March 2025

Cellular Health Screening Market (By Test Type: Single Test Panels, Telomere Tests, Oxidative Stress Tests, Inflammation Tests, Heavy Metals Tests, Multi-test Panels; By Sample Type: Blood, Saliva, Serum, Urine; By Collection Site: Home, Office, Hospital, Diagnostic Labs) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

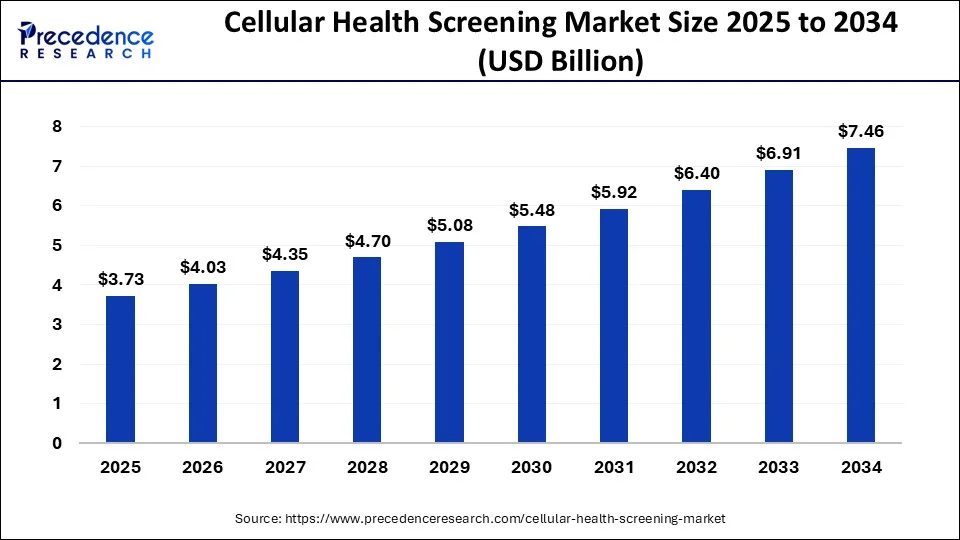

The global cellular health screening market size was USD 3.20 billion in 2023, accounted for USD 3.46 billion in 2024, and is expected to reach around USD 7.46 billion by 2034, expanding at a CAGR of 8% from 2024 to 2034. The North America cellular health screening market size reached USD 1.60 billion in 2023. Cellular health screening plays a crucial role in monitoring the body’s reaction to treatment regimens, which is anticipated to contribute to the growth of the cellular health screening market.

