract manufacturing benefits include the ability to focus on innovation and core competencies, easier-to-scale production and flexibility, reduced errors, more quality control, access to bulk purchasing and skilled labor, and reduced costs of facilities, machinery, labor, and production.

This helps to increase sales due to lower prices for the customers. Outsourcing procedure that keeps overhead and business costs low, which is beneficial for contract manufacturing. Companies that contract with the manufacturers may achieve high productivity and a high level of efficiency. These factors help to the growth of the contract manufacturing segment and contribute to the growth of the market.

The in-house manufacturing segment is anticipated to show considerable growth during the forecast period. The benefits of in-house manufacturing include lower carbon footprint, reduced supply chain risks, shorter lead times, better communication, direct management over the overall product consistency, quality of materials and production timelines, and flexibility to adapt to the changing demands of the market, avoidance of public relations risks linked with outsourcing, less logistic costs or save time and money logistically, less overhead costs, and higher quality control.

The benefits also include physical and intellectual property protection, easy customization, increased efficiency and productivity, rapid testing, no minimums and cost-effectiveness, agility, the ability to react to the market quickly, and easier communication, which helps the growth of the market. These factors help the growth of the in-house manufacturing segment and contribute to the growth of the cell and gene therapy manufacturing market.

The process development segment dominated the cell and gene therapy manufacturing market in 2023. The process development aims to drive down costs and gain efficiency while improving or maintaining quality. It applies to complete process elements like removal of impurities, scale-up, optimization of cell culture media, cell characterization, and cell isolation. Things that we have to know about process development in cell and gene therapy include transfection missteps, which may disrupt production; cell adaptation, which can take time; watching gases; and scaling up, which is easier than simple maths. Process development can help to produce modified or new proteins in the cell, increase the production of working proteins, and reduce the specific disease-causing proteins. These factors help to the growth of the process development segment and contribute to the growth of the market.

The vector development segment is estimated to be the fastest-growing during the forecast period. The benefits of vector development for cell and gene therapy include an effective carrier delivery system; viral vectors that are artificially modified to lose their pathogenicity are highly used as delivery systems. Viral vectors are used for the treatment of many disorders and many types of cancers. These factors help the growth of the vector development segment and contribute to the growth of the cell and gene therapy manufacturing market.

Segments Covered in the Report

By Therapy

By Scale

By Mode

By Workflow

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

January 2025

January 2025

January 2025