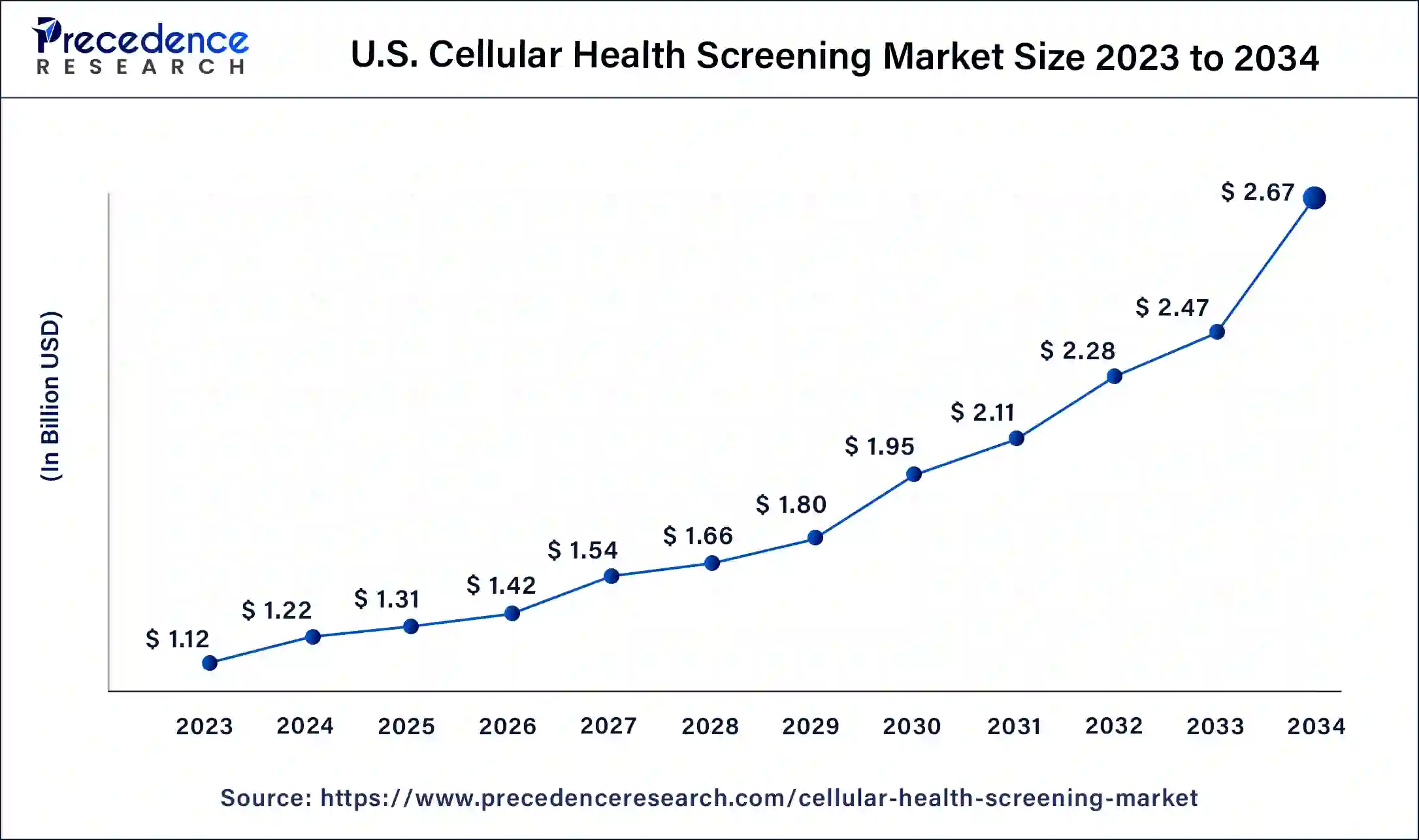

The U.S. cellular health screening market size was estimated at USD 1.12 billion in 2023 and is predicted to be worth around USD 2.67 billion by 2034, at a CAGR of 8.2% from 2024 to 2034.

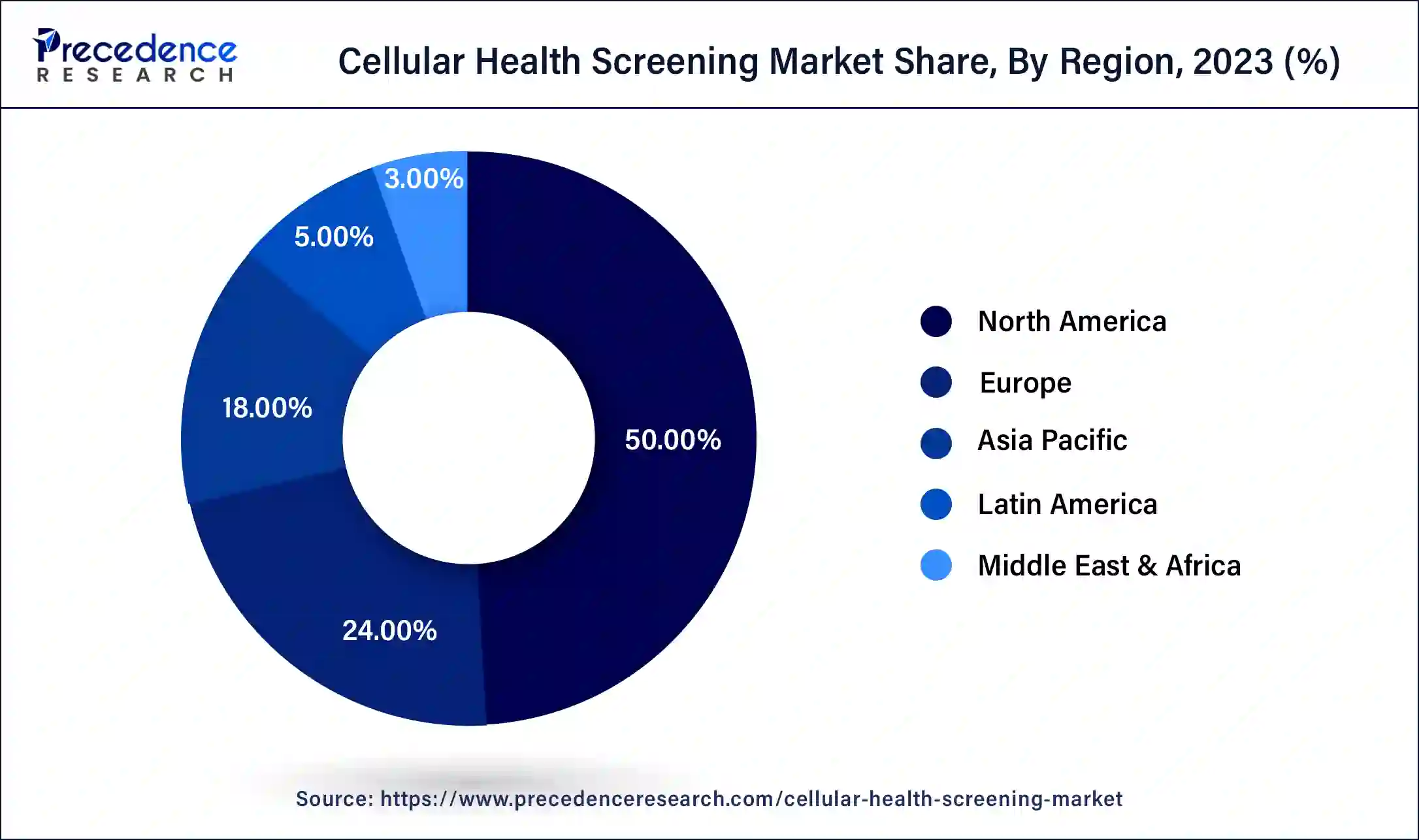

North America dominated the global cellular health screening market share in 2023 due to its advanced healthcare system, early adoption of new medical technologies, and emphasis on preventive healthcare. Key players and research institutions in the region develop innovative screening solutions, driving market growth. Moreover, established healthcare policies and reimbursement mechanisms encourage the widespread adoption of cellular health screening services among healthcare providers and consumers.

Asia Pacific is anticipated to be the fastest-growing region in the forecast period. This is because of its expanding population, which leads to a larger pool of patients, and the improved healthcare infrastructure due to growing economies. The increased adoption of tests and awareness about health among adults are major drivers in the Asia Pacific. Additionally, research on telomeres for aging and government initiatives for disease prevention further contribute to the region's growth.

Cellular health screening, also known as health testing, is a diagnostic approach that examines a person's cells to evaluate overall health and identify potential health issues or abnormalities at the cellular level. This screening involves analyzing various biomarkers like DNA, RNA, proteins, and metabolites to understand how cells in the body are functioning and their condition.

Cellular health screening helps individuals understand their genetic predispositions, lifestyle impacts, and environmental factors affecting their health, enabling them to make informed decisions about preventing and managing illnesses. Healthcare professionals can use cellular health markers to detect early signs of diseases, assess treatment effectiveness, and create personalized health plans for achieving optimal well-being.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 8% |

| Global Market Size in 2023 | USD 3.20 Billion |

| Global Market Size in 2024 | USD 3.46 Billion |

| Global Market Size by 2034 | USD 7.46 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Test Type, By Sample Type, and By Collection Site |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Telomere performance programs

The market for cellular health screening is expected to grow rapidly as telomere performance programs become more widely accepted. Several factors will contribute to this growth between 2024 and 2034. including an increase in chronic disease cases, greater research efforts, a focus on healthy aging, a rise in the average age of the population, and the adoption of digital testing technologies.

Other drivers include the growing elderly population's need for cellular health screening, the rise of direct-to-consumer approaches, the importance of healthy life expectancy, government initiatives for preventive healthcare, the popularity of telomere performance programs for promoting health, and the increasing burden of chronic diseases.

High cost

One significant challenge facing the global cellular health screening market is the high cost associated with advanced screening technologies and tests. While the demand for these services is rising, the expenses involved in developing and implementing cutting-edge diagnostic tools and conducting thorough cellular health assessments can be considerable.

This financial burden might restrict access to cellular health screening for certain individuals and healthcare facilities, particularly in areas with limited resources, thus impeding market growth to some extent. It will be crucial to make these services more affordable and accessible to overcome this challenge and expand the cellular health screening market’s reach.

Advancements in cellular analysis technologies

The progress in cellular analysis technology has led to more precise and effective measurement of biomarkers related to cellular health. Advanced methods like PCR, LC-MS, flow cytometry, and next-generation sequencing have broadened the scope of biomarkers that can be examined in cellular screening.

Automation in laboratory testing has boosted the efficiency of cellular screening processes. Market participants are also introducing new, technologically advanced products, which are anticipated to drive the growth of the cellular health screening market in the coming years.

Testing services for clinical trials

Cellular screening is increasingly used to monitor biochemical indicators in clinical trials and research studies, tracking disease progression, treatment response, and health outcomes. Cellular biomarkers allow for the assessment of subtle biochemical changes caused by experimental drugs, supplements, or interventions. As more biomarkers are validated, clinical researchers expect broader applications for cellular screening. Special testing services for clinical trials represent a significant growth opportunity.

Diagnostics companies offer cellular screening, which can boost adoption by partnering with large healthcare networks and regional providers. By providing integrated reporting, discounts on multi-test packages-branded or customized testing services, and arranging sample collection, these partnerships can incentivize providers to recommend cellular screening to patients. Establishing such strategic partnerships will be crucial for integrating cellular screening into routine care standards and expanding the reach of the cellular health screening market.

The single test panels segment dominated the cellular health screening market in 2023. This is because research studies have highlighted the connection between telomere length and various molecular and cellular functions. Single test panels appeal to individuals who want to address specific health concerns or closely monitor certain cellular parameters. They are preferred for their cost-effectiveness and ability to offer targeted insights into health issues like oxidative stress, inflammation, or mitochondrial function. As awareness about cellular health and preventive healthcare continues to increase, single test panels become the popular choice among health-conscious consumers, significantly driving market growth.

The multi-test panels segment is expected to experience the fastest growth during the forecast period. These panels offer a wide range of cellular health assessments all in one package, giving healthcare professionals and individuals a complete picture of their cellular well-being. The convenience of multi-test panels is a key driver of their popularity, as they allow for the simultaneous evaluation of multiple cellular parameters, saving time and resources while providing a thorough health profile. Additionally, these panels are valued for their ability to identify interconnected cellular issues and potential health risks, which facilitate targeted interventions and personalized treatment plans.

The blood samples segment holds the majority share of the cellular health screening market and is expected to lead the global market throughout the projected period. Clinicians frequently rely on blood samples to diagnose various diseases, assess organ function, and analyze risk factors. The segment's growth is further propelled by the introduction of new diagnostic devices that utilize blood for detection and screening purposes.

The urine samples segment is expected to experience lucrative growth in the upcoming years. This is due to the rising preference for urine-based screening, which is non-invasive and more convenient for patients. Urine samples are easy to collect and don't involve complex procedures, making them suitable for regular monitoring and at-home testing. Also, advancements in urine-based diagnostic technologies have enhanced the accuracy and reliability of cellular health assessments, leading to increased adoption in healthcare settings.

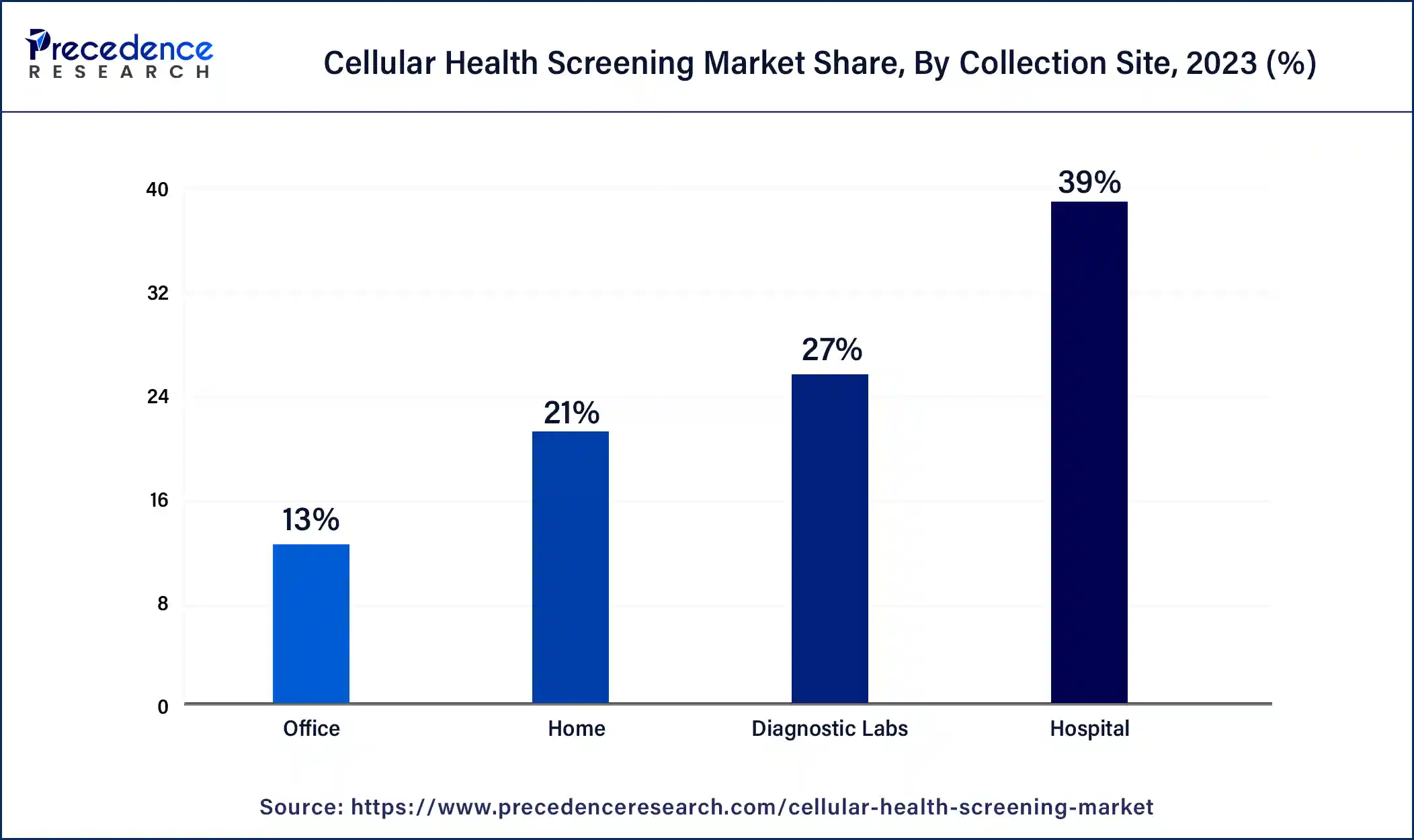

The hospital segment accounted for the largest share of the cellular health screening market in 2023. Hospitals are the primary centers for diagnosis and treatment for most people. The use of diagnostic kits for screening patients, both in-patients and outpatients, is a major factor driving market growth. Moreover, the presence of medical professionals who recommend diagnostic tests for disease identification contributes to market growth. Having sample collection sites, skilled professionals, and advanced diagnostic techniques in one place further enhances growth prospects.

The home segment is expected to experience growth at the highest rate during the forecast period. This is because of growing health awareness and the increasing adoption of self-sampling in major markets. Self-sampling is favored because it's easy to use and doesn't need special infrastructure or trained professionals. Furthermore, the COVID-19 pandemic accelerated the trend of home sample collections due to restricted movements, and this trend is expected to persist in the future.

Segments Covered in the Report

By Test Type

By Sample Type

By Collection Site

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

April 2025

May 2025

January 2025